January 2024 provided further evidence that the cannabis industry not only has a pulse but might actually pull itself together and survive the years-long regulatory nightmare that it has been in. And now, more than ever, there is evidence to suggest that marijuana could possibly shed the decades-long stigma that it is a “Schedule I Narcotic” (why it ever had this designation is a mystery) and that future generations of consumers will think of cannabis-derived products no differently than they think of alcohol or tobacco, or even Tylenol.

With that said, the idea of fully-legalized marijuana in the United States is still difficult to imagine, and we have written many times about the reasons for this. Most importantly, the government here in the US is broken. And those who watch the news occasionally can see that even the most reasonable actions of the legislative branch are seemingly impossible to complete, lest one side be viewed as “granting a victory” to the other side. Furthermore, the so-called “dangers of cannabis” have been almost universally debunked just as the benefits have been widely confirmed. And sadly we are all left waiting as the needs of consumers, businesses, and investors take a backseat to the political aspirations of a handful of elected individuals who are loathe to collaborate, even with members of their own party.

But as we have written several times, hope springs eternal, and for the last three months the largely sentiment-driven legal cannabis market is on a tear. This time around it was the MSO group outperforming (see the chart above), after it lagged the Canadian cannabis group in December. And so in spite of the ongoing indecision in Washington, state-by-state legal cannabis is alive and well and is positioning itself for rescheduling, and eventually, for federal legalization.

According to a recent report by cannabis industry website Flowhub.com, all statistics point to a rosy outlook for the industry. The highlights of the report include:

- Half of Americans have tried cannabis.

- The US cannabis industry is expected to reach almost $40 billion in 2024.

- 1 in 3 women over 21 consume cannabis.

- Cannabis will add $115.2 billion to the economy in 2024.

- Adult-use cannabis is now legal in 24 states.

- Support for legalizing cannabis hit a record 70%.

- Ranks of women and minority cannabis executives are rebounding.

- Cannabis earns higher tax revenue than alcohol in 9 states.

- Average retail cannabis prices dropped -32% since 2021

- Dispensaries accepting debit earn an average of $4,627 more than cash only retailers.

While we are cautiously optimistic that DEA rescheduling (or perhaps descheduling) will happen, largely because it does not require congressional approval, the follow-on effects are complex and will need to play out at the state level and as always the impact on CRB security prices are difficult to predict. So grab your popcorn and stay tuned!

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), struggled in January following a strong finish in 2023. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index posted a -8.4% return in January 2024 and finished ahead of its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (-10.6%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US marijuana touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (HERBAL’s Strength of Theme enhancement et al) as well as rules for inclusion, particularly thresholds for minimum price and market capitalization. It is important to note that POTX has announced that it will be closing down in February 2024.

HERBAL trailed the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (+13.9%) as well as the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which closed out January with a spectacular return of +33.8%. These two funds with US plant-touching MJ exposure rebounded due to their heavy US MJ exposure, benefitting from the positive sentiment that came from US cannabis reform in January.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its unusual composition. Since its origin MJ has held a significant percentage of non-Pure Play (and in a few cases non-CRB) holdings, more specifically tobacco stocks with either very small or no cannabis exposure at all.

Additionally, In 2022 MJ added and maintains close to a 50% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure. It is also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can also deviate materially from HERBAL’s as well (as it did in January), largely due to its significant holding in CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap was positive again in January, gaining 19.7%. This basket, which is an equally-weighted portfolio of the 11 largest Pure Play CRBs (including both US plant-touching and non US plant touching MJ), had a return that landed in between the two groups.

The CRB Monitor equally-weighted basket of Tier 2 CRBs finished the month lagging the Tier 1 CRB basket, posting a +11.0% return in January. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group.

If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. With that said, the breadth of the Tier 2 basket has shrunk over time and the spreads have widened, which will likely contribute to short term volatility and performance differences as well.

US equities posted modest gains in January as we continued to see positive economic data, including control over inflation and lower unemployment numbers. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a +2.2% return for the month and added to their record-setting gains.

