Last month we wrote about some of the sources of risk in the cannabis equity realm, which include shrinking market capitalization, close to nonexistent trade volumes, and tiny stock prices, all of which have contributed to the overall avoidance of cannabis as an asset group by institutional investors. And while the overall trend for the last 5 years has been down, July was one of those exceptional months in which we saw a rebound. Whenever we have this positive swings, they must be accompanied by a sobering disclaimer: that cannabis equity prices are largely sentiment-driven and the illiquidity of even the largest CRBs by market cap can drive those prices through the roof, or more likely, through the floor, at a moment’s notice.

This time it would appear that the spike was related to revelations from the executive branch about the latest DEA Administrator’s approach to marijuana rescheduling. While it is true that the President has made positive overtures with regard to rescheduling (as well as legalization), we can never be certain with the administration which policies will eventually take hold. Nevertheless, we (along with the rest of you stakeholders) will continue to wait for any sort of indication that any cannabis-related reforms will reach the finish line.

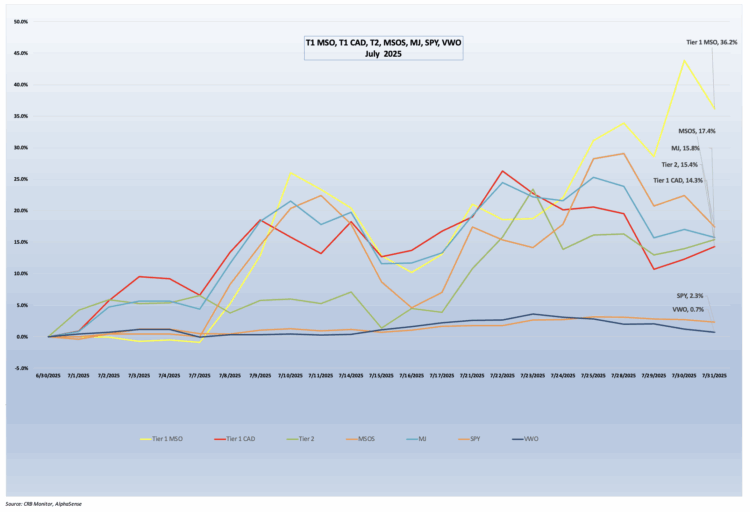

Performance for the two largest US plant-touching cannabis-themed ETFs showed a sharp turnaround from the last few month, with the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (+15.8%) and the actively-managed MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (+17.4%) posting positive returns. Both of these funds are benchmarked to pure play CRB-themed indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. It’s worth mentioning that these funds are not considered Controlled Substances Act (CSA)-friendly, as they both carry exposure to US plant-touching marijuana businesses.

The performance of the CRB Monitor equally-weighted baskets of top Pure Play Tier 1 MSO and CAD CRBs performed well in July, returning +36.2% and +14.3, respectively. These two basket are equally-weighted portfolios of the largest Pure Play CRBs (representing separate groups of US plant-touching and non-US plant-touching MJ companies).

The CRB Monitor equally-weighted basket of Tier 2 CRBs outperformed the Tier 1 CRB basket, posting a +15.4% return for July 2025. This month CRB Monitor published an brand new update to our article on correlations of Pure Play Tier 1 and Tier 2 CRBs. And what we have observed historically is that these two groups tend to display high correlation (~0.50) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. An update of this research is about to be published in the days to come.

In July 2025, U.S. equities were slightly higher and this marked the S&P 500’s third straight monthly gain, powered by upbeat corporate earnings, easing trade tensions, and record-breaking performance across mega-cap tech and AI-driven names. Positive sentiment was supported by robust corporate earnings, particularly in tech and utilities. The defensive healthcare sector, however, lagged, posting monthly losses of around –3.3%. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a return of +2.3% for the month of July.

