Once again cannabis equities took a double-digit beating after a brief flurry of optimism at mid-month. Truth be told, August is typically a month when investors go on holiday, which leaves little support for these microcaps when negative sentiment rears its ugly head. And let’s face it, those optimistic events that get played repeatedly — rescheduling, safe banking and legalization — are “eventually going to happen,” but precisely when has had investors waiting on the sidelines for the better part of the last three years.

When these regulatory reforms finally go into effect, what might happen then? That is anyone’s guess, but so much oxygen has been sucked out of this market that we could imagine, given their tiny aggregate market cap, that one large corporate buyer could swoop down and acquire them all. Is this possible? Well, the total market cap of largest 20 Tier 1 pure play CRBs is currently less than $15 billion, which is a small- to medium-sized M&A deal by today’s standards (the current Verizon/Frontier deal is $20 billion; Blackstone/Airtrunk is $16 billion).

As time grows short leading up to the November election, it is not surprising that there’s widespread majority support for cannabis legalization, DEA rescheduling and “safe” banking access across the U.S., and most importantly in swing states like Pennsylvania, Wisconsin and Michigan. Given that Florida is a critical state for cannabis reform, with adult-use legalization on the November ballot, one of its more famous residents chimed in right at the end of August. Former President Donald Trump stated (if you can believe him) that he believes voters in his home state of Florida will approve a marijuana legalization initiative on the November ballot, arguing that “someone should not be a criminal in Florida, when it’s legal in so many other States.”

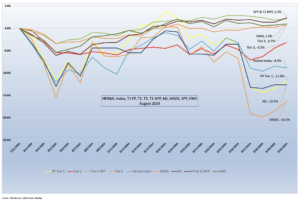

Cannabis-Linked Equity Performance, August 2024

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), was negative in August along with the rest of the companies in the cannabis sector. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index. If it’s any consolation, HERBAL outperformed most of the cannabis field in August, posting a return of -8.9%.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-12.6%) and the actively managed, MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-16.3%), had negative returns. Both of these funds are benchmarked to broad CRB indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching MJ exposure tend to be more sensitive than HERBAL to the U.S. regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin in 2017, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally in 2022, MJ added and maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The U.S. plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It is also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

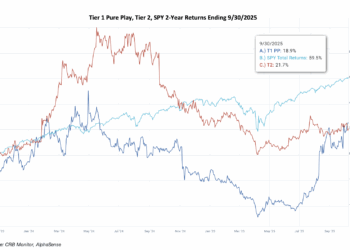

The performance of the recently-expanded CRB Monitor equally weighted basket of top pure play Tier 1 CRBs by market cap pulled back in August, returning -11.8%. This basket, which is an equally weighted portfolio of the 21 largest pure play CRBs (including both U.S. plant-touching and non-U.S. plant-touching MJ companies), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take closer look at some of these below.

The CRB Monitor equally weighted basket of Tier 2 CRBs outpaced the Tier 1 CRB basket, posting a -3.2% return for August. Back in February, CRB Monitor published an update to our piece on correlations of pure play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. We update this data a couple of times per year.

In August, U.S. equities continued July’s volatility and uncertainty, while delivering positive returns for investors (2.28%, 2.43% with dividends). In U.S. election news, the Democratic National Convention, held Aug. 19 to 22, nominated Vice President Kamala Harris as its candidate for president and Minnesota Governor Tim Walz for vice president. They will oppose the Republican ticket of former president Donald Trump for president and Senator J.D. Vance from Ohio for vice president in the November election. Campaigning for the presidential election increased, as polls showed a close race, with most within the statistical margin of error for the White House and conflicting predictions for the control of Congress (Senate and House of Representatives). The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a +2.4% return for the month (now +19.5% YTD).

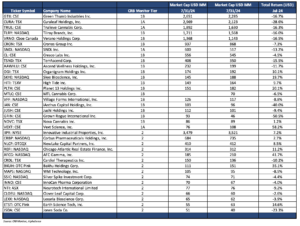

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – August 2024 Returns

CRB Monitor Tier 1

An equally weighted basket of the largest Tier 1 pure play cannabis equities had a -11.8% return in August, with prices showing signs of fatigue and melancholy at summer’s end. This is clear from the data on the table above, where there are a few scattered rays of sunshine splashed across the generally dismal publicly traded CRB space, including both the MSO (U.S. plant-touching) group and Canadian (CSA-Friendly) CRBs. Investors of cannabis equities appear to be out of answers as they await any form of good news, but they will have to wait until after the November election and perhaps will into First Quarter 2025 for any positive action from the federal government.

