In May 2024, investors in cannabis equities were watching yet another rerun of the same sorry episode, just as they have done so many times before. It’s as if the euphoria of the April 30 rescheduling announcement never happened; or if it did happen, it happened in the form of some cruel joke meant to discourage anyone with a connection to the cannabis space. We will spare you the Charlie Brown and Lucy football analogies, at least this time around.

And we are incredulous at this particular event, where some really positive news for the industry was followed not by a leveling off of prices, but instead of a steep collapse across the entire Tier 1 universe. We might theorize that the latest rescheduling news was either a crazy rumor after all (which we now know is not the case), or that Washington gridlock will ultimately derail, or indefinitely delay the recent revelations of the HHS, DEA and DOJ. President Joe Biden’s admonitions notwithstanding, the cannabis equity market unmercifully changed its mind on the notion of rescheduling, at least for the time being. Many of the largest Tier 1 pure play CRBs lost a third or more of their value in the weeks following the April 30 rally, as investors failed to believe that the benefits of a 280E exemption for CRBs would ultimately be a reality in the near term.

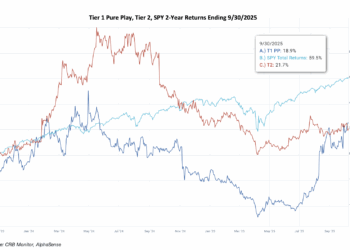

Cannabis-Linked Equity Performance, May 2024

Looking at the chart above, we can see the May carnage, with Tier 1 pure play companies and cannabis-themed funds all getting crushed following the all-too-brief April 30 feeding frenzy.

Looking at the chart above, we can see the May carnage, with Tier 1 pure play companies and cannabis-themed funds all getting crushed following the all-too-brief April 30 feeding frenzy.

A few more words on rescheduling: A May article originally published by Crain’s Chicago and reprinted by the Green Market Report echoes the sentiments of many investors, which could not have been more clear given cannabis equities’ downward spiral. The article states that rescheduling would give most CRBs (particularly the U.S. operators) a lift of tens of millions of dollars in tax savings. The problem is, when will all this actually take effect? The article states:

“How soon it will happen is uncertain. It’s been more than 18 months since President Joe Biden called for a federal review of federal rules governing marijuana. The process has dragged on longer than most expected. Exactly when rescheduling will take effect is up for debate. ”

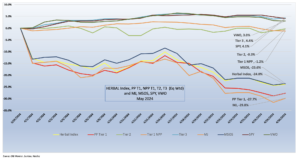

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), was hammered in May along with the rest of the group. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index. HERBAL’s performance was consistent with the rest of the cannabis field in May, posting a return of -24.0%.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-29.8%) and the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-23.6%), all tended to reverse course immediately after April 30, as the reality of a long road to rescheduling started to set in. Unlike HERBAL, which is designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching MJ exposure tend to be more sensitive to the federal regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin, MJ has held a significant percentage of non-Pure Play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally in 2022, MJ added and maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. This component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It is also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

Monthly returns of the self-described (and largest) U.S. plant-touching ETF, MSOS, can also deviate materially from HERBAL’s performance (as it did in May), largely due to its significant holding in CRBs with U.S. marijuana touch-points.

The recently expanded CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap returned -27.7%. This basket, which is an equally weighted portfolio of the 22 largest pure play CRBs (including both U.S. plant-touching and non-U.S. plant-touching cannabis companies) had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take closer look at some of these below.

The also-expanded CRB Monitor equally-weighted basket of Tier 2 CRBs finished the month significantly ahead of the Tier 1 CRB basket, posting a -0.3% return for May. In February, we published an update to our piece on correlations of pure play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces, like marijuana rescheduling, that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time.

U.S. equities tended to ignore the cannabis collapse in May and completely reversed their losses from April, as the Biden Administration announced a new wave of tariffs on imports from China, including quadruple tariffs on electric vehicles. The Federal Reserve kept rates unchanged, and as unemployment numbers trended upward, the Fed removed almost any hope for further rate cuts this year. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a +4.1% return for the month (now +11.3% YTD) and added to its record-setting levels.