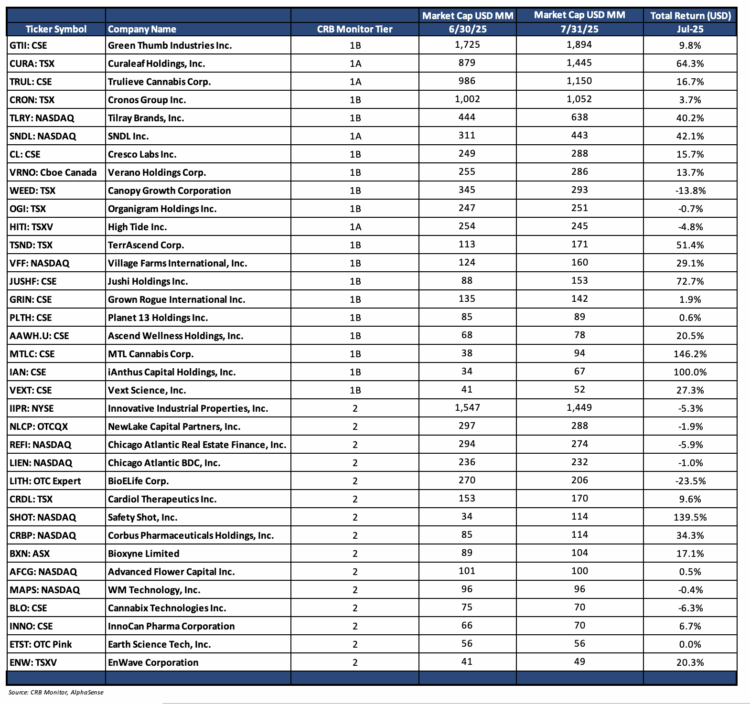

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – July 2025 Returns

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities rebounded in July 2025 with most of the constituents significantly outperforming the broad equity market. Tier I CRBs outpaced the Tier 2 basket by more than 10%.

CRB Monitor Tier 1

July 2025 CRB performance across the universe of Tier 1 cannabis stocks were largely positive for the month with some breathtaking returns. The MSO basket responded well to positive (rescheduling) rumors from the US government. Tier 1A MSOs Trulieve Cannabis Corp. (CSE: TRUL) (+16.7%), Tier 1B Cresco Labs Inc. (CSE: CL) (+15.7%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (+13.7%) and Tier 1B TerrAscend Corp. (TSX: TSND) (+51.4%) rebounded. The largest tier 1B MSO by market cap, Green Thumb Industries Inc. (CSE: GTII) (+9.8%) was also positive while Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+64.3%) busted out following a dismal H1 2025.

The Canadian CRB basket was mixed but had flashes of brilliance as well. Tier 1B CRB Canopy Growth Corporation (TSX: WEED) struggled in July (-13.8%), while Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (+40.2%) and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+42.1%) soared; meanwhile the ever-expanding Tier 1B High Tide Inc. (TSXV: HITI) finished slightly negative (-4.8%) while Tier 1B Cronos Group Inc. (TSX: CRON) (+3.7%) ended the month modestly higher. As we have stated regarding these two groups, short-term performance has deviated between the CAD and the MSO baskets, but they tend to mean-revert over time and historical correlations are high. It is also worth mentioning that as an industry cannabis has fallen to the point where no company’s stock can even be regarded as a small capitalization stock; over the last few years they have all shrunk (some by more than 90%) to the point where they are considered micro-caps and effectively non-investable by most institutions from a policy perspective. For more detail on the MSO/CAD relationship, please see our August Chart of the Month on our CRB Monitor News website.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies underperformed the Tier 1 basket in July 2025, posting a positive return of +15.4%. Historically the performance of these two portfolios has displayed high correlation (please see our new August 2025 “Chart of the Month”), and we do expect the returns of Tier 1 and Tier 2 CRBs to mean-revert over time. When the two baskets deviate from one another in the short term, the deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship. This is due to the fact that Tier 2 CRBs are direct suppliers of goods and services to (and derive their revenues from) Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict and the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lead to losses, so proceed with caution!

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (-5.2%) corrected after a few months of positive performance. On August 6th IIPR issued its 2nd quarter 2025 earnings report, which featured the following highlights:

- Generated total revenues of $62.9 million and net income attributable to common stockholders of $25.1 million, or $0.86 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (“AFFO”) and normalized funds from operations (“Normalized FFO”) of $48.4 million and $44.1 million, respectively.

- Paid a quarterly dividend of $1.90 per common share on July 15, 2025 to stockholders of record as of June 30, 2025. Since its inception, IIP has paid $1.0 billion in common stock dividends to its stockholders.

