For the better part of the last five years, we have used this space to offer monthly commentary on the state of the cannabis industry for the stakeholders, as we wait, in earnest, for that one nugget of positive news that might finally instill permanent confidence in a small group of surviving companies. Unfortunately, some of that damage is permanent, and as we have discussed in past newsletters, the overall size of the publicly-traded cannabis market has gotten so small that institutions will not acknowledge its viability. Share prices for several cannabis stocks have fallen below the necessary compliance threshold for institutional trading desks. And as a result, trade volumes for even the largest CRBs are probative for any reasonable-sized buy side activity to take place. And yet, the peculiarities of the cannabis business seem to provide a ray of hope that we might not expect from any other industry. Why?

To start, cannabis is the only product that comes to mind that:

- Is consumed for both medical and recreational purposes

- Is illegal in the eyes of the US Federal Government

- Is a DEA schedule I narcotic, and yet

- Is legal for some form of use in nearly 70% of states

Is it possible that this paradox, in the midst of this historic downward spiral in prices, has also contributed to its survival? For many individual investors in cannabis (and yes, there are many), whether it is direct or via ETFs, is not driven by economics, but rather by emotion, and perhaps, by activism. Individual investors appear less concerned about share prices than they are about the survival of this industry, as it waits patiently for regulatory reforms amidst our massive cultural and political divide.

To say that the near decade-long topic of cannabis reform is unresolved would be an understatement, as we are now seeing in real-time the intra-party struggles unfold. On September 11th, an article in Cannabis Business Times reported that House Republicans passed its budget package that “would prevent the Department of Justice (DOJ) from using federal funds to remove cannabis from its Schedule I status under the Controlled Substances Act (CSA), where it’s currently listed alongside heroin, LSD and ecstasy as having no currently accepted medical use.” And then cannabis stocks rallied on September 29th when the president reposted a video touting the benefits of CBD for the elderly, which speaks directly to the sensitivity of cannabis share prices to any news, regardless of the magnitude. As always, we will follow this saga as it unfolds.

