If we called what happened in May 2024 a cannabis equities “mini-crash,” we might as well call June “the rebound that didn’t happen.” When markets closed on June 28, cannabis stocks had added to their losses for the second straight month. But even more importantly, they added distance between investors and the April 30 rally, which (lest we forget) was related to DEA rescheduling. But as we have said many times, hope springs eternal, and we certainly hope there is a pot of gold at the end of the rainbow.

To add insult to injury, a perfect storm of distractions in Washington are making any progress toward federal legalization or rescheduling hard to imagine. However, there’s always activity at the state level, and even red states like South Dakota (see regulatory section below) are passing cannabis reforms. Lawmakers in Congress will continue to push for reforms at the federal level, and if (a big if) Democrats win the House, hold the Senate, and win the presidency, we could see reforms in 2025. Hence the weak market for cannabis equities. But we digress.

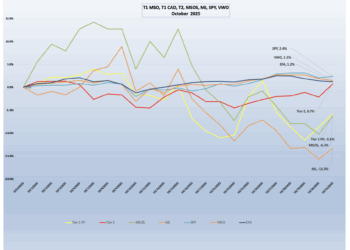

Looking at the chart below, we can see the weakness, with Tier 1 pure play companies and cannabis-themed funds all getting crushed following the all-too-brief April 30 feeding frenzy.

Cannabis-Linked Equity Performance, June 2024

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), took it on the chin in June along with the rest of the group. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index. HERBAL’s performance was consistent with the rest of the cannabis field in June, posting a return of -11.8%.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-8.6%) and the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-6.8%), continued on a downward trend that started immediately following the April 30 euphoria, which is now becoming a distant memory. Unlike HERBAL, which is designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching MJ exposure tend to be more sensitive to the U.S. regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s and other cannabis-themed ETPs due to its current unconventional composition. Since its origin, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally, in 2022, MJ added and maintains a nearly 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The U.S. plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It’s also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

Monthly returns of the self-described (and largest) U.S plant-touching ETF, MSOS, can also deviate materially from HERBAL’s (as it did in June), largely due to its significant holding in CRBs with U.S. marijuana touch points.

The recently expanded CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap returned -8.4% in June. This basket, which is an equally weighted portfolio of the 22 largest pure play CRBs (including both U.S. plant-touching and non-plant-touching MJ companies), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take a closer look at some of these below.

The also-expanded CRB Monitor equally-weighted basket of Tier 2 CRBs finished the month significantly ahead of the Tier 1 CRB basket, posting a -3.1% return for June. In February 2024, CRB Monitor published an update to our piece on correlations of pure play Tier 1 and Tier 2 CRBs (among other tiers and baskets). What we have observed historically is these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time.

U.S. equities continued on their two-month run in June and hit their historic highs, with the S&P 500 index posting seven new closing highs and bringing its YTD total to 31. The index was up 3.6% for the month which came after May’s gain of 5% and April’s anomalous loss of -4.1%. Year-to-date, the S&P 500’s return through June is 15.3%, which annualizes to a return of 33%. The Federal Reserve said all 31 big banks passed their annual stress test, which included a simulation of a 10% U.S. unemployment rate, a 32% decline in housing prices and a 40% drop in commercial real estate. After the end of the month, the banks started to announce their intent to increase their dividends, as well as update their share repurchase program. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a 4.1% return for the month (now 11.3% YTD) and added to its record-setting levels.

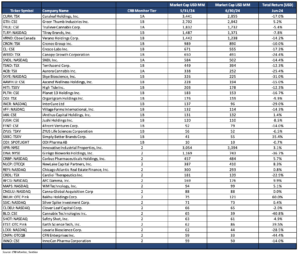

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – June 2024 Returns

CRB Monitor Tier 1

An equally weighted basket of the largest Tier 1 pure-play cannabis equities had a -8.4% return in June, in a continuation of their reversal of April’s gains, which were related to the positive investor vibes surrounding THC rescheduling. This can be seen in the table above, where we witnessed pain and suffering across much of the entire publicly traded CRB space, hitting both the MSO (U.S. plant-touching) group and Canadian (CSA-friendly) CRBs. Investors of cannabis equities (those brave investors who have hung on) for the most part took a big hit, and we have some of the highlights below:

