We do indeed live in interesting times. The world braces for the era of its first American-born pope; hundreds of complex trade deals are being negotiated between the U.S. and counterparties worldwide; wars in Europe and the Middle East have not ended while conflicts in Asia rear their ugly heads; and meanwhile the U.S. government is looking unlike any we have seen in recent memory. Meanwhile, for those of us who are paying attention, there is this seemingly rudderless economy, which leaves most of the global investment community scratching its collective head. But we digress.

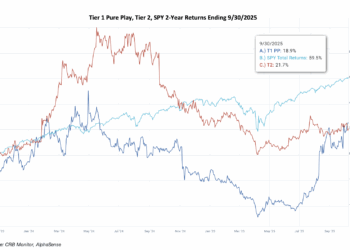

For those of us who have been following the global cannabis industry as closely as we have for nearly a decade, hope for a bright future was relegated to the back burner years ago. Even the memorable “Biden’s Letter to the Regulators” in 2023 could not sway us into complacency, given that the market had already been decimated by that time. And President Joe’s mandate for marijuana re-scheduling and decriminalization was not enough for those of us that had witnessed the meteoric rise and fall of Canopy, Curaleaf and Green Thumb. In fact, Biden’s decree resulted in essentially nothing of substance, much like the fate of the SAFER Banking Act and any proposed legislation that would result in legal cannabis. And while the latest head of the DEA vowed to make cannabis rescheduling a priority, it is safe to say that we stakeholders are not holding our breath, no more than we were back in the hey days of 2023.

With all that said, the naming of the DEA chief at the end of April kept the ventilator on just a bit longer for this perennial, “on-life-support” patient. A story in Marijuana Moment reported, “President Donald Trump’s pick to lead the Drug Enforcement Administration (DEA) says examining a proposal to federally reschedule marijuana will be ‘one of my first priorities’ if he’s confirmed for the role, saying it’s ‘time to move forward’ on the stalled process.”

But not so fast. The nominee, Terrence Cole, was not so bold as to state that this is his objective. “However, DEA administrator nominee Terrance Cole repeatedly declined to commit to support the specific proposed rule to move cannabis from Schedule I to Schedule III of the Controlled Substances Act (CSA) that was initiated under the Biden administration,” the article continued.

Nevertheless, cannabis-related companies surged on this tidbit of news and some ended the month with spectacular returns. But we cannot lose sight of the fact that sentiment-driven surges like this are more about dried-up liquidity and bloated bid/ask spreads than about the good news itself. And yet we can’t look away…

Cannabis-Linked Equity Performance

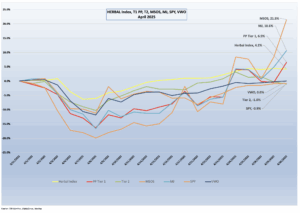

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), had a positive return but underperformed its U.S.-plant-touching peers in April (+4.2%), with most of the underperformance coming from its weight in Tier 2 CRBs. It is important to note that HERBAL’s semiannual reconstitution took place in the month of April. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (+10.6%) and the actively managed, MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (+21.5%), clawed back a portion of their months-long drought. Both of these funds are benchmarked to CRB-themed indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching marijuana exposure tend to be more sensitive than HERBAL to the US regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin in 2017, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally, in 2022 MJ added and still maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, the Amplify Seymour Cannabis ETF (NYSE: CNBS).

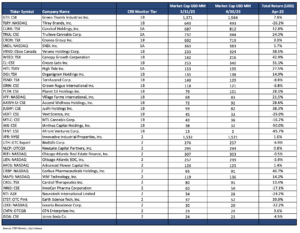

The performance of the CRB Monitor equally weighted basket of top Pure Play Tier 1 CRBs was positive in April, returning +6.5%. This basket, which is an equally weighted portfolio of the 21 largest pure-play CRBs (including both U.S. plant-touching and non-U.S. plant-touching MJ companies), had a return that was in line with its mix of Canadian and MSO holdings. We will take a closer look at some of these below.