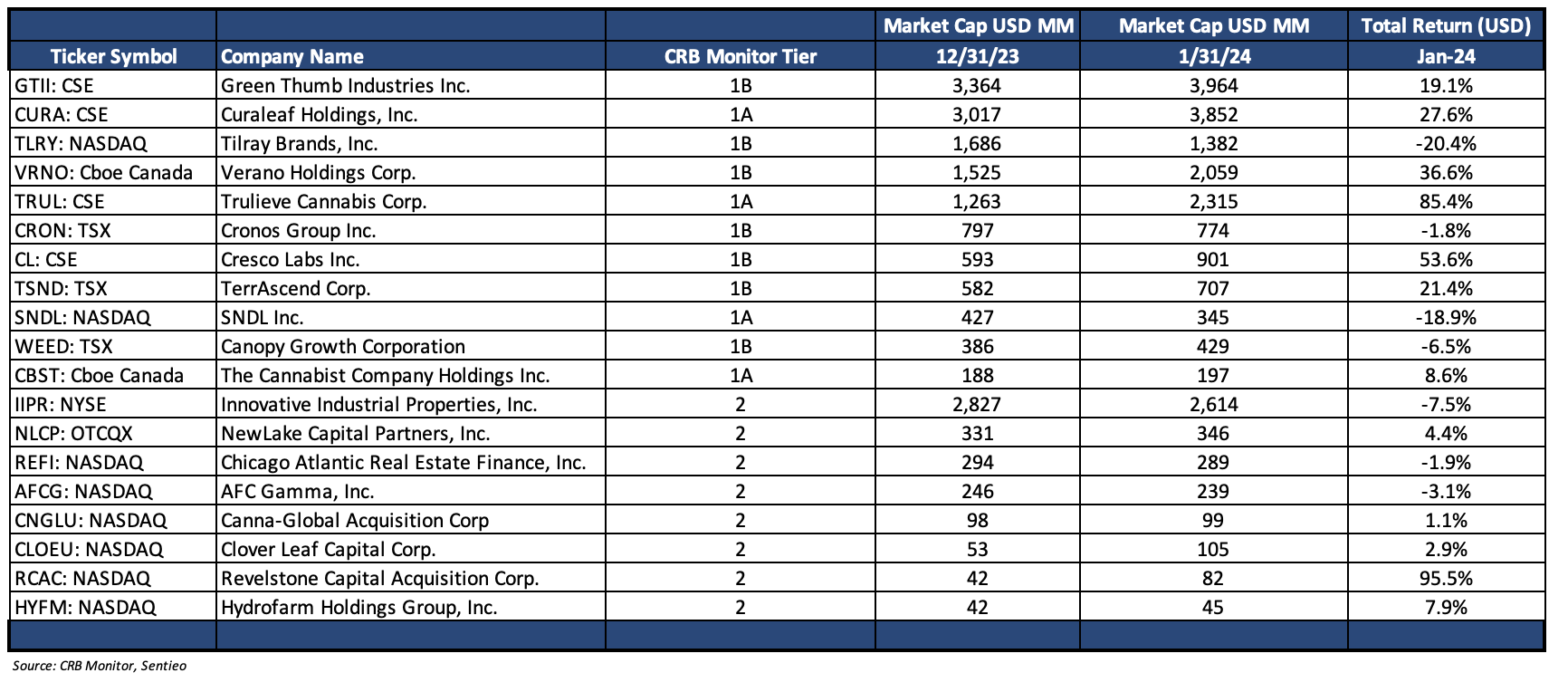

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – January 2024 Returns

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities had a positive return in January (+19.7%), with essentially all of the upside coming from the MSO group while the CAD (legal) CRBs lagging this time. There were a few big winners and we will take a look at them below.

Performance was generally spectacular in January for the MSO basket as Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) (+85.4%) and Tier 1B Cresco Labs Inc. (CSE: CL) (+53.6%) and Tier 1B Verano Holdings Corp. (CSE: VRNO) (+36.6%) led the pack on the heels of positive sentiment from the DEA rescheduling. Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+27.6%), Tier 1B TerrAscend Corp. (TSX: TSND) (+21.4%), and Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (19.1%) spiked as well and while Tier 1A The Cannabist Company Holdings Inc. (CBOE Canada: CBST) (+8.6%) was tame by comparison but still impressive.

