As has been the case for longer than we care to remember, most of the CRB equity market failed its investors in the fourth quarter of 2024. There is not a lot more we can say about this abysmal performance than we have already been saying for much of the last three years.

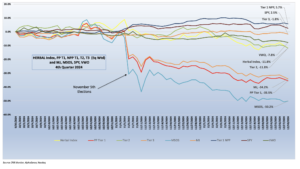

With the Nov. 5 elections, the Republicans retained a majority in the House while flipping the Senate and the presidency to their side as well. What will follow in terms of cannabis reform is anybody’s guess. However, it was clear that the market didn’t appreciate the election results (see the chart below) — not only at the federal level, but also in the handful of states that had legalization on the ballot.

Was there any good news on Election Day? Sadly, there were no obvious silver linings. With that said, we wouldn’t take rescheduling (or even de-scheduling) off the table just yet. SAFER Banking has always been more a reflection of Republican (and not Democratic) ideology. But make no mistake about it, any type of cannabis reform is likely to face a steady stream of headwinds as the conservatives take over in 2025.

The familiar headwinds — the slow walk toward federal legislative reforms, an uncontrollable illicit market, and crippling taxation — have made this industry effectively intolerable for investors. And at this point, these companies, by virtue of their decimated market caps and low prices, have shrunk to the point at which they are impractical if not ineligible for most institutional investment strategies and cannabis-themed indexes. The cannabis-themed ETF market, once a bastion of hope, is a shadow of its former self with only about $12 billion representing the total market cap of pure play cannabis investments.

At the state level, cannabis-related revenues continue to fill the treasury coffers of the now 39 states with some form of legalization on the books. And the reforms that have been in the works for the last few years — DEA rescheduling (or even de-scheduling), SAFER Banking, and even federal legalization — have bipartisan support and are wildly popular across the U.S.

Furthermore, the CRB Monitor database tracks more than 90,000 cannabis-related business that hold more than 200,000 cannabis licenses. And according to an April 2024 report by NORML, the cannabis industry employs more than 440,000 people. The main reason why this multi-billion dollar industry that employs a half million people can’t quite get it together at the corporate level is regulatory friction, plain and simple. If these companies were afforded the same conveniences as their counterparts in alcohol and tobacco (conventional banking and payment systems, interstate and international commerce, normal taxation, employee protections, etc.) and not treated by the federal government like illicit drug dealers, then this market would undoubtedly have a fighting chance.

Cannabis-Related Equity Performance

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL) is a mix of pure play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme (SOT). A well-conceived representation of the universe of legal, pure play Tier 1 and Tier 2 cannabis equities, HERBAL had a -11.8% return for the 4th quarter. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index. HERBAL significantly outperformed its competitors as well as CRB Monitor’s equally weighted basket of Tier 1 pure play cannabis equities. This was largely due to the September 2024 index reconstitution, which resulted in an overweighting of Tier 2 CRBs and a portfolio that is concentrated in fewer overall securities.

The largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-34.2%) and the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-50.2%), barely escaped Q4 with their lives. Unlike HERBAL, which is designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching marijuana exposure tend to be more sensitive to the federal regulatory rollercoaster. And this time around, the HERBAL index outperformed due to its weight in Canopy Growth.

In the past couple of years MJ’s performance has had the potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally in 2022, MJ added and maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The U.S. plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It is also important to note that both MJ and MJUS now operate under a new issuer, Amplify ETFs.

The CRB Monitor equally weighted basket of the largest Pure Play Tier 1 CRBs faced similar challenges in the fourth quarter, returning -35.5%. This basket is essentially a hybrid of CRBs without U.S. touchpoints (the CAD component) and U.S. multistate operators (the MSO component). Because the basket is equally weighted, its performance is likely to deviate from published indexes and listed funds, which generally employ some variation of market cap weighting.

The performance of the CRB Monitor equally weighted basket of the largest Tier 2 CRBs was negative but outperformed the Tier 1 basket significantly, with a -11.8% return in the fourth quarter. As we have indicated in the past, pure play Tier 1 and Tier 2 CRBs tend to display high (~0.8) correlation in the long term (see our section on correlation in the CRB Monitor February 2024 newsletter). But their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. In general, Tier 2 CRBs share in the overall success or failure of the Tier 1 universe and ultimately are expected to converge with the Tier 1 equity basket.