As we seem to report more often than not, CRB performance struggled in June, and while there were some bright moments during the month, results went back to miserable by month end. Returns were negative essentially across the board, for the MSO basket: Tier 1B Cresco Labs Inc. (CSE: CL) (-17.3%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-14.2%), Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-17.0%), Tier 1B TerrAscend Corp. (TSX: TSND) (-12.3%), and Tier 1A CRB The Cannabist Company Holdings Inc. (CBOE Canada: CBST) (-18.8%). Miraculously, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (5.2%) managed to eke out a positive return, as it continued to expand its footprint in Florida. Back on the negative side were Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) (-5.4%) as we follow their efforts to recover $100+ million in Schedule 280-E taxes that it has historically paid.

Not looking any better in June were companies that make up the Canadian CRB basket, as we are reminded that investors view their fate to be tied to the success or failure of cannabis reforms in the United States. And their performance struggled along with the MSO group, with Canopy Growth Corporation (TSX: WEED) (-24.4%), Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-14.4%), and Tier 1B Cronos Group Inc. (TSX: CRON) (-10.0%) all extending their May 2024 losses. Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) (-7.8%), Tier 1A Aurora Cannabis (TSX: ACB) (-25.4%) suffered in June as well, following spectacular returns in April. And Tier 1B High Tide Inc. (TSXV: HITI) (-12.3%) collapsed after being one of the only CRBs with a positive return in May.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies posted a negative 3.2% return for June, which outperformed the equally weighted Tier 1 basket by 5.2%. Typically, these two baskets are highly correlated (please see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to even out over time. When these two portfolios deviate from one another (as they did in April and then changed places in June) a deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so beware!

The largest CRB in the basket, Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (3.1%), outperformed most of the Tier 1 CRBs that lease property from them. IIPR’s stock price has continued to rise over the last 12 months, having maintained stable earnings throughout that difficult period. As we reported last month, IIPR reported its first quarter results on May 8, which featured the following highlights:

- “Generated total revenues of $75.5 million and net income attributable to common stockholders of $39.1 million, or $1.36 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of $63.0 million and $56.4 million, respectively.

- Paid a quarterly dividend of $1.82 per common share on April 15, 2024 to stockholders of record as of March 28, 2024 (an AFFO payout ratio of 82%). The common stock dividends declared for the twelve months ended March 31, 2024 total $7.24 per common share.”

Tier 2 REIT AFC Gamma, Inc. (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+9.9%) finished ahead of IIPR in June and outperformed many of its Tier 1 clients. On May 9, AFCG reported its first quarter 2024 earnings which featured the following statement from CEO Daniel Neville:

“We are pleased to have originated a total of $90.4 million of loans in the first quarter of 2024, with $34.0 million in loans to cannabis operators and $56.4 million to commercial real estate developers. On the cannabis side, we completed a $34.0 million debt investment in Sunburn Cannabis, a private, vertically integrated single-state Florida operator…The investment underscores our commitment to fostering long-lasting relationships with our borrowers and focusing on limited license states with attractive supply and demand dynamics. Additionally, we are encouraged by the promising legislative developments at both the federal and state level, including the anticipated rescheduling at the federal level and the potential transition to adult-use cannabis in states like Ohio and Florida.”

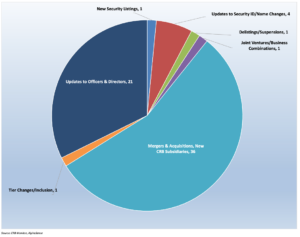

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for June 2024:

Cannabis Business Transaction News

In spite of the chaotic political landscape in Washington, the cannabis news cycle continues in earnest and CRB Monitor’s analysts go to the ends of the earth (literally) to track all the relevant news that should be of use to all of those who take an interest in this volatile industry. The goal is not only to inform our subscribers, but to ensure that the CRB Monitor database is updated so that it accurately reflects this active global news cycle every day.

Here are some of the highlights from June 2024:

First, we continue to hear about the activities from Tier 1B Canadian CRB High Tide Inc. (TSXV: HITI), which issued a June 3 press release announcing its “Canna Cabana retail cannabis store located at 17 Hanes Road, Huntsville, Ontario will begin selling recreational cannabis products and consumption accessories for adult use.” In the words of the press release, “This opening will mark High Tide’s 172nd Canna Cabana branded retail cannabis location in Canada, the 63rd in the province of Ontario and the first store in Huntsville.”

