As has been the case for several years, stakeholders in the cannabis space were treated to a combination of legislative support and pushback, depending on which end of the industry they have planted their flags. On the one hand, cannabis related businesses (CRBs) were celebrating the President’s executive order for government agencies to move ahead with a plan to reschedule marijuana from DEA Schedule I to Schedule III. If this actually happens the action would officially classify THC in the same category as prescription drugs like Tylenol with codeine and ketamine. The rub here is that Marijuana, because it has been classified as Schedule I, has officially had no medical use up to now and therefore it would be in an unusual position of being classified as a prescription drug with exactly zero FDA uses and therefore not eligible as a prescription drug.

This is an interesting Catch-22 situation for marijuana, as rescheduling would have several positive downstream effects, including favorable tax implications for CRBs as well as new avenues for cannabis banking and interstate/international trade. With that said, in the eyes of the US federal government, there is still no such thing as “medical marijuana” or even “recreational marijuana”; there is only “illegal marijuana”. And so we are left to ponder the actual next steps regarding marijuana for the FDA, the DEA, the IRS, and while we are at it, the US Congress.

The second main theme that dominated the cannabis news cycle in December 2025 was new legislation criminalizing the sale of Intoxicating Hemp (HDCP). We are monitoring this story as it develops, but as of the writing of this report there will be at least a one (perhaps two)-year delay of the implementation of this law. This will give all of the HDCP businesses, and there are many of them, sufficient time to get their affairs in order before any type of shutdown occurs. But more likely, given the explosive growth of this legal-loophole cannabis industry, we will see reforms put in place before criminalization goes into effect. CRB Monitor News published a recent update on new developments related to intoxicating hemp. And even more interesting to us is the participation in intoxicating hemp by no fewer than eighteen (18) publicly-traded CRBs, which we highlight in our chart of the month later in this newsletter.

Regarding both of these developing stories, we (both the CRB Monitor Research team and the CRB Monitor News team) have written extensively about both, from an investment and a regulatory perspective, as we will continue to do going forward.

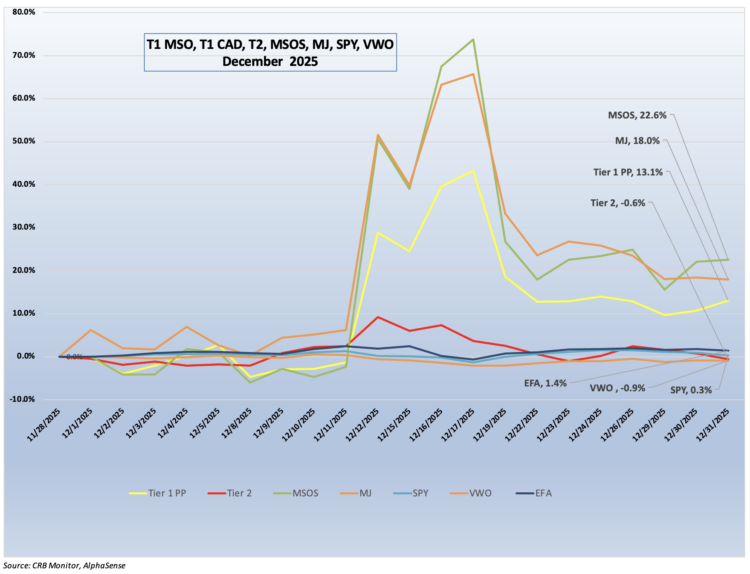

Now onto market performance. In the month of December 2025, cannabis-linked equities rallied significantly in the middle of the month after sputtering for 10 days. The catalyst for this conspicuous spike in performance (see the chart above) was the announcement regarding the President’s executive order for regulators to take steps toward rescheduling marijuana from Schedule I to Schedule III. Some CRBs rallied more than 50% for the week leading up to announcement day. In other words, the market seemed to predict the executive order, which was not announced until December 18th, 2025. In fact, there was suspicion of several leaks, as was discussed in the press. And so rather than a rally on or right after announcement date, the cannabis market recoiled immediately following announcement day. It is true that, overall, cannabis equities finished higher for the month of December; however the pricing patterns resembled those of an early 2000’s Russell Reconstitution (IYKYK).

