It has been about a year since we have written about the sometimes dysfunctional relationship amongst Tier 1 Pure Play, Tier 2, and Tier 3 cannabis-related businesses (CRBs). It’s worth revisiting, given their common sources of revenue and shared sensitivities to the ongoing cannabis news cycle, one would assume that they should exhibit similar equity performance, especially in the long term.

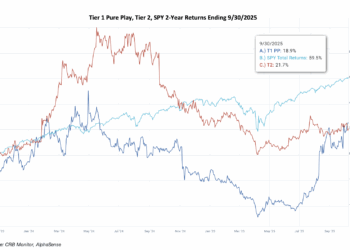

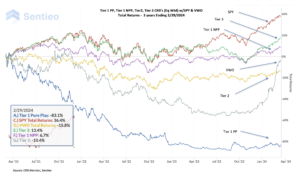

We take this assumption with a grain of salt, recognizing that there can be mitigating factors in the short term, plus there is always dependency on start and end dates of the time series. Nonetheless, we observed a significant deviation from the start of 2024, where Tier 2’s seemed to have taken off while Tier 1’s have, to an extent, fizzled.

First, here is a quick review of the definitions of these four groups (for the purposes of this analysis):

Tier 1 Pure Play: A publicly traded CRB which either directly or through a subsidiary holds a license to cultivate, manufacture, process, wholesale, retail, or test, marijuana or hemp. Additionally, this CRB’s cannabis-related revenue is determined to constitute more than 50% of the company’s overall revenue.

Tier 1 Non-Pure Play: A publicly traded CRB which either directly (or through a subsidiary) holds a license to cultivate, manufacture, process wholesale, retail, or test, marijuana or hemp. However, this CRB’s cannabis-related revenue is determined to constitute less than 50% of the company’s overall revenue.

Tier 2: A publicly traded CRB which provides goods and/or services to a Tier 1 CRB or is a pure play CBD (not THC) business. Additionally, a Tier 2 CRB’s cannabis-related revenue is determined to constitute more than 50% of the company’s overall revenue.

Tier 3: A publicly traded CRB which provides goods and/or services to any other CRB or sells CBD-related products. However, a Tier 3 CRB’s cannabis-related revenue is determined to constitute less than 50% of the company’s overall revenue (generally much less).

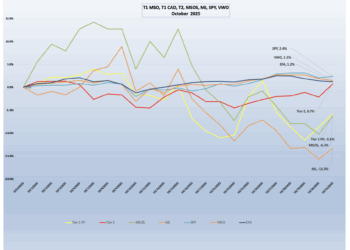

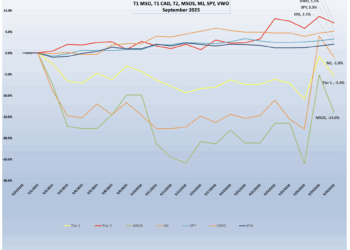

The Tier-separated performance history is an intriguing set of data to monitor and looking at the chart above, we believe it’s worthy of a closer look. Here are the correlations, which have held reasonably firm over time:

Tier 1 Pure Play/Tier 2: It is important to note that, in spite of their high correlation, we expect these two return streams to have a tendency to deviate in the short term, due to temporary demand and general lack of the necessary liquidity to support that demand. But recently these two groups have suddenly deviated more significantly. In fact, the 2024 YTD performance has over a 33% spread (46.3% vs. 12.8%).

While there are a handful of Tier 2 companies that have high returns this year, none is more breathtaking than that of Corbus Pharmaceutical Holdings (Nasdaq: CRBP) (+272%) which had a significant impact equally-weighted Tier 2 basket. In fact, about 13% of the 19% return of the equally-weighted Tier 2 basket comes from Corbus, which announced the successful trials of a new (non-cannabis) drug approved in late January.

Both Tier 1 PP and Tier 2 CRBs have low correlation with U.S. and emerging markets equities (SPY & VWO), which makes them good candidates for inclusion in an asset allocation framework.

Tier 1 Non-Pure Play/Tier 3: These two groups, while important members of the CRB Monitor cannabis universe, are not expected to be good proxies for cannabis and the above data bears this out.

Tier 3 CRBs began to deviate from U.S. equities in Q2 2023 and their correlation has fallen to 0.44 from 0.72 a year ago. Conversely, Tier 1 Non-Pure Play stocks exhibited a high correlation with U.S. and emerging markets equities. But it is also notable that both Tier 3 and Tier 1 NPP CRBs have very low or negative correlation with Tier 1 Pure Play CRBs. With that said, Tier 3 and Tier 1 NPP CRBs have high correlation with each other.

So from an investment perspective, Tier 1 Pure Play and Tier 2 CRBs still look like an excellent representation of the cannabis industry and are attractive baskets due to their lack of correlation with traditional global equities. On the other hand, Tier 1 Non-Pure Play and Tier 3 CRBs can be used for risk control and diversification, but are not quite as effective for their cannabis-ness.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update Defining “Cannabis-Related Business”)