The CRB Monitor equally weighted basket of Tier 2 CRBs underperformed the Tier 1 CRB basket, posting a -1.0% return for April. In 2024, CRB Monitor published an update to our article on correlations of pure-play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time. We update this data a couple of times per year.

In April, U.S. equities experienced significant volatility, culminating in a sharp market downturn and a subsequent rebound. The sell-off was triggered by President Donald Trump’s announcement of sweeping tariffs on April 2, dubbed “Liberation Day.” This move led to a 6.65% drop in the S&P 500 on April 3 and a further 5.97% decline on April 4, marking the worst two-day performance for the index in its history. The market lost over $6.6 trillion in value during this period.

However, by April 9, the S&P 500 rebounded with its largest one-day gain since 2008, rising 9.52% . This recovery was fueled by a temporary tariff pause and optimism surrounding upcoming trade talks with China and the U.K . Despite the rebound, the market remained sensitive to trade policy uncertainties, with investors closely monitoring developments. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a return of -1.0 for the month of April.

Largest Tier 1 & Tier 2 CRBs by Market Cap – April 2025 Returns

An equally weighted basket of the largest Tier 1 pure-play cannabis equities had a positive return (+6.5%) in April 2025 with most of the constituents underperforming the broad equity market. Tier I CRBs outpaced by the Tier 2 basket by around 7.5%.

CRB Monitor Tier 1

Reversing their downward trend, April CRB performance was mostly higher across the universe of Tier 1 cannabis stocks. The MSO basket mostly rebounded, with larger Tier 1A MSOs Trulieve Cannabis Corp. (CSE: TRUL) (+24.3%), Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+12.8%), Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (+7.8%), Tier 1B Cresco Labs Inc. (CSE: CL) (+31.1%)and Tier 1B Verano Holdings Corp. (CSE: VRNO) (+38.5%) tumbling for yet another month. Tier 1B TerrAscend Corp. (TSX: TSND) (-8.8%) struggled, in spite of the optimism that spread among its peer group.

The Canadian CRB basket had mixed results, and it appears as though these companies that operate north of the border reacted less enthusiastically to the positive news out of the U.S. The incredible shrinking Tier 1B CRB Canopy Growth Corporation (TSX: WEED) (+42.9%) soared, Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-26.2%) faltered, ever-expanding Tier 1B High Tide Inc. (TSXV: HITI) (+27.5%) came roaring back, and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+5.7%) and Tier 1B Cronos Group Inc. (TSX: CRON) (+3.9%) had modest gains for the month. As we have stated regarding these two groups, historical performance has deviated between the CAD and the MSO baskets over short periods, but they tend to mean revert over time.

It is also worth mentioning that as an industry cannabis has fallen to the point where no company’s stock can even be regarded as a small capitalization stock. Over the last few years they have all shrunk (some by more than 90%) to the point where they are in micro-cap range.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies underperformed the Tier 1 basket in April, posting a return of -1.0% for the month. Historically these two portfolios are highly correlated (please see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to mean revert over time. When the two baskets deviate from one another (as they have done historically) the deviation could be a signal for investors to rebalance their Tier 1 and Tier 2 baskets given their direct revenue relationship. This is due to the fact that, by definition, Tier 2 CRBs are direct suppliers of goods and services to Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lose money, so proceed with caution!

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+1.6%) was modestly positive after a difficult March. As we reported, on May 7 IIPR issued its 1st quarter 2025 earnings report, which featured the following highlights:

- Total revenues of $71.7 million for the quarter.

- Net income attributable to common stockholders of $30.3 million for the quarter, or $1.03 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- AFFO of $55.3 million, or $1.94 per share.

- Paid a quarterly dividend of $1.90 per common share on April 15, 2025 to stockholders of record as of March 31, 2025.

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+1.4%) was also modestly up in April, and over recent months it has outperformed its Tier 1 CRB lending clients. On May 14, AFCG reported its 1st Quarter 2025 earnings of $6.3 million which featured the following statement from CEO Daniel Neville:

“AFC reported generally accepted accounting principles (“GAAP”) net income of $4.1 million or $0.18 per basic weighted average common share and Distributable Earnings of $4.5 million or $0.21 per basic weighted average common share for the first quarter of 2025. Our top priority at AFC is reducing our exposure to underperforming credits, while also remaining disciplined on providing debt capital to accomplished operators. While cannabis market sentiment continues to hinge on regulatory momentum, we are focused on taking advantage of market dislocations to invest in quality credits with strong risk adjusted returns, which our recent investments demonstrate.”

