Following a multi-period collapse, cannabis equities appeared to be in recovery mode for most of September 2024, with many of the larger (now microcap) Tier 1 CRBs finishing the month in positive territory. This had to be a relief for those cannabis investors who have held on through thick and thin. But there are no assurances that the road ahead is any brighter than it has been since the surge of late April 2024.

Truth be told, investors are clinging to an industry that’s total market cap is barely more than $10 billion, which would make it prohibitive for institutions to own even if cannabis were fully legal in the U.S. This is why we keep the thought in the back of our minds that the largest CRBs might collectively be targets for a post-legalization sweep. We will stay focused ahead of these critical November elections.

Cannabis-linked Equity Performance

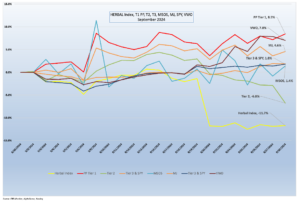

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), was negative in September largely due to security weightings as the index approached its semiannual reconstitution. Read a full description of HERBAL’s strengths and benefits in Introducing: The Nasdaq CRB Monitor Global Cannabis Index. HERBAL’s September return relative to its peers turned out to be a reversal of its outperformance earlier in the third quarter.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (+4.6%) and the actively managed, MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (+1.4%), finished the month in positive territory. Both of these funds are benchmarked to CRB indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching MJ exposure tend to be more sensitive than HERBAL to the U.S. regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin in 2017, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally in 2022, MJ added and maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The U.S. plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It’s also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

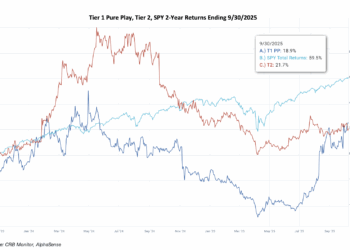

The performance of the recently expanded CRB Monitor equally weighted basket of top pure play Tier 1 CRBs by market cap had a strong recovery in September, returning +8.5%. This basket, which is an equally weighted portfolio of the 21 largest pure play CRBs (including both U.S. plant-touching and non-U.S. plant-touching MJ companies), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take closer look at some of these below.

The CRB Monitor equally weighted basket of Tier 2 CRBs underperformed the Tier 1 CRB basket, posting a -6.8% return for September. Back in February, CRB Monitor published an update to our piece on correlations of pure play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces like marijuana rescheduling that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time. We update this data a couple of times per year.

In September, U.S. equities experienced mixed performance, with major indexes showing a cautious tone amid growing concerns over inflation and interest rates. The S&P 500 ended the month with modest gains, driven by strength in technology and healthcare sectors, although these were offset by weakness in consumer discretionary and energy stocks. The Dow Jones Industrial Average saw a slight decline, weighed down by underperformance in industrial and financial stocks. Meanwhile, the Nasdaq Composite outperformed, buoyed by investor optimism around innovation-driven companies, particularly in artificial intelligence and cloud computing. Overall, volatility persisted as markets awaited further signals from the Federal Reserve regarding future monetary policy. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a +1.8% return for the month (now +21.8% YTD).

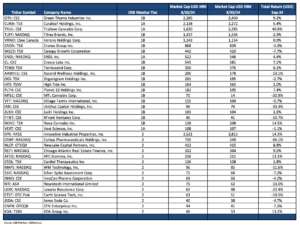

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – September 2024 Returns

CRB Monitor Tier 1

An equally weighted basket of the largest Tier 1 pure play cannabis equities had a -11.8% return in September, with prices showing signs of fatigue and melancholy at summer’s end. This is clear from the data in the table above showing a few scattered rays of sunshine splashed across the generally dismal publicly traded CRB space, including both the MSO (U.S. plant-touching) group and Canadian (CSA-friendly) CRBs. Investors of cannabis equities appear to be out of answers as they await any form of good news, but they will have to wait until after the November election and perhaps well into the first quarter 2025 for any positive action from the federal government.

Publicly traded CRB performance was mixed but net positive in September across the universe of Tier 1 cannabis stocks. The MSO basket ran the gamut of returns, with Tier 1B Cresco Labs Inc. (CSE: CL) (+7.1%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (+0.9%), Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (+40.8%), Tier 1B TerrAscend Corp. (TSX: TSND) (+6.1%), and Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+5.4%) rebounding during the month. The largest CRB by market cap, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (+9.2%) was also positive, but it will take quite a bit more upside to make up for the Q3 swoon (or the last three years of negative performance, for that matter).

