The U.S. and Canadian regulated cannabis markets showed signs of stabilization in late 2024, as business license counts remained steady in the fourth quarter, marking a potential turnaround after several quarters of decline. New York led the U.S. in new licensing, accounting for nearly 80% of new applications nationwide, and experiencing a staggering 1131% annual increase in pre-licensing activity, driven by the state’s long-awaited rollout of its adult-use market. Among major license types, vertically integrated operators saw a notable rebound, with a 23% increase in active licenses in the latter half of the year. These trends underscore the evolving dynamics of the cannabis industry, with regional growth and market consolidation shaping the landscape.

US Business Licenses: Q4 and Full Year 2024

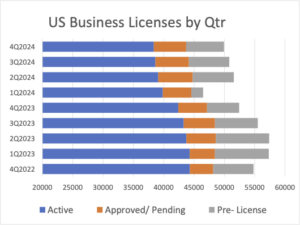

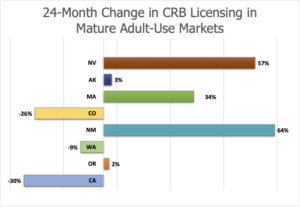

Total active cannabis business licensing in the U.S. was essentially unchanged in the fourth quarter, falling just 1% and continuing an overall stabilization first evidenced in the third quarter. This plateau came after six consecutive quarters of decline, and may reflect a “bottoming out” of the market after two years of contraction. Active licenses remained 2% lower than the previous six-month period, and 9% lower for the full year. Total active business licenses peaked in the fourth quarter of 2022 at 44,323, and ended the recent quarter at 38,367, a 13% decline.

Total active cannabis business licensing in the U.S. was essentially unchanged in the fourth quarter, falling just 1% and continuing an overall stabilization first evidenced in the third quarter. This plateau came after six consecutive quarters of decline, and may reflect a “bottoming out” of the market after two years of contraction. Active licenses remained 2% lower than the previous six-month period, and 9% lower for the full year. Total active business licenses peaked in the fourth quarter of 2022 at 44,323, and ended the recent quarter at 38,367, a 13% decline.

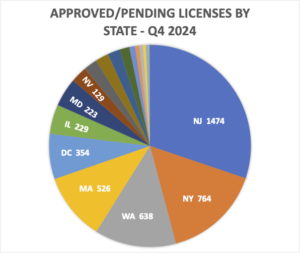

Approved and pending licenses fell 3% for the quarter to 5,340, the second consecutive quarterly decline in new license approvals. The number of new licenses pending at the end of 2024 represented a 6% decline  from the second quarter, but remained 13% higher for the year, propelled by a surge of applications in New York and New Jersey.

from the second quarter, but remained 13% higher for the year, propelled by a surge of applications in New York and New Jersey.

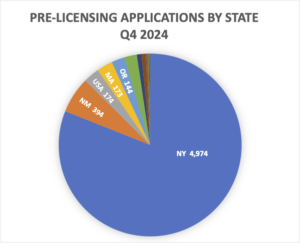

Pre-licensing activity, defined as license applications awaiting approval, fell 7% to 6,230, continuing a sharp decrease that began in the third quarter as a flood of applications in New York moved through the review process. Pre-licensing totals were 8% lower than the previous six months, but remained 17% higher than 2023. As was the case throughout the year, New York accounted for nearly 80% of the new applications.

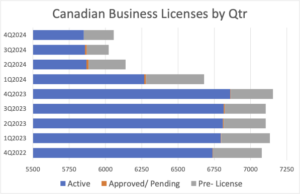

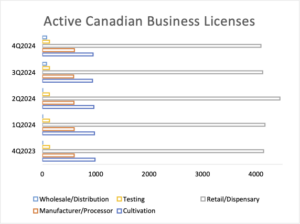

Canada Holds Steady

Active Canadian business licensing counts were unchanged again in the fourth quarter, halting a slide in the first half of 2024 from a peak of 6,860 active permits at the end 2023 to 5,851 at yearend, marking the lowest number of active licenses in four years. Licensing was flat for the preceding six months and declined 15% for the full year.

