December 2023 provided, if nothing else, a ray of hope for those investors that have stuck around for the duration of this performance history that boasts all the excitement of a Henrik Ibsen play. And if we are to look at December as a beginning, as opposed to an end, then people who care about these companies still have a few things to look forward to as this election year starts in earnest.

Truth be told, it is hard to believe that cannabis reform will be a priority in Washington this year, as politicians can scarcely agree on which allies to provide aid to or, even more important, how to keep the US government open. As we get closer to the middle of 2024, the economy will be front and center as a key driver for independent voters. And it will be uncertain whether politicians will want to place cannabis legalization higher on the agenda than the border or Israel/Ukraine aid.

So where does that leave cannabis? Surely, the hot-button issues like SAFE banking and DEA rescheduling will be on Americans’ minds as they pull the lever next fall, but hold on. SAFE banking has been tried and has failed to become a law a half dozen times. And the rescheduling of THC from a Schedule I narcotic to a Schedule III medication is far from a done deal. To that end, we suspect that the idea of rescheduling is more complicated than people have considered, given the persistent push-back from a considerable number of politicians at the federal level. And on that note, we will have to stay tuned this year, and hope that cannabis reform is not pushed aside to make room for bigger fish in 2024. [We will take a look at the full year 2023 in our Chart of the Month later in this newsletter.]

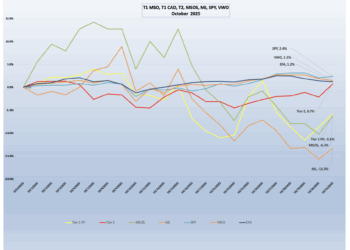

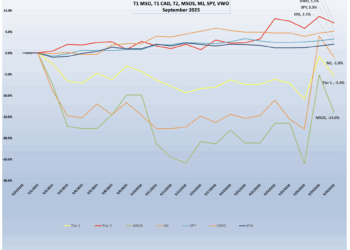

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), had a big December and an optimistic end to 2023. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index posted a positive 9.7% return in December 2023 and finished slightly behind its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (+10.5%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US marijuana touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (HERBAL’s Strength of Theme enhancement et al) as well as rules for inclusion, particularly thresholds for minimum price and market capitalization.

HERBAL finished ahead of the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (+5.6%) as well as the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which closed out December with a return of +2.8%. The funds with US plant-touching MJ exposure were the big victims of the reversal in US MJ, given their sensitivity to the perceived impact from US cannabis reform (or lack thereof).

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its unusual composition. Since its origin MJ has held a significant percentage of non-Pure Play (and in a few cases non-CRB) holdings, more specifically tobacco stocks with either very small or no cannabis exposure at all. Additionally, In 2022 MJ added and maintains close to a 50% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can also deviate materially from HERBAL’s as well (as it did in December), largely due to its significant holding in CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap was positive again in December, gaining 2.5%. This basket, which is an equally-weighted portfolio of the 11 largest Pure Play CRBs (including both US plant-touching and non US plant touching MJ), had a return that landed in between the two groups.

The CRB Monitor equally-weighted basket of Tier 2 CRBs finished the month a bit ahead of the Tier 1 CRB basket, posting a +3.8% return in December. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. With that said, the breadth of the Tier 2 basket has shrunk over time and the spreads have widened, which will likely contribute to short term performance differences as well.

US equities posted gains in December as we continued to see positive signs from the Fed which provided investors with some nice gains at year end. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a +4.6% for the month and propelled US equities to close 2023 with record gains.