The two largest US plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (+18.0%) and the actively-managed MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (22.6%) spiked in advance of rescheduling revelations at mid-month then sharply reversed by month end, finishing with double digit positive returns. Given their thin liquidity, the cannabis holdings in these funds (and other cannabis-themed ETFs) reacted negatively in December to the overall pessimism surrounding cannabis reforms, including the latest legislation regarding intoxicating hemp. Both of these funds are benchmarked to pure play CRB-themed indexes, and while they use different construction methodologies, their returns will be directionally close to each other. It’s worth mentioning that these funds are not considered Controlled Substances Act (CSA)-friendly, as they both carry exposure to US plant-touching marijuana businesses.

Cannabis-Linked Equity Performance

The CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs closed out December in positive territory, with a return of +13.1%. This portfolio is an equally-weighted basket of the largest pure play Ther 1 CRBs (representing both US plant-touching and non-US plant-touching MJ companies).

The CRB Monitor equally-weighted basket of Tier 2 CRBs reversed course and underperformed the Tier 1 CRB basket, posting a -0.6% return for December 2025. In August 2025 CRB Monitor published an update to our article on correlations of Pure Play Tier 1 and Tier 2 CRBs, as well as correlations of MSO and Canadian operators. And what we have observed historically is that these two groups tend to display high correlation (~0.50) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (in this case marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time.

In December 2025, U.S. equities remained an important story on global markets with large-cap U.S. stocks — finishing the year up roughly 16% and sitting near all-time highs after a strong rally through most of the year. Despite a slight pullback in the final trading days, with the index dipping modestly as the year closed, the broader trend reflected sustained investor enthusiasm, particularly driven by gains in technology and AI-related companies throughout 2025. Overall, U.S. stocks posted double-digit annual gains for the third consecutive year, even as volatility and concerns about valuations and macroeconomic policy weighed on sentiment toward year-end. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a return of +0.2% for the month of December.

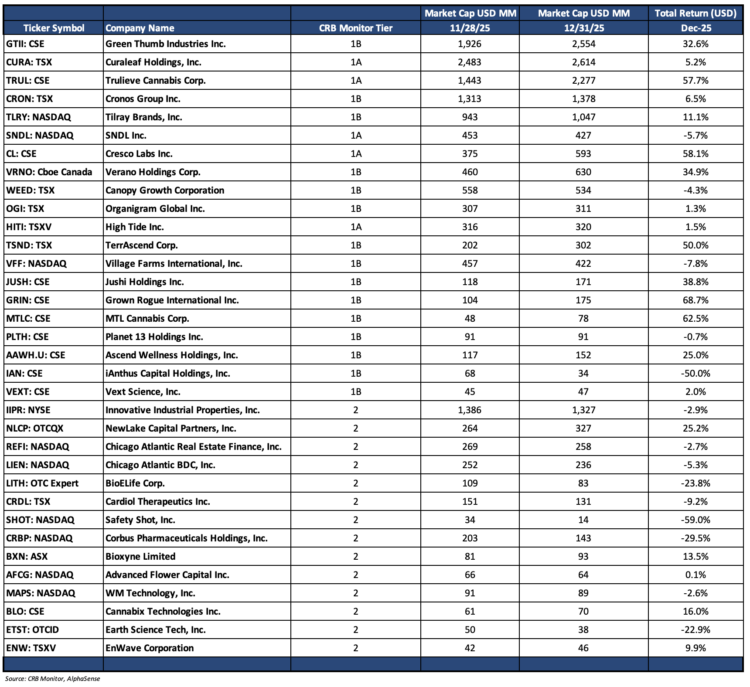

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – December 2025 Returns

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities (a combination of MSO and CAD companies) rebounded in December, with the majority of the basket performing well for the month. Tier 1 CRBs finished the month nearly in line ahead of the Tier 2 basket (+13.1% vs. -0.6%).

CRB Monitor Tier 1

Tier 1 cannabis equities caught rescheduling fever and surged in the second half of December following a several months-long slump. Many of the companies closed out December 2025 with double-digit positive returns. The MSO basket rallied across the board, as investors showed their approval for the latest reform efforts. Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (+57.7%), Tier 1B Cresco Labs Inc. (CSE: CL) (+58.1%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (+34.9%), and Tier 1B TerrAscend Corp. (TSX: TSND) (+50.0%) soared on the news, which carried implications of tax relief and softer banking conditions. The two largest CRBs by market cap, Green Thumb Industries Inc. (CSE: GTII) (+32.6%) and Curaleaf Holdings, Inc. (CSE: CURA) (+5.2%) were higher in December as well.

