This month, we turn our attention to the Sunshine State, where the Florida Supreme Court has issued its decision that legalization of recreational marijuana will be included as a referendum question on the November ballot.

This ruling follows years of advocacy and legislative efforts by various groups (this time led by Trulieve Cannabis Corp. (CSE: TRUL). By allowing voters to decide on this matter directly, the court has empowered citizens to shape the future of cannabis policy in Florida and paved the way for a significant spike in tax revenues. Proponents of legalization also argue that it could alleviate burdens on the criminal justice system and provide safer access to cannabis for adults, while driving a stake through the heart of the illicit marijuana industry. However, opponents raise concerns about potential health risks, particularly among youth, and the implications for public safety.

Amid all the hoopla, we thought it might be interesting to see if these recent revelations have had any impact on the prices of cannabis-related equities, and truth be told, the market for cannabis equities is a constant rollercoaster, featuring wide bid/ask spreads, low stock prices, and largely sentiment-driven performance. Therefore, if you don’t love today’s chart, give it another day or two and look again.

On that note, the above chart compares year-to-date returns through April 18, 2024, for two equally weighted baskets of Tier 1 multi-state operators (MSOs). The dark blue line represents the MSOs with Florida operations while the light blue line represents MSOs with no legal ties to Florida. The red line is the performance of the standard 22-stock basket of the largest Tier 1 Pure Play CRBs (it includes all the companies from the two blue lines plus the Canadian operators).

The Florida basket and the ex-Florida basket move along almost in lockstep until mid-March, when they start to deviate. Our eyes might tell us that this is all about the referendum, but it is also worth noting that Trulieve spiked around this time as the result of their windfall tax refund (which might be reversed). It is worth keeping an eye on the Florida CRBs, as well as polling data, as Election Day approaches. It will likely be even more interesting to see what happens to the Florida operators’ share prices on Wednesday, Nov. 6 (the day after the elections).

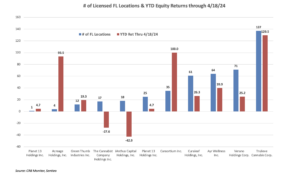

For additional context, the following chart looks at the individual YTD 2024 performance (also through April 18, 2024) of all the listed companies that currently have Florida operations, along with the number of licensed businesses each CRB currently operates (per the CRB Monitor database). We can see that, by and large, performance has been positive, with Trulieve, Cansortium Inc. and Acreage Holdings Inc. leading the pack.

Looking at this chart, it’s true (no pun intended) what everyone has been saying about Trulieve, a company that operates, through its subsidiaries, 137 cannabis-related businesses throughout Florida. This makes Trulieve the largest operator by far in the Sunshine State. The next largest by operational footprint, which is just over half as prolific, is Verano Holdings Corp. (CSE: VRNO) with 71 licensed locations. And while most of these operators have had positive returns this year, there is considerable dispersion among them and, therefore, we hesitate to make any generalizations about their performance as a group. There also appears to be low correlation between the number of locations and equity performance, given the outliers like Acreage, as well as The Cannabist Company Holdings Inc. and iAnthus Capital Holdings Inc., which were significantly negative for the period.