With the current administration (and a few government-adjacent billionaires) calling the shots, the immediate and distant future of all government agencies is unclear. And this lack of clarity suddenly has draped the cannabis industry with a sort of “invisibility canopy.” With spending bills, budgets and debt ceilings on everyone’s mind, we are hard-pressed to know what Congress will do about keeping the train on the tracks, let alone trouble itself with “second-tier” issues like cannabis legalization. As Elon and the lads of DOGE give it their level best, we are left to wonder if DEA rescheduling will even be possible with a decimated DEA, FDA or IRS.

Will regulations that have paved the way for SAFER Banking be in effect by the end of 2025 as agencies are quite possibly gutted in favor of a minimalist federal government? Add to that, the ever-increasing use of tariffs, which will undoubtedly have an impact on the largely agricultural cannabis industry. Make no mistake about it: a small, state-focused business like cannabis will feel the sting of cross-border taxation, and it will not be long before we see the impact on cannabis-related company financials.

With that, we bring you the highlights from February 2025.

Cannabis-Linked Equity Performance

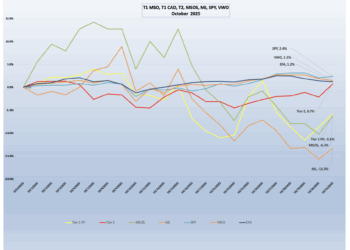

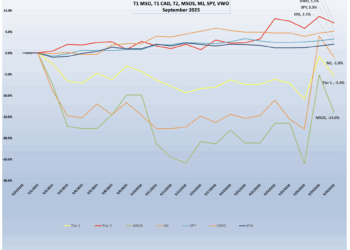

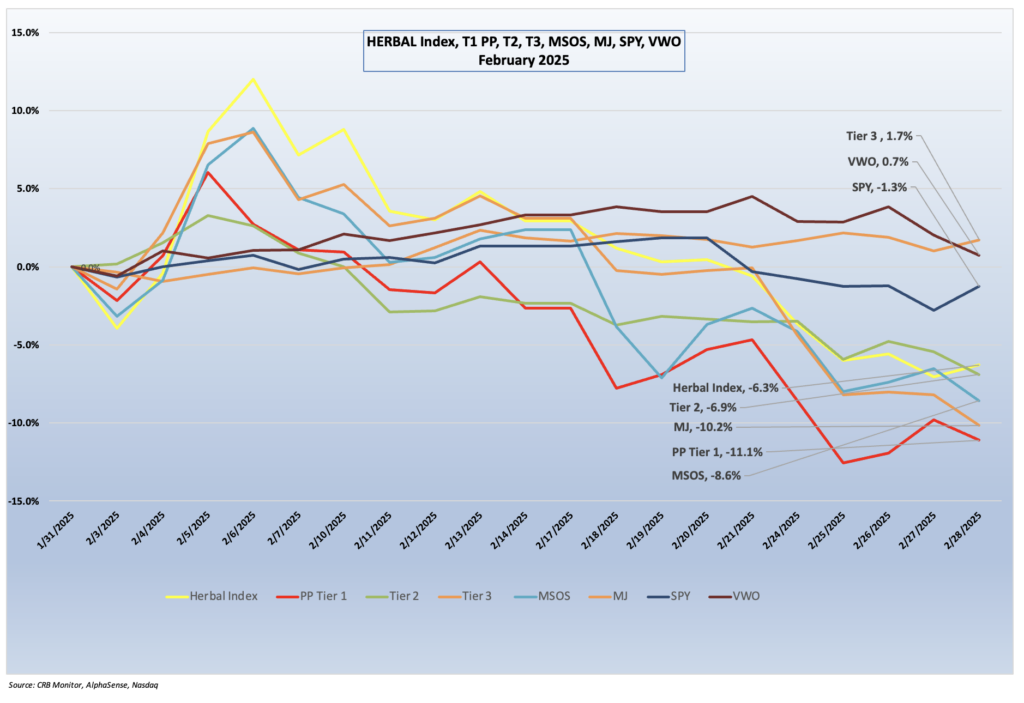

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), was negative but performed better than its peers in February (-6.3%), with most of the negative return coming from Tier 1 CRBs. It is important to note that HERBAL’s semiannual reconstitution will occur in the month of March. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), was negative but performed better than its peers in February (-6.3%), with most of the negative return coming from Tier 1 CRBs. It is important to note that HERBAL’s semiannual reconstitution will occur in the month of March. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-10.2%) and the actively managed, MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-8.6%), simply would not reverse their several months-long downward spiral. Both of these funds are benchmarked to CRB-themed indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching marijuana exposure tend to be more sensitive than HERBAL to the U.S. regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin in 2017, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally in 2022, MJ added and still maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It’s important to note that MJUS was scheduled to close in late February. As a replacement for its U.S. plant-touching exposure, MJ now holds units of the Amplify Seymour Cannabis ETF (NYSE: CNBS).

