October 2023 saw precious little support for cannabis equities (see above), and many CRBs returned to their pre-HHS rescheduling announcement lows. We are all old enough to remember the euphoria of August month end that continued its honeymoon into mid-September, only to level off and enter into a veritable free fall by mid-October. This market for publicly-traded cannabis equities has the emotional stability of a kid in middle school and we are somewhat dumfounded at the complete lack of confidence that investors seem to have in it just a few weeks after some game-changing news.

What happened? While there might be several factors at play, one reasonable explanation would be that the recent chaos in the US House of Representatives did not help. With (possible) THC rescheduling most likely a year away, the only other piece of good news for cannabis investors to cling to is the latest iteration of the SAFE Banking Act, now called the SAFER Banking Act. While SAFER has bipartisan support, the margins are razor thin and it is unclear if there are enough congresspeople from both chambers to get it through particularly in these contentious times. [For an excellent summary of SAFER Banking, please check out CRB Monitor’s article “With Bipartisan Support, Cannabis Banking Bill Heads to Senate Floor” on crbmonitor.com.]

Now enter Mike Johnson (R-Lousiana), the new Speaker of the House, who is about as conservative as we have seen in a leadership role in that body. While we do not know how Mr. Johnson will lean going forward (we can only imagine), we do know that his voting record as it relates to cannabis shows an extreme lack of support for reforms of any kind. And so it was no surprise when Johnson’s ascent to his new job was accompanied by a wholesale cannabis selloff in October.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), felt the October sting that was evident across the cannabis industry. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index posted a negative 20.5% return in October 2023 and finished ahead of its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (-22.9%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US marijuana touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (Strength of Theme et al) as well as rules for inclusion, particularly thresholds for minimum price and market capitalization.

HERBAL finished ahead of the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (-26.3%) and finished significantly ahead of the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which closed out October with a return of -36.2%. The funds with US MJ exposure experienced a more profound recoil following the August-September rally, given their sensitivity to the perceived positive impact from US cannabis reform, and the possible negative impact when reforms are delayed.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its unusual composition. Since its origin MJ has held a significant percentage of non-Pure Play (and in a few cases non-CRB) holdings, more specifically tobacco stocks with either very small or no cannabis exposure at all. Additionally, In 2022 MJ added and maintains close to a 50% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can also deviate materially from HERBAL’s as well (as it did in October), largely due to its significant holding in CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap struggled along with the rest of the industry, losing 30.7% for October 2023. This basket, which is an equally-weighted portfolio of the 11 largest Pure Play CRBs, had a similar result to the field of cannabis-themed ETFs given that it holds essentially the same equities. Individual security returns were weak across the board with no exceptions this time (see the table below).

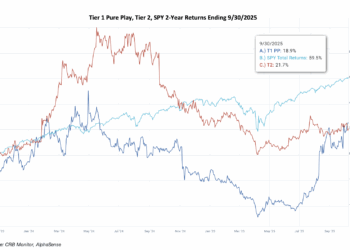

The CRB Monitor equally-weighted basket of Tier 2 CRBs finished the month ahead of the Tier 1 CRB basket, posting a -6.7% return in October. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. With that said, the breadth of the Tier 2 basket has shrunk over time and the spreads have widened, which will likely contribute to short term performance differences as well.

US equities slumped again in October as the war in Israel and Gaza, fears of a government shutdown and chaos in the US House of Representatives succeeded in keeping stock prices down. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a negative -2.8% for the month, which investors would suspect had some impact on the performance of cannabis equities.

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – October 2023 Returns

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities came crashing down to earth, returning -30.7% for October 2023, with both the Canadian and MSO groups experienced a stunning reversal from the euphoria just a month earlier and just weeks ahead of earnings season. While we frequently see the returns of the Canadian (non-US plant-touching) group deviate from the US multistate operator MSO group due to their individual sensitivities to various factors, this time the anguish was displayed equally among the companies in both groups.

The “legal” Canadian CRB basket generally got slammed in the month of October. In a stunning reversal from September, Canadian Tier 1B CRB Canopy Growth Corporation (TSX: WEED) (-25.7%) was the worst performing company in the group. Not too far ahead were Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) (-24.7%) and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-24.2%). The high flier in the Canadian CRB group was Tier 1B Cronos Group Inc. (TSX: CRON) (-7.7%).

