The CRB Monitor Securities Research team covers all aspects of the publicly-traded cannabis ecosystem, including the regulatory environment, operational expansion/M&A activity, updates on officers/directors, and investment performance. With our monthly and quarterly newsletters, we keep our readership informed while we highlight the multi-faceted importance of CRB Monitor’s data to all types of users at financial institutions worldwide.

For additional detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor July 2023 newsletter, CRB Monitor August 2023 newsletter, and the CRB Monitor September 2023 newsletter.

Cannabis-Related Equity Performance

Cannabis Equity Index Returns – An August Pop, Then a Dose of Reality

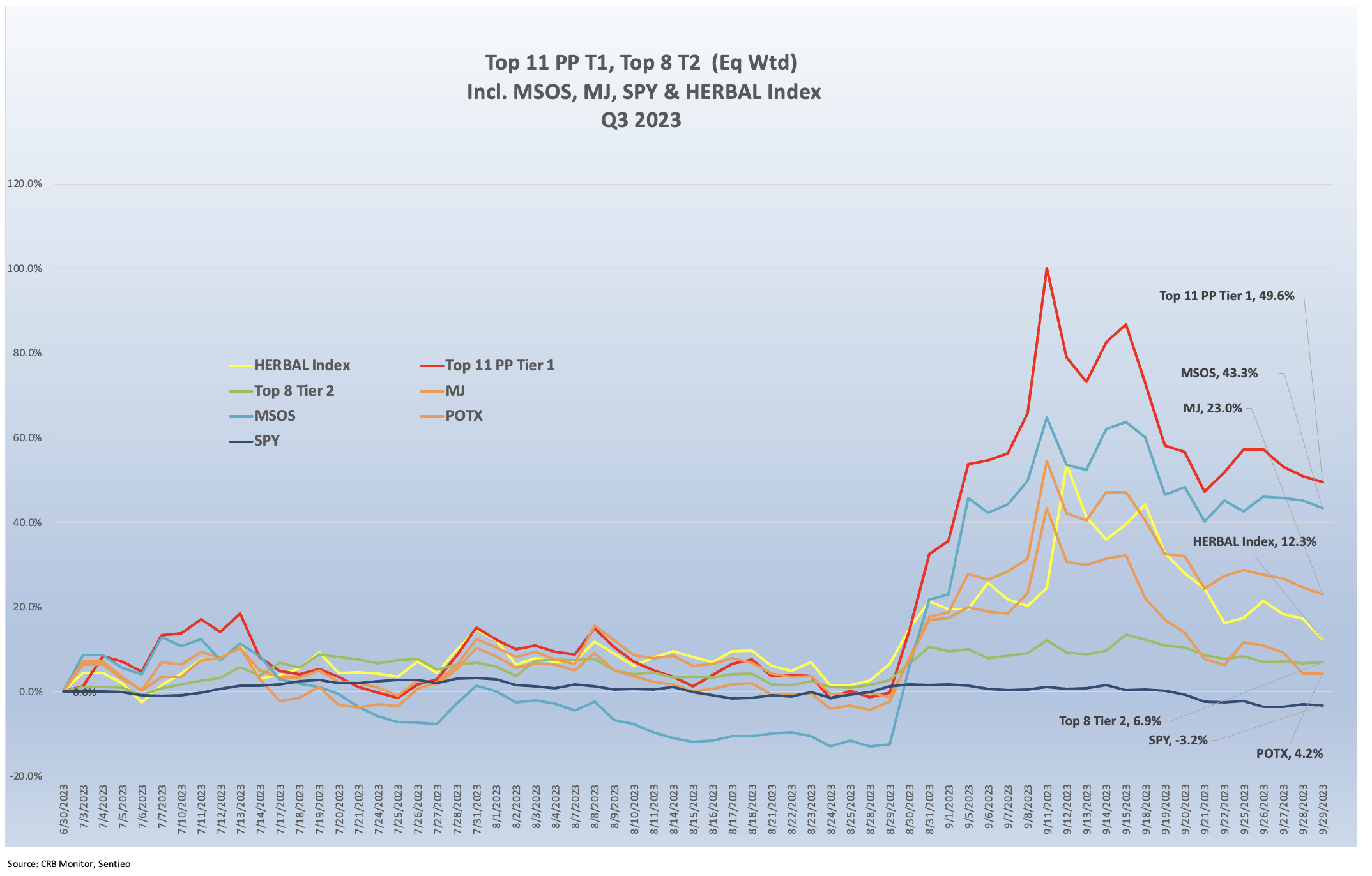

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL) is a mix of Pure Play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme (SOT). A well-conceived representation of the universe of legal, pure play Tier 1 and Tier 2 cannabis equities, HERBAL had a positive 12.2% return for the 3rd quarter of 2023. HERBAL’s Q3 performance finished 8% ahead of its closest non-US plant-touching competitor, the Global X Cannabis ETF (Nasdaq: POTX) (+4.2%). A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (+23.0%), given its significant exposure to US marijuana, benefitted from the positive HHS news at the end of August. MJ’s benchmark’s latest material change in index methodology has the fund holding more than 50% of the fund in US MSO’s (via swap contracts), as well as a ~20% holding in non-pure play CRBs, which tend to have low correlation with Pure Play cannabis. These features, which can be a deal-breaker for institutions that have restrictive policies regarding holdings which violate the US Controlled Substances Act.

Also in the US plant-touching category is the MSO-heavy Advisorshares Pure Us Cannabis ETF(NYSE: MSOS), which posted a return of +43.3% in Q3. MSOS’s performance has a tendency to deviate (but not always) from both HERBAL and POTX largely due to its holdings of CRBs with US Marijuana touch-points (largely MSOs), which dominate in that fund. [HERBAL and POTX cannot hold any securities with direct US touch points.]

