There’s not much we can say about December’s performance of publicly traded cannabis equities that we have not said about nearly every month in 2024. As has been the case for much of the last four years, most of the CRB market failed its investors in the final month of 2024. The chart below continues to tell the story. And while many Americans were singing about their favorite character on screen-defying gravity, cannabis equities were once again surrendering to it.

The familiar headwinds — the slow walk toward federal legislative reforms, an uncontrollable illicit market, and crippling taxation — have made this industry effectively intolerable for investors. At this point, these companies, by virtue of their decimated market caps and low prices, have shrunk to the point where they are impractical, if not ineligible, for most institutional investment strategies. The cannabis-themed ETF market, once a bastion of hope, is a shadow of its former self with only about $12 billion representing the total market cap of pure play cannabis investments.

But there is still hope. Really.

At the state level, cannabis-related revenues continue to fill the coffers of the treasuries of the now 39 states with some form of legalization on the books. And while the U.S. government seems to be operating more like a circus than a government, the reforms that have been in the works for the last few years — DEA re-scheduling (or even de-scheduling), SAFER Banking and even federal legalization — have bipartisan support and are wildly popular across the U.S.

Furthermore, the CRB Monitor database tracks more than 90,000 cannabis-related business records and more than 64,000 cannabis licenses. And according to an April 2024 report by NORML, the cannabis industry employs more than 440,000 people. The main reason why this multi-billion dollar industry that employs a half million people can’t quite get it together at the corporate level is regulatory friction, plain and simple. If these companies were afforded the same conveniences as their counterparts in alcohol and tobacco (conventional banking and payment systems, interstate and international commerce, normal taxation, employee protections, etc.) and not treated by the federal government like illicit drug dealers, then this market would explode.

Cannabis-Linked Equity Performance

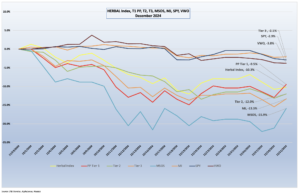

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), outperformed its peers in December (-10.3%), largely due to its security weightings following its semiannual reconstitution in September. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-13.3%) and the actively managed, MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-15.9%), continued their downward slide following the November elections. Both of these funds are benchmarked to CRB-themed indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching MJ exposure tend to be more sensitive than HERBAL to the U.S. regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin in 2017, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally in 2022, MJ added and still maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure.

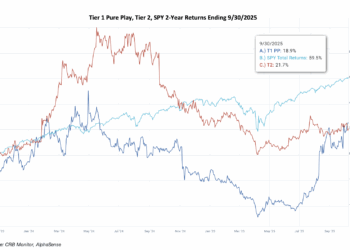

The performance of the recently expanded CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap was negative in December, returning -9.5%. This basket, which is an equally weighted portfolio of the 21 largest pure play CRBs (including both U.S. plant-touching and non-U.S. plant-touching MJ companies), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take a closer look at some of these below.

The CRB Monitor equally-weighted basket of Tier 2 CRBs underperformed the Tier 1 CRB basket, posting a -12.0% return for December 2024. In February 2024, CRB Monitor published an update to our article on correlations of pure play Tier 1 and Tier 2 CRBs (among other tiers and baskets). What we have observed historically is these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time. We update this data a couple of times per year.

U.S. equities ended 2024 on a sour note, falling on their final day of trading but still rewarding investors with an impressive return for the year. U.S. equities have been buoyed by favorable economic indicators and a relatively dovish stance from the Federal Reserve while being held back by concerns over the policies of the new administration. Consumer spending remained resilient, and corporate earnings exceeded expectations, while technology stocks, particularly those in AI, cloud computing, and electric vehicles, were standout performers, continuing their momentum from earlier in the year. The market also benefited from investor optimism about the economic outlook for 2025, with inflation appearing under control and unemployment remaining low. However, volatility spiked toward the end of the month, driven by concerns over global geopolitical tensions and the potential impact on supply chains. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted -2.9% return for the month, but +24.6% for the year.

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – December 2024 Returns

An equally weighted basket of the largest Tier 1 pure-play cannabis equities struggled in December with most of the constituents under water. Tier I CRBs were again outpaced by the Tier 2 basket (-%), which had a number of winners and appears to be de-coupling from Tier 1 at least in the short term.

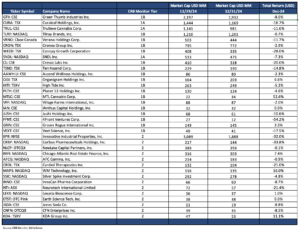

CRB Monitor Tier 1

Publicly traded CRB performance was negative (in a few cases, breathtakingly so) in December across the universe of Tier 1 cannabis stocks. The MSO basket generally went into shock, with Tier 1B Cresco Labs Inc. (CSE: CL) (-20.0%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-11.7%), Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (-11.6%), Tier 1B TerrAscend Corp. (TSX: TSND) (-14.8%), and Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-16.7%) getting crushed for the second month in a row. The largest CRB by market cap, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-8.0%) performed slightly ahead of its peers in December, but it was little consolation for investors, who are seeing their cannabis holdings evaporate before their eyes.

