The CRB Monitor Securities Research team covers all aspects of the publicly-traded and the privately-held cannabis ecosystem, including the regulatory environment, operational expansion/M&A activity, updates related officers and directors, and investment performance. In addition, over the last 3 years we have developed our research platform for businesses operating in the Digital Asset Space and we now include Digital Asset Related Businesses (DARBs) research in many of our newsletters. As such, please feel free to contact us at CRBMonitor.com for the gold standard in business intelligence in both cannabis- and digital asset-related securities.

With our monthly and quarterly newsletters, we keep our readership informed while we highlight the usefulness of CRB Monitor’s essential data to all types of users at financial institutions worldwide.

For additional detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: the CRB Monitor April 2025 Newsletter, CRB Monitor May 2025 newsletter, and the CRB Monitor June 2025 newsletter.

Cannabis Equity Returns – Shrinking Market Caps

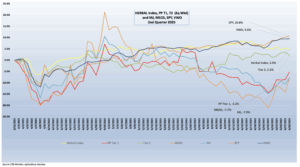

In the second quarter of 2025 cannabis equities ebbed and flowed similar to their behavior in most quarters over the last five years. The chart above is typical of a quarterly period for a volatile industry such as cannabis, which suffered an earnings-related drop in early April followed by sentiment-driven euphoria (largely related to DEA news) later that month. Then in May we experienced a long, lazy downward spiral as investors faced the reality that the U.S. government was not prioritizing cannabis reform any time soon (whether it be re-scheduling (or even de-scheduling), SAFER Banking or federal legalization). Finally, investors enjoyed a mini-surge during the month of June, which some analysts might refer to as a “dead cat bounce”. In other words, cannabis stocks’ positive June returns were less indicative of a recovery and more related to short covering and valuation adjustments. In summary, Q2 2025 brought more of the same for cannabis equities – a sprinkling of optimism followed by a sledgehammer of reality.

With all that said, the size of the universe of cannabis equities is shrinking. As we will mention later in this newsletter, the total current market cap of $7.5 billion of Tier 1 CRBs has gotten conspicuously small and is down more than 60% from where it was just a year ago.

On that note, here are some highlights from our Q2 2025 monthly newsletters:

April: For those of us that have been following the global cannabis industry as closely as we have for nearly a decade, hope for a bright future was relegated to the back burner years ago. Even the memorable “Biden’s Letter to the Regulators” in 2023 could not sway us into complacency, given that the market had already been decimated by that time. And President Joe’s mandate for marijuana re-scheduling and decriminalization was not enough for those of us that had witnessed the meteoric rise and fall of the Canopy’s, the Curaleaf’s, and the Green Thumb’s. In fact, Biden’s decree resulted in essentially nothing of substance, much like the fate of the SAFER Banking Act and any proposed legislation that would result in legal cannabis. And while the latest head of the DEA vowed to make cannabis rescheduling a priority, it is safe to say that we stakeholders are not holding our breath, no more than we were back in the hey days of 2023.

With all that said, the naming of the DEA chief at the end of April 2025 kept the ventilator on just a bit longer for this perennial, “on-life-support” patient. A story in Marijuana Moment reported that “President Donald Trump’s pick to lead the Drug Enforcement Administration (DEA) says examining a proposal to federally reschedule marijuana will be “one of my first priorities” if he’s confirmed for the role, saying it’s “time to move forward” on the stalled process.” But not so fast. The nominee, Terrence Cole, was not so bold as to state that this is his objective. “However, DEA administrator nominee Terrance Cole repeatedly declined to commit to support the specific proposed rule to move cannabis from Schedule I to Schedule III of the Controlled Substances Act (CSA) that was initiated under the Biden administration.” Nevertheless, cannabis-related companies surged on this tidbit of news and some ended the month with spectacular returns. But we cannot lose sight of the fact that sentiment-driven surges like this are more about dried-up liquidity and bloated bid/ask spreads than about the good news itself. And yet we can’t look away…

May: We are hard-pressed to fully understand why federal legalization has been virtually impossible, except to say that congressional gridlock has derailed any meaningful action on cannabis reform for nearly a decade. With that said, members of Congress have recently published the PREPARE Act of 2025 (Preparing Regulators Effectively for a Post-prohibition Adult-use Regulated Environment). We will not hold our collective breath on this one, but once again it will give investors just enough hope to hang onto their shares for dear life. What do they have to lose?