Active Canadian business licensing counts were unchanged again in the fourth quarter, halting a slide in the first half of 2024 from a peak of 6,860 active permits at the end 2023 to 5,851 at yearend, marking the lowest number of active licenses in four years. Licensing was flat for the preceding six months and declined 15% for the full year.

The decline in active licenses was offset by a 36% increase in new license applications in Canada, which added 55 additional licenses to end the quarter with 206 applications in pre-licensing status. However, no applications were approved or pending in during the fourth quarter for the first time in at least four years.

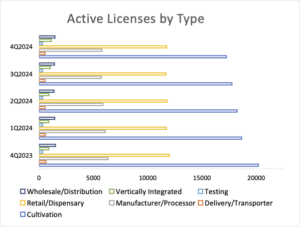

Trends Among License Types

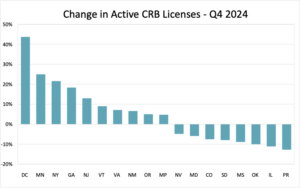

Of the major license types, cultivation and retail/dispensary licenses are far and away the most numerous, comprising 75% total active licenses in the fourth quarter. There were 17,243 active cultivation licenses and 11,746 active retail/dispensary licenses at the end of 2024, virtually unchanged from the past two quarters. However, the relative stasis in aggregate licensing in these two dominant categories belies significant turnover within state markets. Four states: New York, New Jersey, Minnesota and Georgia, and the District of Columbia, recorded double-digit growth of 13-44%; while Oklahoma, Illinois and Puerto Rico registered double-digit declines from 10-13% during the period.

Of the major license types, cultivation and retail/dispensary licenses are far and away the most numerous, comprising 75% total active licenses in the fourth quarter. There were 17,243 active cultivation licenses and 11,746 active retail/dispensary licenses at the end of 2024, virtually unchanged from the past two quarters. However, the relative stasis in aggregate licensing in these two dominant categories belies significant turnover within state markets. Four states: New York, New Jersey, Minnesota and Georgia, and the District of Columbia, recorded double-digit growth of 13-44%; while Oklahoma, Illinois and Puerto Rico registered double-digit declines from 10-13% during the period.

Manufacturer/Processor licenses made up the third largest license type at the end of the second quarter, with 5,793 active licenses, followed by wholesale/distribution licenses, with 1,458, representing 1% and 3% quarterly increases respectively, echoing the market plateau experienced in the cultivation and retail segments.

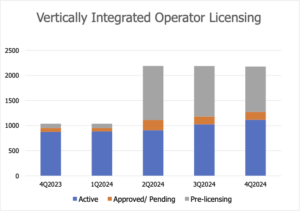

Vertically integrated operators had shown signs of growth in the first half of the year after several quarters of steep declines in 2023, when the industry segment shed 34% of its numbers. That growth continued in the latter half of 2024, with active vertical operator licenses increasing 23%, as anticipation built for the opening of an adult-use market in Florida, a vertical operator-only state. The category grew 27% for the year to 1,115 active permits, yet the number of active vertical operators remains 26% lower than two years ago.

Newly Approved Permit Growth Fades

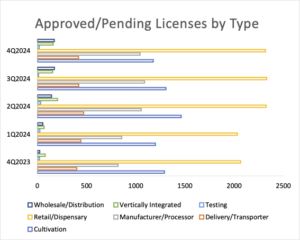

Cannabis business license applications which have been approved but have yet to become operational are grouped by CRB Monitor under the category of “approved/pending” status. They reflect the near-term pipeline of new cannabis business operations poised to enter the regulated market. Approved/Pending license activity had been surprisingly buoyant in the first half of 2024, logging double and triple-digit growth across virtually every major operator type. That growth faded in the second half of the year, with the number of new approved/pending licenses falling 6%. Approved/pending licenses fell 3% in the fourth quarter alone, but remained 13% higher at year-end than a year ago.

Cannabis business license applications which have been approved but have yet to become operational are grouped by CRB Monitor under the category of “approved/pending” status. They reflect the near-term pipeline of new cannabis business operations poised to enter the regulated market. Approved/Pending license activity had been surprisingly buoyant in the first half of 2024, logging double and triple-digit growth across virtually every major operator type. That growth faded in the second half of the year, with the number of new approved/pending licenses falling 6%. Approved/pending licenses fell 3% in the fourth quarter alone, but remained 13% higher at year-end than a year ago.