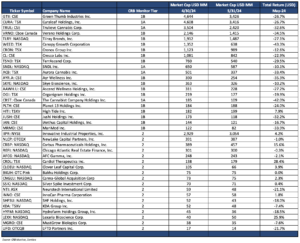

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – May 2024 Returns

CRB Monitor Tier 1

An equally weighted basket of the largest Tier 1 pure-play cannabis equities had a -27.7% return in May, reversing nearly all of April’s gains. One can see the evidence of this bloodbath in the table above, where this collapse cut across the entire publicly traded CRB space, hitting both the MSO (U.S. plant-touching) group and Canadian (CSA-friendly) CRBs. Investors of cannabis equities sustained knockout blows from all directions, and we have some of the highlights below:

As we can see in the Cannabis-Linked Equities chart at the top of this report, CRB performance went from bad to worse starting on May 1 through mid-month and then tanked some more through month-end. Returns were negative essentially across the board for the MSO basket. Tier 1B Cresco Labs Inc. (CSE: CL) (-22.9%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-34.5%), Tier 1A Curaleaf Holdings Inc. (CSE: CURA) (-26.7%), Tier 1B TerrAscend Corp. (TSX: TSND) (-29.5%), Tier 1A CRB The Cannabist Company Holdings Inc. (CBOE Canada: CBST) (-42.0%) and Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-26.7%) all felt the same negative investor sentiment. Even previously hot Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) (-32.6%) was not safe. Apparently the delays in rescheduling were bad news as it seeks to recover more than $100 million in Schedule 280E taxes that Trulieve paid historically.

Companies that make up the Canadian CRB basket fared no better, as their fate is viewed by investors to be unavoidably tied to the success or failure of cannabis reforms in the United States. There was no joy in Mudville this time around, with Canopy Growth Corporation (TSX: WEED) (-43.8%), Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-10.1%), and Tier 1B Cronos Group Inc. (TSX: CRON) (-12.2%) all reversing some or all of their April 30 gains. Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) (-27.1%), which was flat in April, collapsed along with the rest of the Canadian group. And Tier 1A Aurora Cannabis (TSX: ACB) (-33.4%) lost one-third of its value in May as well, following a return of more than 100% in April. Like some if its peers in the CRB space, ACB has made significant inroads in Europe, particularly in Germany, which have been viewed as positive by analysts. But it is clear to us that the fate of ACB and the rest of the cannabis industry depends on reforms in the U.S.

The lone exception in May was High Tide Inc. (TSXV: HITI) (+7.9%), which had a positive return in spite of the major pullback by cannabis investors. A May 2024 article originally published by Zacks Investment Research noted that High Tide is significantly outperforming the medical cannabis field over the last 12 months:

“According to our latest data, HITI has moved about 34.4% on a year-to-date basis. In comparison, Medical companies have returned an average of 3.6%. As we can see, High Tide Inc. is performing better than its sector in the calendar year.”

Whether or not HITI is insulated from the rescheduling roller coaster remains to be seen. But at least for now, they seem to have been spared much of the agony.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies posted a negative 0.3% return for May, which outperformed the equally weighted Tier 1 basket by 27.3%, which was a near total reversal from April. Typically these two baskets are highly correlated (please see our February 2024 Chart of the Month), and we expect the returns of Tier 1 and Tier 2 CRBs to even out over time. When these two portfolios deviate from one another (as they did in April and then changed places in May) a deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so beware!

The largest CRB in the basket, Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+4.2%), had a stellar month when compared to the Tier 1 CRBs that lease property from them. IIPR’s stock price has been gradually creeping upward over the last 12 months, having maintained stable earnings throughout that difficult period. On May 8, IIPR reported its First Quarter Results which featured the following highlights:

- “Generated total revenues of $75.5 million and net income attributable to common stockholders of $39.1 million, or $1.36 per share (all per-share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of $63.0 million and $56.4 million, respectively.

- Paid a quarterly dividend of $1.82 per common share on April 15, 2024, to stockholders of record as of March 28, 2024 (an AFFO payout ratio of 82%). The common stock dividends declared for the twelve months ended March 31, 2024 total $7.24 per common share.”

