Cannabis Industry Shakeout Continues as New York Rises, Canada Stabilizes

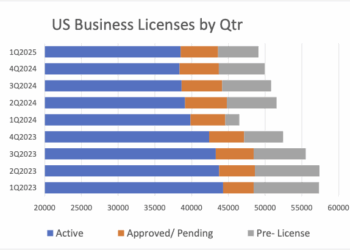

According to the newly released Q4 2025 edition of CRB Monitor’s Cannabis Business Licensing Activity Review, total active U.S. cannabis business licenses fell another 2% to 36,665, marking the 12th quarterly decline in the last 13 periods and capping a staggering 14% drop over the past two years.

The numbers tell a tale of two markets. While mature powerhouses like California, Colorado, and Oklahoma continue shedding operators—Oklahoma alone lost another 823 licenses in Q4, a 56% reduction since 2024—newer states are picking up the slack. New York now dominates the national landscape, accounting for 88% of all pre-licensing applications and 95% of retail applications still under review. The Empire State added 132 new licenses in the quarter, a 413% increase over the past year.

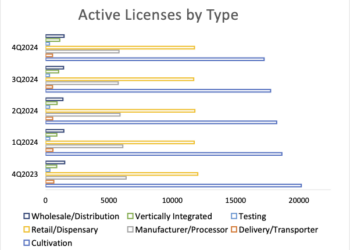

Other notable trends include the explosive 112% annual growth in vertically integrated operators and a continued slump in new testing facilities, which fell to just 16 nationwide for all of 2025.

Perhaps most telling: California, the nation’s largest market, ended the year with only seven new license applications in process. The message is unmistakable—outside of a few remaining frontiers, the window for easy entry into cannabis is firmly closed. As CRB Monitor’s Steven Kemmerling notes, “We are watching a market rationalize itself, squeezing out inefficiency to find a sustainable equilibrium.”

That search for stability is already visible in Canada. North of the border, active licenses have hovered around 5,800 for six straight quarters, reaching a “floor” after a two-year decline.

For complete findings and analysis of permit activity in the licensed cannabis market, download the full report at the link below.