Interestingly, while the MSO group soared, the “legal” Canadian CRB basket had negative performance across the board in the month of January 2024. Tier 1B household names Tilray Brands, Inc. (Nasdaq: TLRY) (-20.4%), Canopy Growth Corporation (TSX: WEED) (-6.5%), SNDL, Inc.(Nasdaq: SNDL) (-18.9%), and Cronos Group Inc. (TSX: CRON) (-1.8%) all struggled as investors are battling fatigue over these CRBs which are heavily dependent on US legalization for their long-term survival.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a positive 11.0% return for January 2024, which underperformed the equally-weighted Tier 1 basket by 8.7%. Typically these two baskets are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), and we expect Tier 1 and Tier 2 CRBs to periodically cross paths.

When these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the precise moment when these two baskets mean revert is not easy to predict. And furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so beware!

Performance across the Tier 2 basket was mixed but featured some bright spots in January 2024. Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (-7.5%), showed signs of cooling off after a two-month winning streak. In mid-December, IIPR announced its quarterly dividend of $1.82/share, which represented a $0.02/share increase over Q3 2023. IIPR describes itself as “the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry.” It is also the largest Tier 2 CRB by market capitalization – more than ten times the next-largest Tier 2 company. However, analysts might be looking at IIPR as a bit too pricey at this point, and are looking ahead to their next earnings announcement with great interest.

And what’s happening with Tier 2 SPAC Revelstone Capital Acquisition Corp. (Nasdaq: RCAC)? RCAC posted a return of 95.5% in January after losing nearly half its value (-48.7%) in the month of December. [As a reminder, in mid-January, Revelstone announced its proposed business combination with a charter private jet company, Set Jet, Inc. As Set Jet is not a cannabis-related business, this company will be removed from the CRB Monitor database upon the closure of this deal. As such, these wild swings in performance are less of a concern to cannabis investors.]

Finally, Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) posted a positive return (+7.9%). Back in November Hydrofarm announced its 3rd quarter results, which featured a significant drop (-$20mm) in sales but repeated an increase in net gross profit of $5mm.

Also covered in this earnings report was the Initiation of “a second phase of restructuring plan, which includes U.S. manufacturing facility consolidations, to improve efficiency and generate further cost savings.” As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day.