The Canadian CRB basket performed better than the MSOs, most likely given their lower (but not complete lack of) exposure to the progress of U.S. cannabis legalization and reforms. As such, returns for Canadian CRBs were a bit less negative in December. And as we have stated periodically, historical performance has deviated between the CAD and the MSO baskets over short periods, but the two groups tend to mean revert over time. Tier 1B legend in the cannabis industry Canopy Growth Corporation (TSX: WEED) (-28.0%) fell into the abyss, while Tier 1B Cronos Group Inc. (TSX: CRON) (-2.9%), Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-0.7%), Tier 1B High Tide Inc. (TSXV: HITI) (-5.2%), and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-7.2%) fared much better for the month.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies underperformed the Tier 1 basket in December 2024, posting a return of 12.0% for the month. Historically these two portfolios are highly correlated (please see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to mean revert over time. When the two baskets deviate from one another (as they did in December) the deviation could be a signal for investors to rebalance their Tier 1 and Tier 2 baskets given their direct revenue relationship, as Tier 2 CRBs are direct suppliers of goods and services to Tier 1 CRBs.

However, the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lose money, so proceed with caution!

The largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (-32%) came crashing down in December and underperformed relative to the Tier 1 CRBs that lease property from them. IIPR’s stock was having a productive 2024 until November, then it lost essentially all of its positive performance over the last two months. This was a shame, considering that IIPR has maintained stable earnings throughout a challenging period for the cannabis industry. On November 6, IIPR issued its 3rd quarter 2024 earnings report, which featured the following highlights:

- “Generated total revenues of $76.5 million and net income attributable to common stockholders of $39.7 million, or $1.37 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of $64.3 million and $57.8 million, respectively.

- Paid a quarterly dividend of $1.90 per common share on December 15, 2024 to stockholders of record as of September 30, 2024 (an AFFO payout ratio of 84%), representing an annualized dividend of $7.60 per common share.

- Sold 402,673 shares of Series A Preferred Stock under IIP’s “at-the-market” equity offering program for $9.6 million in net proceeds.”

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (-0.85%) was close to flat in December, and over recent months it has also outperformed its Tier 1 CRB lending clients. On November 13, AFCG reported its 3rd Quarter 2024 earnings of $7.2 million which featured the following statement from CEO Daniel Neville:

“We are pleased with the strong quarter, driven by our continued focus on active portfolio management and origination. One of my top priorities when I joined AFC was to reinvigorate our origination engine, and I am proud to announce that we have surpassed our 2024 target of $100 million in new originations. This achievement highlights our ability to identify and support high-quality operators in key markets, and we look forward to continuing to build on this momentum as we close out the year.”

Chart of the Month: An Update On Spot Cryptocurrency ETFs

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin-based exchange traded funds, and in doing so introduced a new level of accessibility for investors in cryptoassets. CRB Monitor originally reported on this event in our January 2024 Cannabis-Related Securities Monthly Update. These 11 ETFs, which have now been trading for close to 12 months, invest in and designate spot Bitcoin (BTC) as their benchmark index. They allow U.S. investors to gain daily exposure to the world’s largest and most liquid cryptocurrency without directly holding it, and as a result they simplify and limit some (but not all) of the risks related to the process of investing in Bitcoin.

Since their launch last year, the prices of these ETFs have surged along with their benchmark BTC. In addition, several other crypto ETFs have listed and commenced trading on the London Stock Exchange (LSE) and there is a new wave of listings on the Hong Kong Stock Exchange as well. Consequently, we are seeing interest in these ETFs coming from the world’s largest financial institutions as they enter the field, apparently less concerned about holding these ETFs than they would be about investing directly in spot Bitcoin.

Subsequent to the 11 initial listings, a wave of ETPs has hit the global markets. In the U.S. alone, CRB Monitor tracks no fewer than 37 listed or OTC spot crypto ETFs, largely benchmarked to either Bitcoin or Ethereum. The following table lists the 23 largest U.S.-listed crypto ETFs as of Dec. 31, 2024.