In the fourth quarter, U.S. equities displayed a mix of resilience and volatility, influenced by various macroeconomic factors. The index experienced modest gains, with sectors like technology and energy leading the charge, while investor sentiment was tempered by concerns over inflationary pressures and potential interest rate hikes from the Federal Reserve.

Despite these challenges, corporate earnings generally exceeded expectations, providing support for stock prices. Additionally, investor focus shifted to geopolitical tensions and the presidential election, which added to market uncertainty. Overall, the fourth quarter saw the S&P 500 posting a positive, albeit cautious, performance, reflecting a balancing act between strong corporate fundamentals and broader economic concerns. U.S. equities held their own, with the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) returning a modest +2.5% return. For the year, the S&P 500’s return was +24.9%.

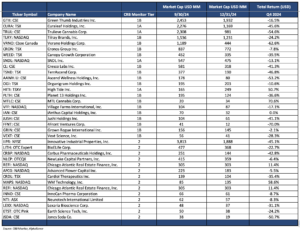

Largest Tier 1 Pure Play CRBs & Tier 2 CRBs – 4th Quarter 2024 Returns

CRB Monitor Tier 1

As we look up and down the table above there were few options from the Tier 1 universe in Q4 that would have provided a positive return for cannabis investors. And while things were relatively stable for the first month, in early November the bottom fell out of the market and continued to slump through the end of 2024. With the exception of one Canadian CRB (High Tide) the Tier 1 universe languished, to the point where a number of the stocks no longer exceed the minimum price or market cap to qualify for cannabis-themed indexes.

The MSO basket got slammed in the aftermath of the elections, with Tier 1B Cresco Labs Inc. (CSE: CL) (-41.3%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-62.6%), Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (-54.6%), Tier 1B TerrAscend Corp. (TSX: TSND) (-46.8%), and Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-45.6%) showing their disappointment for the results, particularly in Florida. The largest CRB by market cap, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-16.5%), fared a bit better but still struggled on behalf of its investors, who are seeing their cannabis holdings evaporate before their eyes.

The Canadian CRB basket also struggled, albeit a bit less than the MSOs, as their need for cross-border trade forces them to have similar exposure to the progress of U.S. cannabis legalization and reforms. And as we have stated periodically, historical performance has deviated between the CAD and the MSO baskets over short periods, but the two groups tend to mean revert over time. Tier 1B legend in the cannabis industry Canopy Growth Corporation (TSX: WEED) (-39.5%) fell into the abyss while Tier 1B Cronos Group Inc. (TSX: CRON) (-7.8%), Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-24.2%), and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-13.1%) provided little optimism for investors. On a happier note, Tier 1B High Tide Inc. (TSXV: HITI) (+50.7%) proved to be the only outlier in the fourth quarter as the only positive-returning CRBs in the Tier 1 basket.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies returned a lackluster but less shocking return of -11.8% for the fourth quarter of 2024, which outperformed the equally weighted Tier 1 basket by nearly 20%. Pure play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (please see our February 2024 “Chart of the Month”), but their respective performance has a tendency to diverge in the short term, as it did in the first quarter, given the occasional lag from the impact (positive or negative) of market forces.

IIPR’s fall from grace: Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) (-45.1%) closely. IIPR is an internally managed real estate investment trust (CRBM sector – REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” IIPR’s stock price was humming along throughout 2024 until November, when the bottom fell out along with the Tier 1 CRBs that they lend to. On Nov. 6, IIPR issued its 3rd quarter 2024 earnings report, which featured the following highlights:

- “Generated total revenues of $76.5 million and net income attributable to common stockholders of $39.7 million, or $1.37 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of $64.3 million and $57.8 million, respectively.

- Paid a quarterly dividend of $1.90 per common share on November 15, 2024 to stockholders of record as of September 30, 2024 (an AFFO payout ratio of 84%), representing an annualized dividend of $7.60 per common share.

- Sold 402,673 shares of Series A Preferred Stock under IIP’s “at-the-market” equity offering program for $9.6 million in net proceeds.”

