November 2023 had cannabis investors saying, “Well, at least it didn’t tank again”. In fact, they were treated to returns that reflected either 1) optimism about federal cannabis reforms or 2) we were witnessing one of those bounces of the “expired cat” nature (we might choose the latter). Recent months notwithstanding, it is safe to say that the long-term trajectory of cannabis equities has been down, down, down, as every rally has been followed by an equally-dramatic correction. However, as we have said periodically, hope springs eternal.

And what about earnings season? While returns for plant-touching CRB equities were positive in November, in the eyes of analysts, the recent earnings season was a mixed bag, with a variety of results across the larger CRBs. With that said, results trended toward very small surprises, including Green Thumb Industries (slight positive), Verano Holdings (slight negative), Curaleaf (slight negative), Trulieve (slight positive) and Cresco Labs (positive). In other words, the positive stock performance could have been in part due to the presence of few major negative surprises…and the dead cat bounce.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), performed in line with its peers in November. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index posted a positive 2.1% return in November 2023 and finished slightly behind its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (+2.3%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US marijuana touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (Strength of Theme et al) as well as rules for inclusion, particularly thresholds for minimum price and market capitalization.

HERBAL trailed the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (+7.3%) as well as the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which closed out November with a return of +21.1%. The funds with US plant-touching MJ exposure were the big beneficiaries of the temporary recovery in US MJ, given their sensitivity to the perceived positive impact from US cannabis reform.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its unusual composition. Since its origin MJ has held a significant percentage of non-Pure Play (and in a few cases non-CRB) holdings, more specifically tobacco stocks with either very small or no cannabis exposure at all. Additionally, In 2022 MJ added and maintains close to a 50% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can also deviate materially from HERBAL’s as well (as it did in November), largely due to its significant holding in CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

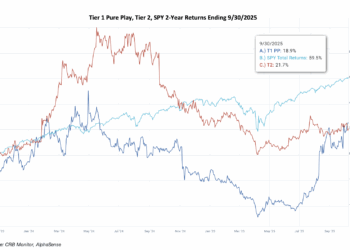

The performance of the CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap rebounded in November, gaining 14.0%. This basket, which is an equally-weighted portfolio of the 11 largest Pure Play CRBs (including both US plant-touching and non US plant touching MJ), had a return that landed in between the two groups.

The CRB Monitor equally-weighted basket of Tier 2 CRBs finished the month behind the Tier 1 CRB basket, posting a +4.5v% return in November. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. With that said, the breadth of the Tier 2 basket has shrunk over time and the spreads have widened, which will likely contribute to short term performance differences as well.

US equities posted gains in November as positive economic data (amidst the chaos of war overseas) was enough to provide investors with some optimism heading into the holiday season. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a +8.7% for the month, which may have contributed positively to the improvement in the performance of cannabis equities.

