The first quarter of 2025 marked a period of stabilization in the U.S. cannabis licensing market, following years of contraction and volatility. Total active licenses saw minimal growth (less than 1%), reflecting a plateau in market expansion. Meanwhile, approved/pending and pre-licensing activities declined, signaling a cooling interest in new market entry. Canada, however, continued its downward trend, with active licenses falling to a four-year low. Key trends included the dominance of cultivation and retail licenses, the rise of vertically integrated operators (particularly in New Mexico), and the outsized influence of New York’s adult-use market on national figures. State-level dynamics varied, with New Mexico and New York leading in growth, while Oklahoma and Oregon experienced significant declines.

U.S. market flatlines after two years of turmoil

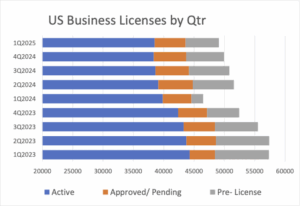

Total active U.S. cannabis business licenses remained stable at 38,509 in the first quarter, increasing less than 1% and continuing a market-wide stabilization first evidenced in the third quarter of 2024. This plateau in licensing growth, now in its third quarter, reflects a bottoming out of the aggregate national market after two years of sharp contraction, when total licenses declined 13%. Active licenses were flat from the previous six-month period and 3% lower for the full year.

Approved and pending licenses fell 5% for the quarter to 5,095, marking the third consecutive quarterly decline in new license approvals. The number of new licenses pending at the end of 2024 represented an 8% decline from the third quarter but remained 8% higher for the year, driven largely by fast-growing adult-use markets in New York, New Jersey and Massachusetts.

Pre-licensing activity, defined as license applications pending approval, fell 12% to 5,493, extending a sharp decline that began in the third quarter as a flood of applications in New York moved through the review process. Pre-licensing totals were 18% lower than the previous six months but remained 185% higher than a year ago, before New York commenced its adult-use market. As was the case for the last four quarters, New York accounted for 87% of the new applications.

Canada contracts

Active Canadian business licensing counts fell 2% in the first quarter, resuming a contraction that began in the first half of 2024, when the Canadian market peaked at 6,860 active permits. Active business licenses stood at 5,757, the lowest number in more than four years. Active licensing in Canada has dropped 8% in the preceding four quarters.

The year-long decline in active Canadian licenses was amplified by the collapse of new license applications, which have fallen 72% from year-ago levels. Only two applications were approved or pending during the first quarter, the second-lowest quarterly total for new approvals in at least four years.

U.S. retail resilient, cultivation cools

Of the major license types, cultivation and retail/dispensary licenses are by far the most numerous, comprising 73% of total active licenses in the U.S. in the first quarter. There were 28,123 active cultivation licenses and 11,505 active retail/dispensary licenses at the end of the quarter, a decline of 4% and 2%, respectively, from the end of 2024. Four states — California, Oklahoma, Michigan, and Oregon — accounted for 43% of all active cultivation and retail licenses. New York accounted for 84% of all new applications for cultivation and retail dispensary licenses in the country at the close of the quarter.

Manufacturer/processor licenses made up the third-largest license type at the end of the second quarter, with 5,565 active licenses, followed by wholesale/distribution licenses, with 1,472, representing a 4% drop and 1% quarterly increase, respectively, reflecting the market plateau experienced in the cultivation and retail segments.

Vertically integrated operators showed the greatest growth of all operator types, in both rate and number. The number of active vertical operators doubled to 2,279, a 104% increase from the end of 2024. Virtually all the growth came from New Mexico, which added 944 new vertical operators to its licensed market, a four-fold increase from the end of 2024. Most of this increase, however, was due to a one-time recharacterization by the state’s licensing authorities of existing licensees rather than organic growth. Operators in the state holding multiple licenses were recharacterized as one of 1,134 “master” licensees holding sub-licenses for each type of permitted activity they engage in. Discounting this administrative change, total active vertical operator licenses would have fallen 3% in the first quarter.

Nationally, the category, which grew 27% last year, is poised to cement its place as the third-largest operator category for the foreseeable future, as New York works through more than 850 applications for new vertical operations in the Empire State.