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (-5.5%) escaped the fourth quarter relatively unscathed and has also outperformed its Tier 1 CRB lending clients over recent months. On Nov. 13, AFCG reported its 3rd Quarter 2024 earnings of $7.2 million, which featured the following statement from CEO Daniel Neville:

“We are pleased with the strong quarter, driven by our continued focus on active portfolio management and origination. One of my top priorities when I joined AFC was to reinvigorate our origination engine, and I am proud to announce that we have surpassed our 2024 target of $100 million in new originations. This achievement highlights our ability to identify and support high-quality operators in key markets, and we look forward to continuing to build on this momentum as we close out the year… On October 15, 2024, the Company paid a regular cash dividend of $0.33 per common share for the third quarter of 2024. AFC distributed an aggregate of $7.2 million in dividends, or $0.33 per common share, compared to Distributable Earnings of $0.35 per basic weighted average common share for such period.”

Chart of the Quarter: November Elections and “The Florida Effect”

The 2024 general election resulted in Republican majorities in both houses of Congress, as well as the Presidency. The congressional majorities will hold for at least the next two years, and those with ties to the cannabis industry must be wondering whether this is a positive or negative development for their interests.

The Nov. 5 elections were full of surprises for some and full of affirmations for others. And a first: America elected a president that has 34 felony convictions, which will hopefully be the one and only time that ever happens. President Donald Trump is somewhat unclear about how he might act on just about everything — from immigration, to the economy, to law enforcement, to any of a number of policies that Americans are curious about — none the least of these is cannabis reform. Recent history tells us that cannabis reform does not have a groundswell of support among Republicans, even with SAFER Banking, which should be a layup for the party of the free market. And even if Republican support exists for SAFER Banking and some form of legalization, where do they reside on the list of priorities for this Congress?

The positions regarding cannabis reform at the House of Representatives and the Senate have been divided, so much so that we have not yet seen any such legislation pass both chambers. More importantly, the flip to a narrow Republican majority in both houses does not speak well for the near-term future of legal cannabis. But hope springs eternal, and the handful of investors that have held on for dear life to their CRB shares might be surprised as the 2025 congressional session and the 47th Presidency of the United States get underway.

It’s worth mentioning, given the prospect of the implementation of Project 2025, whether or not cannabis even exists on the immediate slate of priorities for this administration is unclear as well. Given that one of Project 2025’s objectives is to dismantle government agencies, where does marijuana rescheduling fit into the overall plan? While rescheduling (and the resulting juicy tax cut for businesses) should be another layup for this new government, ideology might once again get in the way and derail the implementation… so stay tuned.

With all this uncertainty at the federal level giving investors fits and starts, we turn to the recent election results at the handful of states that had cannabis legalization on the ballot. With that said, investors had little to celebrate in November.

State Ballot Questions

Of particular interest to cannabis investors on Nov. 5 was the handful of states that had cannabis-related ballot questions, and the results were less than ideal. In total, there were four states that had varying results on cannabis-related referenda on election day: North Dakota, South Dakota, Nebraska, and the “Big Kahuna,” Florida. Here are the results:

| State | On the 11/5/2024 Ballot | Pass/Fail |

| North Dakota | Recreational Marijuana | Failed |

| South Dakota | Recreational Marijuana | Failed |

| Nebraska | Medical Marijuana | Passed |

| Florida | Recreational Marijuana | Failed |

Source: Public Records

One can see that cannabis legalization passed in only one state, Nebraska; and that decision is tenuous at best as the result faces numerous legal challenges before it can advance.

(For the purposes of this article, we will delve a bit deeper into the impact on cannabis investors. For a detailed recap of the investment results and its effects on licensing in the applicable states, there is an excellent report on our CRB Monitor News website.)

Here is a brief summary of the less-than-favorable outcomes:

Florida: By far, the cannabis industry had the most riding on Florida, where Amendment 3 (legalize recreational marijuana) appeared to carry the whole enchilada on its back. In the words of a Nov. 5 article by the Associated Press, “Florida voters rejected ballot measures Tuesday to protect abortion rights and legalize marijuana, handing victories to Republican Gov. Ron DeSantis and solidifying the state’s new reputation as a conservative stronghold. DeSantis used state resources and campaigned heavily against each issue, telling voters that whether they were for or against marijuana or abortion rights, the measures were flawed, poorly worded and would likely never be repealed if enshrined in the state constitution.”

