Hemp beverage companies are finding their way into liquor stores and retail shops across the country even as more states attempt to regulate hemp-derived cannabinoid (HDC) products.

Hemp-derived products, such as Delta-8 flower, vapes and edibles have thrived since the 2018 Farm Bill allowed companies to produce these products and sell them over state lines. While some forms have become staples of gas station and convenience store shelves, especially in states without legal adult-use cannabis, hemp beverages have moved into the retail mainstream right alongside alcohol beverages.

“Hemp beverages do exceptionally well everywhere they are expressly regulated,” said Christopher Lackner, president of the Hemp Beverage Alliance. “In Minnesota, the de-facto birthplace of the hemp beverage industry, these drinks can be found in grocery stores, liquor stores and on-premise locations like bars and restaurants.”

The Land of 10,000 Lakes has largely embraced hemp beverages. Minneapolis Mayor Jacob Frey announced the June 8 was his city’s “Hemp Beverage Day.”

“In 2022 the Minnesota state law changed due to some of the most extraordinary political gymnastics I’ve ever seen by these representatives and senators to allow the processing and sale of goods defined as edible cannabinoid products, including hemp-derived THC beverages,” said Frey.

Frey also said that he had heard from numerous liquor stores that hemp beverages were big sellers, which highlights one of the benefits these products are receiving in contrast to other hemp-derived products. Hemp companies are increasingly finding available shelf space at liquor stores such as national chain Total Wine and Spirits, which has begun stocking HDC beverage brands in select states including Minnesota and Connecticut.

“Liquor stores are reporting significant sales and public response is overwhelmingly positive,” said Lackner. “Growth comes in markets where there are sensible regulations that protect consumers, allow for reasonable milligram levels, and keep these drinks away from children. That’s because sensible regulations allow for bigger stores and distributors to get into the industry. Minnesota continues to be the leader in the category, but we expect sales to boom anywhere smart regulations are in place.”

Hemp beverages seem to be growing in market share regardless of the status of legal adult-use cannabis, according to Lackner. He suggested that hemp beverages are more likely to compete with beer, wine and hard seltzers.

Cheech and Chong’s Global Holding Co. has partnered with Minnesota-based Bent Paddle Brewery to launch a line of hemp seltzers that are available nationally. The holding company’s president, Brandon Harshberger, noted that their seltzers have been doing particularly well in California and Illinois.

“We focus predominantly on liquor stores and retail locations that are critical to our message of making sure these products are sold in a safe and age compliant environment,” he said.

Adam Terry, CEO of Cantrip and Murr-Ma distilling company, said that rather than competing with alcoholic beverages, THC drinks offer a way for alcohol companies to buy into the market. Several beer companies, including Anheueser-Busch and the Boston Beer Company, are exploring the opportunity.

“The supplier side will eventually start acquiring in the hemp THC space,” said Terry. “It’s not that far off from when White Claw and Truly started spoiling beer sales.”

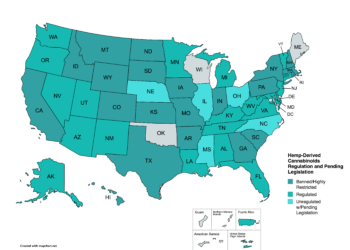

Even as the market for hemp beverages continues to grow, more and more states are targeting the drinks.

“Policy concerns have been a main driver in our decision to engage a lobbyist here in California,” said Harshberger. “We did this to actively engage the entire cannabis community with a balanced conversation addressing how beneficial low dose beverages are, with the right policy. With that said, we’ve witnessed a lot of policy wins in Illinois and Florida recently.”

Florida attempted to pass a broader ban on hemp-derived THC, but Governor Ron DeSantis vetoed it on June 7.

The Illinois legislature attempted to tackle hemp beverages as part of a larger effort to curb hemp-derived products, but the bill, HB 4293, stalled out in the state house which ended its legislative session at the end of May. The largest opponents were from local breweries that had begun dabbling in the hemp beverage market.

Similarly, Iowa passed a law, HF 2605, last May that limited the amount of allowable THC in hemp-derived beverages and was then sued by Climbing Kites and Field Day Brewing. The two companies, who are local producers of hemp beverage that the newly-enacted 4 mg limit on THC content would effectively kill significant portions of their product lines.

“This state-law potency limit violates the Supremacy Clause because it attempts to regulate matters exclusively reserved to the federal government as evidenced by Congress’s express preemption provisions,” said the plaintiffs in the 13-page complaint they filed on June 17.

The companies sought a temporary injunction against the new rules, Kites LLC et all v. State of Iowa et al, in the U.S. District Court of Iowa. The court denied the motion for an injunction on July 2, arguing that the plaintiff companies failed to show that federal law should preempt any state regulation limiting THC content.

Connecticut managed to pass a similar measure in with SB 200, which was amended to allow hemp beverages to be sold in regulated cannabis retail shops as well as liquor stores.

Businesses with existing inventories of hemp beverages were allowed to sell their stock until June 30, as long as they submitted their inventory record to the state and paid a fee of $1 per can.

Meanwhile, the Massachusetts Alcoholic Beverages Control Commission released a memo on May 29, asserting that stores with alcohol licenses were not permitted to also sell hemp beverages.