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+1.0) posted modest gains in July, and over recent months it has outperformed its Tier 1 CRB lending clients. On August 13th AFCG reported its 2nd Quarter 2025 earnings of $6.3 million which featured the following eye-opening statement from CEO Daniel Neville:

“AFC also announced today its intention to seek to convert from a commercial mortgage real estate investment trust (“REIT”) to a business development company (“BDC”), subject to shareholder approval of certain related matters. If approved, the conversion will enable the Company to pursue a broader array of investment opportunities, including both real estate- and non-real estate-related assets. The proposed conversion to a BDC marks an important milestone in AFC’s trajectory,” said Dan Neville, CEO, adding “Given the capital-intensive nature of the cannabis industry, combined with the high cost of capital, many operators do not own real estate, which significantly limits the universe of cannabis operators AFC can lend to as a mortgage REIT. Converting to a BDC would significantly expand our investable universe, allowing us to lend to ancillary cannabis businesses with high growth potential, as well as non-real estate covered, vertically integrated operators.””

Tier 2 wellness company, Safety Shot, Inc. (Nasdaq: SHOT), is a hemp-derived cannabidiol (CBD), consumer product development company. In July this company’s stock posted a return of +139.5%, making it the best-performing CRB for the month. With that said, SHOT is considered a microcap company and its thinly-traded volume can subject its price to wild swings on daily company news.

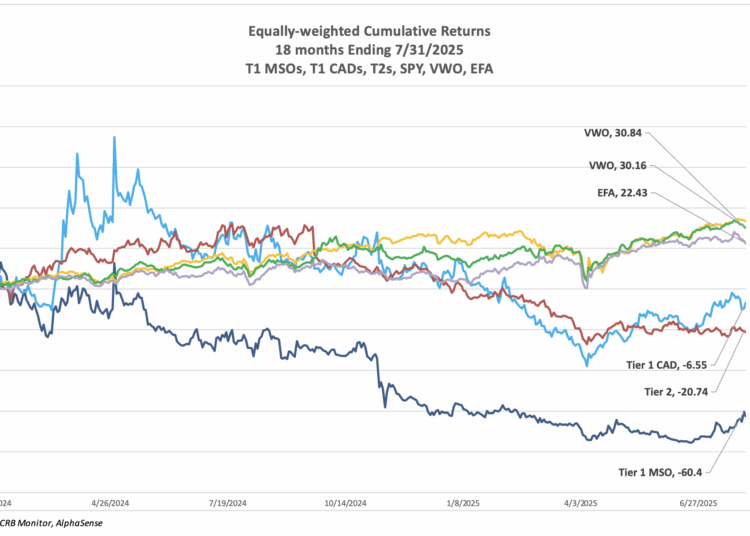

CRB Monitor Chart of the Month – Tier 1-Tier 2, MSO-CAD Cannabis Equity Returns

We periodically analyze the historical performance of several components of the publicly-traded, cannabis-related equity universe, as this information can provide insights into the outside forces that have had a material impact on the space. And while there were no major surprises this time, it was a worthwhile exercise nonetheless.

We need to remind ourselves that cannabis equities of all types have taken a massive hit over the last few years, and we are not likely to see a complete recovery any time soon. The lack of a resolution on federal legalization, banking reform, or DEA rescheduling has severely hamstrung the industry and placed it at a significant disadvantage versus any category you would like to place it in (pharmaceuticals, consumer discretionary, beverages and tobacco, etc.).

It’s difficult to find any silver linings as we look at the recent history of Tier 1 and Tier 2 pure play cannabis companies, as they have had to navigate the same consistent headwinds for several years while global markets have flourished. And sadly the long-lasting collapse of the industry has translated into significantly smaller market caps, thinner trade volumes, and higher volatility across the board. As such, the cannabis equity market is now largely off-limits to institutional investors. Please read the full report on the CRB Monitor News website.