The CRB Monitor equally-weighted basket of the largest Pure Play Tier 1 CRBs benefitted significantly from the HHS August revelations, returning +49.6% in Q3 2023. This basket is essentially a hybrid of CRBs without US touchpoints and US multistate operators (MSO’s). Their equal weighting will cause their returns to deviate from the other indexes, which all employ some variation of market cap weighting. We show the comparative performance of CAD’s vs. MSO’s on a chart below.

The CRB Monitor equally-weighted basket of the largest Tier 2 CRBs underperformed the Tier 1 basket significantly, up by 6.9% in Q3. As we have indicated in the past, Pure Play Tier 1 and Tier 2 CRBs tend to display high (~0.8) correlation in the long term (see our section on correlation in the CRB Monitor September 2022 newsletter), but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. One lingering reality cannot be avoided, that for better or worse Tier 2 CRBs will eventually inherit the overall success or failure of the Tier 1 universe and there will ultimately be convergence of their return streams.

In Q3, similar to several prior periods, we observed significantly different performance by two distinct groups, the Canadian-focused (non-US plant-touching) CRBs and US-focused MSOs. From the chart above, we can see that cannabis equities remained largely flat to slightly negative for the first half of the third quarter, as investors were generally skittish with regard to cannabis, as they were with equities in general (see the S&P 500 ETF return of -3.2%). At the end of August is when the MSO basket spiked given the perceived direct positive impact on this group from marijuana rescheduling (or at least the recommendation of such). And while investors perceived a residual silver lining for the Canadian CRB group, their benefit from rescheduling would likely not include US Federal tax relief and therefore the market sentiment for these companies was somewhat muted.

Q3 2023 was in a way a microcosm of the historical rollercoaster that is cannabis equities, which featured low trade volumes and wide bid/ask spreads; and where the mere suggestion of reform (not the actual reform itself) can cause triple-digit spikes in stock prices. Another factor in this late-August hysteria was the high demand from investors that held several short positions that suddenly needed to be covered. And like several previous sentiment-based CRB rallies, we saw prices recoil in early September and give back a significant portion (however not all) of their gains. It will be interesting to see where things go from here, as the HHS recommendation for rescheduling will face resistance in the US Congress and, even if there is a path for this game-changing event, it could take up to a year to fully implement. [For a more in-depth look at all the implications of cannabis rescheduling, CRB Monitor has published an excellent summary of the HHS recommendation and the various impacts it would have on CRB Monitor’s range of database users: Taking Cannabis Down to Schedule III: What Does It Really Mean?.]

US equities were lackluster in Q3, with the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) hovering around flat throughout the quarter before finally returning -3.2%. In spite of consistently optimistic employment data, investors in equities are obviously airing on the side of caution and indicating that we are not fully over the aftereffects of the pandemic. The Fed has taken an equally cautious approach, indicating that they are not finished tightening and we will likely see one or two additional rate hikes by year end.

