Cannabis Equity Returns

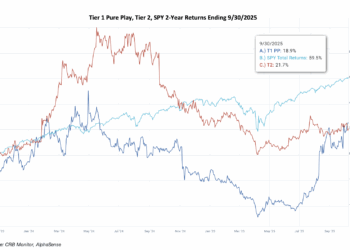

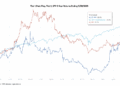

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL) had a positive 24.2% return for the 3rd quarter of 2023. HERBAL is a well-conceived representation of the universe of legal, pure-play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme. HERBAL’s non-U.S. plant-touching competitor, the Global X Cannabis ETF (Nasdaq: POTX), closed in February (see below). A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

A sign of the times

We were saddened by the news in February that the Global X Cannabis ETF (Nasdaq: POTX) closed down in February due to lackluster interest. POTX’s index, which was HERBAL’s closest competitor in the “legal” cannabis equity space, will now be permanently shelved. The inconvenient truth about the ETF industry is that given the high operating expenses a low AUM ($30M) is not sustainable for very long. And when your index (like all the others in the space) drops by 90% over a three-year period, only a few strong ETFs will survive.

The largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (+31.2%) and the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (+42.8%), performed well in March following a frustrating February where both were negative. Unlike HERBAL, which is designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching MJ exposure tend to be more sensitive to the U.S. regulatory rollercoaster, which is covered in this newsletter each month. And this time around, the HERBAL index outperformed due to its weight in Canopy Growth, which we will cover below.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, more specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally, In 2022 MJ added and maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The U.S. plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It is also important to note that both MJ and MJUS are now operating under a new issuer, Amplify ETFs.

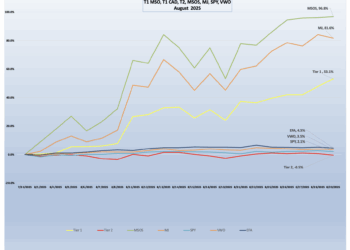

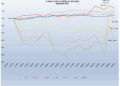

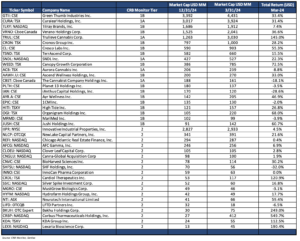

The CRB Monitor equally-weighted basket of the largest pure play Tier 1 CRBs had a spectacular first quarter, returning +48.0% in Q1 2024. This basket is essentially a hybrid of CRBs without U.S. touch-points and U.S. multistate operators (MSOs). Their equal weighting will cause their returns to deviate from the other indexes, which all employ some variation of market cap weighting. We take a look at the comparative performance of CADs vs. MSOs on a chart below.

The CRB Monitor equally-weighted basket of the largest Tier 2 CRBs was the big winner, outperforming even the Tier 1 basket as it posted a stellar +57.2% return in Q1 2024. As we have indicated in the past, pure play Tier 1 and Tier 2 CRBs tend to display high (~0.8) correlation in the long term (see our CRB Monitor February 2024 newsletter), but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. In general, Tier 2 CRBs share in the overall success or failure of the Tier 1 universe and ultimately are expected to converge with the Tier 1 equity basket.

January provided further evidence that the cannabis industry not only has a pulse but might actually pull itself together and survive the years-long regulatory nightmare that it has been in. And now, more than ever, there is evidence to suggest that marijuana could possibly shed the decades-long stigma that it is a Schedule I narcotic and that future generations of consumers will think of cannabis-derived products no differently than they think of alcohol or tobacco, or even Tylenol.

With that said, the idea of fully-legalized marijuana in the United States is still difficult to imagine, and we have written many times about the reasons for this. Most importantly, the U.S. government is broken. And those who watch the news occasionally can see that even the most reasonable actions of the legislative branch are seemingly impossible to complete, lest one side be viewed as “granting a victory” to the other side. Furthermore, the so-called dangers of cannabis have been almost universally debunked just as the benefits have been widely confirmed. And sadly, we are all left waiting as the needs of consumers, businesses and investors take a backseat to the political aspirations of a handful of elected individuals who are loathe to collaborate, even with members of their own party.

February reminded us once again that “we can’t have nice things,” at least not for very long. And as the equity markets rallied over positive economic data, the cannabis industry appeared to ignore it and moved in the opposite direction. After a quick flurry in the first week of the month, cannabis equities seemingly collapsed and failed to recover by Feb. 29. With that said, YTD cannabis is still doing well (MSOS +27% YTD, Tier 1 PP +13% YTD, and Tier 2 +46% YTD), and we can chalk February’s Tier 1 swoon up to election year foot-dragging. Nevertheless, we will take a look at the unbridled success of Tier 2 CRBs and, as always, look at all things cannabis as we try to make sense out of this, the shortest month of the year.