With this addition, High Tide’s operational footprint expands to 202 licenses in either active status or pending approval.

We then travel up the coast to Maryland, where Tier 1B MSO TerrAscend Corp. (CSE: TER) announced in a June 10 press release the opening of The Apothecarium Nottingham, Terrascend’s fourth retail location in Maryland and 39th dispensary nationwide.

“The Apothecarium Nottingham is a sophisticated retail venue featuring a convenient drive-thru and expanded floor space. It offers our wide selection of high-quality cannabis products and brands designed to meet the diverse needs of customers across Baltimore County and beyond, including Kind Tree, Legend, Cookies, Wana, Valhalla, and GAGE Cannabis,” states the press release.

With this new addition, Terrascend’s operational footprint expands to 101 active or pending licenses across seven states and two Canadian provinces.

Household CRB name and Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) made news in June 19 announcing in a press release “the opening RISE Dispensary New Port Richey, the Company’s 17th retail location in Florida and 94th nationwide.” In the words of the announcement, “The dispensary…will offer medical patients a diverse collection of cannabis products, including RYTHM premium flower and full spectrum vapes, Dogwalkers pre-rolls, Good Green flower, Dr. Solomon’s tinctures and & Shine flower, pre-rolls, vapes and chews.”

Green Thumb, which has been a top-three CRB by market cap for the last 2+ years, now holds 97 active licenses across 15 states in the U.S.

Finally, legendary Canadian Tier 1B CRB Canopy Growth Corporation (TSX: WEED) made news June 19 with the announcement that “the option to acquire all of the issued and outstanding Class E subordinate voting shares of Acreage Holdings has been exercised per the terms of the arrangement agreement between Canopy Growth and Acreage. In connection with the arrangement agreement dated October 24, 2022, Canopy U.S.A. will acquire all of the fixed shares and floating shares and Acreage will become a wholly-owned subsidiary of Canopy U.S.A. In addition, Canopy announced that it exercised its option, in part, to acquire certain outstanding debt of Acreage in connection with the option agreement dated November 15, 2022, among a wholly-owned subsidiary of Canopy and the lenders’ party to Acreage’s credit agreement dated as of December 2021, as amended on October 24, 2022, and April 28, 2023.”

So the question to ask is, does this exercise now make Canopy Growth a U.S. marijuana business, and if so, why are the TSX and Nasdaq still allowing it to list? That is an excellent question, because when these options were originally issued, the assumption was that Canopy Growth would only exercise them and take ownership of Acreage when the U.S. legalized marijuana (a nice summary is presented in this article from The Street). This saga has been evolving since shortly after the deal was struck. A September 2020 press release announced an amendment to the original agreement, which altered the terms but still keeps things legal under U.S. federal statute.

Now fast forward to June 2024, and Canopy Growth announced that it has exercised the options, but the transaction is not executed by the parent company (which would be in violation of the CSA) but rather by Canopy USA, a private holding company with an arm’s length relationship to Canopy Growth Corp. Therefore for institutional compliance officers who might be concerned about this from a CSA-restriction perspective, we are happy to discuss the particulars because there is no right answer to this one.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Red Light Holland Corp. | CSE: TRIP | Tier 1B | Departure of CFO (RED LIGHT HOLLAND CORP) |

| Planet 13 Holdings Inc. | CSE: PLTH | Tier 1B | Planet 13 Announces the Appointment of David Loop to the Board of Directors |

| RIV Capital Inc. | TSX: RIV | Tier 1B | RIV Capital Appoints David Vautrin Chief Retail Officer Ahead of Anticipated Merger with Cansortium |

| Ascend Wellness Holdings, Inc. | CSE: AAWH.U | Tier 1B | Ascend Wellness Holdings Appoints Julie Francis to Board of Directors |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Simply Solventless Concentrates Ltd. | TSXV: HASH | Add | Tier 1B – Owner/Investor |

| Arogo Capital Acquisition Corp. | NASDAD: AOGO | Add | Tier 1B – Owner/Investor |

| FBEC Worldwide, Inc. | OTC Pink: FBEC | Move to Watchlist | Tier 2 – CBD – Food, Beverage & Tobacco |

| BioHarvest Sciences Inc. | CSE: BHSC | Move to Watchlist | Tier 2 – Pharma & Biotech |

| Nhale, Inc. | OTC Pink: NHLE | Move to Watchlist | Tier 2 – Electronic Equipment |