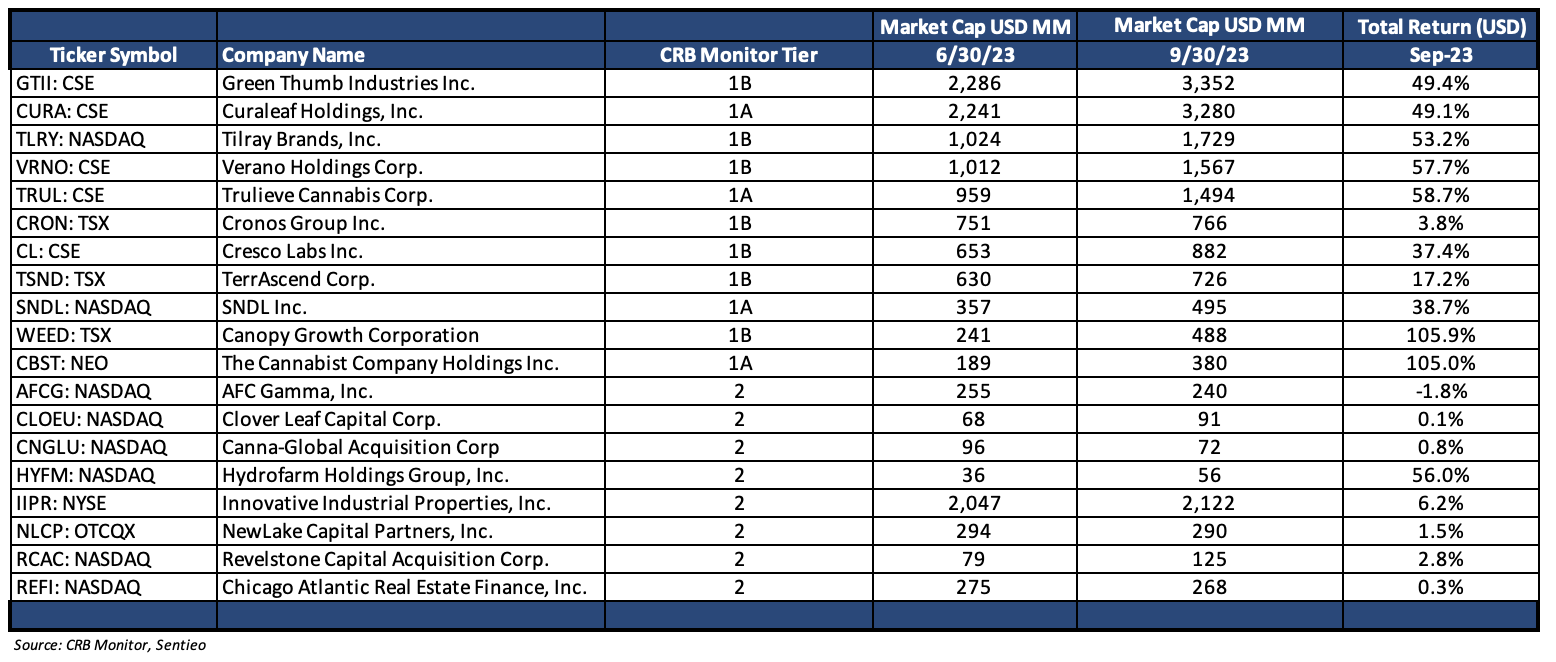

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – Q3 2023 Returns

CRB Monitor Tier 1

The above table shows just how dramatic that August-early September rally was for the publicly-traded Tier 1 CRB space in Q3 2023. The investors that have hung onto their CRB shares this long were rewarded for their patience as cannabis equities and cannabis-themed funds got a long-awaited shot in the arm that they have been asking for since early 2021. With that said, none of the great news is a guarantee of a single step toward legalization, or even rescheduling, for that matter. But in this space we have learned that hope springs eternal and even baby steps in the direction of cannabis reform in the US are greeted with investors willing to pay the offer side of the spread.

The MSO group was, by and large, on fire on the heels of the HHS announcement, with Green Thumb Industries Inc. (CSE: GTII) (+49.4%), Cresco Labs Inc. (CSE: CL) (+37.4%) and its now ex-fiancé The Cannabist Company Holdings, Inc. (CBOE CAD: CBST) (+105.0%), Curaleaf Holdings, Inc. (CSE: CURA) (+49.1%), and Trulieve Cannabis Corp. (CSE: TRUL) (+58.7%). The equally-weighted MSO basket returned +49.5% for the quarter.

The Canadian (non US plant-touching) operators were positively affected by the HHS announcement, as investors see this as a step toward the possibility of cross-border activity. Tier 1 Canadian CRBs Tilray Brands, Inc. (Nasdaq: TLRY) (+53.2%), Canopy Growth Corporation (TSX: WEED) (+105.9%), and Sundial Growers, now called SNDL, Inc., (Nasdaq: SNDL) (+38.7%) kept pace with the MSO group while Cronos Group Inc. (TSX: CRON) (+3.8%) trailed the rest of the group and was a drag on the CAD basket.

It should be noted that these stratospheric returns in Q3 would need to be repeated for several periods before cannabis equities return to their heyday back in early 2021 or even 2019 (as of 9/30/2023 CRBs are still 60-90% below their historic highs).

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies gained 6.9% for the third quarter of 2023, which underperformed the equally-weighted Tier 1 basket by more than 42%. Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (see our analysis of CRB correlations in the CRB Monitor September 2022 newsletter), but their respective performance has a tendency to diverge in the short term, as it did in Q3, given the occasional lag from the impact (positive or negative) of market forces.

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) (+6.2%) closely. IIPR is an internally-managed real estate investment trust (CLS sector – REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” IIPR is of particular interest to financial insitutions largely due to the fact that its stock historically (up to January 2022) defied the volatile price patterns of the cannabis space up to 18 months ago consistently outperformed its peers as well as its CRB-customers. It is also, by far, the largest Tier 2 CRB by market capitalization. But a third and even more important consideration related to IIPR is the source of its revenue, which is essentially 100% derived from US plant-touching activities. As a Tier 2 CRB, IIPR is granted an NYSE listing, but a number of conservative trading desks and custody banks continue to find the company in violation of internal cannabis policies.

IIPR’s stock price did not get the lift from the August HHS announcement that its Tier 1 MSO customers did, returning +6.2% and outperforming most of the CRBs in the Tier 2 basket.

Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) (CLS Sector Agricultural & Farm Machinery) (+56.0%). Hydrofarm is an independent distributor and manufacturer of hydroponics equipment and supplies, primarily to cannabis cultivators. Similar to IIPR (in fact, much worse), HYFM was in a free fall in 2022, posting a return of -95% for that year and its price has not improved materially since, even with this Q3 spike. As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day, as it has done essentially weekly for the last two years. With its price now oscillating around $1, HYFM is now in the midst of consolidation and restructuring, and we believe we have seen the exodus of most investors, who took their optimism with them.