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for April 2025:

Cannabis Business Transaction News

While we sat back and took in the whirlwind of economic and political news from the federal government, several cannabis-related businesses continued to soldier on and expand their operations. CRB Monitor was there, monitoring the news cycle at every turn, always looking for those small rays of hope that keep this industry humming along. The household-name CRBs like Green Thumb, Curaleaf, Trulieve and High Tide all had a busy month, soldiering on in spite of all the uncertainty being handed to investors from this administration.

On that note, here are some of the highlights from April 2025:

We begin in the quiet state of Connecticut, where Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) issued an April press release announcing “the grand opening of Zen Leaf Ashford on Friday, April 4th, elevating the Company’s retail footprint to six Connecticut locations and 154 dispensaries nationwide…Situated in Windham County, Zen Leaf is Ashford’s first cannabis outlet and closest dispensary to the iconic University of Connecticut in Storrs, providing Husky faithful with a convenient location just minutes away from campus. Although Verano has a standing 10% off student deal nationally, Zen Leaf Ashford is upping the ante with a UConn-exclusive 20% “Higher Education” student promotion, and as a nod to the Huskies’ legendary sports prowess, Zen Leaf will celebrate men’s/women’s Husky Soccer, Football, Basketball, Softball and Baseball victories throughout each season with “UConn Wins, You Win” specials for all customers.”

Verano Holdings operates in 13 states plus the District of Columbia and holds 77 active cannabis licenses in the U.S.

Canadian Tier 1B CRB 1B High Tide Inc. (TSXV: HITI) announced in an April press release that “its Canna Cabana retail cannabis store located at 1270 Fischer Hallman Road in Kitchener, Ontario will begin selling recreational cannabis products and consumption accessories for adult use on April 16, 2025. This opening brings High Tide’s total store count to 195 Canna Cabana branded retail cannabis locations across Canada, and 80 in the province of Ontario.”

We have reported over the last year how High Tide has been steadily expanding its operational footprint across the Great White North. The article goes on to say, “Positioned in a high-visibility area, this store will serve a market with favourable competitive demographics and strong potential for growth. The surrounding neighbourhood boasts a young, growing population, and the plaza is home to popular tenants such as a national grocery chain and well-known fast-food options. New residential developments nearby also present an opportunity for Canna Cabana to establish itself as the go-to cannabis store in this sprawling neighbourhood. Our existing locations in Kitchener continue to outperform the competition, and this new opening comes on the heels of that success.”

High Tide now holds 206 active licenses and operates in 3 countries.

Next we head south to Florida, where tier 1B MSO Trulieve Cannabis Corp. (CSE: TRUL) issued an April press release announcing “the opening of a new medical cannabis dispensary in St. Petersburg, Florida. A grand opening celebration will be held Friday, April 11th… ‘This new dispensary provides St. Petersburg patients and caregivers an accessible location with a drive-through option,” said Trulieve’s Chief Executive Officer Kim Rivers. “We are proud to serve patients in Pinellas County with high quality medical cannabis products.’The new dispensary will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

With this opening Trulieve now holds 110 active licenses in the U.S. and operates in 15 states.

While we are talking about Florida, the largest CRB by market cap, Green Thumb Industries Inc. (CSE: GTII) issued an April press release announcing:

