Ten years ago, it would have been nearly impossible to envision where the cannabis industry would have evolved to or rather, devolved to, in 2025. But here we are.

Back in 2018, as North America celebrated Canada’s legalization of adult-use marijuana, everything seemed to be falling into place. The fledgling MSO group stood there, wide-eyed and full of reckless abandon at the prospect of full legalization, which would presumably happen next in the U.S., and then subsequently throughout the world. Visions of interstate and international cannabis trade filled the heads of stakeholders throughout the cannabis ecosystem. The thought of a marijuana cultivator shipping product from Ontario to Miami, or of a Nevada-based manufacturer supplying edibles to a chain of Illinois dispensaries, was not so outrageous.

Also among the dreamers were cannabis investors, ETF issuers, and equity researchers, all of which remained optimistic that legislators would eventually do the logical, common-sense thing. Instead, stakeholders of all types have been left holding the bag for years, and that bag is now more than 90% empty. Investors that have held onto their cannabis securities for more than a few years would now have to see returns in the 2000% range to recoup their losses.

We are hard-pressed to fully understand why federal legalization has been virtually impossible, except to say that congressional gridlock has derailed any meaningful action on cannabis reform for nearly a decade. With that said, members of Congress have recently published the PREPARE Act of 2025 (Preparing Regulators Effectively for a Post-prohibition Adult-use Regulated Environment). We will not hold our collective breath on this one, but once again it will give investors just enough hope to hang onto their shares for dear life. What do they have to lose?

Cannabis-Linked Equity Performance

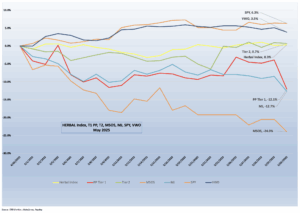

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), was essentially flat for the month of May (+0.3%) but outperformed its U.S.-plant-touching peers in May, with much of the outperformance coming from its relative overweight positions in Tier 2 CRBs. It is important to note that HERBAL’s semiannual reconstitution took place in the month of April. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

It was only doom and gloom for the two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-12.7%) and the actively managed, MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-24.0%), as MSOs suffered a stunning reversal from April’s strong end-of-month spike. Both of these funds are benchmarked to CRB-themed indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching marijuana exposure tend to be more sensitive than HERBAL to the US regulatory rollercoaster.

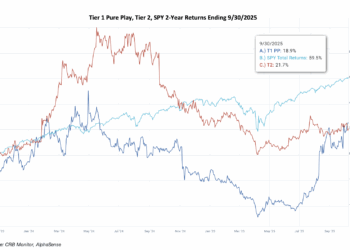

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs was negative in May, returning -12.1%. This basket, which is an equally weighted portfolio of the 21 largest pure play CRBs (including both U.S. plant-touching and non-U.S. plant-touching MJ companies), had a return that was in line with its mix of Canadian and MSO holdings. We will take a closer look at some of these below.

The CRB Monitor equally weighted basket of Tier 2 CRBs outperformed the Tier 1 CRB basket, posting a +0.7% return for May. In 2024, CRB Monitor published an update to our article on correlations of pure play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time. We update this data a couple of times per year.

In May, U.S. equities experienced a robust rebound, with the S&P 500 Index surging 6.3%, marking its best May performance since 1990 and ending a three-month losing streak. This rally was fueled by easing inflation, improved trade sentiment, and strong corporate earnings, particularly in the technology sector, which led with a 10.8% gain. The broader market also saw gains, with 10 of the 11 S&P 500 sectors advancing. Investor optimism was further supported by a temporary suspension of tariffs on China, boosting confidence in the economic outlook .The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a return of +6.3% for the month of May.

