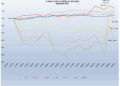

Michigan’s cannabis market seems to have stabilized since prices bottomed in 2022, but cultivators are still struggling in the aftermath of the most recent Croptober harvest.

“I would say flower has dropped significantly since Croptober. Flower prices have plummeted right now. I’m seeing indoor flower buds going for as low as $700-$600 a pound. I’m seeing small buds going for $500 a pound,” said Kevin Seidman, owner of Mood Jackson, an adult-use shop in Jackson, Mich.

Michigan happens to rely heavily on outdoor growing, which creates a fluctuation in monthly prices.October typically marks an annual downturn following the harvest of what is sometimes called “Croptober,” leading to financial distress in the market.

“It’s still almost like the wild west,” said Seidman. “I swear there’s rampant non-payment in the industry on different brand sides. A lot of retailers aren’t paying. We pay cash on delivery because we don’t wanna deal with terms and all the hecticness.”

Michigan’s Cannabis Regulatory Agency (CRA) proposed new rules last summer that would allow the agency to deny licensing renewals for companies with outstanding, court-ordered debts to vendors. A final decision on those rules remains pending.

Such a rule could potentially leave a substantial number of licenses in jeopardy. Seidman said the Facebook group Blacklist of MI Cannabis is specifically dedicated to calling out non-paying cannabis operators in the state.

“The market’s insane and it’s a price-driven market,” he said. “I envision big companies taking over smaller ones.”

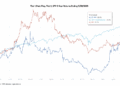

Michigan voters legalized adult-use cannabis in November 2018, making it the first Midwestern state to do so. From there the Wolverine State emerged as a sales powerhouse, second only to California.

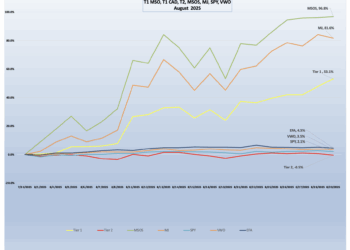

As of Feb. 9, there were 2,149 active cultivation licenses in Michigan, according to the CRB Monitor database. This number is likely much larger than the total number of cultivators because Michigan allows growers to hold up to six cultivation licenses for a single location.

Almost all of the cannabis produced, roughly 98% of both medical and adult-use in the state, comes from Class C growers, which are allowed to stack licenses to produce up to six times the 2,000 square-foot canopy limit per license.

These cultivators serve approximately 1,025 licensed retailers between both the medical and adult-use markets.

Ahead of 2022’s Croptober, the state was addressing concerns that the year’s harvest would be valued lower than the actual cost of producing it. Since then, the state seems to have stopped the bleeding, but growers continue to struggle to find a market for their product.

“Prices have definitely dropped big time,” said Amer Maqboul, a Michigan-based CPA and cannabis consultant. “I mean, Q1 of 2023, I think it was the cost of distillate, it was higher than the price that you could even sell it for. Prices are still really competitive, and there’s not much margin.”

Maqboul suspects that 2024 will continue to see consolidation.

“I think we’re going to see a lot of companies trying to merge together. Hopefully we’ll see retail growth too, which should help with the oversupply,” he said. “The lack of retail locations is a big problem for the oversupply that we have. In 2024, we’re gonna see more business failures, more disputes in the cannabis industry and more litigation. We’re also gonna see some mergers and some growth.”

“Though sales are going up, the growers are getting killed on prices,” said Brent DeClark, co-owner of The Coast, a Michigan cannabis producer.

Seidman also said that growers were struggling, noting there is a lot of competition for shelf space.

“I have probably, I’d say 10 vendors a week stopping by, ranging from edible and extract vendors to flower vendors, and they’re dropping off samples, and we will probably deny like 9.5 out of 10 of those companies,” he said. “We’re just a small mom-and-pop shop, so we don’t have much room as the massive players in the industry.”

Along with the oversupply, Michigan has also seen reports of illicit grows diverting products to other states.

“I know people on a personal level that were dabbling in the illicit market here in Michigan,” said Maqboul. “It’s being grown all over Michigan in rental houses and abandoned houses, flipped houses. It’s all over.”