February reminded us once again that “we can’t have nice things” in the cannabis market, at least not for very long. And as the equity markets rallied over positive economic data, the cannabis industry appeared to ignore it and moved in the opposite direction. After a quick flurry in the first week of the month, cannabis equities seemingly collapsed and failed to recover by the end of the month.

That said, YTD cannabis is still doing well (MSOS +27% YTD, Tier 1 PP +13% YTD, and Tier 2 +46% YTD), and we can chalk February’s Tier 1 swoon up to election year foot-dragging. Nevertheless, we will take a look at the unbridled success of Tier 2 CRBs and, as always, look at all things cannabis as we try to make sense out of this, the shortest month of the year.

Cannabis investors continue to hang onto the promise of DEA rescheduling, or perhaps even descheduling, which could happen not only in our lifetime but maybe even this year. Meanwhile, legal cannabis continues to expand its footprint across the US as well as globally, and both marijuana usage and the idea of legalization both are growing in popularity.

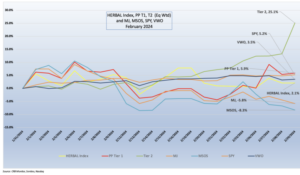

Cannabis-linked Equity Performance

A Sign of the Times: POTX

A Sign of the Times: POTX

We were saddened by the news that the Global X Cannabis ETF (Nasdaq: POTX) closed down in February 2024 due to lackluster interest. POTX’s index, which was HERBAL’s closest competitor in the “legal” cannabis equity space, will now be permanently shelved. The inconvenient truth about the ETF industry is that given the high operating expenses a low AUM ($30mm) is not sustainable for very long. And when your index (like all the others in the space) drops by 90% over a 3-year period only a few strong ETFs will survive.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both “investability” and strength of theme (SOT), rebounded in February following its weak performance in January. A full description of HERBAL’s strengths and benefits can be found here. The HERBAL index posted a positive 2.1% return in February 2024 which generally outperformed the cannabis-themed index space.

Smaller ETFs Struggle

Two of HERBAL’s largest competitors, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-5.8%) and the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-8.3%), struggled in February following a roaring start to 2024 in which both of these ETFs boasted double-digit positive performance. Unlike HERBAL, which is designed to be Controlled Substances Act (CSA)-friendly, these two funds with US plant-touching MJ exposure tend to be more sensitive to the US regulatory rollercoaster which is covered in this newsletter each month.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin MJ has held a significant percentage of non-Pure Play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all.

In 2022 MJ added and maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure. It is also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

Monthly returns of the self-described (and largest) US plant-touching ETF, MSOS, can also deviate materially from HERBAL’s as well (as it did in February), largely due to its significant holding in CRBs with US Marijuana touch-points.

Pure Play Index Falls

The performance of the newly-expanded CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs by market cap reversed direction in February, falling 7.9%. This basket, which is an equally-weighted portfolio of the 22 largest Pure Play CRBs (including both US plant-touching and non US plant touching MJ), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space.

The (also-expanded) CRB Monitor equally-weighted basket of Tier 2 CRBs finished the month with a surge that significantly distanced it from the Tier 1 CRB basket, posting a +25.1% return in February. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.75) in the long term, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group.

If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time. With that said, the breadth of the Tier 2 basket has shrunk over time and the spreads have widened, which will likely contribute to short term volatility and performance differences as well. In this case, the spike in performance came in large part to the late February rally of Corbus Pharmaceutical Holdings (Nasdaq: CRBP) (+272%), which we will take a closer look at in the next section.

Meanwhile, Broad Market Up

U.S. equities were up again in February as we continued to see positive economic data, including control over inflation and lower unemployment numbers. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) posted a +5.2% return for the month (now 6.8% YTD) and added to their record-setting gains. In fact, the S&P 500 Index had eight new record-setting highs in the month of February 2024.

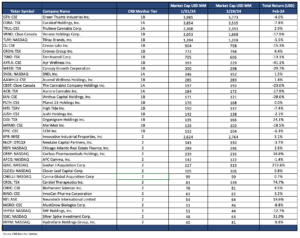

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap

February 2024 Returns

CRB Monitor Tier 1

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities posted a dismal -7.9% return in February, with plenty of pain coming from both the MSO (US plant-touching) group and Canadian (CSA-Friendly) CRBs. There were a few big winners and we will take a look at them below.