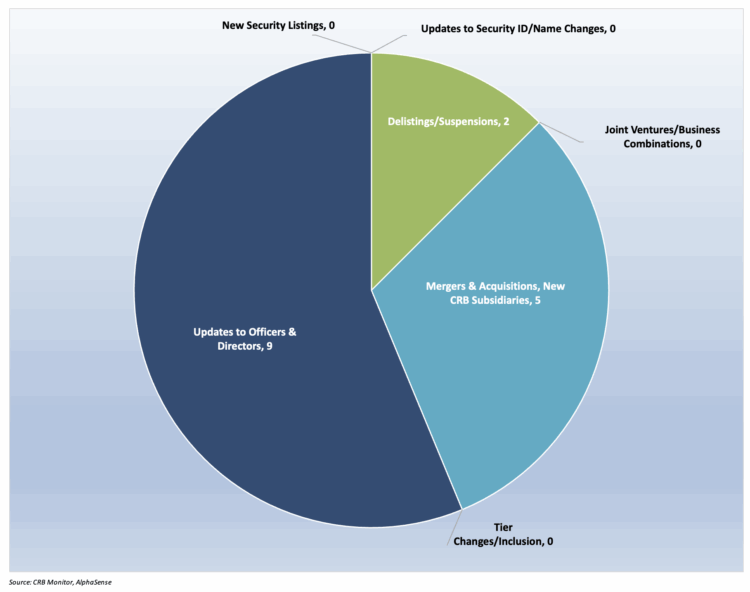

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for July 2025:

Cannabis Business Transaction News

The CRB Monitor research team covers the cannabis news cycle daily, remaining up to date on all the relevant information vital to the ongoing accuracy of our data. Fortunately for investors, cannabis equities remained stable as we waded into the summer months. And the news kept coming, in spite of vacation-level trade volumes.

On that note, here are some of the cannabis company highlights from July 2025:

More activity from Canadian Tier 1B CRB 1B High Tide Inc. (TSXV: HITI), who announced in an July press release that its Canna Cabana retail cannabis store located at 4341 50 Street in Drayton Valley, Alberta, has begun selling recreational cannabis products and consumption accessories for adult use as of July 31, 2025. This opening brings High Tide’s total store count to 203 Canna Cabana branded locations across Canada and 88 in the province of Alberta...Ideally positioned on the south end of Drayton Valley’s town center, the store is set within a bustling plaza alongside a national grocery chain, a pharmacy, and multiple fast-food options. With excellent visibility on the central road that runs through town and well distanced from existing competitors, this new store is perfectly placed to serve the community’s growing demand.” High Tide now holds 215 active licenses and operates in 3 countries.

Next we head south to Florida, where tier 1B MSO Branded Legacy, Inc. (OTCQB: BLEG) issued an July press release announcing “the execution of a non-binding Letter of Intent (LOI) to acquire Bio-Legacy Evaluative Group, a pioneering health innovation company specializing in advanced intranasal drug delivery technologies. The LOI, fully executed by both parties, outlines the proposed acquisition of 100% of Bio-Legacy Evaluative Group’s equity interests, assets, intellectual property, and operations in exchange for $1.5 million worth of Branded Legacy’s Preferred D stock.” Branded Legacy, Inc. is a holding company that specializes in hemp and CBD. With 5 active hemp licenses, Its primary focus is the commercial development of hemp and cannabinoid-infused beverages along with an array of CBD topicals and tinctures with a secondary focus on acquiring manufacturing facilities/companies that can aid in the development of its product lines.

Also in Florida, Tier 1B MSO iAnthus Capital Holdings, Inc. (CSE: IAN) issued a July press release announcing “the opening of its 22nd GrowHealthy dispensary in Florida, now serving patients in Palm Harbor. “The Palm Harbor community has been asking for a GrowHealthy location for some time, and we are thrilled to finally open our doors,” said Kelly Heinichen, Vice President of Retail Operations at iAnthus. “From day one, our focus has been clear – offer safe, consistent access to the highest quality medical cannabis in Florida. Everything about this space – from the layout to the lighting to the local vibes – was built with the patient in mind.” With this acquisition iAnthus Capital now holds 62 active cannabis licenses in the US and operates in 10 US states and 2 Canadian provinces.

Finally, in Ontario, the once all-powerful Canadian Tier 1B CRB Canopy Growth Corporation (TSX: WEED) issued a July press release announcing “the appointment of Tom Stewart as Interim Chief Financial Officer, effective immediately. Mr. Stewart succeeds Judy Hong, who served as Canopy Growth’s Chief Financial Officer since April 2022. During her tenure, Ms. Hong played a key role in improving the Company’s capital structure and significantly strengthening its financial position…Mr. Stewart is an accomplished finance executive with over 20 years of experience with public companies, including accounting, reporting, FP&A, and operational finance. He joined Canopy Growth in 2019 as Chief Accounting Officer, following 10 years in increasingly senior finance roles at Constellation Brands, Inc. Mr. Stewart began his career at PricewaterhouseCoopers and is a Certified Public Accountant in the state of New York. Mr. Stewart’s appointment is part of the Company’s continued execution of its Fiscal 2026 strategy, which includes a sharpened focus on operational efficiency, disciplined capital management, and building a sustainable, performance-led business. His background in performance-driven consumer packaged goods finance and accounting makes him well-suited to support Canopy Growth’s financial and operational priorities in this next phase.” Canopy Growth’s active cannabis license total is now 112 across 3 countries.