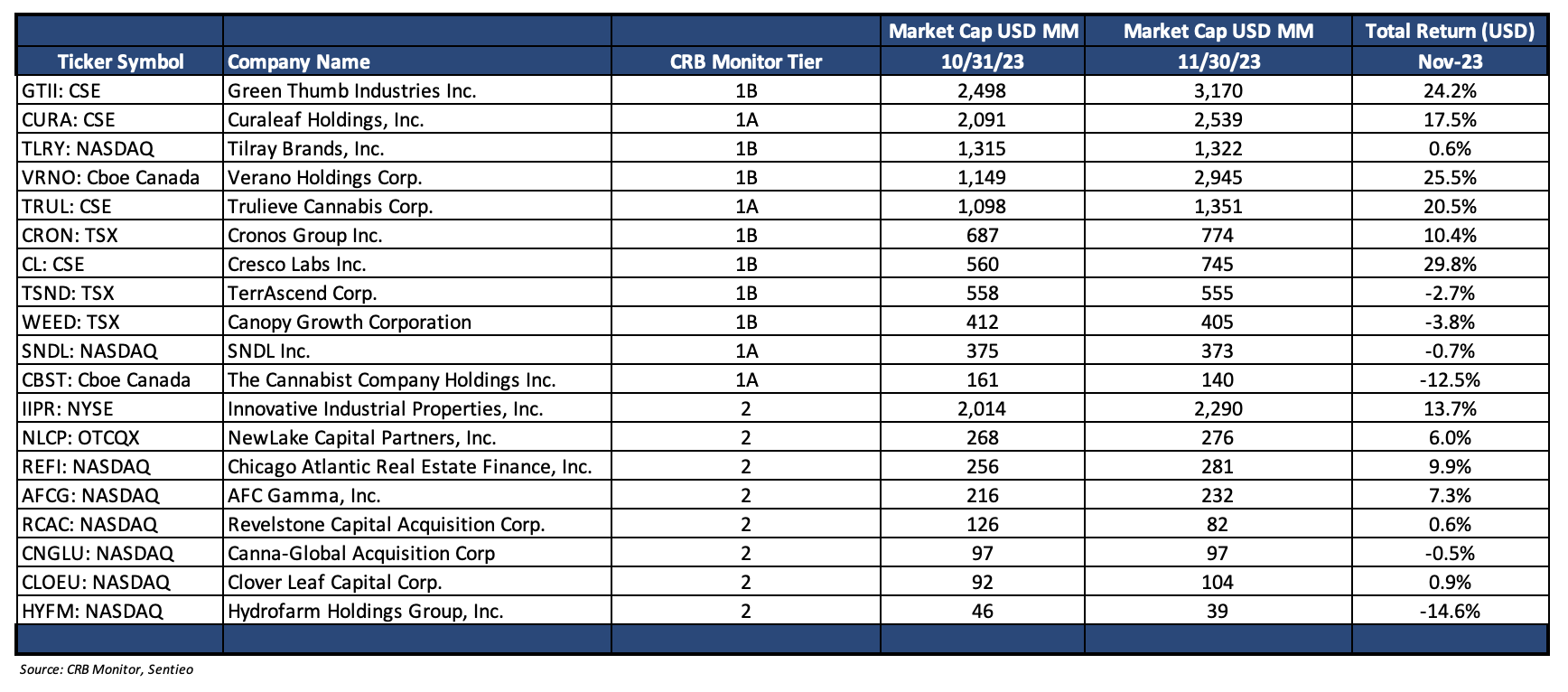

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – November 2023 Returns

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities rebounded in November, returning +14.0%, with most of the positive return coming from the MSO group as the CAD CRBs lagged. As you will see in the historical chart in a few paragraphs, historically these two groups have tended to move reasonably together but more recently we have seen them deviate.

The “legal” Canadian CRB basket had few bright spots in the month of November, however things appeared to have settled down following October’s virtual bloodbath. Canadian Tier 1B CRB and household name Canopy Growth Corporation (TSX: WEED) (-3.8%), along with Tier 1B Tilray Brands, Inc. (Nasdaq: TLRY) (+0.6%) and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-0.7%) were indicators of an unremarkable earnings season, while Cronos Group Inc. (TSX: CRON) (+10.4%) was by far the best performing CRB in the non-US plant-touching basket. This was in spite of the fact that CRON missed earnings estimates by $0.02/share.

Performance was significantly better for the MSO basket as Tier 1A (+20.5%), Tier 1B Cresco Labs Inc. (CSE: CL) (+29.8%), Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (+17.5%), and Tier 1B Verano Holdings Corp. (CSE: VRNO) (+25.5%) have all been riding the performance seesaw over the last few months, rebounding from a dreadful October. Considerably less spectacular in November were Tier 1B TerrAscend Corp. (TSX: TSND) (-2.7%) and Tier 1A The Cannabist Company Holdings Inc. (CBOE Canada: CBST) (-12.5%) which still appears to be finding its way forward after its M&A deal with Cresco Labs failed to consummate earlier in 2023.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a positive 4.5% return for November 2023, which underperformed the equally-weighted Tier 1 basket by 9.5%. Typically these two baskets are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), and we expect Tier 1 and Tier 2 CRBs to periodically “mean revert”; however, we also feel that there is no need to try to game them as a strategy. When these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the precise moment when these two baskets mean revert is not easy to predict. And furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy.

Performance across the Tier 2 basket was mixed but mostly positive in November 2023. Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (+13.7%), rebounded in November but still has a -10.7% year-to-date roller coaster-like return. As we reported last month, IIPR reported its 3rd quarter results on November 2nd, with the following highlights:

- Generated total revenues of approximately $77.8 million in the quarter, representing a 10% increase from the prior year’s quarter.

- Recorded net income attributable to common stockholders of approximately $41.3 million for the quarter, or $1.45 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) of approximately $64.8 million, or $2.29 per share, increases of 7.8% and 7.5% from the prior year’s quarter, respectively.

- Paid a quarterly dividend of $1.80 per common share on November 13, 2023 to stockholders of record as of September 29, 2023. The common stock dividends declared for the twelve months ended September 30, 2023 of $7.20 per common share represent an increase of $0.40, or 6%, over dividends declared for the twelve months ended September 30, 2022.

CannTier 2 CRB AFC Gamma, Inc. (Nasdaq: AFCG) (+7.3%) rebounded in November, as it announced its quarterly dividend of $0.48 mid-month and on October 30th announced the appointment of Daniel Neville as their new CEO. On November 8 AFCG, an institutional lender to the commercial real estate sector, reported “net income of $8.0 million or $0.39 per basic weighted average common share and Distributable Earnings of $9.9 million or $0.49 per basic weighted average common share for the third quarter of 2023.” Not exactly crushing it on the earnings front, we will wait and see if AFCG makes it as a Tier 2 CRB in the long term.

Finally, Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) posted a negative return (-14.6%) for the third straight month. In early November, Hydrofarm announced its 3rd quarter results, which featured a significant drop (-$20mm) in sales but repeated an increase in net gross profit of $5mm. Also covered in this earnings report was the Initiation of “a second phase of restructuring plan, which includes U.S. manufacturing facility consolidations, to improve efficiency and generate further cost savings.”

As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day.

