In the third quarter of 2024, the cannabis licensing landscape across North America presented a mix of stability and strategic shifts. The number of active cannabis licenses in the U.S. remained largely steady, ending a prolonged period of decline, while Canadian licensing held firm after several quarters of modest reductions. However, significant shifts within states and license types reveal that while the industry may be stabilizing, there is still a great deal of adaptation and growth, particularly in new and expanding markets.

U.S. Licensing Trends: Small Declines in Active Licenses, Surge in Pending Applications

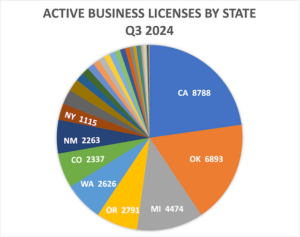

The total number of active U.S. cannabis business licenses stabilized this quarter at 38,631—essentially unchanged from the previous quarter. However, this reflects a broader year-over-year decline of 14% as regulatory adjustments and market dynamics reshape the industry. Active licenses peaked in late 2022 at 44,323, marking a significant pullback over the past year.

The total number of active U.S. cannabis business licenses stabilized this quarter at 38,631—essentially unchanged from the previous quarter. However, this reflects a broader year-over-year decline of 14% as regulatory adjustments and market dynamics reshape the industry. Active licenses peaked in late 2022 at 44,323, marking a significant pullback over the past year.

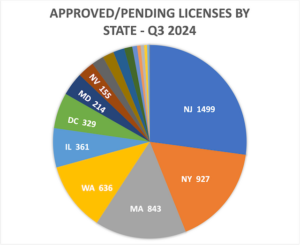

Meanwhile, approved and pending licenses saw a minor decrease of 3%, closing the quarter at 5,521 licenses, yet these numbers remain 7% higher than last year. This activity is driven largely by heightened licensing interest in New York and New Jersey, which together led to a 17% rise in new license applications.

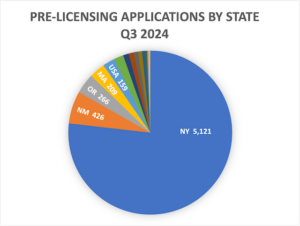

Pre-licensing, or applications still awaiting approval, also saw a slight dip of 2% to 6,667 applications. However, New York dominated in this area, with a staggering 5,121 applications in process, comprising over three-quarters of the U.S. total. This reflects New York’s growing importance in the national cannabis market as it rolls out adult-use licenses, drawing a surge of interest from prospective operators.

Canada’s Cannabis Licensing: A Model of Maturity and Stability

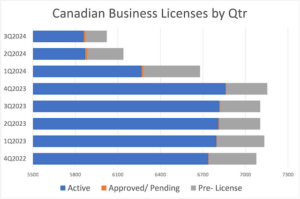

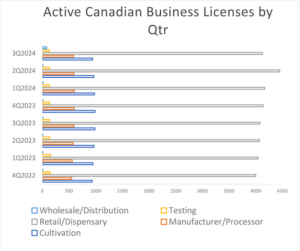

Canada’s cannabis market continues to display signs of stability and gradual decline in active licenses as the market matures. Active licenses remained virtually unchanged this quarter, holding at 5,859—the lowest since late 2021 and down 7% from six months earlier.

Canada’s cannabis market continues to display signs of stability and gradual decline in active licenses as the market matures. Active licenses remained virtually unchanged this quarter, holding at 5,859—the lowest since late 2021 and down 7% from six months earlier.

Approved and pending licenses fell modestly to 12, while pre-licensing applications dropped significantly to a two-year low of 151. The relative steadiness of Canada’s market underscores a pattern of slow, incremental adjustments as the country’s cannabis industry reaches a level of maturity not yet seen in the U.S.

to a two-year low of 151. The relative steadiness of Canada’s market underscores a pattern of slow, incremental adjustments as the country’s cannabis industry reaches a level of maturity not yet seen in the U.S.

License Types in Focus: Cultivation and Retail Dominate, Social Use Clubs on the Rise

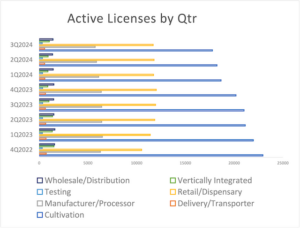

Of the major license types, cultivation and retail/dispensary licenses are far and away the most numerous, comprising 78% total active licenses in the third quarter. There were 17,758 active cultivation licenses and 11,686 active retail/dispensary licenses at the end of the quarter, virtually unchanged from the past two quarters.

The relative stasis in aggregate licensing in these two dominant categories belies significant turnover within state markets, with four states recording double-digit growth and one, Nevada, a double-digit decline during the period. On an annual basis, active retailer permits declined 2%, while cultivation permits declined a more substantial 15%, led by sharp declines in Oklahoma.