Top 23 Crypto ETFs – US Listed |

||||||

| Primary Exchange | Ticker | ETF Name | Fund Type | AUM (USD MM) | Expense Ratio | Digital Asset Custodian |

| NASDAQ | IBIT | iShares Bitcoin Trust ETF | Spot | $53,798.76 | 0.25% | Coinbase Custody Trust Company, LLC |

| NYSE Arca | GBTC | Grayscale Bitcoin Trust ETF | Spot | $19,958.92 | 1.50% | Coinbase Custody Trust Company, LLC |

| BATS | FBTC | Fidelity Wise Origin Bitcoin Fund | Spot | $19,170.00 | 0.25% | Fidelity Digital Asset Services, LLC |

| BATS | ARKB | Ark 21Shares Bitcoin ETF | Spot | $4,801.00 | 0.21% | Coinbase Custody Trust Company, LLC |

| NYSE Arca | ETHE | Grayscale Ethereum Trust ETF | Spot | $4,570.00 | 2.50% | Coinbase Custody Trust Company, LLC |

| NYSE Arca | BITB | Bitwise Bitcoin ETF | Spot | $3,975.52 | 0.20% | Coinbase Custody Trust Company, LLC |

| NYSE Arca | BTC | Grayscale Bitcoin Mini Trust ETF | Spot | $3,644.28 | 0.15% | Coinbase Custody Trust Company, LLC |

| NASDAQ | ETHA | iShares Ethereum Trust ETF | Spot | $3,388.85 | 0.25% | Coinbase Custody Trust Company, LLC |

| BATS | FETH | Fidelity Ethereum Fund | Spot | $1,550.00 | 0.25% | Fidelity Digital Asset Services, LLC |

| NYSE Arca | ETH | Grayscale Ethereum Mini Trust ETF | Spot | $1,454.46 | 0.15% | Coinbase Custody Trust Company, LLC |

| BATS | HODL | VanEck Bitcoin ETF | Spot | $1,340.00 | 0.20% | Gemini Trust Company, LLC |

| NASDAQ | BRRR | Coinshares Valkyrie Bitcoin Fund | Spot | $862.51 | 0.25% | Coinbase Custody Trust Company, LLC |

| BATS | BTCO | Invesco Galaxy Bitcoin ETF | Spot | $757.40 | 0.25% | Coinbase Custody Trust Company, LLC |

| BATS | EZBC | Franklin Bitcoin ETF | Spot | $743.06 | 0.19% | Coinbase Custody Trust Company, LLC |

| BATS | BTCW | WisdomTree Bitcoin Fund | Spot | $376.49 | 0.25% | Coinbase Custody Trust Company, LLC |

| NYSE Arca | ETHW | Bitwise Ethereum ETF | Spot | $344.00 | 0.20% | Coinbase Custody Trust Company, LLC |

| OTCQX | ETCG | Grayscale Ethereum Classic Trust | Spot | $274.59 | 2.50% | Coinbase Custody Trust Company, LLC |

| OTCQX | BCHG | Grayscale Bitcoin Cash Trust (BCHG) | Spot | $165.06 | 2.50% | Coinbase Custody Trust Company, LLC |

| BATS | ETHV | VanEck Ethereum ETF | Spot | $133.61 | 0.20% | Gemini Trust Company, LLC |

| BATS | EZET | Franklin Ethereum ETF | Spot | $38.14 | 0.19% | Coinbase Custody Trust Company LLC |

| BATS | QETH | Invesco Galaxy Ethereum ETF | Spot | $21.90 | 0.25% | Coinbase Custody Trust Company, LLC |

| NYSE Arca | DEFI | Hashdex Bitcoin ETF | Spot | $15.49 | 0.90% | BitGo Trust Company, Inc |

| BATS | CETH | 21Shares Core Ethereum ETF | Spot | $15.36 | 0.21% | Coinbase Custody Trust Company LLC |

Source: Issuer & Exchange Websites

As mentioned above, the U.S. market for spot crypto ETFs has ballooned to more than 30 issues with total AUM of over $120 billion. Whether or not the market needs all of these funds remains to be seen. But if history is any guide, we would expect a number of fund closures by the next time we update this article. The fixed costs of launching and maintaining an ETF are simply too high to keep an unprofitable fund open.

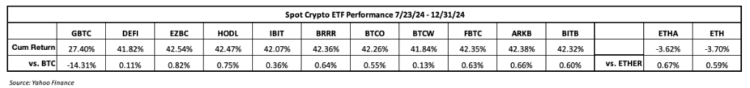

Looking at the recent crypto-based ETF performance, since our last update the SEC approved a number of Ethereum-based funds which appear to be in lock-step with one another (we have included two of them plus the underlying ETHER return on this chart). The same is true for the Bitcoin-based offerings that were launched a year ago, with one exception, the Greyscale Bitcoin ETF Trust. We chose this time period because it coincides with the launch dates of the newly approved Ethereum-based crypto ETFs.

During this period crypto returns were tepid until the spikes which immediately followed the November elections. And the relative performance across the basket of ETFs was predictable given that they all hold the same underlying assets (either BTC or ETHER). In other words, one would expect that all ETFs holding Bitcoin should perform closely to one another, and the same should be true for the Ethereum-based ETFs as well.

