The second quarter of 2024 revealed several notable trends in cannabis business licensing, reflecting both consolidation and growth in different regions.

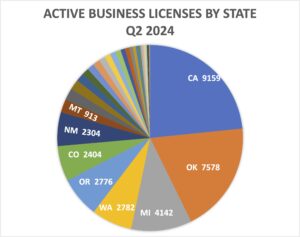

In the United States, the total number of active cannabis business licenses declined by 2%, marking the sixth consecutive quarter of reduction. By the end of the quarter, there were 39,103 active licenses, an 8% drop from the previous six months and an 11% decrease compared to the same period last year. This decline from the peak of 44,323 active licenses in Q4 2022 signals ongoing consolidation in the industry.

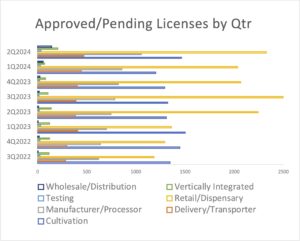

Conversely, there was a significant increase in the number of approved and pending licenses, which rose by 21% to 5,687 — the highest number in over two years. This growth was largely driven by a surge in new applications in states like New York and New Jersey, with the total number of approved and pending licenses nationwide remaining 17% higher than the previous year.

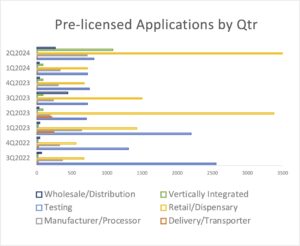

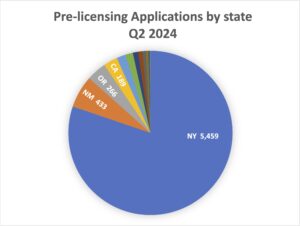

Pre-licensing activity, which includes applications submitted but not approved, experienced a dramatic rise of 251% nationally, reversing a year-long decline. This surge was predominantly due to an influx of applications in New York. Nationwide pre-licensing numbers remain 23% lower than a year ago.

Retail dispensary and manufacturer/processor applications exploded 445% and 119% respectively. Retail/dispensary applications increased to 3,910, the highest number of new license applications recorded in two years, led almost entirely by applicants in New York. But the largest percentage increase came in vertically integrated operators, which ended the quarter with 1,078 applications in pre-licensing, a 1183% rise clustered in vertical-only Florida as operators bet on a successful outcome of the state’s adult-use referendum in November.

Significant increases were also recorded incultivation and wholesale/distribution licenses in application, which rose 13% and 760%, respectively. Delivery transport and testing applications remained nominal as they have for the past several quarters.

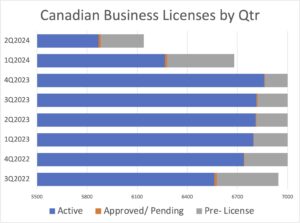

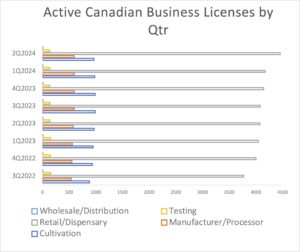

In Canada, the cannabis business landscape showed signs of maturity and stability. The number of active licenses fell by 6% in the second quarter, marking the second consecutive quarterly decline. Canada ended the quarter with 5,869 active licenses, down from a multi-year peak of 6,860 in Q4 2023. This represents a 14% drop over the past six months and year-over-year.

Despite the decline in active licenses, there was a slight increase in approved and pending licenses in Canada, which rose modestly to 14 by the end of the quarter. However, applications in pre-licensing fell to a two-year low of 256, indicating a slowdown in new business entrants.

Despite the decline in active licenses, there was a slight increase in approved and pending licenses in Canada, which rose modestly to 14 by the end of the quarter. However, applications in pre-licensing fell to a two-year low of 256, indicating a slowdown in new business entrants.

License Types: Florida leads surge in vertically integrated apps

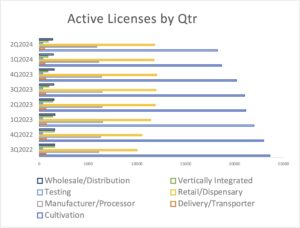

Across different license types, cultivation and retail/dispensary licenses remained the most common in boththe U.S. and Canada. In the U.S., there were 18,237 active cultivation licenses and 11,772 active retail/dispensary licenses at the end of Q2 2024. These categories also saw growth in approved and pending licenses, with cultivation and retail/dispensary applications increasing by 22% and 14%, respectively.

Manufacturer/processor licenses made up the third largest license type at the end of the second quarter, with more than 5,870 active licenses, followed by wholesale/distribution licenses with 1,367, representing a 4% quarterly decline in each category and continuing a year-long trend of consolidation in these segments.

Manufacturer/processor licenses made up the third largest license type at the end of the second quarter, with more than 5,870 active licenses, followed by wholesale/distribution licenses with 1,367, representing a 4% quarterly decline in each category and continuing a year-long trend of consolidation in these segments.

Manufacturer/processor and wholesale/distribution licenses experienced declines in active numbers but showed optimism in approved and pending categories. Approved and pending manufacturer/processor licenses rose by 23%, while wholesale/distribution licenses saw a notable 160% increase.