The two largest major license types, cultivation and retail dispensaries, ended the fourth quarter with 1,176 and 2,317 approved/pending licenses, representing a 10% and 1% quarterly drop in approved and pending applications, respectively. Cultivation permit approval activity has dropped 19% overall in the past two years, reflecting ongoing right-sizing and production consolidation in established markets. Similar contractions in established retail markets were balanced by the mid-year opening of Ohio’s adult-use market and the ongoing stand-up of retail operators in New York.

Licensing approval levels among manufacturer/processors, delivery/transporters, and wholesale/distributors were substantially unchanged in the fourth quarter, and mixed for the full year. This was especially true of pending wholesale/distribution licenses, which declined slightly in the fourth quarter but ended the year more than 600% higher than a year ago, with 171 operators approved and awaiting commencement of operations. Approved and pending manufacturer/processor license activity fell 4% for the quarter, but remained 27% higher than a year ago.

Given the relative operating size and investment capital required to stand up new vertically integrated operations, the overall increase in approved/pending licensing of vertical operators in 2024 was impressive. While the pace of new approvals tailed off in the last half, rising only 3% in the fourth quarter, vertical operators with newly approved and pending permits rose 101% for the full year to 159.

Given the relative operating size and investment capital required to stand up new vertically integrated operations, the overall increase in approved/pending licensing of vertical operators in 2024 was impressive. While the pace of new approvals tailed off in the last half, rising only 3% in the fourth quarter, vertical operators with newly approved and pending permits rose 101% for the full year to 159.

Applications for New Licenses Slow

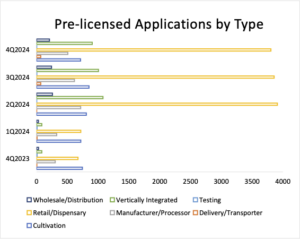

Applications for new cannabis business licenses that have yet to be approved are classified as having a “pre-licensing” status at CRB Monitor. While the proportion of these applicants that may succeed in gaining approval, let alone in opening a cannabis business, is unknown, pre-licensing data nonetheless serves as a leading indicator of interest in entering or expanding commercial activities in a given market.

Applications for new cannabis business licenses that have yet to be approved are classified as having a “pre-licensing” status at CRB Monitor. While the proportion of these applicants that may succeed in gaining approval, let alone in opening a cannabis business, is unknown, pre-licensing data nonetheless serves as a leading indicator of interest in entering or expanding commercial activities in a given market.

Applications in the pre-licensing stage fell 7% in the fourth quarter, the second consecutive quarterly decline after a surge of applications for new adult-use markets in New York, New Jersey and Ohio moved into the pipeline early in the year. For the full year applications in pre-licensing status rose 17%.

Applications in pre-licensing declined across all major license types in the last quarter of 2024, and by double-digit percentages in all but retail/dispensary and delivery/transport operators. Manufacturer/processor applications fell 17%, cultivation dropped 16%, and wholesale/distribution declined 14%.

Retail/dispensary applications in pre-licensing maintained their post-New York surge levels, ending 2024 with 3,857 in review. The last three quarters of 2024 saw the highest levels of new license applications in two years, led almost entirely by applicants in New York.

New license applications by vertically integrated operators, which had surged in the run-up to Florida’s failed adult-use initiative this past November, ended the year with 903 applications in pre-licensing, a 10% quarterly drop. But that was still 905% higher than a year ago as a mid-year change in New York’s adult-use licensing greatly expanded the availability of vertically integrated operator licenses. A late year surge of 894 vertical operator applications in New York comprised nearly all the new permit applications recorded nationally in the fourth quarter.

Cultivation and wholesale/distribution licenses in application fell in the fourth quarter by 16% and 17%, respectively, perhaps as a consequence of the focus on consolidated operations in the country’s new largest market. The addition of 66 new delivery/transport applications in Massachusetts reversed several previous quarters of nominal activity in the license type.

