Co-authored by Kyle Buckley, CRB Monitor Senior Analyst

Our September 2024 CRB Monitor Chart of the Month is an update to our article from December 2023: CRB Monitor Chart of the Month: MSO Business Trends. We remain curious about the migration of cannabis operations in a market where parent companies have faced significant headwinds over the last few years. In an industry where M&A activity has all but dried up, publicly traded MSOs continue to jockey for position in the states where they feel they can make an impact while they withdraw from the states where they feel their presence is inconsequential.

Multistate operators (MSOs) are CRBs that spread their revenue-generating, licensed cannabis operations (cultivation, manufacturing, distribution, etc.) across two or more states in the U.S. This model for doing business can be complicated and painful. But CRBs’ hands are tied while cannabis is still federally illegal, and operating on a state-by-state basis (and internal to each state) is the only way to grow revenues within the U.S.

As such, MSOs face a number of obstacles that historically have limited their ability to operate profitably in every state where they are licensed. Some notable hurdles include:

- Licensing requirements that seek to establish or restore social equity to CRB ownership

- Varying levels of state taxation

- Barriers to using mainstream banking services, such as payments, lending and deposit accounts

- Varying degrees of participation by the illicit market, which undermine the legal market

Given these unique hurdles on top of the challenges faced by all businesses in emerging industries, several large, publicly traded MSOs have closed their operations and moved out of one or more states. And as such, we thought it might be interesting to take another look at this trend in the cannabis industry as it is a reflection of companies’ need to survive while the politicians figure things out.

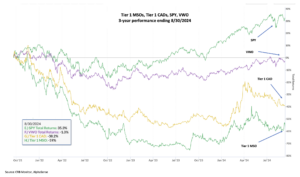

But first, and to provide some context, let’s take a look at market performance. It is an understatement to say that cannabis-related equities have been in a free-fall for several years (see the charts below).

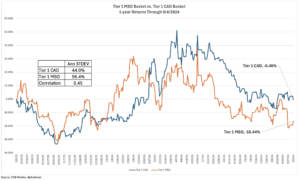

The two lines on the above chart represent the recent one-year performance of a basket of the largest 20 MSOs (red) and the largest 20 Canadian-based CRBs (blue). While it’s been a volatile year for the entire cannabis industry, we can see how the Canadian (non-U.S. MJ) basket outperformed the MSO basket in spite of the fact that the two lines crossed on multiple occasions throughout the period. And while both baskets have high historical volatility, the MSO basket has been the more volatile portfolio of the two. The correlation between the two portfolios (0.45) continues to be high as well.

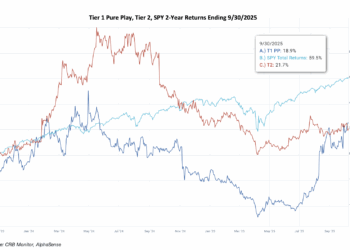

Here is a look at the last three years of performance, which shows an even more dramatic underperformance by the MSO group:

As we observed in our original article, the two equally-weighted CRB baskets performed in lock-step until fourth quarter 2022, when they started to diverge with MSOs underperforming the CADs right up to the present. Observing this persistent underperformance (with a few exceptions), it can be inferred that the MSO group has had a lot more to lose from the lack of progress toward any form of cannabis reform over the last few years.

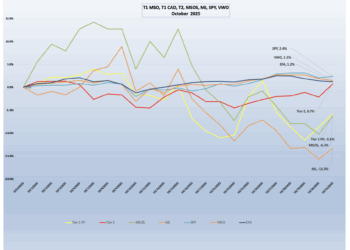

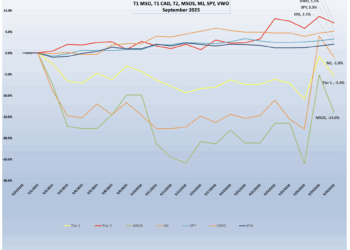

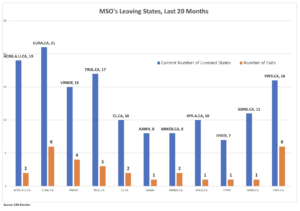

On that note, we thought it would be interesting to see if this trend is persistent. Now that another eight months has passed, it has shown no signs of reversing. The chart and table below are new, updated versions of the analysis that we presented in December 2023. All the data are cumulative.