Cannabis investors continue to hang onto the promise of DEA rescheduling, or perhaps even descheduling, which could happen not only in our lifetime but maybe even this year. Meanwhile, legal cannabis continues to expand its footprint across the U.S. as well as globally, and both marijuana usage and the idea of legalization both are growing in popularity.

With March’s frothy returns, we asked the question, “Is this the turnaround we have been waiting for?” To which we responded that this was a silly question to ask, given that cannabis equities would have to stage a quadruple-digit comeback to fully recover from their highs of three years ago. But to be fair, this actually could be the year (of sorts) for cannabis, as almost all legislative activities seemingly remain on hold while representatives take vacations, threaten to vacate speakers, withhold foreign aid and chase dead-end impeachment procedures.

Truth be told, cannabis reform might be the one piece of legislation that has a chance of getting done because it is overwhelmingly popular with Americans, and therefore those veritable titans in congress should consider it to be one of the safest votes they will take. Without an obvious downside, politicians should love bills like SAFER, given its deference to the financial services industry and its obvious benefits for people who live in the now 38 states or territories that currently have some form of legalized marijuana.

And with DEA rescheduling on the horizon, the cannabis train keeps-a-rolling. Whether it’s before or after Election Day, reforms are bound to happen… eventually. The bottom line is that federal marijuana legalization is popular today and will most likely gain in popularity in the next few years. Cannabis legalization and decriminalization at the federal level would be beneficial to consumers, businesses, and the federal government while deterring the black market from advancing its cause. So we ask the question, “What will be the ultimate deus ex machina that solves this problem?” We would suggest that the most effective path to the ultimate signing of these bills into law is through the election process.

Which brings us to the State of Florida, where the Supreme Court kept us all in suspense before ruling that adult-use marijuana legalization can be on the November ballot. The lead-up to this decision, which was announced April 1, provided a lift for the CRBs that hold Florida cannabis licenses as they stand a chance to benefit directly from legalized, recreational weed.

U.S. equities had a robust first quarter, with the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) returning a record-setting 12% return. Consistently favorable economic data suggest that inflation is under control while the threat of a recession is in the rear view mirror. And historically low unemployment data combined with some administration-supported election-year optimism should make for a few more record-setting days in the coming months.

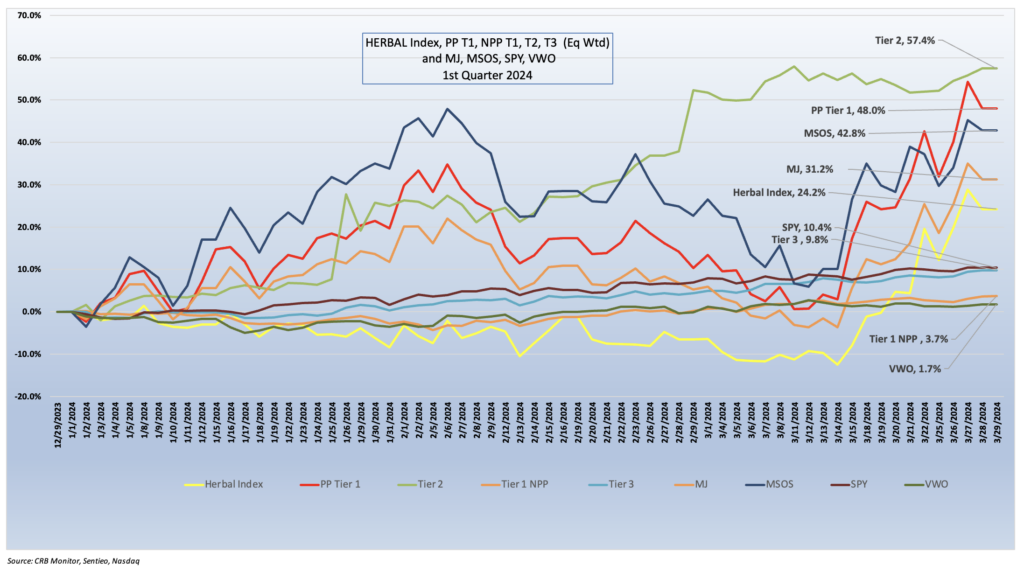

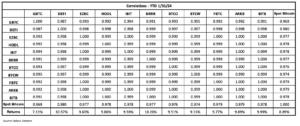

Largest Tier 1 Pure Play CRBs & Tier 2 CRBs – 1st Quarter 2024 Returns

CRB Monitor Tier 1

The table above is all one needs to restore their faith in the resilience of cannabis equities, as the vast majority of the Tier 1 universe delivered returns that rewarded investors who have stayed on the train – at least for now. Over the last few years, we have witnessed a near-shutdown of cannabis-related M&A activity, and both share prices and trade volumes would place cannabis stocks in microcap territory. We choose to refrain from showing a multi-year performance chart, as it might bring painful flashbacks for long-term investors, but suffice it to say that these companies still have a long way to go to get back to their heyday, and this can only happen through regulatory reforms in the U.S.