Minor License Types

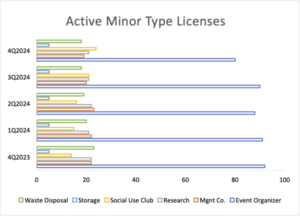

License types that total less than 300 active licenses nationally are considered minor license types. They include event organizers, management companies, research organizations, social use clubs, storage and waste disposal companies. Most minor types were flat or down for the quarter and the year, with event, management and waste disposal operators off sharply, with full year declines ranging from 13% to 22%. The single minor type that experienced sustained growth throughout the year was social use clubs, which were up 14% in the fourth quarter and 71% for the full year, as Nevada joined Colorado to establish an extensive social use sector in their adult-use markets.

License types that total less than 300 active licenses nationally are considered minor license types. They include event organizers, management companies, research organizations, social use clubs, storage and waste disposal companies. Most minor types were flat or down for the quarter and the year, with event, management and waste disposal operators off sharply, with full year declines ranging from 13% to 22%. The single minor type that experienced sustained growth throughout the year was social use clubs, which were up 14% in the fourth quarter and 71% for the full year, as Nevada joined Colorado to establish an extensive social use sector in their adult-use markets.

Canadian Growth Focused on Wholesale/Distributors

The Canadian cannabis market remained a model of maturity and stability in 2025, in sharp contrast with the state-level volatility seen in the Lower 48. All licensing types except whole/distributors logged less than a five-point variance during the year or the final quarter.

The Canadian cannabis market remained a model of maturity and stability in 2025, in sharp contrast with the state-level volatility seen in the Lower 48. All licensing types except whole/distributors logged less than a five-point variance during the year or the final quarter.

Active wholesale/distributors increased from a handful to 79 permitted operators in the latter half of the year, the only notable area of growth in Canadian licensee counts. Retail dispensary licenses remained the largest license type with 4,093 active permits, a 1% decrease from the third quarter. Cultivation and manufacturer/processor licenses remained the second and third largest license types in Canada, rising 1% and 2% during the second quarter to 948 and 599, respectively.

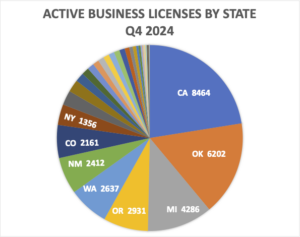

State Licensing Activity Uneven

Two years into a moratorium on new licensing, coupled with a crackdown on non-compliant operators, Oklahoma continued to shed licensed cannabis businesses in the fourth quarter. The Sooner State’s count of active licensees declined 10% again in the fourth quarter, to 6,202, marking a 41% plunge in active licensees for the full year. Oklahoma lost the greatest number of active licensees in the fourth quarter as well, shedding 691 active licensees. Nonetheless the state remains the second largest state cannabis market in total active licensed businesses.

Two years into a moratorium on new licensing, coupled with a crackdown on non-compliant operators, Oklahoma continued to shed licensed cannabis businesses in the fourth quarter. The Sooner State’s count of active licensees declined 10% again in the fourth quarter, to 6,202, marking a 41% plunge in active licensees for the full year. Oklahoma lost the greatest number of active licensees in the fourth quarter as well, shedding 691 active licensees. Nonetheless the state remains the second largest state cannabis market in total active licensed businesses.

California held its position as the leading state for cannabis operators, despite a 4% drop in active licenses in the fourth quarter, and a 14% decline from 2023, closing out the quarter with 8,464 licensed operators. The nation’s largest adult-use market has lost 30% of its active licensees in the past two years.

Michigan retained its position as the third largest U.S. market in terms of active licensees, even as it shed 188 licenses to end the quarter with 4,286, a 4% quarterly decrease but still 15% higher than the year ago period.  New York led the large population states in both the highest percentage and greatest absolute increase in new licensing, adding 241 new licenses to increase its active count 22% in the third quarter and over 240% in the past 12 months, to 1,356 at yearend. Other states with significant percentage increases in active licensing during the quarter include Minnesota (25%), New Jersey (13%), Georgia (18%) and the District of Columbia (44%). States besides New York with the largest absolute gains included New Mexico (149), Oregon (140), Vermont (49) and New Jersey (45).