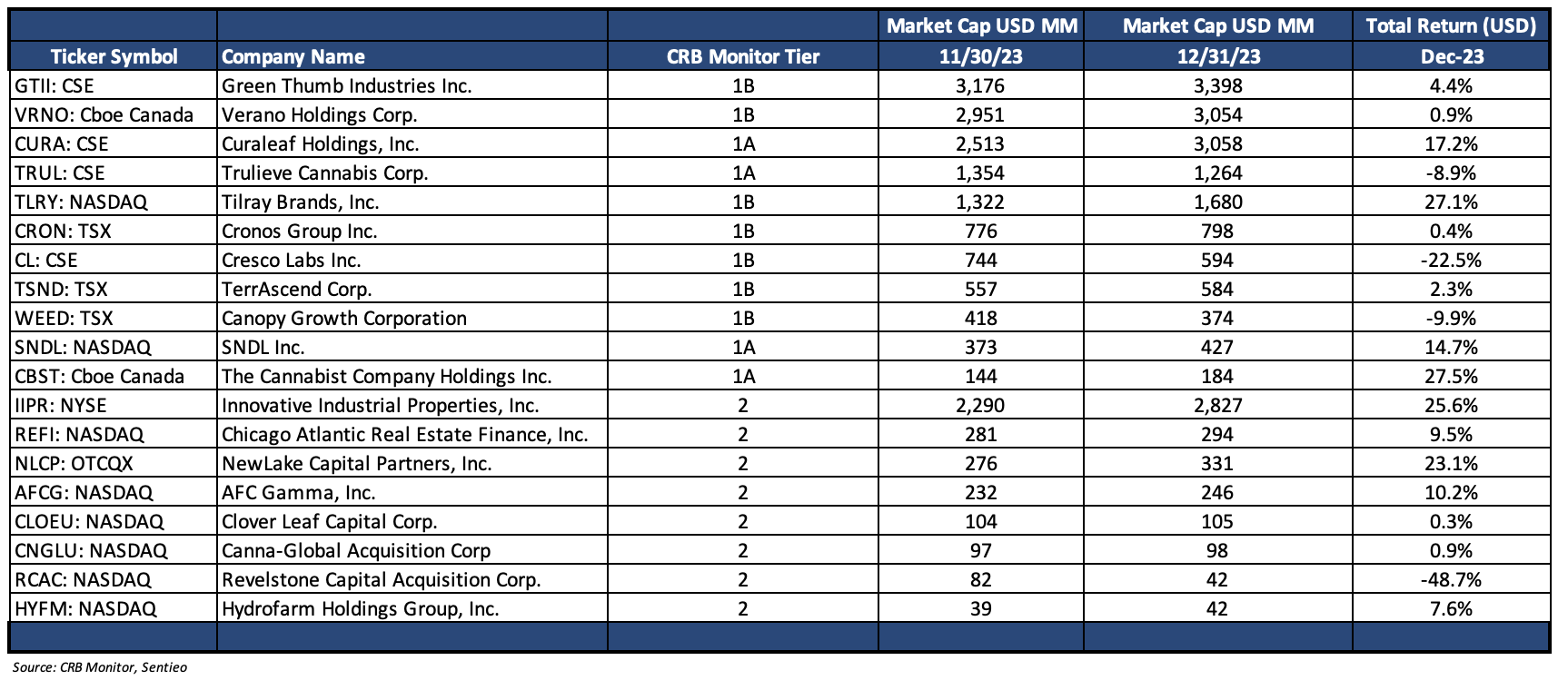

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – December 2023 Returns

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities had a positive return in December (+2.5%), with most of the upside coming from the CAD group with the MSO CRBs falling behind this time. The near-flat performance indicates the spread of returns, which seemed to be fairly equal between the gainers and losers. With that said, we saw the MSOs reversing their outperformance from November.

The “legal” Canadian CRB basket generally did well in the month of December, with an array of double-digit returns that certainly pleased investors, particularly in the ETF space. Canadian Tier 1B CRB and household name Canopy Growth Corporation (TSX: WEED) (-9.9%) was the only dark spot in an otherwise bright December for the Canadian cannabis basket. Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) (+27.1%) soared throughout the month on the heels of its November 15th announcement that it would be releasing “a bold new range of cannabis-infused beverages from its renowned brands XMG and Mollo. Recognized for their diverse flavors and innovative cannabinoid profiles, including THC, CBG, and CBD.” Canadian CRBs also performing well in December included Tier 1A SNDL, Inc.(Nasdaq: SNDL) (+14.7%), while we saw essentially flat performance from Tier 1B Cronos Group Inc.(TSX: CRON) (0.4%).