Looking at the Canadian CRB basket, we saw a mixed bag of returns in September. While historical performance has deviated with the MSO basket over short periods, the two groups tend to mean revert over time. Canopy Growth Corporation (TSX: WEED) (-7.7%) and Tier 1B Cronos Group Inc. (TSX: CRON) (-3.3%) continued their third quarter slide. Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (+2.9%), Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+4.6%), and Tier 1B High Tide Inc. (TSXV: HITI) (+1.0%) posted single-digit positive gains that did little to quell investors’ concerns over the future of this perennially emerging industry.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies posted a negative 6.8% return for September, which underperformed the equally weighted Tier 1 basket by 15.3%. Typically these two baskets are highly correlated (please see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to even out over time. When these two portfolios deviate from one another, as they did significantly in September, it could be a signal for investors to rebalance their Tier 1 and Tier 2 baskets given their direct revenue relationship, but the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so proceed with caution!

The largest CRB in the basket, Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+14.3%) continued its streak of outperformance relative to the Tier 1 CRBs that lease property from them as it hit its one-year high on Sept. 19. IIPR’s stock price has been consistently positive over the last year, having maintained stable earnings throughout a challenging period for the cannabis industry. In early August, IIPR reported its second quarter 2024 results which appeared to have buoyed investor optimism. Here are the highlights:

- Generated total revenues of $79.8 million and net income attributable to common stockholders of $41.7 million, or $1.44 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) and normalized funds from operations of $65.5 million and $58.8 million, respectively.

- Paid a quarterly dividend of $1.90 per common share on July 15, 2024, to stockholders of record as of June 28, 2024 (an AFFO payout ratio of 83%), representing a 4.4% increase over IIP’s first quarter 2024 dividend and an annualized dividend of $7.60 per common share.

Tier 2 REIT AFC Gamma, Inc. (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+14.3%) surged again in September, and over recent months it has outperformed its Tier 1 CRB lending clients. On September 7, AFCG reported its second quarter 2024 earnings, which featured the following statement from CEO Daniel Neville:

“We are excited to announce that AFC is now a pure-play cannabis lender after the spin-off of our commercial real estate portfolio on July 9, 2024. This transition positions us well to capitalize on cannabis market opportunities, and we are on track to meet or exceed our $100 million origination goal for this year. This quarter has been marked by strong performance. Our active portfolio management is showing positive momentum, with reduced reserves and increased book value, highlighting the effectiveness of our strategic initiatives.”

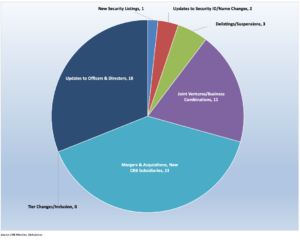

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for September 2024:

Cannabis Business Transaction News – September 2024

We are not surprised to report that while the cannabis industry struggles to stay afloat during these challenging political times, there are plenty of stories of operational success (and sometimes failure) to share with our audience. We are cautiously encouraged by a handful of CRBs’ persistent expansion into new states, provinces, and countries as well as announcements of joint ventures that result in new product lines in new locations.

With that said, the clock continues to tick as the cannabis industry waits for progress on cannabis reform. Last month, we teased the idea that a large company in a “related” industry (perhaps pharma, beverages, or tobacco) would be an excellent candidate to purchase a number of these decimated CRBs once cannabis is legalized in the U.S. As such, we continue to monitor the legalization progress at the state and federal levels, as well as internationally, as we update the CRB Monitor database to reflect any changes in company operations and strategic personnel.

Here are some of the highlights from September:

First, let’s head out west to Arizona where Tier 1A MSO Trulieve Cannabis Corp. (CSE:TRUL) issued a press release announcing the relocation of a dispensary in Tucson. In the words of the announcement:

“The new Trulieve Tucson Menlo Park…(will carry) a wide variety of Trulieve in-house brands including Alchemy, Avenue, Co2lors, Loveli, Modern Flower, Muse, and Roll One, as well as a broad assortment of products from popular partner brands.”

Trulieve’s Arizona footprint includes licensed dispensaries in Apache Junction, Avondale, Casa Grande, Chandler, Cottonwood, Glendale, Guadalupe, Mesa, Peoria, Phoenix, Scottsdale, Sierra Vista, Tempe and Tucson. They operate in 16 states and three Canadian provinces and hold 125 licenses in either active status or pending approval.