June: One issue that has made it to the forefront of our collective psyche has been the growth in the market for intoxicating hemp, sometimes called Delta-8. Taking advantage of the 2018 Farm Bill, a law who’s purpose was to promote the non-intoxicating hemp industry, businesses have found a loophole that has allowed them to operate unlicensed dispensaries where they sell hemp-derived products with a high THC content. And there are efforts in the US government as well as that the state level to curtail this business; however, it remains to be seen whether politicians will be able to put this genie back in the bottle. In light of recent events we are not holding our collective breath over a total ban on intoxicating hemp.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL) is a mix of Pure Play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme (SOT). A well-conceived representation of the universe of legal, pure play Tier 1 and Tier 2 cannabis equities, HERBAL had a +5.0% return for the Quarter of 2025. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index. HERBAL significantly outperformed its competitors over the quarter. This was due to the composition of the index, which resulted in an overweighting of Tier 2 CRBs and a portfolio that is concentrated in fewer overall securities. [Note: this is the final quarterly installment for the HERBAL index as it was decommissioned as of June 30, 2025.]

The largest US plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-7.9%) and the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-7.7%), finished Q2with their tails between their legs. Unlike HERBAL, which is designed to be Controlled Substances Act (CSA)-friendly, these two funds with US plant-touching marijuana exposure tend to be more sensitive to the US regulatory rollercoaster which is covered in this newsletter each month.

The CRB Monitor equally-weighted basket of the largest Pure Play Tier 1 CRBs faced similar challenges in the Second quarter, returning -5.2%. This basket is essentially a hybrid of CRBs without US touchpoints (the CAD component) and US multistate operators (the MSO component). Because the basket is equally-weighted its performance is likely to deviate from published indexes and listed funds, which generally employ some variation of market cap weighting.

The performance of the CRB Monitor equally-weighted basket of the largest Tier 2 CRBs was negative, but outperformed the Tier 1 basket significantly with a return of +2.2%. As we have indicated in the past, Pure Play Tier 1 and Tier 2 CRBs tend to display high (~0.8) correlation in the long term (see our section on correlation in the CRB Monitor February 2024 newsletter), but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. In general, Tier 2 CRBs share in the overall success or failure of the Tier 1 universe and ultimately are expected to converge with the Tier 1 equity basket.

U.S. Equities: Throughout Q2 2025, U.S. stock markets underwent a dramatic yet ultimately strong recovery. After a steep ~12% plunge in early April following new tariff measures dubbed “Liberation Day,” the S&P 500 rebounded sharply and rose approximately 10.9% over the quarter, closing June around 6,205, one of its fastest-ever recoveries to a new all‑time high. The broad U.S. equity market (Russell 3000) returned about 11.0%, with growth stocks significantly outperforming—Russell 1000 Growth surged roughly 17.8%, while Russell 1000 Value delivered a modest 3.8% gain. Despite early volatility from war in the Middle East and tariff uncertainty, investor confidence was buoyed by the de-escalation of planned trade measures and better-than-expected corporate earnings—S&P 500 aggregated earnings growth in Q2 2025 came in at approximately 9.8%, with a notable 81% of companies beating expectations. In summary, Q2 2025 was a tale of volatility transformed into recovery: the S&P 500 climbed nearly 11%, led by a rebound in growth and tech stocks, even as value, energy, and health care lagged. US equities held their own in Q1, with the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) returning a resilient -4.6%.