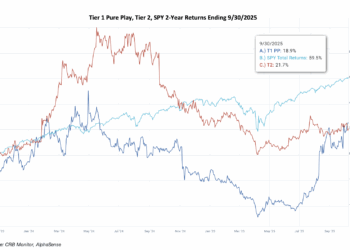

The performance of the CRB Monitor equally weighted basket of top pure play Tier 1 CRBs was negative in February, returning -11.1%. This basket, which is an equally weighted portfolio of the 21 largest pure play CRBs (including both U.S. plant-touching and non-U.S. plant-touching MJ companies), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take a closer look at some of these below.

The CRB Monitor equally weighted basket of Tier 2 CRBs outperformed the Tier 1 CRB basket, posting a -6.9% return for February. In 2024, CRB Monitor published an update to our article on correlations of Pure Play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their revenue sources derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time. We update this data a couple of times per year.

In February, U.S. equities were slightly negative as a group, as investors expressed their uncertainty over the global economy in the near term. The S&P 500 Index experienced a modest decline, marking its first monthly loss since September 2024. This downturn was primarily driven by investor concerns over the Trump Administration’s trade policies, including the announcement of new tariffs, which contributed to heightened market volatility. Despite this, the index remained positive for the year, with an average year-to-date return of 1.23% as of February 28. The S&P 500, represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY), posted -1.3% return for the month.

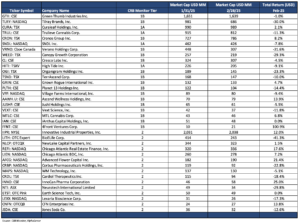

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – February 2025 Returns

An equally weighted basket of the largest Tier 1 pure play cannabis equities once again was negative in February with most of the constituents underperforming the broad equity market. Tier I CRBs were outpaced by the Tier 2 basket by 5.5%.

CRB Monitor Tier 1

With a few exceptions, publicly traded CRB performance was negative in February across the universe of Tier 1 cannabis stocks. The MSO basket continued its downward trend, with larger Tier 1A Trulieve Cannabis Corp. (CSE: TRUL) (-11.3%), Tier 1B TerrAscend Corp. (TSX: TSND) (-10.0%), Tier 1B Green Thumb Industries Inc. (CSE: GTII) (-1.0%), Tier 1B Cresco Labs Inc. (CSE: CL) (-4.5%) and Tier 1B Verano Holdings Corp. (CSE: VRNO) (-31.6%) losing investors’ value for another month. Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+2.1%) was slightly positive for the month, but did little to improve the performance of the overall basket.