Even more compelling was this additional information: “But DeSantis’ campaign would have failed if it wasn’t for former Republican Gov. Jeb Bush, who 20 years ago successfully pushed the threshold to change the constitution to 60% support. Both measures had support from a majority of voters, but not enough to pass.”

Sadly for cannabis investors, legalized recreational marijuana was rejected, gathering only 56% of the 60% needed to pass. And how strange things are in the Sunshine State where a clear majority is not sufficient to satisfy the will of the people.

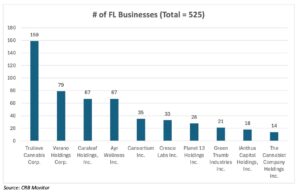

Here is a breakdown of the publicly traded CRBs and their operational footprint in the Sunshine State:

The above list is effectively a “who’s who” of multistate operators and the extent of their respective Florida bets. Stakeholders in these companies are painfully aware of the impact that the election had on their expected value, and on the expectations of investors.

Here are these companies’ equity returns, for both YTD leading up to November, and then November:

As an equally weighted portfolio this group lost more than 30% of its value in November, and there are a few reasons for this. First, MSOs have been increasing their medical cannabis footprint in Florida for years at a considerable expense, betting on the legalization of recreational marijuana. This narrow defeat, while not necessarily the end of the road, was a major blow to these companies, and we will see what their plan will be going forward.

North Dakota: In North Dakota, where the legislature legalized medical marijuana in 2016, Measure 5 (legalize recreational marijuana) was rejected by a margin of 53% to 47%. North Dakota is apparently not ready for legal adult use. Per a Nov. 5 article in The North Dakota Monitor: “In the words of Pat Finken, chair of the Brighter Future Alliance, a group opposing Measure 5, said he hopes the recreational marijuana issue has been put to rest in North Dakota. ‘Once again, the voters of North Dakota have wisely rejected an attempt to legalize recreational marijuana,’ Finken said late Tuesday. ‘They understand that today’s marijuana is not safe and legalization will only add to the addiction and mental health crisis already punishing North Dakota families.’”

South Dakota: On to South Dakota, where residents failed to distinguish themselves from their neighbors to the north, defeating Measure 29 (legalize recreational marijuana) by a margin of 56% to 44%. Medical marijuana became legal in South Dakota in July of 2021.

Nebraska: As one of the eleven remaining states where marijuana is completely illegal for any purpose, Nebraskans passed Ballot Initiatives 437 and 438, which would decriminalize and legalize medical marijuana across the state going forward. Here’s how they are summarized in a Nov. 6 article in Marijuana Moment:

- “The patient-focused measure says that its aim is to “enact a statute that makes penalties inapplicable under state and local law for the use, possession, and acquisition of limited quantities of cannabis for medical purposes by a qualified patient with a written recommendation from a health care practitioner, and for a caregiver to assist a qualified patient in these activities.”

- The other initiative will create a new a Nebraska Medical Cannabis Commission to provide “necessary registration and regulation of persons that possess, manufacture, distribute, deliver, and dispense cannabis for medical purposes.’”

And while this victory is something to be celebrated, legalization might be just a “pipe” dream for the foreseeable future, as a multi-pronged battle in the courts awaits. Please stay tuned.

And then there is the impact of this new federal administration, which is about to start implementing its agenda in January 2025. If rescheduling or de-scheduling are off the table, the tax implications for CRBs will be devastating as well. Ditto for SAFER Banking and legalization, the fate of which seems to be more and more hazy as the November elections become a more distant memory.

The advent of a Republican trifecta and the failure of Florida voters to pass adult-use legalization have dealt the cannabis industry a significant blow, and this is evident given the performance of the MSO group, particularly the companies with ties to the Sunshine State. While investors and other cannabis industry stakeholders are very welcome to remain hopeful following the November elections, we feel that the future has gotten murky due to the results both at the federal and state levels.