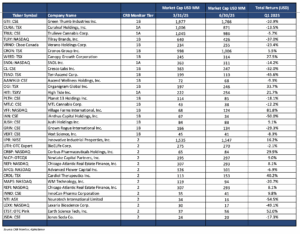

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – Q2 2025 Returns

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities was negative in June 2025 with most of the constituents underperforming the broad equity market. Tier I CRBs were outpaced by the Tier 2 basket by more than 11%.

CRB Monitor Tier 1

The table above indicates that there were precious few options from the pure play Tier 1 universe in that performed well in the second quarter. And while that is an unfortunate (if not depressing) thought for cannabis investors, we are faced with the reality that the cannabis industry is shrinking. The total 6/30/2025 market cap of the Tier 1 companies in the table above is just under $7.5 billion; in other words, if all these companies were combined, that single entity could still qualify as a small cap company. As a comparison, the June 2024 combined Tier 1 market cap was over $19 billion (that is not a typo). And so while industry analysts look for silver linings (such as High Tide expanding its Canadian footprint or Canopy Growth finding a way to sell cannabis in the U.S.) developments such as these alone will not save this industry.

On that note, here are some comments on Q2 2025 performance:

The MSO basket generally struggled, with Tier 1B Cresco Labs Inc. (CSE: CL) (-32.0%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-23.4%), Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (-5.7%), Tier 1B TerrAscend Corp. (TSX: TSND) (-45.6%), and Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-13.5%) ending the quarter lower following the flurry at the end of April. The largest CRB by market cap, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-10.9%) sank for the third quarter in a row, as investors’ interest flapped in the wind.

The Canadian CRB basket, while going through its own pain related to the U.S. stalemate, has had less of a struggle over the last 18 months than their industry mates across the border. While we do expect these groups to ultimately trade in line, they have diverged recently and we will highlight this in an upcoming update to our research into these two baskets. Case in point: Tier 1B legend in the cannabis industry Canopy Growth Corporation (TSX: WEED) (+27.5%) surged after losing 2/3 of its value in Q1. Tier 1B Cronos Group Inc. (TSX: CRON) (+5.5%) recovered as well, while Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-37.0%) and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-14.2%) slumped for the third quarter in a row. On a positive note, Tier 1B High Tide Inc. (TSXV: HITI) (+21.7%) rebounded in Q2 2025 as it continued to expand its retail operations in Canada.

In other big news about a tiny cannabis company, shares of Village Farms International, Inc. (Nasdaq: VFF) (+81.8%), soared 69% in May 2025 following their May 12th earnings report, which was largely optimistic. Then in June, VFF issued a press release announcing that “it had received formal notice from The Nasdaq Stock Market LLC informing the Company that it has regained compliance with the minimum closing bid price of US$1.00 per share listing requirement (Nasdaq Listing Rule 5550(a)(2)) and the matter is now closed.”

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a return of +2.2% for the Second quarter of 2025, outperforming the equally-weighted Tier 1 basket by 7.4%. Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (please see our February 2024 “Chart of the Month”), but their respective performance has a tendency to diverge in the short term, as it did in Q2, given the occasional lag from the impact (positive or negative) of market forces.

IIPR comes back: Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) (+16.2%) closely. IIPR is an internally-managed real estate investment trust (CRBM sector – REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” On May 7th IIPR issued its 1st quarter 2025 earnings report, which featured the following highlights:

- Total revenues of $71.7 million for the quarter.

- Net income attributable to common stockholders of $30.3 million for the quarter, or $1.03 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- AFFO of $55.3 million, or $1.94 per share.

- Paid a quarterly dividend of $1.90 per common share on June 15, 2025 to stockholders of record as of March 31, 2025.