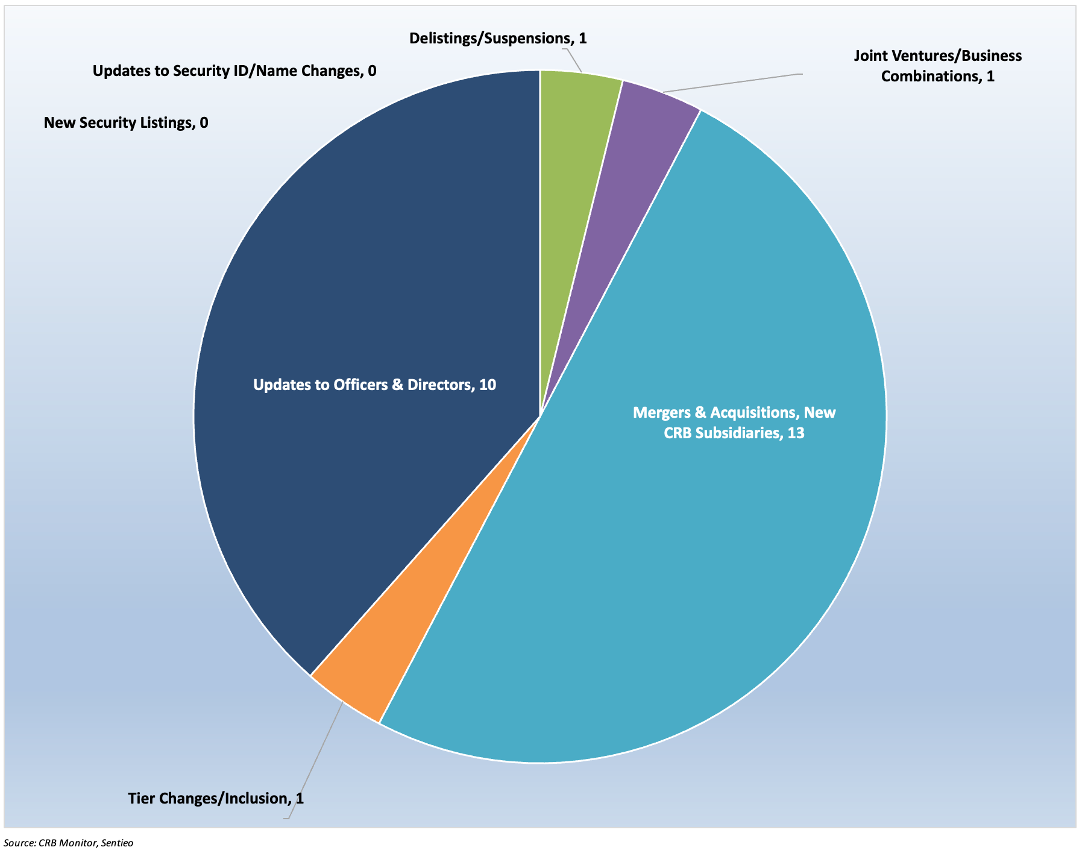

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for January 2024:

Cannabis Business Transaction News – January 2024

There is no shortage of news coming out of the cannabis industry, and our analysts have been diligent as they ensure that the CRB Monitor database reflects the current state of the cannabis ecosystem. Here are some of the highlights from January 2024:

Always looking to expand their operational footprint in the US, Tier 1B MSO Verano Holdings Corp.(CSE: VRNO) issued a January press release announcing the opening of MÜV Yulee, the Company’s 74th Florida dispensary and 137th location nationwide. In the words of the press release, “MÜV Yulee enhances the Company’s footprint in the Jacksonville metropolitan area, accompanying MÜV dispensaries in Jacksonville and Jacksonville Beach….” With this latest opening, Verano (through its subsidiaries) holds 83 active cannabis licenses and operates in 13 states plus the District of Columbia.

Also in January, Tier 1B MSO Ascend Wellness Holdings, Inc. (CSE: AAWH.U) announced in a press release the opening of an Ascend Dispensary Outlet, located at 1206 Recker Rd, Piqua, Ohio. According to the announcement, this dispensary will be “Ascend’s fourth in the state of Ohio and 34th across its seven-state footprint…The dispensary will offer medical products and accept both cash and debit cards through provided cashless ATM terminals.” With this new opening Ascend’s footprint has expanded to 74 licences that are either active or pending approval and operating in 7 states in the US.

Tier 1B Jushi Holdings Inc. (CSE: JUSH) announced on January 10th the opening of its relocated Beyond Hello™ Hazleton dispensary in Pennsylvania, through its subsidiary, Franklin Bioscience – NE LLC. Given that Pennsylvania is still a medical cannabis-only state, This new dispensary will be serving medical cannabis clients only. In the words of the press release, “The dispensary will begin serving medical cannabis patients and caregivers in Northeast Pennsylvania and beyond on Saturday, January 13…THC and CBD-rich medicinal products – all locally produced at the nearby grower-processor facility in Scranton, Pennsylvania, which is operated by Jushi’s subsidiary Pennsylvania Medical Solutions, LLC.” With this addition, Jushi’s operational footprint expands to 54 active or pending licenses across 7 states.

Now onto Connecticut, where Tier 1B MSO Acreage Holdings, Inc. (CSE: ACRG.A.U) issued a January press release announcing “the relocation of its third Connecticut location to the town of Vernon, marking the first-ever cannabis dispensary in the borough of over 30,000 residents.” This new opening represents further expansion of Acreage into Connecticut. The Company’s licenses, which are held by wholly-owned subsidiaries, are now 114 that are either in active status or pending approval. Acreage now operates in 19 states as well as 3 Canadian provinces and has operations in Australia as well.

Finally, household name and Tier 1B Canadian CRB Tilray Brands, Inc. (NASDAQ: TLRY) announced in a January press release the completion of its acquisition of Truss Beverage Co. from Molson Coors Beverage Company (NYSE: TAP).

According to the announcement, the Truss Beverage acquisition provides several key strategic benefits, including:

- “Bolsters Tilray’s Beverage Operations in Canada. Since acquiring the remaining 57.5% equity ownership from Molson Coors in August 2023, Tilray has transitioned all cannabis beverage operations to its London, Canada manufacturing facility, maximizing utilization, and lowering costs. Tilray plans to operate the state-of-the-art Truss Beverage facility in Belleville, Ontario to explore the production of new beverage innovations and to expand its beverage portfolio.

- Strengthens Tilray’s #1 Cannabis Market Share Position and Solidifies Leadership in Cannabis Beverage Market. Tilray boosts its leading cannabis market share position in Canada with ~40% market share in cannabis beverages.

