While the goal of this newsletter is to be effectively a March-only report, as we put it together, it is difficult for us to ignore the events from early April. In fact, it is impossible to unsee what has been taking place across the global economy following the self-inflicted chaos that originated here in the U.S. at the beginning of this month. The new, super-sized tariffs that seem to have been calculated on the back of a napkin have roiled the equity markets and left speechless nearly everyone who has passed high school history.

When it comes right down to it, the tariffs that were announced on April 2 make no sense. There is no way to connect the by-country percentages to actual tariffs that have been assessed by those countries; rather, they are calculated from trade deficits that only include goods, not services. The administration assessed tariffs that are multiples of what they should have been, and thus it is no surprise that global markets have responded in kind, falling to levels that preceded Trump’s November victory and eating deeper and deeper into post-Covid era gains.

For those investors who are still hanging onto their cannabis stocks, what will the impact of these tariffs be on our incredible shrinking industry? We can look at this two ways. On the one hand, the U.S. cannabis market, by virtue of it being insular within states and a prohibition on international transactions, is virtually isolated from the tariff issue. However, U.S. cannabis businesses across the operational spectrum are dependent on suppliers of goods and services from around the globe. Given their already razor-thin margins, the April tariffs could force many of these CRBs to the brink of disaster. And so we wait and hope there are more than two shoes that could drop over the coming months.

Cannabis-Linked Equity Performance

With that said, here are the highlights from March 2025. Please note this performance does not reflect the April tariffs.

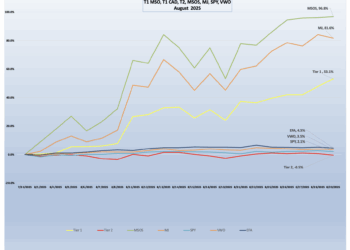

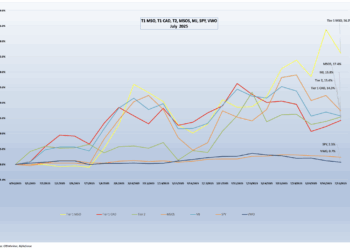

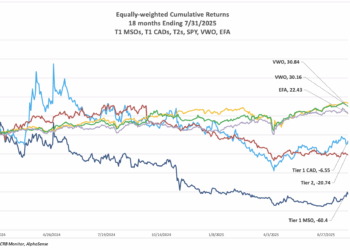

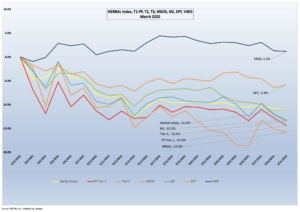

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure-play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), was negative while outperforming its peers in March (-11.0%), with negative returns coming from both Tier 1 and Tier 2 CRBs. It’s important to note that HERBAL’s semiannual reconstitution took place in the month of March. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-13.3%) and the actively managed MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-15.8%), simply would not reverse their several months-long downward spiral. Both of these funds are benchmarked to CRB-themed indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching marijuana exposure tend to be more sensitive than HERBAL to the federal regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin in 2017, MJ has held a significant percentage of non-pure-play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally, in 2022 MJ added and still maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, the Amplify Seymour Cannabis ETF (NYSE: CNBS).

The performance of the CRB Monitor equally weighted basket of top pure-play Tier 1 CRBs was negative in March, returning -14.4%. This basket, which is an equally weighted portfolio of the 21 largest pure-play CRBs (including both U.S. plant-touching and non-plant-touching marijuana companies), had a return that was a reflection of the disappointing performance across the entire Tier 1 pure-play space. We will take a closer look at some of these below.

The CRB Monitor equally weighted basket of Tier 2 CRBs outperformed the Tier 1 CRB basket, posting a -13.5% return for March. In 2024, CRB Monitor published an update to our article on correlations of pure-play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time. We update this data a couple of times per year.