Things were even worse for the MSO basket as Tier 1A The Cannabist Company Holdings Inc.(CBOE Canada: CBST) (-57.7%) finished last in this downward spiral as it began trading on the CBOE Canada. The rest of the MSO group fared a bit better, but still horrendous, with Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-34.4%), Tier 1A Trulieve Cannabis Corp. (CSE: TRUL) (-24.4%), Tier 1B Cresco Labs Inc. (CSE: CL) (-34.6%), and Tier 1B TerrAscend Corp. (TSX: TSND) (-20.8%) all giving back most if not all of their temporary gains in late August/early September.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a negative 6.7% return for October 2023, which outperformed the equally-weighted Tier 1 basket by 24%. Typically these two baskets are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), and we expect Tier 1 and Tier 2 CRBs to “mean revert” periodically; however, we also feel that there is no need to try to game them as a strategy. When these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the time it takes to mean revert is not so easy to predict. And furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains.

Performance across the Tier 2 basket was mixed but mostly negative in October 2023. Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (-5.1%), continued to reverse out more than 100% of its August gains as this company struggles to recoup all of its investors’ losses over the last two years. On November 2nd IIPR reported its 3rd quarter results, with the following highlights which had a temporary positive impact on IIPR’s share price (before it corrected in mid-November):

- Generated total revenues of approximately $77.8 million in the quarter, representing a 10% increase from the prior year’s quarter.

- Recorded net income attributable to common stockholders of approximately $41.3 million for the quarter, or $1.45 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) of approximately $64.8 million, or $2.29 per share, increases of 7.8% and 7.5% from the prior year’s quarter, respectively.

- Paid a quarterly dividend of $1.80 per common share on October 13, 2023 to stockholders of record as of September 29, 2023. The common stock dividends declared for the twelve months ended September 30, 2023 of $7.20 per common share represent an increase of $0.40, or 6%, over dividends declared for the twelve months ended September 30, 2022.

Tier 2 CRB REIT AFC Gamma, Inc. (Nasdaq: AFCG) (-9.9%) struggled in October as well, as it announced its quarterly dividend of $0.48 mid-month and on October 30th announced the appointment of Daniel Neville as their new CEO.

Finally, Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) was negative (-18.2%) and has now slumped for two straight months. In early November, Hydrofarm announced its 3rd quarter results, which featured another significant drop (-$20mm) in sales but repeated an increase in net gross profit of $5mm. As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day.

Chart of the Month: CRB Monitor Strength of Theme

This edition of the CRB Monitor Chart of the Month some insight into the work that we have been doing for the last 3 years, the calculation of a risk factor for cannabis equities that we call Strength of Theme (SOT). As we have written in the past, Cannabis is one of our latest emerging markets, and we call it that given it’s unique characteristics that make it on a different level of investability than typical equities. And cannabis will remain an emerging market until investors and financial service providers are unburdened by the fear that their participation in the space is illegal in the eyes of many regulators around the world.

Strength of Theme combines 10 sub-factors including sentiment, CRB Monitor risk tier, Pure Play designation, and universe members’ subsidiaries’ underlying license characteristics. The inputs to these factors are derived from publicly-available information; however, without the CRB Monitor securities database this data would be very difficult, if not impossible, to accumulate effectively and efficiently. The CRB Monitor database, now eight years into its evolution, is in a unique position to provide the data necessary to calculate relative Strength of Theme across the entire HERBAL index universe.

The SOT risk factor and sub-factors can be used to construct indexes, risk models and portfolios. The breadth of the CRBM universe (now 1,300 companies) and the depth of the data (information on more than 200,000 cannabis licenses) that are used to calculate individual factors speak to the effectiveness of the SOT.

It is important to note that the CRB Monitor Strength of Theme factor is not intended to be a calculation of alpha or expected return, but rather a measure of a company’s risk and overall exposure to the cannabis industry. When combined with measures of investability (e.g., market capitalization, ADV, etc.), Strength of Theme can be an effective tool in the construction of indexes and investment vehicles, particularly ETFs.

We have provided two interesting charts to demonstrate the value of Strength of Theme. On the one hand, (looking at the first chart below) the really great thing about this factor is it’s dispersion across the Tier 1 and Tier 2 universe. While identifying all of the companies on the chart would be exceedingly messy, it is easy to see that SOT makes for a nice balance to market cap weight – not necessarily as a source of outperformance but rather as a tool for risk management.

Source: CRB Monitor

Source: CRB Monitor

Looking at the second chart below, we can see how, in spite of the factor’s dispersion across the CRB universe, it is largely is stable historically. This suggests that, in a market as volatile as cannabis equities, the SOT factor as a diversifier will not cause wild swings in portfolio weights over time. With that said, there will be exceptions from time to time, as new companies are added to the universe or if a CRB makes a significant acquisition of licensed businesses, which would require a more significant reweighting.

