It would be an understatement to say that cannabis equities as a group are not as critical in an asset allocation as they used to be. The market capitalizations of the companies that are directly involved in the space (CRBM Pure Play Tier 1, specifically) have shrunk by as much as 90% over the last four years. CRBs across the board, including cannabis-themed ETFs, have become too small to be considered investable by institutions.

Essentially all of the companies in the Tier 1 “pure play” group have market caps that place them in the micro-cap zone, which is one disqualifier, but their liquidity (as indicated by average daily volume) and share price are strikes two and three, respectively. And this basket of cannabis operators, which has been a source of hopes and dreams for stakeholders just a decade ago, has been severely hamstrung largely by the inaction of the US Federal Government.

One issue that has made it to the forefront of our collective psyche has been the growth of the market for intoxicating hemp, sometimes referred to as “Delta-8”. Taking advantage of the 2018 Farm Bill, a law that was originally intended to promote the non-intoxicating hemp industry, businesses have found a loophole that has allowed them to operate unlicensed Delta-8 dispensaries where they sell hemp-derived products with a high THC content. There are efforts in the US government as well as at the state level to curtail this business; however, it remains to be seen whether politicians will be able to put this genie back in the bottle. In light of recent events we are not holding our collective breath over a total ban on intoxicating hemp, just yet.

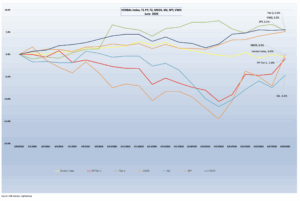

Cannabis-Linked Equity Performance

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), was essentially flat for the month of June (-0.6%) and was largely in line with its US-plant-touching peers in June. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index. [Note: this will be the final month for the HERBAL index as it has been decommissioned as of June 30, 2025.]

Performance was flat-to-negative for the two largest US plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-4.6%) and the actively-managed MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-0.0%). Both of these funds are benchmarked to pure play CRB-themed indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with US plant-touching marijuana exposure tend to be more sensitive than HERBAL to the US regulatory rollercoaster.

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs was slightly negative in June, returning -1.0%. This basket, which is an equally-weighted portfolio of the 21 largest Pure Play CRBs (including both US plant-touching and non-US plant-touching MJ companies), had a return that was in line with its mix of Canadian and MSO holdings. We will take a closer look at some of these below.

The CRB Monitor equally-weighted basket of Tier 2 CRBs outperformed the Tier 1 CRB basket, posting a +5.3% return for June 2025. In 2024 CRB Monitor published an update to our article on correlations of Pure Play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. An update of this research is about to be published in the days to come.

In June 2025, U.S. equities rebounded, helped by easing trade tensions, stable labor market data, and generally good vibes over inflation. The rebound was reinforced by solid earnings reports, declines in volatility, and improved inflation readings, with CPI rising just 0.1% in May and core PCE remaining contained. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a return of +5.1% for the month of June 2025.

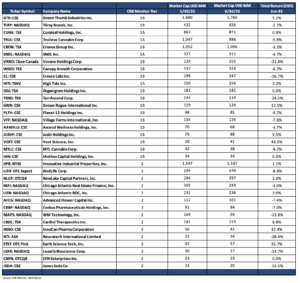

Largest T1 Pure Play & T2 CRBs by Market Cap – June 2025 Returns

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities was negative in June 2025 with most of the constituents underperforming the broad equity market. Tier I CRBs were outpaced by the Tier 2 basket by more than 11%.

CRB Monitor Tier 1

June 2025 CRB performance across the universe of Tier 1 cannabis stocks had mixed results, with a wide range of returns for the month. The MSO basket, still feeling the pain while US legislators fail to pass any sort of cannabis reform, mostly struggled once again. Tier 1A MSOs Trulieve Cannabis Corp. (CSE: TRUL) (-5.8%), Tier 1B Cresco Labs Inc. (CSE: CL) (-16.7%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-21.8%) and Tier 1B TerrAscend Corp. (TSX: TSND) (-24.5%) proved that we have not seen the bottom for these stock prices. With that said, tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (+5.1%) was positive and in line with US equities for June, and Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+0.9%) was slightly positive for the month.