In March, U.S. equities experienced significant volatility, primarily driven by President Donald Trump’s aggressive trade policies, including the imposition of substantial tariffs on imports from Canada, Mexico and China. In response to these developments, major Wall Street banks like Morgan Stanley and Oppenheimer adjusted their forecasts for the S&P 500 index, while raising their expectations and probability of a recession. These actions and reactions heightened investor concerns about potential inflation and a looming recession, leading to sharp declines across major indices. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a dismal -5.9% return for the month.

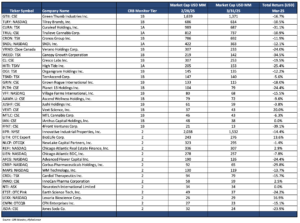

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – March 2025 Returns

An equally weighted basket of the largest Tier 1 pure-play cannabis equities once again was negative in March with most of the constituents underperforming the broad equity market. Tier 1 CRBs were outpaced by the Tier 2 basket by around 1%.

CRB Monitor Tier 1

Continuing on their downward trend, March CRB performance was lower across the universe of Tier 1 cannabis stocks. The MSO basket struggled, with larger Tier 1A MSOs Trulieve Cannabis Corp. (CSE: TRUL) (-10.9%), Tier 1B TerrAscend Corp. (TSX: TSND) (-5.6%), Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-16.7%), Tier 1B Cresco Labs Inc. (CSE: CL) (-19.5%)and Tier 1B Verano Holdings Corp. (CSE: VRNO) (-24%) tumbling for yet another month. Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-31.1%) could not sustain its positive trend from February, as it got crushed along with its rivals.

The Canadian CRB basket fared no better than the MSO group, and we can chalk that up to the same economic anxiety that affects the rest of the world. Tier 1B Canopy Growth Corporation (TSX: WEED) (-34.5%), Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-10.5%), Tier 1B High Tide Inc. (TSXV: HITI) (-25.4%), and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-12.1%) lost even more of their value in March, while Tier 1B Cronos Group Inc. (TSX: CRON) (-11.9%) erased its gains from February. As we have stated regarding these two groups, historical performance has deviated between the CAD and the MSO baskets over short periods, but they tend to mean revert over time.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies performed in line with the Tier 1 basket in March, posting a return of -13.5% for the month. Historically, these two portfolios are highly correlated (please see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to mean revert over time. When the two baskets deviate from one another (as they have done historically) the deviation could be a signal for investors to rebalance their Tier 1 and Tier 2 baskets given their direct revenue relationship. This is due to the fact that by definition, Tier 2 CRBs are direct suppliers of goods and services to Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lose money, so proceed with caution!

March provided evidence that whether or not they are lagging in performance, Tier 2 CRBs will eventually “catch up” to their main sources of revenue, namely Tier 1 CRBs.

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (-14.4%) fell back to earth after two months of positive returns. As we reported last month, on February 19 IIPR issued its fourth quarter 2024 earnings report, which featured the following highlights:

- “Total revenues of $308.5 million.

- Net income attributable to common stockholders of $159.9 million, or $5.52 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Adjusted funds from operations (AFFO) of $256.1 million, or $8.98 per share, and normalized funds from operations (Normalized FFO) of $231.0 million, or $8.10 per share.

- Declared dividends to common stockholders totaling $7.52 per share, increasing IIP’s common stock dividends declared each year since its inception in 2016.

- Committed over $70 million for the payment of purchase prices and funding of qualifying building infrastructure improvements for two property acquisitions and lease amendments for three properties.

- Released 530,000 square feet totaling ~6% of the total portfolio’s rentable square feet.

- Improved liquidity by increasing IIP’s revolving credit facility capacity from $30.0 million at December 31, 2023 to $87.5 million at December 31, 2024.

- At year-end, IIP’s portfolio totaled $2.5 billion of invested / committed capital and was comprised of 109 properties totaling 9 million rentable square feet in 19 states.”

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (-24.4%) reversed its positive course in March, in spite of the fact that over recent months it has outperformed its Tier 1 CRB lending clients. As we reported last month, on Feb. 13, AFCG released its fourth quarter 2024 earnings of $6.3 million which featured the following statement from CEO Daniel Neville:

“We believe that the capital supply and demand imbalance in the cannabis sector will remain in the medium-term, given the Republican sweep in November and the lack of progress on Federal reform. This provides the opportunity for AFC to deploy capital into deals with strong risk adjusted returns,” stated Daniel Neville, AFC’s Chief Executive Officer. He added, “We continue to put capital preservation at the forefront of our investments and remain disciplined on providing debt capital in a challenging environment for operators. As we have done over the last year and plan to do in the coming year, we continue to focus on diversifying our portfolio and providing debt capital to operators who have previous success executing in the cannabis industry.”