Chart of the Month: MSO Business Trends

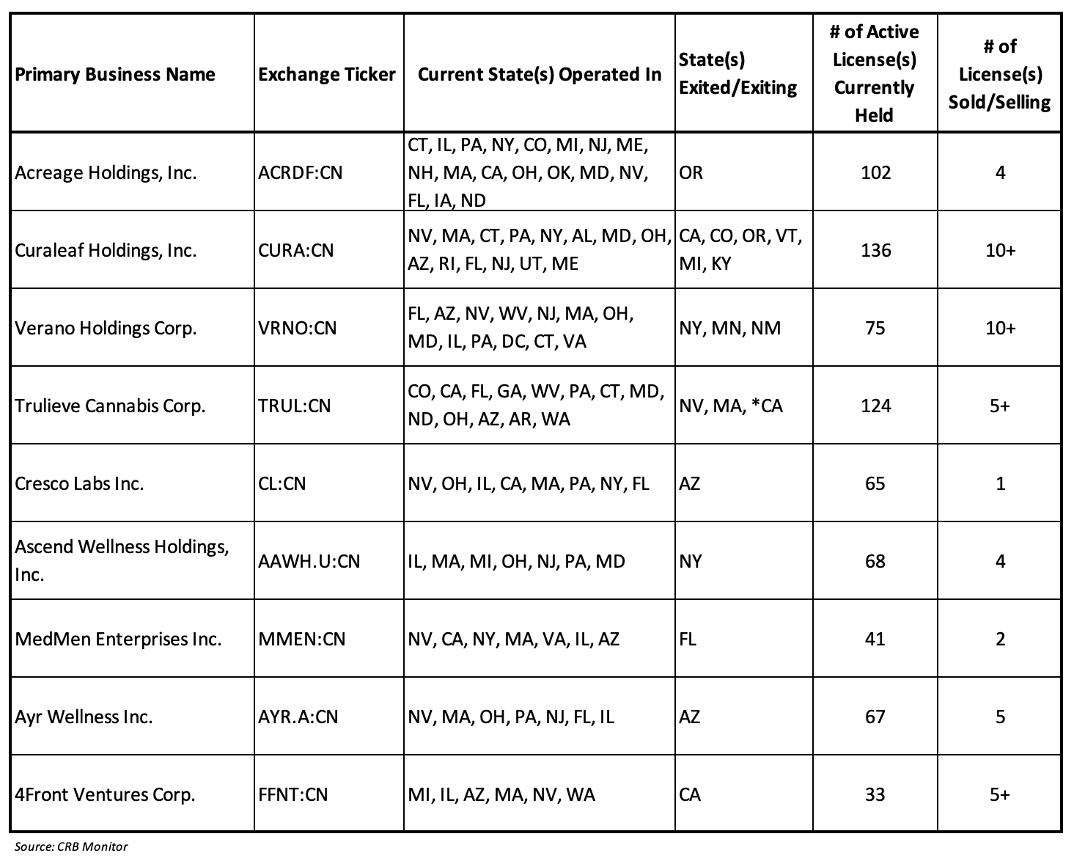

Multistate operators (MSOs) are CRBs that spread their revenue-generating, licensed cannabis operations (cultivation, manufacturing, distribution, etc.) across two or more states in the US. This model for doing business can be complicated and painful, but CRBs’ hands are tied while cannabis is still federally illegal and operating on a state-by-state basis (and internal to each state) is the only way to grow revenues within the US.

As such, MSOs face obstacles that can limit their ability to operate profitably in every state where they are licensed. Some notable hurdles include:

- Licensing requirements that seek to establish or restore social equity to CRB ownership

- Varying levels of state taxation

- Barriers to using mainstream banking services, such as payments, lending, and deposit accounts

- Varying degrees of participation by the illicit market which undermine the legal market

And so given these (and other) headwinds, several large, publicly-traded multistate operators have closed their operations in one or more states. And we thought it might be interesting to take a look at this trend in the cannabis industry as it could be a reflection of companies’ need to survive while the politicians figure things out.