Canadian Tier 1B CRB Tilray Brands, Inc. (NASDAQ: TLRY) announced in a Sept. 3 press release that it has “successfully completed the previously announced acquisition of craft breweries Hop Valley Brewing Company, Terrapin Beer Co., and Revolver Brewing, from Molson Coors Beverage Company (NYSE: TAP).”

This is no small feat, as Tilray is clearly immersing itself in the malt beverage industry. In fact, this and previous acquisitions have resulted in Tilray’s ascension to the “Top 5” in craft brew manufacturing:

“This acquisition further strengthens Tilray’s leadership position in the U.S. craft beer market as the 5th largest craft brewer in the country and the top craft brewer in the Pacific Northwest and Georgia. It also anchors Tilray in Texas, the second largest beer consumption state, and expands Tilray’s craft beer portfolio across key beer markets, adding 30% new beer buying accounts. Tilray Brands’ impressive beverage portfolio now includes some of the leading craft beer, spirits, and non-alcohol beverage brands such as SweetWater Brewing Company, Montauk Brewing Company, Alpine Beer Company, Green Flash Brewing Company, Shock Top, Breckenridge Brewery, Breckenridge Distillery, Blue Point Brewing Company, 10 Barrel Brewing Company, Redhook Brewing Company, Widmer Brothers Brewing, Square Mile Cider Company, HiBall Energy, Happy Flower CBD, along with Canada’s top recreational cannabis and THC beverage brands, Mollo and XMG.”

Currently Tilray’s cannabis-related operations are in 10 countries outside the U.S., and it holds 334 active cannabis licenses.

In Florida, Tier 1B MSO Verano Holdings Corp. (CSE: VRNO), issued a Sept. 12 press release announcing “the openings of MÜV Melbourne and MÜV Okeechobee on Friday, September 13, raising the Company’s retail footprint to 79 Florida dispensaries and 152 retail locations nationwide.”

The announcement goes on to report: “Situated in Florida’s Brevard County, a growing region counting more than 606,000 residents1, MÜV Melbourne complements Verano’s nearby MÜV West Melbourne and Satellite Beach dispensary locations. The opening of MÜV Okeechobee also expands Verano’s footprint in south central Florida near existing MÜV dispensaries in Port Saint Lucie, Fort Pierce, Stuart and Hobe Sound. MÜV dispensaries feature online menus for effortless browsing of their extensive, award-winning product selection, including the Company’s signature Verano Reserve, MÜV and Sweet Supply flower, Encore edibles, On the Rocks concentrates and extracts, and (the) Essence and Savvy flower and extracts, spanning an extensive array of options for patients. The Company also offers one-on-one virtual and in-store consultations, at no cost to patients, and provides patient-centric concierge services via phone, email, web chat and text to address patient inquiries.”

Currently, Verano holds 73 active licenses through its subsidiary businesses across 14 states.

Canadian Tier 1B High Tide Inc. (TSXV: HITI) announced Sept. 10 that it has “entered into a joint-venture with Positive Intent Events (PIE) to establish a leading position in Canada’s nascent cannabis hospitality sector. The announcement follows Alberta’s decision to allow licensed cannabis pop-up stores at adults-only festivals and events. With 183 Canna Cabana branded retail stores across Canada, making it the second largest cannabis retailer in the world by store count, and the largest in Alberta, High Tide will leverage the strength of its national brand to deliver incredible retail experiences at a broad variety of events and venues, while working with PIE to create additional opportunities for cannabis pop-ups across Canada.”

Currently High Tide holds, through its subsidiaries, 193 active cannabis licenses in six Canadian provinces.

Finally, we turn to the Netherlands, where Tier 1B Canadian CRB Village Farms International, Inc. (TSX: VFF) issued a Sept. 24 press release announcing it “has acquired the remaining equity ownership interest in Leli Holland, B.V. (“Leli”). This transaction increased Village Farms’ equity ownership in Leli to 100 percent from 85 percent. The Company also announced that it has completed construction of its cultivation facility in the town of Drachten. The Drachten facility is an indoor facility with five flower rooms and additional space for drying, manufacturing, and packaging of finished goods for distribution to approximately 80 Dutch coffeeshops in participating jurisdictions. Leli anticipates commencing cultivation in October, pending final regulatory inspections, with its first sales expected to occur during the first quarter of 2025.”