With that said, the one outlier in this analysis is the significant underperformance of the Grayscale Bitcoin Trust ETF (NYSE: GBTC) versus the rest of the Bitcoin field (GBTC underperformed by 14% from 7/23 to 12/31). What’s happening here? While it’s true that GBTC holds an identical portfolio to the rest of the field – a position in Bitcoin – its relatively high expense ratio of 1.5% has had investors scrambling for the exits since it commenced trading in the U.S. in January 2024.

Consequently, as the price of Bitcoin gained over 40% during the above period, GBTC’s AUM (around $19 Billion) remained relatively unchanged. And this mass liquidation of units in GBTC in a rising market translated into a massive cash drag which was borne by fund participants. So while the difference in expense ratio has had a small impact on relative performance, the impact from redemptions related to this differential was catastrophic. (It is important to note that it would take a rigorous daily calculation to determine the precise net “performance slippage” due to all the cash outflows. And because only cash redemptions are permitted for crypto ETFs in the U.S. (as opposed to in-kind), GBTC bears the transaction costs for all cash flows.)

We have updated the above correlation table for the July-December performance period and added the two Ethereum-based funds as well as the cryptocurrency ETHER. There are no real surprises here, as all the BTC funds are highly correlated as are the Ethereum funds. In addition, the Ethereum funds are very highly correlated to the Bitcoin funds, in spite of the fact that there was a significant difference in returns (45%) over the period. In the long run, there is no reason to believe that one of these assets (or funds) should outperform another.

We have updated the above correlation table for the July-December performance period and added the two Ethereum-based funds as well as the cryptocurrency ETHER. There are no real surprises here, as all the BTC funds are highly correlated as are the Ethereum funds. In addition, the Ethereum funds are very highly correlated to the Bitcoin funds, in spite of the fact that there was a significant difference in returns (45%) over the period. In the long run, there is no reason to believe that one of these assets (or funds) should outperform another.

Challenges Presented by Spot Bitcoin ETFs

Spot Bitcoin ETFs represent a significant opportunity for the crypto industry and for investors, as they provide a convenient and cost-efficient way to access the world’s largest cryptocurrency. They also have the potential to attract new institutional and retail investors to the crypto space, increasing the liquidity, adoption, and credibility of Bitcoin.

With that said, spot Bitcoin ETFs face a number of challenges and risks to investors, given that the ETFs will not provide cover from the embedded risks that are inherent in the digital asset industry. This is because in the eyes of the regulators (specifically the SEC) Bitcoin does not meet the criteria to be defined as a “security.” Consequently, spot Bitcoin ETFs are not covered by the Investment Company Act of 1940, and so investors in these ETFs are not afforded the protections that they enjoy when they hold more conventional investments.

For example, the prospectus for the iShares Bitcoin Trust (IBIT) describes a critical and risky aspect of the create/redeem process as follows:

“The Trust will create Shares by receiving Bitcoin from a third party that is not the Authorized Participant and the Trust—not the Authorized Participant—is responsible for selecting the third party to deliver the Bitcoin. Further, the third party will not be acting as an agent of the Authorized Participant with respect to the delivery of the Bitcoin to the Trust or acting at the direction of the Authorized Participant with respect to the delivery of the Bitcoin to the Trust. The Trust will redeem Shares by delivering Bitcoin to a third party that is not the Authorized Participant and the Trust—not the Authorized Participant—is responsible for selecting the third party to receive the Bitcoin. Further, the third party will not be acting as an agent of the Authorized Participant with respect to the receipt of the Bitcoin from the Trust or acting at the direction of the Authorized Participant with respect to the receipt of the Bitcoin from the Trust. The third party will be unaffiliated with the Trust and the Sponsor…The Prime Execution Agent facilitates the purchase and sale or settlement of the Trust’s Bitcoin transactions. Bitcoin Trading Counterparties settle trades with the Trust using their own accounts at the Prime Execution Agent when trading with the Trust.”

What all this suggests (and why investors should take note) is, because of the fractured nature of how digital assets transact, that the success of a critical link in the operational chain cannot be guaranteed. And while we will not go into the mechanics of typical, standard ETFs, suffice it to say that trade and settlement are not left to “unaffiliated third parties.”

And as such, we conclude that investors in these 11 new ETFs are subject to the same risks as investors in the underlying digital assets themselves:

- Regulatory uncertainty: The SEC has approved the spot Bitcoin ETFs under the condition that they comply with the Securities Act of 1933, the Securities and Exchange Act of 1934, and the Commission’s rules regarding cryptocurrency. However, the SEC has also expressed its skepticism and caution about the crypto industry, and has warned investors about the risks involved in investing in Bitcoin and crypto-related products. The SEC may also impose additional requirements or restrictions on the spot Bitcoin ETFs in the future, or even revoke their approval, depending on the market conditions and the regulatory environment.