With a few exceptions, CRB performance suffered in August across the universe of Tier 1 cannabis stocks. The MSO basket had very little to write home about, with Tier 1B Cresco Labs Inc. (CSE: CL) (-4.5%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-16.5%), Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (-16.3%), Tier 1B TerrAscend Corp. (TSX: TSND) (-15.5%), and worst of all, Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-28.6%) dashing investors’ hopes for a pleasant end to the summer. And the largest CRB by market cap, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-16.7%) provided no end-of-summer relief either.

Looking at the Canadian CRB basket, August returns were similarly disappointing. As always we are reminded that the future of this group is viewed by investors to be tied to the success or failure of cannabis reforms in the United States. Canopy Growth Corporation (TSX: WEED) (-33.2%), Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-13.2%), and Tier 1B Cronos Group Inc. (TSX: CRON) (-7.3%) all reversing their July gains. Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) (-16.0%) languished as it continued to build up its beverage portfolio. And Tier 1B High Tide Inc. (TSXV: HITI) (+9.7) provided a ray of hope in August, as it continued with its retail expansion in Canada.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies posted a negative 3.2% return for August, which outperformed the equally weighted Tier 1 basket by 8.6%. Typically, these two baskets are highly correlated (please see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to even out over time. When these two portfolios deviate from one another (as they did in April and then changed places in August) a deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so beware!

The largest CRB in the basket, Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+7.2%), once again outperformed nearly all of the Tier 1 CRBs that lease property from them. IIPR’s stock price has continued to rise over the last 12 or more months, having maintained stable earnings throughout that difficult period. In early August, IIPR reported its second quarter 2024 results which appeared to have buoyed investor optimism. Here are the highlights:

- “Generated total revenues of $79.8 million and net income attributable to common stockholders of $41.7 million, or $1.44 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of $65.5 million and $58.8 million, respectively.

- Paid a quarterly dividend of $1.90 per common share on July 15, 2024 to stockholders of record as of June 28, 2024 (an AFFO payout ratio of 83%), representing a 4.4% increase over IIP’s first quarter 2024 dividend and an annualized dividend of $7.60 per common share.”

Tier 2 REIT AFC Gamma, Inc. (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+41.7%) had a spectacular August and vastly outperformed many of its Tier 1 CRB lending clients. On August 7, AFCG reported its second quarter 2024 earnings, which featured the following statement from CEO Daniel Neville:

“We are excited to announce that AFC is now a pure-play cannabis lender after the spin-off of our commercial real estate portfolio on July 9, 2024. This transition positions us well to capitalize on cannabis market opportunities, and we are on track to meet or exceed our $100 million origination goal for this year. This quarter has been marked by strong performance. Our active portfolio management is showing positive momentum, with reduced reserves and increased book value, highlighting the effectiveness of our strategic initiatives.”

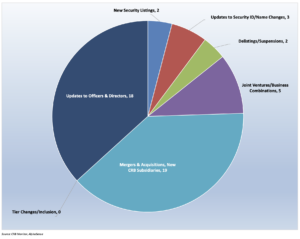

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for August 2024:

Cannabis Business Transaction News – August 2024

As the world turns and seemingly larger issues prevail in the news cycle, the cannabis industry finds itself at a particularly difficult time in its yet-to-be-written full story. It seems as though we have been on this perilous trail for a number of years throughout which we expected progress but rather have been treated to a series of false starts and scattered dreams. We have seen a veritable stoppage in M&A activity as investors and CRBs bore witness to the last, failed attempt at a significant deal (Cresco/Columbia Care) and have since lost interest in taking any new chances in that arena again.

In a world where the universe of public companies has lost more than 80% of its value over the last 3 years we are compelled to ask the question, “Where will help come from?” It seems like a layup, given that the total market cap of the largest 20 CRBs would still be a mid-cap company if they were combined into one. In other words, it really shouldn’t be much of a stretch to imagine that when legalization finally becomes a reality (in someone’s lifetime) that this group of scrappy little CRBs will be target-rich, and it is not difficult to imagine the possibility of a package deal. We will not explore the interesting prospect of this here, but it will likely be the subject of a future article by the CRB Monitor securities research team.

