Financial institutions filed the most marijuana-related Suspicious Activity Reports (SARs) in the first quarter 2024 than in any other quarter during the last 10 years, according to newly released data from the U.S. Treasury. Marijuana-related account terminations also reached the highest quarterly amount since 2019.

There were 23,159 SARs filed last quarter, up 17.3% from the fourth quarter 2023 and up 22.9% from first quarter 2023.

The vast majority of them, 20,410 or 88%, were Marijuana Limited reports, which signify that the marijuana-related businesses banking at the institution didn’t raise any red flags as outlined in a 2013 memo written by then then-Deputy Attorney General James M. Cole, widely known as the “Cole Memo,” or violate state law.

The increase in Marijuana Limited reports appears to reflect a growing acceptance for institutions to bank the expanding cannabis industry as states such as Delaware, Maryland, Minnesota, Ohio, Kentucky and Missouri launch new medical or adult-use markets.

However, Marijuana Termination filings totaled 2,857 in the first quarter. It was the most since the third quarter 2019, when a record 2,979 terminations were filed.

Marijuana Priority reports, which mean a marijuana-related business may have violated banking or red flag rules and further investigations are being conducted, totaled 1,303 in the first quarter. Fourth quarter 2023 saw a record Marijuana Priority reports filed at 1,534, which may account for the higher terminations last quarter.

The Treasury Department says some SAR filings may reflect more than one type of report. “For example, a SAR containing the terms ‘Marijuana Limited’ and ‘Marijuana Priority’ in the narrative would be reflected in both the ‘Marijuana Limited’ and ‘Marijuana Priority’ metrics,” it discloses in the data.

There were 815 total filers in the first quarter, including 505 banks, 178 credit unions and 132 non-depository institutions. However, cannabis industry financial experts do not believe that many institutions are actively serving the industry. Some may have a limited number of cannabis-related businesses or are terminating accounts because they don’t want to get into this market at all.

It’s been 10 years since the Treasury’s Financial Crimes Enforcement Network (FinCEN) wrote guidelines to clarify Bank Secrecy Act obligations so that institutions could provide financial services to cannabis businesses in legalized states. By and large, the guidelines have helped the industry to safely deposit and borrow money. However, the constant monitoring to “know your customer” and SARs filing requirements are onerous and costly, keeping many institutions at bay.

A grand total of 412,724 SARs have been filed since the Treasury Department started keeping stats in 2014.

Maine, Washington see big jumps in SARs reports

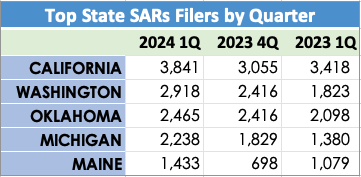

Among the top five state filers, Maine and Washington had the highest increases in SARs filings in the first quarter, while California and Michigan had the highest number of filings to date.

The federal data does not show the type of reports each state files.

Holding the No. 1 spot, California filed 3,841 reports in the first quarter, a 25.7% increase from 3,055 in the fourth quarter 2023. It filed 3,418 in the first quarter 2023.

Washington was the second-highest filer with a record 2,918 reports, a 72.7% increase from the fourth quarter 2023.

Roberta Hollingshead, director of banking for the Washington Department of Financial Institutions, said the department has not seen an uptick in suspicious banking activity, account closings or number of financial institutions offering banking services to cannabis businesses, among the institutions they regulate. However, they don’t examine SARs data in aggregate.

The DFI regulates only state-charted banks and credit unions. She told CRB Monitor that they examine individual institutions every 12 or 18 months. At that time, they look at all BSA procedures and SARs reports, and that’s when they may notice an increase in filings.

Hollingshead said the number of financial institutions offering services in Washington hasn’t changed since 2022, and they have been doing it for 10 years. “They’re doing a really great job complying,” she said.

In addition to the compliance costs, she said the fact that cannabis is a cash-intensive business keeps banks away. She said if Visa and Mastercard started offering electronic services and clearly identified cannabis-related transactions, more banks would be comfortable entering the space.

Oklahoma, at No. 3 with 2,465 reports, saw only a 2% increase from the previous quarter as that state has been tallying more than two thousand SARs each quarter since the fourth quarter 2022.

Michigan, at No. 4, surpassed the 2,000 mark for the first time last quarter with 2,238 reports, a 22.4% increase from the fourth quarter.

“The cannabis business in Michigan is one of the strongest in the nation and the banks and credit unions that the Department supervises that support cannabis-related businesses are operating in compliance with regulatory expectations,” said Department of Insurance and Financial Services Director Anita Fox in an email. “With the proposed rescheduling of cannabis by the Drug Enforcement Agency, it is possible that more Michigan-based financial institutions will seek to provide these services, leading to an increase in limited filings,” she added.

Fox said she would not comment on filings regarding suspicious or illegal activity as they are confidential.

Maine, which has been cracking down on illegal cannabis operations, more than doubled to 1,433 reports from 698 the previous quarter to take the No. 5 spot.

Superintendent Lloyd LaFountain of the Maine Bureau of Financial Institutions, in an email, declined to comment on SARs filings or trends, citing confidentiality laws. He said the BFI does not maintain a list of banks or credit unions that accept marijuana-related deposits.

At the other end of the spectrum, Wyoming, which doesn’t have a legal cannabis program, apparently has no illicit cannabis banking problems. It has not filed a single SAR since the second quarter of 2021.