With that said, we witnessed a very pleasant reversal of fortune, largely with the MSO group, that hit in the month of March. Given that a rising tide tends to lift all boats, the Canadian CRBs surged as well.

Looking at the MSO basket vs. the CAD basket, what cannabis equities in both groups delivered in the first quarter was a sharp reversal from the prior period. The MSO group soared in January and remained on top through the end of the quarter, with positive returns from Green Thumb Industries Inc. (CSE: GTII) (+33.4%), Cresco Labs Inc. (CSE: CL) (+55.3%), Curaleaf Holdings, Inc. (CSE: CURA) (+31.4%), and Trulieve Cannabis Corp. (CSE: TRUL) (+145.0%). The equally weighted MSO basket returned 31.3% for Q1 2024.

The Canadian (non U.S. plant-touching) operators underperformed the MSOs but still had a productive quarter, with Tier 1 Canadian CRBs Tilray Brands, Inc. (Nasdaq: TLRY) (+7.4%), Canopy Growth Corporation (TSX: WEED) (+72.5%), Sundial Growers, now called SNDL, Inc., (Nasdaq: SNDL) (+22.3%) and Cronos Group Inc. (TSX: CRON) (+28.2%) performing well on the heels of cannabis reforms in Germany and optimism in the U.S.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies returned an impressive +57.4% for the first quarter of 2024, which outperformed the equally-weighted Tier 1 basket by 9.4%. pure play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (see our February 2024 “Chart of the Month”), but their respective performance has a tendency to diverge in the short term, as it did in Q1, given the occasional lag from the impact (positive or negative) of market forces.

Corbus Breaks Out

The performance of the equally weighted basket, in spite of the fact that we expanded the number of constituents to 21, was significantly attributable to the return of Corbus Pharmaceutical Holdings (Nasdaq: CRBP) (CRBM Sector: Pharma & Biotech (+549.7%). The big news regarding Corbus came in the form of a Jan 26 press release in which Corbus announced that data from the first-in-human clinical study of CRB-701 (SYS6002) “Demonstrates Encouraging Safety and Efficacy in Patients with Nectin-4 Positive Tumors.” Sadly for the cannabis industry, this new drug and its success are not cannabis-related. Nevertheless, Corbus is still a Tier 2 CRB and the rest of the basket benefits from its good fortune.

IIPR Dominates Cannabis Real Estate

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) (+4.5%) closely. IIPR is an internally managed real estate investment trust (CLS sector – REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” At the end of February, IIPR issued its fourth quarter and 2024 financials, which we find interesting as these tend to be an indicator of the success or failure of the Tier 1 CRB market in the immediate and medium term. Here are a few of the highlights:

“For the full year 2023:

- Generated total revenues of approximately $309.5 million, representing an increase of 12% over 2022.

- Recorded net income attributable to common stockholders of approximately $164.2 million, or $5.77 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Recorded adjusted funds from operations (AFFO) and normalized funds from operations (Normalized FFO) of approximately $256.5 million and $234.1 million, increases of 10% and 9% over 2022, respectively.

- Declared dividends to common stockholders totaling $7.22 per share, increasing IIP’s common stock dividends declared each year since its inception in 2016.

- Committed up to approximately $119.5 million (excluding transaction costs) for the payment of purchase prices and funding of qualifying building infrastructure improvements for two property acquisitions, lease amendments for three properties, two new leases in the existing portfolio and an additional commitment under a construction loan where IIP is lender.

- Sold a portfolio of properties in March located in California for $16.2 million (excluding transaction costs), which included secured seller financing with the buyer of the property for $16.1 million (interest only, payable monthly).

- Published IIP’s third annual Sustainability Report, highlighting IIP’s commitment to sound environmental management, collaborative community engagement and corporate governance principles that align to the core values of the IIP team, and available on its corporate website at www.innovativeindustrialproperties.com.

- At year-end, IIP’s footprint comprised 108 properties totaling 8.9 million rentable square feet in 19 states.”

