Recently released fourth quarter 2024 marijuana-related Suspicious Activity Report (SAR) data show cannabis banking has started to stabilize, except in Illinois where there was a 115% increase in SAR filings compared to the previous year.

The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) regularly posts quarterly SAR data on a page labeled Frequently Requested FOIA -Processed Records. When fourth quarter data hadn’t been posted by Aug. 26, CRB Monitor sent a Freedom of Information Act request for the fourth quarter 2024, as well as for the first two quarters of 2025.

FinCEN responded to CRB Monitor on Sept. 19, after it posted the fourth quarter data online. It did not provide 2025 data as requested. “FinCEN has not yet posted 2025 metrics,” the email simply said without any further explanation.

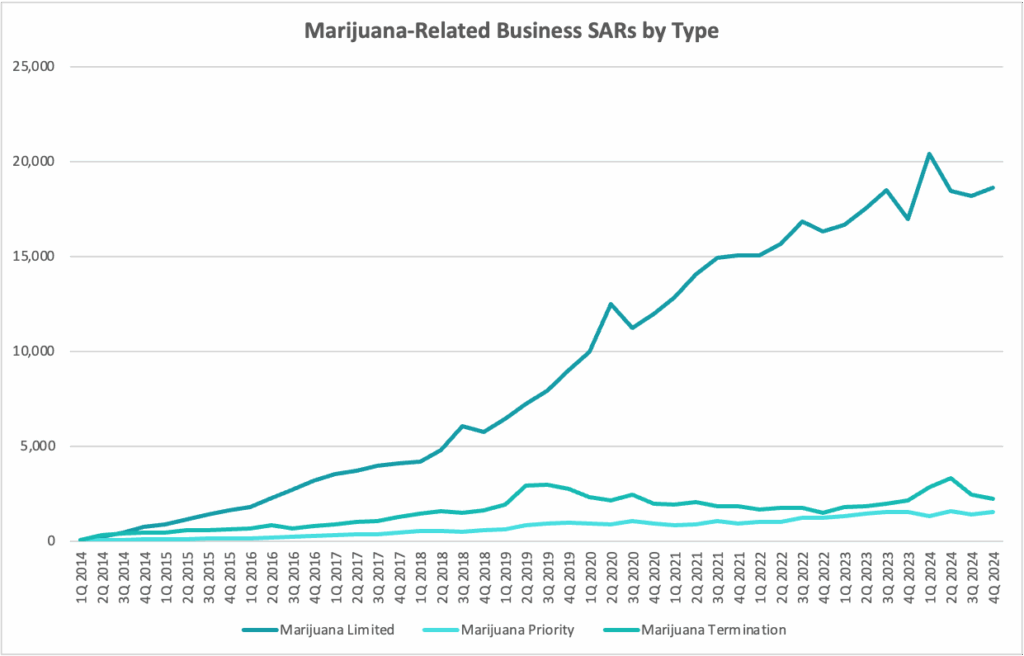

After reaching a high of 23,159 SARs in the first quarter 2024, total filings dropped in the second and third quarters before bumping up slightly to 21,480 in the fourth quarter, an 8.8% increase over the fourth quarter 2023.

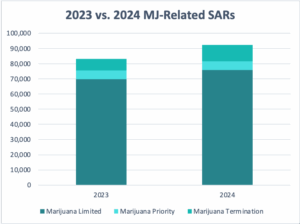

A total 88,326 SARs were filed in 2024, an increase of 8,929, or 11.2%, since 2023. By the end of the 11thyear FinCEN has been tracking marijuana-related SARs, a total of 477,891 reports had been filed.

MJ terminations increase 40% in 2024

There are three types of marijuana-related SARs, and the one that is the best indicator of active banking in the industry is called Marijuana Limited reports. Marijuana Limited signify that the businesses banking at the institution didn’t raise any red flags as outlined in the 2013 Cole Memo, written by then-Deputy Attorney General James M. Cole, or violate state law.

Marijuana Limited reports increased 2.3% over the third quarter to 18,614, and were up 9.7% over fourth quarter last year. Year-over-year, total Marijuana Limited increased by 6,036 reports, or 8.7%.

Marijuana Priority reports indicate the customer raises Cole Memo red flags or is potentially violating state law. At 1,546 reports, Marijuana Priority increased by 9.3% since the third quarter and by a mere 12 reports compared to fourth quarter 2023. Year-over-year Marijuana Priority reports increased by only 36.

Marijuana Termination reports are just as the name implies, accounts were closed “in order to maintain an effective anti-money laundering compliance program,” according to the FinCEN definition.

After reaching a record 3,307 reports in the second quarter 2024, Marijuana Terminations dropped to 2,235 in the fourth quarter, a decline of 9.4% since the third quarter and the lowest quarterly tally of the year. There were only 84 more reports than in the fourth quarter 2023. However, total Marijuana Terminations for last year, at 10,867, jumped by 39.7% compared to 2023.

Total SARs in each category add up to more than total SARs filed because some filings may list multiple types in the SAR narrative. For example, a SAR containing “Marijuana Limited” and “Marijuana Priority” in the narrative would be reflected in both metrics.

Active credit unions hit record

When it comes to financial institutions serving the cannabis industry, the data show stagnation. The number of “active filers” stood at 816 in the fourth quarter, two less than in the third quarter 2024 and 17 more than the fourth quarter of 2023.

While it’s the best data the industry has, the actual number of institutions actively catering to the cannabis market is likely lower as the definition of active filers includes financial institutions that filed Marijuana Priority reports. An institution that files a Marijuana Termination report but also files a Limited or Priority report in the quarter would still be identified as an active filer, according to FinCEN.

There were 507 active filer banks in the fourth quarter, down four from the third quarter and up 22 from the fourth quarter 2023. Credit unions reached a record 182 in the fourth quarter 2024, up by 10 since the third quarter. There were 127 active non-depository institutions, the lowest number since fourth quarter 2022.

Illinois jumps to 5th place

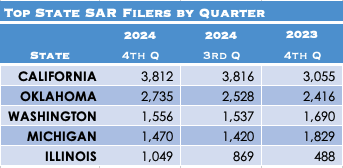

Among individual states, Illinois stands out. The adult-use state climbed to fifth place with a record-breaking 1,049 SARs filed in the fourth quarter. That represents a 20.7% jump since the third quarter, when it was in sixth place, and a 115% increase over fourth quarter 2023, which had only 488 SARs.

The top four SAR-filing states remained the same for the quarter, with California ranking first with 3,816 reports, followed by Oklahoma, Washington and Michigan.

After reaching a record 4,073 reports in the second quarter 2024, California fell 6.4% in the fourth quarter. Compared to fourth quarter 2023, California SARs were up 24.8%, despite a two-year decline in licensed businesses.

No. 2 Oklahoma also filed a record number of SARs in the fourth quarter with 2,735. That’s up 8.2% since the third quarter and 13.2% since fourth quarter 2023.

Ohio, which was the third quarter’s No. 5, dropped to sixth place with 1,020 SARs, only 14 fewer reports than the previous quarter.

FinCEN doesn’t break down the type of SAR reports filed for each state.