The Canadian CRB basket, which would enjoy a lesser benefit from rescheduling than MSOs, had mixed performance in December. Tier 1B CRB Canopy Growth Corporation (TSX: WEED) (-4.2%) added to its two-month slide, while Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (+11.1%) rebounded from a dreadful November. Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-5.7%), Tier 1B High Tide Inc. (TSXV: HITI) (+1.5%) and Tier 1B Cronos Group Inc. (TSX: CRON) (+6.5%) were mixed but performed generally in line with the basket.

As we have stated regarding these two groups (MSOs and CADs), short-term performance has deviated between the CAD and the MSO baskets (December 2025 was clearly one of those months), but they tend to mean-revert over time and historical correlations are high. It is also worth mentioning that as an industry cannabis has fallen to the point where no company’s stock can even be regarded as a small capitalization stock; over the last few years they have all shrunk (some by more than 90%) to the point where they are considered micro-caps and effectively non-investable by most institutions from a policy perspective. For more detail on the MSO/CAD relationship, please see our August Chart of the Month on our CRB Monitor News website.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies underperformed the Tier 1 basket in December 2025, posting a return of -0.6%. Historically the performance of these two portfolios (given their close business ties) has displayed high correlation (please see our recently-published August 2025 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to mean-revert over time. When the two baskets deviate from one another in the short term, the deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship. This is due to the fact that Tier 2 CRBs are direct suppliers of goods and services to (and derive their revenues from) Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict and the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lead to losses, so proceed with caution!

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (-2.9%) was lower in December following a double digit negative return in November. On November 3rd IIPR reported its 3rd quarter 2025 results which featured the following highlights:

Total revenues of $64.7 million and net income attributable to common stockholders of $28.3 million, or $0.97 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

Adjusted funds from operations (“AFFO”) and normalized funds from operations (“Normalized FFO”) of $48.3 million and $45.2 million, respectively.

Paid a quarterly dividend of $1.90 per common share on October 15, 2025 to stockholders of record as of September 30, 2025. Since its inception, IIP has paid over $1.0 billion in common stock dividends to its stockholders.

Tier 2 REIT Advanced Flower Capital, Inc. (Nasdaq: AFCG) (CRBM Sector: Real Estate) (0.1%) was essentially flat for the month. On November 12th AFCG reported its 3rd Quarter 2025 financial results (featuring a net loss of $12.5) and the statement from CEO Daniel Neville:

“We continue to make progress resolving our nonaccrual positions and driving loan repayments across our portfolio. There remains limited new capital entering the cannabis market, and our conversion opens the investment universe for AFC beyond real estate owners in cannabis. Today, we see meaningful lending opportunities in several attractive markets, and we are actively evaluating opportunities in the lower-middle market that we believe can generate attractive risk-adjusted returns for the benefit of our shareholders.”

Tier 2 technology company, WM Technology, Inc. (Nasdaq: MAPS), operates Weedmaps, the leading online listings marketplace for cannabis consumers and businesses, and WM Business, the most comprehensive SaaS subscription offering sold to cannabis retailers and brands. WM Technology’s crashed along with the Tier 1 group, with a -18.9% return for December. On Nov ember 6th, MAPS reported its 3rd Quarter 2025 earnings, with the following chilling headlines:

- Net income decreased to $3.6 million as compared to $5.3 million in the prior year period.

- Adjusted EBITDA(3)decreased to $7.6 million from $11.3 million in the prior year period.

- Total shares outstanding across Class A and Class V Common Stock were 157.2 million as of September 30, 2025.

- Cash increased to $62.6 million as of September 30, 2025, as compared to $52.0 million as of December 31, 2024.

CRB Monitor News Featured Article: President Orders Rescheduling and Hemp Reconsideration

It finally happened. After weeks of rumors and speculation, President Donald Trump signed an executive order on Dec. 18, ordering his attorney general to expedite the process of moving cannabis to Schedule III from Schedule I under the Controlled Substances Act.

