Cannabis and hemp markets experienced a tumultuous end to 2025, thanks to moves from the U.S. legislature to practically ban hemp-derived THC, followed by President Donald Trump signing an executive order calling for an expedited cannabis rescheduling process.

Before all that happened, cannabis-related businesses saw licensing delays, volatile markets and financial challenges.

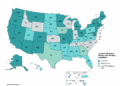

California continued to dominate in terms of total sales, although Michigan is catching up. California saw $3.97 billion in 2025, which reflects a 7% drop from the $4.27 billion in sales in 2024, according to data from Headset. Michigan saw a slighter dip, with $3.16 billion in 2025 compared to $3.29 billion in 2024.

New York’s market picked up steam, with $1.6 billion in sales last year. The state now has more than 500 dispensaries open for business, according to state data.

Massachusetts stayed flat with $1.65 billion, while Illinois fell to $1.58 billion from about $2 billion in 2024, a 21% drop.

Ohio had its first full calendar year of adult-use sales in 2025, during which the Buckeye State pulled in $836 million. Combined with about $233 million in medical sales, the state’s cannabis market surpassed the $1 billion mark.

Rhode Island already has adult-use sales, as the state allowed its existing medical operators to convert to a hybrid model. The Rhode Island Cannabis Control Commission gave final approval to the regulations on April 11.

Delaware, Minnesota and Alabama finally launch markets

Delaware and Minnesota launched adult-use sales in 2025, starting in August and September, respectively. Both states saw delays.

Minnesota was able to launch its market, despite a legal effort to block its first attempt at rolling out new licenses. The state originally planned to hold a pre-approval lottery at the end of 2024 for social equity applicants. Ultimately, Minnesota dropped those plans and moved forward with uncapped license types.

Microbusiness license applications exploded in Minnesota at the start of the year. In just one-month’s time, the state received 1,322 applications for microbusinesses, for which the state does not have a cap. By June, Minnesota’s Office of Cannabis Management held a series of lotteries to select 50 cultivation licenses, 24 manufacturing, 100 mezzobusiness and 150 retail.

Delaware was also delayed in its attempts to issue its first round of adult-use licenses. The state’s Office of the Marijuana Commissioner missed its deadlines to issue cultivation licenses by Nov. 1, 2024, processor licenses by Dec. 1, 2024, and retail licenses by March 1, 2025.

The delay was a result of the state having to wait on the Federal Bureau of Investigation to approve its use of a federal fingerprinting database for criminal background checks.

After years of legal setbacks, a state appellate court in Alabama lifted the temporary restraining order that prevented the Alabama Medical Cannabis Commission from issuing processor and retail licenses for over a year.

Weeks after the appellate court ruling, a separate state court sent the AMCC back to the drawing board when it voided the agency’s integrated facility license awards. A Montgomery Circuit Court judge ruled that the licenses were awarded under illegitimate emergency regulations.

The AMCC would finally issue its first retail licenses in December.

Meanwhile, Missouri rejected more microbusiness licenses after determining that at least 25 of 57 licenses awarded in July, 2024 were given to owners who did not actually qualify as social equity candidates.

Meanwhile, the 22 license winners from Florida’s first attempt to create new operators since it launched its medical cannabis market spent the year waiting to actually receive state approval. Despite Florida announcing the new licenses in early 2023, and then announcing winners in late 2024, no new licenses have been issued. The state’s Office of Medical Marijuana Use said it was waiting until it was done contending with applicants who did not win, but sued.

Many companies had a rough year

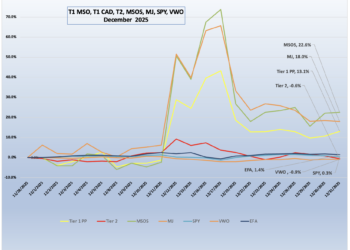

State shifts aside, several large companies and investors faced challenges throughout 2025, as they waited for the DEA to reclassify cannabis to Schedule III.

Navy Capital wound down investments in the cannabis industry after eight years in the sector. The change came shortly after the company faced federal fines for failing to properly follow Anti-Money Laundering compliance protocols.

Despite the legal penalties, the company said it decided to exit cannabis after voters in Florida failed to pass legalization in 2024.

California giant Gold Flora (GRAM) filed for receivership in Los Angeles County Superior Court on March 27. The company once owned 16 dispensaries and cultivation sites with a combined 107,000 square feet of canopy.

Multi-state operator 4Front Holdings Inc. (FFNTF) also announced that it would be entering receivership through a Massachusetts state court after the company failed to file a fourth-quarter report in 2024 because it was unable to pay its auditors.

Ayr Wellness (AYRWF) entered into Companies’ Creditors Arrangement Act proceedings, which is a Canadian alternative to receivership. The Toronto-based company will be restructured with a portion of its assets transferring to a new company created by senior noteholders of Ayr Wellness’ debt. Company assets in Massachusetts, Connecticut, Illinois, New Jersey and Nevada were divested.

Curaleaf (CURLF) announced it intended to purchase retail and cultivation operations in Virginia from The Cannabist Company (CBSTF), formerly known as Columbia Care. Within weeks Curaleaf backed out of the deal citing discrepancies in the assessed value of the Virginia medical cannabis assets.

CRB compliance news

The crackdown on dispensaries using cashless ATM systems to simulate card transactions for cannabis continued in 2025. Switch Commerce, an Irving, Texas-based ATM company, sued Trulieve (TCNNF) for allegedly operating a cashless ATM system that resulted in Switch Commerce being sanctioned.

Last year saw a major development in seed-to-sale systems when the nation’s two largest STS competitors, Metrc and BioTrack announced a partnership that would allow for Metrc to take over BioTrack’s state contracts.

So far, New York is the only state to announce a changeover to Metrc, creating further delay in that state’s attempts to curb product diversion.

Hemp remained in play

Several large cannabis companies continued to dabble in hemp, even as state and federal lawmakers began cracking down on the proliferation of hemp-derived intoxicants.

Glass House Brands (GLASF) became the latest cannabis company to expand into the hemp industry in the beginning of 2025, when the company announced that it was starting to cultivate a hemp crop for research and development purposes. At the time, the company said it intended to use hemp to expand its reach outside of California.

In April, Curaleaf announced the launch of a hemp-exclusive shop in West Palm Beach, Fla., under The Hemp Company brand. By the end of the year, Curaleaf Chairman Boris Jordan reportedly said the company would exit the hemp space, with the West Palm Beach shop closing by April 2026.

This move was the result of Congress closing the 2018 Farm Bill loophole which allowed intoxicating hemp to be legalized in the first place. The new restrictions, which are set to take effect on Nov. 12, 2026, were part of the budget bill that reopened the federal government on Nov. 12, 2025.

Until then, the hemp industry faces an uncertain future as House representatives have already filed a bill to delay the ban.