Performance was mostly negative in February for the MSO basket as Tier 1B Cresco Labs Inc. (CSE: CL) (-15.3%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-17.9%), Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-7.8%), Tier 1B TerrAscend Corp. (TSX: TSND) (-13.1%), Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-4.0%) and The Cannabist Company Holdings Inc. (CBOE Canada: CBST) (-23.0%) all disappointed investors by reversing out their strong January returns. One of the only exceptions was Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) (+2.9%) which is now close to +90% in 2024 as it seeks to recover $100+ million in Schedule 280-E taxes that Trulieve paid historically.

This time around the Canadian CRB basket had performance that was largely consistent with the MSO basket. Tier 1B household names Tilray Brands, Inc. (Nasdaq: TLRY) (-5.5%), Canopy Growth Corporation (TSX: WEED) (-29.7%), and Tier 1A Aurora Cannabis (TSX: ACB) (-17.9%) all prolonged the agony of their January performance, while Tier 1A SNDL, Inc. (Nasdaq: SNDL) (+1.5%), and Tier 1B Cronos Group Inc. (TSX: CRON) (+4.4%) managed to eke out positive returns which hardly quelled investors’ angst over cannabis equities.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a positive 25.1% return for February 2024, which outperformed the equally-weighted Tier 1 basket by 26.6%. Typically these two baskets are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), and we expect Tier 1 and Tier 2 CRBs to periodically cross paths. When these two portfolios deviate from one another (as they did in February) it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the precise moment when these two baskets mean revert is not easy to predict. And furthermore, the costs required to systematically rebalance these illiquid baskets could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can be a losing strategy, so beware!

And let’s cut to the chase: the performance of the equally weighted basket, in spite of the fact that we expanded the number of constituents to 21, was significantly attributable to the +272.6% return of Corbus Pharmaceutical Holdings (Nasdaq: CRBP). The big news regarding Corbus came in an announcement in late January that data from the first-in-human clinical study of CRB-701 (SYS6002) “Demonstrates Encouraging Safety and Efficacy in Patients with Nectin-4 Positive Tumors.” Sadly for the cannabis industry, this new drug and its success are not cannabis-related. Nevertheless, Corbus is still a Tier 2 CRB and the rest of the basket benefits from its good fortune.

Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR +5.5%), reversed its negative trend from January and maintained its position as the largest Tier 2 CRB by market cap. At the end of February IIPR issued its Q4 and 2024 financials, which we find interesting as they tend to be an indicator of the performance of the Tier 1 CRB market in the immediate and medium term. Here are a few of the highlights:

For the full year 2023:

-

Generated total revenues of approximately $309.5 million, representing an increase of 12% over 2022.

-

Recorded net income attributable to common stockholders of approximately $164.2 million, or $5.77 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

-

Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of approximately $256.5 million and $234.1 million, increases of 10% and 9% over 2022, respectively.

-

Declared dividends to common stockholders totaling $7.22 per share, increasing IIP’s common stock dividends declared each year since its inception in 2016.

-

Committed up to approximately $119.5 million (excluding transaction costs) for the payment of purchase prices and funding of qualifying building infrastructure improvements for two property acquisitions, lease amendments for three properties, two new leases in the existing portfolio and an additional commitment under a construction loan where IIP is lender.

-

Sold a portfolio of properties in March located in California for $16.2 million (excluding transaction costs), which included secured seller financing with the buyer of the property for $16.1 million (interest only, payable monthly).

-

Published IIP’s third annual Sustainability Report, highlighting IIP’s commitment to sound environmental management, collaborative community engagement and corporate governance principles that align to the core values of the IIP team, and available on its corporate website at www.innovativeindustrialproperties.com.

-

At year-end, IIP’s footprint comprised 108 properties totaling 8.9 million rentable square feet in 19 states.

-

As we reported last month, in mid-December, IIPR announced its quarterly dividend of $1.82/share, which represented a $0.02/share increase over Q3 2023. IIPR describes itself as “the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry.

Finally, Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) posted a positive return (+7.9%). Back in November Hydrofarm announced its 3rd quarter results, which featured a significant drop (-$20mm) in sales but repeated an increase in net gross profit of $5mm. Also covered in this earnings report was the Initiation of “a second phase of restructuring plan, which includes U.S. manufacturing facility consolidations, to improve efficiency and generate further cost savings.” As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day.