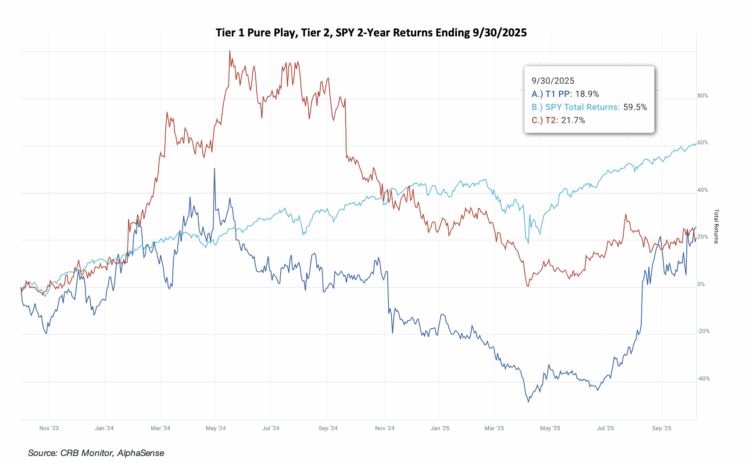

Cannabis-Linked Equity Performance

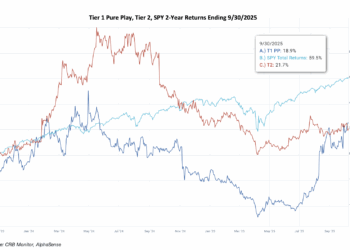

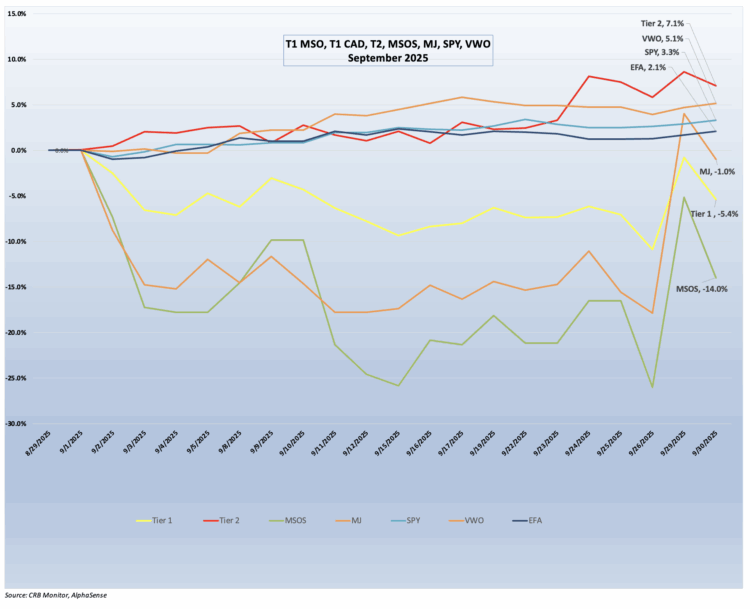

Performance for the two largest US plant-touching cannabis-themed ETFs was negative, with the Amplify Alternative Harvest ETF (NYSE Arca: MJ) slightly down (-1.0%) and the actively-managed MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) much lower (-14.0%) following August’s euphoric returns. Both of these funds are benchmarked to pure play CRB-themed indexes, and while they use different construction methodologies, their returns will be directionally close to each other. It’s worth mentioning that these funds are not considered Controlled Substances Act (CSA)-friendly, as they both carry exposure to US plant-touching marijuana businesses.

The CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs also reversed course in September, returning -5.4%. This portfolio is an equally-weighted basket of the largest Pure Play CRBs (representing both US plant-touching and non-US plant-touching MJ companies).

The CRB Monitor equally-weighted basket of Tier 2 CRBs outperformed the Tier 1 CRB basket, posting a +7.1% return for September 2025. In August CRB Monitor published an update to our article on correlations of Pure Play Tier 1 and Tier 2 CRBs, as well as correlations of MSO and Canadian operators. And what we have observed historically is that these two groups tend to display high correlation (~0.50) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (in this case marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time.

In September 2025 U.S. equities were positive despite historical headwinds for that month. The combination of robust earnings, signaling of further easing by the Fed, and strong investment in AI and tech provided much of the upside. But elevated valuations and narrow leadership pose risks looking ahead. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a return of +3.3% for the month of September.

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – September 2025 Returns

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities (a combination of MSO and CAD companies) gave back some of its August gains in September, largely attributable to the performance of the MSO group. Tier I CRBs underperformed the Tier 2 basket by around 12%.