“The facts compel the federal government to recognize that marijuana can be legitimate in terms of medical applications when carefully administered,” said Trump during the live-streamed executive order signing event. “This reclassification order will make it far easier to conduct marijuana related medical research, allowing us to study benefits, potential dangers, and future treatments. It’s going to have a tremendously positive impact.”

Click here for the full article on our CRB Monitor News website.

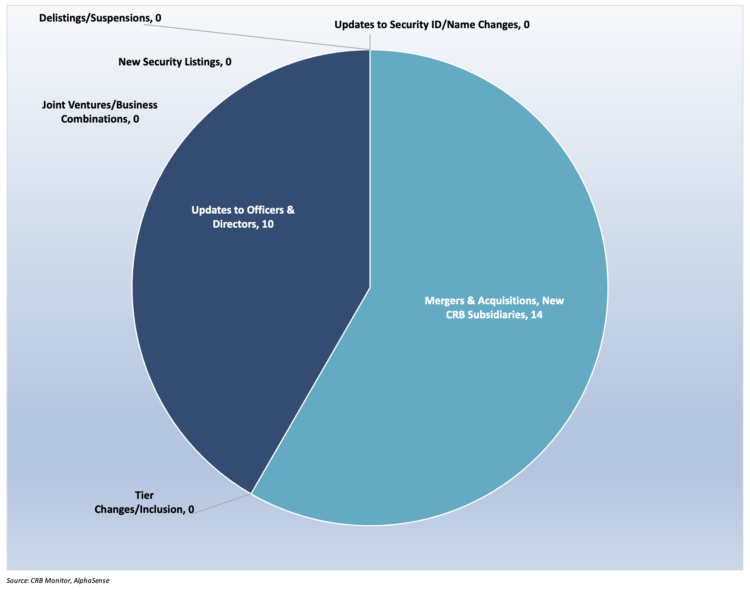

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for December 2025:

Cannabis Business Transaction News

The CRB Monitor research team has followed cannabis industry regulations daily for close to a decade. For that time we have remained up to date on all the information that is vital to the ongoing breadth and accuracy of our data in the CRB Monitor securities database. While the cannabis industry has faced major regulatory headwinds over those years, we have remained plugged into the news as licensed CRBs’ operations have evolved and survived in a complicated regulatory environment.

On that note, here are some of the cannabis company highlights from December 2025:

Across the Atlantic: Tier 1A MSO High Tide Inc. (TSXV: HITI) announced in an December press release that it “has opened its first international Canna Cabana in Berlin, Germany—focused on cannabis accessories and consumer lifestyle goods—marking the brand’s formal bricks-and-mortar entry into both Europe and the German market.” This represents High Tide’s first European operation. The announcement goes on to state, “This flagship store represents the first step in High Tide’s broader European retail strategy, following its recent acquisition of Remexian Pharma GmbH, a licensed medical cannabis importer and distributor based in Germany. The Berlin opening reflects the Company’s commitment to growing its European presence, which encompasses bricks-and-mortar retail, e-commerce, and medical cannabis distribution across key international markets.” Following this transaction High Tide holds, either directly or through its subsidiaries, 229 active licenses in 3 countries.

Ianthus further expands operations in Florida: Tier 1B Canadian CRB iAnthus Capital Holdings, Inc. (CSE: IAN) issued a December press release announcing “its expansion into St. Petersburg with the opening of its 25th GrowHealthy dispensary in Florida. The new St. Petersburg location opens its doors…with an expanded lineup of premium product brands, including The Vault, MPX and Sunshine State, offering patients greater choice and quality all under one roof.” The announcement goes on to say, “GrowHealthy continues to set itself apart through a focus on whole-plant wellness, premium genetics and community connection. Built on the foundation of cultivators and caregivers, the company leads with a flower-first philosophy, strong community ties, and a deep respect for the cannabis plant. The St. Petersburg dispensary offers an extensive menu of products including flower, vapes, concentrates and additional form factors designed to meet the diverse wellness needs of the local community.” With this acquisition Ianthus now holds 54 active licenses in the U.S and 3 in Canada.