The Canadian CRB basket performed worse than the MSO group, and there is little doubt that the uncertainty over trade wars with the U.S. playing a role. Tier 1B Canopy Growth Corporation (TSX: WEED) (-29.3%), Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-30.0%), Tier 1B High Tide Inc. (TSXV: HITI) (-9.1%) and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-7.8%) lost even more of their value in February, while Tier 1B Cronos Group Inc. (TSX: CRON) (+8.2%) managed to eke out a positive return to offset a sliver of its long-suffering underperformance. As we have stated regarding these two groups, historical performance has deviated between the CAD and the MSO baskets over short periods, but they tend to mean revert over time.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies outperformed the Tier 1 basket in February, posting a return of -6.9% for the month. Historically, these two portfolios are highly correlated (see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to mean revert over time. When the two baskets deviate from one another (as they have done historically), the deviation could be a signal for investors to rebalance their Tier 1 and Tier 2 baskets given their direct revenue relationship. This is due to the fact that by definition Tier 2 CRBs are direct suppliers of goods and services to Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lose money, so proceed with caution!

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+12.0%) soared for the second month in a row. On February 19, IIPR issued its 4th quarter 2024 earnings report, which featured the following highlights:

- “Total revenues of $308.5 million.

- Net income attributable to common stockholders of $159.9 million, or $5.52 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Adjusted funds from operations (AFFO) of $256.1 million, or $8.98 per share, and normalized funds from operations (Normalized FFO) of $231.0 million, or $8.10 per share.

- Declared dividends to common stockholders totaling $7.52 per share, increasing IIP’s common stock dividends declared each year since its inception in 2016.

- Committed over $70 million for the payment of purchase prices and funding of qualifying building infrastructure improvements for two property acquisitions and lease amendments for three properties.

- Released 530,000 square feet totaling ~6% of the total portfolio’s rentable square feet.

- Improved liquidity by increasing IIP’s revolving credit facility capacity from $30.0 million at December 31, 2023 to $87.5 million at December 31, 2024.

- At year-end, IIP’s portfolio totaled $2.5 billion of invested / committed capital and was comprised of 109 properties totaling 9 million rentable square feet in 19 states.”

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+21.4%) awarded investors in February, and over recent months it has also outperformed its Tier 1 CRB-lending clients. On March 13, AFCG reported its 4th Quarter 2024 earnings of $6.3 million which featured the following statement from CEO Daniel Neville:

“We believe that the capital supply and demand imbalance in the cannabis sector will remain in the medium-term, given the Republican sweep in November and the lack of progress on Federal reform. This provides the opportunity for AFC to deploy capital into deals with strong risk adjusted returns,” stated Daniel Neville, AFC’s Chief Executive Officer. He added, “We continue to put capital preservation at the forefront of our investments and remain disciplined on providing debt capital in a challenging environment for operators. As we have done over the last year and plan to do in the coming year, we continue to focus on diversifying our portfolio and providing debt capital to operators who have previous success executing in the cannabis industry.”

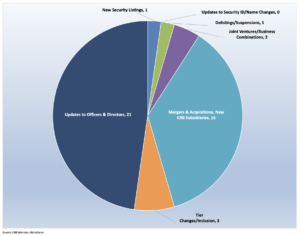

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for February 2025.

Cannabis Business Transaction News

The cannabis business news cycle soldiered on in February, with several CRBs expanding operations while others entered into joint ventures. And we witnessed significant officer/director turnover. CRBs like Trulieve, Canopy Growth and High Tide had a particularly busy month, in spite of the uncertainty from Washington that is gradually taking its toll on the industry.

On that note, here are some of the highlights from February 2025:

First, we head south to Florida, where Tier 1A CRB Trulieve Cannabis Corp. (CSE: TRUL) issued a Feb. 11 press release announcing the opening of a new medical cannabis dispensary in Middleburg, Fla. In the words of the article, “Trulieve Middleburg, located at 1539 Blanding Boulevard… will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, O.pen, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

As of the time of this opening, Trulieve holds 118 active cannabis licenses in the U.S. and Canada.