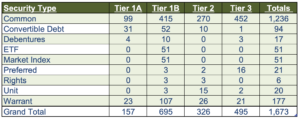

CRB Monitor Securities Database

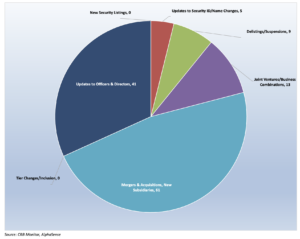

As of December 31, 2024, the breakdown of publicly traded, cannabis-linked securities was as follows:

Source: CRB Monitor

As we have lamented over the last few years, cannabis M&A activity is largely a thing of the past, and that will be the status quo until we see more action related to cannabis reform out of the U.S. government. With that said, the CRB Monitor research team operates in a busy daily environment as we build out and maintain, in real time, an accurate record of each CRB’s corporate structure and current security details. We make hundreds of updates to CRB profiles every quarter and fourth quarter 2024 was no exception. In addition to business expansion and corporate finance, we are tracking daily changes to company identifiers, new security listings, risk tier changes, new additions, possible removals, and updates to company officers and directors.

CRB Monitor News-Related Securities Database Updates – Q4 2024

Cannabis Business Transaction News

Of the thousands of announcements and filings reviewed during the full year, our daily research resulted in a total of 394 updates to CRB Monitor company profiles (129 updates to issuers’ records and 191 news articles added). The complete list of securities and detailed profiles for more than 1,200 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our latest monthly newsletters in October, November and December.

The following is a sampling of the highlights from the Q4 2024 cannabis news cycle:

First, in October: Let’s head out west to Arizona where Tier 1A MSO Trulieve Cannabis Corp. (CSE:TRUL) issued a press release announcing a “partnership with Black Buddha Cannabis, a purpose-driven and women-owned medical marijuana brand. The collaboration will introduce Black Buddha Cannabis products to Trulieve dispensaries in Arizona and Pennsylvania starting in October 2024. Black Buddha Cannabis, founded by Roz McCarthy, CEO of Soaring High Industries and Minorities for Medical Marijuana, brings a unique approach to the medical marijuana industry with a focus on wellness and healing.”

As cannabis investors are well aware, Trulieve is a major player in the industry, particularly in Florida, where it is the leading license holder. This is important to note, as Trulieve has made a significant investment in the Sunshine State. The press release goes on to say, “Trulieve’s partnership with Black Buddha Cannabis marks a significant milestone in expanding the Company’s product offerings and supporting brands that align with Trulieve’s commitment to wellness, innovation, and quality. This collaboration is expected to resonate with customers who seek premium medical marijuana crafted with intention and care.”

With this partnership, Trulieve operates legally in 16 states and three Canadian provinces and holds 121 cannabis licenses in either active status or pending approval.

Also in October, Canadian Tier 1B CRB Canopy Growth Corporation (TSX: WEED) announced in an Oct. 9 press release, “Canopy USA, LLC has completed its acquisition of Wana, inclusive of Wana Wellness, LLC, The CIMA Group, LLC, and Mountain High Products, LLC…As a result of this acquisition, Canopy USA now owns 100% of the outstanding equity interests in Wana.”

Why is this significant? Canopy Growth, a Canadian CRB, should have no business acquiring a licensed, plant-touching entity in the U.S. – and yet here we are. But wait, there is a catch – Canopy USA, LLC was spun out of Canopy Growth months ago and therefore the ownership in Wana will have no benefit (and will provide no revenue) to Canopy Growth Corp. Instead, WEED holds warrants that give the listed company an option to purchase Canopy USA if and when cannabis is legalized in the U.S. This loophole allows WEED to have ties to U.S. marijuana without jeopardizing their TSX and Nasdaq listings.

The press release continues, “This announcement follows Wana’s recent launch of Wanderous™, a first-of-its-kind direct-to-consumer marketplace designed to offer consumers a curated selection of high-quality hemp-derived products, including Delta-9-THC and non-intoxicating CBD gummies from leading brands like Wana, Cann™, Happi™, Charlotte’s Web™, Martha Stewart CBD™, and MXXN™. As part of this launch, Wana introduced its new line of Wana Beverages, ready-to-drink infused sparkling beverages that combine hemp extracts, real fruit juice, and other beneficial ingredients, offering consumers a new and highly sessionable way to experience Wana products.”