Another Tier 2 REIT that we tend to follow, AFC Gamma, Inc. (Nasdaq: AFCG) (CRBM Sector: Real Estate) (-2.1%) finished behind IIPR in May, but unlike the Tier 1 baskets the bottom did not fall out for the company’s share price. On May 9, AFCG reported its First Quarter 2024 earnings which featured the following statement from CEO Daniel Neville:

“We are pleased to have originated a total of $90.4 million of loans in the first quarter of 2024, with $34.0 million in loans to cannabis operators and $56.4 million to commercial real estate developers. On the cannabis side, we completed a $34.0 million debt investment in Sunburn Cannabis, a private, vertically integrated single-state Florida operator…The investment underscores our commitment to fostering long-lasting relationships with our borrowers and focusing on limited license states with attractive supply and demand dynamics. Additionally, we are encouraged by the promising legislative developments at both the federal and state level, including the anticipated rescheduling at the federal level and the potential transition to adult-use cannabis in states like Ohio and Florida.”

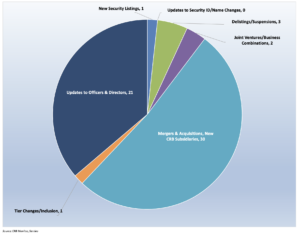

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for May 2024.

Cannabis Business Transaction News

The cannabis business news cycle continues to merrily roll along, and CRB Monitor’s analysts go to the ends of the earth to track all the relevant news that should be of use to all of those who take an interest in this volatile industry. The goal is not only to inform our subscribers but to ensure that the CRB Monitor database accurately reflects this active global news cycle every day.

Here are some of the highlights from May 2024:

Seemingly always in expansion mode, Verano Holdings Corp. (CSE: VRNO) issued a press release in early May announcing the grand opening of Zen Leaf Naugatuck, the company’s third social equity joint venture location in Connecticut and fifth cannabis dispensary statewide. In the spirit of doing good while doing well, the announcement highlights some aspects of this socially-responsible business:

“In opening Zen Leaf Naugatuck, Verano received support for the Company’s approved social equity plan from several local community organizations, including the Brass City Gamers Tournament, Rivera Memorial Foundation, The UnGroup Society and the Waterbury Opportunities Industrialization Center Inc. Through these community partnerships, Zen Leaf will directly fund area youth education initiatives, including: LifeLaunch Waterbury: an innovative 12-week e-learning curriculum for teens and young adults in Waterbury that teaches a broad range of life skills and financial literacy. STEM Training and Laptop Donations: in partnership with Waterbury-based Brass City Gamers, Zen Leaf will sponsor an 8-week STEM certified course and provide the first 10 graduates of the program with new Acer coding laptops, enabling local youth to continue pursuing STEM education goals.”

Verano currently holds 82 cannabis licenses which are either active or pending approval, and it operates in 13 states, plus the District of Columbia.

Next, more news from Tier 1B Canadian CRB High Tide Inc. (TSXV: HITI), which issued a May press release announcing that its Canna Cabana retail cannabis store located at 1660 20th Avenue East, Owen Sound, Ontario “has begun selling recreational cannabis products and consumption accessories for adult use.”

This opening marks High Tide’s 169th Canna Cabana-branded retail cannabis location in Canada, the 60th in the province of Ontario and the first in Owen Sound. High Tide, which has been actively expanding its Canadian operations, now holds 196 active or pending cannabis licenses with operations in six Canadian provinces, plus Australia.

Now onto the Sunshine State, where Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) issued a press release on May 10 that announced the opening of a new medical cannabis dispensary in Stuart, Fla. The grand opening celebration took place on May 17, and in the words of the press release:

“The new location will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, O.pen, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

Trulieve, with a massive retail medical cannabis footprint in Florida, actually operates in 19 states and now holds 120 licenses in either active status or pending approval.

Tier 1B MSO Planet 13 Holdings Inc. (CSE: PLTH) issued a press release announcing the closing on May 10 of its acquisition of VidaCann, LLC, “following the previously announced approval from the Florida Office of Medical Marijuana Use on April 26, 2024 and sale of 100% of the equity interests in Planet 13 Florida, Inc. on May 6, 2024. The Company acquired VidaCann from the sellers who held all of the membership interests in VidaCann in exchange for: (i) 81,872,252 shares of common stock of Planet 13; (ii) approximately US$4 million in cash; and (iii) US$5 million in aggregate principal amount of promissory notes, subject to adjustments under the definitive agreement.”