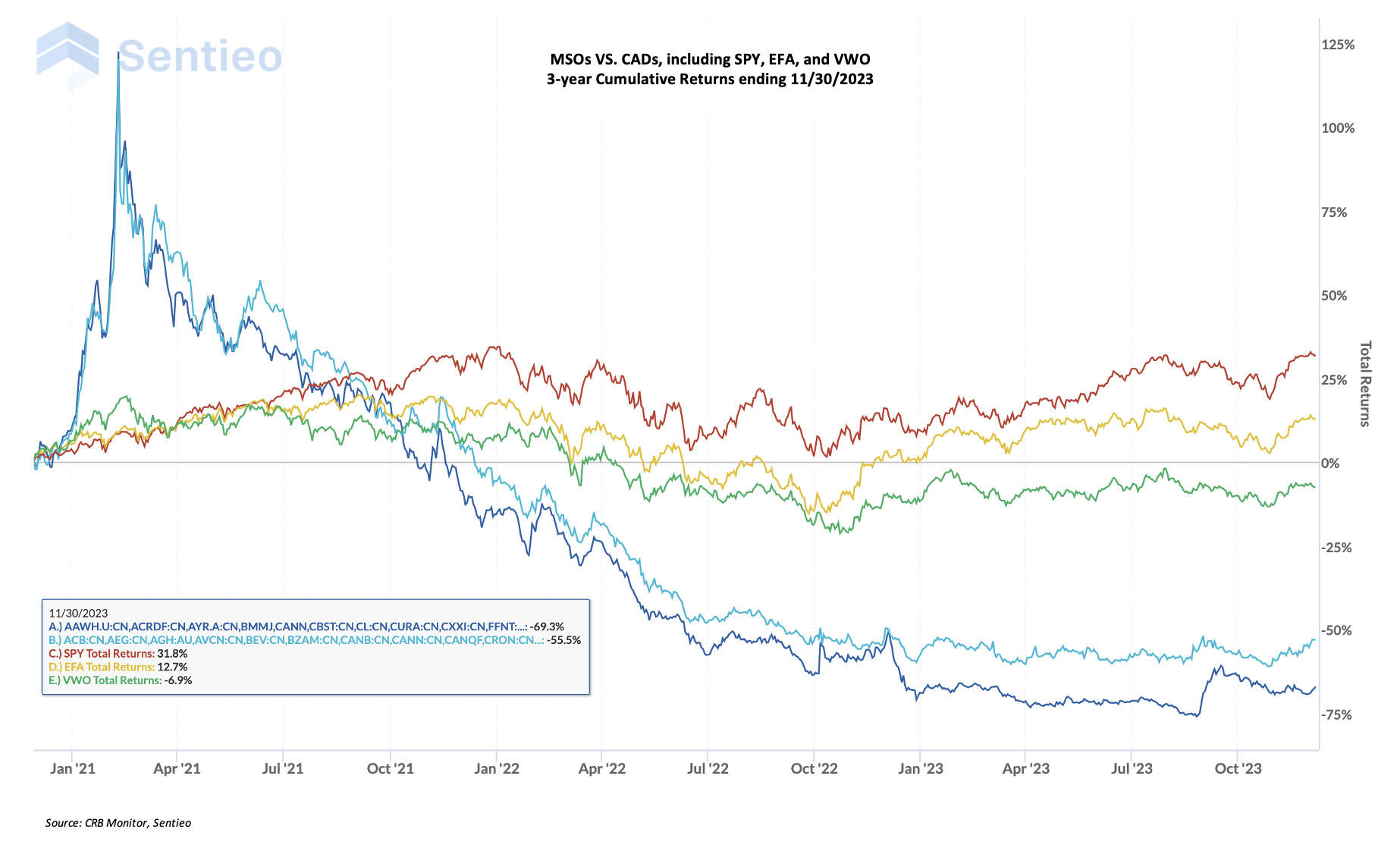

But first, and to provide some context, let’s take a look at market performance. It is an understatement to say that cannabis-related equities have been in a free fall for the better part of the last 3 years (see chart below).

The two lines at the bottom of this chart represent the performance of a basket of the largest 30 MSOs (dark blue) and the largest 30 Canadian-based CRBs (light blue). The remaining three series represent the performance of SPY (S&P 500 ETF), EFA (MSCI International ETF), and VWO (Vanguard Emerging Markets ETF). Not only have the cannabis baskets spent most of the last 3 years in a downward spiral, they are largely uncorrelated with the other broad market equity indexes.

Interestingly, the two equally-weighted CRB baskets were largely in lock-step until Q4 2022, when they started to diverge, with MSOs underperforming the CADs. Why the bottom fell out for MSOs can be traced to the progress, or lack thereof, of cannabis reforms by our leaders in the US Congress. It could be inferred from the data that the MSO group has taken a significant hit (following a major bubble) as our congressional leaders have dragged their feet; and whether or not the damage is reversible is anyone’s guess.