Performance was balanced in December for the MSO basket as Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+17.2%) and Tier 1A The Cannabist Company Holdings Inc. (CBOE Canada: CBST) (+27.5%) were the all-stars for the month in an otherwise ho-hum field. Curaleaf was on a veritable rollercoaster ride, spiking early in the month following the announcement that it had conditional approval to up-list its subordinate voting shares on the TSX which would require a reorganization of its US operations – so stay tuned. The Cannabist Company’s strong return looks like a claw-back from two straight months of dreadful returns.

Tier 1B TerrAscend Corp. (TSX: TSND) (+2.3%) and Tier 1B Verano Holdings Corp. (CSE: VRNO) (+0.9%) were modestly positive while Tier 1B Cresco Labs Inc. (CSE: CL) (-22.5%) and Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) (-8.9%) struggled throughout the month, reversing out a significant chunk of their November gains. Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) finished the month up 4.4%.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a positive 3.8% return for December 2023, which outperformed the equally-weighted Tier 1 basket by 1.3%. Typically these two baskets are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), and we expect Tier 1 and Tier 2 CRBs to periodically cross paths. When these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the precise moment when these two baskets mean revert is not easy to predict. And furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so beware!

Performance across the Tier 2 basket was mixed but featured some bright spots in December 2023. Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (+25.6%), is on a two-month winning streak and finished 2023 up 12.3%. In mid-December, IIPR announced its quarterly dividend of $1.82/share, which represented a $0.02/share increase over Q3 2023. IIPR describes itself as “the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry.” It is also the largest Tier 2 CRB by market capitalization – more than ten times the next-largest Tier 2 company.

Tier 2 SPAC Revelstone Capital Acquisition Corp. (Nasdaq: RCAC) lost nearly half its value, down 48.7% for the month of December. In mid-December, Revelstone announced its proposed business combination with a charter private jet company, Set Jet, Inc. As Set Jet is not a cannabis-related business, this company will be removed from the CRB Monitor database upon the closure of this deal.

Finally, Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) posted a positive return (+7.6%). In early December, Hydrofarm announced its 3rd quarter results, which featured a significant drop (-$20mm) in sales but repeated an increase in net gross profit of $5mm. Also covered in this earnings report was the Initiation of “a second phase of restructuring plan, which includes U.S. manufacturing facility consolidations, to improve efficiency and generate further cost savings.” As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day.