As we reported last month, IIPR announced its quarterly dividend of $1.82/share in mid-December, which represented a $0.02/share increase over Q3 2023. IIPR describes itself as “the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry.”

Chart of the Quarter: SEC Approves Eleven New Spot Bitcoin ETFs

The U.S. Securities and Exchange Commission (SEC) has recently approved 11 spot bitcoin-based exchange traded funds marking a historic milestone for the crypto industry, the ETF market and investors. Now actively trading for the last few weeks, these vehicles allow U.S. investors to gain daily exposure to the world’s largest and most liquid cryptocurrency without directly holding it, and as a result they simplify and reduce some of the risk related to the process of investing in bitcoin (BTC). SEC approval of these ETFs has been on the radar of CRB Monitor research for several months, and this latest development has resurrected interest in digital assets by the institutional and retail investment communities.

The following table has some of the key pieces of information regarding these new ETFs:

| US-Listed Bitcoin ETFs – As of 1/31/2024 | ||||||

| Primary Exchange | Ticker | ETF Name | Fund Type | AUM (USD MM) | Expense Ratio** | Digital Asset Custodian |

| NYSE Arca | GBTC | Grayscale Bitcoin Trust ETF | Spot | $20,708.07 | 1.50% | Coinbase Custody Trust Company, LLC |

| NYSE Arca | DEFI | Hashdex Bitcoin Futures ETF | Spot* | $17.18 | 0.92% | BitGo Trust Company, Inc |

| Cboe BZX | EZBC | Franklin Bitcoin ETF | Spot | $60.89 | 0.19% | Coinbase Custody Trust Company, LLC |

| Cboe BZX | HODL | VanEck Bitcoin Trust | Spot | $126.09 | 0.25% | Gemini Trust Company, LLC |

| NASDAQ | IBIT | iShares Bitcoin Trust | Spot | $2,720.49 | 0.25% | Coinbase Custody Trust Company, LLC |

| NASDAQ | BRRR | Valkyrie Bitcoin Fund | Spot | $112.92 | 0.25% | Coinbase Custody Trust Company, LLC |

| Cboe BZX | BTCO | Invesco Galaxy Bitcoin ETF | Spot | $300.00 | 0.25% | Coinbase Custody Trust Company, LLC |

| Cboe BZX | BTCW | WisdomTree Bitcoin Fund | Spot | $11.15 | 0.30% | Coinbase Custody Trust Company, LLC |

| Cboe BZX | FBTC | Fidelity Wise Origin Bitcoin Fund | Spot | $1,340.00 | 0.25% | Fidelity Digital Asset Services, LLC |

| Cboe BZX | ARKB | Ark 21Shares Bitcoin ETF | Spot | $10.32 | 0.21% | Coinbase Custody Trust Company, LLC |

| NYSE Arca | BITB | Bitwise Bitcoin ETF | Spot | $640.84 | 0.20% | Coinbase Custody Trust Company, LLC |

| * The Hashdex Bitcoin Futures ETF is in the process of being converted to a Bitcoin Spot ETF and renamed “Hashdex Bitcoin ETF”

** Expense Ratio after waiver period has ended |

||||||

Some Key Information About Spot Bitcoin ETFs

An ETF is, in essence, a mutual fund that is listed and traded on an exchange, giving investors and traders the benefit of real-time pricing and intraday execution.

Spot Bitcoin ETFs such as the 11 that have recently started trading invest directly in Bitcoin (BTC), which is a departure from competing funds that achieve their exposure through futures or return swaps. In other words, this group of ETFs buys and sells actual Bitcoins which reside in a digital vault that is managed by a registered custodian. Shares in Bitcoin ETFs are created and redeemed via cash-settled (as opposed to in-kind) creations and redemptions, which removes some of the operational complexities and risks for authorized participants and market makers – but not the volatility and certainly not the regulatory concerns.

Spot Bitcoin ETFs offer several advantages over investing in the physical Bitcoins, whether it requires trading directly on a crypto exchange or through a peer-to-peer platform. These advantages include:

- Convenience: Investors can trade spot Bitcoin ETFs through brokerage accounts without having to deal with the technical and operational aspects of owning and storing Bitcoins, setting up a digital wallet, transferring funds or securing private keys.

- Security: Investors do not have to worry about the risk of losing their Bitcoins due to hacking, theft or human error, as the ETFs rely on professional and regulated custodians to safeguard the digital assets. The custodians also provide insurance coverage and regular audits to ensure the safety and transparency of the ETFs.

- Pricing: Bitcoin ETFs trade and price throughout the day on regulated exchanges while the underlying coins transact 24/7 with no central pricing source, making valuations a challenge.