Following this acquisition, Planet 13 has cannabis operations in four states (Florida, Nevada, Illinois and California) and holds 26 licenses that are either active or pending approval.

And in a forward-looking move, Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) announced on May 17 that it has “filed a prospectus supplement with the U.S. Securities and Exchange Commission, under which it may offer and sell shares of its common stock having an aggregate offering value of up to $250 million from time to time through an at-the-market equity program.”

The Company has entered into an equity distribution agreement with TD Securities LLC and Jefferies LLC. “Pursuant to the equity distribution agreement, TD Securities and Jefferies may sell the Company’s Common Stock in transactions that are deemed an ‘at-the-market offering’ defined in Rule 415 under the Securities Act of 1933, as amended, including sales made directly on or through the Nasdaq Global Select Market. The timing and amount of any such sales will be determined by a variety of factors considered by the Company. Sales may be made at market prices prevailing at the time of a sale or at prices related to prevailing market prices.”

Why are they doing this? In the words of the announcement: “The Company currently intends to use the net proceeds from the ATM Program, if any, to fund strategic and accretive acquisitions or investments in businesses, including potential acquisitions of assets in the U.S. and internationally in order to capitalize on expected regulatory advancements or expansion opportunities. The Company does not currently intend to use the net proceeds from the ATM Program for general working capital purposes.”

Tilray currently operates in ten countries (not the U.S.) and holds 356 cannabis licenses that are either active or pending approval.

Finally, Tier 1A CRB and the pride of Wakefield, Mass., Curaleaf Holdings, Inc. (CSE: CURA) issued a late-May press release announcing the opening of Curaleaf Miami North Biscayne, which marks the company’s 62nd dispensary in Florida and 146th nationwide. In the words of the announcement:

“Curaleaf Miami North Biscayne will feature the Company’s premium suite of products, including Grassroots craft flower and pre-rolls, Select Briq all-in-one vape and Liquid Diamonds. Pending regulatory approval, the Company also expects to debut a range of new products in the coming months, across categories including tinctures, edibles and more.”

Curaleaf now operates in six countries, including the U.S. and Canada, and holds 134 licenses that are either active or pending approval.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| High Tide Inc. | TSXV: HITI | Tier 1B | High Tide Announces Appointment of New Chief Financial Officer |

| Aurora Cannabis Inc. | TSX: ACB | Tier 1A | Appointment of New Director (AURORA CANNABIS INC) |

| Cansortium Inc. | CSE: TIUM.U | Tier 1B | Cansortium Announces Change in Chief Financial Officer |

| 22nd Century Group Inc. | NYSE: XXII | Tier 1A | John Miller Resigns from 22nd Century Group

|

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Beijing Chieftain Control Engineering Technology Co., Ltd. | SZSE: 300430 | Move to Watchlist | Tier 3 – Industrial Machinery |

| MetaWorks Platforms, Inc. | OTCQB: MWRK | Move to Watchlist | Tier 3 – Financial Services |

| Nature’s Miracle Holding Inc. | NASDAQ: NMHI | Move to Watchlist | Tier 1B – Owner/Investor |

| BioLargo, Inc. | OTCQX: BLGO | Move to Watchlist | Tier 3 – Agricultural & Farm Machinery |

| Eco Science Solutions, Inc. | OTC Expert: ESSI | Move to Watchlist | Tier 2 – Professional Services |

Cannabis News: Regulatory Updates

As cannabis investors and industry participants of all types (including consumers) await any sort of an update related to DEA rescheduling, the cannabis regulatory train keeps rolling. We covered the latest news on rescheduling at the top of this newsletter, but to reiterate, if the market is considered a predictor of regulatory progress, let’s not hold our collective breath with regard to rescheduling. Given the high stakes nature of cannabis reform in general, it is entirely possible that this action gets challenged in the courts and remains there for the foreseeable future. And so CRBs that are looking for their 280E-related tax refunds might be waiting a while to receive them, or even be entitled to them at all.