“RISE Dispensary Ocala, the Company’s 22nd retail location in Florida and 104th nationwide, will open on April 29. Located at 3873 SW College Road, the dispensary will offer medical patients a diverse collection of cannabis products from brands including RYTHM, Dogwalkers, &Shine, Good Green, and Doctor Solomon’s. As part of RISE and Green Thumb’s ongoing commitment to supporting local communities, RISE Dispensary Ocala will donate a portion of one day’s profits to community-based organization The Bridge 4 Veterans…Green Thumb joined the Florida community in 2018 and operates two production facilities in Ocala and Homestead, where the Company cultivates and produces its branded products. Green Thumb’s cultivation and manufacturing practices reflect the highest quality standards to ensure all its products offer a true-to-plant, consistent experience. The Company’s retail brand, RISE Dispensaries, is committed to expanding access to well-being through cannabis and making a positive impact on the communities it serves. In addition to RISE Dispensa Ocala, there are 21 other RISE Dispensaries in Florida, including locations in Bonita Springs, Brandon, Clearwater, Crystal River, Deerfield Beach, Dunnellon, Fruitland Park, Hallandale Beach, Jacksonville, Kendall, New Port Richey, Orlando on Good Homes Road, Oviedo, Pinellas Park, Port Orange, Sun City Center, Tallahassee, Tampa, Wesley Chapel, and West Palm Beach. Delivery services are available to the areas surrounding RISE Dispensaries in Florida.”

With this acquisition Green Thumb now holds 98 active cannabis licenses in the U.S. and operates in 15 states.

Finally, in Canada, Tier 1A CRB Organigram Global Inc. (TSX: OGI) issued an April press release announcing “the acquisition of 100% of the issued and outstanding shares of Collective Project Limited for upfront consideration of approximately C$6.2 million, potential milestone payments and potential earnout payments totaling in the aggregate up to C$24M for the twelve-month periods ending September 30, 2025 and September 30, 2026. ‘The acquisition of Collective Project marks yet another strategic milestone towards Organigram’s global leadership ambitions. Not only does this acquisition represent our first commercial entry into the fast-growing hemp-derived THC beverage market in the U.S., it also fast tracks our entry into the cannabis beverage category in Canada, a category that we believe is on the cusp of growth at home as well,’ said Beena Goldenberg, CEO of Organigram. Collective Project is an innovative brand launched by Collective Arts, a Hamilton, Ontario-based company founded in 2013. Known for its unique approach to blending craft beverages with art, Collective Arts has featured over 2,000 artists from 40 countries on its products. Collective Project extends this creative ethos into the cannabis market, producing cannabis and hemp-derived infused sparkling juices, teas and sodas.”

Organigram now holds 15 active cannabis licenses in three Canadian provinces.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| BioQuest Corp. | OTC Pink: BQST | Moved to Watchlist | Tier 2 – CBD – Online Wholesale & Retail |

| SNM Global Holdings, Inc. | OTC Expert: SNMN | Moved to Watchlist | Tier 3 – IT Services & Software |

| Art Group Holdings Limited | SEHK: 0565 | Moved to Watchlist | Tier 3 – CBD – Personal Products |

| Eiken Chemical Co., Ltd. | TSE: 45490 | Moved to Watchlist | Tier 3 – Health Care Equipment, Devices & Supplies |

| Clean Seed Capital Group Ltd. | TSXV: CSX.H | Moved to Watchlist | Tier 3 – Agricultural & Farm Machinery |

Cannabis News: Regulatory News Updates

We continued to follow the cannabis regulatory news cycle in earnest throughout the month of April. As we will cover below, the United States appears to be no closer to legalization, decriminalization, safe banking, or rescheduling than it has been for the last couple of years. With the new administration’s apparent goal of deregulation, it is unclear if Congress now has the ability to get cannabis reform back on course. As always, we refill our popcorn buckets and watch as the battle wages on in our nation’s capital.

With that said, here are some of the April 2025 highlights from the cannabis-related regulatory news cycle:

We begin with the U.S. Government, and an article from our very own CRB Monitor News Team which reported that “Ninety days after a DEA administrative law judge postponed a hearing on rescheduling cannabis because of a motion to have the DEA removed from the entire process, the DEA has done nothing to hear the appeal.”

As our readers might recall, the notion of rescheduling marijuana to Schedule III was originally suggested in a letter from President Joe Biden to the DOJ in October 2022. However, in the years since, rescheduling has faced a series of fits and starts, and it is unclear when or even if it will ever happen. The article goes on to report, “Many had hoped that given President Donald Trump’s public statements in favor of rescheduling cannabis and legalizing adult-use in Florida, he would support the proposed rule to move marijuana from Schedule I to Schedule III. However, it reportedly is not really a drug policy priority of his right now.”

