The last couple of years of cannabis equity performance (many downs, a few ups, and repeat) remind us of that 1980’s cross-country road trip where you get a few hours into the ride and discover that you left your fancy vinyl case of cassette tapes back at your parents’ house, and you are left with the one tape that happens to be playing at the moment. So what we have here is “Dark Side of the Moon” on infinite repeat.

As they have done at several points in time, cannabis stocks rallied in July. We will consider why this happened, but it is important to note that volatility persists in this space largely due to the fact that prices are depressed, spreads are wide and trade volumes are paper thin. When an investor chooses to purchase or sell a cannabis stock, they must get mentally prepared for the price to move against them, as being a liquidity taker in this realm can be expensive. Hence, we end up with the performance that we witnessed in each month this year. And we must recognize that monthly price moves of plus or minus 25% are not normal; nevertheless, the die-hards hang on, as they probably should, given that their losses cannot get much worse. Or could they?

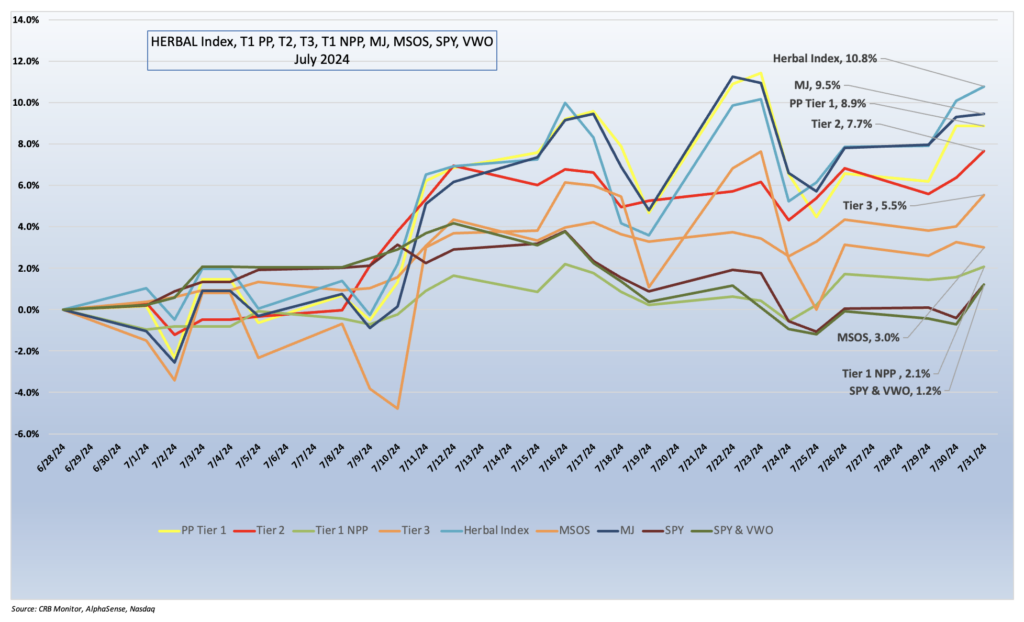

Cannabis-Linked Equity Performance, July 2024

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), had a strong rebound in July along with the rest of the group. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index. HERBAL’s performance outperformed most of the cannabis field in July, posting a return of +10.8%.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), had a strong rebound in July along with the rest of the group. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index. HERBAL’s performance outperformed most of the cannabis field in July, posting a return of +10.8%.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (+9.5%) and the actively managed MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (+3.0%), had positive returns. However, MSOS’s heavy weight to Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-6.1%) was its undoing and caused much of its underperformance to the rest of the basket. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds tend to be more sensitive than HERBAL to the U.S. regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin in 2017, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally, in 2022 MJ added and maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The U.S. plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It’s also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

The performance of the recently expanded CRB Monitor equally weighted basket of top pure play Tier 1 CRBs by market cap performed well in July, returning +8.9%. This basket, which is an equally weighted portfolio of the 24 largest pure play CRBs (including both U.S. plant-touching and non-U.S. plant-touching MJ companies), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take closer look at some of these below.