VFF, which operates in the cannabis industry outside of the U.S., currently holds 10 active licenses in four Canadian provinces as they await the opening of the Dutch facility.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| 1933 Industries Inc. | CSE: TGIF | Tier 1B | Board Resignation (1933 INDUSTRIES INC) |

| Cresco Labs Inc. | CSE: CL | Tier 1B | Cresco Labs Announces Dennis Olis to Retire as Chief Financial Officer |

| Aurora Cannabis Inc. | TSX: ACB | Tier 1A | CEO Miguel Martin takes on additional role as Executive Chairman of Board of Directors (AURORA CANNABIS INC) |

| IM Cannabis Corp. | CSE: IMCC | Tier 1B | IM Cannabis appoints Shmulik Arbel to BOD |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Jayex Technology | ASX: JTL | Move to Watchlist | Tier 1B – Owner/Investor |

| Johnson Matthey Plc | LSE: JMAT | Moved to Watchlist | Tier 3 – Electronic Equipment |

| MGX Minerals Inc. | OTC Expert: MGXMF | Moved to Watchlist | Tier 3 – Energy |

| Heritage Cannabis Holdings Corp. | CSE: CANN | Moved to Watchlist | Tier 1B – Owner/Investor |

| Worthington Industries Inc. | NYSE: WOR | Moved to Watchlist | Tier 3 – Industrial Machinery |

Cannabis News: Regulatory Updates

Now that autumn has begun and we are within smelling distance of election day, cannabis seems to be taking a backseat (perhaps even a rumble seat) to the more politically charged issues, like the economy and reproductive rights. With that said, we believe we know where each party stands on the issue of cannabis reform and only time will tell how the U.S. government will land regarding the biggest cannabis-related issues, including safe banking, rescheduling, and of course, legalization. And we will be following ballot questions at the state level, including Florida, South Dakota, Oregon, North Dakota, Nebraska and Arkansas. Not only will the results of these referenda be critical to the economics and cultural advancement of each of these states, they will serve as an indicator of where the U.S. goes with regard to cannabis reform at the federal level.

With that said, here are some regulatory highlights from September:

Let’s begin in the battleground state of Pennsylvania, where lawmakers have introduced a new, bipartisan bill to legalize adult-use marijuana in September. House Bill 2500, sponsored by Democratic state Rep. Emily Kinkead and Republican Rep. Aaron Kaufer, follows a proposed marijuana legalization framework that the duo proposed in a June memo. According to a press release from advocacy organization Responsible PA, the bipartisan legislation would:

- Include strong social equity and criminal justice provisions

- Impose strict labeling and adverting standards

- Devote “significant” resources to law enforcement as well as public education and “social equity opportunities”

The article expressed some degree of skepticism when it comes to the chances of this bill passing, given “the partisan gridlock that’s kept other cannabis legalization proposals from passing in the state Senate.” With hundreds of millions of dollars in potential revenue at stake, we will continue to monitor the progress as Pennsylvania attempts to get out of its own way with this new bill.

Next, we head just north to New Jersey, where an August article in Marijuana Moment reported that the governor recently signed a bill restricting sales of hemp cannabinoid products (such as Delta-8). The measure will put hemp products, which are federally legal, under the purview of the state’s Cannabis Regulatory Commission, the agency that oversees New Jersey’s recreational and medicinal marijuana markets.

In the words of the article, “In a signing statement, (Governor) Murphy called the bill flawed, but said in the two-and-a-half months since the bill landed on his desk, he’s held discussions with supporters and critics that convinced him it’s “very unlikely that revisions to the bill would have the broad support necessary to move through the Legislature quickly.”…Congress legalized hemp in 2018, but with little regulation, testing or enforcement, intoxicating products have been spotted on shelves of corner stores and gas stations. Lawmakers moved to pass the bill amid concerns that children are buying products advertised with thousands of milligrams of THC.”

Under this new law, it’s now illegal to sell products with any detectable amount of THC to a person under 21 years of age.

Following a similar theme, we turn our attention to California and an article from our very own CRB Monitor News Team entitled “CA Governor Bans Intoxicating Hemp Products.” In this terrific story, we learned that in September, California Gov. Gavin Newsom issued emergency orders “banning all intoxicating hemp-derived cannabinoids in consumer products from retail stores. Taking a page out of the Missouri governor’s book, the move follows the California Legislature’s failure to pass a bill that would have brought hemp-derived products into California’s regulated cannabis program. The new regulations, proposed by the Department of Public Health, would require that all hemp food, beverage and dietary products intended for human consumption have no detectable THC or other intoxicating cannabinoids. This would include CBD products. It sets a minimum age to purchase hemp products to 21 and limits the number of servings of hemp consumables to five per package.”