Next, in November: We head across the Atlantic to Germany, where Canadian Tier 1B CRB Tilray Brands, Inc. (NASDAQ: TLRY) is expanding its product offering. In November 2024, Tilray issued a press release announcing “the launch of its first commercial German grown medical cannabis flowers from its Aphria RX GmbH facility. This launch marks the first medical cannabis products to be grown in Germany by Aphria RX under the newly issued medical cannabis cultivation license under MedCanG. On July 15, 2024, Tilray Medical was the first to receive a new cannabis cultivation license issued under MedCanG. This license allows Aphria RX to cultivate and manufacture a broad range of commercially available medical cannabis in Germany. The strains to be grown at this indoor facility have been carefully selected from top performing varieties popular with patients across Canada.” Through its subsidiary businesses, Tilray currently holds 350 active licenses across 10 countries.

Also in November: We head west to the two great states of Nevada and Minnesota, where the largest CRB by market cap, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII), issued a Nov. 22 press release announcing “the opening of its landmark 100th retail location, with RISE Dispensary Carson City on US HWY 50 on November 23. In addition, the Company announced the opening of its 101st retail location with RISE Dispensary Brooklyn Park…The two new locations represent the 11th and 8th dispensaries to open in Nevada and Minnesota, respectively.”

Green Thumb, which has been in expansion mode for the last few years, appeared to escape much of the post-election spiral that hammered its peer group, with a November return of about -9%. With regard to GTII’s charitable efforts, the article goes on to say, “Profits from the RISE Dispensary Carson City on US HWY 50 grand opening will benefit The Boys & Girls Clubs of Western Nevada, an organization that positively impacts young people by providing a safe, structured, and positive environment where they can build relationships with caring adults, participate in fun and engaging programs, learn important skills, make new friends, and develop their talents. Profits from the RISE Dispensary Brooklyn Park grand opening will benefit Metro Meals on Wheels, a mission-driven nonprofit dedicated to providing fresh, nutritious meals to seniors and individuals with disabilities throughout the Twin Cities metro area.”

With these new additions, Green Thumb now holds 95 active licenses across 15 states.

Finally, in December: One of Florida’s largest MSOs, Tier 1A Trulieve Cannabis Corp. (CSE: TRUL), apparently undeterred by November’s election results, announced Dec. 9 “the opening of a new medical cannabis dispensary in Tampa, Florida. The new dispensary will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, O.pen, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

With this purchase Trulieve’s footprint expands to 108 licensed retail cannabis operations in Florida and holds, directly or through subsidiaries, 108 active licenses in the U.S.

Next, Canadian Tier 1B and household CRB name Canopy Growth Corporation (TSX: WEED) issued a press release in December confirming that “Canopy USA, LLC has completed its acquisition of Acreage. Canopy USA now owns 100% of the issued and outstanding shares of Acreage. Together with the completed acquisition of 100% of Wana Wellness, LLC, The CIMA Group, LLC and Mountain High Products, LLC (collectively, “Wana”), as announced on October 9, 2024, and approximately 77% of the shares of Lemurian, Inc. (“Jetty”) as announced on June 4, 2024, Canopy USA is fulfilling its ambition of establishing a leading brand-focused cannabis company in the U.S.”

The article goes onto report, “The completed acquisitions of Acreage and Wana, and approximately 77% of the shares of Jetty, are expected to enable Canopy USA to realize anticipated financial benefits, including revenue growth and cost synergies, marketing efficiencies, and joint sales advantages across key cannabis product categories such as vapes, edibles, and flower.”

Canopy Growth currently holds, through its subsidiaries, 58 active cannabis licenses to operate in Canada, Germany and Colombia.

Regulatory News Updates

In the aftermath of the November elections, owners and investors of CRBs licked their wounds and continued on their individual paths toward business survival. It goes without saying that the U.S. government will soldier on, and we will see the next wave of proposed cannabis-related reforms from the next Congress. Meanwhile, the DEA will continue, at a snail’s pace, to move forward with its plan for rescheduling (or perhaps descheduling) in the months to come. And there’s no doubt we will see progress toward the legalization of marijuana for adult use in new states, over and above the current count of 24.

