Taxpayers holding at least 17% of New Mexico’s cannabis retailer licenses have been late filing sales tax reports.

More than 100 New Mexico cannabis retail license holders have not complied with state sales tax requirements, says the state’s Taxation and Revenue Department. Another 80 retailers have been brought into compliance since the tax department started a proactive outreach in July targeting delinquent tax reports.

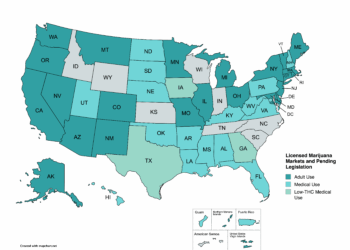

New Mexico legalized adult use in 2021, and licensed sales began in April 2022. Adult-use sales are subject to a 12% cannabis excise tax and a gross receipts tax. The base state gross receipts tax rate is 4.875%, plus any additional taxes assessed by the local community. The businesses are required to file monthly sales activity reports to the tax department, even if they have no sales. Businesses must be in good standing with their taxes to renew their licenses.

According to the New Mexico Regulation and Licensing Department, there were 1,035 approved retail licenses as of Nov. 1. Adult-use sales totaled over $34.63 million in October.

As retailers are coming up on the annual renewal of their licenses, the tax department has been identifying companies that have missed at least one tax filing and encouraging a voluntary approach toward compliance. Tax and Revenue spokesman Charlie Moore said that means being caught up on their filings, not necessarily their taxes due.

“Cannabis is a relatively new industry with many new players who may be struggling to get their businesses up and running,” said Taxation and Revenue Secretary Stephanie Schardin Clarke in a press release. “We are here to assist taxpayers to voluntarily comply with the tax law, but cannabis retailers must also make a good faith effort to comply.”

Moore said there wasn’t any primary reason for the late filings among the 80 businesses that have caught up. But because it’s a new program, it’s possible there was some confusion about the law, he said. While excise tax reports must be filed monthly, even if there are no sales, the gross receipts tax report may be quarterly or semi-annual, with approval, until a $200 monthly tax liability threshold is met.

Most of the 80 taxpayers didn’t take advantage of the department’s managed audit program, which would allow them to avoid penalties and interest, he said.

Of the 100 license holders still outstanding, Moore said there could be fewer taxpayers since one operator may hold multiple licenses at different locations. Tax and Revenue is working with Regulation and Licensing to confirm which license holders are actually operating, and both agencies may perform in-person compliance checks.

Moore declined to identify any of the businesses, citing confidentiality laws. He didn’t know if any of the 80 brought into compliance held more than once license.

More compliance means more money

The tax department’s efforts appear to be paying off for the state. Cannabis excise tax revenue grew by $1 million from approximately $3.5 million in August to $4.5 million September, according to monthly business activity reports, while sales revenue increased by only $500,000. Retailers are required to report monthly sales by the 25th of the following month. So the August excise tax income is from July sales.

New Mexico deposits its tax revenue into the general fund and distributes taxes to local communities. Penalties into the general fund increased by more than $13,000 to $47,689 from August to September, and interest collected grew by over $4,000 to $10,155 in September.

The department expects payments from the 80 taxpayers who have come into compliance will result in larger distributions in the coming months.

Moore said the Tax and Revenue Department will continue to do compliance checks. “In the long run, we expect compliance to be pretty good because their license depends on it.”