- Market volatility: Bitcoin is known for its high volatility, as its price can fluctuate significantly in a short period of time, due to various factors such as supply and demand, news and events, speculation, and manipulation. Investing in spot Bitcoin ETFs exposes investors to the same volatility risk as investing in Bitcoin directly, and may result in substantial losses or gains. Investors should be prepared for the possibility of extreme price movements and have a long-term perspective when investing in spot Bitcoin ETFs.

- Operational risk: Spot Bitcoin ETFs rely on third-party custodians to store and safeguard the Bitcoins backing the ETFs. While these custodians are professional and regulated entities that provide insurance coverage and regular audits, investors should understand the underlying risks involved related to trade, pricing and settlement of the coins held by each ETF.

Finally, from the GBTC Factsheet risk disclosures: “Digital assets represent a new and rapidly evolving industry. The value of GBTC depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of th digital asset. Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related digital asset.”

BIS Digital Asset Classification

New challenges persist beyond the wide range of quality among digital asset regulators. Despite notable strides, risks endure, particularly in the global circulation and trading of digital assets. The heightened exposure of Bitcoin ETFs to underlying risks emphasizes the need for a comprehensive understanding of evolving standards.

As major financial institutions prepare for new Basel Committee on Banking Supervision standards by January 1, 2026, the landscape becomes more intricate, categorizing Cryptoassets into four risk classes (Group 1a & 1b and Group 2a & 2b), with the 2’s presenting higher levels of operating risk and directly affecting a bank’s capital requirements.

Bitcoin’s placement in Group 2, specifically subgroup 2A, confirms the necessity for institutions to adapt risk management strategies that are in line with the elevated risk that is assigned by this new classification, which goes into effect in January 2026. This new set of standards would then place all spot Bitcoin ETFs in group 2A, given that Bitcoin is essentially all that they hold.

Why is this important? Because regulators will require financial institutions to report their exposure to Group 1 and Group 2 Cryptoassets as their exposure to them will need to be limited and disclosed. In the words of the Basel report, “A bank’s total exposure to Group 2 Cryptoassets must not exceed 2% will apply the more conservative Group 2b capital treatment to the amount by which the limit is exceeded. Breaching the 2% limit will result in the whole of Group 2 exposures being subject to the Group 2b capital treatment of the bank’s Tier 1 capital and should generally be lower than 1%. Banks breaching the 1% limit.”

Digital Asset Global Regulatory Risk – Update

While it is appropriate to describe the digital asset industry as “heavily” regulated, it is also accurate to describe digital asset regulation as “complicated.” Truth be told, there are now hundreds of regulatory agencies worldwide that are doing their best to keep up with several different categories of market participants, with varying degrees of success. But the reality is that, given its attraction for bad actors, regulating the crypto industry is a challenge and financial institutions that facilitate trading and custody of digital asset ETPs should be aware of this added layer of risk.

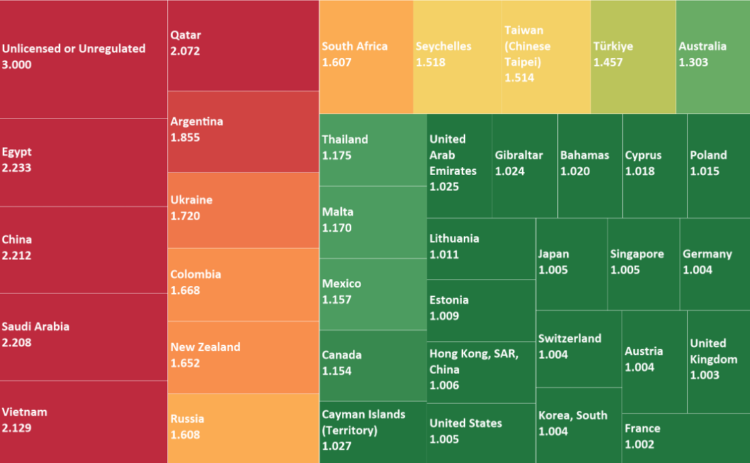

As such, CRB Monitor has developed a model which applies “quality” scores to many of the world’s largest licensing authorities. A summary of this model can be found in our August 2023 article Applying Risk Ratings to Digital Asset Regulators. In a nutshell, financial institutions are wedged between a rock and a hard place, craving a transparent, regulatory framework while trying to accommodate the needs of their clients and shareholders to hold crypto assets. And while these institutions expand their participation in the still-nascent digital asset industry through custody, trading and even new digital asset issuance, the desire for greater transparency and a global regulatory framework persists. This table (updated through May 31, 2024), which contrasts the degree and effectiveness of regulators in digital asset space, highlights the differences in risk across most of the largest regulatory authorities, and brings to light one of the hidden challenges associated with investing in a spot Bitcoin ETF.

