A former Verano (VRNOF) executive is facing insider trading charges in regards to his alleged actions while still employed by the cannabis multi-state operator during a period when Verano was attempting to acquire Goodness Growth.

Verano’s proposed acquisition would ultimately sour, but not before the defendants attempted to use their knowledge of the proposed transaction to game the stock market, federal authorities allege.

The Department of Justice charged former Executive Vice President Anthony Marsico in a special grand jury indictment with six separate counts of securities fraud on Jan. 16 in the Northern U.S. District Court of Illinois. He and three of his associates were also accused of conspiracy related to an alleged scheme to take advantage of insider knowledge of Verano’s proposed buyout, as well as advanced knowledge of that deal’s demise.

The grand jury estimated that Marsico made about $607,338 in illegal profits from his insider knowledge. Marsico opened a brokerage account in December 2021 and began buying shares of Goodness Growth before the potential merger was announced in February 2022.

Marsico allegedly told one of his friends, Arthur Pizzello, about the proposed acquisition. Pizzello then allegedly informed the two other defendants, Robert Quattrocchi and Timothy Carey. All three would go on to purchase stock in Goodness Growth, which is now known as Vireo Growth. The complaint noted that Marsico and the other three defendants were all golf buddies at a private country club.

All four defendants have been charged with conspiracy to commit securities fraud, while Marsico also received six separate counts of securities fraud.

Marsico also allegedly paid others in January 2022 to post social media messages pumping up Verano ahead of the announced acquisition. This was allegedly done to boost the share price of Verano, which would have given the company greater leverage in acquiring Goodness Growth through an all-stock transaction, potentially ensuring that the deal went through.

In total, Marsico allegedly purchased 906,934 shares of Goodness Growth ahead of the announced acquisition, spending about $1.46 million in 359 transactions in January.

Ultimately, the buyout did not go through, and on Oct. 14, 2022, the failure of the deal was publicly announced. Marsico sold all of his shares of Goodness Growth prior to the announcement, according to the indictment.

Verano condemns actions

Verano, which was not charged in the indictment, condemned the alleged actions in a statement and pledged to cooperate with authorities investigating the matter. In fact, the criminal complaint noted that Verano corporate policy specifically barred insider training, and Marsico received training toward that end.

“We strongly condemn the alleged actions taken by a former employee, and upon learning of the alleged conduct, fully cooperated with authorities investigating this matter,” said a spokesperson through an email.

“We strive to operate our business with a high degree of legal and ethical standards to comply with all applicable securities laws and regulations, including maintaining and requiring employees to adhere to the Company’s insider trading policy, employee codes of conduct and mandatory trainings,” he continued. “The alleged actions by this former employee, who was terminated a year ago, had no material impact on our business and have no bearing on our operations moving forward.”

Failed transaction is still being fought in court

The insider trading allegations occurred in the backdrop of an ongoing dispute between Verano and Goodness Growth, which has since changed its name to Vireo Growth in a Canadian court.

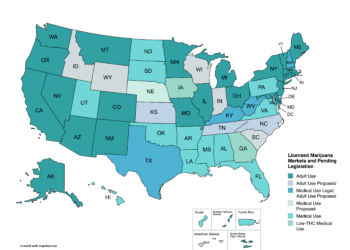

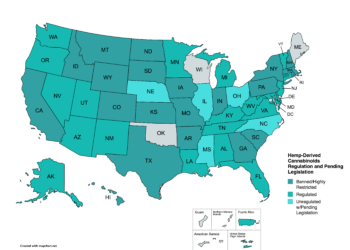

Verano Holdings Corp. announced on Feb. 1, 2022, that it planned to acquire Goodness Growth and that the proposed transaction was estimated to be worth $413 million. At the time, the deal was presented as a means for Verano to enter the New York, Minnesota, New Mexico, Arizona and Maryland markets.

Verano would eventually terminate the agreement, claiming that Goodness Growth failed to re-evaluate the proposed transaction. Upon announcing the termination of the deal, Verano was also demanding a $14.9 million termination fee, along with $3 million to cover expenses accrued from the failed transaction.

Goodness Growth claimed that Verano was seeking to buy the company for a lesser amount than was originally negotiated, and subsequently sued Verano in a British Columbia court.

Goodness Growth was seeking $860.9 million in damages from the failed transaction. The company filed an application for summary determination on April 29, 2024.

“The transaction with Verano was anticipated to be transformative: it was going to provide Goodness Growth with a means of unlocking its potential, including in the key markets of New York and Minnesota,” said Vireo CEO Josh Rosen in a statement released at the time of the filing. “We are committed to pursuing Verano for what we believe was a calculated and wrongful termination that deprived Goodness Growth of both access to capital and operational improvements.”

Verano filed a counterclaim of $14.9 million. The company disputed Vireo’s assessment of damages from the failed transaction and filed a petition on June 20, 2024, for their case to go to trial.

The case remains pending. If the court decides to allow a trial, it is expected to take place sometime in 2026, according to Verano.