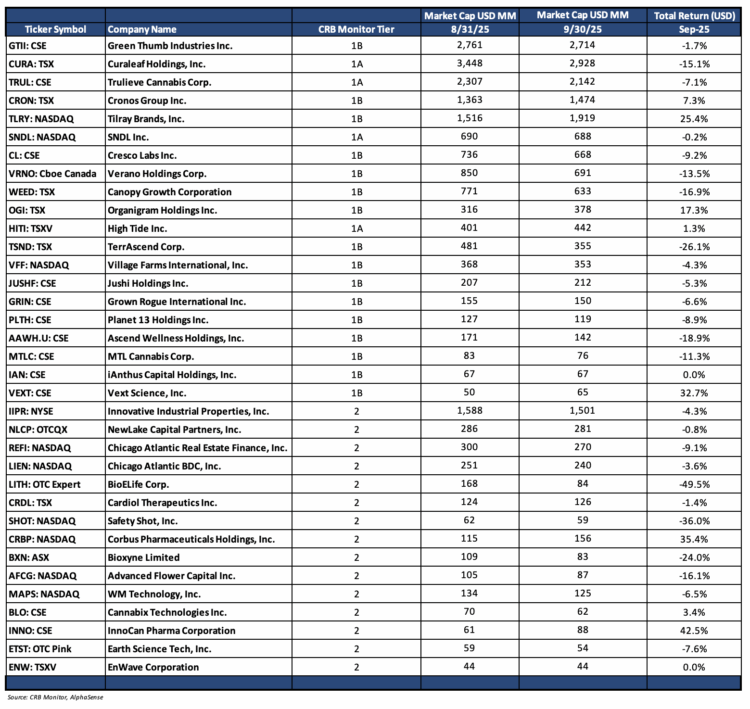

CRB Monitor Tier 1

September 2025 CRB performance of Tier 1 cannabis equities largely reversed course from August’s meteoric returns, with many of the companies closing out the month in the red. The MSO basket corrected sharply after double- and triple-digit returns a month earlier. Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (-7.1%), Tier 1B Cresco Labs Inc. (CSE: CL) (-9.2%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-13.5%), and Tier 1B TerrAscend Corp. (TSX: TSND) (-26.1%) trended downward throughout the month with the exception of a positive, news-driven spike on September 29th. There was a similar reversal for the two largest MSOs by market cap, Green Thumb Industries Inc. (CSE: GTII) (-1.7%) and Curaleaf Holdings, Inc. (CSE: CURA) (-15.1%).

The Canadian CRB basket was mixed but generally performed better than the MSOs in September. Tier 1B CRB Canopy Growth Corporation (TSX: WEED) gave back a significant portion of its stellar August (-16.9%), while Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (+25.4%) continued its rally from the prior month. Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-0.2%) was essentially flat while the ever-expanding Tier 1B High Tide Inc. (TSXV: HITI) finished modestly higher (+1.3%). Tier 1B Cronos Group Inc. (TSX: CRON) (+7.3%) ended the month higher for the third month in a row.

As we have stated regarding these two groups (MSOs and CADs), short-term performance has deviated between the CAD and the MSO baskets (August 2025 was one of those months), but they tend to mean-revert over time and historical correlations are high. It is also worth mentioning that as an industry cannabis has fallen to the point where no company’s stock is large enough to be regarded even as a small capitalization stock; over the last few years they have all shrunk (some by more than 90%) to the point where they are considered micro-caps and effectively non-investable by most institutions from a policy perspective. For more detail on the MSO/CAD relationship, please see our September Chart of the Month on our CRB Monitor News website.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies outperformed the Tier 1 basket in September 2025, posting a return of +7.1%. Historically the performance of these two portfolios (given their close business ties) has displayed high correlation (please see our recently-published September 2025 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to mean-revert over time. When the two baskets deviate from one another in the short term, the deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship. This is due to the fact that Tier 2 CRBs are direct suppliers of goods and services to (and derive their revenues from) Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict and the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lead to losses, so proceed with caution!

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (-4.3%) reversed course from August, rebounding from a disappointing July. On September 15th IIPR declared its quarterly dividend (required by law) of 7.5%. This followed IIPR’s 2nd quarter 2025 earnings report, which featured the following highlights:

- Generated total revenues of $62.9 million and net income attributable to common stockholders of $25.1 million, or $0.86 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (“AFFO”) and normalized funds from operations (“Normalized FFO”) of $48.4 million and $44.1 million, respectively.

- Paid a quarterly dividend of $1.90 per common share on September 15, 2025 to stockholders of record as of June 30, 2025. Since its inception, IIP has paid $1.0 billion in common stock dividends to its stockholders.

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (-16.1%) struggled in September, underperforming the overall Tier 2 group. On August 13th AFCG reported its 2nd Quarter 2025 earnings of $6.3 million which featured the following eye-opening statement from CEO Daniel Neville, which emulates the actions of AFCG’s peer Chicago Atlantic (Nasdaq: REFI):

“AFC also announced today its intention to seek to convert from a commercial mortgage real estate investment trust (“REIT”) to a business development company (“BDC”), subject to shareholder approval of certain related matters. If approved, the conversion will enable the Company to pursue a broader array of investment opportunities, including both real estate- and non-real estate-related assets.

“The proposed conversion to a BDC marks an important milestone in AFC’s trajectory,” said Dan Neville, CEO, adding “Given the capital-intensive nature of the cannabis industry, combined with the high cost of capital, many operators do not own real estate, which significantly limits the universe of cannabis operators AFC can lend to as a mortgage REIT. Converting to a BDC would significantly expand our investable universe, allowing us to lend to ancillary cannabis businesses with high growth potential, as well as non-real estate covered, vertically integrated operators.””