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (-6.9%) struggled for the second quarter in a row. On May 14th AFCG reported its 1st Quarter 2025 earnings of $6.3 million which featured the following statement from CEO Daniel Neville:

“AFC reported generally accepted accounting principles (“GAAP”) net income of $4.1 million or $0.18 per basic weighted average common share and Distributable Earnings of $4.5 million or $0.21 per basic weighted average common share for the first quarter of 2025. Our top priority at AFC is reducing our exposure to underperforming credits, while also remaining disciplined on providing debt capital to accomplished operators. While cannabis market sentiment continues to hinge on regulatory momentum, we are focused on taking advantage of market dislocations to invest in quality credits with strong risk adjusted returns, which our recent investments demonstrate.”

CRB Monitor Securities Database

As of June 30, 2025, the breakdown of publicly-traded, cannabis-linked securities was as follows:

Source: CRB Monitor

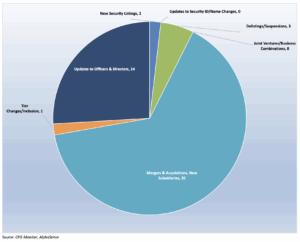

We have observed over the last few years (following the failure of the Cresco and Columbia Care merger in July 2023) that we have seen the end of any meaningful cannabis M&A activity for the foreseeable future. With that said, the CRB Monitor research team updates our cannabis company data daily, in real time, so that we deliver an accurate record of each CRB’s corporate structure and current security details. On that note, we make hundreds of updates to CRB profiles every quarter and Q2 2025 was no exception. In addition to business expansion and corporate finance, we are tracking, on a daily basis, changes to company identifiers, new security listings, risk tier changes, database additions & removals, and updates to company officers and directors.

Cannabis Business Transaction News

Of the 4,226 announcements and filings reviewed during the Second quarter, our daily research resulted in a total of 123 updates to CRB Monitor company profiles (54 updates to issuers’ records, 69 source documents added). The complete list of securities and detailed profiles for the approximately 1,200 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our latest monthly newsletters: the CRB Monitor April 2025 Newsletter, CRB Monitor May 2025 newsletter, and the CRB Monitor June 2025 newsletter.

The following is a sampling of some of the highlights from the Q22025cannabis news cycle:

First, in April: We start in Florida, where the largest CRB by market cap, Green Thumb Industries Inc. (CSE: GTII) issued an April press release announcing that “RISE Dispensary Ocala, the Company’s 22nd retail location in Florida and 104th nationwide, will open on April 29. Located at 3873 SW College Road, the dispensary will offer medical patients a diverse collection of cannabis products from brands including RYTHM, Dogwalkers, &Shine, Good Green, and Doctor Solomon’s. As part of RISE and Green Thumb’s ongoing commitment to supporting local communities, RISE Dispensary Ocala will donate a portion of one day’s profits to community-based organization The Bridge 4 Veterans…Green Thumb joined the Florida community in 2018 and operates two production facilities in Ocala and Homestead, where the Company cultivates and produces its branded products. Green Thumb’s cultivation and manufacturing practices reflect the highest quality standards to ensure all its products offer a true-to-plant, consistent experience. The Company’s retail brand, RISE Dispensaries, is committed to expanding access to well-being through cannabis and making a positive impact on the communities it serves. In addition to RISE Dispensa Ocala, there are 21 other RISE Dispensaries in Florida, including locations in Bonita Springs, Brandon, Clearwater, Crystal River, Deerfield Beach, Dunnellon, Fruitland Park, Hallandale Beach, Jacksonville, Kendall, New Port Richey, Orlando on Good Homes Road, Oviedo, Pinellas Park, Port Orange, Sun City Center, Tallahassee, Tampa, Wesley Chapel, and West Palm Beach. Delivery services are available to the areas surrounding RISE Dispensaries in Florida.” With this acquisition Green Thumb now holds 98 active cannabis licenses in the US and operates in 15 states.

