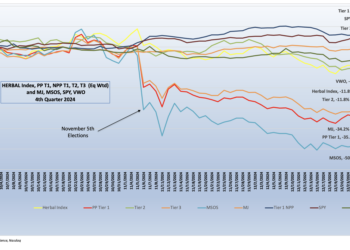

October was, as usual, a volatile month for cannabis equities as the November 5 elections loomed large throughout the month. As such, those companies suffered, plunging in the last few trading days leading up to month end. Let’s face it, 2024 has been nothing to write home about, with many stocks in the cannabis space losing a third or more of their value over the course of the year. Volatility in the market reflected investor caution over concerns about profitability and market oversupply in the cannabis sector, as well as uncertainty over the looming November elections and an overly cautious approach toward reforms by the U.S. government.

Cannabis-Linked Equity Performance

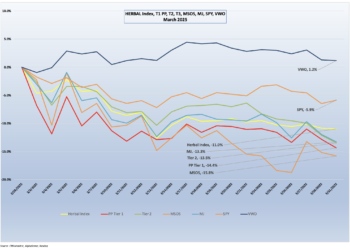

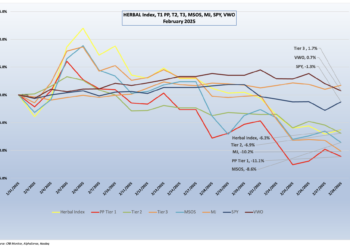

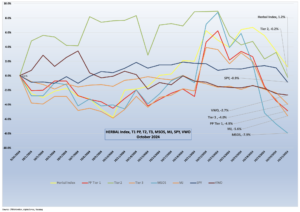

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), performed well in October relative to its peers (+1.2%), largely due to its security weightings following its semiannual reconstitution in September. See a full description of HERBAL’s strengths and benefits in Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-5.6%) and the actively managed, MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-7.9%), suffered a reversal from their positive September returns. Both of these funds are benchmarked to CRB indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching MJ exposure tend to be more sensitive than HERBAL to the federal regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s and other cannabis-themed ETPs due to its current unconventional composition. Since its origin in 2017, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally in 2022, MJ added and still maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The U.S. plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict cannabis exposure. It is also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

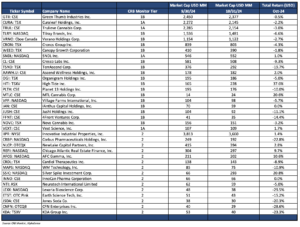

The performance of the recently expanded CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap was negative in October, returning -4.9%. This basket, which is an equally weighted portfolio of the 21 largest pure play CRBs (including both U.S. plant-touching and non-U.S. plant-touching MJ companies), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take closer look at some of these below.

The CRB Monitor equally-weighted basket of Tier 2 CRBs outperformed the Tier 1 CRB basket, posting a -0.2% return for October. In February, CRB Monitor published an update to our article on correlations of Pure Play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. We update this data a couple of times per year.

In October, U.S. equities rallied early in the month, with gains fueled by strong corporate earnings, particularly in the technology and healthcare sectors. Investor sentiment was bolstered by signs of easing inflation and resilience in the labor market, which offset concerns about interest rates. While some volatility persisted due to global geopolitical tensions and inflationary pressures, the market showed overall stability before retreating in the last week of the month. Growth stocks, particularly in AI and renewable energy, attracted investor interest, contributing to positive performance across major indices. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a -0.9% return for the month, now +21 % YTD.

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – October 2024 Returns

CRB Monitor Tier 1

An equally weighted basket of the largest Tier 1 pure play cannabis equities had a -4.9% return in October, with prices dropping abruptly as the market headed into month end. Overall, returns were mixed across the space, but it is clear from the table above that the cannabis industry as a whole is not conveying a lot of investor optimism. Similar to September, investors in cannabis equities are retreating rather than waiting for good news of any kind, whether it be in the form of successful state referenda at the polls or reforms at the federal level. We will wait to see what happens to the few hangers-on once the November election results are final, but the wait for any action by the federal government will undoubtedly take much longer.

Publicly traded CRB performance was net negative in October across the universe of Tier 1 cannabis stocks. The MSO basket ran the gamut of returns, with Tier 1B Cresco Labs Inc. (CSE: CL) (-9.3%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-2.7%), Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (-3.0%), Tier 1B TerrAscend Corp. (TSX: TSND) (-19.7%), and Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-2.2%) falling back to earth during the month. The largest CRB by market cap, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-0.5%) was essentially flat in October.