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for February 2024:

Cannabis Business Transaction News – February 2024

We continue to monitor all the business-related news coming out of the cannabis industry, and as such our analysts have been diligent as they ensure that the CRB Monitor database reflects the current state of the cannabis ecosystem. Here are some of the highlights from February 2024:

Tier 1B Canadian CRB Avicanna Inc. (TSX: AVCN) announced in a February press release that an exclusive supply agreement for two of the Company’s proprietary topical products with a multinational pharmaceutical company.

According to the announcement, the partner company:

“manufactures and markets a wide range of pharmaceuticals across 4 continents and has established commercial infrastructure in the European region that will be utilized for the initial launch of the selected products…(the company) has committed to launch the initial products in 6 European countries during 2024 with expectations of expanding throughout the region shortly after. Avicanna will be earning licensing fees associated to specific milestones and the parties have also agreed to specific minimum order quantities and efforts for (the company) to maintain the exclusivity.”

Avicanna operates in two countries (Colombia and Canada) and through its subsidiaries it holds 4 licenses to manufacture and sell cannabis.

Also in February, Wakefield, MA Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) announced its acquisition of Tier 1A private business Can4Med, “a prominent pharmaceutical wholesaler specializing in cannabinoid medications in Poland.”

According to the press release:

This strategic move marks a significant milestone for both companies and underscores Curaleaf’s commitment to enhancing patient access to high-quality medical cannabis products across Europe. Poland boasts one of Europe’s largest patient populations seeking medical cannabis; by joining forces with Can4Med, Curaleaf International gains a strong foothold in this dynamic market, allowing it to serve patients more effectively and expand its product offerings…As Poland positions itself at the forefront of the European cannabis market, its substantial population of 38 million is poised to catalyze significant growth and innovation in the sector. The Polish Pharmaceutical Chamber estimates that the potential number of medical cannabis users could reach 300,000, while the number of legal cannabis users (both medical and CBD) is expected to reach 1.3 million by 2026.

Currently Curaleaf holds, directly or through its subsidiary businesses, 130 cannabis licenses and the Can4Med acquisition expands Curaleaf’s global footprint to 5 countries where it holds licenses to operate in the industry.

Seemingly always in expansion mode, Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) announced in February the grand opening of “Zen Leaf Norristown, the Company’s 18th affiliated dispensary in Pennsylvania.”

According to the announcement,

The dispensary is located in Montgomery County, the second largest county in the Commonwealth, with a total population of over 856,0001. Situated at the site of a former bank, Zen Leaf Norristown includes a drive-through window for greater accessibility and convenience for online orders, and large in-store kiosks and numerous point-of-sale stations to enhance the browsing and ordering experience for patients… Zen Leaf Norristown adds another convenient outlet for Philadelphia area patients, and extends Verano’s footprint in the state as the Company’s 18th affiliated Pennsylvania dispensary. Verano’s operations in the state also include a state-of-the-art 62,000 square foot cultivation and processing facility in Chester, where the Company produces its signature Verano Reserve flower and Troches, concentrates and vapes; (the) Essence and Savvy flower and extracts; and Avexia RSO cannabis oil and topicals.

Verano (through its subsidiaries) holds 83 active cannabis licenses and operates in 13 states plus the District of Columbia.

Also in February, Tier 1B MSO Ascend Wellness Holdings, Inc. (CSE: AAWH.U) announced the execution of “a definitive agreement to acquire its second cultivation license and associated operations in Massachusetts.”

The announcement goes on to say,

The targeted acquisition, situated in Amesbury, is currently pending regulatory approval, which is expected to be granted in the first half of 2024. In the intervening period, AWH will operate the facility under an interim consulting agreement. The Amesbury facility boasts a spacious 54,000 sq. ft. area, with plans for a targeted investment to encompass 15,000 sq. ft. of canopy and a state-of-the-art kitchen. When combined with AWH’s existing cultivation and production facility in Athol, Massachusetts, this move will elevate the Company’s total cultivation space in the state to an impressive 70,000 sq. ft. of canopy…The expansion is a response to the increasing demand for AWH’s products in Massachusetts, underscored by the resounding success of the Simply Herb brand, which AWH introduced in the state less than two years ago. Simply Herb has swiftly ascended to the top spot1, capturing a meaningful sales lead over the second highest-ranked brand in the entire state.

Ascend’s operational footprint is currently 74 licences that are either active or pending approval that have been issued by 7 states in the US.