Tier 2 technology company, WM Technology, Inc. (Nasdaq: MAPS), operates Weedmaps, the leading online listings marketplace for cannabis consumers and businesses, and WM Business, the most comprehensive SaaS subscription offering sold to cannabis retailers and brands. Following a an August rally, WM Technology’s stock came back to earth with a -6.5% return. On August 7th, MAPS reported its 2nd Quarter 2025 earnings, with the following headlines:

- Revenues for the second quarter ended June 30, 2025 were $44.8 million as compared to $45.9 million in the prior year period

- Net income increased to $2.2 million as compared to $1.2 million in the prior year period.

- Adjusted EBITDA(3) increased to $11.7 million from $10.1 million in the prior year period.

- Total shares outstanding across Class A and Class V Common Stock were 156.5 million as of June 30, 2025.

- Cash increased to $59.0 million as of June 30, 2025, as compared to $52.0 million as of December 31, 2024

CRB Monitor Chart of the Month – 1-Year Cash Projections for Tier 1 CRBs – Update

This month we are taking fresh look at the near-term health of the largest 20 pure play Tier 1 CRBs, as we consider what investors have to look forward to given the latest wave of positive sentiment in the cannabis industry. Similar to our original analysis in 2023, sentiment (relative to fundamentals) overwhelmingly drives cannabis equity prices. Bid-ask spreads have widened and trade volumes have shrunk to the point where the mere hint at progress toward (or a stall from) cannabis reform can move markets by double digit percentages. In other words, cannabis equity volatility has not changed in the 2 years since we published the original analysis.

Please read the full report on the CRB Monitor News website.

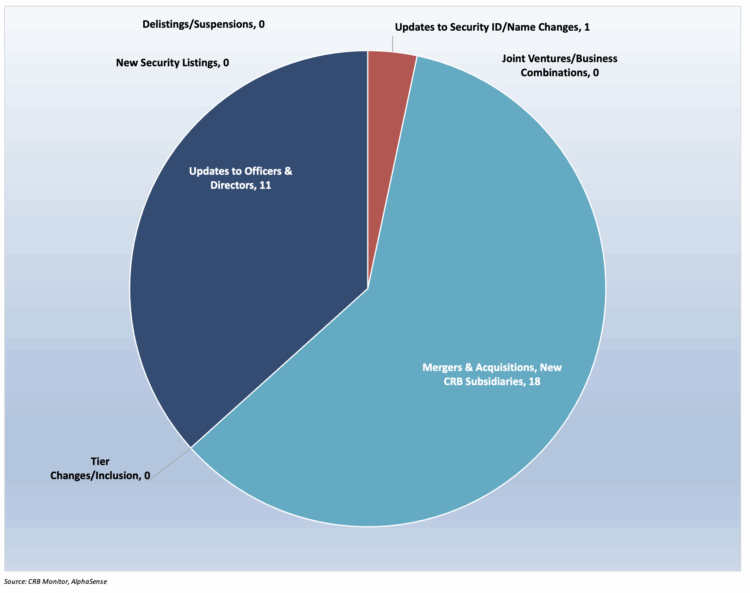

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for September 2025:

Cannabis Business Transaction News

As we have done for more than half a decade, the CRB Monitor research team covers the cannabis news cycle daily. Our goal is to remain up-to-date on all the relevant information vital to the ongoing breadth, depth, and accuracy of our data in the CRB Monitor securities database. And while the cannabis industry has faced major regulatory obstacles over those years, there has never been a shortage of news as licensed CRBs’ operations evolve to survive in a complicated business and regulatory environment.