What is happening with hemp products? What we know from the last few years since the Farm Bill was signed into law, there has been a surge in hemp-derived products which contain a significant percentage of THC; however these products have technically been legal as they originate from the hemp plant and not marijuana.

The article goes on to discuss a recent failed attempt at legislation: “California, one of the oldest and largest adult-use markets, tried to regulate hemp product sales and manufacturing with AB 2223. But it was Gov. Gavin Newsom’s last-minute amendments to strictly control all hemp-derived THC, as well as the high cost to implement it, that ultimately doomed the legislation for another year. A similar attempt to regulate the hemp industry last year with AB 420 also failed. AB 2223 had opponents in both the cannabis and hemp markets, for different reasons. It passed the state Assembly in May. However in the Senate, after being approved by the Committee on Health, it failed to advance in the Committee on Appropriations.”

Hence the governor’s emergency order. Regarding the response from cultivators of hemp, the article goes on to report, “According to the Senate Committee on Health’s report, the Origins Council said permitting hemp-derived THC would undercut regulated cannabis cultivators. They requested the bill prohibit naturally occurring hemp cannabinoids until both hemp and cannabis cultivation were equally regulated. They also wanted the THC limit reduced to .5 mg.”

[An excellent, comprehensive summary of all U.S. states that are currently seeking to regulate hemp products can be found our CRB Monitor News site: States Try to Regulate Competing Hemp, Cannabis Markets.]

Now we move on to the U.S. Senate, where it was announced on Sept. 18 that a bill authored by Sen. Gary Peters (D-MI) to ensure applicants for federal positions or security clearances are not being denied solely on the basis of past recreational and medical marijuana use has advanced. The bill, S. 4711, aptly titled the Dismantling Outdated Obstacles and Barriers to Individual Employment or DOOBIE Act, states that covered agencies “may not base a suitability determination with respect to an individual solely on the past use of marijuana by the individual.”

The bill goes on to state, “the head of a Federal agency may not base a determination that a covered person is ineligible for a security clearance solely on the past use of marijuana by the covered person.”

In the words of the press release issued by Peters, “Peters’ bill would align federal law with the current OPM and ODNI guidance on past marijuana use, providing clarity for prospective federal employees. The bill would prohibit federal agencies from using past marijuana use as the sole factor in determining employment suitability, qualification standards, or eligibility for security clearances and federal credentials. The bill would also exempt marijuana from a blanket denial in security clearance statutes and add statutory clarification that past marijuana use alone cannot disqualify candidates from federal employment. The bill would require OPM and ODNI to update their regulations and guidance to convey that past marijuana use is not an automatic disqualifier. The bill is a companion to the bipartisan Cannabis Users Restoration of Eligibility (CURE) Act in the House.”

Finally, we head to the Big Apple, where a story in the Green Market Report noted that officials in New York “expect legal cannabis sales to top $800 million this year, but some have their sights set even higher: $1 billion in just the second full year of adult-use sales for the state. John Kagia, director of policy for the New York Office of Cannabis Management, spoke at both the National Cannabis Industry Association’s New York Stakeholder event and the Cannabis Insider Conference held in Albany this week, where he told attendees that the state is on pace to report $470 million in sales before the end of the third quarter. He said that the state has been logging roughly $21.5 million in sales per week to date, but that number has increased by about a million dollars every three weeks. If that trend continues, the state will reach $24 million in sales per week by year end.”

What is the main driver of this surge in cannabis sales? “Kagia noted there were 200 stores open and the state was on pace to open 21 stores in 23 days. He also pointed out that there are 500 brands in retail stores,” Green Market Report said.

Finally, on the lingering topic of hundreds of unlicensed CRBs that never seem to go away: “Kagia acknowledged that the OCM’s enforcement group is focused on closing unlicensed operators versus targeting existing operators who are trying to drive business. However, he strongly urged licensees to follow current rules. Regarding the enforcement push, Kagia said that the stepped-up efforts to close unlicensed operations had resulted in same-store sales for some operations increasing by 50%, with some outlets reporting a 200% increase in sales.”

CRBs In the News

The following is a sampling of highlights from the September 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business.”)