It is important to note that the CRB Monitor Strength of Theme is a critical factor in the construction of the Nasdaq CRB Monitor Global Cannabis Index (HERBAL). Because Strength of Theme is a comparative measure of operational diversification it is an excellent complement to Nasdaq’s current inclusion and weighting criteria, which do not feature unique data like ours. It is also worth repeating that CRB Monitor is not in the business of stock selection or making buy/sell recommendations; however, because our research does provide a unique measure of operational diversification and relative risk, we encourage cannabis investors to approach us to discuss potential uses for this data.

[Our readers should expect to see additional analyses from us in the future, including backtesting results, which we expect will reinforce our expectations that SOT, when combined with standard investability factors like market cap and trade volume, will help to control risk in cannabis equity portfolios and indexes.]

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for October 2023:

Cannabis Business Transaction News – October 2023

Cannabis business activity kept moving along in October, coincidentally regardless of the impact of recent revelations regarding HHS’s recommendation for rescheduling and SAFER Banking, offset by the turmoil in the US House of Representatives. Now for some news:

In early October Canadian Tier 1B CRB Tilray Brands, Inc. (NASDAQ: TLRY) issued a press releaseannouncing that they “closed their all-cash previously-announced acquisition of eight beer and beverage brands from Anheuser-Busch (NYSE: BUD), including the breweries and brewpubs associated with them.” The acquired businesses include Shock Top, Breckenridge Brewery, Blue Point Brewing Company, 10 Barrel Brewing Company, Redhook Brewery, Widmer Brothers Brewing, Square Mile Cider Company, and HiBall Energy.

The press release goes on to say: “Irwin D. Simon, Chairman and Chief Executive Officer, Tilray Brands, said, “…With this EBITDA accretive transaction, Tilray has acquired a stellar lineup of eight craft beer and beverage brands that both solidify our leadership in the craft beer industry and strengthen our business in the expansive beverage sector in which we see tremendous opportunity to reinvigorate innovation across many categories including non-alcoholic beverages, energy, and nutritional drinks.””Tilray, which now holds, through its subsidiaries, 353 active cannabis licenses. The acquisition of these 8 beverage brands gives TLRY a runway to secure a foothold in the cannabis-infused beverage industry, which is set to take off in the years to come.

Also in October, Tier 1B MSO Cresco Labs Inc. (CSE: CL) announced in a press release the opening of its latest legal medical cannabis dispensary, Sunnyside Altoona in the Commonwealth of Pennsylvania. In the words of the announcement, “Sunnyside Altoona is dedicated to helping qualified patients unlock all the benefits that medical marijuana can provide. The new store will offer a wide assortment of accessories and medical marijuana products like flower, vape cartridges, disposable vape pens, concentrates, troches, topicals, tinctures and more from the Company’s branded portfolio that includes Cresco, Supply, FloraCal Farms, Wonder Wellness Co. and Remedi.” With the closing of this new purchase, Cresco’s active and pending-approval license count expands to 67 across 9 states.

Ever-expanding Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) announced the opening of Zen Leaf Newington, the company’s second social equity joint venture location in Connecticut and fourth cannabis dispensary statewide. In the words of the October press release, “In opening Zen Leaf Newington, Verano received support for the company’s approved social equity plan by several local organizations, including Connecticut Foodshare, Connecticut Pardon Team, New Life II Ministries of New Britain, North Oak Neighborhood Revitalization Zone of New Britain, St. Mark’s Episcopal Church of New Britain and the New Britain Food & Resource Center.” With all of that said, Connecticut adult-use dispensary openings have been a slow crawl since legalization two years ago. Verano’s ongoing expansion has resulted in their ownership of 80 active cannabis licenses across 12 states plus the District of Columbia.

Finally, in October it was announced that Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) will open RISE Dispensary Sun City Center, the Company’s tenth retail location in Florida and 86th nationwide, on October 27th. In the words of their October 25th press release, “RISE Dispensary Sun City Center will welcome patients with a grand opening celebration on November 14th, where profits from the day will be donated to Minorities for Medical Marijuana.” With this recent opening, Green Thumb’s licence count is 99 that are either in active status or are pending approval.

Select CRB Business Transaction Highlights

Security/Exchange Highlights

| Company Name | Ticker Symbol | EVENT Type | Result |

| Verano Holdings Corp. | CBOE Canada: VRNO | New Listing | Verano Commences Trading on Cboe Canada |

| 4Front Ventures Corp. | CSE: FFNT | New Listing | 4Front Ventures Announces Agreement to Issue Warrants to Lender in Connection with Amendment to Previously Entered Promissory Note Agreement |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Pathway Health Corp. | TSXV: PHC | Added to DB | Tier 3 – Professional Services |

| Santo Mining Corp. | OTC Pink: SANP | Added to DB | Tier 2 – IT Services & Software |

| Revvity, Inc. | NYSE: RVTY | Added to DB | Tier 3 – Health Care Equipment, Devices & Supplies |

Cannabis News: Regulatory Updates

First, in October it was reported by our very own CRB Monitor journalists that the Oklahoma Medical Marijuana Authority (OMMA) and law enforcement are focusing attention on illegal activity at licensed cannabis businesses, resulting in arrests, fines and business shut downs.