With that said, here are some of the Q4 2024 highlights from the cannabis-related regulatory news cycle:

First, in October: Let’s begin with U.S. federal regulation and an Oct. 23 story reported in Marijuana Moment in October, entitled “Accountants Group Urges IRS And Treasury To Update Marijuana Tax Guidance Ahead Of Federal Rescheduling.” This story states, “A national association of accountants is asking the Treasury Department and Internal Revenue Service (IRS) to issue updated guidance on federal tax policy for marijuana businesses as the administration’s rescheduling proposal moves through the process.” Additionally, this group, called “The American Institute of Certified Public Accountants (AICPA) is also requesting that the federal financial agencies give cannabis companies a chance to correct tax deduction claims they’ve made in anticipation of a potential federal rescheduling decision, after IRS notified stakeholders that it intends to recoup any payouts that might’ve been made prior the government potentially finalizing a rule moving marijuana from Schedule I to Schedule III of the Controlled Substances Act (CSA).”

This highlights the complexities associated with rescheduling, which is far from its finish line. We have argued that, without FDA approval, technically no cannabis products will qualify as Schedule 3 drugs and even those designated as “medical marijuana” could have challenges in court with regard to their tax consequences.

Next, we head south down Interstate 95 to New York, where our very own CRB Monitor News Team reported in October, “New York’s Cannabis Control Board awarded three new Registered Organization (RO) licenses on Oct. 10, expanding the Empire State’s medical market after more than three years of attention on the state’s contentious adult-use market roll out. The CCB granted RO licenses to Nonna Farms LLC, NYRO Partners LLC and VNY-Ops Inc. All three appear to be newcomers to the cannabis business, though Nonna Farms LLC has a pre-license as an adult-use processor in New York. These new operators will also have the opportunity to enter the adult-use market by obtaining either an RO dispensing or RO non-dispensing license. On the medical side, they enter a market that is dominated by nine multi-state operators.”

The article goes on to discuss the prioritization that will be given to underserved communities: “The Marihuana Regulation and Taxation Act, the law that legalized adult-use cannabis, increased the maximum number of dispensaries ROs could operate from four to eight. The only stipulation was that the fifth and sixth dispensaries must be located in a medically unserved or underserved area, as determined by the CCB. That determination includes seven variables, as per the MRTA, including population-provider ratio, population over 65, uninsured rate, low birth weight rates, premature deaths, household disability rate and travel time to healthcare providers. In total, there are 34 medical dispensaries, of which 10 are currently operating in a medical/adult-use hybrid model, according to a recent market report released by OCM. The state also lists five additional dispensaries as being “temporarily closed,” with no further details about their status.”

Next, in November, we have a wrap-up of the election defeats in Florida and the Dakotas, where our CRB Monitor News Team reported on the election results. The article states, “Legalization in the Sunshine State was hotly anticipated among investors. The way the proposed amendment was written, existing medical operators would have had the first opportunity to sell in the adult-use market. Any licensing of new adult-use operators would have to be approved by the legislature.” Additionally, “Third time was not the charm for adult-use supporters in North Dakota and South Dakota as initiatives in those states also failed. In North Dakota, Measure 5, received only 47% yes votes compared to 53% opposed. Proposed by New Economic Frontier, the measure would have legalized adult-use possession, production and sales, as well as limited home cultivation…South Dakota’s Measure 29 would have only allowed adult-use possession and use, as well cultivation of up to six plants per person or 12 per household. Currently, medical patients can grow only two flowering and two non-flowering plants. The initiative was rejected by 56% of the voters.”

This article goes into detail regarding the impact of these election results on several CRBs, and we take a closer look at this in our Chart of the Month section above.

