Please believe us, the chart below is not an AI-generated visualization. This performance really happened in August 2025 – where cannabis equities, particularly those issues tied to multistate operators (MSOs), collectively nearly doubled in price from the prior month. To what do we owe this jaw-dropping performance?

This could either be the sign that cannabis investors were waiting for – that things are finally going to be alright – or that we are headed for whiplash once again, as we have seen so many times over the last half decade. What we witnessed in August appeared to be a reaction to the latest revelations about rescheduling, more specifically the possible Drug Enforcement Administration (DEA)’s reclassification of THC from a dangerous narcotic (Schedule I) to something more like strong aspirin (Schedule III). And last month the President of the United States chimed in, advocating for just that.

To be sure, Donald Trump’s words regarding rescheduling were far from an actual plan or even an endorsement; however, they were enough to send many Tier 1 cannabis stocks nearly to the moon, and when the dust settled by month end several CRBs had more than doubled in price.

As we have written in the past, this is unusual behavior for equities, but there are three reasons why good news (and let’s face it, this wasn’t definitive good news) can rock an industry like cannabis:

- These companies’ market capitalizations have fallen by as much as 90% over the last few years and are now considered “micro caps”; they therefore have limited or no interest from institutional investors

- Prices have dropped as well, and several of the largest CRBs have stock prices below $2, rendering them “untouchable” to many institutions

- Wide bid-ask spreads and poor liquidity lead to wild price swings when demand from buyers and sellers far outweighs supply

In this case, the market will hold its breath while investors wait for the final decision regarding rescheduling, and in the words of the President:

“…we’re looking at reclassification, and we’ll make a determination over the next few weeks, and that determination, hopefully, will be the right one. It’s a very complicated subject, you know, the subject of marijuana.” But we digress.

Cannabis-Linked Equity Performance

Not surprisingly, Performance for the two largest US plant-touching cannabis-themed ETFs was sharply higher, with the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (+81.6%) and the actively-managed MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (+96.8%) on a two-month hot streak. Both of these funds are benchmarked to pure play CRB-themed indexes, and while they use different construction methodologies, their returns will be directionally close to each other. It’s worth mentioning that these funds are not considered Controlled Substances Act (CSA)-friendly, as they both carry exposure to US plant-touching marijuana businesses.

The CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs also performed well in August, returning +53.1%. This basket is an equally-weighted portfolio of the largest Pure Play CRBs (representing both US plant-touching and non-US plant-touching MJ companies).

The CRB Monitor equally-weighted basket of Tier 2 CRBs significantly underperformed the Tier 1 CRB basket, posting a nearly-flat -0.5% return for August 2025. In August CRB Monitor published an brand new update to our article on correlations of Pure Play Tier 1 and Tier 2 CRBs. And what we have observed historically is that these two groups tend to display high correlation (~0.50) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (in this case marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. An update of this research is about to be published in the days to come.

In August 2025 U.S. equities posted robust gains, with indexes surging and reaching new record highs, propelled by strong earnings, resilient economic data, and rate‑cut hopes, despite a modest downturn in the final trading days of the month. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a return of +2.1% for the month of August.

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – August 2025 Returns

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities (a combination of MSO and CAD companies) posted significant gains in August 2025 with most of the constituents, particularly from the MSO group, crushing the broad equity market. Tier I CRBs outpaced the Tier 2 basket by more than 50%.

CRB Monitor Tier 1

August 2025 CRB performance across the universe of Tier 1 cannabis stocks was sharply higher, with returns that must have been a welcome sight for investors’ sore eyes. The MSO basket responded well to positive (rescheduling) news from the US government combined with pleasant earnings reports as well. Tier 1A MSOs Trulieve Cannabis Corp. (CSE: TRUL) (+100.5%), Tier 1B Cresco Labs Inc. (CSE: CL) (+155.6%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (+200.3%, not a typo!) and Tier 1B TerrAscend Corp. (TSX: TSND) (+180.4%) had strong performance throughout the month. The two largest MSOs by market cap, Green Thumb Industries Inc. (CSE: GTII) (+45.7%) and Curaleaf Holdings, Inc. (CSE: CURA) (+138.6%) both finished sharply higher.