Next we head west to Nebraska where an April 8 article from our CRB Monitor News Team reported the legalization of medical cannabis still remains uncertain for Nebraskans. In the words of the report:

“Technically, medical use of cannabis is currently legal in the state of Nebraska. Under Measure 437, which was approved by 71% of the voters in November, an adult can obtain a written recommendation from a doctor and ‘use, possess, and acquire’ up to five ounces of the plant to alleviate illness symptoms. Gov. Jim Pillen reluctantly signed Measure 437 and its companion, Measure 438, into law on Dec. 12. But the voter initiatives remain challenged by two lawsuits filed by a former state official, while bills to enact rules allowing for patient access and a legal market slog through the state legislature with a dim chance of being signed by Pillen. Therefore, a legal market may not start by the end of the year as voters expected. Crista Eggers, campaign manager for Nebraskans for Medical Marijuana and co-sponsor of the initiative measures, told CRB Monitor News they get questions “all the time” from patients asking about how to get a doctor’s recommendation and acquire medical cannabis. But they have received no direction from the Attorney General’s Office, law enforcement, regulators or doctors.”

We will keep watching the Cornhusker State for any new developments.

Next we head back east to North Carolina, where an April article in the Cannabis Business Times reported:

“North Carolina House Democrats filed legislation on April 14 that would legalize up to 1.5 ounces of medical cannabis for patients participating in a registered cannabis research study. The Cannabis Treatment Research Act, sponsored by Rep. Julia Greenfield, D-Mecklenburg, and nine of her colleagues in the lower chamber, would allow hospitals, universities, laboratories, pharmaceutical manufacturers or private medical research corporations that register with the state’s Department of Health and Human Services (DHSS) to conduct cannabis research. Under the legislation, House Bill 984, the DHSS would be required to establish a cannabis treatment research database for patients, caregivers, physicians, institutions and their researchers to register for medical cannabis studies and to be protected from criminal penalties, arrests and prosecutions.”

One step forward, two steps back: We have some news out of Alabama, where an article in MJ Biz Daily reported:

“The yearslong odyssey to license medical cannabis businesses in Alabama will drag on longer after a state judge revoked already-awarded permits and ordered a lengthy process to be restarted again. It seems unlikelier than ever that MMJ sales will start in the Deep South state in 2024, as previously promised, after Montgomery Circuit Court Judge James Anderson canceled coveted vertically integrated licenses issued in 2023.”

It is hard to imagine that this kind of politically motivated behavior still exists in 2025, but here we are. The article goes on to report, “The legal odyssey is disrupting cannabis operators’ business plans, according to Ray French, the CEO of Foley-based Specialty Medical Products and Oscity Labs. ‘There’s flower being grown already that we could immediately turn around and make these medical products,” he told WPMI.’”

Finally, we head back out west to New Mexico, where an article published in the Cannabis Business Times reported:

“Patients with behavioral health conditions cannot make insurance claims for medical cannabis, a federal judge ruled April 23 in the U.S. District Court of New Mexico.” This is an obvious blow to the progress of medical marijuana as an acceptable treatment for certain conditions. The article goes on to report, “Judge Martha Vázquez granted a motion by three health insurance providers to dismiss a complaint by a New Mexico cannabis company and four individuals who pay out of pocket for medical cannabis to treat behavioral health conditions. Three of the individuals were diagnosed with post-traumatic stress disorder (PTSD), while the fourth individual is a father whose child has nonverbal autism. Other qualifying conditions for medical cannabis in New Mexico—such as opioid-use disorder, severe anorexia and Parkinson’s disease—are also considered behavioral health conditions in New Mexico. New Mexico Top Organics, a vertically integrated cannabis company doing business as Ultra Health Inc., filed the lawsuit in 2022, arguing that under state law that became effective that year, insurance companies that cover behavioral health services are required to fully cover the cost of medical cannabis used for behavioral health issues.”

CRBs In the News

The following is a sampling of highlights from the April 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know