The above chart represents an interesting trend for eleven MSOs which over the last 20 months “picked up their ball and went home,” selling licensed operations in states where they had moved in not long ago. (We provide more detail at the company level in the table below.) As we originally indicated, the process of moving into a state is complex and expensive as an operator must secure one or more licenses from a state authority while navigating the twists and turns of doing business in local municipalities that have mixed levels of acceptance among residents.

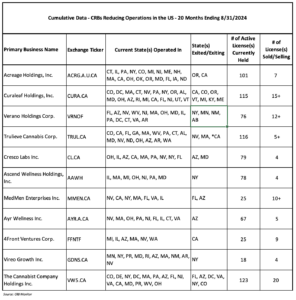

The following table represents the cumulative results over the last 20 months, and as you can see the trend continues. While a few MSOs continue to build their operational footprint in states where they are already located (e.g. Trulieve in Florida), the trend of companies reducing their operations is too obvious to ignore.

Updates on MSO operations

Most recently we have observed the significant consolidation of operations by The Cannabist Company Holdings Inc. (formerly Columbia Care) (Cboe CAD: CBST) across a number of states. In the past few months, The Cannabist has closed down or reduced its operations in Florida, Arizona, Washington DC, Virginia, New York and Colorado. Regarding its decision to exit Florida, an article in the Green Market Report discussed the rationale for The Cannabist’s new strategy: “The Cannabist Co. – which lost $34 million in the first quarter of 2024 and $174.3 million last year – expects to post $10 million in annual cost savings through the restructuring and up to $20 million in added earnings, CEO David Hart said in a press release. The restructuring plan was kicked off on June 13 and included “both labor and non-labor reductions,” the company said in a release.”

In several cases, licensed subsidiaries have been purchased from CBST by rival CRBs (e.g. Verano Holdings Corp. (CSE: VRNO) has purchased their licenses in New York and Florida.

Speaking of which, another MSO that appears to be shifting its focus following their significant U.S. expansion is Tier 1B CRB Verano Holdings Corp. (CSE: VRNO). While Verano has been buying up CBST’s licenses in New York and Florida, it has been closing down its operations in Alabama (more like never opening them in the first place). Because the Verano situation involved a 2024 legal dispute in the Alabama courts, a license was never issued, and Verano was forced to close up shop before their grand opening.

One more large, familiar name in cannabis is Tier 1A Curaleaf Holdings, Inc. (CSE: CURA), an MSO that in the last 18 months has closed its operations in six states. Beginning in 2023, Curaleaf Holdings, Inc. concluded its operations in multiple states including California, Colorado, Oregon, Vermont and Michigan. In 2024, Curaleaf announced it exited its CBD operations in Kentucky. More recently (Q2 2024) Curaleaf announced it would be closing its operations in Maine. With that said, Curaleaf continues to operate through licensed subsidiaries in 20 States with 115 active licenses.

Finally, we would be remiss if we didn’t mention Tier 1B CRB Medmen Enterprises, Inc. (OTC Expert: MMNFQ), a company that has been on the move out of several states in 2024 as it faces bankruptcy proceedings. This year alone, we have witnessed Medmen exit Arizona while downsizing in California, Illinois, Nevada, and New York.

The last 20 months have continued to be a challenge for both the cannabis industry and its investors. With DEA re-scheduling, SAFER Banking, and legalization all in a holding pattern at least until after the elections, CRBs have had to make difficult choices as they look to the future. Since our original article was published in December 2023, we have identified 14 new examples of states where cannabis companies are either reducing operations or closing them down altogether. CRB Monitor’s research team will keep a close watch on these CRBs as we get closer to year end.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

(See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business”, and its update, Defining “Cannabis-Related Business”).