The Canadian CRB basket performed well but returns were not quite as breathtaking as the MSOs. Tier 1B CRB Canopy Growth Corporation (TSX: WEED) rebounded in August (68.7%), while Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (+137.6%) gave investors “Game Stop” flashbacks. Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+55.8%) soared for the second month in a row while the ever-expanding Tier 1B High Tide Inc. (TSXV: HITI) finished sharply higher (64.2%). Tier 1B Cronos Group Inc. (TSX: CRON) (+31.3%) ended the month higher for the second month in a row. As we have stated regarding these two groups, short-term performance has deviated between the CAD and the MSO baskets, but they tend to mean-revert over time and historical correlations are high (August 2025 was one of those months). It is also worth mentioning that as an industry cannabis has fallen to the point where no company’s stock is even large enough to be classified as a “small cap” stock; over the last few years they have all shrunk (some by more than 90%) to the point where they are considered “micro-caps” and as such non-investable by most institutions from a policy perspective.

For more detail on the MSO/CAD relationship, please see our August Chart of the Month on our CRB Monitor News website.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies underperformed the Tier 1 basket in August 2025, posting a generally flat return of -0.5%. Historically the performance of these two portfolios (given their close business ties) has displayed high correlation (please see our new August 2025 “Chart of the Month”), and we do expect the returns of Tier 1 and Tier 2 CRBs to mean-revert over time. When the two baskets deviate from one another in the short term, the deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship. This is due to the fact that Tier 2 CRBs are direct suppliers of goods and services to (and derive their revenues from) Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict and the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lead to losses, so proceed with caution!

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+10.8%) was higher, rebounding from a disappointing July. On August 6th IIPR issued its 2nd quarter 2025 earnings report, which featured the following highlights:

- Generated total revenues of $62.9 million and net income attributable to common stockholders of $25.1 million, or $0.86 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (“AFFO”) and normalized funds from operations (“Normalized FFO”) of $48.4 million and $44.1 million, respectively.

- Paid a quarterly dividend of $1.90 per common share on August 15, 2025 to stockholders of record as of June 30, 2025. Since its inception, IIP has paid $1.0 billion in common stock dividends to its stockholders.

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+7.6%) performed well in August, and had been outperforming most Tier 1 CRBs until the wild returns of August 2025. On August 13th AFCG reported its 2nd Quarter 2025 earnings of $6.3 million which featured the following eye-opening statement from CEO Daniel Neville:

“AFC also announced today its intention to seek to convert from a commercial mortgage real estate investment trust (“REIT”) to a business development company (“BDC”), subject to shareholder approval of certain related matters. If approved, the conversion will enable the Company to pursue a broader array of investment opportunities, including both real estate- and non-real estate-related assets.

“The proposed conversion to a BDC marks an important milestone in AFC’s trajectory,” said Dan Neville, CEO, adding “Given the capital-intensive nature of the cannabis industry, combined with the high cost of capital, many operators do not own real estate, which significantly limits the universe of cannabis operators AFC can lend to as a mortgage REIT. Converting to a BDC would significantly expand our investable universe, allowing us to lend to ancillary cannabis businesses with high growth potential, as well as non-real estate covered, vertically integrated operators.””

Tier 2 technology company, WM Technology, Inc. (Nasdaq: MAPS), operates Weedmaps, the leading online listings marketplace for cannabis consumers and businesses, and WM Business, the most comprehensive SaaS subscription offering sold to cannabis retailers and brands. In August WM Technology’s stock posted a return of +38.9%, making it the best-performing Tier 2 CRB for the month. On August 7th, MAPS reported its 2nd Quarter 2025 earnings, with the following headlines:

- Revenues for the second quarter ended June 30, 2025 were $44.8 million as compared to $45.9 million in the prior year period

- Net income increased to $2.2 million as compared to $1.2 million in the prior year period.