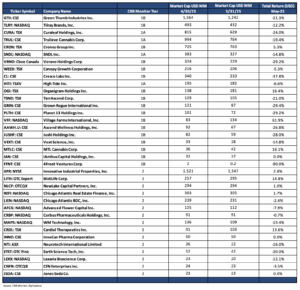

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – May 2025 Returns

An equally weighted basket of the largest Tier 1 pure play cannabis equities was negative in May, with most of the constituents underperforming the broad equity market. Tier I CRBs were outpaced by the Tier 2 basket by more than 11%.

CRB Monitor Tier 1

May 2025 CRB performance across the universe of Tier 1 cannabis stocks was largely negative, giving back much or all of their gains from April. The MSO basket struggled mightily, with larger Tier 1A MSOs Trulieve Cannabis Corp. (CSE: TRUL) (-19.4%), Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-24.0%), Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-21.3%), Tier 1B Cresco Labs Inc. (CSE: CL) (-37.8%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-29.2%) and Tier 1B TerrAscend Corp. (TSX: TSND) (-21.0%) all giving investors indigestion. It would appear as though the gains from the April month end surge were more short-lived than we expected.

The Canadian CRB basket struggled as well, but to a lesser extent than the MSO group. Tier 1B CRB Canopy Growth Corporation (TSX: WEED) (-5.3%), Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-12.2%), the ever-expanding Tier 1B High Tide Inc. (TSXV: HITI) (-6.6%), Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-14.8%) suffered reversals from their positive returns in April, while Tier 1B Cronos Group Inc. (TSX: CRON) (+5.3%) showed signs of optimism in May.

As we have stated regarding these two groups, short-term performance has deviated between the CAD and the MSO baskets, but they tend to mean revert over time and historical correlations are high. It is also worth mentioning that as an industry, cannabis has fallen to the point where no company’s stock can even be regarded as a small capitalization stock. Over the last few years they have all shrunk (some by more than 90%) to the point where they are considered micro-caps and effectively non-investable by most institutions from a policy perspective.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies outperformed the Tier 1 basket in May, posting a modestly positive return of +0.7%. Historically, the performance of these two portfolios has displayed high correlation (please see our February 2024 “Chart of the Month”), and we would expect the returns of Tier 1 and Tier 2 CRBs to mean revert over time. When the two baskets deviate from one another in the short term, the deviation could be a signal for investors to rebalance their Tier 1 and Tier 2 baskets given their direct revenue relationship. This is due to the fact that Tier 2 CRBs are direct suppliers of goods and services to (and derive their revenues from) Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict and the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lose money, so proceed with caution!

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+2.8%) was positive for the second month in a row. On May 7, IIPR issued its 1st quarter 2025 earnings report, which featured the following highlights:

- “Total revenues of $71.7 million for the quarter.

- Net income attributable to common stockholders of $30.3 million for the quarter, or $1.03 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- AFFO of $55.3 million, or $1.94 per share.

- Paid a quarterly dividend of $1.90 per common share on May 15, 2025 to stockholders of record as of March 31, 2025.”

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+1.4%) was also modestly up in May, and over recent months, it has outperformed its Tier 1 CRB lending clients. On May 14th AFCG reported its First Quarter 2025 earnings of $6.3 million which featured the following statement from CEO Daniel Neville:

“AFC reported generally accepted accounting principles (“GAAP”) net income of $4.1 million or $0.18 per basic weighted average common share and Distributable Earnings of $4.5 million or $0.21 per basic weighted average common share for the first quarter of 2025. Our top priority at AFC is reducing our exposure to underperforming credits, while also remaining disciplined on providing debt capital to accomplished operators. While cannabis market sentiment continues to hinge on regulatory momentum, we are focused on taking advantage of market dislocations to invest in quality credits with strong risk adjusted returns, which our recent investments demonstrate.”