Looking at the Canadian CRB basket, we saw a mixed bag of returns in October. And while historical performance has deviated with the MSO basket over short periods, the two groups tend to mean revert over time. Canopy Growth Corporation (TSX: WEED) (-1.8%) and Tier 1B Cronos Group Inc. (TSX: CRON) (-4.3%) continued their third quarter slide. Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-6.6%). We saw positive returns from Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+1.0%) and the big winner, Tier 1B High Tide Inc. (TSXV: HITI) (+37.6%), which has been relentless in recent months with its operational expansion across Canada.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies was essentially flat (-0.2%) for October, which outperformed the equally weighted Tier 1 basket by 4.7%. Typically, these two baskets are highly correlated (please see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to even out over time.

When these two portfolios deviate from one another, as they did in October, a deviation could be a signal for investors to rebalance the Tier 1 and Tier 2 baskets given their direct revenue relationship. But the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so proceed with caution!

The largest CRB in the Tier 2 basket, popular REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+1.4%) continued its streak of outperformance relative to the Tier 1 CRBs that lease property from them. IIPR’s stock price has been consistently positive over the last year, having maintained stable earnings throughout a challenging period for the cannabis industry. On November 6, IIPR issued its third quarter 2024 earnings report, which featured the following highlights:

- “Generated total revenues of $76.5 million and net income attributable to common stockholders of $39.7 million, or $1.37 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- “Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of $64.3 million and $57.8 million, respectively.

- “Paid a quarterly dividend of $1.90 per common share on October 15, 2024 to stockholders of record as of September 30, 2024 (an AFFO payout ratio of 84%), representing an annualized dividend of $7.60 per common share.

- “Sold 402,673 shares of Series A Preferred Stock under IIP’s “at-the-market” equity offering program for $9.6 million in net proceeds.”

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+10.6%) performed well again in October, and over recent months it has also outperformed its Tier 1 CRB lending clients. On November 11, AFCG reported its third quarter 2024 earnings of $7.2 million which featured the following statement from CEO Daniel Neville:

“We are pleased with the strong quarter, driven by our continued focus on active portfolio management and origination. One of my top priorities when I joined AFC was to reinvigorate our origination engine, and I am proud to announce that we have surpassed our 2024 target of $100 million in new originations. This achievement highlights our ability to identify and support high-quality operators in key markets, and we look forward to continuing to build on this momentum as we close out the year.”

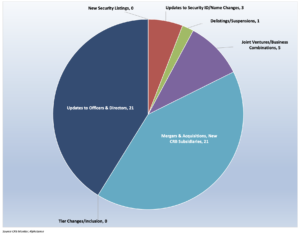

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for October 2024:

Cannabis Business Transaction News – October 2024

As the United States steamrolled toward Election Day, cannabis reform seemed to take a backseat to more pressing issues of the day (inflation, the boarder, reproductive rights, etc.). With that said, cannabis was on the ballot in several states, and CRB Monitor will review all of these in more detail when we issue our November securities newsletter. For now, we feature a broad range of critical October news and look at some of the highlights in more detail, as CRBs survive and navigate through sometimes treacherous waters.

It would be an understatement to say that the legal cannabis industry is in need of legislative help, which would need to come in several forms — the most notable of these being actual legalization. However, the other popular reforms — rescheduling and “safe” banking — would provide welcome relief as well. While we don’t feel like holding our collective breath any longer (some of us have been nearly suffocating for years) we will remain optimistic that the new congress and administration will finally bring federal cannabis reforms to the United States, and investors in CRBs can finally disconnect their heart rate monitors and go back to leading normal lives.

Here are some of the news highlights from October:

First let’s head out west to Arizona where Tier 1A MSO Trulieve Cannabis Corp. (CSE:TRUL) issued a press release on Oct. 1 announcing a “partnership with Black Buddha Cannabis, a purpose-driven and women-owned medical marijuana brand. The collaboration will introduce Black Buddha Cannabis products to Trulieve dispensaries in Arizona and Pennsylvania starting in October 2024. Black Buddha Cannabis, founded by Roz McCarthy, CEO of Soaring High Industries and Minorities for Medical Marijuana, brings a unique approach to the medical marijuana industry with a focus on wellness and healing.”