Tier 1B Cannabis giant Trulieve Cannabis Corp. (CSE: TRUL) announced on February 19 the opening of a new medical cannabis dispensary in Pinellas Park, Fla. Largely focused in Florida’s medical cannabis market, Trulieve has opened its new Pinellas Park dispensary which according to the press release,

will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, O.pen, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.

With this addition, Trulieve’s operational footprint expands to 177 active or pending licenses across 15 states and 3 Canadian provinces.

Finally, Tier 1B MSO Green Thumb Industries (CSE: GTII) announced in February “the opening of its 15th retail location in Florida and 92nd nationwide, RISE Dispensary Dunnellon.”

The new store will offer medical cannabis patients a range of high-quality THC and CBD products, including RYTHM premium flower and full spectrum vapes, Dogwalkers pre-rolls, Good Green flower, and &Shine flower, pre-rolls, vapes and chews…Green Thumb joined the Florida community in 2018 and operates two production facilities in Ocala and Homestead where the Company cultivates and produces its branded products. Green Thumb’s cultivation and manufacturing practices reflect the highest quality standards to ensure all its products offer a true-to-plant, consistent experience. The Company’s retail brand, RISE Dispensaries, is committed to expanding access to well-being through cannabis and making a positive impact on the communities it serves. In addition to RISE Dunnellon, there are 14 other RISE Dispensaries in Florida, including locations in Bonita Springs, Brandon, Clearwater, Crystal River, Deerfield Beach, Fruitland Park, Hallandale Beach, Kendall, Oviedo, Pinellas Park, Port Orange, Sun City Center, Tampa and West Palm Beach. Delivery services are available to the areas surrounding RISE Dispensaries in Florida.

With this opening, GTII’s operational footprint expands to 98 active or pending licenses across 16 states.

Select CRB Business Transaction Highlights:

Officers/Directors Highlights:

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Planet 13 Holdings Inc. | CSE: PLTH | Tier 1B | Expansion of Leadership Team and Board (PLANET 13 HOLDINGS INC) |

| Glass House Brands Inc. | NEO: GLAS.A.U | Tier 1B | Glass House Brands Announces Resignation of Board Member John Pérez |

| Aurora Cannabis Inc. | TSX: ACB | Tier 1A | Aurora Cannabis names Simona King as CFO |

| Medicine Man Technologies, Inc. | OTCQX: SHWZ | Tier 1A | Schwazze names CFO Forrest Hoffmaster as interim CEO |

Select Updates to CRB Monitor:

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Financial Institutions, Inc. | NASDAQ: FISI | Add | Tier 3/Financial Services |

| American Hemp Ventures Inc. | OTC Pink: AMHV | Moved to Watchlist | Tier 1B/Owner/Investor |

| Akerna Corp. | NASDAQ: KERN | Moved to Watchlist | Tier 2/IT Services & Software |

| Global X Cannabis ETF | NASDAQ: POTX | Moved to Watchlist | Tier 1B / ETF – Cannabis-Themed |

| Sunora Foods Inc. | TSXV: SNF | Moved to Watchlist | Tier 3/Textiles, Apparel & Retail Goods |

Cannabis News: Regulatory Updates

Understanding the regulatory environment is critical to cannabis investing, as the future of the industry largely depends on the actions of our representatives in Washington. In the contentious political environment which we find ourselves, cannabis reform sometimes appears to get lost in the shuffle. At the moment, keeping the U.S. government open, immigration reform, and Ukraine /Israel aid are understandably higher (and highly contentious) priorities. We continue to closely follow the regulators in hopes that our tiny industry gets the airtime it deserves, and the good news is that there is always progress at the state level and internationally as well.

And so our mantra for cannabis investors is, as it always has been, patience. With that said, here are some highlights from the cannabis regulatory news cycle:

To start thing off, this story belongs somewhere in between the business operations section and the regulatory section, as we were treated to a uniquely-Florida brand of news story in the month of February. It was reported that Tier 1B MSO Trulieve Cannabis Corp. (CSE: TRUL) “has received $113 million worth of tax refunds as it challenges what it owes under Section 280E of the Internal Revenue Code.”

This is a massive win for Trulieve, which (see table above) has a market cap of $2.3 billion. Can this be legal? We find it curious, given that Section 280E is still in effect until the DEA rescheduling (or de-scheduling) is fully resolved. Here are a few more details from the announcement:

- Is still seeking $31 million in state tax refunds.