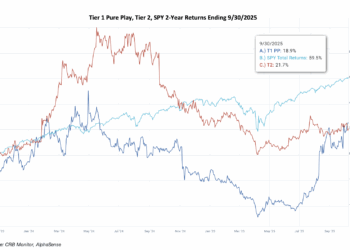

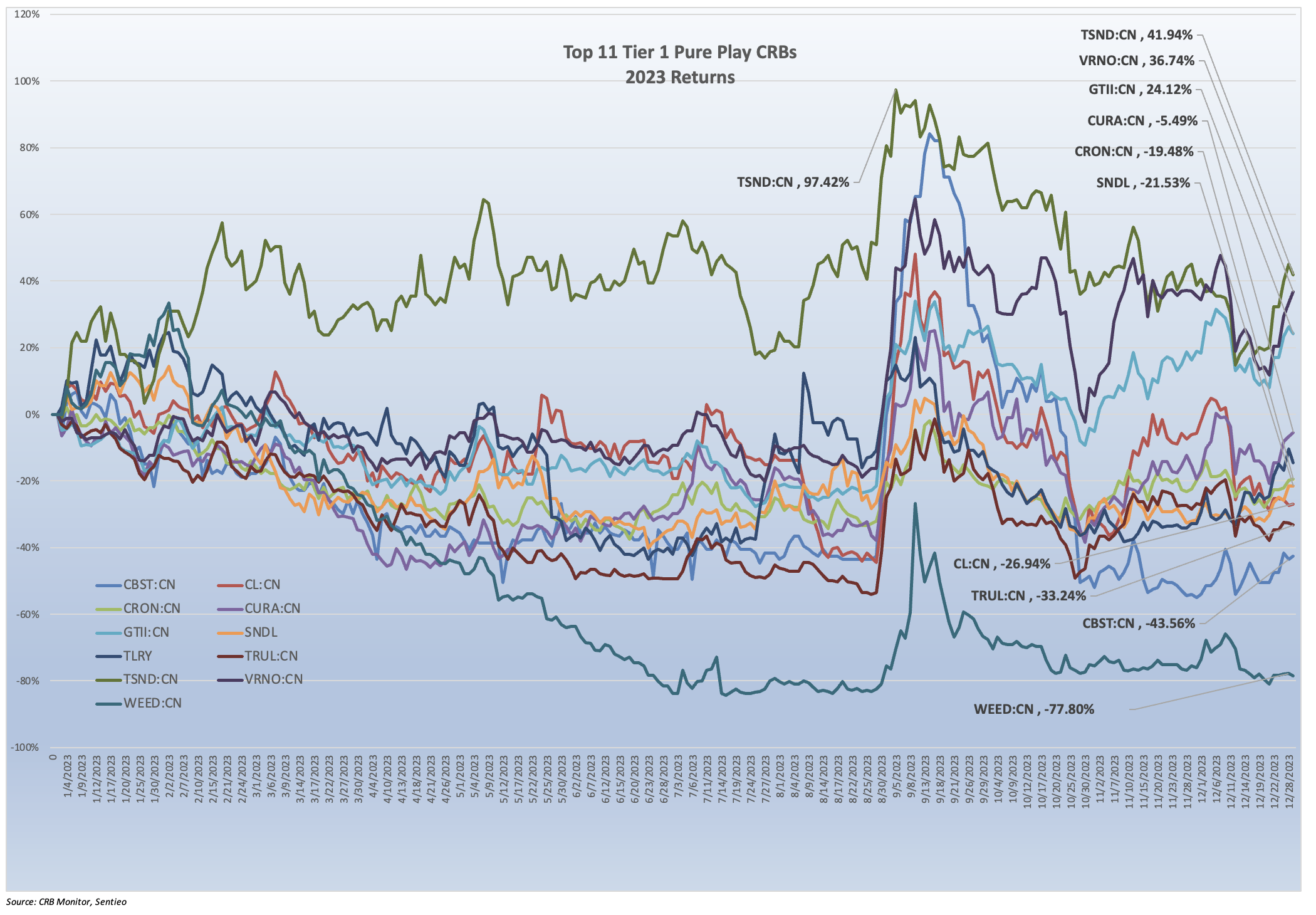

Chart of the Month: 2023 Cannabis Equity Performance

It’s hard to believe that it has been a whole calendar year, but here we are, post-December 31, and arguably we are no closer than we were a year ago to the legalization of marijuana at the federal level. Chalk it up to political gridlock, or prioritization, or apathy, but cannabis businesses will need to accept the fact that state-by-state legalization is all they will see for the foreseeable future. With that said, the two frequently-discussed reforms, SAFER and Rescheduling, offer a glimmer of hope while they are still in progress.

Some disappointing results for some

And because it is year end, we find it appropriate to take a look at the year that was for cannabis-related businesses, specifically the ones that we can buy shares of on the open market. The chart below is not an optical illusion, it really is a look at 2023 performance of the largest Tier 1 pure play CRBs. The double black diamond-like line at the bottom of the chart tracks the return of Canopy Growth Corporation (TSX: WEED) (-77.8%), a company that was once called “the Google of cannabis.”

In 2024 it is safe to say that Canopy boasts a lot less “Googli-ness” than it used to, given its wild price swings and incredible shrinking market cap. In December 2023, Canopy Growth announced a 1 for 10 reverse split, which (of course) resulted in an automatic, significant price increase (this was short-lived). This move was more for self-preservation than anything else, as WEED was in danger of losing its exchange listing due to its falling price. And so the 1-10 split took care of this; however, investors initiated a sell-off that persisted for the entire year. We also know that Canopy Growth’s new minimalist operating strategy, while viewed as defensive, has not helped to stem the sell pressure.

The one moment of relief for Canopy Growth’s share price was the September spike, caused by the leaked memo by the HHS that recommended rescheduling marijuana to Schedule III from Schedule I. It is clear that, aside from the rescheduling spike in September (see the chart below), WEED had a dreadful year.