The Canadian CRB basket had mixed returns as well, but performed in a narrower range than the MSO group. Tier 1B CRB Canopy Growth Corporation (TSX: WEED) (-6.7%), Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-2.7%), the ever-expanding Tier 1B High Tide Inc. (TSXV: HITI) (+2.2%), Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-4.7%) Tier 1B Cronos Group Inc. (TSX: CRON) (-3.5%) had a somewhat normal month for companies that operate in the cannabis space. As we have stated regarding these two groups, short-term performance has deviated between the CAD and the MSO baskets, but they tend to mean-revert over time and historical correlations are high. It is also worth mentioning that as an industry cannabis has fallen to the point where no company’s stock can even be regarded as a small capitalization stock; over the last few years they have all shrunk (some by more than 90%) to the point where they are considered micro-caps and effectively non-investable by most institutions from a policy perspective. Nevertheless, we will be publishing an update to our MSO/CAD returns and correlations data in the coming weeks.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies outperformed the Tier 1 basket in June 2025, posting a modestly positive return of +5.3%. Historically the performance of these two portfolios has displayed high correlation (please see our February 2024 “Chart of the Month”), and we would expect the returns of Tier 1 and Tier 2 CRBs to mean revert over time. When the two baskets deviate from one another in the short term, the deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship. This is due to the fact that Tier 2 CRBs are direct suppliers of goods and services to (and derive their revenues from) Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict and the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lose money, so proceed with caution!

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+1.1%) was positive for the second month in a row. On May 7th IIPR issued its 1st quarter 2025 earnings report, which featured the following highlights:

- Total revenues of $71.7 million for the quarter.

- Net income attributable to common stockholders of $30.3 million for the quarter, or $1.03 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- AFFO of $55.3 million, or $1.94 per share.

- Paid a quarterly dividend of $1.90 per common share on June 15, 2025 to stockholders of record as of March 31, 2025.

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (-7.4%) was also modestly up in June, and over recent months it has outperformed its Tier 1 CRB lending clients. On May 14th AFCG reported its 1st Quarter 2025 earnings of $6.3 million which featured the following statement from CEO Daniel Neville:

“AFC reported generally accepted accounting principles (“GAAP”) net income of $4.1 million or $0.18 per basic weighted average common share and Distributable Earnings of $4.5 million or $0.21 per basic weighted average common share for the first quarter of 2025. Our top priority at AFC is reducing our exposure to underperforming credits, while also remaining disciplined on providing debt capital to accomplished operators. While cannabis market sentiment continues to hinge on regulatory momentum, we are focused on taking advantage of market dislocations to invest in quality credits with strong risk adjusted returns, which our recent investments demonstrate.”

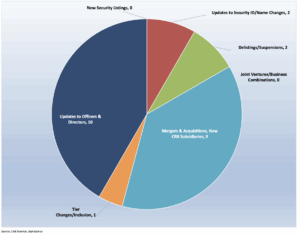

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for June 2025:

Cannabis Business Transaction News

The CRB Monitor research team covers the cannabis news cycle daily, remaining up to date on all the relevant information vital to the ongoing accuracy of our data. Fortunately for investors, cannabis equities remained stable as we waded into the summer months. And the news kept coming, in spite of vacation-level trade volumes.

On that note, here are some of the cannabis company highlights from June 2025:

We begin in Ohio, where Tier 1B MSO Vext Science, Inc. (CSE: VEXT) issued an June press release announcing that “the Herbal Wellness Center cannabis dispensary in Portsmouth, Ohio commenced operations and officially opened to the public on Friday, June 13, 2025. Located in southern Ohio along the Ohio River, the Dispensary marks the Company’s fifth retail location in the state, advancing Vext toward the state dispensary license cap of eight… While the Dispensary is not yet consolidated, the Company is actively advancing the license transfer process with state regulators and expects the transfer to be completed in Q3 or Q4 2025. Subject to regulatory approval, Portsmouth will become Vext’s fifth fully consolidated dispensary in Ohio. Vext Science holds at total of 13 active cannabis licenses across 3 states.

Canadian Tier 1B CRB 1B High Tide Inc. (TSXV: HITI) announced in an June press release that its Canna Cabana retail cannabis store located at 1439 Henderson Highway in Winnipeg, Manitoba, will begin selling recreational cannabis products and consumption accessories for adult use on June 27, 2025, and that its Canna Cabana retail cannabis store located in The Well shopping mall, at 486 Front St. West in Toronto, Ontario, will begin selling recreational cannabis products and consumption accessories for adult use on July 1, 2025. These openings bring High Tide’s total store count to 202 Canna Cabana locations across Canada, 83 in the province of Ontario and 12 in the province of Manitoba.” High Tide now holds 213 active licenses and operates in 3 countries.

Next we head south to Florida, where tier 1B MSO Trulieve Cannabis Corp. (CSE: TRUL) issued an June press release announcing the opening of a new medical cannabis dispensary in Oakland Park, Florida. According to the announcement, “The new dispensary will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, and Sweet Talk. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.” With this opening Trulieve now holds 110 active licenses in the U.S. and operates in 19 states.