- Adjusted EBITDA(3) increased to $11.7 million from $10.1 million in the prior year period.

- Total shares outstanding across Class A and Class V Common Stock were 156.5 million as of June 30, 2025.

- Cash increased to $59.0 million as of June 30, 2025, as compared to $52.0 million as of December 31, 2024

Announcement: CRB Monitor Securities Database Adds New Cannabis-Linked Sectors

CRB Monitor of Nashville, TN is pleased to announce that its global database of more than 1,600 cannabis-linked securities has undergone a review of Cannabis-linked Sector Classification System which has resulted in the addition of two new sectors to its universe.

The two new cannabis-linked sectors in the CRB Monitor database are Professional Services – Advertising and Professional Services – Consulting. The motivation for these new sectors was CRB Monitor’s goal to align its database elements with the U.S. Drug Enforcement Administration’s Controlled Substances Act, which characterizes these two activities as prohibitive under the Act.

The ongoing process of researching the capital markets’ underlying links to the cannabis industry has resulted in what we believe is the new standard in cannabis sector classification. Given CRB Monitor’s deep, proprietary information set, we have constructed a sector classification system that is an accurate reflection of each CRB’s connection to the cannabis industry. And the addition of two sectors in September 2025 sharpens the tools our clients need to better identify violators of the CSA.

Please click here to read the full article.

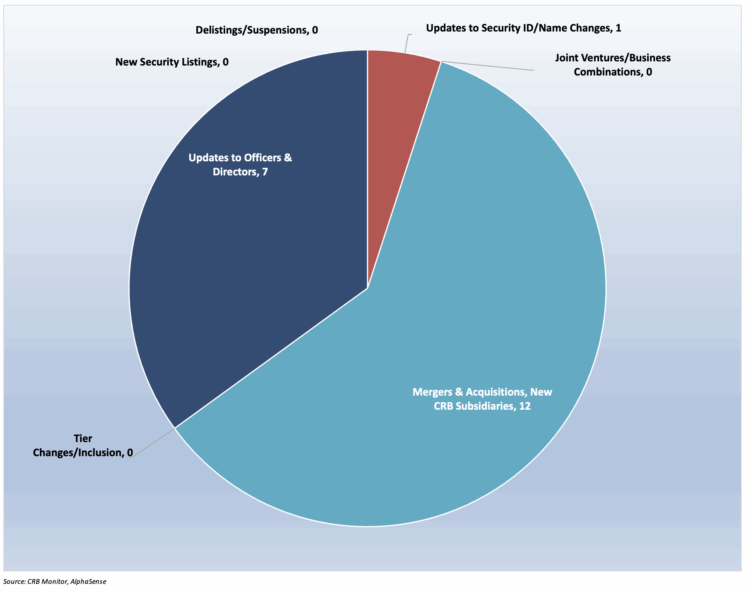

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for August 2025:

Cannabis Business Transaction News

As we have for more than half a decade, the CRB Monitor research team covers the cannabis news cycle daily. Our goal is to remain up to date on all the relevant information vital to the ongoing accuracy of our data in the CRB Monitor securities database. And while the cannabis industry has faced major regulatory obstacles over those years, there has never been a shortage of news as licensed CRBs’ operations evolve to survive in a complicated business and regulatory environment.