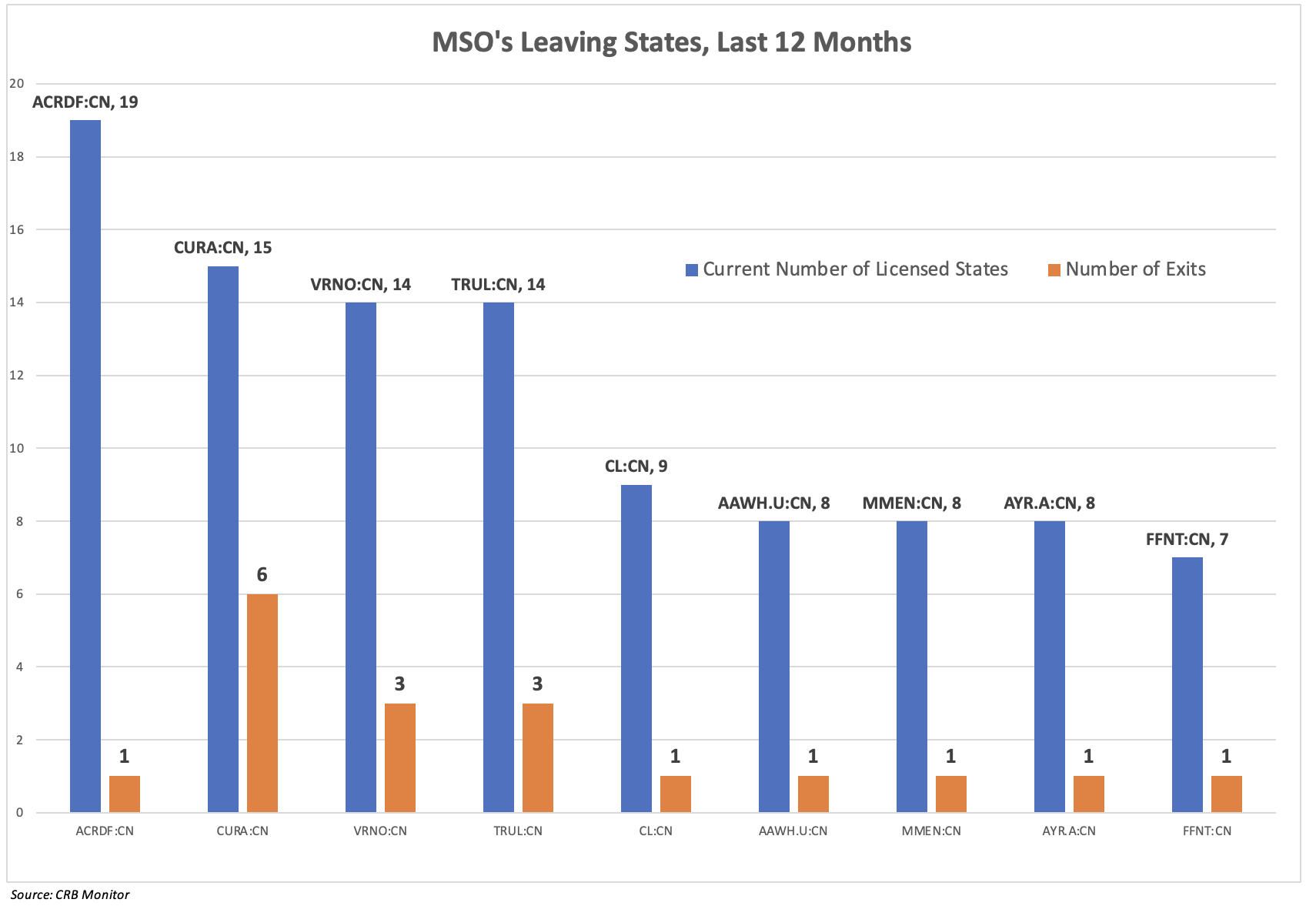

On that note, over the last year the MSO group has been forced into playing defense, and that is where CRB monitor’s research kicks in. What has interested us is the trend of the largest MSOs packing up and moving operations out of a number of states over the last 12 months and the data is eye-opening.

The above chart represents an interesting trend for nine of the largest CRBs which recently “picked up their ball and went home,” selling licensed operations in states where they had moved in not long ago. [We have provided more detail at the company level in the table below]. The process of moving into a state is complex and expensive, as an operator must secure one or more licenses from a state authority while navigating the twists and turns of doing business in local municipalities that have mixed levels of acceptance among residents.

One significant example of this phenomenon is Tier 1A Curaleaf Holdings, Inc. (CSE: CURA), an MSO that has unwound operations in 6 states in the last 12 months. During 2023, Curaleaf Holdings, Inc. concluded its operations in multiple states including California, Colorado, Oregon, Vermont and Michigan. The company exited production and cultivation facilities in California, Colorado and Oregon and sold two dispensary locations and a cultivation/manufacturing facility in Vermont. Additionally, the Curaleaf announced it has exited operations in Michigan and Kentucky. Per Curaleaf’s Chairman: “Throughout 2023, the company’s been focused on improving efficiency metrics and dialing in operations to maximize its existing base.”

Another Tier 1 MSO that has made its exit from multiple states is perennial acquirer and Tier 1B CRB Verano Holdings Corp. (CSE: VRNO). In Q1 2022, Verano Holdings Corp. entered into an agreement to acquire publicly-traded Tier 1B CRB “Goodness Growth Holdings Inc.” Through this acquisition, Verano would have entered the states of New York, Minnesota and New Mexico. Goodness Growth, a Tier 1A private CRB, operates multiple cultivation facilities and dispensary locations across these three states. Goodness Growth also operates a manufacturing and processing facility in New York. However, in Q4 2022 Verano terminated this agreement. Per Verano’s CEO: “We believe the decision to terminate this arrangement agreement was in the best interest of Verano and our shareholders.”

A third Tier 1 MSO that has backed out of several states is Trulieve Cannabis Corp. (CSE: TRUL). In late Q2 2023, Trulieve announced its plans to wind down cannabis operations in Massachusetts and Nevada. At that time, Trulieve also announced the consolidation (not a total exit) of its California operations with the closure of select retail assets in Palm Springs and Venice.* Trulieve exited the Nevada wholesale market and expects to cease Massachusetts operations by the end of 2023. Per Trulieve’s CEO: “These difficult but necessary measures are part of ongoing efforts to bolster business resilience and our commitment to cash preservation as we continue to focus on our business strategy of going deep in our core markets and jettisoning non-contributive assets.”

*Trulieve closed three dispensary locations in California; however, one still remains active.