Select CRB Business Transaction Highlights

| Company Name | Ticker Symbol | CRBM

Tier |

Event |

| FLUENT Corp. | CSE: FNT.U | Tier 1B | FLUENT Celebrates First Adult-Use Dispensary with the rebrand of the recently acquired Kingston Dispensary in New York |

| iAnthus Capital Holdings, Inc. | CSE: IAN | Tier 1B | iAnthus Continues Expansion in Florida with GrowHealthy Dispensary of Palm Harbor |

| THC Therapeutics, Inc. | OTC Expert: THCT | Tier 2 | THC Therapeutics, Inc. Announces Acquisition of SugarTop Buddery |

| Branded Legacy, Inc. | OTCQB: BLEG | Tier 1B | Branded Legacy, Inc. Signs Letter of Intent to Acquire Bio-Legacy Evaluative Group, Advancing Innovations in Intranasal Drug Delivery |

| High Tide Inc. | TSXV: HITI | Tier 1B | High Tide Opens New Canna Cabana Location in Drayton Valley, Alberta |

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Eat Beyond Global Holdings Inc. | CSE: EATS | Tier 1B | Digital Asset Technologies Appoints Alexander Kravets to Advisory Board |

| Canopy Growth Corporation | TSX: WEED | Tier 1B | Canopy Growth Appoints Tom Stewart as Interim Chief Financial Officer |

| Verano Holdings Corp. | CSE: VRNO | Tier 1B | Verano Announces Promotion and Appointment of James Leventis as Chief Strategy and Compliance Officer |

| Organto Foods Inc. | TSXV: OGO | Tier 1B | Appointment of Javier Reyes de la Campa as Co Chair of the Board (ORGANTO FOODS INC) |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Safety Shot, Inc. | NASDAQ: SHOT | Moved to Watchlist | Tier 2/ CBD – Personal Products |

| Kyn Capital Group Inc. | OTCID: KYNC | Moved to Watchlist | Tier 3/ Professional Services |

| SGD Holdings, Ltd. | OTC Pink LTD: SGDHD | Moved to Watchlist | Tier 2/Real Estate |

| Ceapro Inc. | TSXV: CZO | Moved to Watchlist | Tier 3/ CBD – Pharma & Biotech |

| Telco Cuba, Inc. | OTCID: QBAN | Moved to Watchlist | Tier 3/ Containers & Packaging |

Cannabis News: Regulatory News Updates

The cannabis industry soldiered on in July, and as such we closely followed the cannabis news cycle as it faced newer challenges along with some of the old ones. The emergence of “intoxicating hemp” (with products like Delta-8), by virtue of its compliance with the Farm Bill, has taken the United States by storm. Indeed, Delta-8’s loophole-aided success has added to the headwinds that have impeded the progress of legal marijuana sales while the legalization process for marijuana has stalled. With that said, there continue to be signs of a “jump-start” and we have no doubt that the market will always have its moments of temporary euphoria. What is unfortunate is that, because Delta-8 businesses may operate unlicensed, they place law-abiding licensed cannabis businesses at a significant economic disadvantage which begs the question – why wouldn’t licensed CRB’s change their strategy and sell intoxicating hemp? Stay tuned.

On that note, here are some of the July 2025 highlights from the cannabis-related regulatory news cycle:

We begin in the state of Kentucky, where an article published by our CRB Monitor News team reported that “Kentucky’s first licensed medical cannabis cultivator is open for business, despite continued pushback over how the state conducted its licensing lotteries last fall.” Kentucky is finally taking the plunge, thanks to the efforts of cannabis lobbyists and perhaps a bit of listening to constituents by their legislators. ““This administration made a commitment to Kentuckians suffering from cancer, PTSD, multiple sclerosis and other eligible conditions, and I am proud we are making progress to deliver safe, affordable access to medical cannabis,” said Gov. Andy Beshear in a July 15 statement. “Through work with the General Assembly to move up business licensing by six full months and providing licensees with the tools they need to get up and running, we are closer than ever to providing Kentuckians with life-changing relief.””