Manufacturer/processor and wholesale/distribution licenses experienced declines in active numbers but showed optimism in approved and pending categories. Approved and pending manufacturer/processor licenses rose by 23%, while wholesale/distribution licenses saw a notable 160% increase.

Vertically integrated operators, which combine multiple business activities under one license, saw a 2% increase in active licenses in the U.S., suggesting stabilization after previous declines.  There was also a 200% surge in approved and pending licenses for these operators, particularly in anticipation of Florida’s potential adult-use market.

There was also a 200% surge in approved and pending licenses for these operators, particularly in anticipation of Florida’s potential adult-use market.

Approved/Pending license counts, which can be a leading indicator of sentiment and future growth in the market, were surprisingly buoyant in the second quarter, logging double and triple-digit growth across virtually every major operator type and suggesting optimism among companies eyeing new market entries and expansion.

State Trends: Oklahoma shrinks, New York and Michigan grow

State-specific trends also emerged in Q2 2024. Oklahoma continued to experience a decline in active licenses, down 10% due to regulatory constraints and enforcement actions against non-compliant operators, to 7,578, marking a 36% drop in active licenses from a year ago.

California held its position as the leading state for cannabis operators, despite a 3% drop in its active licenses in the quarter and a 14% decline from a year earlier, closing out the quarter with 9,159 licensed operators.

In contrast, Michigan and New York saw significant increases in active licenses, with Michigan adding nearly 600 new licenses, representing a 17% increase, and New York boosting its count by 48%, adding 221 new licenses and expanding its active license count 80% over the past 12 months. Other states with significant percentage increases in active licensing during the quarter include Illinois (23%), New Jersey (38%), Connecticut (51%) and Utah (109%).

Notably, no state market recorded a greater than 10% decrease in active licenses during the second quarter, marking a broad stabilization across the country’s regulated cannabis markets after two years of tumultuous retrenchment and consolidation. Indeed, with only 10 of 46 regulated markets tracked by CRB Monitor recording any decline at all in license counts, a cautious optimism that a bottom in the market has been reached seems warranted.

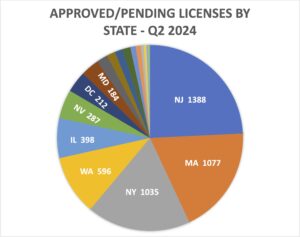

Cannabis business license applications which have been approved but have yet to become operational are grouped by CRB Monitor under the category of “approved/pending” status, and reflect the near-term pipeline of new cannabis business operations poised to enter the regulated market. While no guarantee that these new operations will commence, the investment of resources required to prepare, submit and successfully obtain a cannabis license does suggest a level of commitment that can be used as a proxy for future business activity.

The U.S. saw robust growth in pending licenses, with New York leading the way by adding 667 licenses, a 42% quarterly increase. California, on the other hand, experienced the sharpest drop in pending licenses, declining by 67%, which may indicate market saturation or regulatory challenges.

Ten states experienced double or triple-digit growth in new approved/pending licenses in the second quarter. New York led the country in the increased number of approved/pending during the quarter, adding 667 additional licenses to end the quarter at 1,077 new licenses pending activation, for a 42% quarterly increase. New Jersey once again led the country in the total number of approved/pending licenses outstanding, with 1,388, a slight decrease over the previous quarterly period.

Other states with notable increases in approved licenses include Massachusetts, which added 417 approved/pending permits in the quarter, a 42% increase over the first quarter. Washington and Illinois added 66 and 16 new licenses, respectively, ending the quarter with 596 and 398 pending new licenses.

Other states with notable increases in approved licenses include Massachusetts, which added 417 approved/pending permits in the quarter, a 42% increase over the first quarter. Washington and Illinois added 66 and 16 new licenses, respectively, ending the quarter with 596 and 398 pending new licenses.

California experienced the sharpest drop in pending licenses, falling 67% to just 52 approved or pending licenses at the end of June.

New York ended the second quarter with the largest number and largest percentage increase in applications in pre-licensing, with 5,459 permits in application, a 1251% increase from the first quarter. Indeed, as the Empire State’s challenged two-year rollout of its adult-use market finally appeared to be moving forward, the state’s total licenses in application exceeded the total number of applications in pre-licensing in all of the rest of the country’s state markets by a factor of four.

New Mexico, which led the country in pre-licensing in the first quarter, had the second most number of applications in pre-approval status, with 433 applications awaiting approval, a 6% increase from the prior three months. Other states showed little change in new applications, with the District of Columbia and Maine logging notable quarterly declines, falling 47% and 26%, respectively.

New Mexico, which led the country in pre-licensing in the first quarter, had the second most number of applications in pre-approval status, with 433 applications awaiting approval, a 6% increase from the prior three months. Other states showed little change in new applications, with the District of Columbia and Maine logging notable quarterly declines, falling 47% and 26%, respectively.

Overall, the trends in cannabis business licensing for Q2 2024 paint a picture of a dynamic industry. While the number of active licenses continued to decline, the arc of the curve flattened, and the surge in approved, pending and pre-licensing activities suggests optimism for future growth, particularly in emerging markets like New York and Florida. This mixed landscape reflects the evolving nature of the cannabis industry, where regulatory changes and market maturation are driving both challenges and opportunities.