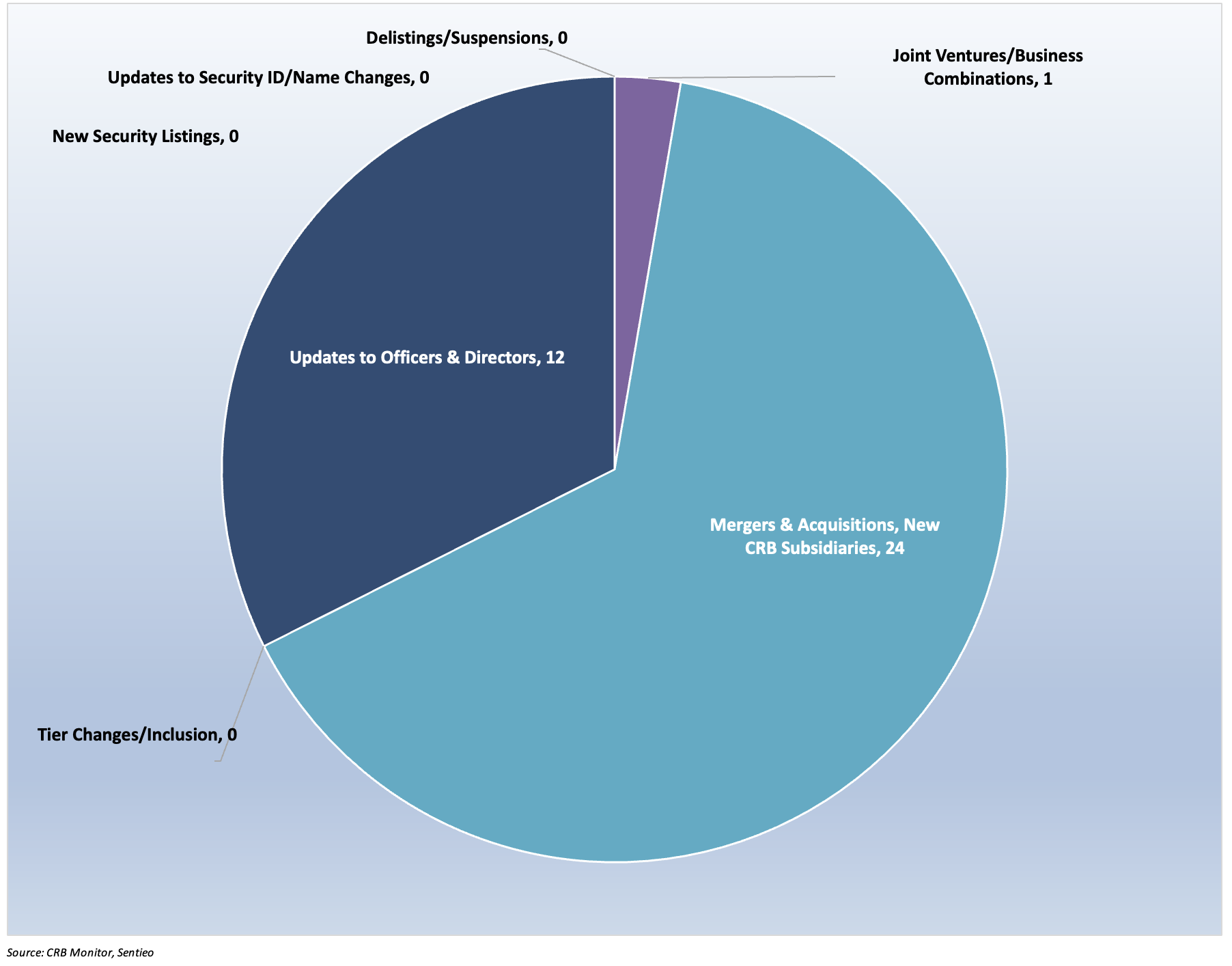

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for November 2023:

Cannabis Business Transaction News – November 2023

Cannabis business activity kept moving along in November, and as we can see in the above table the focus of our daily database coverage has been on operational expansion as well as officer/director announcements. Now for some news:

In November Green Thumb Industries Inc. (CSE: GTII) and Incredibles, a cannabis edibles brand from Green Thumb, announced a partnership with Magnolia Bakery, New York City’s world-famous bakeshop. In the words of the November 1st announcement, “Starting today, fans of both brands can shop the collaboration featuring two limited-edition THC-infused chocolate bars at RISE Dispensaries in Illinois, Nevada and Massachusetts, with wider availability across the three states to follow.” Green thumb’s operation footprint stretches across 17 states plus British Columbia and through their subsidiaries GTII controls 94 licenses which are either active or pending approval.

Also in November, Tier 1B Canadian CRB RIV Capital Inc. (TSX: RIV) announced in a press releasethat the expansion of its cannabis cultivation and production facility located in Chestertown, New York is now operational. Introducing the new 75,000 square foot facility, CEO Mike Totzke said, “The completion of our Chestertown facility is a major milestone in our New York growth story as we near our anticipated and long-awaited entry into the adult-use cannabis market…This expansion, paired with our expertise and advanced knowledge of the state market, will accelerate the development of a robust wholesale program, and significantly increase product output in step with the expansion of New York’s consumer base.” Following this expansion, RIV Capital’s active and pre-license license total is 139 across 4 countries.