Also in April: In Canada, Tier 1A CRB Organigram Global Inc. (TSX: OGI) issued an April press release announcing “the acquisition of 100% of the issued and outstanding shares of Collective Project Limited for upfront consideration of approximately C$6.2 million, potential milestone payments and potential earnout payments totaling in the aggregate up to C$24M for the twelve-month periods ending September 30, 2025 and September 30, 2026. “The acquisition of Collective Project marks yet another strategic milestone towards Organigram’s global leadership ambitions. Not only does this acquisition represent our first commercial entry into the fast-growing hemp-derived THC beverage market in the U.S., it also fast tracks our entry into the cannabis beverage category in Canada, a category that we believe is on the cusp of growth at home as well,” said Beena Goldenberg, CEO of Organigram. Collective Project is an innovative brand launched by Collective Arts, a Hamilton, Ontario-based company founded in 2013. Known for its unique approach to blending craft beverages with art, Collective Arts has featured over 2,000 artists from 40 countries on its products. Collective Project extends this creative ethos into the cannabis market, producing cannabis and hemp-derived infused sparkling juices, teas and sodas.” Organigram now holds 15 active cannabis licenses in 3 Canadian provinces.

Also in January, we head to the Great White North, where Canadian Tier 1B High Tide Inc. (TSXV: HITI) announced in a January press release that it is “entering the fast growing German medical cannabis market by signing a definitive agreement pursuant to which the Company will acquire 51% of Purecan GmbH, for approximately €4.8 Million , and will have a future option to acquire the remaining interest in Purecan. Purecan is a profitable, import-oriented pharmaceutical wholesaler based in Germany, that holds a license to import medical cannabis into Germany and is preparing to launch a telemedicine portal for medical cannabis patients in Germany, along with complete warehousing and logistics infrastructure.” High Tide has been in expansion mode for much of the last 12 months, and now holds 201 active cannabis licenses in Canada and Australia.

Next, in May: Canadian Tier 1B CRB 1B High Tide Inc. (TSXV: HITI) announced in an May press release that “its Canna Cabana retail cannabis store located at 300 King George Road in Brantford, Ontario, will begin selling recreational cannabis products and consumption accessories for adult use on May 20, 2025, and that its Canna Cabana retail cannabis store located at 722 85th Street SW in Calgary, Alberta, will begin selling recreational cannabis products and consumption accessories for adult use on May 23, 2025. Brantford, ON location:

This former Tokyo Smoke location…marks Canna Cabana’s first location in Brantford and benefits from major co-tenants, including multiple national grocery chains, two liquor stores, and a cinema. West Springs, AB location: This new Canna Cabana retail store is located on the west end of Calgary along Old Banff Coach Road, strategically situated in a rapidly growing area surrounded by new and developing residential neighborhoods… Notably, there are no competitors within a 4-kilometers radius of this new location—which encompasses a population of over 46,000 residents—offering the Company a strong opportunity for market capture and growth.” High Tide now holds 211 active licenses and operates in 3 countries.

Also in May: We down to Ohio, where Tier 1B MSO TerrAscend Corp. (CSE: TER) issued a May press release announcing the closing of its previously announced acquisition of the assets of Ratio Cannabis LLC, “a cannabis dispensary located in Goshen Township, Ohio. The acquisition represents TerrAscend’s initial entry into its sixth state, Ohio, and is expected to be immediately accretive on an EBITDA and cashflow basis. This acquisition increases TerrAscend’s retail footprint to 39 dispensaries across six U.S. states and Canada. The Company intends to acquire additional Ohio dispensaries in the future. “Ratio Cannabis is a strong performer, with no competition within a 20-mile radius, generating $9 million in annualized revenue. Entering Ohio has long been a priority for us,” stated Jason Wild, Executive Chairman of TerrAscend. “This acquisition is a great first step in Ohio and we will continue to aggressively pursue additional accretive dispensary acquisitions, up to the eight dispensary state limit.”” With this acquisition TerrAscend now holds 79 active cannabis licenses in the US and operates in 8 states and 3 Canadian provinces.