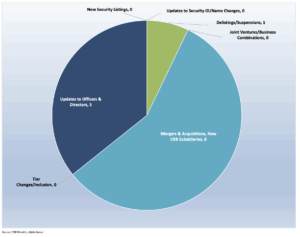

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for May 2025:

Cannabis Business Transaction News

CRB Monitor continues to monitor the cannabis news cycle at every turn, capturing all the essential information to keep our data current and relevant. And while the cannabis equity markets took a tumble once again, there were a number of critical stories of operational expansion that we are happy to report on.

On that note, here are some of the highlights from May 2025:

We begin in New Jersey, where Tier 1B MSO TerrAscend Corp. (CSE: TER) issued a May 6 press release announcing it has signed an agreement where its consolidated entities will operate its fourth dispensary in New Jersey.

“Union Chill Cannabis Company LLC, a high-performing, single dispensary operator in Hunterdon County, is expected to be immediately accretive to TerrAscend on an EBITDA and cashflow basis and further solidifies the company’s leadership position in the state. The closing remains subject to regulatory approval,” the announcement says. “Established in 2023, Union Chill is well situated with limited competition within a 10-mile radius. Upon closing of the transaction, Union Chill will increase TerrAscend’s retail footprint to 39 dispensaries across five U.S. states and Canada.”

Terrascend Corp. holds at total of 79 active cannabis licenses across eight states and three Canadian provinces.

Canadian Tier 1B CRB 1B High Tide Inc. (TSXV: HITI) announced May 20 that “its Canna Cabana retail cannabis store located at 300 King George Road in Brantford, Ontario, will begin selling recreational cannabis products and consumption accessories for adult use on May 20, 2025, and that its Canna Cabana retail cannabis store located at 722 85th Street SW in Calgary, Alberta, will begin selling recreational cannabis products and consumption accessories for adult use on May 23, 2025.

“Brantford, ON location: This former Tokyo Smoke location…marks Canna Cabana’s first location in Brantford and benefits from major co-tenants, including multiple national grocery chains, two liquor stores, and a cinema. West Springs, AB location: This new Canna Cabana retail store is located on the west end of Calgary along Old Banff Coach Road, strategically situated in a rapidly growing area surrounded by new and developing residential neighborhoods… Notably, there are no competitors within a 4-kilometers radius of this new location—which encompasses a population of over 46,000 residents—offering the Company a strong opportunity for market capture and growth.”

High Tide now holds 211 active licenses and operates in three countries.

Next we head over to Ohio, where tier 1B MSO Trulieve Cannabis Corp. (CSE: TRUL) issued a May 14 press release announcing “the opening of a new Trulieve-branded dispensary in Lorain, Ohio. Harvest Grows LLC will operate the dispensary under the Trulieve brand through a licensing agreement with the Company. ‘We are thrilled to open this new dispensary under our licensing agreement with Trulieve,’ said Harvest’s Chief Executive Officer, Mark Eiland. ‘We are proud to be associated with the Trulieve brand and look forward to serving customers at this new location. “Harvest Grows is leveraging the Trulieve brand because they know our reputation for quality, value, and exceptional customer service,’ said Trulieve’s Chief Executive Officer Kim Rivers. ‘We wish them all the best in operating their new dispensary.’”

With this opening, Trulieve now holds 106 active licenses in the U.S. and operates in 19 states.

While we are talking about Ohio, Tier 1B MSO TerrAscend Corp. (CSE: TER) issued a May 7 press release announcing the closing of its previously announced acquisition of the assets of Ratio Cannabis LLC, “a cannabis dispensary located in Goshen Township, Ohio. The acquisition represents TerrAscend’s initial entry into its sixth state, Ohio, and is expected to be immediately accretive on an EBITDA and cashflow basis. This acquisition increases TerrAscend’s retail footprint to 39 dispensaries across six U.S. states and Canada. The Company intends to acquire additional Ohio dispensaries in the future. ‘Ratio Cannabis is a strong performer, with no competition within a 20-mile radius, generating $9 million in annualized revenue. Entering Ohio has long been a priority for us,’ stated Jason Wild, Executive Chairman of TerrAscend. ‘This acquisition is a great first step in Ohio and we will continue to aggressively pursue additional accretive dispensary acquisitions, up to the eight dispensary state limit.’”