New York led the large population states in both the highest percentage and greatest absolute increase in new licensing, adding 241 new licenses to increase its active count 22% in the third quarter and over 240% in the past 12 months, to 1,356 at yearend. Other states with significant percentage increases in active licensing during the quarter include Minnesota (25%), New Jersey (13%), Georgia (18%) and the District of Columbia (44%). States besides New York with the largest absolute gains included New Mexico (149), Oregon (140), Vermont (49) and New Jersey (45).

In all, only two states recorded declines in active licensees greater than 10% during the fourth quarter, reflecting a broad stabilization across the country’s regulated cannabis markets that began in the second quarter of 2024, ending two years of tumultuous retrenchment and consolidation. Nonetheless, the damage was done in the first half of the year, as mature markets in the U.S. experienced wrenching contractions. First-mover Colorado lost 26% of its active licensees in 2024, joining California’s 15% decline, Missouri’s 19% drop, and Connecticut’s 50% contraction in licensed businesses.

Approved/Pending Permits Mostly Down

Approved/Pending license activity can be an indicator of sentiment and future growth in the market, While no guarantee that these new operations will commence, the investment of resources required to prepare, apply for, and successfully obtain a cannabis license does suggest a level of commitment that can be used as a proxy for future business activity.

Approved/Pending license activity can be an indicator of sentiment and future growth in the market, While no guarantee that these new operations will commence, the investment of resources required to prepare, apply for, and successfully obtain a cannabis license does suggest a level of commitment that can be used as a proxy for future business activity.

Approved and pending cannabis license counts increased in three U.S. states – Ohio, Florida, Maryland – and District of Columbia during the fourth quarter. Approved/pending counts fell by 10% or more in 11 states, and were flat or slightly down in seven others.

Ohio led the country in the increased number of approved/pending applications during the quarter, adding 62 additional new licenses to end the quarter at 106 licenses pending activation, for a 141% quarterly increase. New Jersey once again led the country in the total number of approved/pending licenses outstanding, with 1,474, a slight decrease over the previous quarter. Massachusetts experienced the greatest fall-off in absolute numbers of approved applications, as new approvals in the fourth quarter fell by 317 to 526, a 38% decline from the third quarter.

New York Dominates Pre-licensing

Applications for new cannabis business licenses, which reflect activity and sentiment in newer and expanding markets, declined in most markets in the fourth quarter. New York ended the year with the largest number and largest annual percentage increase in applications in pre-licensing, with 4,974 permits in application, a 1,131% increase from a year ago.

Applications for new cannabis business licenses, which reflect activity and sentiment in newer and expanding markets, declined in most markets in the fourth quarter. New York ended the year with the largest number and largest annual percentage increase in applications in pre-licensing, with 4,974 permits in application, a 1,131% increase from a year ago.

Indeed, as the Empire State’s challenged two-year rollout of its adult-use market finally appeared to be moving forward, the state’s total licenses in application exceeded the total number of applications in pre-licensing in the rest of the country by a factor of four. New Mexico, which led the country in pre-licensing in the first quarter of the year, had the second-most number of applications in pre-approval status, with 394 applications awaiting approval, an 8% decrease from the prior quarter. Oregon, which implemented a licensing cap in mid-2024, saw new applications fall 46% to 144 applications in pre-licensing at yearend.

Summary

In 2024 the U.S. cannabis market showed signs of stabilization after two years of significant contraction. New York stood out as a major driver of growth, dominating pre-licensing activity and experiencing a dramatic surge in new applications as its adult-use market finally gained momentum. Meanwhile, vertically integrated operators showed signs of recovery, though the sector has yet to fully rebound from earlier declines. In Canada, the market was stable in the fourth quarter but saw a 15% annual decline in active licenses, reflecting a mature and consolidating industry. Overall, the ongoing disparities in the age and maturity of state markets, shaped the evolving dynamics within the cannabis industry, with some states experiencing rapid growth while others continue to face challenges.

*Registered users can download the full 2024 Cannabis Business Licensing Review in PDF format here.*