Also hitting the skids in 2024 was Tier 1A MSO The Cannabist Company Holdings Inc. (CBOE Canada: CBST) (-43.6%). The Cannabist, formerly known as Columbia Care, struggled, but survived following its failure to be acquired by larger Tier 1B Cresco Labs Inc. (CSE: CL) (-26.9%), which also had a rough year. This 18-month long adventure should serve as a cautionary tale to any CRB that is looking for a business combination in this heavily-regulated space, and we watched as the Cresco/Columbia Care deal collapsed as they raced to divest of cannabis subsidiaries to satisfy local authorities.

Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) (-33.2%), famous for its sizable medical cannabis presence in the state of Florida, delivered significant losses to investors in 2023. Trulieve, whose stock price is now approximately 95% lower than it was just two years ago, was once considered a hot property by investors who were willing to take a flyer on the future legalization of US plant-touching marijuana. If legalization had come through, TRUL was in an excellent position to rally, having secured significant market share in Florida while moving into several other states. But their expansion was also their downfall. From a March 2023 article in The Motley Fool: “The company’s $2.1 billion acquisition of Harvest Health & Recreation in 2021 made Trulieve the largest MSO in the country in terms of dispensaries, but that deal is the biggest reason Trulieve isn’t profitable.” In an increasingly competitive market, where success depends not only on legalization at the federal level but legalization of adult-use marijuana in the state of their largest operational footprint, Florida.

And on the bright side, the others

The best performing CRB in the basket in 2023 was Tier 1B TerrAscend Corp. (TSX: TSND) (+41.9%), but as we can see in the chart below that there is more to the story: TSND climbed to a +97% YTD return with the aforementioned September euphoria before losing more than 50% of its value by year end. With that said, Terrascend, with more than 100 active or pending cannabis licenses, had the distinction of remaining in positive territory throughout 2023, posting a YTD return of more than 40% by the date of their Q4 2022 earnings report (March 16), which spun a positive tale of significant increases in net revenue, profits, and cash flows from operations. And it is safe to say that even TerrAscend, with it’s impressive year-on-year financials, was and is just as vulnerable to the political environment as every other company in the Tier 1 basket. In fact, TSND has fallen more than 70% over the last two years.

Also closing out 2023 on a positive note was Tier 1B Verano Holdings Corp. (CSE: VRNO) (+36.7%), an MSO that has been widely known for its rapid expansion across the US over its 3-year history. Verano’s performance was largely negative for much of the first three quarters of 2023 (-17%), but the HHS recommendation for rescheduling turned VRNO’s year around, propelling it more than 50% over the last 100 days of 2023. And a mediocre Q3 earnings report in November notwithstanding, Verano’s financials were good enough for investors to prop up their share price, but in this volatile year these mostly sentiment-driven share prices can turn around quickly.

The largest pure play Tier 1 CRB, Green Thumb Industries Inc. (CSE: GTII) (+24.1%) followed a similar pattern in as most of its peers in 2023, which featured a depressed share price that had fallen by more than 22% before the rescheduling spike in mid-September. That event triggered a rally that boosted GTII by more 50% by the end of 2023. On November 8th, Green Thumb reported its 3rdQuarter financials, which were respectable given that the company earned a profit and boasts a reasonably healthy balance sheet with $137 million in cash. But similar to the rest of the pure play cannabis space, the impact of the progress (and lack thereof) toward legalization in the US continues to overshadow the operating highlights. Green Thumb has had a decent run relative to the rest of the MSO basket, with a two-year return of minus 45%, which looks horrific but is actually far better than most of its peers in the cannabis space.

