Ohio, which launched its adult-use market last year, jumped to fifth place among states filing marijuana-related Suspicious Activity Reports (SARs) during the third quarter 2024, according to newly released data by the U.S. Department of the Treasury.

In total, the Financial Crimes Enforcement Network (FinCEN) received 21,239 total SARs in the third quarter 2024, a 5.4% decrease from the 22,448 reports filed in the second quarter 2024. Still, it was 311 more than the third quarter 2023.

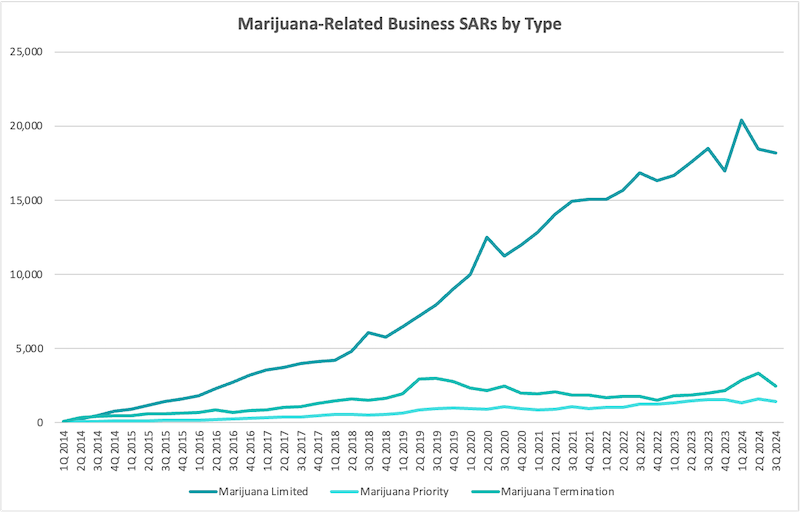

As part of their anti-money laundering programs, financial institutions are required to file SARs for marijuana-related accounts. FinCEN classifies them in three categories:

- Marijuana Limited — An institution believes the business doesn’t raise any red flags under the enforcement priorities outlined in the 2013 Cole Memo or violate state law.

- Marijuana Priority — The institution believes the account has Cole Memo red flags or has violated state laws.

- Marijuana Termination — When a financial institution terminates an account or relationship to maintain an effective money-laundering compliance program.

Marijuana Limited reports are seen as an indicator of institutions, primarily banks and credit unions, that welcome cannabis-related business. The vast majority of reports filed are Limited. The number of Limited reports filed in the third quarter, 18,191, was virtually unchanged from the second quarter 2024 and the third quarter 2023, just a slight drop of less than 300 reports each quarter. But it’s still a 10.9% drop from the record 20,410 in the first quarter of last year.

Marijuana Priority also fell slightly in the third quarter, from the second quarter’s 1,594 to 1,415.

After a record number of Marijuana Termination reports in the second quarter last year, Termination reports fell by 25.4% to 2,468 in the third quarter.

In total, FinCEN has received 456,411 marijuana-related SARs since it started collecting reports in 2014.

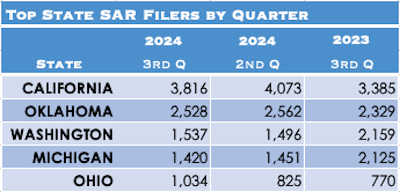

Ohio jumps to 5th, California still 1st

Following a successful voter initiative in 2023, Ohio issued its first adult-use dispensary certificates of operation in August last year. Since then, it has sold more than $333 million in adult-use cannabis. The state had 134 active retail licenses, 38 cultivation licenses and 46 manufacturing/processor licenses, according to the CRB Monitor licensing database, as of Feb. 21.

As a result of this new business market, banking has increased. Ohio rose from seventh place in the second quarter to fifth place in the third quarter with 1,034 total SARs filed, a 20.2% increase.

California remains No. 1, with 3,816 SARs filed, a 6.3% drop from the previous quarter, but still more than the third quarter last year.

Oklahoma also stays at No. 2, with 2,528 SARs in the third quarter, practically unchanged from the 2,562 filed in the second quarter.

Washington continued to file more SARs than Michigan, placing third and fourth, respectively. Washington had 1,537 total reports, and Michigan had 1,420 in the third quarter. Both states were pretty close to what they had in the second quarter, but they still marked a roughly 30% drop from the previous year.

South Dakota, which had catapulted to the third-place SAR-filing state in the second quarter, fell down to 10th place with a 61.2% drop to 718 reports in the third quarter.

FinCEN data do not break down the types of reports filed by each state.

Cannabis banking institutions remain steady

The number of institutions that are considered “active filers” by FinCEN remains virtually unchanged for the year, with 818 in the third quarter. This includes 511 banks and 172 credit unions. The rest are non-depository institutions such as casino and card clubs, money services businesses, securities, and loan or finance companies.

FinCEN defines an active filer as an institution that has filed Limited or Priority SARs that did not refer to a termination in the narrative, although some of the active filers may have also submitted Termination reports.

However, it appears that credit unions are serving more cannabis-related businesses than federally regulated banks this year. The National Credit Union Administration was the regulator for 5,859 SARs, compared to 5,574 regulated by the Federal Deposit Insurance Corp. in the third quarter. The NCUA had more SARs than the FDIC in the first and second quarters as well. This is a flip from 2023, when more FDIC-regulated SARs were filed than under the NCUA.

Additionally, credit union SARs fell 22.8% from the 7,586 filed in the first quarter 2024. FDIC SARs dropped 12.4% since the first quarter.

The Office of the Comptroller of the Currency, with 3,585 reports in the third quarter, and the Internal Revenue Service with 3,347, were also top regulators. The Securities and Exchange Commission was the regulator of only 55 SARs, the lowest number reported since the third quarter 2017.

Regulator reports are not broken down by type or whether they are from active filers.