On that note, here are some of the cannabis company highlights from September 2025:

Canadian Tier 1A CRB High Tide Inc. (TSXV: HITI) announced in a September press release that “further to its press release dated August 14, the Company has completed the acquisition of a 51% interest in Remexian for an estimated purchase price of €26.4 million, such amount to be finalized in 30 days, once the final closing balance sheet is available, and will have a five-year option to acquire the remaining 49% of Remexian at any time after 24 months. Capitalized terms not otherwise defined herein have the meanings attributed to them in the August 14 Release.” Over the last year we have been following High Tide’s expansion, which has generally be limited to the purchase of Canadian dispensaries, so this acquisition is noteworthy. The announcement continues:

“High Tide acquired 51% of Remexian for (i) €7.65 million in cash (ii) €7.65 million via a Loan with the sellers. The Loan will mature on December 31, 2029, bear 7% annual interest (paid quarterly), and be prepayable at any time by the Company with no penalty, and (iii) 5,864,373 High Tide Shares valued at €11.1 million, on the basis of a deemed price of US$2.1912 per High Tide Share, representing the volume weighted average price per High Tide Share on the Nasdaq for the 10 trading days ending August 8, 2025. The High Tide Shares issued are subject to a hold period of four months and one day. The Transaction has been conditionally approved by the TSXV and is awaiting final approval.”

In the words of Raj Grover, Founder and Chief Executive Officer of High Tide, “This transaction not only diversifies our revenue base beyond Canada but also creates a clear runway for expansion across Europe’s regulated cannabis markets. With our proven track record of disciplined growth and free cash flow generation, we believe this acquisition positions High Tide for long-term global leadership.”

High Tide currently holds 218 active licenses in three countries (Canada, Australia, Germany).

Curaleaf expands its footprint in Ohio: Tier 1A MSO Curaleaf Holdings, Inc. (TSX: CURA) issued a September press release announcing “the opening of a new Curaleaf-branded dispensary near New Albany, Ohio, located at 6500 N Hamilton Rd Westerville, OH 43081. Curaleaf provides support services to the current owner and operator, ensuring both medical patients and adult-use customers in Ohio will receive the same elevated retail experience and access to high-quality cannabis they have come to expect when visiting Curaleaf’s other dispensaries. Curaleaf has the future right to ownership of the dispensary, subject to regulatory approval, which would expand Curaleaf’s footprint to four stores in the Buckeye State and 155 nationwide. Conveniently located off of 161’s Hamilton Road Exit, the new dispensary, branded as Curaleaf New Albany, boasts a broad selection of premium cannabis products, curated for medical and adult-use consumers. Customers can explore a wide variety of trusted, best-in-class brands and products including Select BRIQ all-in-one vapes, Grassroots high-quality flower, JAMS edibles, and Find flower.” Curaleaf operates in 6 countries and holds 114 cannabis licenses that are in active status.

Now heading southeast to Florida, where Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) issued a September press release announcing “the opening of MÜV Crystal River on September 19, elevating the Company’s Florida retail footprint to 82 MÜV locations and 158 dispensaries nationwide…Located a few blocks from Kings Bay Riverwalk, MÜV Crystal River is conveniently surrounded by local businesses and attractions including restaurants, hotels and scenic wildlife. The opening of MÜV Crystal River also expands the Company’s retail footprint in western Florida near existing MÜV dispensaries in Ocala, Spring Hill and Port Richey… Most recently, the Company introduced a series of new products in Florida in fast-growing categories, including Savvy 10-pack barrel-style pre-rolls, incorporating a unique yet recognizable barrel-style shape, delivering consumer affordability without sacrificing quality, and Avexia’s award-winning topicals, including pain relief balm, lotion and bath soak designed for localized, fast-acting relief and carefully formulated with a blend of high-quality cannabinoids and essential oils.” Following this purchase Verano’s operational footprint now includes dispensaries in 14 states and 77 active licenses.

Finally, in Ohio, Tier 1B MSO Vext Science, Inc. (CSE: VEXT) issued a September press release announcing “ it has received regulatory approval from the Ohio Department of Commerce to transfer ownership of the Herbal Wellness Center dispensary in Portsmouth, Ohio to Vext. The Company expects to complete the closing and associated title transfers by October 1, 2025…Located in southern Ohio along the Ohio River, the Portsmouth Dispensary includes a drive-thru, providing added convenience for customers. The Portsmouth Dispensary was granted a provisional license by the Ohio Division of Cannabis Control under the 10(B) license program. Following completion of the Company’s Ohio Expansion Transaction, it became part of Vext’s retail footprint and as previously announced, officially opened to the public on June 13, 2025.” After completing this transaction, Vext’s operational footprint includes 9 active licenses in 3 states.