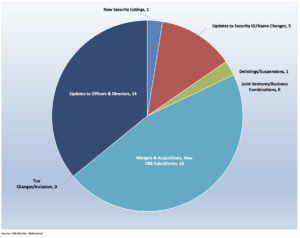

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for March 2025:

Cannabis Business Transaction News

In spite of all the hysteria coming from the federal government, cannabis businesses continued to complete transactions while seeking out new ones. And CRB Monitor was there, monitoring the news cycle at every turn, always looking for those small rays of hope that keep this industry humming along. The household-name CRBs like Green Thumb, Curaleaf, Trulieve and High Tide all had a busy month, soldiering on in spite of all the uncertainty being handed to investors from this administration.

Here are some of the highlights from March:

First, we head south to Florida, where Tier 1A CRB Trulieve Cannabis Corp. (CSE: TRUL) issued a March press release announcing the opening of a new medical cannabis dispensary in North Miami Beach, Florida. In the words of the article, “The new dispensary will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida. Across Florida, Trulieve offers home delivery, convenient online ordering, and in-store pickup. Veterans receive 20% off every order when they show their military ID, and all first-time guests are eligible for a 60% new customer discount at any Florida Trulieve location.”

As of the time of this opening, Trulieve holds 113 active cannabis licenses in the U.S. and Canada.

Canadian Tier 1B CRB 1B High Tide Inc. (TSXV: HITI) announced in a March 18 press release that “its Canna Cabana retail cannabis store located at 99 Balsam Street in Collingwood, ON will begin selling recreational cannabis products and consumption accessories for adult use on March 13, 2025; and that its Canna Cabana retail cannabis store located at 1 Hespeler Road in Cambridge, ON will begin selling recreational cannabis products and consumption accessories for adult use on March 17, 2025. These openings will mark High Tide’s 193rd and 194th Canna Cabana branded retail cannabis locations in Canada, and the 78th and 79th in the province of Ontario.”

The press release goes on to announce one more detail: “In addition, High Tide announces the grant of 25,000 incentive stock options to consultants of the Company. Each Option is exercisable at the closing price of the Company’s common shares listed on the TSX Venture Exchange based on the last trading day immediately prior to this press release, expires two years from the date of grant, and vests over a one-year period. Each Option is exercisable to purchase one common share of the Company and are being issued pursuant to the terms of the Company’s Omnibus Plan, which became effective on June 2, 2022.”

High Tide now holds 204 active licenses and operates in three countries.

Next, we head out west to Nevada, where the largest publicly traded CRB by market cap, tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) issued a March press release announcing “the opening of RISE Dispensary Henderson on Boulder, located at 1000 S Boulder Hwy, Henderson, NV 89015, on March 4. The new Henderson location, conveniently near the Downtown Henderson Water Street District, marks the 12th RISE Dispensary location in Nevada and 102nd nationwide. Beginning March 4, RISE Dispensary Henderson on Boulder will bring patients and adult-use customers award-winning, high-quality products and convenient services, such as curbside pickup. RISE Dispensary Henderson on Boulder will be open 8 a.m. until 11 p.m. Monday through Sunday, offering a broad selection of curated products from Green Thumb’s family of brands, including RYTHM, Dogwalkers, Incredibles, Beboe, Good Green, &Shine and Doctor Solomon’s. RISE Dispensary Henderson on Boulder is the second RISE location in Henderson, Nevada. RISE Dispensary Henderson is located just 10 miles away from the new location at 4300 E Sunset Rd, Suite A3, Henderson, NV 89014.”

With this opening Green Thumb now holds 96 active licenses in the U.S. and operates in 15 states.