With this acquisition TerrAscend now holds 79 active cannabis licenses in the U.S. and operates in eight states and three Canadian provinces.

Finally, in Connecticut, Tier 1B CRB Verano Holdings Corp. (CSE: VRNO) issued a May 21 press release announcing “the opening of Zen Leaf Enfield on May 23, elevating the Company’s Connecticut retail footprint to seven locations and 157 dispensaries nationwide. Zen Leaf Enfield…The dispensary will also feature a drive-thru for additional customer and patient convenience. Zen Leaf joins the Enfield business community adjacent to the Enfield Square Mall as the township prepares for the transformative $250 million Enfield Marketplace project that aims to deliver economic and job growth with new onsite retail, hotel and residential development. With the opening of Zen Leaf Enfield, Verano is firmly planting roots in the community, and will remain actively engaged as a supporter and stakeholder in the Enfield Marketplace project, and looks forward to contributing to Enfield’s long-term success by investing and providing exciting career opportunities in the community.”

Verano now holds 77 active cannabis licenses in 14 states.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Metalore Resources Limited | TSXV: MET | Moved to Watchlist | Tier 3/Professional Services |

| Medical Developments International Limited | ASX: MVP | Moved to Watchlist | Tier 3/CBD – Pharma & Biotech |

| MYS Group Co., Ltd. | SZSE: 002303 | Moved to Watchlist | Tier 3/Containers & Packaging |

| ICC Holdings, Inc. | NASDAQ: ICCH | Moved to Watchlist | Tier 3/Financial Services |

| AppSwarm, Corp. | OTC Pink: SWRM | Moved to Watchlist | Tier 3/IT Services & Software |

Cannabis News: Regulatory News Updates

Throughout the month of May, we followed the cannabis news cycle with an air of caution, as uncertainty from the U.S. government appeared to trickle down to several states that have yet to legalize marijuana for adult use. And as we have reported over the last few months, the phenomenon that is now known as “intoxicating hemp” continues to give the legal cannabis industry fits and starts. Is it possible that legislators have painted themselves into a proverbial corner as delta-8 shops open up across the country? We will monitor this ongoing saga as the legal, regulated cannabis industry faces its newest adversary: unlicensed, intoxicating hemp.

With that said, here are some of the May 2025 highlights from the cannabis-related regulatory news cycle:

We begin with an article from our very own CRB Monitor News team entitled “New Administration Pulls Out Old Tactic to Threaten Cannabis Business” which reported, “Under the Trump Administration, federal threats to dispensaries have emerged again. On April 25, Edward R. Martin, Jr., interim U.S. Attorney for the District of Columbia, wrote a letter to Green Theory warning that the dispensary on MacArthur Boulevard, N.W., was too close to schools. ‘I am concerned that you are in violation of federal laws, which are intended to protect children. To that end, the need to address this issue is serious,’ Martin wrote. He said enhanced federal penalties may apply when a dispensary is operating within 1,000 feet of a school. Under 21 United States Code § 860(a), the criminal penalty can be up to 20 years in prison. He also warned that property owners and managers may also be implicated under controlled substances laws.”

This should send chills down the spines of MSO-operators throughout the U.S., as the Trump administration’s possible plan to remove legal protections for cannabis businesses and consumers could result in closures and perhaps prosecutions. We will keep our readers up to date on this story.

Next, we head to Maryland where CRB Monitor News reported that the state of Maryland has made it easier for dispensary owners to get out of the cannabis business sooner than the statutory five-year waiting period for license transfer.