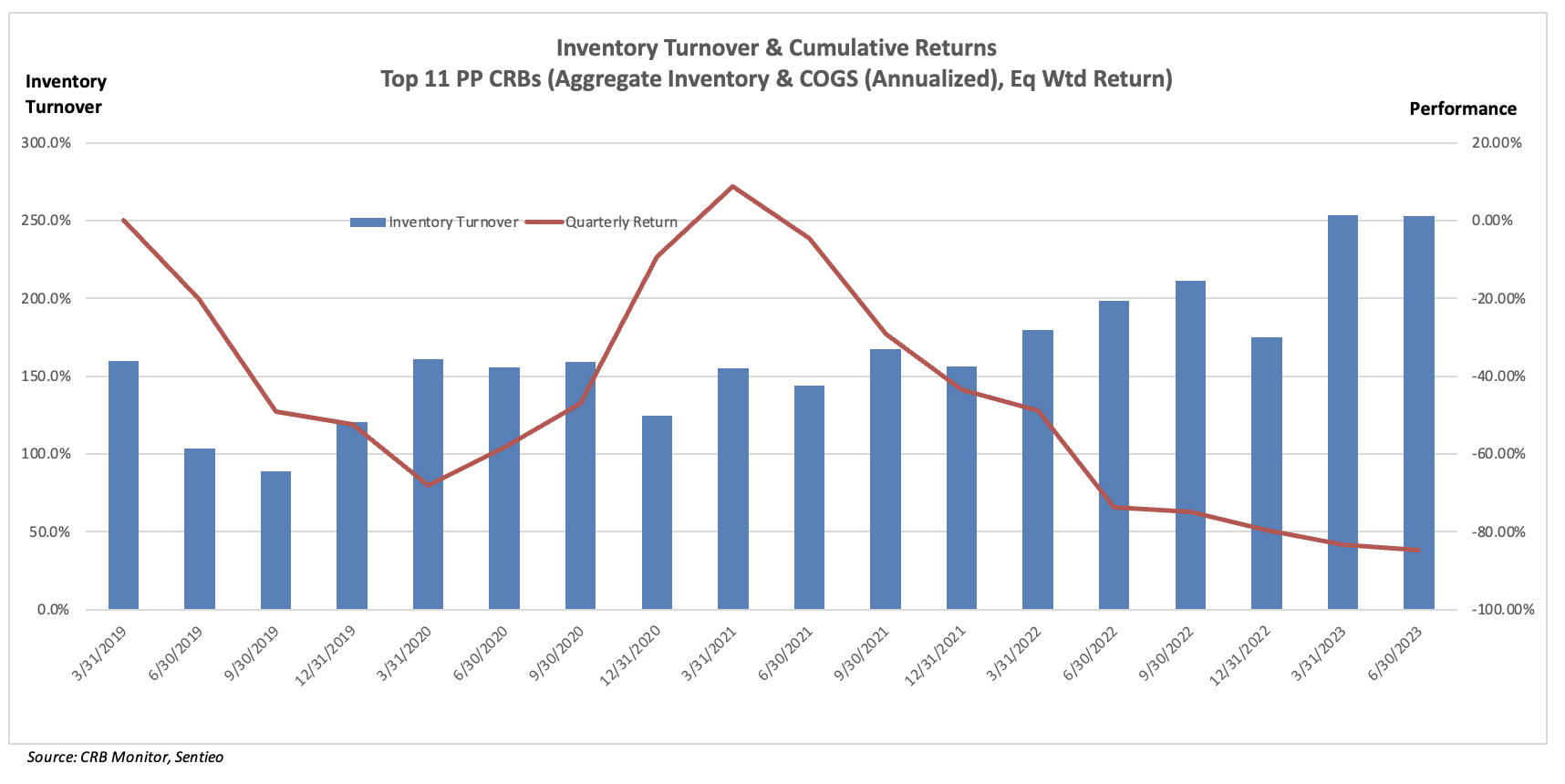

Chart of the Quarter: Inventory Turnover

In our quest for all the answers related to these curious, sometimes-legal cannabis-linked businesses, we direct our attention to a common multiple: inventory turnover. Quite simply, inventory turnover is the ratio of cost of goods sold (COGS) to average inventory for a particular period. In the words of Investopedia.com, here is a summary of what inventory turnover is useful for:

- “Inventory turnover measures how efficiently a company uses its inventory by dividing the cost of goods sold by the average inventory value during the period.

- Inventory turnover ratios are only useful for comparing similar companies, and are particularly important for retailers.

- A relatively low inventory turnover ratio may be a sign of weak sales or excess inventory, while a higher ratio signals strong sales but may also indicate inadequate inventory stocking.

- Accounting policies, rapid changes in costs, and seasonal factors may distort inventory turnover comparisons.”

Inventory turnover is an area of focus for the entire cannabis industry and it is referenced in essentially all company financials. Here is an excerpt from Tier 1B Lifeist Wellness’s (TSXV: LFST) most recent Management Discussion and Analysis:

“The Company continues its forward-looking inventory management strategy, designed to: 1) reduce the amount of slow-moving inventory; 2) improve inventory turnover; and 3) leverage existing technology to further reduce the inventory risk.”

Similarly we have this statement that can be found in Tier 1B MSO Ayr Wellness Inc.’s (CSE: AYR.A) Q2 2023 Financials:

“Pennsylvania is a similar story to Nevada, where, in a steady market, we maintained our improved margins, thanks to our optimization efforts in the state. This is a market where we see the opportunity to improve inventory turnover to generate cash and will be increasing our internalization efforts.”

For this exercise, we summed the quarterly values in order to calculate the aggregate inventory for each period and COGS (annualized) for the top 11 pure play Tier 1 CRBs by market capitalization. Performance for this equally-weighted basket is the red line while the blue bars represent the aggregate inventory turnover ratio for the basket. While we do feel it’s useful to look at this data on a company-by-company basis, it also works to view it in the aggregate. Aggregating the data serves to smooth it out over the periods and we feel that the basket is so focused in its theme that combining the numbers into one total value is appropriate.

Now for the useful part of this exercise – what are we looking at here? It appears that, while Rome has been burning, cannabis has been selling – not spectacularly, but respectably (1.5 – 2.5X). Now don’t be fooled, this is not a pretty picture, particularly as we witness this breathtaking, downward spiral of the industry group. However, what we also see is these companies surviving via their ability to turn over their inventories.

While it is obvious that publicly-traded CRBs are far from out of the woods – let’s face it, nearly 90% of pure play Tier 1 market cap has evaporated over the last 30 months – the companies that continue to expand operations and are mindful of expenses will survive. And the fact that marijuana legalization and decriminalization is expanding to include (dare I say) red states, the cannabis industry has legs – and lots of new revenues, and jobs, and economic opportunities for struggling communities.

Another important fact that favors this industry is that the vast majority of cannabis licenses are not held by publicly-traded CRBs (either directly or through subsidiary businesses). Of the more than 200,000 cannabis licenses tracked globally by CRB Monitor, just over 10,000 (5%) are connected to publicly-traded Tier 1 companies. Hence, there is plenty of room for these companies to expand, particularly the multistate operators.