- Received $62 million worth of tax refunds during the quarter ended Dec. 31.

- Received a total of $113 million in refunds to date, including $50.3 million received in January 2024.

- Received one rejection notice in the amount of $1.2 million.

Trulieve did not specify whether or how much of the refunds came from the federal government or state governments.

What makes this story fascinating is the possible impact it will have on the universe of US plant-touching CRBs, which could follow suit. So grab your popcorn, as this will only get more interesting for investors.

Now from Nevada: There is always plenty to report at the individual state level, and let’s begin with Nevada, where the news broke in February that the first license for a cannabis consumption lounge in Nevada has been issued to a business in Las Vegas. “Smoke and Mirrors” was awarded its consumption lounge license “after passing a CCB inspection”.

According to the report, the establishment received a conditional license June 20, 2023. The CCB said 19 lounges have been approved for a conditional license, including 14 retail-adjacent locations and five independent lounges. Administrative setbacks, tight funding and changing regulations governing smoke ventilation delayed the launch of dozens of lounges in Nevada for months last year.

Next, a February article reported that New York regulators,

…have approved draft rules to allow for the home cultivation of recreational marijuana, and have signed off on more than 100 new cannabis business licenses that they hope will help the legal market overcome its “rocky start” this year….Regulators approved over 100 licenses for retailers, microbusinesses, cultivators, processors and distributors. Two cannabis research licenses were also granted under a separate resolution.

The regulations would allow adults to grow up to six plants for personal use, only three of which could be mature at one time. A residence with multiple adults could have a maximum of 12 plants, and people could possess up to five pounds of marijuana derived from the plants. The rules also contain requirements on storing the plants and remediating any odors if they become a nuisance to neighbors.

Also in February, who would have predicted that the state of Kansas would be legalizing cannabis, but here we are, as the Sunflower State begins to move in that direction. A February article reported that the Kansas House of Representatives “calmly went through the motions of passing a bill making certain the state’s list of controlled substances was compliant with federal law when Wichita Democratic Rep. Silas Miller stepped forward with an amendment to delist marijuana entirely.” The amendment failed, 41-80, and the House voted 120-0 to reinforce marijuana as a Schedule I narcotic.

However, a bill to legalize marijuana in Kansas is on the horizon and many feel that it is necessary as Kansans need only take a short drive to purchase their stash in neighboring states such as Missouri, Oklahoma, and Colorado. Under a recent version of a new legalization bill, the medical cannabis pilot would be launched in late 2024. The Kansas Department of Health and Environment would oversee a program with one to four “medical cannabis operators” in control of vertically integrated businesses responsible for medical marijuana cultivation, processing, packaging and distribution of cannabis flowers, patches, ointments and extracts.

Marijuana products in Kansas would be available to adults with profound medical issues, including cancer, epilepsy, multiple sclerosis, Parkinson’s disease, sickle cell anemia, traumatic brain injury, and post-traumatic stress disorder. The bill would distribute medical cannabis through a set of delivery hubs to individuals with a doctor-endorsed certificate. It would put Wichita State University in charge of cannabis testing and research during the pilot phase, which would run through 2032.

We will stay tuned as this legislation plays out.

Finally, it was reported in February by our CRB Monitor News team in an article entitled State Psychedelics Bills Begin to Mushroom in 2024 that we are seeing a significant increase in legislation which would pave the way for legal psychedelics at the state level.

According to editor Maria Brosnan,

[A]t least 13 states have introduced bills by the end of January. Some propose personal use via regulated provider-assisted treatment centers. Others would create working groups or task forces to study the potential of psychedelic therapies and make recommendations for legalized use. Hawaii would allow for personal therapeutic use, while Rhode Island would legalize personal possession and sharing…Meanwhile, a citizen’s petition in Massachusetts that would legalize personal use, service centers and cultivation has received enough signatures to present the proposal to the state legislature. If lawmakers don’t act on it, voters may get to decide.

While the psychedelics space is heavily regulated and also faces its own Schedule I challenges, there are some specific contrasts between it and cannabis, none the least of which that we consider any form of “recreational psychedelics” to be a long way off. Nevertheless, this article provides an excellent state-by-state summary of the progress toward some form of legalization.

CRBs In the News

The following is a sampling of highlights from the February 2024 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update Defining “Cannabis-Related Business”)