In the words of the May 19 report, “Gov. Wes Moore signed SB 215 into law on April 22. As part of a larger assortment of adjustments to the state’s market, the legislation created an exception to the five-year restriction for cannabis businesses that wish to convert to an Employee Stock Ownership Plan (ESOP). Aside from the ESOP waiver, the bill included a series of reforms for the state’s relatively young adult-use cannabis market, such as clarifying some of the rules for consumption lounges and allowing the Office of Cannabis Management to ensure that at least 25% of dispensary shelf spaces are reserved for producers with social equity status.”

We will keep watching this one for any new developments.

Next we head out west to Texas, where a May 22 article in MJBIzDaily reported, “Texas’ estimated $5.5 billion market in hemp-derived THC is in mortal danger after the state House approved a blanket ban on intoxicating products. The ban, pushed by Lt. Gov. Dan Patrick and approved by the state Senate in March, passed the House by a 86-53 vote on Wednesday night. Though a final House vote on Senate Bill 3 is scheduled for Thursday, it’s expected to pass and the ban is likely to be signed into law by Gov. Greg Abbott, according to the Houston Chronicle. ‘We are banning high, Republican state Rep. Tom Oliverson said, according to the Dallas Morning News. ‘If it gets you high, it is not legal anymore.'”

As we mentioned above, the spread of intoxicating hemp has become an explosive issue since these unlicensed “THC” businesses have emerged, thanks to a loophole in the 2018 Farm Bill.

Now we head back east to Pennsylvania, where a May 8 article in MJBizDaily reported that “For the first time, the Pennsylvania state House has advanced an adult-use marijuana legalization bill.”

But not so fast! The article goes on to say, “However, Republican lawmakers in the state Senate warned that the Democrat-sponsored proposal – which, according to Philadelphia TV station WPVI, advanced Wednesday on a 102-101 party-line vote – is ‘dead on arrival,’ Spotlight PA reported. “With annual medical marijuana sales totaling roughly $1.7 billion, Pennsylvania is considered one of the biggest potential new markets for the U.S. marijuana industry if recreational cannabis is passed. Democratic Pennsylvania Gov. Josh Shapiro has repeatedly called on state lawmakers to legalize adult-use marijuana. And with the state staring down a sizable budget deficit, lawmakers are under pressure to find new sources of revenue. However, House Bill 1200, sponsored by Democratic state Rep. Rick Krajewski, has no Republican support and is considered unlikely to pass the GOP-controlled state Senate.”

Sadly we are seeing the gridlock of Washington spreading to the states, where overwhelmingly popular legislation simply stalls out when it makes it to the floor of the legislature.

Should we be optimistic? We head back to the U.S. government in Washington, D.C., where an article in Business of Cannabis reported, “Two separate bipartisan cannabis reform bills that, if passed, would transform US cannabis regulation across the country. On April 17, the PREPARE Act of 2025 (Preparing Regulators Effectively for a Post-prohibition Adult-use Regulated Environment) was introduced by Republican Congressman Dave Joyce of Ohio. On the same day, Joyce also introduced the Strengthening the Tenth Amendment Through Entrusting States 2.0 Act, or STATES 2.0 Act, both of which propose sweeping overhauls of how cannabis is regulated at the federal level.”

As we know, the devil is in the details and these two bills will require lots of review to see what hidden goodies lay within.

The article goes on to summarize the two bills: “The PREPARE Act seeks to establish a ‘Commission on the Federal Regulation of Cannabis,’ which would be tasked with constructing proposals for a ‘fair, honest, and transparent process for the federal government to establish effective regulations… In parallel, Joyce also introduced the STATES 2.0 ACT, which seeks to grant full autonomy to individual states and Native American tribes to regulate cannabis without federal interference. It also lays the groundwork for federal regulatory oversight of cannabis products by the Food and Drug Administration (FDA), empowering the administration to regulate cannabis products under existing food, drug, dietary supplement, and cosmetic laws.”

In other words, a home run for essentially all cannabis stakeholders. What could go wrong? Stay tuned.

CRBs In the News

The following is a sampling of highlights from the May 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business.”

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know.