Cannabis business license applications that have been approved but have yet to become operational are grouped by CRB Monitor under the category of “approved/pending” status and reflect the near-term pipeline of new cannabis business operations poised to enter the regulated market. Approved/pending license activity contracted again in the first quarter, a decline now in its third consecutive quarter after peaking in the first half of 2024. In aggregate, new approved licenses fell 5% and were down 8% from six months ago.

Cultivators ended the quarter with 1,106 approved/pending licenses, representing a 6% dip from the end of 2024. Retail operators ended the quarter with 2,307 newly approved permits, statistically unchanged from the fourth quarter and still 14% more than a year ago.

Cultivation permit approval activity has dropped 26% overall in the past two years, reflecting ongoing right-sizing and production consolidation in established markets. Similar consolidation in established retail markets was balanced by the mid-2024 opening of Ohio’s adult-use market and the ongoing stand-up of retail operators in New York.

Licensing approval levels among the other major license types — manufacturer/processors, delivery/transporters, and wholesale/distributors — all declined in the first quarter. This was especially true of pending wholesale/distribution licenses, which fell 23% to 131 operators approved and awaiting the commencement of operations. Pending and approved manufacturer/processor license activity fell 10% for the quarter and was down 14% from six months ago.

Applications for new cannabis business licenses that have yet to be approved are classified as having a “pre-licensing” status at CRB Monitor. While the proportion of these applicants that may succeed in gaining approval, much less opening a cannabis business, is unknown, pre-licensing data nonetheless serves as an indicator of interest in entering or expanding commercial activities in a given market.

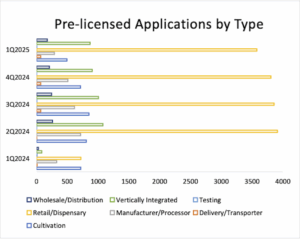

Applications in the pre-licensing stage, which is typically the most volatile licensing stage quarter to quarter due to its direct correlation to newly opening and expanding markets, fell 12% in the first quarter to just under 5,500 applications in review. It marked the third consecutive quarterly decline after an early 2024 surge of applications for new adult-use markets in New York, New Jersey, and Ohio peaked in the second quarter of 2024 at 6,772 permits sought.

Applications in pre-licensing declined across all major license types and by double-digit percentages among cultivators, manufacturers, and wholesaler/distributors. Manufacturer/processor applications fell 43%, cultivation dropped 31%, and wholesale/distribution declined 16%.

Retail/dispensary applications in pre-licensing held their post-New York surge levels, ending the quarter with 3,576 in review, a 6% decrease from the end of 2024. Nonetheless, they represent a nearly four-fold increase in new retail license applications over a year ago, led almost entirely by applicants in New York.

New York also dominated licensing applications by vertically integrated operators, which ended the quarter with 869 applications in pre-licensing nationally, of which 858 were seeking New York permits.

Minor license types:

Consumption lounge permits boom

License types that total fewer than 300 active licenses nationally are considered minor license types and include event organizers, management companies, research organizations, social use clubs, storage, and waste disposal companies. Most minor types were flat or down for the quarter, with event, management, and waste disposal operators declining between 4% and 11%. Once again, the single minor type that experienced sustained growth in the first quarter was social use clubs, which surged 183% in the quarter, marking a nearly four-fold increase in the past 12 months to 68 licensed clubs, as New Mexico joined Nevada, Colorado, and Michigan in establishing a social use format in their adult-use markets.

While most licensed sectors of the Canadian cannabis market exhibited continued stability in the first quarter, wholesale/distributors struggled, losing 11% of their active licensees. Retail dispensary licenses remained the largest license type, with just over 4,000 active permits, a 1% decrease from the fourth quarter.

Cultivation and manufacturer/processor licenses remained the second and third largest license types in Canada, falling 4% and 2% during the quarter to 910 and 585, respectively.

State-by-state breakdown:

New York leads nation in new licenses

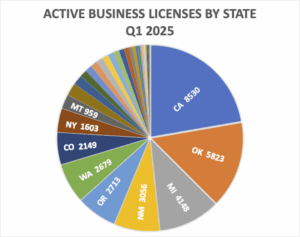

More than two years into a moratorium on new licensing, coupled with a crackdown on non-compliant operators, Oklahoma continued to shed licensed cannabis businesses in the first quarter. The Sooner State’s count of active licensees declined 6% in the quarter, to 5,823, marking a 53% plunge in active licenses over the past eight quarters. Oklahoma lost the greatest number of active licensees of any state in the fourth quarter as well, shedding 379 active licensees. Nonetheless, the state remains the second-largest state cannabis market in total active licensed businesses.