The (also-expanded) CRB Monitor equally weighted basket of Tier 2 CRBs finished the month slightly behind the Tier 1 CRB basket, posting a +7.7% return for July 2024. Back in February 2024, CRB Monitor published an update to our piece on correlations of pure play Tier 1 and Tier 2 CRBs (among other tiers and baskets). What we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time. We update this data a couple of times per year.

U.S. equities had positive albeit subdued returns in July, driven by robust economic indicators and investor optimism. The major indices — including the S&P 500, Dow Jones Industrial Average and Nasdaq Composite — all posted gains, reflecting a sustained positive sentiment in the market. Corporate earnings reports exceeded expectations for many blue-chip companies, contributing to the upward momentum. Additionally, strong consumer spending and encouraging employment data bolstered investor confidence, despite ongoing geopolitical tensions and interest rate uncertainty. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a +1.2% return for the month (now +17.3% YTD).

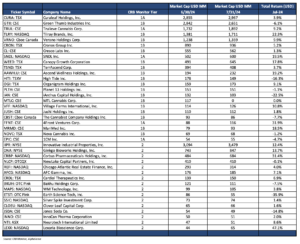

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – July 2024 Returns

CRB Monitor Tier 1

CRB performance recovered to some extent in July, but there were mixed results across the universe of Tier 1 cannabis stocks.

An equally weighted basket of the largest Tier 1 pure-play cannabis equities had an +8.9% return in July, showing some fight in the wake of a difficult two-month slump. We can see this on the table above, where there was a wide range of returns across the entire publicly traded CRB space, including both the MSO (U.S. plant-touching) group and Canadian (CSA-Friendly) CRBs. Investors of cannabis equities (those brave investors that have hung on) were rewarded some spare change for their patience.

The MSO basket had a few bright spots and a few duds. Tier 1B Cresco Labs Inc. (CSE: CL) (+1.3%) scratched out a positive return while Tier 1B Verano Holdings Corp. (CSE: VRNO) (9.9%) and Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (+9.2%) were more consistent with the return of the MSO basket. Tier 1B TerrAscend Corp. (TSX: TSND) (+3.7%) finished behind the pack, along with Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+3.9%). As we wrote above, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-6.1%) dragged down the return of the MSOS ETF given its near 30% weight in the portfolio.

Looking at the Canadian CRB basket, we found a mix of returns in July as well. And, as always, we are reminded that the future of this group is viewed by investors to be tied to the success or failure of cannabis reforms in the United States. Canopy Growth Corporation (TSX: WEED) (+17.8%), Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+19.5%), and Tier 1B Cronos Group Inc. (TSX: CRON) (+5.2%) all extending their May 2024 losses. Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) (+22.3%) and Tier 1B High Tide Inc. (TSXV: HITI) (-16.3%) struggled for the second month in a row, after being one of the only Tier 1 CRBs with a positive return in May.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies posted a -3.2% return for July, which outperformed the equally weighted Tier 1 basket by 5.2%. Typically these two baskets are highly correlated (please see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to even out over time. When these two portfolios deviate from one another (as they did in April and then changed places in July) a deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so beware!

The largest CRB in the basket, Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (3.1%), outperformed most of the Tier 1 CRBs that lease property from them. IIPR’s stock price has continued to rise over the last 12 months, having maintained stable earnings throughout that difficult period. As we reported last month, IIPR reported its First Quarter Results on May 8, which featured the following highlights:

- Generated total revenues of $75.5 million and net income attributable to common stockholders of $39.1 million, or $1.36 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of $63.0 million and $56.4 million, respectively.

- Paid a quarterly dividend of $1.82 per common share on April 15, 2024 to stockholders of record as of March 28, 2024 (an AFFO payout ratio of 82%). The common stock dividends declared for the twelve months ended March 31, 2024 total $7.24 per common share.

Tier 2 REIT AFC Gamma, Inc. (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+9.9%) finished ahead of IIPR in July and outperformed many of its Tier 1 clients. On May 9, AFCG reported its First Quarter 2024 earnings which featured the following statement from CEO Daniel Neville:

“We are pleased to have originated a total of $90.4 million of loans in the first quarter of 2024, with $34.0 million in loans to cannabis operators and $56.4 million to commercial real estate developers. On the cannabis side, we completed a $34.0 million debt investment in Sunburn Cannabis, a private, vertically integrated single-state Florida operator. … The investment underscores our commitment to fostering long-lasting relationships with our borrowers and focusing on limited license states with attractive supply and demand dynamics. Additionally, we are encouraged by the promising legislative developments at both the federal and state level, including the anticipated rescheduling at the federal level and the potential transition to adult-use cannabis in states like Ohio and Florida.”