Canadian Tier 1B High Tide Inc. (TSXV: HITI) issued a press release announcing that it is expanding its retail cannabis operations by “acquiring certain assets of Canadian Cannabis Media Corp. related to its store located at 1208 Davie Street in Vancouver, British Columbia for $1.33 Million, paid via a combination of High Tide shares and cash, pursuant to a definitive agreement…The closing of the Transaction brings High Tide to a total of 8 Canna Cabana retail cannabis stores in British Columbia, which is the maximum number of stores allowed to operate by any one entity in the province.” With this purchase, High Tide’s active and pending license total is now at 204 across 5 Canadian provinces plus Australia.

Legendary Tier 1B Canadian CRB Cronos Group Inc. (TSX: CRON) issued a press release where it announced that its wholly owned subsidiary “entered into an agreement with Future Farmco Canada Inc., a vertical farming company, for the sale and leaseback of its property located at 4491 Concession 12 Sunnidale Road, Stayner, Ontario, Canada, L0M 1S0 (the “Peace Naturals Campus”.” According to the press release, “the Buyer has agreed to acquire the Peace Naturals Campus for C$23 million cash, subject to the terms and conditions set forth therein. The parties also plan to enter into a lease agreement upon closing for portions of the Peace Naturals Campus, ensuring continued operations.” The announcement goes on to state that the purpose of the sale-leaseback agreement is cost savings, which is not surprising given Cronos’ downturn over the last two years. Cronos, which still has a significant percentage of its shares held by tobacco giant Altria Group, Inc. (NYSE: MO), holds 139 active or pending licenses across 8 Canadian provinces plus Greece and Australia.

Also in November, Las Vegas household name, Planet 13 Holdings Inc. (CSE: PLTH) announced that its long-awaited Illinois dispensary will open on December 4, 2023. The 4,000 square foot dispensary located at 4000 Northpoint Blvd in Waukegan, 30 miles north of Chicago, will be Planet 13’s fourth dispensary and first in Illinois.” In the words of Bob Groesbeck, Co-CEO of Planet 13: “The addition of our new Illinois dispensary will be a key driver of revenue growth throughout 2024 as we ramp up sales. We have high expectations for this dispensary given the great potential of the Illinois market and our strategic placement in a shopping and entertainment district in the ‘Chicagoland’ metro area.” Originally famous for sporting the world’s largest cannabis dispensary, Planet 13 now operates in 4 states (NV, CA, FL, IL) and holds (through its subsidiaries) 27 licenses that are either in active status or are pending approval.

Finally, ever-expanding Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) issued a press releaseannouncing the opening of MÜV North Miami-Biscayne on Friday, November 17th, which is Verano’s 73rd Florida dispensary and 136th location nationwide. In the words of the press release, “MÜV North Miami-Biscayne – Verano’s second dispensary in Florida’s largest metropolitan area with more than 2.7 million residents1 – adds another complementary location to the Company’s existing MÜV Miami-Kendall dispensary situated on the city’s Southwest side.” Joel Noonan, EVP of Verano’s Southern Region, commented: “We are so excited to open MÜV North Miami on beautiful Biscayne Boulevard…Adding a second MÜV location in Florida’s largest market provides another convenient location for the Miami medical cannabis community to access our patient-centric service and wide variety of high quality products in a warm and welcoming environment.” By CRB Monitor’s count, Verano now holds, through its subsidiaries, 75 active cannabis licenses in the United States.

Select CRB Business Transaction Highlights

Security/Exchange Highlights

| Company Name | Ticker Symbol | EVENT Type | Result |

| Verano Holdings Corp. | CBOE Canada: VRNO | New Listing | Verano Commences Trading on Cboe Canada |

| 4Front Ventures Corp. | CSE: FFNT | New Listing | 4Front Ventures Announces Agreement to Issue Warrants to Lender in Connection with Amendment to Previously Entered Promissory Note Agreement |

Officers/Directors Highlights

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Premier Products Group, Inc. | OTC Pink: PMPG | Moved to Watchlist | Tier 2 – IT Services & Software |

| Nuvus Gro Corp. | OTC Pink: SONG | Moved to Watchlist | Tier 2 – IT Services & Software |

| Amfil Technologies Inc. | OTC Pink: FUNN | Moved to Watchlist | Tier 3 – Professional Services |

| Fortium Holdings Corp. | OTC Pink: FRTM | Moved to Watchlist | Tier 1B – Owner/Investor |

| Storage Drop Storage Technologies Ltd | TASE: STRG | Moved to Watchlist | Tier 1B – Owner/Investor |

| Video River Networks, Inc. | OTC Pink: NIHK | Moved to Watchlist | Tier 2 – Real Estate |

Cannabis News: Regulatory Updates

First, in November it was reported by our very own CRB Monitor journalists that the state of Ohio has become the 24th state to legalize adult-use cannabis. According CRB Monitor reporters, “Issue 2 handily passed 57% to 43%. Polls indicated that the measure would pass by such a margin, even as Republicans adopted a resolution opposing it and opponents were accused of releasing misleading ads. Supporters reportedly included U.S. Rep. Dave Joyce, co-chair of the Congressional Cannabis Caucus, and U.S. Senate Banking Committee Chairman Sherrod Brown.”