We stay out west (Arizona, specifically) with a new opening for Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA). In a Feb. 27 press release, Curaleaf announced “the relocation of its Sedona, Arizona dispensary to 1610 State Road 89A, offering a more convenient and accessible location for customers in the Sedona area, directly off of the city’s major highway. Curaleaf Sedona’s new location will be…accommodating both adult use and medical patients. Customers can explore Curaleaf’s premium suite of products, including its wide variety of trusted brands such as Select, Grassroots, JAMS, Find and Curaleaf. Products range across flower, concentrates, vapes, infused pre-rolls and more, and feature Select Zero Proof Hemp Seltzer, Select vapes with a new strain offering across Stiq, Cliq and Briq hardware, as well as Find flower (half ounce and ounce), and Grassroots (1/8ths, concentrates and infused pre-rolls). With over 150 vendors represented and a continually growing roster, Curaleaf Sedona offers a rich variety of cannabis products to meet the needs of all customers and will introduce even more innovative product offerings in the weeks to come.”

With this addition, Curaleaf now holds cannabis licenses in six countries, including 111 active licenses issued by U.S. regulators.

Finally, we head back down to Florida, where Tier 1B MSO Planet 13 Holdings Inc. (CSE: PLTH) issued a March 27 press release announcing “the grand opening of its 31st Florida dispensary in Port Richey…this 3,465-square-foot dispensary will host its grand opening on March 28 and 29, 2025. ‘We are eager to expand our presence in Florida and in the rapid-growth Tampa Bay region with the opening of Planet 13 Port Richey,’ said Larry Scheffler, Co-CEO of Planet 13. “This location is strategically positioned on Ridge Road, a major arterial route with high visibility and accessibility. We look forward to bringing our best-in-class cannabis products and unmatched customer service to the residents of Pasco County and beyond.”

With this Florida opening, Planet 13 now holds 18 active cannabis licenses across four U.S. states.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Little Green Pharma Limited | ASX: LGP | Tier 1A | Appointment of Managing Director – Mr Paul Long |

| Trulieve Cannabis Corp. | CSE: TRUL | Tier 1A | Trulieve Announces Appointment of Ryan Blust as Interim Chief Financial Officer |

| Ayr Wellness Inc. | CSE: AYR.A | Tier 1B | AYR Wellness Announces Changes to Management |

| Red Light Holland Corp. | CSE: TRIP | Tier 1B | Red Light Holland Appoints Michael Galloro to Board of Directors |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Beckett’s Inc. | CSE: BKTS | Move from Tier 1B to Tier 2 | Tier 2 – Food, Beverage & Tobacco |

| Global Wholehealth Partners Corp | OTC Expert: GWHP | Moved to Watchlist | Tier 3 – Electronic Equipment |

| Valid Solucoes SA | B3: VLID3 | Moved to Watchlist | Tier 3 – Electronic Equipment |

| The Sustainable Nutrition Group Ltd. | ASX: TSN | Moved to Watchlist | Tier 1A – Licensed CRB |

| GreenBank Capital Inc. | CSE: GBC | Moved to Watchlist | Tier 3 – IT Services & Software |

Cannabis News: Regulatory News Updates

In spite of the many unrelated distractions giving us fits and starts over the month of March, we continued to follow the cannabis regulatory news cycle in earnest. As we said in our February newsletter, the United States appears to be no closer to legalization, decriminalization, safe banking or rescheduling than it has been for the last 18 months. The new administration has called into question the future existence of all government agencies, even though (we believe) it would take an act of Congress to remove them completely. As always, we sit back and watch as we see just how many shoes will drop before we see any common sense from the right.

Here are some of the March 2025 highlights from the cannabis-related regulatory news cycle:

We begin with an article from our very own CRB Monitor News Team which reported that “the Alabama Medical Cannabis Commission may finally move forward with dispensary and integrated facility licensing after an appellate court lifted a year-long restraining order against the beleaguered agency.”

According to the article, “Alabama’s legislature legalized medical cannabis in 2021. By 2023, the AMCC had licensed cultivators and producers. The agency then hit some legal speed bumps when three subsequent attempts to award processor and retail licenses were blocked by legal actions. On March 7, Alabama’s Court of Civil Appeals overturned a lower court’s temporary restraining order from January 2024 that had left the AMCC unable to move forward with any more attempts at licensing.”