Finally, in March: We head south to Florida, where Tier 1A CRB Trulieve Cannabis Corp. (CSE: TRUL) issued a March press release announcing the opening of a new medical cannabis dispensary in North Miami Beach, Florida. In the words of the article, “The new dispensary will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida. Across Florida, Trulieve offers home delivery, convenient online ordering, and in-store pickup. Veterans receive 20% off every order when they show their military ID, and all first-time guests are eligible for a 60% new customer discount at any Florida Trulieve location.” As of the time of this opening, Trulieve holds 113 active cannabis licenses in the US and Canada.

Next, in June: We head south to Florida, where tier 1B MSO Trulieve Cannabis Corp. (CSE: TRUL) issued an June press release announcing the opening of a new medical cannabis dispensary in Oakland Park, Florida. According to the announcement, “The new dispensary will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, and Sweet Talk. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.” With this opening Trulieve now holds 110 active licenses in the U.S. and operates in 19 states.

Finally, in June: We head west to Arizona, where Tier 1B MSO Verano Holdings Corp. (CSE: TER) issued a June press release announcing “the unveiling of a new dispensary format that aims to revolutionize the traditional cannabis retail experience. The new bodega-style model – debuting at Verano’s Zen Leaf Phoenix-Cave Creek… provides visitors with a unique opportunity to browse, interact with, and choose their favorite items throughout the store, offering unparalleled convenience and a modern retail experience historically unavailable for cannabis shoppers.” A cannabis bodega? The announcement goes on to say, “Zen Leaf Cave Creek’s transformation offers customers unrivaled convenience, accessibility, and the freedom to choose their desired shopping experience. Customers who prefer to shop via the new bodega-style format can hand-select their favorite items from category-specific shelves including “Flower,” “Vapes,” “Edibles,” “Best Sellers,” “Accessories,” and more, with Zen Leaf experts available to offer guidance along the way.” With this acquisition Verano now holds 77 active cannabis licenses in the US and operates in 13 states and the District of Columbia.

Cannabis News: Regulatory Updates

Here are some of the Q2 2025 regulatory highlights from the cannabis-related regulatory news cycle:

First, in April: We begin with the US Federal Government, and an article from our very own CRB Monitor News Team which reported that “Ninety days after a DEA administrative law judge postponed a hearing on rescheduling cannabis because of a motion to have the DEA removed from the entire process, the DEA has done nothing to hear the appeal.” As our readers might recall, the notion of rescheduling marijuana to Schedule III was originally suggested in a letter from President Joe Biden to the DOJ in October 2022. However, in the years since, rescheduling has faced a series of fits and starts and it is un clear when or even if it will ever happen. The article goes on to report, “Many had hoped that given President Donald Trump’s public statements in favor of rescheduling cannabis and legalizing adult-use in Florida, he would support the proposed rule to move marijuana from Schedule I to Schedule III. However, it reportedly is not really a drug policy priority of his right now.”

Also in April: We head west to Nebraska where an article from our very own CRB Monitor News Team reported that the legalization of medical cannabis still remains uncertain for Nebraskans. In the words of the report, “Technically, medical use of cannabis is currently legal in the state of Nebraska. Under Measure 437, which was approved by 71% of the voters in November, an adult can obtain a written recommendation from a doctor and “use, possess, and acquire” up to five ounces of the plant to alleviate illness symptoms. Gov. Jim Pillen reluctantly signed Measure 437 and its companion, Measure 438, into law on Dec. 12. But the voter initiatives remain challenged by two lawsuits filed by a former state official, while bills to enact rules allowing for patient access and a legal market slog through the state legislature with a dim chance of being signed by Pillen. Therefore, a legal market may not start by the end of the year as voters expected. Crista Eggers, campaign manager for Nebraskans for Medical Marijuana and co-sponsor of the initiative measures, told CRB Monitor News they get questions “all the time” from patients asking about how to get a doctor’s recommendation and acquire medical cannabis. But they have received no direction from the Attorney General’s Office, law enforcement, regulators or doctors.” We will keep watching the Cornhusker State for any new developments.