On that note, here are some of the cannabis company highlights from August 2025:

Canadian Tier 1A CRB High Tide Inc. (TSXV: HITI) announced in an August press release that it is entering the fast growing German medical cannabis market by signing a definitive agreement pursuant to which the Company will acquire 51% of Remexian Pharma GmbH, for a preliminary estimated purchase price of €27.2 million, subject to certain adjustments on closing, and will have an option to acquire the remaining interest in Remexian.” In the last 12 months, High Tide has been a standout among its peers in the area of operational expansion, primarily across Canada. With regards to the target company, the press release goes on to say the following: “Founded in 2018 and headquartered just outside of Berlin, Germany, Remexian is a leading and established pharmaceutical company built for the purpose of importation and wholesale of medical cannabis, and has a fully certified EU GDP warehouse. Among all German medical cannabis procurers, Remexian has one of the most diverse reaches across the globe, currently licensed to import into Germany from 19 countries, including Canada which represents approximately 33% of their total imports into Germany. Given its over $1.9 billion in Canadian cannabis sales since legalization, High Tide has the Canadian procurement expertise and relationships to leverage this transaction to significantly increase the Canadian share of medical cannabis imports into Germany.” High Tide now holds 215 active licenses and operates in 3 countries – Canada, Australia, and Germany.

The Cannabist moves into Delaware: Tier 1B MSO The Cannabist Company Holdings Inc. (CBoe Canada: CBST) issued an August press release announcing “the commencement of adult-use cannabis sales in Delaware. Delaware consumers aged 21 and older can now purchase cannabis products at The Cannabist Company’s three established Columbia Care dispensary locations throughout Delaware…The Cannabist Company operates three Columbia Care dispensaries strategically located across Delaware. Columbia Care Rehoboth Beach serves Delaware’s popular coastal region, while Columbia Care Wilmington is located in the state’s largest city. Columbia Care Smyrna was recently expanded to handle increased customer demand from adult-use sales. Each location features dedicated point-of-sale stations for adult-use customers while continuing to prioritize medical patients.” The Cannabis Company Holdings, originally named Columbia Care, once was the target of a friendly takeover in 2023 by Cresco Labs. When that takeover failed, a decimated Columbia Care was re-branded as The Cannabist, which has been gradually rebuilding its business in the US. Currently The Cannabist holds, through its subsidiaries, 115 active licenses to operate in 13 states as well as Puerto Rico and Washington D.C..

Now heading north to Massachusetts, where Tier 1B MSO TILT Holdings Inc. (CSE: TILT) issued an August press release announcing “the closing of the sale of two of its Massachusetts dispensaries to In Good Health. The definitive agreement for this transaction was previously announced on February 3, 2025. Simultaneously, with the closing, the parties entered into an amendment adjusting the purchase price to $1.75 million.

The retail transaction is part of TILT’s overall strategic alternatives review. Under the terms of the transaction for the two stores, In Good Health will operate the Taunton location going forward and the Brockton dispensary was shut down.” With this sale Tilt Holdings now holds 10 active cannabis licenses in the US and operates in 5 US states.

Finally, in Ohio, Florida’s largest operator. Tier 1B MSO Trulieve Cannabis Corp. (CSE: TRUL) issued an August press release announcing “the opening of a new Trulieve-branded dispensary in Cincinnati, Ohio. Harvest Grows LLC will operate the dispensary under the Trulieve brand through a licensing agreement with the Company… “We are excited to bring a new dispensary to the Cincinnati community under the trusted Trulieve brand,” said Harvest’s Chief Executive Officer, Mark Eiland. “We look forward to serving adult use customers and medical patients with Trulieve’s high quality products and elevated customer experience.”…”We are proud to see the expansion of the Trulieve brand in Ohio through our agreement with Harvest Grows,” said Trulieve’s Chief Executive Officer Kim Rivers.” Trulieve’s active cannabis license total is now 117 across 15 states and 4 Canadian provinces.