The suspension of the TRO provides optimism to operators in the state, as they wait to resume operations of their businesses.

Next, we head down to the Sunshine State, where Florida regulators have set their sights on the distribution of hemp-derived products. A March 31 article in the Cannabis Business Times reported that The Florida Senate Fiscal Policy Committee voted unanimously, 18-0, on March 27 to advance Senate Bill 438, which “aims to prohibit all products containing hemp-derived synthetic cannabinoids, incorporate comprehensive rules for product testing, restrict where stores selling hemp products can be located and ban certain product advertising, among other regulations. The cannabinoids that would be prohibited under the legislation include delta-8 THC, delta-10 THC, HHC, THC-O, THCP and THCV.”

We have seen, typically in states that have yet to legalize adult-use marijuana, unlicensed businesses legally selling the above-mentioned compounds to the public. Because it is unregulated, this practice can be dangerous to consumers while undermining the progress of legal cannabis in those states. The article goes on to report, “For quality control, (the) latest legislation (S.B. 438) aims to require hemp extracts to be tested by a certified medical cannabis laboratory—rather than an independent lab—before it may be sold in the state. Product labels would be required to have accurate THC and CBD concentrations and ensure the absence of contaminants that are unsafe for human consumption.”

On a similar note we head west to Arizona, where a March 25 article in MJ Biz Daily reported that sales of THC-infused products in Arizona anywhere but at licensed marijuana stores “is illegal and enforcement will begin next month, the state’s attorney general warned in letters to cannabis retailers.”

Once again this is no surprise, and we would say that it is somewhat late in coming, as operators have taken advantage of the 2018 Farm Act, which emboldened production and sale of ingestible hemp-derived THC products. The article goes on to report, “Arizona Attorney General Kris Mayes issued the directive after her office became aware that some unlicensed businesses – including local shops and national retail chains – are selling hemp-derived, THC-infused beverages and edibles.”

The news report continues, “The warnings prompted the Arizona Dispensaries Association (ADA) to issue an alert to its members, other retailers and consumers urging awareness and compliance.”

On a similar note, we head over to Colorado for one more story related to the headache being caused by the proliferation of hemp-derived THC products. A March 14 article published by MJ Biz Daily reported that “Colorado’s regulated marijuana market is riddled with unsafe and illegal hemp-derived THC, a flow that regulators are unable or unwilling to stop, a state-licensed cannabis company alleges in a lawsuit. In a March 10 complaint filed in state court in Denver, cultivator and manufacturer Mammoth Farms accused the Marijuana Enforcement Division (MED) of allowing Colorado’s distillate market to be ‘illegally taken over by synthetic THC from outside’ the state.”

Not another one! In all likelihood this phenomenon has all the makings of an epidemic, but this should be no surprise to investors given all the headwinds that legal cannabis businesses have faced over the last five to 10 years. The article goes on to report, “The suit by Mammoth, headquartered in the rural town of Saguache, lists crimes allegedly committed by ‘bad actors who often have connections with drug cartels and other potentially dangerous criminals’ that MED has failed to stop.”

Finally we head back east, to the Commonwealth of Virginia, where a March 25 article published in MJ Biz Daily reported that Virginia Republican Gov. Glenn Youngkin has once again rejected a bill that would allow sales of adult-use marijuana in the state. Stating that this veto was “as expected,” the article reports, “A year ago, lawmakers sent Youngkin similar legislation, which he similarly rejected. That means Virginia remains the only state to have legalized adult-use cannabis without allowing regulated sales. Virginia legalized adult use in 2021, but a quirk in that law required further legislation to create a framework for sales. And so far, efforts to legalize sales have failed. Youngkin justified the veto of the adult-use sales bill and other legislation with a blanket statement, claiming the measures would ‘take the Commonwealth backward by … making our communities less safe,’ according to Norfolk TV station WVEC.”

CRBs In the News

The following is a sampling of highlights from the March 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.