For now, here are some of the highlights from August:

First let’s once again head down to the Sunshine State (aka Florida) where Tier 1A MSO Trulieve Cannabis Corp. (CSE:TRUL) issued a press release announcing the opening of a new medical cannabis dispensary in New Port Richey, Fla. According to the announcement, “Trulieve New Port Richey SR54 will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, O.pen, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

Trulieve currently holds 122 active licenses in the U.S. and Canada.

We will keep taking a look at new cannabis operations in Florida, where Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) announced on August 9 that it will open a new medical dispensary in the Sunshine State.

In the words of the press release, “Curaleaf Pensacola, located at 2E 9 Mile Rd, Pensacola, FL 32534, will begin welcoming patients on Friday, August 9. The Company’s latest expansion in the Sunshine State will increase its retail footprint to 63 retail locations statewide and 149 nationwide. Curaleaf Pensacola is the Company’s second medical dispensary in the area, conveniently located in the shopping district along the city’s historic Nine Mile Road. The Company’s latest expansion will reach more patients in northwest Florida, providing access to a wide selection of cannabis products and brands, including the new Select Fruit STIQ all-in-one vape, JAMS edibles, B NOBLE, and the Company’s all-in-one two gram vape, Select BRIQ.”

Curaleaf currently holds a total of 118 active licenses across six countries with the majority of those issued by authorities in 20 U.S. states.

Apparently batting “cleanup,” Tier 1B Canadian CRB Sundial Growers Inc. (NASDAQ: SNDL) announced in an August press release that that it “has completed the acquisition of the principal indebtedness of Delta 9 Cannabis Inc. from Connect First and Servus Credit Union Ltd. for a purchase price of CAD $28,138,284 pursuant to a purchase and sale of indebtedness agreement dated July 5, 2024. As a result of the Debt Acquisition, SNDL has become Delta 9’s senior secured creditor with a first priority security interest in all of the assets of Delta 9 and certain Delta 9 subsidiaries. The Purchased Indebtedness brings Delta 9’s total indebtedness owing to SNDL to CAD $40,653,352.”

Sundial, which also announced a major cost-cutting campaign in July that will feature significant reductions in the workforce, currently operates in eight Canadian provinces and holds (through its subsidiaries) 130 active cannabis licenses.

Canadian “power CRB” Tilray Brands, Inc. (NASDAQ: TLRY) announced in an August press release that it “has entered into a definitive agreement to acquire four craft breweries from Molson Coors Beverage Co., Chicago. The acquisition includes Hop Valley Brewing Co., Terrapin Beer Co., Revolver Brewing and Atwater Brewery. Tilray’s beverage business is poised for even greater success with the latest addition of sought-after craft beer brands, known for their unique portfolio of beers. With the pending acquisition of these breweries, Tilray’s portfolio will expand across key beer markets adding 30% new beer buying accounts.”

What is interesting here is Tilray’s expansion into the non-THC-infused beverage market and makes us curious about what could be the endgame. Perhaps the acquisition of these craft brewers is part of a long-term strategy to integrate them with cannabis beverages down the road. Stay tuned! Currently Tilray’s cannabis-related operations are in 10 countries outside the US and it holds 333 active cannabis licenses.

Finally, Tier 1B MSO Verano Holdings Corp. (CSE: VRNO), issued an August 22 press release announcing the closing of acquisitions “pursuant to agreements previously announced on July 29, 2024, and acquired all of the ownership interests of three subsidiaries of The Cannabist Company Holdings Inc. (Cboe CA: CBST), one of the most experienced cultivators, manufacturers and retailers of cannabis products in the U.S. Two subsidiaries, 203 Organix, L.L.C. and Salubrious Wellness Center, Inc. operate in Arizona, and the third subsidiary, Columbia Care Eastern Virginia LLC, operates in Virginia. In Virginia, Verano will be the sole vertical cannabis operator in HSA 5 in Eastern Virginia – a region with nearly two million residents and 14 million annual tourists – and gains an active cultivation and production facility and six operational dispensaries in Hampton, Norfolk, Portsmouth, Suffolk, Virginia Beach and Williamsburg. In Arizona, Verano gains an active cultivation and production facility and raises the Company’s retail footprint to eight locations with the addition of stores in Tempe and Prescott, complementing its existing six Zen Leaf dispensaries and multiple cultivation and processing facilities in the state.”