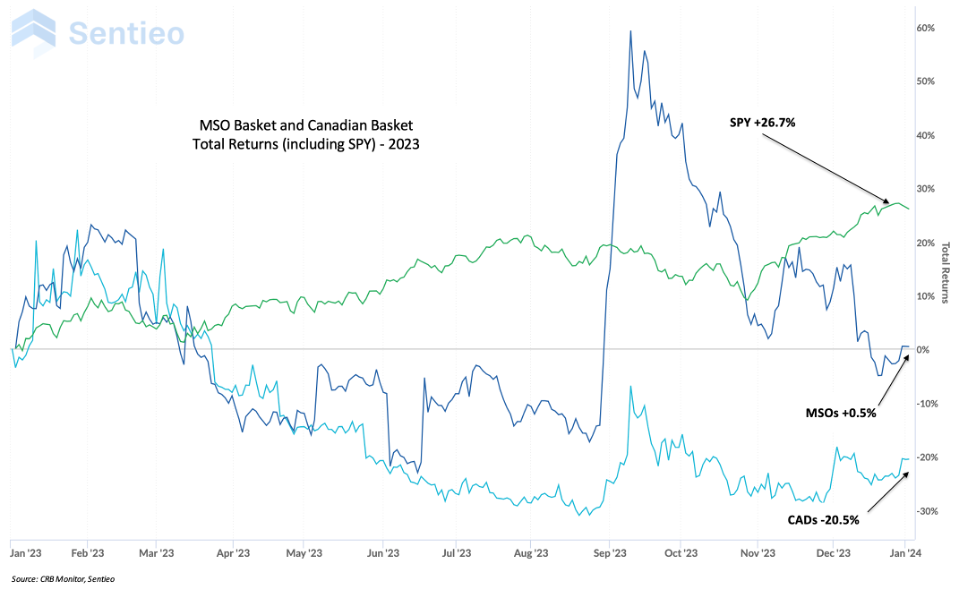

MSOs and CADs

Our last Chart of the Month featured the long-term performance of the MSO group vs. those CRBs with no US marijuana touch points. Since the returns of these baskets showed some significant divergence, we thought it would be useful to show how those two groups performed in 2023. Truth be told, the volatility has been off the charts, particularly as investors attempt to time this market, which features low share prices, weak volumes, and wide spreads. We would not be surprised for these two paths to cross (perhaps more than once) in 2024, as sentiment continues to shift with the evolving regulatory environment.

Multistate operators (MSOs) are CRBs that spread their revenue-generating, licensed cannabis operations (cultivation, manufacturing, distribution, etc.) across two or more states in the US. This model for doing business can be complicated and painful, but CRBs’ hands are tied while cannabis is still federally illegal and operating on a state-by-state basis (and internal to each state) is the only way to grow revenues within the US.

As such, MSOs face obstacles that can limit their ability to operate profitably in every state where they are licensed. Some notable hurdles include:

- Licensing requirements that seek to establish or restore social equity to CRB ownership

- Varying levels of state taxation

- Barriers to using mainstream banking services, such as payments, lending, and deposit accounts

- Varying degrees of participation by the illicit market which undermine the legal market

Given the abovementioned headwinds, several large, publicly-traded multistate operators have closed their operations in one or more states. And we thought it might be interesting to take a look at this trend in the cannabis industry as it could be a reflection of companies’ need to survive while the politicians figure things out.

And we are quite sure that investors in cannabis equities are happy that 2023 is finally in the rear-view mirror.