California held its position as the leading state for cannabis operators, closing out the quarter with 8,530 licensed operators, a 1% increase. The increase, however slight, marked the first rise in active licenses in the nation’s largest adult-use market in more than three years. The Golden State has lost 30% of its active licensees in the past two years.

Michigan remains the third-largest U.S. market in terms of active licensees, even as it shed 138 licenses to end the quarter with 4,148, a 3% quarterly decrease but still 17% higher than the year-ago period. The state’s active license counts grew 30% over the past two years, peaking in the third quarter of 2024 at nearly 4,500 licensees.

New York again led the large-population states with both the highest percentage and greatest absolute increase in new licensing, adding 247 new licenses to increase its active count by 18% in the quarter and over 249% in the past 12 months, to 1,503.

But it was New Mexico, with just over a tenth of the population of New York, that added the greatest absolute number of new licenses (644) and experienced the greatest percentage growth (27%) of any regulated market in the U.S. New Mexico, which has fueled the explosive growth of its regulated cannabis market with a laissez-faire licensing regime that allows operators to commence operations ahead of full inspection and application review, appears to be headed toward an Oklahoma-style reckoning as the state’s regulator struggles to get its grip around another booming Wild West market.

Other states with significant percentage increases in active licensing during the quarter include Connecticut (51%), Illinois (17%), New Jersey (16%), and Maryland (11%). Vermont added the most licenses per capita in the first quarter, granting 52 new licenses to give the Green Mountain State one cannabis operator for every 1,005 residents.

No established state market lost more than 10% of its active licenses during the first quarter, a welcome reprieve from what has been a wrenching multi-year retrenchment and rationalization of regulated cannabis markets across the U.S. Oklahoma, Oregon, and Michigan experienced the largest decline in absolute numbers, losing 379, 218, and 138 licenses, respectively, in the quarter.

Slowdown in applications & approvals presage

slower growth

With approved/pending licenses down 5% and pre-licensing applications dropping 12%, analysts expect slower future growth.

Approved/pending license activity can be a leading indicator of sentiment and future growth in the market. While no guarantee that these new operations will commence, the investment of resources required to prepare, apply for, and successfully obtain a cannabis license does suggest a level of commitment that can be used as a proxy for future business activity.

Approved and pending cannabis license counts increased in six U.S. states — Illinois, Massachusetts, Alabama, Missouri, New Jersey, Kentucky — and the District of Columbia in the first quarter. Approved/pending counts fell by double digits or more in nine states and were flat or slightly down in seven others.

West Virginia led the country in the number of approved/pending licenses during the quarter, approving 574 licenses to launch its long-awaited medical program. Massachusetts and Illinois added 197 and 102 new approvals pending activation, respectively. New Jersey, which has led the country in the total number of approved/pending licenses outstanding for nearly two years, added another 24 approvals to the backlog, now totaling 1,498 licenses pending activation.

Washington experienced the greatest fall-off in absolute numbers of approved applications, as new approvals in the fourth quarter fell by 629 to nine, a 99% decline from the end of 2024.

New permit activity dips ex-New York

Applications for new cannabis business licenses, which reflect activity and sentiment in newer and expanding markets, were mixed across markets in the first quarter, with only five states increasing the number of new permits applied for during the quarter, among only 11 states that recorded any new applications in review.

New York completed the quarter once again with the largest number of applications in pre-licensing, with 4,762 permits in application, a slight decrease from the end of 2024. The state’s total licenses in application exceeded the total number of applications in pre-licensing in the rest of the country by a factor of nearly seven times.

Massachusetts had the second-most applications in pre-approval status, with 241 applications awaiting approval, a 39% increase from the prior quarter. West Virginia accepted 193 new applications, and the District of Columbia recorded 130 applications for its licensed retailer program. Oregon, which implemented a licensing cap in mid-2024, saw new applications dwindle to just a single application in pre-licensing at the end of the quarter.

Conclusion

The U.S. cannabis licensing market has entered a phase of stabilization, with active licenses plateauing after years of contraction. However, declining approved/pending and pre-licensing activities suggest slower future growth. Canada’s market continues to shrink, with few signs of recovery.