Next, in May: Next we head to Maryland where an article from our very own CRB Monitor News Team reported that the state of Maryland has made it easier for dispensary owners to get out of the cannabis business sooner than the statutory 5-year waiting period for license transfer. In the words of the report, “Gov. Wes Moore signed SB 215 into law on April 22. As part of a larger assortment of adjustments to the state’s market, the legislation created an exception to the five-year restriction for cannabis businesses that wish to convert to an Employee Stock Ownership Plan (ESOP). Aside from the ESOP waiver, the bill included a series of reforms for the state’s relatively young adult-use cannabis market, such as clarifying some of the rules for consumption lounges and allowing the Office of Cannabis Management to ensure that at least 25% of dispensary shelf spaces are reserved for producers with social equity status.” We will keep watching this one for any new developments.

Also in May: We head out west to Texas, where a May article in MJ Biz Daily reported that “Texas’ estimated $5.5 billion market in hemp-derived THC is in mortal danger after the state House approved a blanket ban on intoxicating products. The ban, pushed by Lt. Gov. Dan Patrick and approved by the state Senate in March, passed the House by a 86-53 vote on Wednesday night. Though a final House vote on Senate Bill 3 is scheduled for Thursday, it’s expected to pass and the ban is likely to be signed into law by Gov. Greg Abbott, according to the Houston Chronicle. “We are banning high,” Republican state Rep. Tom Oliverson said, according to the Dallas Morning News. “If it gets you high, it is not legal anymore.” As we mentioned above, the spread of intoxicating hemp has become an explosive issue since these unlicensed “THC” businesses have emerged, thanks to a loophole in the 2018 Farm Bill.

Now from our June newsletter: We look north to Minnesota where an article in MJ Biz Daily reported that “Minnesota has issued the state’s first recreational marijuana license to a microbusiness, Herb Quest, which will start by growing cannabis plants outdoors. “With our first licensed cultivator now able to begin growing plants and more than 600 businesses within the final steps of completing their applications and securing approvals from local governments, we are now seeing the first pieces of Minnesota’s adult-use market fall into place.”” The article goes on to say that Minnesota regulators recently announced “249 winners of adult-use business permits through a lottery” and that all of these businesses will be required to “pass a criminal background check and secure a labor peace agreement to receive preliminary approval for a license.”

Finally, we have some sobering commentary the state of the industry in the U.S., as a June article by our CRB Monitor News Team reported that “The first quarter of 2025 marked a period of stabilization in the U.S. cannabis licensing market, following years of contraction and volatility.” This indicator of a leveling off of the cannabis industry can be, among other things, connected to what we have been seeing in the publicly-traded cannabis space, and of course, to the lack of progress toward federal reforms. The article goes on to report, “Total active licenses saw minimal growth (less than 1%), reflecting a plateau in market expansion. Meanwhile, approved/pending and pre-licensing activities declined, signaling a cooling interest in new market entry.” And as we might have expected, this phenomenon is not limited to the United Stats. “Canada, however, continued its downward trend, with active licenses falling to a four-year low.” Also important to note were some trends withing the universe of cannabis licenses: “Key trends included the dominance of cultivation and retail licenses, the rise of vertically integrated operators (particularly in New Mexico), and the outsized influence of New York’s adult-use market on national figures. State-level dynamics varied, with New Mexico and New York leading in growth, while Oklahoma and Oregon experienced significant declines.” What we could be seeing is the cannabis industry suffering from fatigue as it waits in earnest for some progress from representatives on Capitol Hill, but time will tell.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know