- Optimizes Commercial Network Through Collective Sales, Marketing and Distribution Force. Tilray is optimizing its sales, marketing, and distribution network with GND and its recently acquired cannabis beverage brands. This expanded network is expected to strengthen the Company’s commercial footprint and drive market share growth.”

Tilray’s operational footprint covers 10 countries (not the US) and their subsidiary businesses currently hold 380 cannabis licenses. [As of February 1, 2023, Molson Coors no longer qualifies as a cannabis-related business per CRB Monitor rules.]

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Trulieve Cannabis Corp. | CSE: TRUL | Tier 1A | Trulieve names Marie Zhang as COO |

| Vext Science, Inc. | CSE: VEXT | Tier 1B | Transition of Jason Thai Nguyen out of Executive Role (VEXT SCIENCE INC) |

| MedMen Enterprises Inc. | CSE: MMEN | Tier 1B | MedMen Announces Management and Board Changes |

| BevCanna Enterprises Inc. | CSE: BEV | Tier 1A | Change in Directors and Officers (BEVCANNA ENTERPRISES INC) |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| PSYC Corporation | (OTC Pink: PSYC) | Add | Tier 3/Media & Publishing |

| Stran & Company, Inc. | (NASDAQ: SWAG) | Add | Tier 3/Containers & Packaging |

| AdvisorShares MSOS 2x Daily ETF | (NYSE Arca: MSOX) | Add | Tier 1B/ETF/Cannabis-Themed |

| Revelstone Capital Acquisition Corp. | (NASDAQ: RCAC) | Moved to Watchlist | Tier 2/SPAC |

| Vert Infrastructure Ltd. | (OTC Expert: CRXPF) | Moved to Watchlist | Tier 2/Real Estate |

| De La Rue PLC | (LSE: DLAR) | Moved to Watchlist | Tier 3/Professional Services |

Cannabis News: Regulatory Updates

The regulatory tug-of-war for cannabis reform is feeling a bit overdone and without a whole lot of pulling on either side, thanks to a veritable stalemate on Capitol Hill with regard to essentially everything.

As we wrote in last month’s newsletter, the only compelling cannabis-related news out of Washington is regarding DEA rescheduling, which has been an ongoing story since September of 2022 when President Biden issued his recommendations for cannabis reform. Then came the recommendation from Department of Health and Human Services (HHS) that the DEA reschedule marijuana from Schedule I to Schedule III, which on the surface seems reasonable but below the surface can be complicated, particularly for the path of medical marijuana going forward.

The one piece of good news is that the DEA has the authority to reschedule (or even de-schedule) marijuana without a congressional vote, which (let’s face it) would be highly unlikely in the polarized political environment in which we live. So once again we recommend patience, as the only path to a really broad, deep publicly-traded cannabis market is through federal legalization (or a much clearer path to it). And while this could take a number of years and a few more congressional sessions to get there, it is the logical outcome for the cannabis industry.

With that said, here are some highlights from the cannabis regulatory news cycle:

Not enough flower? First, in January it was reported by CRB Monitor News that “roughly one year into the launch of Connecticut’s adult-use cannabis market, the Nutmeg State is pushing back against alternative market suppliers amid a slow adult-use cultivation rollout and recent reports of dispensaries completely selling out of flower.”

As a result of an increased purchase limit (in November 2023) for adult-use cannabis to half an ounce, up from the previous limit of one quarter or 7 grams, the supply at Connecticut dispensaries has suffered, according to the CRB Monitor report. “By the end of the month, there were social media reports of shops completely running out of flower. CRB Monitor confirmed over the phone that several dispensaries were sold out.”

And to add insult to injury, this shortage has led to instances of unlicensed cannabis “gatherings”, at which attendees purchase cannabis paraphernalia and for a $20 admission fee they are offered “free gifts of cannabis.” According to the report, “Connecticut Attorney General William Tong sent a cease and desist letter, on Jan. 4, 2024 to the organizer of the High Bazaar”, a weekly gathering that features this type of activity.

The article goes on to discuss recent actions by Connecticut which started last October when “the state also began cracking down on retail shops that were selling hemp-derived THC products, leaving many shop owners on the verge of closure. The new rules required all hemp-derived products be regarded as cannabis, which means they would be subject to seed-to-sale tracking and could only be legally sold in a licensed dispensary.”

