CRB Monitor is closely following the latest developments in cannabis rescheduling. Question: Were cannabis investors given the straight scoop about the fate of marijuana on April 30 or was it just another false alarm? Given the source – a story reported by the Associated Press – the news appeared to be credible. And the AP’s sources – five well-connected individuals who are close to the Department of Justice and Drug Enforcement Agency – would suggest that this news was real. So it should have been no surprise when the market loved it, at least for a day… similar to how the market responded in January and back in October 2022 with the President’s initial announcement.

And then on May 16, there was a new development in this story, as President Joe Biden issued a video reiterating his position on cannabis reform while the Justice Department announced that it was “formalizing its process to reclassify the drug as lower-risk and remove it from a category in which it has been treated as more dangerous than fentanyl and meth,” as the NBC News report stated.

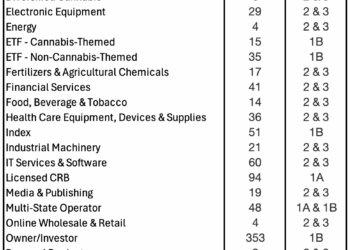

It is reasonable to believe that of all CRBs, the MSOs are expected to derive the greatest benefit from rescheduling, and that benefit would come in the form of tax relief under IRS Section 280E. We will not go into all the painful details related to 280E, except to say that once marijuana is moved off Schedule I, cannabis operators would then be permitted to deduct previously un-deductible ordinary business expenses such as rent, advertising expenses, wages and salaries, and travel expenses. And quite understandably, the multistate operators are celebrating this news, so much so that a number of them are starting to retroactively claim tax refunds; the most notable of these being Tier 1B Trulieve Cannabis Corp. (CSE: TRUL), who in 2024 attempted to reclaim more than $140 million in previously-paid 280E-related taxes.

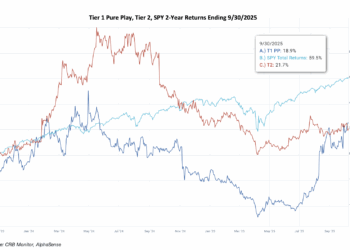

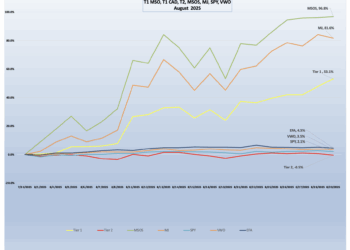

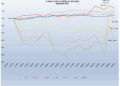

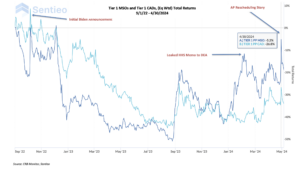

With that said, let’s take a look at the performance of the MSO basket vs. the Canadian basket since the original announcement back in 2022:

We have highlighted the three significant dates in recent rescheduling history: October 6, 2022, (President Biden’s announcement), January 12, 2024, (Release of Health and Human Services’ memo), and April 30, 2024, (AP story). While the spikes are interesting (and to some industry participants, inspirational), we look to the right side of the chart where the two groups – the MSOs and the CADs – deviate. This appeared to happen with the January HHS revelations and unlike previous shocks, there wasn’t an immediate reversal to the mean. This period is what contributed most significantly to the 20+% spread between the two groups over the period.

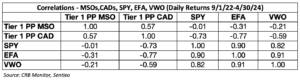

Looking at the correlations above, there are no surprises except to say that while high (0.57), the MSO-CAD correlation has dropped over time. In fact the MSO-CAD correlation for the period of Sept. 1, 2022, through Dec. 31, 2023, was 0.73. We do not have a crystal ball, but this potential new regulatory landscape could see these groups diverge along with their individual operational paths.

While it cannot be disputed that cannabis has taken a giant step toward normalization, the details regarding how any of this will be implemented and its impact on the cannabis industry are still unknown. With that said, CRB Monitor will continue to be the leading source of cannabis market intelligence, and as such will provide an unbiased approach to new developments as they come to light.