As cannabis investors are well aware, Trulieve is a major player in the industry, particularly in Florida, where it is the leading license holder. This is important to note, as Trulieve has made a significant investment in the Sunshine State and as such its future will depend on (among other things) Florida’s citizens’ approval of recreational marijuana in the November elections.

The press release goes on to say that “Trulieve’s partnership with Black Buddha Cannabis marks a significant milestone in expanding the Company’s product offerings and supporting brands that align with Trulieve’s commitment to wellness, innovation, and quality. This collaboration is expected to resonate with customers who seek premium medical marijuana crafted with intention and care.”

With this partnership Trulieve operates legally in 16 U.S. states and three Canadian provinces and holds 121 cannabis licenses in either active status or pending approval.

Staying in Arizona, Tier 1B MSO Verano Holdings Corp. (CSE: VRNO), issued a press release announcing the grand opening of Zen Leaf Arcadia in Phoenix on Sept. 27.

“After relocating from its former home on the city’s south side, Zen Leaf Arcadia will offer an array of enhanced features and conveniences for cannabis consumers, including additional point-of-sale stations, increased parking and an original cannabis-inspired mural painted by Verano in-house artist Jeremiah Kaniaupio.,” the press release said. “Zen Leaf Arcadia adds another convenient location for Phoenix area cannabis consumers as one of the Company’s eight Arizona dispensaries. Verano’s Arizona footprint also includes 90,000 square feet of state-of-the-art cultivation and processing operations, where the Company produces its portfolio of award-winning brands including Verano™ Reserve flower, Swift Lift™ pre-roll joints and vapes; (the) Essence™ and Savvy flower, edibles and vapes; On the Rocks™ Live Rosin vapes and extracts; BITS™ low-dose high-function edibles; Hi-Klas™ flower, extracts and vapes; Vital™ edibles and tinctures; and MÜV™ transdermal patches and topicals.”

With this latest expansion Verano Holdings holds 74 active licenses through its subsidiary businesses across 14 states.

Now onto Florida, where Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) issued an Oct. 3 press release announcing it has opened a new medical dispensary in Port St. Lucie, Fla., located at 1720 Southwest Gatlin Boulevard.

“This dispensary brings its Florida store count to 65 locations, with 151 dispensaries total across the U.S., According to the press release. “Curaleaf Port St. Lucie is the Company’s second medical dispensary in St. Lucie County, broadening its presence on Florida’s Treasure Coast. The new medical dispensary provides expanded access to its wide selection of high-quality cannabis products and brands, including Select Fruit STIQ all-in-one vape, Grassroots craft flower and pre-rolls and Select Liquid Diamonds. With an established location in nearby Fort Pierce, Curaleaf continues to enhance its commitment to serving patients across Southeast Florida with premium care and cannabis offerings.”

The press release goes on to say, “Curaleaf supports patients and team members across Florida’s Gulf Coast and the Southeast region who have been impacted by Hurricane Helene. The Company has taken all appropriate measures to ensure the safety of our team members, and has established a Curaleaf Emergency Relief Fund to benefit impacted employees in the wake of the storm. Across the state, Curaleaf has deployed an at-register round-up campaign raising funds for Feeding Tampa Bay, which is conducting emergency distributions throughout Gulf Coast communities impacted by Hurricane Helene.”

With its newest acquisitions, Curaleaf’s active license count is 130 and these licenses have been issued by six countries including the U.S. and Canada.

In Canada, Tier 1B High Tide Inc. (TSXV: HITI) announced on Oct. 11 it has opened a new Canna Cabana store in Toronto’s Greektown district, located at 201 Danforth Ave., and is looking to expand into the U.S.

“The opening gives Calgary-based High Tide 184 stores in Canada, including 70 in Ontario and 10 in Toronto. High Tide is looking to capitalize on population density, proximity to amenities and high foot traffic in an area popular with tourists,” the press release said. “The company is Canada’s largest cannabis retailer, operating stores in B.C., Alberta, Saskatchewan and Manitoba as well as Ontario. High Tide is also looking at possible moves into the U.S. and Europe as part of a global growth effort.”

Currently High Tide holds, through its subsidiaries, 193 active cannabis licenses in six Canadian provinces.

Finally, Canadian Tier 1B CRB Canopy Growth Corporation (TSX: WEED) announced Oct. 9 that Canopy USA, LLC has completed its acquisition of Wana, including Wana Wellness, LLC, The CIMA Group, LLC, and Mountain High Products, LLC.

“As a result of this acquisition, Canopy USA now owns 100% of the outstanding equity interests in Wana,” the company said in the press release.

