After eight years of operating in the legal cannabis space, investment adviser Navy Capital Green Management is shutting down because of Florida’s failure to legalize adult use and a continued lack of available capital for cannabis companies.

At the same time, the SEC recently levied a $150,000 fine against Westport, Conn.-based Navy Capital for allegedly failing to follow its own AML procedures.

“Navy Capital’s private fund investors included multiple foreign-based entities with opaque beneficial ownership and sources of wealth, at least one of which was owned by an individual publicly reported to be suspected of being connected to money laundering activities,” said the nine-page order.

Without admitting or denying the SEC’s findings, Navy Capital agreed to cease and desist the alleged activity, be censured and pay the $150,000 civil penalty.

“This case reinforces the fundamental duty of investment advisers to say what they do and do what they say,” said Tejal D. Shah, associate regional director of the SEC’s New York Regional Office, in a Jan. 14 statement announcing the action. “Here, Navy Capital failed to follow the AML due diligence procedures that it said it would, thus misleading investors about the level of risk they were undertaking.”

Although investment advisers are not yet required to establish AML programs, the SEC has recently cracked down on firms that fail to properly operate those programs if they claim to have them in place. Last month, SEC fined LPL Financial $18 million for similar violations.

New AML rules for investment advisers take effect next year

New FinCEN rules that were finalized Aug. 28, 2024, and officially take effect Jan. 1, 2026, require investment advisers to establish AML programs.

“The new rule adds registered investment advisers (RIAs) and exempt reporting advisers to the definition of ‘financial institution’ under the Bank Secrecy Act,” said the final rule. It applies to RIAs and ERAs that have to register with the SEC.

Prior to the final rule, the Department of the Treasury produced a 40-page risk assessment report justifying the updated regulation. The report specifically mentions that financial influence from China and Russia are cited as key potential threats. Cannabis is not mentioned once in the report, but the rule appears to also apply to cannabis investment advisers.

Under those new requirements, RIAs and ERAs will have to implement AML programs, and they are obligated to file Suspicious Activity Reports with FinCEN.

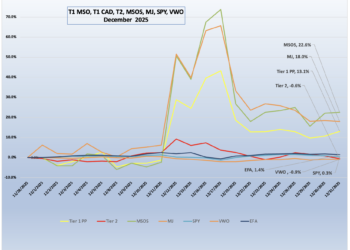

Navy Capital was classified as an ERA before it started closing down. As of March 27, 2024, it had $322.2 million under management, according to the SEC. It stopped accepting subscribers in November. A couple of the cannabis companies it financed were MSOs 4Front Ventures Corp. and MariMed Inc.

Sarah Beth Felix, founder and president of Palmera Consulting wrote in a LinkedIn post that until RIAs and ERAs are required to adopt AML programs, they should probably avoid claiming to have one when they do not.

“Biggest lesson here today for all investment firms, of any kind, if you list anything related to AML in investor-facing documentation, either comply with it OR remove the language (if you’re not required to have it),” she wrote.

Sean Stiefel, CEO and founder of Navy Capital Green Management, did not respond to requests for comment.

Continued cannabis prohibition leads to closure

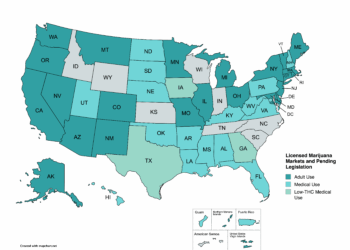

Steifel recently spoke to investors about the plan to close up shop. He explained that the decision to wind down started last fall when Florida voters failed to pass cannabis legalization, according to a letter he sent to investors shortly after the election, which was published by Cultivated.

“The failure to pass was particularly disappointing because we viewed Florida as one of the most opportunistic structures for participants in the country, as we believed around $4B of revenue would potentially accrue to the publicly traded stocks and also create a substantial growth and profitability narrative in the sector, Additionally, had Florida gone recreational, it would have likely pressured neighboring Southern states such as Georgia to follow suit. “

Although President Donald Trump indicated that he was in support of Florida’s legalization effort, Stiefel wrote that he was not convinced that change at the federal level would come anytime soon.

“It is not at all clear if Trump will be willing to spend any time or political capital on the issue given that the old guard Republican Senators in leadership positions are hard-line opponents of cannabis,” he said.

Stiefel sent another letter to investors on Jan. 31, further explaining the reasoning for the shutdown. In the letter, which was also republished by Cultivated, Stiefel says that the company was originally formed with the idea that cannabis would eventually be legalized nationwide, and that smaller investments would benefit from financing first movers before the larger lending institutions were willing to enter the market.

“Eight years hence, we have concluded that the thesis was simply wrong,” wrote Stiefel. “And that while it may eventually play out as we’d hoped and imagined over time, the investments made, particularly during periods of greatest enthusiasm, have not worked.”

Despite the decision to shut down his fund, Stiefel said he remained optimistic that cannabis would one day grow into a nationwide industry.

“While we have been wrong about the pace at which states would crack down on the illicit market and create regulatory structures that allow the legal industry to succeed, we do see significant signs that things are changing,” wrote Stiefel.

“We also believe that when we have national markets with national players who can access traditional channels for brand building and marketing, branded products will emerge, and national retail chains will emerge. Over what period of time that happens, we simply cannot predict.”