CRB Monitor Securities Database

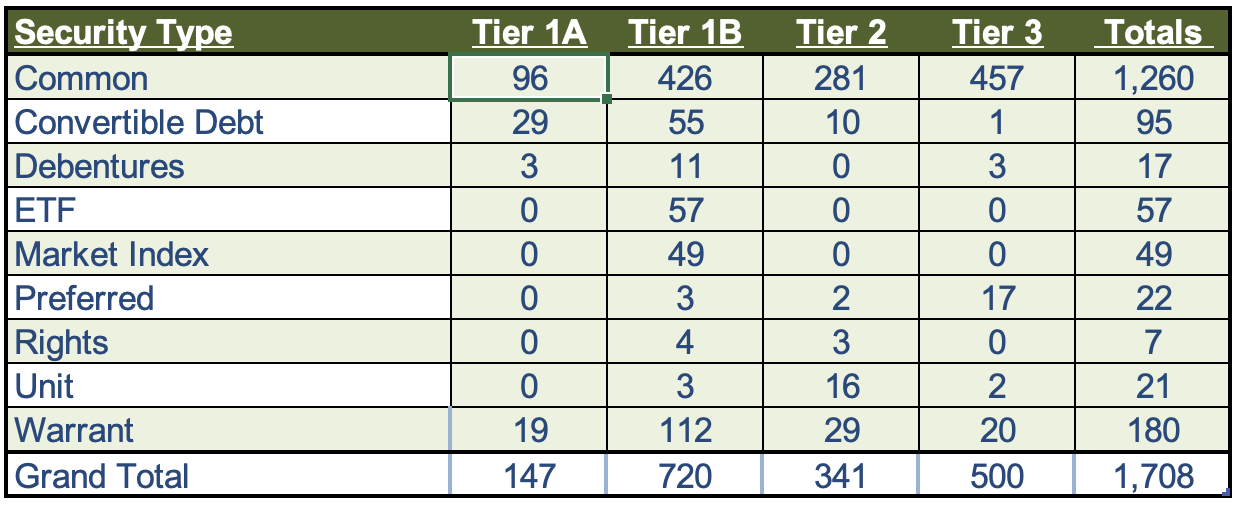

As of September 30, 2023, the breakdown of publicly-traded, cannabis-linked securities was as follows:

Source: CRB Monitor

Source: CRB Monitor

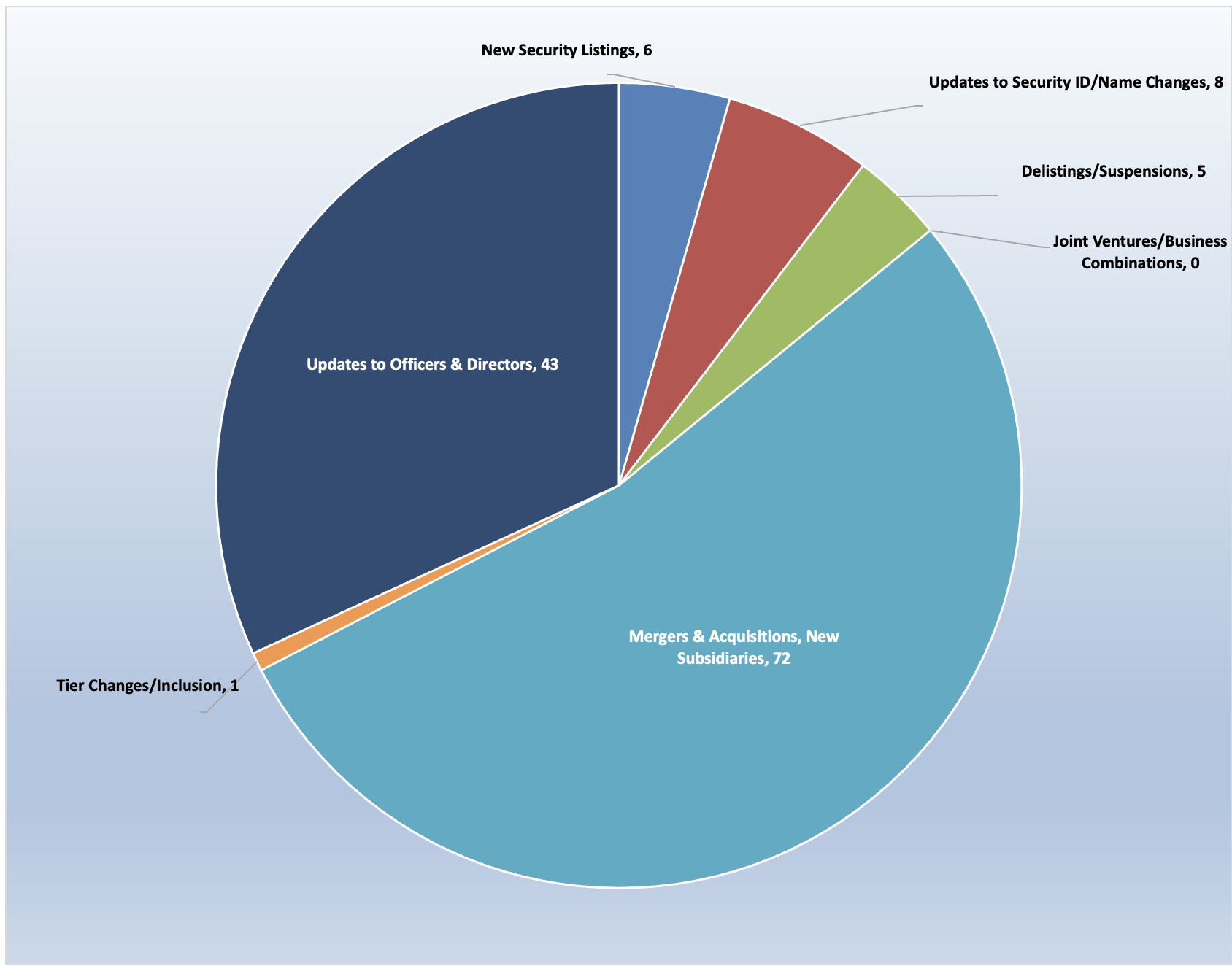

The level and frequency of M&A activity at the listed company level has not improved, but with that said Q3 2023 featured plenty of daily updates to the CRB Monitor database. Of the thousands of announcements and filings reviewed during the full year, our daily research resulted in a total of 353 updates to CRB Monitor company profiles (135 updates to issuers’ records, 218 news releases added). The complete list of securities and detailed profiles for more than 1,300 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our latest monthly newsletters: CRB Monitor July 2023 newsletter, CRB Monitor August 2023 newsletter, and the CRB Monitor September 2023 newsletter.

CRB Monitor Securities Database Updates – Q3 2023

Source: CRB Monitor, Sentieo

Cannabis Business Transaction News – Q3 2023

We closely tracked the cannabis news cycle throughout the third quarter of 2023, making a total of 453 updates to the CRB Monitor database from daily securities alerts (179 profile updates, 274 articles added). Cannabis equity prices were generally mixed in Q3 2023, and we were there, standing by to capture all the critical information necessary to maintain the world’s best cannabis-linked securities database – CRB Monitor. The following is a sampling of some of the highlights from the Q3 cannabis news cycle.

In early July, Tier 1A MSO Columbia Care Inc. (CSE: CCHW) and Tier 1B MSO Cresco Labs Inc. (CSE: CL) announced in a brief press release on July 31 that “a mutual agreement, dated July 30, 2023, to amicably terminate the definitive arrangement agreement dated March 23, 2022, as amended on February 27, 2023, pursuant to which Cresco agreed to acquire all of the issued and outstanding shares of Columbia Care. There are no penalties or fees related to the mutual agreement to terminate the Transaction.” This roller coaster ride proved to be too high a legal hurdle for both parties, who were required to divest of a number of subsidiary businesses by June 30th in order to satisfy regulators. That hurdle, in addition to the failure of lawmakers at the federal level to make substantial progress on any cannabis-related reforms, seemed to be the dagger in the heart of this deal from the very beginning. With that said, the two companies will continue to operate individually as they attempt to hold the attention of investors, who have had little to celebrate about in the last two years. Following the separation, Cresco’s active license count sits at 69 across 8 states while Columbia Care’s is 115 across 13 states plus DC and Puerto Rico.

An excellent epilogue to the Cresco/Columbia Care adventure, “Failed Cresco-Columbia Care Merger Ices Combs’ Cannabis Deal”, can be found on the CRB Monitor website.

Also in July, Legendary Canadian Tier 1A CRB Aurora Cannabis Inc. (TSX: ACB) issued a press release announcing that “a wholly-owned subsidiary of the Company has closed the sale of its Medicine Hat, Alberta facility on July 21, 2023 to Bevo Farms Ltd., a wholly-owned subsidiary of Bevo Agtech Inc. The sale of the Aurora Sun Facility was completed via Bevo Farms’ acquisition of one of Aurora’s wholly-owned subsidiaries.” The announcement goes on to say that “Aurora has a controlling interest in Bevo, one of the largest suppliers of propagated vegetables and ornamental plants in North America.” CRB Monitor includes this private subsidiary business as a Tier 1B CRB, regardless of its connection to the cannabis industry (in this case, Bevo has none other than their relationship to ACB).

Finally in July, Tier 1B MSO Ascend Wellness Holdings, Inc. (CSE: AAWH.U) announced in a July press release that the Company intends to commence selling of recreational cannabis sales in Maryland at their four licensed dispensaries located in Aberdeen, Crofton, Ellicott City, and Laurel beginning Saturday, July 1st. According to the announcement, “Ascend acquired these dispensaries on April 28th, 2023 and has since rebranded the four stores to the ‘Ascend’ brand. The Company also made significant aesthetic and operational improvements to the stores, including doubling points of sale at many of the locations in anticipation of adult-use demand.” With these new licensed subsidiary businesses, Ascend holds 71 cannabis licenses through its subsidiary businesses in seven states.

Tier 1B MSO Avicanna Inc. (TSX: AVCN) announced in August that it closed its previously announced acquisition of the Medical Cannabis by Shopper’s Business from Shoppers Drug Mart® and that it has launched an all-new medical cannabis care platform, MyMedi.ca. The platform’s features include:

- Medical Cannabis Marketplace: A diverse medical cannabis marketplace featuring approximately 200 unique products supplied by a network of 35 brands from various leading Canadian licensed producers.

- Pharmacist-Led Patient Care Services: Pharmacist-led fully bilingual (English and French) patient care service programs including pharmacovigilance, compassionate pricing, and insurance adjudication in compliance with standards established by private and public payers.

- Patient Education: Patient education programs and informational resources, including harm reduction strategies and risk mitigation.

- Education for Healthcare Professionals: Medical education, training, and resources available to health care practitioners, hospitals, clinics, and institutions, along with potential collaboration opportunities, through the Company’s Medical Affairs department

What’s also significant here is that when this deal closes it would signify the departure of Tier 1B non-pure play CRB Loblaw Companies Limited (TSX: L) from the cannabis industry. Shoppers Drug Mart, a long-time subsidiary business of Loblaw’s, began selling medical cannabis in 2019. All of its cannabis business will now be taken over by Avicanna.