Relative Quality Scores – Global Regulatory Authorities – Q4 2024

We have witnessed a veritable flood of crypto-related ETP issuance over the last year, not only in the U.S. but globally and CRB Monitor tracks and maintains data on more than 500 of these issues.

As crypto investors continue to wade into this vast sea of operational risk and volatility, there are a number of considerations that will be essential components of compliance and risk management beyond those required for typical ETF investing. Rather, it can be assumed that an investment in a spot Bitcoin ETF is akin, from a risk perspective, to an investment in Bitcoin itself. And it should not be overlooked that Bitcoin is actively traded on global exchanges of varying qualities and degrees of regulation, and as such lends itself to illicit activity. CRB Monitor reviews global regulators of crypto activity on an ongoing basis to ensure that our clients are fully aware of all the embedded risks in this volatile space.

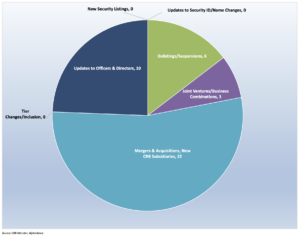

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for December 2024:

Cannabis Business Transaction News – December 2024

The cannabis business news cycle slowed a little in December, but there were a number of notable deals to report in spite of the fact that voters in Florida and the Dakotas rejected adult-use cannabis sales in their respective states. [For more, please see our coverage in the CRB Monitor November Securities Newsletter]. With that said, we remained plugged into the news cycle and have a number transactions to report this time around. Here are some of the highlights from December 2024:

Next we head north, where Canadian Tier 1B High Tide Inc. (TSXV: HITI) announced in a Dec. 10 press release that its “Canna Cabana retail cannabis store located at 5921 Perth Street, Richmond, Ontario will begin selling recreational cannabis products and consumption accessories for adult use on Saturday, December 14. This opening will mark High Tide’s 189th Canna Cabana branded retail cannabis location in Canada, the 75th in the province of Ontario, and the first location in Richmond… With low competitive density, this organic Canna Cabana provides the Company with attractive cannabis demographics.”

As we have been reporting, High Tide has been in expansion mode for much of the last 12 months, and now holds 201 active cannabis licenses in Canada and Australia.

One of Florida’s largest MSOs, Tier 1A Trulieve Cannabis Corp. (CSE: TRUL), apparently undeterred by November’s election results, announced Dec. 9 “the opening of a new medical cannabis dispensary in Tampa, Florida. The new dispensary will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, O.pen, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

With this purchase Trulieve’s footprint expands to 108 licensed retail cannabis operations in the state of Florida and holds, directly or through subsidiaries, 108 active licenses in the U.S.

Next, Canadian Tier 1B and household CRB name Canopy Growth Corporation (TSX: WEED) issued a Dec. 9 press release confirming that “Canopy USA, LLC has completed its acquisition of Acreage. Canopy USA now owns 100% of the issued and outstanding shares of Acreage. Together with the completed acquisition of 100% of Wana Wellness, LLC, The CIMA Group, LLC and Mountain High Products, LLC (collectively, “Wana”), as announced on October 9, 2024, and approximately 77% of the shares of Lemurian, Inc. (“Jetty”) as announced on June 4, 2024, Canopy USA is fulfilling its ambition of establishing a leading brand-focused cannabis company in the U.S.”

While this acquisition would make things appear that Canopy Growth now has U.S. marijuana touch points, in reality the company accomplished this transaction while remaining CSA-compliant. That’s because the parent company owns Canopy USA, LLC through a warrant that is exercisable only upon U.S. federal legalization of marijuana. In other words, unless and until marijuana is federally legal, Canopy Growth Corp. continues to have no direct ownership of a U.S. cannabis business.

The press release continues, “The completed acquisitions of Acreage and Wana, and approximately 77% of the shares of Jetty, are expected to enable Canopy USA to realize anticipated financial benefits, including revenue growth and cost synergies, marketing efficiencies, and joint sales advantages across key cannabis product categories such as vapes, edibles, and flower.”

Canopy Growth currently holds, through its subsidiaries, 58 active cannabis licenses to operate in Canada, Germany and Colombia.

Finally, Tier 1A Canadian CRB MediPharm Labs Corp. (TSX: LABS) and Kensana Health Inc. jointly issued a December press release announcing that they have “entered into a share purchase agreement for the purchase and sale of MediPharm’s facility in Napanee, Ontario through a disposition of all of the Company’s indirect equity interests in its wholly-owned subsidiary ABcann Medicinals Inc. to Kensana Health for $5.5 million in cash.”

