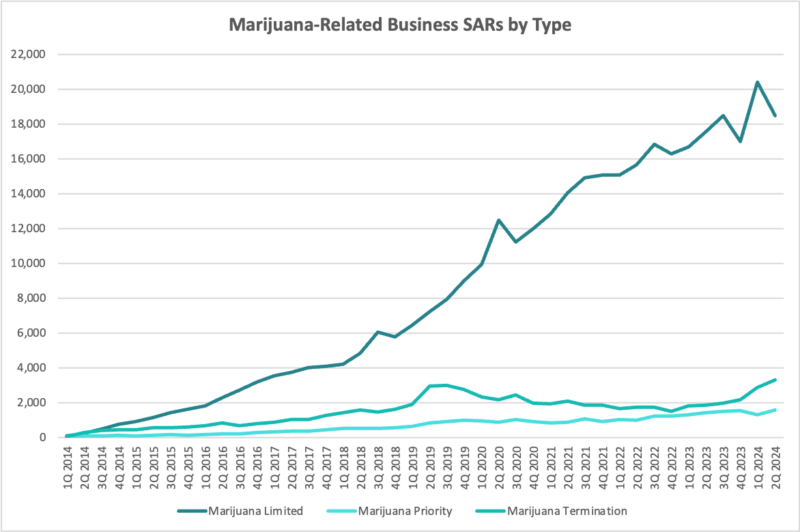

Financial institutions in the second quarter 2024 terminated the most cannabis accounts since records have been tracked, while reports indicating they are actively serving the cannabis industry fell, according to marijuana-related Suspicious Activity Report (SAR) data recently released by the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN).

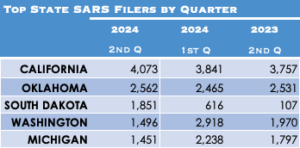

Additionally, South Dakota, a medical use state that is voting on legalizing adult use this election, skyrocketed to third place among states that filed SARs by submitting 1,851.

Total SARs declined by 3% from the first quarter to 22,448 in the second quarter, but it’s still 13% higher than the 19,877 filed in the second quarter last year.

As part of their anti-money laundering programs, financial institutions are required to file SARs for marijuana-related accounts. Marijuana Limited reports mean an institution believes the business doesn’t raise any red flags under the enforcement priorities outlined in the 2013 Cole Memo or violate state law.

Marijuana Limited reports are an indicator of institutions, primarily banks and credit unions, that welcome cannabis-related business. The vast majority of reports filed in the second quarter, 18,462, were Limited. It was a drop of 1,948 from the first quarter but still 928 more than the second quarter 2023.

On the other hand, Marijuana Termination SARs, for when a bank terminates an account to maintain an effective money-laundering compliance program, reached a new quarterly record of 3,307. It was a 16% increase from the first quarter and a whopping 80% increase from the 1,838 in the second quarter last year.

Marijuana Priority reports, where the institution believes the account has Cole Memo red flags or has violated state laws, also grew 22% to 1,594 compared to the first quarter’s 1,303. It was a 10% increase from second quarter 2023.

Unique active filers also increased to a record 831, up from 815 last quarter. These are financial institutions that have filed Limited or Priority SARs that do not reference a termination in the report, although some of these institutions may have also filed Termination reports.

Among them, 515 were banks, 173 were credit unions and 143 were non-depository institutions such as casino or card clubs, money services businesses, and loan and finance companies.

While a potential indicator of rising banking services, cannabis industry financial experts believe it is not an accurate count of the number of institutions actively serving the industry. Some may have a limited number of cannabis-related businesses or are terminating accounts because they don’t want to be in this market at all.

Since FinCEN started keeping SARs records in the first quarter 2014, a grand total of 435,172 SARs have been filed.

South Dakota SARs skyrocket

Among top SAR-filing states, South Dakota skyrocketed from 13th place in the first quarter, with only 616 filings, to third place in the second quarter with 1,851. A year ago, it filed a mere 107 reports.

South Dakota legalized medical use in 2020 and currently has 135 active business licenses through the Department of Health, according to the CRB Monitor licensing database, a drop of 11 since Aug. 5. A few tribal nations also have medical sales, with the Rosebud Sioux Tribe launching a program in February. The Oglala Sioux Tribe also allows for recreational use, according to Keloland.

Voters are going to the polls to decide on Measure 29, which would legalize adult-use possession and home grow, but not create a business market.

California remains the top filing state with 4,073 reports, a 6% increase since the first quarter and up 8% from the second quarter 2023. This year, the California Department of Cannabis Control has greatly increased product recalls and license revocations, which may explain some of the rise.

Oklahoma, which is still actively shutting down illicit cannabis operators, climbed from number three to second place in the second quarter with 2,562 filings, 97 more than the first quarter.

Washington dropped from second to fourth place. It filed 1,496 in the second quarter compared to 2,918 in the first quarter, a 49% decrease.

Michigan also dropped from fourth place to fifth place. It filed 1,451 reports in the second quarter compared to 2,238 in the first quarter, a 35% drop.

Maine, which jumped to fifth place last quarter, fell to eighth place this quarter with 822 SARs filed, a 43% decline.