Also in August, Tier 1B MSO Jushi Holdings Inc. (CSE: JUSH) issued a press release announcing that its sixth medical cannabis dispensary in Virginia, Beyond Hello™ Woodbridge would begin serving Virginia medical cannabis patients and registered agents on Wednesday, August 23rd. In the words of the press release, “Along with offering convenient transaction processing through the Company’s industry-leading online reservation platform, beyond-hello.com, Jushi designed Beyond Hello™ Woodbridge to serve Virginia’s growing patient population. Beyond Hello™ Woodbridge patients will also have access to five of Jushi’s in-house brands, including Sèchè, The Bank, Tasteology Fruit Chews, The Lab, and Nira + Medicinals – all locally grown at Jushi’s nearby grower-processor facility in Manassas. Additionally, this new location will offer dry leaf, concentrates, cartridges, tinctures, topicals, edibles, capsules, pills, and various ancillary products such as approved batteries and devices.” Jushi now holds, through its subsidiary businesses 59 (active or pending approval) cannabis licenses across 7 states.

In September, Tier 1B mega-dispensary operator Planet 13 Holdings Inc. (CSE: PLTH) announced in September that it entered into a purchase agreement on Aug. 28 “for the ownership interests of Jacksonville-based VidaCann LLC.” According to the Orlando Business Journal, “The proposed deal includes 26 VidaCann dispensaries, including two in Orlando and one in Clermont, as well as a distribution and growing facility that can support 60 dispensaries.” This significant operational expansion in Florida brings Planet 13’s total license count to 27 that are either active or pending approval.

Also in September, Tier 1B MSO TILT Holdings Inc. (CSE: TILT) issued a press release announcing that its subsidiaries, SFNY Holdings Inc. and Standard Farms New York LLC “have entered into a membership interest purchase agreement with CGSF Investments, LLC, a wholly owned subsidiary of PowerFund Holdings II LLC, pursuant to which CGSF acquired from SFNY all the membership interests in Standard Farms NY for $1.4 million.”

What is significant about this news is that these transactions were executed so that Shinnecock Nation Will Open Tribally Owned Cannabis Dispensary This Fall. In the words of the press release, “Standard Farms NY holds a 75% interest in CGSF Group LLC, which was formed to establish vertical cannabis operations on the Shinnecock Nations aboriginal tribal territory in the Hamptons on Long Island, New York.” Through its subsidiary businesses, Tilt Holdings currently holds 19 cannabis licenses across 5 states that are either in active status or pending approval.

Finally, Tier 1B vertical cannabis operator Leef Brands Inc. (CSE: LEEF) issued a September 20 press release announcing the successful closing of the acquisition of the Salisbury Canyon Ranch LLC, “a 1,900-acre ranch located in Santa Barbara County. Additionally, as previously announced on June 1, 2023, the Company has sold a 60% interest in the Ranch for $7.0 Million through an interest-free loan agreement, of which the proceeds will be used to finance the buildout and operation of one of the largest biomass cultivation sites in California.” And furthermore: “LEEF will remain the 100% owner of the state cannabis licenses and shall exclusively occupy and manage the Ranch and the cultivation operation.” LEEF, a CRB that is generally flying below the radar due to its size ($23mm market cap), is excited about this opportunity for future expansion of its operations. LEEF Brands currently controls, through its subsidiaries, 9 cannabis licenses in California that are either in active status or are pending approval.

Regulatory Updates

In July, Washington State officially launched an online portal that people can use to request reimbursement of their legal fees if they were prosecuted under drug criminalization laws that the state Supreme Court deemed unconstitutional in 2021. A story on marijuanamoment.net reported that the Administrative Office of the Courts (AOC) launched the Blake Refund Bureau website “to facilitate the relief in coordination with courts, county clerks, public defenders, prosecutors, advocates and other stakeholders.” The article goes on to report: “The novel reimbursement fund is being created following the state Supreme Court’s landmark 2021 ruling in Washington v. Blake that found the state’s criminal code for drug possession crimes was unconstitutionally flawed because it didn’t take require proof that a person knowingly committed the offense—creating a situation where people could be criminalized for inadvertent possession.”

Great news out of Missouri: in July an article on the website komu.com reported that since adult-use marijuana sales started in Missouri on 2/3/2023, an average of $4mm of legal cannabis has been sold per day, according to the Missouri Cannabis Trade Association (MoCannTrade). In the words of the article, “Over those five months, total marijuana sales in Missouri have reached over $592 million. In June alone, sales of adult-use and medical cannabis totaled $121.2 million, the fourth month in a row sales reached $120 million, according to Missouri’s Division of Cannabis Regulations. More than 16,000 direct jobs in the cannabis industry have been created since February, compared to only 8,571 jobs during this time last year, according to the MoCannTrade.”

Also in July from the United Kingdom, as reported in July on Hempgazette.com: the Cannabis Industry Council (CIC) says allowing more doctors to prescribe medical cannabis could slash NHS waiting lists. According to the article, “Currently in the UK, patients are unable to have medical cannabis products prescribed by their GP – they must be prescribed by a specialist hospital doctor. This has resulted in the number of patients using legally prescribed medicinal cannabis remaining very low. The CIC has been calling for change, most recently through its ‘Protect Our Patients’ campaign that is lobbying for GPs to have prescribing rights.” And the challenges are real, leaving many patients out of luck as they await treatment. The article goes on to say, “In a new report associated with that campaign, the CIC notes NHS waiting lists have now reached 7.4 million. It says the NHS estimates 34% of adults have chronic pain, and many on its waiting lists would be chronic pain patients seeking treatment for their condition. As medical cannabis can be effective in treating chronic pain symptoms – and improve quality of life – its broader use could help drive down waiting lists.”