Now we head west to Arizona, where Tier 1B MSO Verano Holdings Corp. (CSE: TER) issued a June press release announcing “the unveiling of a new dispensary format that aims to revolutionize the traditional cannabis retail experience. The new bodega-style model – debuting at Verano’s Zen Leaf Phoenix-Cave Creek… provides visitors with a unique opportunity to browse, interact with, and choose their favorite items throughout the store, offering unparalleled convenience and a modern retail experience historically unavailable for cannabis shoppers.” A cannabis bodega? The announcement goes on to say, “Zen Leaf Cave Creek’s transformation offers customers unrivaled convenience, accessibility, and the freedom to choose their desired shopping experience. Customers who prefer to shop via the new bodega-style format can hand-select their favorite items from category-specific shelves including “Flower,” “Vapes,” “Edibles,” “Best Sellers,” “Accessories,” and more, with Zen Leaf experts available to offer guidance along the way.” With this acquisition Verano now holds 77 active cannabis licenses in the US and operates in 13 states and the District of Columbia.

Finally, in British Columbia, the circle of life: Canadian Tier 1B CRB MediPharm Labs Corp. (TSX: LABS) issued a June press release announcing the closing of the sale of its Hope, British Columbia facility to Rubicon Organics Inc. (TSXV: ROMJ) for $4.5 million in cash. In the words of the announcement: “In parallel, the Company is expanding annual international cultivation capacity at its EU GMP-certified facility in Napanee, Ontario by approximately 30% in 2025. These developments underscore MediPharm’s strategic focus on operational efficiency, financial strength, and delivering premium pharmaceutical-grade cannabis products to a growing global customer base.” David Pidduck, CEO of MediPharm: “This sale also significantly improves our cash position and provides us with additional financial flexibility to pursue our strategic growth objectives.” This transaction results in a single active license for Rubicon Organics, while MediPharm Labs’ license total is now 19 across 3 Canadian provinces.

Select CRB Business Transaction Highlights

| Company Name | Ticker Symbol | CRBM

Tier |

Event |

| MediPharm Labs Corp. | TSX: LABS | Tier 1B | MediPharm Labs Closes $4.5 Million Sale of Hope, BC Facility and Announces Plans to Expand EU GMP Cultivation Capacity at Napanee Facility |

| Vext Science, Inc. | CSE: VEXT | Tier 1B | Vext Opens Fifth Ohio Dispensary in Portsmouth, Growing Retail Footprint in Key Ohio Market |

| Verano Holdings Corp. | CSE: VRNO | Tier 1B | Verano Unveils Bodega-Style Dispensary Experience at Zen Leaf Cave Creek in Phoenix |

| Trulieve Cannabis Corp. | CSE: TRUL | Tier 1B | Trulieve to Open Medical Cannabis Dispensary in Oakland Park, Florida |

| High Tide Inc. | TSXV: HITI | Tier 1B | High Tide to Open Two New Canna Cabana Locations in Toronto and Winnipeg |

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| SOL Global Investments Corp. | CSE: SOL | Tier 1B | Appoints Davide Marcotti as Chief Executive Officer (SOL GLOBAL INVESTMENTS CORP) |

| Lobe Sciences Ltd. | CSE: LOBE | Tier 1A | Lobe Sciences Appoints Mr. Yong Yao as Chief Financial Officer to Support Strategic Growth |

| Curaleaf Holdings, Inc. | CSE: CURA | Tier 1B | Curaleaf Appoints CPG Leader Rahul Pinto as President, Bolsters Marketing Leadership Team |

| Eat & Beyond Global Holdings Inc. | CSE: EATS | Tier 1B | Digital Asset Technologies Appoints Marcus Ingram as Chief Executive Officer and Director |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Bespoke Extracts, Inc. | OTCQB: BSPK | Upgrade to Tier 1A | Tier 1A/Licensed CRB |

| Tony G Co-Investment Holdings Ltd. | CSE: TONY | Moved to Watchlist | Tier 2/ Professional Services |

| Eviana Health Corporation | CSE: EHC | Moved to Watchlist | Tier 2/Personal Products |

| NewAge, Inc. | OTC Expert: NBEVQ | Moved to Watchlist | Tier 3/CBD – Personal Products |

| Victory Battery Metals Corp. | CSE: VR | Moved to Watchlist | Tier 2/Professional Services |

Cannabis News: Regulatory News Updates

Throughout the month of June we followed the cannabis news cycle, as the US federal government teased us with visions of legalization/re-rescheduling/banking reforms and as several states’ efforts to legalize marijuana for adult use have apparently stalled, for the time being. And as we have reported in recent months, the phenomenon that is now known as “intoxicating hemp” continues to dominate the legal cannabis industry news cycle. We will monitor this ongoing saga as the legal, regulated cannabis industry faces its newest adversary: the current state of unlicensed, intoxicating hemp.