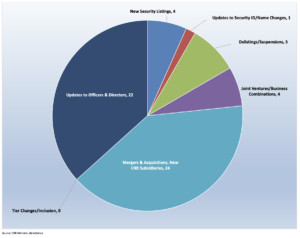

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for July 2024:

Cannabis Business Transaction News – July 2024

In spite of the chaotic political landscape in Washington, the cannabis news cycle continues in earnest and CRB Monitor’s analysts go to the ends of the earth (literally) to track all the relevant news that should be of use to all of those who take an interest in this volatile industry. The goal is not only to inform our subscribers, but to ensure that the CRB Monitor database is updated so that it accurately reflects this active global news cycle every day.

Here are some of the highlights from July:

First we head down to the Sunshine State (a.k.a. Florida) where Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) issued a press release announcing the opening of new medical cannabis dispensaries in Madison and Panama City, Fla.

In the words of the press release, “Both locations will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, O.pen, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

With these additions, Trulieve’s operational footprint expands to 122 licenses in either active status or pending approval.

Next, one of the largest Tier 1 CRBs by market cap, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) made news announcing in a press release the opening of RISE Dispensaries in Tallahassee, Fla., on July 12.

“The two locations expand the Company’s retail footprint to 19 Florida locations and 96 nationwide. Beginning July 12, RISE Tallahassee on Mahan and RISE Tallahassee on Tennessee will introduce RISE Dispensaries’ best-in-class products and service to Florida’s capital city,” the statement said. “The new RISE Dispensaries in Tallahassee will offer delivery service and feature online menus showcasing the diverse selection of cannabis products available, including RYTHM premium flower and full spectrum vapes, Dogwalkers pre-rolls, Good Green flower, Doctor Solomon’s tinctures and &Shine flower, pre-rolls, vapes and chews. RISE Dispensary Tallahassee on Tennessee will also offer roll-thru service, allowing patients to place their order from home and pick it up at a drive-thru window. A team of Patient Care Specialists at each location is ready to address patient questions and offer complimentary one-on-one virtual and in-store consultations.”

Green Thumb operates in 15 states and through its subsidiaries holds 98 licenses in active status.

Next, we travel up the East Coast to New York, where Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) announced in a July 26 news release that it will open “two new medical dispensaries, as well as begin co-located adult-use sales at two existing medical dispensaries in New York.”

The press release goes on to say, “Curaleaf said each new medical dispensary is staffed with a team of three full-time pharmacists to assist patients in exploring the company’s expansive collection of brands and products, including Grassroots indoor-grown flower, Select’s full line up of vape and edible products including the new Select Fruit STIQ All-In-One Vape, JAMS edibles, B NOBLE, and New York’s best-selling all-in-one two-gram vape, Select BRIQ.”

These new dispensaries, which are still pending regulatory approval, will be Curaleaf Rochester and Curaleaf Syracuse. Curaleaf currently holds a total of 121 active licenses across six countries, with the majority of those issued by authorities in 20 U.S. states.

Tier 1B Canadian CRB Sundial Growers Inc. (NASDAQ: SNDL) announced in a July press release that it has “completed the acquisition of the principal indebtedness of Delta 9 Cannabis Inc. from Connect First and Servus Credit Union Ltd. for a purchase price of CAD $28,138,284 pursuant to a purchase and sale of indebtedness agreement dated July 5, 2024. As a result of the Debt Acquisition, SNDL has become Delta 9’s senior secured creditor with a first priority security interest in all of the assets of Delta 9 and certain Delta 9 subsidiaries. The Purchased Indebtedness brings Delta 9’s total indebtedness owing to SNDL to CAD $40,653,352.”

Sundial, which also announced a major cost-cutting campaign in July that will feature significant reductions in the workforce, currently operates in eight Canadian provinces and holds (through its subsidiaries) 131 active cannabis licenses.