How do these ETFs differ from one another?

What is interesting about the these 11 ETFs is the broad range across the space with regard to both size and expense ratio. The range of assets under management (AUM) stretches from the barely viable Ark 21Shares Bitcoin ETF (Cboe BZX: ARKB) at $10 million to the clear leader (for now), the Grayscale Bitcoin Trust ETF (NYSE Arca: GBTC) at $21 billion. To be fair, GBTC had a head start, as this fund has been trading for more than a decade as a Bitcoin futures-based ETF and transitioned to a 100% spot ETF. Not surprisingly GBTC’s bloated AUM is shrinking, as investors have already begun their exodus out of them and into lower expense-ratio ETFs. But investors should proceed with caution as they sell out of GBTC in search of lower fee ETFs, as the tax consequences of this switch could eat up a significant portion of the savings.

Aside from the differences in expense ratio and AUM these 11 funds are very similar (perhaps identical in their construction), which is evidenced in the performance and the correlations displayed below.

What are the chart and the table showing us? First, that investors should not worry about the relative performance of these ETFs and their tracking error vs. spot Bitcoin. Rather, we advise to select on the combination of high AUM and low expense ratio. On the performance chart above, the only real outliers are GBTC, which has had an early sell-off of over $1 billion largely due to its outlier expense ratio (1.50%), and DEFI, which is still futures-based until it completes its transition to spot. Much of the positive tracking could be coming from the spreads of spot BTC vs. futures, but more investigation will be needed to confirm this. However, aside from these two pricey outliers, the field looks very much like a dead heat in terms of its inception-to-date performance and correlation. And this is good news for investors, as apparently all they need to worry about related to selection are expense ratios and AUM. For all intents and purposes, these ETFs are essentially the same and should produce similar results.

Now for a few things to worry about, once you have decided to invest in spot Bitcoin ETFs.

Challenges Presented by Spot Bitcoin ETFs

Spot Bitcoin ETFs represent a significant opportunity for the crypto industry and for investors, as they provide a convenient and cost-efficient way to access the world’s largest cryptocurrency. They also have the potential to attract new institutional and retail investors to the crypto space, increasing the liquidity, adoption, and credibility of Bitcoin.

However, spot Bitcoin ETFs also face a number of challenges and risks to investors, given that the ETFs will not provide cover from the embedded risks that are inherent in the digital asset industry. For example, the prospectus for the iShares Bitcoin Trust (IBIT) describes a critical aspect of the create/redeem process as follows:

“The Trust will create Shares by receiving Bitcoin from a third party that is not the Authorized Participant and the Trust—not the Authorized Participant—is responsible for selecting the third party to deliver the Bitcoin. Further, the third party will not be acting as an agent of the Authorized Participant with respect to the delivery of the Bitcoin to the Trust or acting at the direction of the Authorized Participant with respect to the delivery of the Bitcoin to the Trust. The Trust will redeem Shares by delivering Bitcoin to a third party that is not the Authorized Participant and the Trust—not the Authorized Participant—is responsible for selecting the third party to receive the Bitcoin. Further, the third party will not be acting as an agent of the Authorized Participant with respect to the receipt of the Bitcoin from the Trust or acting at the direction of the Authorized Participant with respect to the receipt of the Bitcoin from the Trust. The third party will be unaffiliated with the Trust and the Sponsor…The Prime Execution Agent facilitates the purchase and sale or settlement of the Trust’s Bitcoin transactions. Bitcoin Trading Counterparties settle trades with the Trust using their own accounts at the Prime Execution Agent when trading with the Trust.”

What all this suggests (and why investors should take note) is the success of a critical link in the operational chain cannot be guaranteed because of the fractured nature of how digital assets transact. And while we will not go into the mechanics of typical, standard ETFs, suffice it to say that trade and settlement are not left to unaffiliated third parties.

And as such, we conclude that investors in these 11 new ETFs are subject to the same risks as investors in the underlying digital assets themselves:

- Regulatory uncertainty: The SEC has approved the spot Bitcoin ETFs under the condition that they comply with the Securities Act of 1933, the Securities and Exchange Act of 1934, and the Commission’s rules regarding cryptocurrency. However, the SEC has also expressed its skepticism and caution about the crypto industry, and has warned investors about the risks involved in investing in Bitcoin and crypto-related products. The SEC may also impose additional requirements or restrictions on the spot Bitcoin ETFs in the future or even revoke their approval, depending on the market conditions and the regulatory environment.