The Department of Consumer Protection, which oversees the state’s legal cannabis market, confirmed in December that the agency was aware of shortages, according to spokesperson Kaitlyn Krasselt. She argued that “the lack of product was a result of increased demand during the Thanksgiving and December holiday seasons.”

And now, from Virginia: In January it was reported in Marijuana Moment that a second Virginia Senate committee has now advanced a bill to legalize retail marijuana sales in the commonwealth, moving the proposal “one step closer to the chamber floor.” The panel also approved a separate measure that would resentence people currently incarcerated for cannabis-related crimes. According to the article, “The Senate Courts of Justice Committee passed the measures after making amendments to both at a hearing Wednesday. The marijuana sales bill was approved on a 7–5 vote, with three members abstaining, while the vote on the resentencing bill was 10–5…Both measures take up matters advocates would like to see addressed following the state’s legalization of adult-use cannabis: the establishment of a legal, regulated market and relief for people still serving time as the result of prohibition.”

At the hearing, members first adopted a substitute version of the bill which included the removal of a prohibition on homemade edible products and also struck a section that would have made it a misdemeanor to bring cannabis across state lines (already a federal crime). The article goes on to say, “Another change removed a provision that would have barred selling any sort of cannabis-related paraphernalia to people under 21.”

Next, onto Kentucky, where Republicans are doing all they can to make recreational marijuana legalization a challenge. According to a January article in Marijuana Moment lawmakers in Kentucky “have filed new marijuana legislation with a notable bill number: HB 420. If passed, it would legalize and regulate cannabis for adults 21 and older, though few expect the proposal to get through in the state’s Republican-controlled legislature this session.” Rep. Rachel Roberts (D) introduced this bill, which would “legalize marijuana and license a variety of business types, including cultivators, processors and retailers. A 9 percent excise tax would be imposed both on wholesale and retail purchases, and local governments could levy an additional licensing fee of up to 5 percent ‘for the privilege of operating within the limits of the local government.’”

While all this looks promising for legalization in Kentucky, the state legislature has a heavy Republican majority which will make it an uphill battle. The article goes on to say, “A more limited legalization measure, HB 72, was introduced earlier this month by Rep. Nima Kulkarni (D). It would end all penalties for simple possession and use of marijuana by adults 21 and older and also allow adults to grow a small number of cannabis plants at home. Commercial sales, however, would remain prohibited. Both legalization measures have been referred to the House Committee on Committees. However, no action has been taken on HB 72 since it was introduced on January 2.”

Optimism out of Germany: A January 22 article in MJ Biz Daily reported that Germany’s health minister Karl Lauterbach believes that “marijuana legalization will become a reality in the country this spring.” According to this report, Lauterbach has set a target for the Bundestag, the national parliament, “to approve the nation’s long-awaited cannabis law in February. “I am continuing to assume that the Cannabis Act will be passed by the Bundestag in the week between Feb. 19 and 23 and will go into force from April 1,” Lauterbach told the newspaper Die Welt, broadcaster Deutsche Welle reported.” With all that said, the ruling coalition in the Bundestag has not passed this into law.

The article notes that the latest plan calls for:

- Decriminalization of cannabis.

- Home cultivation and possession starting April 1, 2024.

- “Cultivation clubs” that would launch potentially in July.

We will stay tuned as German legalization could lead to further legalizations globally.

Finally, from the great state of Florida: in January it was reported in MJ Biz Daily that Florida voters “will likely see marijuana legalization on their presidential election ballots this fall”, Gov. Ron DeSantis suggested.

According to the article, The Florida Supreme Court is currently weighing a constitutional challenge brought by the DeSantis administration against a campaign to legalize adult-use cannabis in the state, currently the largest medical marijuana market in the country. A ruling is pending. But while wrapping up his failed presidential election bid in New Hampshire, DeSantis told a marijuana lobbyist that the legalization measure will “be on the ballot.” The article goes on to say, “The $39.5 million Smart & Safe Florida initiative is bankrolled almost exclusively by Florida-based multistate operator Trulieve Cannabis. As written, the ballot measure would allow existing medical cannabis dispensaries to start selling recreational products.”

Legalized recreational marijuana in Florida is by no means a done deal, however, as this ballot measure will require a 60% majority vote to pass.

CRBs In the News

The following is a sampling of highlights from the January 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update Defining “Cannabis-Related Business”