Finally, it was another busy month for 1B Canadian CRB High Tide Inc. (TSXV: HITI), which issued a July press release announcing the opening of four new Canna Cabana retail cannabis stores: two in Calgary, Alberta, one in Ottawa, Ontario, and the fourth in Stoney Creek, Ontario.

In the words of Raj Grover, High Tide founder and chief executive officer, “I can’t think of a better way to end our third fiscal quarter than by announcing the opening of four new Canna Cabanas, bringing our ever-expanding store count to 180 across Canada and 65 in Ontario. Many of these new stores are part of our organic expansion strategy, which includes onboarding proven locations previously run by competitors through lease takeovers, resulting in minimal store buildout costs. Since January 1, we have already added 18 new Cabanas to our retail portfolio and are confident that we will meet or exceed our previously communicated goal of adding 20 to 30 new locations this year.”

High Tide currently holds 190 active licenses across six Canadian Provinces.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Dr. Reddy’s Laboratories Limited | NYSE: RDY | Tier 1B | Neha Jain Elevated as Group HR Director At Dr. Reddy’s Laboratories |

| Organigram Holdings Inc. | TSX: OGI | Tier 1B | Appointment of Craig Harris to Board of Directors (ORGANIGRAM HOLDINGS INC) |

| Red Light Holland Corp. | CSE: TRIP | Tier 1B | Appoints New Interim Chief Financial Officer (RED LIGHT HOLLAND CORP) |

| Lifeist Wellness Inc. | TSXV: LFST | Tier 1B | Lifeist Appoints Andrea Judge CEO of Mikra Cellular Sciences |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Rising Biosciences, Inc. | OTC Expert: RBII | Downgraded to Tier 2 | Tier 2 – CBD – Pharma & Biotech |

| Acacia Diversified Holdings, Inc. | OTC Expert: ACCA | Moved to Watchlist | CBD – Food, Beverage & Tobacco |

| Evergreen Sustainable Enterprises, Inc. | OTC Expert: EGSE | Moved to Watchlist | Tier 1B – Owner/Investor |

| American Eagle Outfitters, Inc. | NYSE: AEO | Moved to Watchlist | Tier 3 CBD – Traditional Retail |

| Life On Earth, Inc. | OTC Expert: LFER | Moved to Watchlist | Tier 2 – Electronic Equipment |

Cannabis News: Regulatory Updates

Amid these lazy days of summer, while we contemplate the impact of upcoming elections and attempt to tune out the noise of presidential campaigns and an insufferable news cycle, it seems as though cannabis legalization and reforms have been moved to the background. The euphoria surrounding rescheduling has seemingly gone quiet for several months.

A July article in MJ Biz Daily highlights one potential, significant obstacle to rescheduling: the Supreme Court’s decision on Loper Bright v. Raimondo, which has the potential to redefine the role of government agencies. In the words of the MJ Biz article, “The high court’s ruling in Loper v. Bright massively curtails the power of regulatory agencies to set and enforce rules, including the proposal to recategorize marijuana as a Schedule 3 substance. Were it to play out on the current path as an administrative action, rescheduling could fail. But that’s not the problem. Rescheduling now will take far longer than it otherwise would have because the Supreme Court gave the opposition new lines of attack against the rescheduling decision.”

For CRBs and cannabis investors this does not sound productive, and we will stand by as this new regulatory landscape unfolds.

On that sober note, here are some (perhaps more uplifting) regulatory highlights from July:

Let’s begin in New Mexico: In an article from our own CRB Monitor News team, we learn that cannabis seizures from licensed businesses by U.S. Customs and Border Protection agents continue near the U.S. border in New Mexico, and state officials are still wondering why. This complicated issue is seemingly without an obvious solution, given the dichotomy between state and federal (namely the Department of Homeland Security) regulations regarding transportation of cannabis. In the eyes of the U.S. government, cannabis is a Schedule I narcotic, while the State of New Mexico regards it as legal for any business that holds a license to operate. In the words of the CRB Monitor News story:

“The CBP (Customs and Border Protection) is allowed to operate within 100 miles of the U.S. border. While the U.S. Department of Justice is legally prohibited from enforcing federal cannabis laws in states with legal programs, the CBP is under the Department of Homeland Security, a completely separate agency. The CBP reportedly said anyone stopped at a checkpoint with a controlled substance is subject to seizure, fines and arrest. … The seizures are happening as couriers from businesses south of a checkpoint, such as in Las Cruces, try to drive north. This enforcement has not been reported to be a problem in other cannabis-legal border states, although data in Arizona show a high number of seizures.”