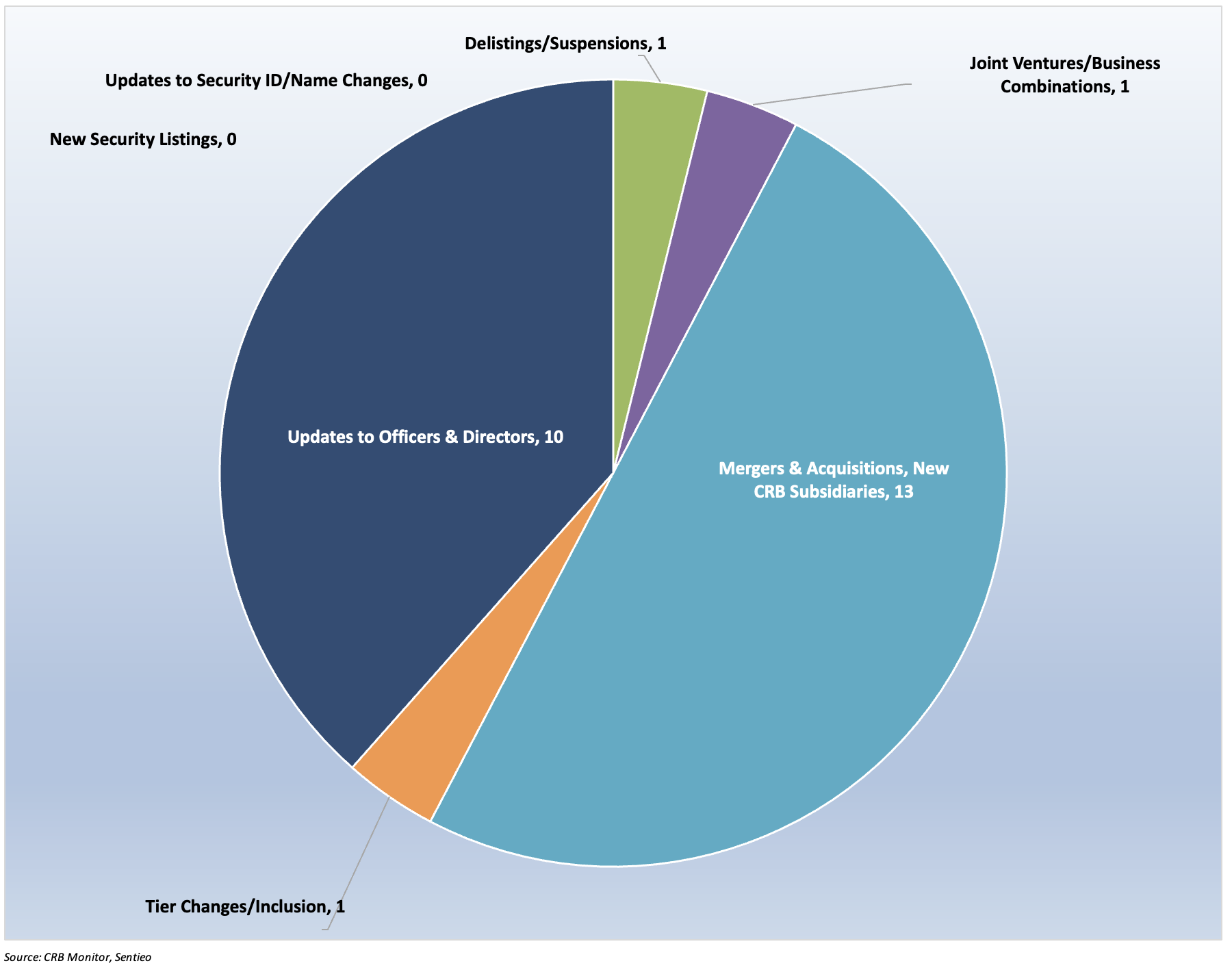

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for December 2023:

Cannabis Business Transaction News – December 2023

Cannabis business activity kept our analyst busy in December, and as we can see in the above table the focus of our daily database coverage has been on operational expansion as well as officer/director announcements. Now for some news:

In December Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) issued a press release announcing the opening of “its second dispensary location in Sarasota, Florida”. According to the announcement, “this is the company’s 61st location in Florida…Curaleaf’s second Sarasota dispensary will offer a curated menu of premium cannabis products, featuring an extensive selection of flower and pre-rolls, JAMS and Blue Kudu edibles, as well as the top-selling Select line, including Select Briq, Select Live Rosin, Select Live Rosin X Bites and the innovative vape hardware, Cliq by Select.” With this new opening, Curaleaf’s operational footprint has grown to 4 countries (19 states + DC) and 138 cannabis licenses that are either in active or pending status.