Also from our November newsletter: Onto Minnesota, where an article published by the CRB Monitor News Team entitled “Minnesota Seizes Illegal Products from Hemp Shops” took a deep dive into an issue that has seized the attention of cannabis stakeholders throughout the U.S. Specifically, Minnesota’s Office of Cannabis Management (OCM) is going after shops that have begun selling THC products ahead of next year’s official start to the legal adult-use market. How can this happen? According to the report: “Recently, the state filed a civil action against the owner of Zaza, which has two locations that sell hemp products in the Twin Cities area. The lawsuits allege that employees at both Zaza Grand Ave. in Minneapolis and Zaza Lake St. in St. Paul, which are not licensed to sell adult-use cannabis, were selling vapes, pre-rolls and flower that contained more than the state’s limit of 0.3% THC or THCA for hemp products. Further, the suit alleges that employees attempted to hide the illicit products from inspectors using a backpack. The legal action, which seeks a court order allowing the state to destroy seized contraband, comes within weeks of the state conducting a lottery for social equity retail licenses. Winners of those lotteries will get the first crack at Minnesota’s emerging adult-use market, while having to contend with competition from existing hemp shops that are possibly blurring legal lines with hemp-derived intoxicants.”

As with other hemp-related violations, we will (along with our CRB Monitor News Team) continue to follow this story as questionable hemp-related activities spread across the U.S.

In December, we reported from New York, where our CRB Monitor News Team reported that a New York judge has “once again ordered the Cannabis Control Board (CCB) to stop issuing retail licenses after the state agency lifted requirements that certain retail applicants secure locations prior to license approval.”

This ruling is clearly intended to stifle the proliferation of the black market, which can emerge when a lack of controls are in place. The article goes on to report, “’We are not recommending issuing any more cultivation licenses until we at least have a better sense of the outlook and state of production moving forward,” said OCM Policy Director John Kagia. “One of the things that we have learned from other jurisdictions is that when you have a hyper-saturated market of production, cultivators generally don’t reduce how much they produce, and then you start seeing products seeping out of the back of the barns and falling off the back of trucks into the illicit market.'”

The article continues: “Currently, the state estimates there are about 75,000 people per operating dispensary. If all of the roughly 800 approved licenses from the November cohort were to open, that ratio would drop to about 25,000 per store. Adding an additional 1,000 from the December cohort would bring the state’s total number of retail shops to about 2,000, which would lower the ratio to about 10,000 people per store.

“The court ruling came one day before the Office of Cannabis Management’s Cannabis Advisory Board recommended limits on the number of retail licenses approved over the next 18 months.”

Finally, in December, we head west to Wisconsin, where a Dec. 16 article in Marijuana Moment reported that Wisconsin’s Senate minority leader said she plans to “introduce a medical marijuana legalization bill in the coming legislative session, building on past legalization efforts that have fallen short in the face of pushback from Republican lawmakers.”

Like most states’ battles over legalization, the dissent falls along party lines, and Wisconsin is no exception. A majority of Democrats are in favor while a majority of Republicans are opposed, plain and simple. And a major issue, which is also universal, is money. Legalization would likely be dead in the water if not for all the revenues that are being left on the table; or more accurately, escaping to neighboring states. And the fact that marijuana is still illegal for both medical and recreational use means that exactly no cannabis-related revenue is available to the people of Wisconsin. It appears to go against the will of those people. In the words of the report, “…a survey of rural voters in Wisconsin that was released last week revealed that nearly 2 in 3 (65 percent) support legalizing marijuana broadly. The poll, from the conservative nonprofit Institute for Reforming Government and the State Policy Network, asked 541 voters from rural counties in Wisconsin about a range of policy issues.”

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”).

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know.

The CRB Monitor Securities Research team covers all aspects of the publicly traded, as well as much of the privately held, cannabis ecosystem, including the regulatory environment, operational expansion/M&A activity, updates on officers and directors: and investment performance. Over the last two years, we also have developed our research platform for businesses operating in the Digital Asset Space. As such, we now include pieces of our research into Digital Asset Related Businesses (DARBs). Please feel free to contact us at CRBMonitor.com for more information about the gold standard in business intelligence in both cannabis- and digital asset-related securities.

With our monthly and quarterly newsletters, we keep our readership informed while we highlight the multi-faceted importance of CRB Monitor’s data to all types of users at financial institutions worldwide.

For additional detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor October 2024, CRB Monitor November 2024 and CRB Monitor December 2024.