What this amounts to is MediPharm is looking to scale back its operations and eliminate inefficiencies wherever possible. The announcement goes on to say, “Pursuant to the Purchase Agreement, Kensana Health has agreed to acquire all of the issued and outstanding shares in the capital of ABcann from the Company’s operating subsidiary MediPharm Labs Inc. If the Transaction is successfully completed, through its acquisition of ABcann, Kensana Health will acquire the license in respect of the Napanee Facility as well as the building, land, and equipment associated with the Napanee Facility. Current commercial agreements and activities of the Company will stay with MediPharm Labs… This strategic Transaction aligns with MediPharm’s focus on streamlining its operations and maximizing value for stakeholders. This Transaction is also expected to further complement the Company’s already strong cash position and combined with the materially debt-free balance sheet, allow the Company to invest in future growth opportunities.”

MediPharm Labs currently holds 11 active licenses in three Canadian provinces.

Select CRB Business Transaction Highlights

Select Updates to CRB Monitor

Added to DBTier 3 – CBD – Pharma & Biotech

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Institute of Biomedical Research Corp. | OTC Pink: MRES | ||

| Phoenix Life Sciences International Limited | OTC Expert: PLSI | Moved to Watchlist | Tier 2 – CBD – Pharma & Biotech |

| Dotz Nano Limited | ASX: DTZ | Moved to Watchlist | Tier 3 – Professional Services |

| DMG Blockchain Solutions Inc. | TSXV: DMGI | Moved to Watchlist | Tier 3 – IT Services & Software |

| Canadian Nexus Team Ventures Corp. | CSE: TEAM | Moved to Watchlist | Tier 3 – Agricultural & Farm Machinery |

Cannabis News: Regulatory News Updates

In the aftermath of the November 2024 elections, owners and investors of CRBs licked their wounds and continued on their individual paths toward business survival. It goes without saying that the U.S. government will soldier on, and we will see the next wave of proposed cannabis-related reforms from the next Congress. Meanwhile, the DEA will continue, at a snail’s pace, to move forward with its plan for rescheduling (or perhaps descheduling) in the months to come. And there is no doubt that we will see progress toward the legalization of marijuana for adult use in new states, over and above the current count of 24. With that said, here are some of the December highlights from the cannabis-related regulatory news cycle:

We begin in the State of New York, where our very own CRB Monitor News Team reported Dec. 20 that a state judge has “once again ordered the Cannabis Control Board (CCB) to stop issuing retail licenses after the state agency lifted requirements that certain retail applicants secure locations prior to license approval.”

This ruling is clearly intended to stifle the proliferation of the black market, which can emerge when a lack of controls are in place. The article goes on to report, “’We are not recommending issuing any more cultivation licenses until we at least have a better sense of the outlook and state of production moving forward,” said OCM Policy Director John Kagia. ‘One of the things that we have learned from other jurisdictions is that when you have a hyper-saturated market of production, cultivators generally don’t reduce how much they produce, and then you start seeing products seeping out of the back of the barns and falling off the back of trucks into the illicit market.’”

The article continues: “Currently, the state estimates there are about 75,000 people per operating dispensary. If all of the roughly 800 approved licenses from the November cohort were to open, that ratio would drop to about 25,000 per store. Adding an additional 1,000 from the December cohort would bring the state’s total number of retail shops to about 2,000, which would lower the ratio to about 10,000 people per store.

The court ruling came one day before the Office of Cannabis Management’s Cannabis Advisory Board recommended limits on the number of retail licenses approved over the next 18 months.”

Next, to a national story that was reported by our CRB Monitor News Team entitled Rescheduling Testimony Scheduled for January. Although the hearing has since been canceled, the subject of rescheduling (now more than two years old and counting) looms large among the CRB community. Stakeholders of all kinds wait with interest as the DEA gets its ducks in order. With that said, this could get complicated as a new, “no business as usual” administration heads into the White House with its own, unconventional agenda.

In the words of the article, “While the Drug Enforcement Administration’s lead attorney affirmed the agency is the “proponent” of the proposed rule, rescheduling supporters skeptical of the DEA’s position were told they could not cross-examine the DEA’s witnesses. Chief Administrative Law Judge John J. Mulrooney II, likewise, questioned the federal agency’s delay in filing documents and case strategy in his Dec. 4 order. DEA Administrator Anne Milgram has selected 25 ‘designated participants,’ representing both sides of the proposed rule, to provide evidence.”

The process will unquestionably get complicated with the arrival of the new administration, and as the article states, “Meanwhile, how the process will play out once President-Elect Donald Trump takes over in January remains to be seen, especially since his nominations for attorney general and DEA administrator are going through a revolving door.”