Select CRB Business Transaction Highlights

| Company Name | Ticker Symbol | CRBM

Tier |

Event |

| High Tide Inc. | TSXV: HITI | Tier 1B | High Tide Closes Acquisition of a Majority Stake in Remexian Pharma GmbH |

| Cresco Labs Inc. | CSE: CL | Tier 1A | Cresco Announces Strategic Transaction to Build Regional Powerhouse in Corporate Services and BPO |

| Curaleaf Holdings, Inc. | TSX: CURA | Tier 1A | New Curaleaf Branded Dispensary Opens in New Albany, Ohio, in Partnership with RC Retail 2 |

| Verano Holdings Corp. | CSE: VRNO | Tier 1B | Verano Broadens Florida Retail Footprint to 82 Dispensaries with the Opening of MÜV Crystal River |

| Vext Science, Inc. | CSE: VEXT | Tier 1B | Vext Secures State Approval for Portsmouth Dispensary Ownership Transfer |

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Dr. Reddy’s Laboratories Limited | NYSE: RDY | Tier 1B | Dr Reddy’s Labs CHRO Archana Bhaskar resigns |

| Lobe Sciences Ltd. | CSE: LOBE | Tier 1B | Lobe Sciences Announces the Appointment of Marco Mastrodonato to its Board of Directors |

| Canopy Growth Corporation | TSX: WEED | Tier 1B | Canopy Growth Appoints Tom Stewart as Chief Financial Officer |

| Avicanna Inc. | TSX: AVCN | Tier 1A | Avicanna Announces Change in CFO |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Natura & Co Holding SA | B3: NTCO3 | Moved to Watchlist | Tier 3/ CBD – Personal Products |

| Cannabis Sativa Inc. | OTCQB: CBDS | Moved to Watchlist | Tier 1B/Owner/Investor |

| Resonate Blends Inc. | OTCID: KOAN | Moved to Watchlist | Tier 1B/Owner/Investor |

| Emergent Health Corp. | OTCID: EMGE | Moved to Watchlist | Tier 3/ CBD – Personal Products |

| Royal Road Minerals Limited | TSXV: RYR | Moved to Watchlist | Tier 1B/Owner/Investor |

Cannabis News: Regulatory News Updates

We continued to monitor the cannabis regulatory news cycle throughout September, which featured stories at both state and federal levels of government. As is evident from the performance chart above, the cannabis market is sentiment-driven and highly sensitive to the news cycle. With that said, here are some of the September 2025 highlights:

Let’s start with the complicated relationship between banks and the U.S. Federal Government. A September article in Marijuana Moment reported that “Federal officials have released updated data on the number of banks reporting that they work with marijuana businesses–and most financial institutions don’t seem especially concerned with their cannabis clientele. The Financial Crimes Enforcement Network (FinCEN), which falls under the U.S. Department of Treasury, has been publishing data for years about suspicious activity reports (SARs) related to marijuana-related businesses. This latest batch shows relative stability in the willingness of banks to service cannabis clients even under federal prohibition. But notably, the portion of SARs identified as “marijuana limited” stands at 80 percent. That term refers to cannabis businesses that appear to be operating in compliance with state law and meet the agency’s standard for being serviceable under existing federal guidelines, as opposed to “marijuana priority” or “marijuana termination,” which indicate potential violations or account closures.” As a reminder, CRB Monitor continues to be the industry standard for cannabis market intelligence, for both private and publicly-traded cannabis related businesses.