Why is this significant? Canopy Growth should have no business acquiring a licensed, plant-touching entity in the U.S. – and yet here we are. But wait, there’s a catch – Canopy USA, LLC was spun out of Canopy Growth months ago and therefore the ownership in Wana will have no benefit (and will provide no revenue) to Canopy Growth Corp. Instead, WEED holds warrants that give the listed company an option to purchase Canopy USA if and when cannabis is legalized in the US. This loophole allows WEED to have ties to U.S. marijuana without jeopardizing their TSX and Nasdaq listings.

The press release continues, “This announcement follows Wana’s recent launch of Wanderous™, a first-of-its-kind direct-to-consumer marketplace designed to offer consumers a curated selection of high-quality hemp-derived products, including Delta-9-THC and non-intoxicating CBD gummies from leading brands like Wana, Cann™, Happi™, Charlotte’s Web™, Martha Stewart CBD™, and MXXN™. As part of this launch, Wana introduced its new line of Wana Beverages, ready-to-drink infused sparkling beverages that combine hemp extracts, real fruit juice, and other beneficial ingredients, offering consumers a new and highly sessionable way to experience Wana products.”

Canopy’s (ex-USA) operational footprint covers three countries (Canada, Germany and Colombia), and they hold through their subsidiaries 58 cannabis licenses that are in active status.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| RIV Capital Inc. | TSX: RIV | Tier 1B | RIV Capital Appoints David E Vautrin to Interim CEO |

| TILT Holdings Inc. | CSE: TILT | Tier 1B | TILT Holdings Announces Board Changes |

| SLANG Worldwide Inc. | CSE: SLNG | Tier 1A | SLANG Worldwide Announces Resignation of Director |

| MediPharm Labs Corp. | TSX: LABS | Tier 1B | MediPharm Labs Announces Departure of President and Co-Founder Keith Strachan Read News |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Where Food Comes From, Inc. | NASDAQ: WFCF | Move to Watchlist | Tier 3 – Professional Services |

| Art’s-Way Manufacturing Co., Inc | NASDAQ: ARTW | Moved to Watchlist | Tier 3 – Industrial Machinery |

| CannaGrow Holdings, Inc. | OTC Pink: CGRW | Moved to Watchlist | Tier 2 – Professional Services |

| Cann Global Ltd. | ASX: CGBDA | Moved to Watchlist | Tier 1B – Owner/Investor |

| Roto-Gro International Limited | ASX: RGI | Moved to Watchlist | Tier 2 – Agricultural & Farm Machinery |

Cannabis News: Regulatory Updates

As we come to this section of the newsletter, we are aware of the election results. With that said, a Trump victory (as well as Republican control of the Senate and House) will determine the future of the cannabis industry both in the U.S. and globally. There is no telling at this point where cannabis resides in the hierarchy of legislative priorities given that it was conspicuously absent as a factor when both candidates delivered their closing arguments prior to election day. And while recreational marijuana was on the ballot in several states, the holy grail of states, a.k.a. Florida, failed to pass its legalization question. This led to a cannabis equity market collapse on November 6, which was an obvious reflection of how important this Florida vote was to investors. Nevertheless, we will cover the regulatory highlights from October and will continue to monitor the regulatory space in Washington as it unfolds.

Let’s begin with the U.S. government and a story reported in Marijuana Moment in October, titled “Accountants Group Urges IRS And Treasury To Update Marijuana Tax Guidance Ahead Of Federal Rescheduling.”

This story states that, “A national association of accountants is asking the Treasury Department and Internal Revenue Service (IRS) to issue updated guidance on federal tax policy for marijuana businesses as the administration’s rescheduling proposal moves through the process.”

Additionally, this group, called The American Institute of Certified Public Accountants (AICPA) “is also requesting that the federal financial agencies give cannabis companies a chance to correct tax deduction claims they’ve made in anticipation of a potential federal rescheduling decision, after IRS notified stakeholders that it intends to recoup any payouts that might’ve been made prior the government potentially finalizing a rule moving marijuana from Schedule I to Schedule III of the Controlled Substances Act (CSA).”

This highlights the complexities associated with rescheduling, which is far from the finish line. We have argued that, without FDA approval, technically no cannabis products will qualify as Schedule 3 drugs and even those designated as “medical marijuana” could have challenges in court with regard to their tax consequences.