- Market volatility: Bitcoin is known for its high volatility, as its price can fluctuate significantly in a short period of time due to various factors such as supply and demand, news and events, speculation, and manipulation. Investing in spot Bitcoin ETFs exposes investors to the same volatility risk as investing in Bitcoin directly, and may result in substantial losses or gains. Investors should be prepared for the possibility of extreme price movements and have a long-term perspective when investing in spot Bitcoin ETFs.

- Operational risk: Spot Bitcoin ETFs rely on third-party custodians to store and safeguard the Bitcoins backing the ETFs. While these custodians are professional and regulated entities that provide insurance coverage and regular audits, investors should understand the underlying risks involved related to trade, pricing and settlement of the coins held by each ETF.

Finally, from the GBTC Factsheet risk disclosures: “Digital assets represent a new and rapidly evolving industry. The value of GBTC depends on the acceptance of the digital assets, the capabilities and development of blockchain technologies and the fundamental investment characteristics of th digital asset. Digital asset networks are developed by a diverse set of contributors and the perception that certain high-profile contributors will no longer contribute to the network could have an adverse effect on the market price of the related digital asset.”

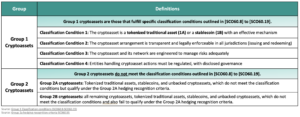

BIS Digital Asset Classification

New challenges persist beyond the wide range of quality among digital asset regulators. Despite notable strides, risks endure, particularly in the global circulation and trading of digital assets. The heightened exposure of Bitcoin ETFs to underlying risks emphasizes the need for a comprehensive understanding of evolving standards.

As major financial institutions prepare for new Basel Committee on Banking Supervision standards by January 1, 2025, the landscape becomes more intricate, categorizing cryptoassets into four risk classes (Group 1a & 1b and Group 2a & 2b), with the Group 2’s presenting higher levels of operating risk.

Bitcoin’s placement in Group 2, specifically subgroup 2a, confirms the necessity for institutions to adapt risk management strategies that are in line with the elevated risk that is assigned by this new classification, which goes into effect in January 2025. This new set of standards would then place all spot Bitcoin ETFs in group 2a, given that Bitcoin is essentially all that they hold.

Why is this important? Because regulators will require financial institutions to report their exposure to Group 1 and Group 2 cryptoassets as their exposure to them will be limited. In the words of the Basel report, “A bank’s total exposure to Group 2 Cryptoassets must not exceed 2% will apply the more conservative Group 2b capital treatment to the amount by which the limit is exceeded. Breaching the 2% limit will result in the whole of Group 2 exposures being subject to the Group 2b capital treatment of the bank’s Tier 1 capital and should generally be lower than 1%. Banks breaching the 1% limit.”

Global Regulatory Risk

While it is appropriate to describe the digital asset industry as heavily regulated, it is also accurate to describe digital asset regulation as complicated. Truth be told, there are now hundreds of regulatory agencies worldwide that are doing their best to keep up with several different categories of market participants, with varying degrees of success. But the reality is that, given its attraction for bad actors, regulating the crypto industry is a challenge and financial institutions that facilitate trading and custody of digital asset ETPs should be aware of this added layer of risk.

As such, CRB Monitor has developed a model which applies “quality” scores to many of the world’s largest licensing authorities. A summary of this model can be found in our August 2023 article Applying Risk Ratings to Digital Asset Regulators. In a nutshell, financial institutions are wedged between a rock and a hard place, craving a transparent, regulatory framework while trying to accommodate the needs of their clients and shareholders to hold crypto assets. And while these institutions expand their participation in the still-nascent digital asset industry through custody, trading, and even new digital asset issuance, the desire for greater transparency and a global regulatory framework persists. This table, which contrasts the degree and effectiveness of regulators in digital asset space, highlights the differences in risk across most of the largest regulatory authorities, and brings to light one of the hidden challenges associated with investing in a spot Bitcoin ETF.

Relative Quality Scores – Global Regulatory Authorities

As crypto investors begin to wade into this vast sea of operational risk and volatility, there are a number of considerations that will be essential components of compliance and risk management beyond those required for typical ETF investing. Rather, it can be assumed that an investment in a spot Bitcoin ETF is akin, from a risk perspective, to an investment in Bitcoin itself. And it should not be overlooked that Bitcoin is actively traded on global exchanges of varying qualities and degrees of regulation, and as such lends itself to illicit activity.