Next we head west to Missouri, where a July article from our CRB Monitor News team reported that “Regulators in Missouri stripped C&C Manufacturing of its cannabis manufacturer’s license on July 17, following a massive product recall last summer. The revocation comes about five months after the state rescinded the license of Delta Extraction for a similar recall. Last year, the state discovered that C&C was illegally importing cannabis products from out of state to use in the production of distillate, which was then used to create products such as vapes or edibles. That discovery led to the state’s largest cannabis recall, pulling over 132,000 products from the shelves.” Why is this significant? We would suggest the size of the market and the excess demand are factors. The article goes on to report: “Missouri first allowed adult-use sales Feb. 3, 2023, with existing medical operators getting the first crack at the market. Since then, the state has authorized 62 active cultivators, 83 manufacturers and 218 retailers, according to the CRB Monitor licensing database. By some estimates, the Show Me State has transformed into the fifth largest adult-use market in the nation. Demand is high, and the market has reached a point where suppliers feel the need to look outside the state for products to fill that demand.”

Now we head back to our nation’s capital, where a July article in MJ Biz Daily reported that “Congressional lawmakers sent another clear signal that they intend to halt federal protections for intoxicating hemp-derived THC products when a bill that closes the so-called “hemp loophole” passed the U.S. Senate Appropriations Committee…Although the redefinition of hemp proposed by U.S. Sens. Mitch McConnell and Jeff Merkley would not take effect for one year, it would effectively ban 90% of hemp products on the market, hemp advocates warned.” What is happening is what we have been reporting for several months, that intoxicating hemp has been taking the US by storm and it’s popularity has created headwinds for lawmakers that are committed to regulating it. The article goes on to report: “Under the bill, industrial hemp, which remains legal under federal law, is:

- Cannabis sativa with a “total” THC concentration, including THCA, of 0.3% or less.

- Grown for fiber, fuel, food, or “any other non-cannabinoid derivative” final product.

- The definition of “hemp-derived cannabinoid products” would also prohibit both synthetically derived THC, such as delta-8 and delta-10 THC.

Next, we drive north on I-95 to Pennsylvania, and a July article in MJ Biz Daily which reported that Pennsylvania lawmakers have reintroduced a pair of bipartisan adult-use marijuana legalization proposals over the past week. On Monday, Democratic state Rep. Emily Kinkead and Republican state Rep. Abby Major introduced House Bill 20. That follows last week’s introduction of Senate Bill 20 from Republican state Sen. Dan Laughlin and Democratic state Sen. Sharif Street. For those that haven’t been following the drama play out in the Keystone state, Pennsylvania has been in this battle over adult-use cannabis for several years. In the words of the article, “Pennsylvania is one of the largest medical-only marijuana markets in the U.S. that’s still waiting for adult-use legalization. Legal cannabis could net the state as much as $2.1 billion in sales in year one, according to an economic study commissioned by legalization advocacy group Responsible PA. But despite pressure from Gov. Josh Shapiro, who said he’d sign a legalization bill into law if the state General Assembly would pass one, attempts to do that this spring fell short.” We will continue to follow the tug-of-war in Pennsylvania as it plays out.

Finally, we head extremely far to the west, and to the state of Hawaii, where politicians are seeking to prop up medical cannabis sales through business expansion. A July article in MJ Biz Daily reported that “Hawaii’s sagging medical marijuana market is set to expand after the governor signed a bill into law that allows for more qualified patients and for dispensaries to sell more products. It’s a welcome boost for cannabis in Hawaii, where adult-use marijuana legalization failed again this spring. Hawaii’s MMJ program remains extremely modest, with roughly 30,000 registered patients as of last fall – a decrease of 15% from a peak of 35,444, according to state data.”

In the meantime, Hawaii is experiencing some of the same problems as other states with illicit marijuana sales and competition from hemp-derived THC products.

Many more patients ought to qualify for medical marijuana under HB 302, which:

- Allows medical professionals to recommend MMJ via telehealth.

- Allows both physicians and “advanced practice registered nurses” t recommend marijuana for any condition where “the benefit of the medical use of cannabis would likely outweigh the health risks.”

- Establishes criminal penalties for illegal cannabis sales, including for anyone who posts ads or notices for unlicensed sales online.

CRBs In the News

The following is a sampling of highlights from the July 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know