CRB Monitor will be looking out for any updates and will pass them along as they happen. In the meantime, here are some regulatory highlights from May 2024:

A number of excellent accounts of the recent developments in rescheduling have been published by our very own CRB Monitor News Team, and one of these in May entitled “Rescheduling Cannabis: Formal Rulemaking Process Can Drag On for Years” highlight the reasons why cannabis operators should not be opening their celebratory champagne any time soon. Unfortunately for investors and operators alike, the complexities related to DEA rescheduling, particularly for a drug as controversial as marijuana, will likely make this process a long and painful one. In the words of our CRB Monitor reporter:

“Optimists believe that given President Joe Biden’s political motivation to get this done quickly, we may actually have a final rule before the election. The fact that Attorney General Merrick Garland signed and submitted the proposed rule himself, apparently without DEA leadership support, is a strong sign of that. However, past scheduling efforts through what is known as a “formal rulemaking process” signal otherwise. Expected legal challenges in what has historically been a long process could drag this out until next year at the soonest, possibly years.”

For anyone who is the least bit optimistic about rescheduling, we suggest they read this article.

In another offering from the CRB Monitor News Team, who reported on some interesting activity in May in the hemp industry. An issue that has had growing concerns among regulators is the proliferation of hemp-derived cannabinoids, which include not only CBD but also THC that is extracted not from marijuana, but rather from hemp. And the Agriculture Improvement Act of 2018 (aka The Farm Bill), appears to have given cover to the manufacturers and sellers of unlicensed forms of THC. In our May article entitled “Six States Pass Hemp Laws; More Wait in the Wings” the CRBM News Team discusses this issue in detail:

“…the 2018 U.S. Farm Act, which defines legal hemp as having no more than 0.3% delta-9 THC on a dry weight basis, has left room for wildly divergent legal interpretations. Two federal courts have come to differing opinions in preliminary injunction rulings which have been appealed to circuit courts. Meanwhile, lawsuits are playing out in state courts, such as Alaska, Georgia and Maryland, as most states have their own definition of legal hemp, which may include total THC, not just the delta-9 cannabinoid.”

With that said, several states are working on solving this problem – Georgia, Oregon, South Dakota, Utah, West Virginia, and Wyoming have passed new laws this year, while Missouri and Oklahoma have bills pending – all geared toward limiting the THC content in consumable products. We will be watching the progress of these laws closely as the hemp problem threatens to spread to other areas in the U.S.

Now on to Ohio, where an article in MJ Biz Daily said that a key legislative approval in Ohio has cleared a path for adult-use cannabis sales to begin next month. According to this article (which was originally reported by the Associated Press), “The Joint Committee on Agency Rule Review issued no objections to proposed regulations…clearing the way for medical marijuana dispensaries to apply to serve recreational customers.”

As this approval leads to legal adult-use sales, there is now a path for medical cannabis operators to apply for recreational licenses. In the words of the article, “Most MMJ dispensary operators, such as Curaleaf Holdings, are expected to apply for dual licenses to sell both medical and recreational marijuana products.”

Finally, news out of a long-standing legal cannabis state, Illinois: Our CRB Monitor News Team published a story in May that reported Illinois “awarded about three dozen new social equity dispensary conditional licenses in the state’s second round of social equity lottery licensing since the state legislature legalized adult-use cannabis in 2020.”

This is excellent news for the community at large, as the original issuance of cannabis licenses across the U.S. up to around 2020 seemed to ignore the concept of social equity. The article continues:

“The Illinois Department of Financial and Professional Regulation which oversees the state’s legal cannabis market, approved 35 new social equity dispensary licenses on May 3. The conditional licenses grant awardees a year to build out their operations and gain local approval. The department said it expects to issue 13 more conditional licenses in the near future. Illinois currently has 202 adult-use dispensaries in operation, of which 92 qualify for social equity status, according to a press release. Another 108 social equity conditional licenses awarded in 2022 are still not open for business.”

CRBs In the News

The following is a sampling of highlights from the May 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update Defining “Cannabis-Related Business”).