CRB Monitor Securities Database

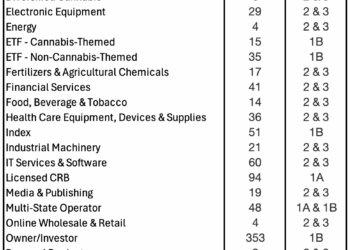

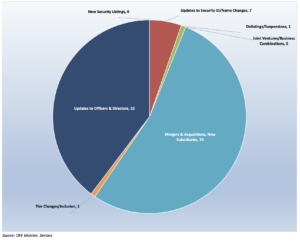

As of March 31, 2024, the breakdown of publicly traded, cannabis-linked securities was as follows:

The salad days of cannabis-linked companies merging and acquiring is essentially a thing of the past. However, the CRB Monitor research team continues to operate in a busy daily environment as we build out and maintain, in real time, an accurate record of each CRB’s corporate structure. On that note, we are still making hundreds of updates to CRB profiles every quarter and the first quarter was no exception. In addition to business expansion, we are tracking daily changes to company identifiers, new security listings, risk tier changes, possible removals, and updates to company officers and directors.

CRB Monitor News-Related Securities Database Updates – Q1 2024

Cannabis Business Transaction News

Of the thousands of announcements and filings reviewed during the full year, our daily research resulted in a total of 354 updates to CRB Monitor company profiles (131 updates to issuers’ records and 223 news articles added). The complete list of securities and detailed profiles for nearly 1,300 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our latest monthly newsletters: CRB Monitor January 2024 newsletter, CRB Monitor February 2024 newsletter, and the CRB Monitor March 2024 newsletter.

The following is a sampling of some of the highlights from the Q1 2024 cannabis news cycle:

January: Always looking to expand their operational footprint in the U.S., Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) issued a January press release announcing the opening of MÜV Yulee, the company’s 74th Florida dispensary and 137th location nationwide. In the words of the press release, “Situated in Nassau County, which counts more than 90,000 residents1, MÜV Yulee enhances the Company’s footprint in the Jacksonville metropolitan area, accompanying MÜV dispensaries in Jacksonville and Jacksonville Beach…MÜV dispensaries feature online menus for effortless browsing of their extensive, award-winning product selection, including the Company’s signature Verano Reserve, MÜV and Sweet Supply flower, Encore edibles, On the Rocks concentrates and extracts, and Savvy flower and extracts, spanning an array of categories. The Company also offers one-on-one virtual and in-store consultations at no cost to patients and provides patient-centric concierge services via phone, email, web chat and text to address patient questions and inquiries.”

With this latest opening, Verano (through its subsidiaries) holds 83 active cannabis licenses and operates in 13 states plus the District of Columbia.

Also in January, Tier 1B MSO Ascend Wellness Holdings, Inc. (CSE: AAWH.U) announced in a press release the opening of an Ascend Dispensary Outlet, located at 1206 Recker Rd, Piqua, Ohio. According to the announcement, this dispensary will be “Ascend’s fourth in the state of Ohio and 34th across its seven-state footprint…The dispensary will offer medical products and accept both cash and debit cards through provided cashless ATM terminals. Via Ascend’s support relationship with OPA, this is Ascend’s second outlet store in the state, offering everyday low pricing and discounts. Ascend is proud to offer a wide range of products at everyday low prices, including a variety of cannabis strains, edibles, tinctures, topicals, and other cannabis-infused products.” With this new opening Ascend’s footprint has expanded to 74 licences that are either active or pending approval and operating in seven states in the U.S.

February: Wakefield, Mass.-based, Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) announced its acquisition of Tier 1A private business Can4Med, “a prominent pharmaceutical wholesaler specializing in cannabinoid medications in Poland.”

According to the press release, “This strategic move marks a significant milestone for both companies and underscores Curaleaf’s commitment to enhancing patient access to high-quality medical cannabis products across Europe. Poland boasts one of Europe’s largest patient populations seeking medical cannabis; by joining forces with Can4Med, Curaleaf International gains a strong foothold in this dynamic market, allowing it to serve patients more effectively and expand its product offerings. … As Poland positions itself at the forefront of the European cannabis market, its substantial population of 38 million is poised to catalyze significant growth and innovation in the sector. The Polish Pharmaceutical Chamber estimates that the potential number of medical cannabis users could reach 300,000, while the number of legal cannabis users (both medical and CBD) is expected to reach 1.3 million by 2026.”

Currently Curaleaf holds, directly or through its subsidiary businesses, 130 cannabis licenses and the Can4Med acquisition expands Curaleaf’s global footprint to 5 countries where it holds licenses to operate in the industry.