Cannabis News: Regulatory Updates

While the political landscape both in the U.S. and globally continues to evolve, cannabis-related news tends to get buried under the pile of election-based stories that will most likely dominate the cycle for the next few months. And given the recent U.S. election shake-up and associated revelations, it is unlikely that Congress would be inclined to pass any meaningful cannabis-related legislative reforms before 2025. Nevertheless, there are newsworthy developments at the state level and internationally, and our CRB Monitor News and Research teams are hard at work digesting and reporting these developments, which have significant implications for cannabis investors, businesses, regulators, and even casual observers, for the future of this ever-emerging industry.

Here are some regulatory highlights from June:

While not quite approaching the discussion of legalizing marijuana, the U.S. federal government was active with a piece of cannabis-related legislation, as the House of Representatives approved a large-scale defense bill that includes a section to “prevent military branches from testing recruits for marijuana as a condition of enlistment.” According to a story in Marijuana Moment, “While the House Rules Committee on Tuesday blocked a number of pro- and anti-cannabis amendments from floor consideration, the full chamber’s approval of the underlying bill means the military marijuana screening section, as well as psychedelics report language, is advancing.”

In other state legislative news, for the third time, South Dakotans will be able to vote to legalize adult-use of cannabis. A ballot initiative submitted by South Dakotans for Beter Marijuana Laws was validated by the Secretary of State on June 3.

Next, we move to New York. Our CRB Monitor News Team published a June 19 article entitled “New York Continues Its Hot Streak Of License Approvals.” This story should be interesting for anyone who has followed the checkered history of cannabis licensing, or lack thereof, in the state of New York. Our team reported that New York’s Cannabis Control Board “approved 105 more licenses and denied 100 applications during its monthly meeting on June 11, as the embattled agency continues to transition leadership. The 105 new adult-use licenses included 25 cultivator, 22 distributor, 22 microbusiness, 19 processor and 17 retail.” The article goes on to state, “the CCB denied approval to 21 conditional adult-use retail dispensary applicants for either failure to show that the applicant had a prior cannabis conviction in New York or they failed to disclose a proper business structure. The board also denied 79 applications for annual licenses because the recipients had already exceeded the maximum number retail licenses.”

Where does this leave New York today? This new flurry of cannabis licenses of all types “brought the total number of adult-use licenses approved in New York this year to 654, according to Chief Operating Officer Patrick McKeage of the Office of Cannabis Management (OCM). They include 132 dispensaries that have opened for business, of which 65 are in New York City and Long Island, while the remaining 67 are evenly spread across the rest of the state.”

Now for some somber news out of the Granite State: In an article published in MJ Biz Daily, once again New Hampshire continues to be the only state in New England “without a regulated adult-use cannabis program after state lawmakers refused to compromise on a controversial legalization bill.” Those of us close to the cannabis biz tend to scratch our heads when a state that generally leans left struggles to get recreational cannabis over the finish line. In the words of the article, “As expected, Republican Gov. Chris Sununu’s vision for a unique state-run sales model – 14 government-owned marijuana stores throughout the state – failed 178-173 with lawmakers in the libertarian-leaning state House of Representatives, the Associated Press reported.”

The effort to legalize adult-use marijuana in New Hampshire is unique, as the governor’s plan provides very little opportunity for business-owners to participate, which is a parallel with the state-run liquor industry. The article goes on to report, “According to the Associated Press, Democratic state Rep. Jared Sullivan called Sununu’s marijuana legalization idea ‘the most intrusive, big-government marijuana program proposed anywhere in the country, one that ignores free-market principles, will stifle innovation in an emerging industry and tie future generations of Granite Staters to an inferior model indefinitely.’”

CRBs In the News

The following is a sampling of highlights from the June 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update, Defining “Cannabis-Related Business”.