This could be a hint of what might be the final act for The Cannabist, which was riding high in 2022 and 2023 ahead of its failed M&A deal with Tier 1B MSO Cresco Labs Inc. (CSE: CL). Currently Verano Holdings holds 76 active licenses through its subsidiary businesses across 14 United States.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Curaleaf Holdings, Inc. | CSE: CURA | Tier 1A | Curaleaf Announces CEO Transition |

| Agrify Corporation | NASDAQ: AGFY | Tier 1A | Agrify Corporation Announces Results from Annual Meeting of Stockholders |

| Global Hemp Group Inc. | CSE: GHG | Tier 1B | Welcomes Christopher Cherry as its New CFO (GLOBAL HEMP GROUP INC) |

| Dr. Reddy’s Laboratories Limited | NYSE: RDY | Tier 1B | Dr. Reddy’s and Nestle Health Science names Mansi Khanna as COO |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| GPO Plus, Inc. | OTCQB: GPOX | Downgraded to Tier 3 | Tier 2 – CBD – Online Wholesale & Retail |

| Bettermoo(d) Food Corporation | CSE: MOOO | Downgraded to Tier 3 | Tier 2 – CBD – Food, Beverage & Tobacco |

| Quanta, Inc. | OTC Expert: QNTA | Moved to Watchlist | Tier 3 – CBD – Personal Products |

| Jinhua Capital Corporation | TSXV: JHC | Moved to Watchlist | Tier 2 – SPAC |

| Ackrell SPAC Partners | NASDAQ: ACKIU | Moved to Watchlist | Tier 2 – SPAC |

Cannabis News: Regulatory Updates

As the summer winds down we are seeing a ramping up (of sorts) of discussion surrounding all the usual cannabis-related issues, including safe banking, rescheduling, and of course, legalization. It is surprising that we still have states in the nation where marijuana is illegal for any type of use, but they do exist and efforts to legalize and decriminalize cannabis in these states (Idaho, Kansas, South Carolina and Wyoming) have fallen short. With that said, six states (Florida, South Dakota, Oregon, North Dakota, Nebraska and Arkansas) have marijuana-related initiatives on the November 5 ballot and, knowing how popular legalization is, we are eager to see how they all play out.

On that note, here are some regulatory highlights from August:

Let’s begin in New York: In an article from our very own CRB Monitor News team, we read that “New York’s Office of Cannabis Management is anticipating that the state market could surpass $5 billion annually once the market matures. Toward that end, the state Cannabis Control Board continued its months-long streak of approving adult-use cannabis licenses, with some bullish expectations about the future of the state’s market.”

From our point of view, it’s difficult to understand why it has been taking so long for New York’s cannabis market to take off, given the population and level of income and sophistication of this state.

And we suspect that we know the answer to that, but our news team confirms our fears: “We already know that consumers in New York are currently spending roughly $5 billion on unregulated cannabis as it is,” said OCM Policy Director John Kagia during the Aug. 6 meeting of the Cannabis Control Board. “We do think that once the market is fully optimized it will be capturing at least that level of demand.”

Finally, some words of comfort for New York’s licensed CRBs: “While ramping up on licensing, the state has also been increasing its enforcement efforts against illicit shops… As a result of these enforcement efforts, legal cannabis owners, especially those who have been open more than 12 weeks, have reported a 50% increase in sales since June. … Legal dispensaries in operation within New York City have reported a 99% increase.”

Our next story, also from our CRB Monitor News team has an impact for multiple states and regards the current state of hemp legalization and litigation in 2024. Hemp has become a bit of a conundrum for our nation since the passage of The Agriculture Improvement Act of 2018 (2018 Farm Bill). Legalization of hemp has opened the doors to a wide range of products and has bolstered economies, particularly in states that lend themselves to outside cultivation. There has been a downside, however, as hemp producers have used the Farm Bill to pave the way to the production of THC-based extracts which have made their way into mainstream culture across the U.S.