The biggest news of the quarter: In late August it was reported in Marijuana Moment that the Head of the US Department of Health and Human Services (HHS) issued a recommendation to the US Drug Enforcement Administration (DEA) “officially recommending that marijuana be moved from Schedule I to Schedule III under federal law”. The significance of this rescheduling cannot be understated; however, there are several questions that will need to be answered before the industry can fully understand the implications. With that said, if and when this change takes effect, the cannabis industry might very well never be the same. In the words of the August 30 article:

“After completing a scientific review into cannabis under a directive from President Joe Biden last year, HHS is now telling the Drug Enforcement Administration (DEA) that it believes marijuana should be placed in Schedule III of the Controlled Substances Act (CSA). The recommendation is not binding, and DEA has the final say, but the scientific analysis combined with growing political support for cannabis reform may well influence DEA to make the change.”

[For a more in-depth look at all the implications of cannabis rescheduling, CRB Monitor has published an excellent summary of the HHS recommendation and the various impacts it would have on CRB Monitor’s range of database users: Taking Cannabis Down to Schedule III: What Does It Really Mean?.]

Also in August, the latest out of Ohio: Early in the month, it was reported that activists turned in their final signatures to put marijuana on the ballot in November. According to a story in Marijuana Moment, “Ohio activists have turned in a final batch of signatures to put a marijuana legalization initiative on the November ballot after falling short in a prior submission. The new batch includes more than 6,000 additional signatures on the petition, which a GOP congressman newly told Marijuana Moment he would’ve signed in order to let voters decide on the reform.” This affirms the overwhelming popularity of legalization in yet another state, and while cannabis-related reforms at the US Federal level continue to go through fits and starts, even red states are starting to understand the benefits of legal cannabis.

A number of key measures could appear on the November ballot, including a 2.5-ounce limit for possession, a 12-plant per household limit on growing, and a 10% sales tax on all cannabis sales.

Now from the State of Israel: It was reported in mid-August that “The Health Ministry published the outlines of its new reform in the use of medical cannabis, which will come into effect in December and would allow more patients to have access to the drug and remove bureaucratic obstacles currently in place. The ministry said it would review the matter in one year and may expand access to more potential users.” The article from Ynetnews.com must come as a relief for those who are hoping for any steps toward full legalization, which seem to resemble the slow crawl at the US Federal government. The article goes on to report: “According to the ministry, patients suffering from cancer, Crohn’s disease, dementia, autism, multiple sclerosis (MS), or HIV, and terminally ill patients who are not expected to live more than six months, will be able to receive prescriptions from their doctors and not have to go through the process of obtaining a license.” With that said, the ministry’s statement intentionally left out conditions that could have been included, much to the dismay of critics, who “slammed the reform for ignoring the many who suffer from PTSD and those suffering chronic pain including fibromyalgia, among other ailments, who would still be required to obtain a license or rely on traditional pain medication that could cause addiction.”

Now onto September: As for the SAFER Banking Act, who doesn’t believe in that old saying, “eight times a charm”? And it is a certainty that cannabis investors, CRBs, and cannabis consumers alike are united in their hope that this one ultimately makes it to the President’s desk for a signature. But in spite of the considerable optimism out there in the media, this bill will face some hurdles on its journey from committee, to the Senate Chamber, to the House, then to Mr. Biden. In a September article on CNBC.com, it was reported on September 27th that this new version of SAFE Banking “that aims to give the marijuana industry access to banking services” advanced out of the Senate Banking Committee with a bipartisan 14-9 vote and will now move to the Senate floor. In the words of the article, “The bill would provide legal protection to banks or other financial institutions that offer services to state-legal marijuana businesses.”

The opposition to SAFER Banking comes from two flanks: 1) legislators on the left who are pushing for social reforms who are not happy moving this bill forward without their priorities attached; and 2) Republicans on the right who are opposed to handing the cannabis industry or the Democrats any form of a victory. Therefore, SAFER Banking is by no means a slam dunk and we will see how it plays out in Congress in the coming months.

Meanwhile in Ohio, it was reported in September in Marijuana Moment that “roughly three out of five Ohio voters support a marijuana legalization measure that will appear on November’s ballot, according to a newly released poll, with nearly two thirds of respondents saying they believe legalization in the state is “inevitable.”

With several polls pointing toward overwhelming support for legalizing adult use marijuana, the issue heads for the ballot in November in the form of “Issue 2”.

The ballot measure allows for the following:

- Possession of up to 2.5 ounces of marijuana or 15 grams of marijuana extract by adults;

- Ohioans could purchase marijuana at retail locations or grow up to 12 plants in a private residence (where at least two adults reside); and,

- Retail cannabis products would be taxed at 10%.

If this measure passes Ohio could become the 24th state to legalize cannabis for recreational use.

Finally in September, and interestingly enough, it was announced in Cannabis Health News that The Netherlands plans to launch a cannabis legalization pilot in December 2023. This might be a surprise to those of us who have visited the Netherlands, where cannabis has been a staple in coffee shops for decades. According to the announcement:

“Under current laws, coffee shops are allowed to sell small amounts of cannabis to consumers, but they must operate under strict rules, and suppliers are prohibited from selling any cannabis to the businesses, creating what has become known as the ‘backdoor policy’… the sale and cultivation of cannabis for recreational purposes remains illegal outside of these establishments”.

What has been approved by Netherlands’ officials is a program called Wietexperiment (Weed Experiment), which permits several cultivators to supply legal cannabis to coffee shops in 10 cities throughout the Netherlands.