Select CRB Business Transaction Highlights

| Company Name | Ticker Symbol | CRBM

Tier |

Event |

| Curaleaf Holdings, Inc. | CSE: CURA | Tier 1A | Curaleaf Expands Florida Footprint with New St. Augustine, Florida Dispensary |

| The Cannabist Company Holdings Inc. | CBoe Canada: CBST | Tier 1A | The Cannabist Company Celebrates Launch of Adult-Use Cannabis Sales in Delaware |

| High Tide Inc. | TSXV: HITI | Tier 1A | High Tide to Become Major Player in German Medical Cannabis Market Through Acquisition of Majority Stake in Remexian Pharma GmbH |

| TILT Holdings Inc. | CSE: TILT | Tier 1B | TILT Holdings Announces Closing on Sale of Massachusetts Dispensaries to In Good Health |

| Trulieve Cannabis Corp. | CSE: TRUL | Tier 1A | Trulieve-Branded Dispensary to Open in Cincinnati, Ohio |

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Verano Holdings Corp. | CSE: VRNO | Tier 1B | Verano Announces Resignation of Company President Darren Weiss |

| Steep Hill Inc. | CSE: STPH | Tier 2 | Appointment of Director (STEEP HILL INC) |

| Trulieve Cannabis Corp. | CSE: TRUL | Tier 1A | Trulieve Announces Appointment of Board Member Matthew Foulston and Chief Financial Officer Jan Reese |

| Burcon NutraScience Corporation | TSX: BU | Tier 1A | Chief Financial Officer Transition (BURCON NUTRASCIENCE CORP) |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Findit, Inc. | OTCID: FDIT | Moved to Watchlist | Tier 3/CBD – Personal Products |

| Cannindah Resources Limited | ASX: CAE | Moved to Watchlist | Tier 3/CBD – Professional Services |

| Twinlab Consolidated Holdings, Inc | OTC Expert: TLCC | Moved to Watchlist | Tier 3/CBD – Food, Beverage & Tobacco |

| Intouch Insight Ltd. | TSXV: INX | Moved to Watchlist | Tier 3/CBD – Professional Services |

| Solar Integrated Roofing Corporation | OTC Expert: SIRC | Moved to Watchlist | Tier 3/Agricultural & Farm Machinery |

Cannabis News: Regulatory News Updates

As we indicated above, August was a month for the ages, as investors inhaled shares of cannabis stocks like they were free shrimp at an office party. And while we can only speculate as to the cause of the hysteria this time, it is safe to assume that we were witnessing another regulatory rebound. This time the spike in CRBs was seemingly driven by positive rescheduling (or perhaps descheduling) vibes from our leaders in Washington. It is interesting that, given the uncertainty of what rescheduling would even imply, that just the idea of it would have such a profound impact on share prices. We aren’t even talking about federal legalization or banking reforms this time around, but here we are.

With all that said, here are some of the August 2025 highlights from the cannabis-related regulatory news cycle:

We begin in the states of Texas and California, where an article published by our CRB Monitor News team reported that “Texas and California are both keeping up the push to illegalize intoxicating hemp-derived cannabinoids. In Texas, the state Senate on Aug. 1 approved SB 5, which would ban hemp products containing any cannabinoid other than cannabidiol (CBD) or cannabigerol (CBG). It now heads to the Texas House of Representatives. But whether it will move forward is uncertain as most Democrat representatives fled the state to prevent a vote on redistricting…In California, the Department of Public Health held a public hearing as part of its process to make permanent the state’s emergency rule banning intoxicating HDC products.

Similar to the Texas proposal, California prohibited all HDC products with any amount of THC under an emergency rule ordered by Gov. Gavin Newsom in September. The emergency ban was extended in March while the department goes through the legal process of making the rule permanent.”