Next we head out west to Nebraska, where Marijuana Moment on Oct. 14 reposted a Nebraska Examiner article that reported, “A Lancaster County District Court judge said … that the ongoing legal challenges to Nebraska’s two medical cannabis ballot measures might not be resolved by Election Day. Judge Susan Strong, during a virtual hearing Friday, proposed dividing the trial set to start October 29 into two parts. Under the proposal, attorneys for Secretary of State Bob Evnen (R) and John Kuehn, a former Republican state senator and former State Board of Health member who launched the lawsuit, would need to first prove there are enough questionable signatures.”

This is a reflection of the challenges close to election day across the U.S., not only on cannabis-related ballot questions, but on voters in general. The article goes on to report, “The challenges would need to prove that a sufficient number of signatures are invalid based on allegations of technical or clerical errors, circulator fraud or malfeasance. If a sufficient number of signatures were successfully challenged, the ballot sponsors would have the opportunity to show proof that some signatures were genuinely collected and should not be tossed.”

And while this is a spoiler alert, the ballot measure overcame all obstacles and passed on November 5. However, there are a number of legal challenges that will have to be defended before medical marijuana can finally be legalized in Nebraska. So stay tuned!

And now we head north to Vermont, where a story published by our CRB Monitor News Team reported:

“The Cannabis Control Board voted to stop issuing new retail licenses and all but the smallest tier of cultivation licenses. The board came short of referring to the move as a “moratorium,” in favor of the term “pause.” They emphasized that it would be temporary and would likely last less than a year.” According to the article, “State law requires the CCB to provide a 30-day notice before halting licensure, so Oct. 25 is the last day to submit applications for retail. … Retail applicants who have already submitted will have until Nov. 15 to complete the approval process. Cultivation applicants have until Oct. 25. … Vermont’s adult-use market launched on Oct. 1, 2022. Since then, 75 dispensaries have active licenses, supported by 380 cultivation sites, according to the CRB Monitor database.”

Next, we head south down Interstate 95 to New York, where our very own CRB Monitor News Team reported in October that “New York’s Cannabis Control Board awarded three new Registered Organization (RO) licenses on Oct. 10, expanding the Empire State’s medical market after more than three years of attention on the state’s contentious adult-use market roll out. The CCB granted RO licenses to Nonna Farms LLC, NYRO Partners LLC and VNY-Ops Inc. All three appear to be newcomers to the cannabis business, though Nonna Farms LLC has a pre-license as an adult-use processor in New York. These new operators will also have the opportunity to enter the adult-use market by obtaining either an RO dispensing or RO non-dispensing license. On the medical side, they enter a market that is dominated by nine multi-state operators.”

The article goes on to discuss the prioritization that will be given to underserved communities:

“The Marihuana Regulation and Taxation Act, the law that legalized adult-use cannabis, increased the maximum number of dispensaries ROs could operate from four to eight. The only stipulation was that the fifth and sixth dispensaries must be located in a medically unserved or underserved area, as determined by the CCB. That determination includes seven variables, as per the MRTA, including population-provider ratio, population over 65, uninsured rate, low birth weight rates, premature deaths, household disability rate and travel time to healthcare providers. In total, there are 34 medical dispensaries, of which 10 are currently operating in a medical/adult-use hybrid model, according to a recent market report released by OCM. The state also lists five additional dispensaries as being “temporarily closed,” with no further details about their status.”

Finally, from the Commonwealth of Massachusetts, the Worcester Business Journal reported that the Massachusetts Cannabis Control Commission’s open data portal “is now back online following an outage which began during the summer, as newly updated figures from the state regulatory agency show a dip in total sales figures and the price of cannabis. The portal, included as part of the agency’s website, offers the general public a glimpse of sales figures and other statistics about the state’s cannabis industry, but had not been updated since the first week of July. … The CCC said the problems are limited to the ability to extract and analyze data for the open data platform and staff have experienced no technical difficulties when using the platform to monitor for compliance from licensed cannabis businesses. The agency said it is working with Microsoft to attempt to resolve the outstanding issues behind the outage.”

What’s happened to sales and the price of cannabis? According to the article, “With the portal now up-to-date, CCC stats show $133.2 million in recreational cannabis sales in September, down 10% from the $148 million seen in August. September saw $14 million in medical cannabis sales, the lowest monthly total dating back until at least the beginning of 2020. The average monthly cost of one ounce of recreational cannabis sat at just under $138 in September, the lowest total since legal sales began in 2018.”

CRBs In the News

The following is a sampling of highlights from the October 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.