The article goes on to report: “The new law allows adults 21 and older to consume and possess up to 2.5 ounces of cannabis and cultivate up to six plants, 12 per household, for personal use. It would permit controlled and regulated commercial cultivation and sales by licensed businesses overseen by a new Division of Cannabis Control (DCC) under the Department of Commerce. It would also exempt financial institutions that provide services to licensed cannabis businesses from criminal liability.”

Also in November, our CRB Monitor team wrote an excellent report entitled Startup or Scam? Bogus Cannabis Unions Not Just a California Concern detailing the little-known existence of fraudulent unions that have infiltrated the cannabis industry. According to the article, “Shady unions and labor peace agreements (LPA) are not just a problem for California cannabis workers. The ProTech 33-related National Production Workers Union claims that it is organizing cannabis workers in states outside of California, while the upstart Cannabis Engineers, Extractors and Distributors (CEED) Union Local 420 has announced its first successful unionizing effort in the Northeast, the United Food and Commercial Workers International’s (UFCW) traditional stomping grounds…The UFCW has accused CEED Local 420 of being a company union, but a spokesperson with CEED claims that the UFCW is threatened by an upstart union.”

On the topic of hunting down fake unions, the article reports, “With the need for an LPA comes the possibility that upstart organizations could swoop in, help companies fulfill the LPA obligation, and then put no further effort into actually organizing that company’s workers. Most of the country’s unionized cannabis workers are members of either the Teamsters or the UFCW. Both unions have been critical of upstart unions and what they allege are bad-faith efforts to fulfill LPAs.”

Also in November, The Alabama Medical Cannabis Commission met to vote for applicants to be awarded medical cannabis business licenses and released a list of 20 businesses now licensed including cultivators, processors, and dispensaries. In an article on the local ABC News website, it was reported that “the Commission will hear presentations from integrated facility applicants… and will award such licenses on Dec. 12. Under the rules created by the Alabama Board of Medical Examiners, physicians may begin the certification process to recommend medical cannabis to patients after business licenses have been issued. For a patient to qualify for medical cannabis, the patient must have at least one of the qualifying conditions and be recommended for medical cannabis by a certified physician.” Finally, the report goes on to say, “While the Commission is limited as to the number of licenses it can issue pursuant to the statute, the Commission intends to open a second offering of licenses for various license categories.”

Looking globally, according to a story in the Japan News Japan’s parliament enacted legislation in November “to revise the cannabis control law to lift a ban on the use of medicines containing cannabis-derived substances…The House of Councillors, the parliament’s upper chamber, approved the legislation with support mainly from the ruling coalition. The legislative change comes as calls have been growing in Japan to enable the use of a medicine for treatment of intractable epilepsy that contains a cannabis-derived substance called cannabidiol.” The article goes on to say that the revised law “imposes a ban on narcotic use of cannabis and makes offenders punishable with an imprisonment of up to seven years…Tetrahydrocannabinol, a hallucinogenic component of cannabis plants, will be placed under regulation as narcotics under the narcotics control law.”

Now this from Colombia: A November article in Marijuana Moment reported that a Colombian Senate committee has approved a bill to legalize marijuana, sending it the full chamber for consideration. According to the article, “The legislation—which has already moved through committee and on the floor in the Chamber of Representatives in recent months—cleared the First Committee of the Senate…This marks the third of eight planned debates before the measure is potentially sent to the president next year.” This is by no means a “done deal”, however. The MM story goes on to say, “Lawmakers nearly enacted a version of the reform into law earlier this year, but it stalled out in the final stage in the Senate last session, meaning the two-year legislative process needed to start over again. Rep. Juan Carlos Losada and Sen. María José Pizarro reintroduced the legislation in July.”

Finally, a wake-up call for Indiana: An article published on the WFYI Indianapolis website discussed how the Hoosier State is now effectively surrounded on three sides by legal adult-use marijuana. In November WFYI reported that, while cannabis remains fully illegal in Indiana, “Ohioans voted last week to make recreational marijuana legal in their state. Challenges lay ahead in the Ohio statehouse, but if the referendum becomes law Indiana will be surrounded on three sides by recreational marijuana states.” This has become a lost revenue issue for Indiana, and as the article goes on to say, “Like Hoosiers, Ohioans have been pouring money into dispensaries across state lines.” The fact of the matter is that residents of Indiana will cross the border into Ohio (when legalization takes effect), as well as Michigan and Illinois, where recreational marijuana is legal. With that said, the article reminds readers that “Indiana is one of 24 states that don’t allow referendums. But last session, numerous lawmakers, mostly Republicans, introduced bills at the statehouse that would legalize marijuana in some form. None of them made it to a vote.” We will stay tuned, but this one could take a while to get across the finish line.

CRBs In the News

The following is a sampling of highlights from the October 2023 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.