On a less happy note, Tier 1B household cannabis name MedMen Enterprises Inc. (CSE: MMEN) announced in a December press release that it has “entered into definitive agreements to sell its non-core business operations in Arizona and certain assets in Nevada to an affiliate of Mint Cannabis, a private multi-state cannabis operator headquartered in Arizona”. The announcement goes on to say, “The transactions consist of the sale of MedMen’s wholly-owned operating subsidiary in Arizona and its two operating dispensaries located in Clark County, Nevada. These sales are the result of MedMen’s previously announced strategic review and evaluation of divestiture opportunities of its non-core assets. The transactions are subject to customary closing conditions, including, among others, the receipt of applicable regulatory approvals.” In the words of Ellen Deutsch Harrison, MedMen’s CEO: “MedMen is pleased with the outcome of our strategic review and has made good progress in our restructuring efforts. These transactions will bolster liquidity in the short term, reduce liabilities, and enable the Company to focus on operating efficiencies and executing our long-term asset-light growth strategy in our core markets.” Following this consolidation of operations, Medmen holds 45 cannabis licenses in 7 states that are either in active or in pending status.

Some news out of Florida: Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) continuing its domination of the medical cannabis landscape Sunshine State, announced in a December press release the opening of two new medical dispensaries in Crawfordville and Crestview, Florida. Grand opening celebrations were held in Crawfordville on Friday, December 29 and Crestview on Saturday, December 30. Both events begin at 9 a.m., featuring music, specials, discounts, and opportunities to register for upcoming patient education sessions. In the words of Trulieve’s Chief Executive Officer Kim Rivers, “We are excited to open these dispensaries, providing high quality products and service for Florida patients in the Big Bend and Panhandle regions”. The announcement goes on to say that “Both locations will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, O.pen, Seed Junky and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

Canadian Tier 1B High Tide Inc. (TSXV: HITI) issued a press release announcing that its Canna Cabana retail cannabis store located at 11501 Buffalo Run Blvd Tsuut’ina, Alberta “will begin selling recreational cannabis products and consumption accessories for adult use on Saturday, December 23.This opening will mark High Tide’s 160th Canna Cabana branded retail cannabis location in Canada, the 78th in the province of Alberta and the first Canna Cabana on the Tsuut’ina Nation.”

According to the announcement, “this brand-new Canna Cabana will serve community members of the Tssut’ina Nation, South West Calgary residents and the surrounding rural communities. Situated steps away from an internationally recognized membership-only wholesale grocery and retail chain, this new store stands out among other strong anchor tenants such as banks, quick-service restaurant chains, and major discount retailers. Located just off the newly completed section of Stoney/Tsuut’ina Trail, Calgary’s ring road, this store will welcome ELITE and Cabana Club members as one of the only cannabis stores within a two-kilometer radius.” Following this acquisition, High Tide holds 208 cannabis licenses in Canada and Australia that are active or pending approval.

Tier 1B Canadian CRB BZAM Ltd. (CSE: BZAM) (formerly The Green Organic Dutchman Holdings Ltd.) issued an early December press release announcing that it has entered into a definitive share exchange agreement to acquire Final Bell Canada Inc. (“FBC”) from Final Bell Holdings International Ltd. (“FBHI”). Under the terms of the Agreement, FBHI, the sole shareholder of FBC, will receive 90,000,000 common shares of BZAM at a deemed price of $0.15 per share, representing approximately one-third of the issued and outstanding shares of BZAM following the closing of the Transaction…BZAM will also enter into a supply agreement under which FBHI’s wholly owned subsidiary, 14th Round Inc., will continue to provide industry leading child-resistant packaging, high-tech vaporization hardware, and pre-roll cones to BZAM.” BZAM currently holds 14 active licenses in 4 Canadian provinces.

Finally, Tier 1B CRB Ayr Wellness Inc. (CSE: AYR.A) announced in a December press release the opening of two Florida retail stores which are located in Leesburg and Fort Myers. With the opening of these dispensaries, AYR’s operational footprint grows to 64 locations in Florida and 91 locations nationwide. It is important to note that Florida is still a medical cannabis-only state, so these new retail businesses will only serve medical customers while Florida wrestles with the issue of full legalization.

In the words of Sevi Borrelli, SVP, General Manager, Florida at AYR: “We remain committed to building strong relationships with our patients and the communities that we serve, and we are excited to bring that approach to Leesburg and Fort Myers via our two newest stores….Throughout 2023 we’ve opened 12 new stores in Florida, bringing our total to 64 across the state. We’re proud to have such a strong presence in the nation’s most robust medical cannabis market.”