According to the article, the step-up in enforcement began at the beginning of the year, but a lot of activity has occurred since this summer.

In June, OMMA Executive Director Adria Berry identified eight enforcement areas:

- Untagged inventory

- Certificate of Analysis (testing) compliance

- Sales over legal limit

- Multiple licenses for one address

- Timely waste disposal

- Monitoring for unauthorized movement or diversion

- Plant destruction to prevent diversion

- Patient license reuse

The Oklahoma regulators expect to see a reduction of 30%-40% in the number of cannabis licenses, which is not great news for good actors in the industry but still a necessary move to clean things up.

In October an article in Marijuana Moment reported that The Eastern Band of Cherokee Indians(EBCI), members of which last month voted to legalize adult-use cannabis, “began issuing its first medical marijuana patient cards last week.” In the words of the article, “It’s a major milestone for the program, which was passed by the Tribal Council in 2021 but has yet to see a single sale as the result of numerous delays.” This will be an interesting story to follow, as North Carolina is one of the only states in the US where cannabis is still illegal in any form. The author goes on to say, “It’s still not clear when registered patients will actually be able to shop in the tribe’s dispensary on the 57,000-acre Qualla Boundary—technically the only place within North Carolina where cannabis is legal in any form as a medical marijuana bill continues to stall in the state legislature. But last Thursday, officials issued the tribe’s first medical marijuana card, according to the newspaper Cherokee One Feather.”

Also in October, an article in MJ Biz Daily reported that Germany-based Sanity Group is teaming up with the Swiss Institute for Addiction and Health Research (ISGF) to open two legal recreational cannabis stores (the first legal dispensaries in Europe) in Switzerland as part of the country’s pilot study into dispensing marijuana. In the words of the article, “Overall, the Sanity Group-ISGF pilot project is the sixth that has been given the green light. ISGF and Sanity Group said they received final approval from the Federal Office of Public Health to conduct the cannabis pilot study.

That followed approval from the Ethics Committee Northwest and Central Switzerland last year…The study will examine the regulated sale of cannabis for nonmedical purposes. It will be led by Michael Schaub, the ISGF’s scientific director.”

Another October article in MJ Biz Daily reported that the regulators in the great state of Alabama, currently featuring no available legal marijuana, pledged “to issue the first medical MJ business licenses by the end of 2023.” According to the author, That would be some relief to marijuana entrepreneurs, which this summer watched the Alabama Medical Cannabis Commission (AMCC) twice award and then retract business permits amid lawsuits and allegations of impropriety…In the meantime, legal medical marijuana remains unavailable in Alabama, more than two years after state lawmakers legalized access to the drug.”

After the two false starts, the AMCC at its Thursday meeting unveiled a third method for awarding business. The article goes on to say, “Companies will make fresh presentations to the AMCC, which may also weigh scored applications from the previous two scotched rounds.”

Meanwhile, Bloomberg reported that New York State “will license five new marijuana dispensaries to open, part of an effort to keep up with growing demand and out-compete illicit sellers, according to the state’s cannabis regulator.” According to the article, “The new stores include locations in New York City’s Astoria, Harlem and the Lower East Side districts…that will bring the state’s total to 27.” As has been widely reported, New York’s legal cannabis program got off to a rocky start with many “pop-up” illegal dispensaries scattered throughout the five boroughs. The article goes on to say, “Sales from the stores have hit $83 million year-to-date, even with many closed for renovation, according to the agency.” We will take a wait-and-see approach when it comes to the illicit market, which seems to have been a challenge for regulators in New York to control.

Finally, from Denmark: It was reported in October on the website businessofcannabis.com that Denmark’s medical cannabis Pilot Programme has seen patient numbers grow by more than 90% between Q2 2022 and Q2 2023. According to the article, “Recently published data from the Danish Health Data Authority shows that the number of patients taking part in the medical cannabis Pilot Programme, launched in 2018, has skyrocketed this in 2023, and now represents the largest access scheme in the country.” The article goes on to report: “According to Danish medical cannabis operator and Tier 1A CRB Stenocare A/S (Nasdaq Nordic: STENO), which produces two cannabis oil formulations for the pilot, this coincides with the introduction of its oils to the scheme and represents a shift in preference away from cannabis flower towards oils.”

CRBs In the News

The following is a sampling of highlights from the October 2023 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.