Next we head east to New York, where an August article in the Cannabis Business Times reported that “State Senator Luis R. Sepúlveda, D-Bronx, filed Senate Bill S8469 in an attempt to amend New York’s cannabis law to exempt any adult-use dispensary that opened before July 28, 2025, from having to change locations based on a 500-foot school buffer zone.” What might this mean for dispensary owners? The article goes on to say: “In essence, the bill would grandfather in locations for 106 adult-use dispensaries—including 87 in New York City—that were approved in error by the OCM and are now impacted by the office’s proximity correction released on July 28. The proposal comes after state cannabis regulators indicated they had misguided retail licensees based on erroneous entrance-to-entrance measurements they published in 2022 that conflicted with the Marijuana Regulation and Taxation Act (MRTA). Under the proximity correction released last week, the OCM is now measuring the 500-foot buffer zone from a dispensary entrance in a straight line to the nearest property line boundary of a school’s grounds.” We’ll follow this story to see if this legislation makes any progress.

Also in New York , where an August article on CRBMonitor.Com reported that “The Second Circuit Court of Appeals ruled, in a 2-1 decision, that the dormant commerce clause of the U.S. Constitution applies to cannabis, despite the plant’s federally illegal status. The ruling throws yet another wrench into New York’s efforts to roll out adult-use dispensary licenses, while federal courts in other states hear the same challenge to state resident preferences.” Really? The article goes on to report: ““The dormant commerce clause prohibits state protectionism unless Congress clearly authorizes specific protectionist laws. The only thing Congress has clearly authorized by criminalizing marijuana is federal prosecution for the manufacture, distribution, and possession of marijuana. Congress has given New York no clear permission to favor its residents over others whose businesses skirt the federal drug laws,” wrote Circuit Judge Dennis Jacobs in a 46-page majority opinion released Aug. 12.” What this does, in general, is complicate the licensing process in New York (not exactly what was needed) and for the whole story we recommend reading the entire article on CRBMonitor.Com.

Next, we drive north on I-95 to Pennsylvania, and a August article in MJ Biz Daily which reported that Pennsylvania lawmakers have reintroduced a pair of bipartisan adult-use marijuana legalization proposals over the past week. On Monday, Democratic state Rep. Emily Kinkead and Republican state Rep. Abby Major introduced House Bill 20. That follows last week’s introduction of Senate Bill 20 from Republican state Sen. Dan Laughlin and Democratic state Sen. Sharif Street. For those that haven’t been following the drama play out in the Keystone state, Pennsylvania has been in this battle over adult-use cannabis for several years. In the words of the article, “Pennsylvania is one of the largest medical-only marijuana markets in the U.S. that’s still waiting for adult-use legalization. Legal cannabis could net the state as much as $2.1 billion in sales in year one, according to an economic study commissioned by legalization advocacy group Responsible PA. But despite pressure from Gov. Josh Shapiro, who said he’d sign a legalization bill into law if the state General Assembly would pass one, attempts to do that this spring fell short.” We will continue to follow the tug-of-war in Pennsylvania as it plays out.

For this month’s hemp-related drama we head north on I95 to Connecticut, where an August article in MJ Biz Daily reported that “Several Connecticut hemp farmers filed a federal lawsuit (in August) challenging state laws they say violate the 2018 Farm Bill by restricting hemp-derived THC products. A series of laws first passed in 2023 that reclassified many hemp products as marijuana has caused the number of licensed hemp operations in the state to plummet by nearly 80%, the suit filed in U.S. District Court in Connecticut claims…Connecticut received federal approval for its hemp program using that definition in December 2021.” But not so fast, as the article goes on to report: “…beginning in 2023, the state passed new laws lowering THC limits, which reclassified many hemp products as cannabis. Under the new laws, which took effect Oct. 1, manufactured hemp products sold in Connecticut can contain no more than:

- 1 milligram of THC per serving

- No more than 0.5 mg of THC”

What’s the result of this new law? What the businesses are not saying out loud (and what was left out of this article) is that (we suspect) these newly-implemented limits are aimed at choking out the market for intoxicating, ingestible hemp products, not the innocent CBD and textile markets from the early 2020’s. This one will be interesting as it plays out, not just in Connecticut but across the U.S.

CRBs In the News

The following is a sampling of highlights from the August 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know