Next, Tier 1B CRB TILT Holdings Inc. (CSE: TILT) issued a press release in February announcing that it has signed an asset purchase agreement to divest two dispensaries in Massachusetts. In the words of the announcement, “The Transaction is aligned with TILT’s broader strategy to explore strategic alternatives for its plant touching business, streamline operations, and unlock value in its vape hardware business, Jupiter Research. Under the terms of the Transaction, TILT will transition ownership of its Taunton dispensary to In Good Health, a private single-state cannabis operator, and shut down its Brockton dispensary for $2 million in cash considerations. The Company still has one location in Cambridge that is part of plant-touching assets under review.”

Could this be a sign of things to come in the Bay State? It’s too early to tell, but there have been rumblings of oversaturation there for more than a year. With this divestiture, Tilt now holds 13 active cannabis licenses in the U.S.

Is it high tide? Canadian Tier 1B CRB 1B High Tide Inc. (TSXV: HITI) announced in on Feb. 13 that “its Canna Cabana retail cannabis store located at 447 Main Street East in Hamilton, ON will begin selling recreational cannabis products and consumption accessories for adult use on February 15, 2025. This opening will mark High Tide’s 192nd Canna Cabana branded retail cannabis location in Canada, the 77th in the province of Ontario and the 6th in the City of Hamilton. Hamilton, located at the western edge of Ontario’s Golden Horseshoe, has emerged as a key investment hotspot in both Canada and North America, experiencing remarkable growth over the past decade. Historically centered on steel and textiles, the city has become one of the most economically diverse municipalities in Ontario, establishing itself as a leader in sectors such as life sciences, advanced manufacturing, logistics, creative industries, and emerging technologies.”

High Tide, a company that seems to be expanding with every new CRB Monitor newsletter, now holds 205 active licenses and operates in three countries.

Finally, we head south to Michigan, where Tier 1B MSO Ascend Wellness Holdings, Inc. (CSE: AAWH.U) issued a Feb. 12 press release announcing “the grand reopening of its Detroit dispensary…which will now serve recreational adult-use consumers. This marks Ascend’s 38th dispensary within its seven-state footprint, and the Company’s eighth dispensary in Michigan with additional locations in Ann Arbor, Battle Creek, Grand Rapids, East Lansing, and Morenci…The revamped Detroit dispensary features a modernized showroom with seven points of sale to ensure seamless shopping. Customers can explore a curated selection of top-shelf flower through a deli-style experience, Ascend’s first in Michigan. Orders can be placed in-store and online, with delivery options coming soon.”

With this opening, Ascend Wellness now holds 74 active cannabis licenses across 10 states.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Grown Rogue International Inc. | CSE: GRIN | Tier 1B | Grown Rogue Appoints Josh Rosen as Chief Strategy Officer |

| Ayr Wellness Inc. | CSE: AYR.A | Tier 1A | AYR Wellness Announces Leadership Update |

| Pineapple Express Cannabis Company | OTC Pink: PNXP | Tier 1B | Pineapple Express Cannabis Company Announces Leadership Transition |

| Ascend Wellness Holdings, Inc. | CSE: AAWH.U | Tier 1B | Ascend Adds VP of Partnerships |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Mojave Brands Inc. | CSE: MOJO | Moved to Watchlist | Tier 1B – Owner/Investor |

| Eastern Bankshares, Inc. | NASDAQ: EBC | Moved to Watchlist | Tier 3 – Financial Services |

| Integrated Financial Holdings, Inc. | OTCQX: IFHI | Moved to Watchlist | Tier 3 – Financial Services |

| Luther Burbank Corporation | NASDAQ: LBC | Moved to Watchlist | Tier 3 – Financial Services |

| Verde AgriTech Plc | TSX: NPK | Moved to Watchlist | Tier 3 – Fertilizers & Agricultural Chemicals |

Cannabis News: Regulatory News Updates

February 2025 featured breaking regulatory news from around the globe. With that said, some would argue that the United States is no closer to legalization, decriminalization, safe banking or rescheduling. The installation of a new administration has not only muddied the waters regarding cannabis reform, they have also added an additional layer of confusion related to the future of all government agencies. For the time being, it’s “wait and see” while states and nations outside the U.S. continue to make progress with their cannabis evolution.