With that said, here are some of the June 2025 highlights from the cannabis-related regulatory news cycle:

We begin with the US Federal Government, who are working overtime to put the hemp genie back in the bottle. A June article in MJ Biz Daily reported that “on a recent vote “that would ban hemp-derived THC under federal law passed a committee vote but is still far from becoming law. By a party-line vote of 35-27 on Monday, the House Appropriations Committee approved the Fiscal Year 2026 Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Appropriations Act.” It will be interesting to see how this legislation progresses, given that intoxicating hemp has become a profitable industry in several states, having a profound impact on the legal marijuana industry. The article goes onto report, “The bill’s fortunes are far from clear either on the full House floor or in the Senate, where observers believe Republicans from states with robust hemp industries such as Kentucky, North Carolina or Texas will be opposed.”

Next, we head west to Texas, and an article from our very own CRB Monitor News Team entitled “Texas Governor Vetoes Hemp-Derived THC Ban” which reported that “Texas Gov. Greg Abbott vetoed a bill that would have prohibited THC in consumable hemp products, while California Gov. Gavin Newsom seeks to make the ban that he temporarily put in place last year permanent. Abbott kept the hemp industry and HDC ban supporters on pins and needles until practically the last minute when he decided to veto SB 3 on Sunday, June 22. Had he done nothing with the bill, passed by the state legislature on May 26, it would have automatically become law.” As we have foreseen, intoxicating hemp, given its tendency to provide a similar high to legal marijuana but without the expensive regulations, has become wildly profitable. As such, it will likely attract numerous interests with deep pockets and therefore will be increasingly complicated to regulate. We are seeing this play out in Texas but expect this phenomenon to appear in due time in a legislature near you.

Next we look north to Minnesota where an article in MJ Biz Daily reported that “Minnesota has issued the state’s first recreational marijuana license to a microbusiness, Herb Quest, which will start by growing cannabis plants outdoors. “With our first licensed cultivator now able to begin growing plants and more than 600 businesses within the final steps of completing their applications and securing approvals from local governments, we are now seeing the first pieces of Minnesota’s adult-use market fall into place.”” The article goes on to say that Minnesota regulators recently announced “249 winners of adult-use business permits through a lottery” and that all of these businesses will be required to “pass a criminal background check and secure a labor peace agreement to receive preliminary approval for a license.”

Next we have some sobering commentary the state of the industry, as a June article by our CRB Monitor News Team reported that “The first quarter of 2025 marked a period of stabilization in the U.S. cannabis licensing market, following years of contraction and volatility.” This indicator of a leveling off of the cannabis industry can be, among other things, connected to what we have been seeing in the publicly-traded cannabis space, and of course, to the lack of progress toward federal reforms. The article goes on to report, “Total active licenses saw minimal growth (less than 1%), reflecting a plateau in market expansion. Meanwhile, approved/pending and pre-licensing activities declined, signaling a cooling interest in new market entry.” And as we might have expected, this phenomenon is not limited to the United States. “Canada, however, continued its downward trend, with active licenses falling to a four-year low.” Also important to note were some trends withing the universe of cannabis licenses: “Key trends included the dominance of cultivation and retail licenses, the rise of vertically integrated operators (particularly in New Mexico), and the outsized influence of New York’s adult-use market on national figures. State-level dynamics varied, with New Mexico and New York leading in growth, while Oklahoma and Oregon experienced significant declines.” What we could be seeing is the cannabis industry suffering from fatigue as it waits in earnest for some progress from representatives on Capitol Hill, but time will tell.

Finally, we head south to the Sunshine State, where a June article in MJ Biz Daily reported that “A campaign to legalize recreational marijuana in Florida have collected enough signatures to send the proposed ballot language to the state Supreme Court for review, according to election officials.” It is important to note that, in spite of the overwhelming popularity (57% in the last referendum vote) for full legalization, that Florida still has failed to pass it into law. The article goes on to report, “Smart & Safe Florida, the organization behind last fall’s failed adult-use ballot initiative, submitted more than 377,000 signatures to the state Division of Elections…It’s not yet clear whether the administration of Republican Gov. Ron DeSantis, who campaigned against Amendment 3 after Moody’s failed bid to keep legalization off the ballot, will mount a similar effort this time.” Why the Republican governor is so opposed to legalization is a mystery, as revenues from medical cannabis continue to pour into Florida’s treasury.

In other words, we will not hold our collective breath over the future of recreational-use legalization in Florida. Or the United States.

CRBs In the News

The following is a sampling of highlights from the April 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know.