Now we head west to Wisconsin, where a December article in Marijuana Moment reported that Wisconsin’s Senate minority leader said that she plans to “introduce a medical marijuana legalization bill in the coming legislative session, building on past legalization efforts that have fallen short in the face of pushback from Republican lawmakers.”

Like most states’ battles over legalization, the dissent falls along party lines, and Wisconsin is no exception. A majority of Democrats are in favor while a majority of Republicans are opposed, plain and simple. And a major issue, which is also universal, is money. Legalization would likely be dead in the water if not for all the revenues that are being left on the table; or more accurately, escaping to neighboring states. And the fact that marijuana is still illegal for both medical and recreational use means that exactly no cannabis-related revenue is available to the people of Wisconsin. And this appears to go against the will of those people. In the words of the report, “…a survey of rural voters in Wisconsin that was released last week revealed that nearly 2 in 3 (65 percent) support legalizing marijuana broadly. The poll, from the conservative nonprofit Institute for Reforming Government and the State Policy Network, asked 541 voters from rural counties in Wisconsin about a range of policy issues.”

Next we head out west to Nebraska, where a December article on our CRB Monitor News website reported that on Dec. 12, Nebraska’s governor certified certain measures that will eventually lead to legalization in the state. According to the article, “Former Nebraska state senator John Kuehn is not giving up his fight to prevent state residents from using and purchasing medical cannabis. Despite overwhelming voter support for legalization initiatives, Kuehn has appealed one lawsuit he lost to the state Supreme Court and has filed another legal challenge to Measures 437 and 438. Gov. Jim Pillen signed proclamations certifying the enactment of the legalization measures Thursday, Dec. 12, after Lancaster County District Judge Susan Strong denied Kuehn’s request for an emergency injunction on Wednesday. However, Pillen and Attorney General Mike Hilgers said in a joint statement that the proclamations don’t express a judgement on the validity of the measures, noting that marijuana is still illegal under federal law.”

We reported last month on Nebraska’s ballot questions 437 and 438, which asked voters to either approve or reject legalized medical marijuana in the state and also provide for a commercial market for it. Both measures passed handily, with 71% and 67% majorities, respectively. With that said, legal cannabis still faces a battle in the courts.

The December article goes on to report, “In his first lawsuit filed before the election, Kuehn, who is also a former member of the State Board of Health, alleged that there were not enough valid signatures collected for the pair of initiatives after a signature gatherer and notary were arrested for alleged fraud and malfeasance. Secretary of State Bob Evnen joined the lawsuit, represented by the attorney general’s office. The charges against the notary were later dismissed by a Hall County judge. Judge Strong then ruled Nov. 26 that the evidence did not demonstrate pervasive fraud. While Strong said the ‘presumption of validity’ was lost on more than 700 signatures for the legalization petition and over 800 for the regulatory petition, the initiatives were still valid, the Nebraska Examiner reported.”

We will follow this battle closely, and if the voters prevail, medical marijuana is planned to hit Nebraska’s shelves in 2026.

Finally, we head to Minnesota, where our CRB Monitor News Team reported on the Minnesota Adult-Use Lottery Held Up In Appellate Court. The article states, “The Minnesota Office of Cannabis Management’s plan to award 217 social equity adult-use cannabis licenses through a lottery is stuck in state appellate court that must weigh the merits of lawsuits filed by applicants that were deemed ineligible just days before the scheduled lottery. The state announced Nov. 22 that only 648 of the original 1,807 applicants were eligible for the lottery. That same announcement included a set date for the anticipated lottery as four days later on Nov. 26. The day before that announcement, rejected applicants Cristina Aranguiz and Jodi Connolly sued OCM in state court, alleging they were not given an explanation about why they failed to qualify.”

The article goes on to report, “In court filings, the state alleged that Aranguiz and Connolly had entered into agreements with NXMN Partnership LLC, which is controlled by an individual who is not eligible for the lottery. As part of those agreements, the state says the plaintiffs planned to sell their businesses to NXMN for $100,000 if they were awarded licenses. The state claimed that this was part of a larger effort from NXMN to flood the lottery process. NXMN, a Delaware-registered company, is associated with Tate Kapple. Kapple and Aranguiz are owners of the Iowa Cannabis Company. He is also associated with multiple licenses in Washington, Oregon and Iowa. Kapple applied for a retail and a delivery license in Minnesota using an MNcanna.org email address, the state said. OCM general counsel Eric Taubel said the agency was able to identify 120 retail applications and 120 delivery applications from Iowa that are linked to Kapple’s business and had the same $100,000 sale arrangement, according to a 60-page affidavit Taubel filed with the court.”

Needless to say, we will continue to monitor all of this activity in Minnesota as they make their way in this brave new world of adult-use cannabis.

CRBs In the News

The following is a sampling of highlights from the December 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update Defining “Cannabis-Related Business”.)

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know