This particular CRB Monitor story focuses on that downside: “The battle against hemp-derived cannabinoids (HDCs) certainly got hotter this year as several more states passed laws to regulate them, and hemp companies pushed back in courts. Meanwhile, language that would ban virtually all hemp-derived THC, and potentially even CBD, in consumable products has made it into two significant federal agriculture bills. The Republican-led House Agriculture Committee in May approved the draft Farm, Food and National Security Act of 2024, better known as the Farm Bill (HR 8467). Hemp industry advocates were seemingly caught off guard when an amendment by Rep. Mary Miller was included. It would change the definition of legal industrial hemp to contain no more than 0.3% total THC, rather than just delta-9. It also excludes ‘cannabinoids that are not capable of being naturally produced by a Cannabis sativa L. plant” and naturally occurring cannabinoids that “were synthesized or manufactured outside the plant.’”

Now we travel west, where North Dakota officials approved a marijuana legalization measure for November’s ballot. In an article published in Marijuana Moment it was reported that North Dakota voters will have the chance to legalize adult-use marijuana at the polls this fall.

According to the article, “Secretary of State Michael Howe (R) certified on Monday that organizers behind a legalization initiative had collected enough valid voter signatures to put the measure on November’s ballot.”

The report highlights some of the aspects of the proposed legislation, should it come to pass: “Under the new legalization measure, adults 21 and older would be able to possess up to one ounce of marijuana flower, four grams of concentrate and 300 milligrams of edibles that they could buy from a limited number of licensed dispensaries. Adults could also grow up to three plants for personal use, with a six-plant cap per household. … The new proposal would limit regulators to approving licenses for up to seven cannabis manufacturers and 18 retailers. There are also provisions meant to avoid creating intrastate monopolies, such as limiting licensees to no more than four dispensaries.”

The article provides further context of what could happen should this ballot question pass: “Currently, there are eight medical cannabis dispensaries operating in North Dakota. The initiative requires regulators to develop separate application processes for those businesses to become dual licensees and non-existing companies that wish to become recreational operators.”

Continuing with our “ballot question” theme, we head down to Nebraska, where an August article in MJ Biz Daily reported that two proposed referendums in Nebraska that “would legalize medical marijuana and protect MMJ patients from prosecution” appear to have qualified for the state’s November ballot. The article points out that “Secretary of State Bob Evnen has asked county election offices to continue verifying signatures until they reach the 110% threshold required by Nebraska law.”

The story goes on to report some of the details: “Separate petitions to put the Nebraska Medical Cannabis Patient Protection Initiative and the Nebraska Medical Cannabis Regulation Initiative on the ballot both surpassed the requirement of 87,126 valid signatures to make it onto the Nov. 5 ballot, according to a Friday news release from the secretary of state’s office. … The release noted that the petitions had not yet been certified but confirmed that 89,051 valid signatures had been collected. The measures ‘will qualify’ once verification and certification are complete, according to the release. Nebraskans for Medical Marijuana, the group behind both measures, submitted more than 114,000 signatures for both petitions on July 3. The Nebraska Medical Cannabis Regulation Initiative would create the Nebraska Medical Cannabis Commission, which would regulate medical marijuana businesses in the state.”

We will be watching this one closely, given that the people of scarlet-red Nebraska have failed in their last two attempts (2020 and 2022) at cannabis reform.

Finally, a story from the Commonwealth of Massachusetts: yet another interesting article from our CRB Monitor News team reported in August that Massachusetts is seeing a jump in inactive licenses. “A market correction could be in the works in Massachusetts, as the state’s Cannabis Control Commission has seen a jump in non-active licenses in recent months, indicating that more operators are unable to survive in the tightening adult-use cannabis market. … Businesses, including Heka Inc., TYCA Green Inc., and even Fine Fettle on Martha’s Vineyard, have reportedly closed facilities or are in the process of doing so. Licenses become non-active when they are either revoked by the state, voluntarily surrendered or allowed to expire, which typically happens when a licensee goes out of business. Expiration is the most common reason that a license becomes inactive, according to the CCC.”

Are we surprised at this news? While it is true that our focus is largely on the publicly traded CRB space, it is impossible to analyze the success or failure of the parent companies without a full understanding of the businesses that operate in the states and provinces. [Our Chart of the Month (above) sheds some additional light on this topic.]

CRBs In the News

The following is a sampling of highlights from the August 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.