Manufacturer/Processor licenses made up the third largest license type at the end of the second quarter, with 5,731 active licenses, followed by wholesale/distribution licenses, with 1,412, representing a 1% and 2% quarterly decline respectively, continuing a five-quarter trend of consolidation in these segments.

Vertically integrated operators had shown signs of growth in the first half of the year after several quarters of steep declines in active licensees in 2023, when the industry segment shed 34% of its numbers. That trend continued in the third quarter, with vertically integrated licenses increasing 13% to 1,026 active permits. The number of vertical operators increased 4% over the year prior, as anticipation built for the opening of an adult-use market in Florida, a vertically integrated-only state.

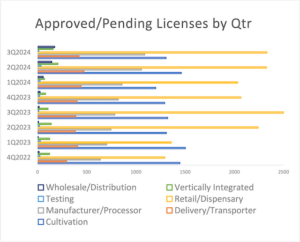

Approved and Pending Applications Decline among Major Types

Approved/Pending license counts, which can be a leading indicator of sentiment and future growth in the market, generally declined in the third quarter, logging double-digit drops across several major operator types, suggesting pessimism among companies eyeing new market entries and expansion. The two largest of major license types, cultivation and retail dispensaries, ended the third quarter with 1,305 and 2,330 approved/pending licenses respectively. This represents a 11% decline in cultivators, while retailers remained unchanged from the previous quarter.

Approved and pending applications among manufacturer/processors, delivery/transporters, and wholesale/distributors were mixed. Pending wholesale/distribution licenses increased 20% over the second quarter, rising to 172 permits. Pending and approved manufacturer/processor licenses increased 3% to over 1088 new permits, while delivery/transporter licenses fell 10% to 420.

Approved and pending applications among manufacturer/processors, delivery/transporters, and wholesale/distributors were mixed. Pending wholesale/distribution licenses increased 20% over the second quarter, rising to 172 permits. Pending and approved manufacturer/processor licenses increased 3% to over 1088 new permits, while delivery/transporter licenses fell 10% to 420.

Two major license types experienced significant drops in approved/pending licensing during the quarter. After declining 52% over the previous 6 months, testing companies with pending and approved permits fell another 64% to just 12.

Pending and approved vertically-integrated operator permits fell 24%, reversing a multi-quarter trend of increasing activity in this license type.

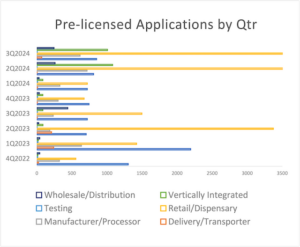

New Applications Mixed among Major Types

Similarly, applications in the pre-licensing stage, which reflect activity and sentiment in newer and expanding markets, showed mixed results during the third quarter. Retail dispensary and manufacturer/processor applications fell 1% and 14% respectively, after experiencing large increases in the second quarter. Retail/dispensary licenses declined to 3,857, the second highest number of new license applications recorded in two years, comprised almost entirely by applicants in New York.

New applications for vertically-integrated operators dropped 7%, ending the quarter with 1,005 applications in pre-licensing. Significant declines were also recorded in manufacturer/processor and wholesale/distribution licenses in application, which fell 14% and 6%, respectively. Delivery transport and testing applications remained nominal as they have for the past several quarters.

New applications for vertically-integrated operators dropped 7%, ending the quarter with 1,005 applications in pre-licensing. Significant declines were also recorded in manufacturer/processor and wholesale/distribution licenses in application, which fell 14% and 6%, respectively. Delivery transport and testing applications remained nominal as they have for the past several quarters.

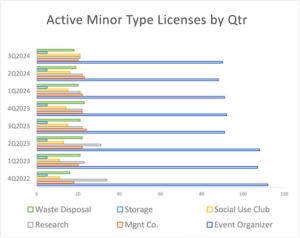

Some of the strongest growth this quarter was seen in social use club licenses, a new type allowing on-site cannabis consumption. Social use clubs expanded by 31%, led by activity in states like Colorado, Michigan, and Nevada. While still a relatively small license category with 21 active licenses nationwide, this growth indicates the industry’s evolving interest in creating social consumption spaces where cannabis can be bought and consumed on site.

Shifts Among U.S. States: Emerging Markets and Consolidation in Mature Markets

State-level licensing data reveals contrasting trends between established and emerging markets, for generally showed continued consolidation after several years of torrid growth. California, the nation’s largest cannabis market, maintained its leadership position despite a 4% quarterly drop in licenses, reflecting a longer-term trend of license reductions in this highly regulated state. Meanwhile, Oklahoma, a year into a moratorium on new licenses and an ongoing enforcement crackdown, saw the largest drop in active licenses, down by 9% this quarter and a full 39% over the past year.