We head west to the state of Texas and some news regarding the expansion of their medical marijuana program. An article published by our CRB Monitor News team reported that “Texas is accepting applications for dispensary organizations as it expands its low-THC Compassionate Use Program under a new law, while a third legislative effort to ban hemp-derived THC failed to move forward. Texas has often been excluded in tallies of states having a medical cannabis program. But since 2015, the state has allowed doctors to prescribe the use of products with no more than 1% THC for nine ailments including epilepsy, cancer and autism. It also has a business licensing program with three active, vertically integrated dispensary organizations: Surterra Texas, Cansortium Texas and Compassionate Cultivation. All three are in central Texas, about an hour from Austin, according to DPR’s Compassionate Use Program Analysis report for 2024.”

Next we head north to Wisconsin, and some big news on legalization. A September article in the Cannabis Business Times reported that “Wisconsin could be the 41st state to legalize medical cannabis under bicameral legislation that the state’s top senators are putting their clout behind. Senate President Mary Felzkowski, R-Tomahawk, and Senate President Pro Tempore Patrick Testin, R-Stevens Point, introduced the bill on Sept. 29, with state Rep. Patrick Snyder, R-Weston, sponsoring a companion proposal in the lower chamber…While Wisconsin maintains some of the least permissive cannabis laws in the nation, the Badger State borders Minnesota, Michigan and Illinois, where licensed dispensaries sell cannabis to those 21 years and older.” CRB Monitor will closely monitor developments in Wisconsin and update our daily database of market intelligence as things change.

Some new Insights on Rescheduling: A September article published by our CRB Monitor News team reported on the hot cannabis topic of the day, the ever-complex progress toward rescheduling marijuana to Schedule III from Schedule I. “National cannabis reform may be on the horizon, but what would that mean for banks working with an industry that’s already expected to surpass $35 billion in sales in 2025, despite still being federally illegal? Strict reporting and compliance regulations remain a barrier for many banks interested in entering the space, but as public acceptance of state-legal cannabis continues to grow, so too does the demand for financial services within the industry. President Donald Trump brought marijuana rescheduling back into the national conversation on Aug. 11 when he said his administration was actively considering a change that would loosen restrictions on cannabis under the Controlled Substances Act (CSA).” Of course we will continue to track the progress (or lack thereof) toward rescheduling and provide updates.

Let’s head back to Texas and the latest news regarding intoxicating hemp., and a September article in MJ Biz Daily which reported that “A special session of the Texas state Legislature ended on Wednesday night without lawmakers passing a blanket ban on hemp-derived THC products. The failure of Senate Bill 6, which would have outlawed all hemp products with any “detectable amount of any cannabinoid,” means a major reprieve for a state market worth an estimated $5.5 billion.” But apparently all is not lost for hemp opposers in the Lone Star state, as this process is not officially deceased: “It’s still possible for Gov. Greg Abbott, who called the special session in part to pursue a hemp-THC ban, to summon lawmakers back to the state Capitol for yet another go at a ban. Though it was Abbott who unexpectedly vetoed a hemp ban lawmakers passed in June, the governor in a July interview said lawmakers “must continue to criminalize marijuana in the state of Texas.””

Finally, and also on the topic of intoxicating hemp, we head east to Maryland, where an article in Cannabis Business Times reported that “Delta-8 and delta-10 THC are illegal, and state law that prohibits businesses from selling hemp-derived products without a license is constitutional, the Appellate Court of Maryland ruled on Sept. 9. The ruling reverses a lower court’s decision to grant a preliminary injunction to the Maryland Hemp Coalition and several hemp retailers, producers, farmers and consumers, who had challenged the state’s licensing requirement under the Cannabis Reform Act (CRA) that the Maryland General Assembly passed in 2023 to regulate an adult-use marketplace.” This is sad news for the Delta-8 and Delta-10 market and we’ll keep an eye on Maryland as well as other “intoxicating hemp” states. The article goes on to report: ”The now-lifted injunction had prevented state officials from enforcing the CRA’s licensing requirement for hemp-related businesses wishing to sell intoxicating products. Although the state is now allowed to enforce the licensing requirements on hemp businesses, the Maryland Appellate Court ruled that intoxicating products containing synthetic hemp derivatives created in a chemical process remain illegal.”

CRBs In the News

The following is a sampling of highlights from the September 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know