Here are some of the February highlights from the cannabis-related regulatory news cycle:

We begin with an article from our very own CRB Monitor News Team that highlighted five states that will be looking to legalize recreational marijuana in 2025. Midway through February, five states had filed bills to legalize adult use and one state had legislation to allow medical use, while a lawmaker in South Dakota wants to go in the other direction and outlaw the state’s current medical-use program. The states moving the ball forward are Kentucky (SB 36), New Hampshire (HB 198 and HB 75), Tennessee (SB 809 and HB 836), Texas (HB 1208), and Hawaii (HB 1246 and SB 1613).

As the article states: “In Nebraska, where voter-approved medical-use measures are still being challenged in court, lawmakers have filed four separate bills to implement the laws. Other state bills introduced so far this year would decriminalize cannabis in three states where it is still illegal, allow for cannabis lounges in two adult-use states, require lab testing and track and trace in two states, increase law enforcement in New Mexico, and create new licensing restrictions in Montana. But the fastest moving legislation that will likely hit a brick wall at the governor’s mansion are a pair of bills to create a legal adult-use market in Virginia.”

Roll Tide: In a February article from CRB Monitor News, the great state of Alabama is apparently moving forward with a plan for cannabis licensing. It has actually been four long years since Alabama passed medical use legalization, and businesses are still awaiting licenses to operate in the state.

“The Alabama Medical Cannabis Commission (AMCC) has attempted three separate times to issue the inaugural round of licenses for vertically integrated cannabis producers. Each attempt has been hindered by lawsuits from unsuccessful applicants. Most of the lawsuits currently remain before the Alabama Court of Appeals,” the article says. “SB 72, introduced Feb. 4, is the latest attempt at a legislative fix to the commission’s legal trouble, though Schelper said she was skeptical it will solve the state’s licensing problem. Currently, the AMCC is authorized to issue no more than four processor licenses, four dispensary licenses and five integrated facility licenses, but the commission is also allowed to issue fewer than the cap. SB 72 would increase the number of available vertically integrated licenses from five to seven. Adding two more integrated facility licenses is a positive step, according to Schelper before explaining that she would rather see an unlimited number of licenses available.”

Finally, let’s head to Ohio, and another excellent article written by our news team entitled Ohio Becomes a Top SAR State After Launching Adult-Use. Ohio, which launched its adult-use market last year, jumped to fifth place among states filing marijuana-related Suspicious Activity Reports (SARs) during the third quarter 2024, according to newly released data by the U.S. Department of the Treasury.

The article reports, “In total, the Financial Crimes Enforcement Network (FinCEN) received 21,239 total SARs in the third quarter 2024, a 5.4% decrease from the 22,448 reports filed in the second quarter 2024. Still, it was 311 more than the third quarter 2023. As part of their anti-money laundering programs, financial institutions are required to file SARs for marijuana-related accounts. FinCEN classifies them in three categories:

- Marijuana Limited — An institution believes the business doesn’t raise any red flags under the enforcement priorities outlined in the 2013 Cole Memo or violate state law.

- Marijuana Priority — The institution believes the account has Cole Memo red flags or has violated state laws.

- Marijuana Termination — When a financial institution terminates an account or relationship to maintain an effective money-laundering compliance program.”

The article goes on to say, “Marijuana Limited reports are seen as an indicator of institutions, primarily banks and credit unions, that welcome cannabis-related business. The vast majority of reports filed are Limited. The number of Limited reports filed in the third quarter, 18,191, was virtually unchanged from the second quarter 2024 and the third quarter 2023, just a slight drop of less than 300 reports each quarter. But it’s still a 10.9% drop from the record 20,410 in the first quarter of last year.”

Other states ranking high on the SAR list included California, Oklahoma, Washington and Michigan.

CRBs In the News

The following are a sampling of highlights from the February cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update Defining “Cannabis-Related Business”)