In contrast, Michigan is bucking the national trend of consolidation, reporting an 8% increase in licenses this quarter, with 4,474 active cannabis businesses—a 23% year-over-year gain. This makes Michigan the third-largest U.S. market for active licenses. New York, following a slow start in adult-use licensing, also made major strides, increasing its active license count by 64% this quarter and nearly tripling its total over the past year. New Jersey, Washington, D.C., and Connecticut also showed significant growth.

In contrast, Michigan is bucking the national trend of consolidation, reporting an 8% increase in licenses this quarter, with 4,474 active cannabis businesses—a 23% year-over-year gain. This makes Michigan the third-largest U.S. market for active licenses. New York, following a slow start in adult-use licensing, also made major strides, increasing its active license count by 64% this quarter and nearly tripling its total over the past year. New Jersey, Washington, D.C., and Connecticut also showed significant growth.

Approved and Pending Licenses: Pockets of Optimism Amid Overall Decline

Cannabis business license applications which have been approved but have yet to become operational are grouped by CRB Monitor under the category of “approved/pending” status, and reflect the near-term pipeline of new cannabis business operations poised to enter the regulated market.

While no guarantee that these new operations will commence, the investment of resources required to prepare, submit and successfully obtain a cannabis license does suggest a level of commitment that can be used as a proxy for future business activity.

While no guarantee that these new operations will commence, the investment of resources required to prepare, submit and successfully obtain a cannabis license does suggest a level of commitment that can be used as a proxy for future business activity.

Five states experienced double-digit growth in new approved/pending licenses in the third quarter. New Jersey again led the country in the number of approved/pending licenses during the third quarter, adding 111 licenses to end the quarter at 1,499 new licenses pending activation, for an 8% quarterly increase.

Other states with notable increases in approved licenses included District of Columbia, which added 117 approved/pending permits in the quarter, a 55% increase over the second quarter. Washington added 40 new licenses, and Missouri added 36 licenses, ending the quarter with 329 and 113 pending new licenses, respectively. Maryland increased its new approvals 16%, for a total 214 permits approved and pending commencement of operations at end of the quarter.

Massachusetts experienced the largest drop in pending licenses, falling 234 to 843 approved or pending licenses at the end of September, a 22% decrease from the second quarter.

New York Dominates New Applications

Applications for new cannabis business licenses that have yet to be approved are classified as having a “pre-licensing” status at CRB Monitor. While the proportion of these applicants that may succeed in gaining approval, much less opening a cannabis business, is unknown, pre-licensing data nonetheless serves as an indicator of interest in entering or expanding commercial activities in a given market.

New York ended the third quarter with the largest number of applications in pre-licensing, with 5,121 permits in application, a 6% decrease from the second quarter. Indeed, as the Empire State’s challenged two-year rollout of its adult-use market finally appeared to be moving forward, the state’s total licenses in application exceeded the total number of applications in pre-licensing in all of the rest of the country’s state markets by a factor of four.

New York ended the third quarter with the largest number of applications in pre-licensing, with 5,121 permits in application, a 6% decrease from the second quarter. Indeed, as the Empire State’s challenged two-year rollout of its adult-use market finally appeared to be moving forward, the state’s total licenses in application exceeded the total number of applications in pre-licensing in all of the rest of the country’s state markets by a factor of four.

New Mexico, which led the country in pre-licensing in the first quarter of 2024, had the second highest number of applications in pre-approval status in the third quarter, with 426 applications awaiting approval, a 2% decrease from the prior three months. Other states showed little change new applications, with the California and Vermont logging notable quarterly declines, falling 71% and 27% respectively.

Emerging Trends and Implications

The licensing activity in the third quarter of 2024 underscores a few key themes shaping the cannabis industry:

Consolidation in Mature Markets – California, Oklahoma, and Nevada are seeing reductions in active licenses as markets mature and regulatory conditions tighten, indicating a shift toward stability and compliance.

New Opportunities in Emerging Markets – States like New York, New Jersey, and Michigan continue to attract substantial new licensing activity, showing that opportunities are robust in markets that are just opening or expanding adult-use permissions.

Rise of Social Use Spaces – The rapid growth of social use clubs marks a potential new segment within the cannabis industry, catering to consumers seeking a communal consumption experience.

Vertical Integration Growth – Anticipation over the potential for a new multibillion-dollar adult-use market in Florida spurred interest in vertically integrated licenses in the third quarter, as companies positioned themselves for entry in that vertical-only state. That anticipation turned to disappointment in early November when the state’s adult-use ballot initiative failed pass.

Conclusion

Overall, the third quarter of 2024 reflects a period of both consolidation and opportunity in the North American cannabis industry. Established markets are seeing a pullback in active licenses, while newer markets continue to draw strong interest from licensees. The introduction of social use clubs and increasing vertical integration highlight the evolving landscape as businesses adapt to changing regulations and consumer demands. As more states implement adult-use cannabis markets, the industry is likely to continue evolving with a mix of caution in mature markets and optimism in emerging regions.