CRB Monitor will continue to provide updates to this situation, which does not appear to have been resolved at this point.

Next we head back to New Hampshire, which continues to be the only New England state without legal, adult-use cannabis. An article published by Marijuana Moment reported that “Generalized anxiety disorder will be added as a qualifying condition for medical marijuana in New Hampshire under a bill signed into law by Gov. Chris Sununu. The governor vetoed separate legislation, however, that would have allowed medical marijuana businesses to open second cultivation locations, including in greenhouses. Currently all cannabis grown under the state’s medical program must be cultivated indoors. The anxiety bill approved by Sununu, HB 1349, from Rep. Heath Howard (D), adds “generalized anxiety disorder” to the state’s list of qualifying conditions for its medical marijuana program. The new law takes effect 60 days after passage.”

Could this be a step toward full legalization? The article goes on to report, “As for more far-reaching reforms, lawmakers at the last minute this year narrowly shot down legislation that would have legalized marijuana for adults in the state. A poll released last month showed 61 support for that bill among New Hampshire residents—just a few percentage points below the 65 percent support that respondents to a separate poll said they have for legalization generally.”

Perhaps New Hampshire will get there, but it is complicated politically, as (similar to the Granite State’s control over alcohol sales) the governor’s intent appears to be for the state to control marijuana sales as well.

Now we head south to Pennsylvania, where an article in MJ Biz Daily reported that Pennsylvania state lawmakers passed an annual budget without the adult-use marijuana legalization – and accompanying revenue – that the governor had planned for.

What happened? In the words of the article, “Gov. Josh Shapiro’s $48.3 billion state spending proposal, pitched in February, included $250 million from adult-use sales taxed at 20%. That’s tax revenue the state could access, if only lawmakers would act and pass longstanding bipartisan legalization proposals. But adult-use legalization was not included in the final $47.6 billion state budget that passed last week, nearly two full weeks beyond a June 30 deadline, Harrisburg-based Spotlight PA noted.

Legal recreational cannabis – now a fixture in every state bordering Pennsylvania except for West Virginia – was part of a revenue package that also included skill games…In the case of legalizing adult use, Democrats and existing medical marijuana operators fell out over a Democratic proposal under which cannabis would be sold in state-run stores, similar to alcohol.”

Pennsylvanians will have to wait and, in the meantime, do their cannabis shopping in one of several neighboring states.

Next we head further south to Alabama, where an article in MJ Biz Daily reported in July that a not-so-forward-thinking circuit court judge “has extended a temporary restraining order on the issuance of medical marijuana business licenses in yet another delay to the market’s launch. Montgomery County Circuit Judge James Anderson, according to the Alabama Reflector, also instructed the state’s Medical Cannabis Commission to begin investigative hearings requested by companies denied licenses in the previous round.”

The article also notes that “more than three years have passed since the governor signed into law the Alabama Compassionate Act, which allowed MMJ products for patients suffering from a host of chronic health issues.”

We will continue to follow the progress of licensing in Alabama, in hopes that they finally figure things out and allow their CRBs to begin operating there.

Finally, a story from the District of Columbia: one more interesting article from our CRB Monitor News team reported in July that “the District of Columbia Alcohol Beverage and Cannabis Administration is cracking down on businesses that are allegedly selling cannabis without a license as the district also works toward creating a pathway for operators in the vibrant gifting market to obtain a medical dispensary license.”

This issue, which has also been a serious problem with operators in New York, has negative implications for the legal cannabis industry as well as its consumers and, of course, its investors. According to the article, “The ABCA ordered four gray-market cannabis shops to shut down on July 3 after they were found to be allegedly selling cannabis without a proper license. So far, ABCA has also sent out 55 warning letters to businesses suspected of not being in compliance, according to a spokesperson for the agency. They did not say whether more cease-and-desist letters could be coming. The move comes as neighboring states are growing their own adult-use cannabis markets, adding competitive pressure to district operators.”

CRBs In the News

The following is a sampling of highlights from the July 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update Defining “Cannabis-Related Business”.