Now heading north to Virginia, Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) issued a December press release announcing that “it has entered into a binding commitment to acquire The Cannabist Company’s Virginia assets, which include a fully-operational cultivation facility and five retail dispensaries and the right to open one additional dispensary. Assuming all closing conditions are met, Curaleaf anticipates the transaction closing in the first quarter of 2026…In the event a competing bid for the Virginia assets is accepted during the go-shop period or if The Cannabist fails to receive noteholder consent for the transaction, Curaleaf is entitled to receive a $3.3 million break-up fee and all associated expenses up to $350,000.” Following this purchase Curaleaf’s operational footprint now includes CRBs in 6 countries and 112 active licenses. The Cannabist holds 119 active licenses in the US.

Canopy Growth acquiring MTL Cannabis: Pure Play Canadian Tier 1B CRB Canopy Growth Corporation (TSX: WEED) issued a December press release announcing that “they have entered into a definitive arrangement agreement pursuant to which Canopy Growth will acquire all of the issued and outstanding common shares of MTL and will settle all debt and debt-like instruments owed by MTL, in a transaction valued at approximately $125 million on a fully-diluted equity basis and approximately $179 million on an enterprise value basis. Under the terms of the Arrangement Agreement, each shareholder of MTL will receive fixed consideration for each MTL Share equal to: (i) 0.32 of a common share of Canopy, and (ii) $0.144 in cash.” Following this transaction Canopy Growth operates in 3 countries and holds 63 active licenses.

Select CRB Business Transaction Highlights

| Company Name | Ticker Symbol | CRBM

Tier |

Event |

| High Tide Inc. | TSXV: HITI | Tier 1A | High Tide Opens First European Canna Cabana in Berlin |

| Curaleaf Holdings, Inc. | CSE: CURA | Tier 1A | Curaleaf Enters into an Equity Purchase Agreement for the Virginia Assets of The Cannabist Company |

| Cronos Group Inc. | TSX: CRON | Tier 1B | Cronos to enter the Netherlands with acquisition of Europe’s largest adult-use cannabis company |

| iAnthus Capital Holdings, Inc. | CSE: IAN | Tier 1B | iAnthus Continues Expansion in Florida with the Opening of GrowHealthy’s 25th Dispensary in St. Petersburg |

| Canopy Growth Corporation | TSX: WEED | Tier 1B | Canopy Growth to Acquire MTL Cannabis; Transaction Expected to Create Canadas Leading Medical Cannabis Business and Enhance Capacity to Serve Growing International Demand (CANOPY GROWTH CORP) |

| FLUENT Corp. | CSE: FNT.U | Tier 1B | FLUENT Corp. Announces Sale of Pennsylvania Operations Strengthening Balance Sheet and Sharpening Focus on Core Growth Markets |

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Cronos Group Inc. | TSX: CRON | Tier 1B | Ryan Wyatt Appointed CEO of Cronos (CRO) Labs to Drive DeFi Innovation |

| Dr. Reddy’s Laboratories Limited | NYSE: RDY | Tier 1B | Ritu Satya Sharma appointed Associate General Counsel at Dr. Reddy’s Laboratories |

| IM Cannabis Corp. | CSE: IMCC | Tier 1B | IM Cannabis Appoints Asi Levi as Chief Financial Officer |

| Avicanna Inc. | TSX: AVCN | Tier 1A | Avicanna Announces Changes to its Board of Directors |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Dick’s Sporting Goods, Inc. | NYSE: DKS | Moved to Watchlist | Tier 3/ Traditional Retail |

| Verb Technology Company, Inc. | NASDAQ: VERB | Moved to Watchlist | Tier 3/IT Services & Software |

| Verde Resources, Inc. | OTCQB: VRDR | Moved to Watchlist | Tier 3/CBD – Pharma & Biotech |

| Zero Gravity Solutions, Inc. | OTC Expert: ZGSI | Moved to Watchlist | Tier 3/ Fertilizers & Agricultural Chemicals |

Cannabis News: Regulatory News Updates

The cannabis regulatory news cycle continues to run hot, featuring stories at both state and federal levels of government as well as around the world. And not surprisingly, cannabis-related investments are largely sentiment-driven and highly sensitive to news (rather than value or growth-based), particularly when the news comes from Washington. With that said, here are some of the December 2025 highlights:

We begin with an update on intoxicating hemp: An article published by our CRB Monitor News Team reported that “Hemp producers and product manufacturers face a tough year ahead as they contemplate whether to keep their businesses going on high hopes. Industry advocates and politicians have wasted no time fighting a hemp-THC ban that slipped into federal appropriations legislation that ended the government shutdown on Nov. 12.” The uncertainty surrounding the passage of this bill promises to be an inconvenience for dealers of HDCP (hemp derived cannabis products) for the coming year. Furthermore, it is unclear whether this bill will actually pass both houses of congress in 2026. If it doesn’t pass, then it will likely be pushed to 2027 and a new, Democratically-run House might push for a new bill or perhaps kill the process altogether.

Some long overdue news from Kentucky: An article published by Marijuana Moment reported that “The governor of Kentucky has announced that the state’s first licensed medical marijuana dispensary will be opening…And he’s anticipating that the business will “run out” of its supply by the end of the day. During a press briefing…Gov. Andy Beshear (D) delivered what he called the “great news” that The Post Dispensary in Beaver Dam will officially start serving registered medical cannabis patients beginning on Saturday—with cannabis supplied by the state’s first licensed cultivator, Farmtucky…The governor, who has long championed cannabis reform, previewed the market launch earlier this month, while making the case that medical marijuana will help thousands of patients find an alternative to opioids for pain management.” According to the CRB Monitor database, Out of the approximately 5000 cannabis licenses that were issued starting in 2024, just over 100 are in active status or are pending approval.

Say it ain’t so, Ohio: A December article in Marijuana Moment reported that “Ohio’s Republican governor says he will sign a controversial bill to scale back the state’s voter-approved marijuana law and ban the sale of what he described as “juiced-up hemp” products that fall outside of a recently revised federal definition for the crop unless they’re sold at licensed cannabis dispensaries. Just days after the legislature gave final approval to the marijuana legislation, Gov. Mike DeWine (R) said…that he intends to enact it into law. Is it possible that the governor might be undermining the will of Ohio voters? We will see. The article goes on to report, “The bill on DeWine’s desk would recriminalize certain marijuana activity that was legalized under that ballot initiative, and it’d also remove anti-discrimination protections for cannabis consumers that were enacted under that law.”

Next we head north to Maine for some sobering news for cannabis operators: A December article in MJ Biz Daily reported that “The Maine Secretary of State on Dec. 8 approved the Act to Amend the Cannabis Legalization Act and the Maine Medical Use of Cannabis Act to begin collecting signatures. If it qualifies for the ballot and is approved by a majority vote, Maine’s adult-use cannabis industry would sunset on Jan. 1, 2028. Existing operators could transition back to medical marijuana, and personal use and possession of up to 2.5 ounces would remain legal, as would medical marijuana…To qualify for the ballot, the petition must collect roughly 68,000 valid signatures from registered voters by early February.” Why is Maine thinking about rolling back recreational marijuana? It seems that regardless of cannabis’ popularity, there will always be a vocal minority that seeks to derail its success.

Finally, we head out to the Lone Star state and some expansion: A December article on our CRB Monitor News site reported that “Multi-state operators Verano Holdings Corp. (VRNO), Trulieve (TCNNF) and PhamaCann are among the nine cannabis companies awarded conditional licenses during phase one of the Texas Compassionate Use Program expansion. Texas has had a limited, low-THC medicinal program since 2015. The legislature expanded its program this year with the passage of House Bill 46. Twelve new dispensing organization licenses will ultimately be added to the three currently under operation: Surterra Texas, Cansortium Texas and Compassionate Cultivation.” While Texas has yet to approve marijuana for recreational use, this constitutes a step in the right direction. With that said, Texas is one of the states that contends with the “intoxicating hemp loophole”. While there are no guarantees that these MSOs will ultimately receive operating licenses, this legislation is a step in the right direction. The article goes on to say, “HB 46 also allows licensed dispensary organizations to have satellite storage locations and expands qualifying medical conditions to include chronic pain, Crohn’s disease and other inflammatory bowel diseases, and a terminal illness for which the patient is receiving hospice or palliative care.”

CRBs In the News

The following is a sampling of highlights from the November 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know