Also in February, Tier 1B MSO Ascend Wellness Holdings, Inc. (CSE: AAWH.U) announced in a press release the execution of “a definitive agreement to acquire its second cultivation license and associated operations in Massachusetts.” The announcement goes on to say, “The targeted acquisition, situated in Amesbury, is currently pending regulatory approval, which is expected to be granted in the first half of 2024. In the intervening period, AWH will operate the facility under an interim consulting agreement. The Amesbury facility boasts a spacious 54,000 sq. ft. area, with plans for a targeted investment to encompass 15,000 sq. ft. of canopy and a state-of-the-art kitchen. When combined with AWH’s existing cultivation and production facility in Athol, Massachusetts, this move will elevate the Company’s total cultivation space in the state to an impressive 70,000 sq. ft. of canopy. … The expansion is a response to the increasing demand for AWH’s products in Massachusetts, underscored by the resounding success of the Simply Herb brand, which AWH introduced in the state less than two years ago. Simply Herb has swiftly ascended to the top spot, capturing a meaningful sales lead over the second highest-ranked brand in the entire state.”

Ascend’s operational footprint is currently 74 licences that are either active or pending approval that have been issued by seven states in the US.

March: Green Thumb Industries Inc. (CSE: GTII), Tier 1B MSO and the largest CRB by market capitalization, issued a March press release announcing “the opening of its 15th retail location in Florida and 92nd nationwide, RISE Dispensary Dunnellon. … The new store will offer medical cannabis patients a range of high-quality THC and CBD products, including RYTHM premium flower and full spectrum vapes, Dogwalkers pre-rolls, Good Green flower, and &Shine flower, pre-rolls, vapes and chews. … The menu will feature a special Brownie Scout donut, named after the popular RYTHM flower strain.”

Green Thumb’s expansion in Florida comes on the heels of the Sunshine State’s progress toward adult-use legalization, which will be a referendum question on the November ballot. With this acquisition, Green Thumb’s active/pending license count sits at 101 (the new Florida business operates under the existing license).

Finally, in March, Tier 1B MSO Ayr Wellness Inc. (CSE: AYR.A) announced in a March press release the opening of its relocated AYR Cannabis Dispensary Tallahassee, Fla.. In the words of the press release, “…AYR Cannabis Dispensary Tallahassee occupies a spacious, 1,650-square foot location, conveniently located in the heart of the state capital for pedestrians and has both street parking and covered garage parking available for those traveling by car. New and returning patients can enjoy a wide variety of premium cannabis products from leading brands, including Kynd, Haze, KIVA, Entourage, Nordic Wellness and Levia.”

Similar to the actions of Green Thumb, Ayr is undoubtedly looking ahead to the November elections, after which a victory could mean a windfall of revenues in the future. At present, Ayr Wellness holds, through its subsidiaries, 78 licenses that are in active status or are pending approval across seven states in the U.S.

Cannabis Regulatory Updates

Not enough flower? First, in January it was reported by our very own CRB Monitor journalists that “roughly one year into the launch of Connecticut’s adult-use cannabis market, the Nutmeg State is pushing back against alternative market suppliers amid a slow adult-use cultivation rollout and recent reports of dispensaries completely selling out of flower.”

As a result of an increased purchase limit (in November 2023) for adult-use cannabis to half an ounce, up from the previous limit of one quarter or 7 grams, the supply at Connecticut dispensaries has suffered. According to the CRB Monitor report, “By the end of the month, there were social media reports of shops completely running out of flower. CRB Monitor confirmed over the phone that several dispensaries were sold out.”

And to add insult to injury, this shortage has led to instances of unlicensed cannabis “gatherings”, at which attendees purchase cannabis paraphernalia and for a $20 admission fee they are offered “free gifts of cannabis.” According to the report, “Connecticut Attorney General William Tong sent a cease and desist letter, on Jan. 4, 2024 to the organizer of the High Bazaar”, a weekly gathering that features this type of activity.

The article goes on to discuss recent enforcement actions by Connecticut officials, which started last October when “the state also began cracking down on retail shops that were selling hemp-derived THC products, leaving many shop owners on the verge of closure. The new rules required all hemp-derived products be regarded as cannabis, which means they would be subject to seed-to-sale tracking and could only be legally sold in a licensed dispensary.”

The Department of Consumer Protection, which oversees the state’s legal cannabis market, confirmed in December that the agency was aware of shortages, according to spokesperson Kaitlyn Krasselt. She argued that “the lack of product was a result of increased demand during the Thanksgiving and December holiday seasons.”

Optimism out of Germany: A January 22 article in MJ Biz Daily reported that Germany’s health minister Karl Lauterbach believes that “marijuana legalization will become a reality in the country this spring.” According to this report, Lauterbach has set a target for the Bundestag, the national parliament, “to approve the nation’s long-awaited cannabis law in February. “I am continuing to assume that the Cannabis Act will be passed by the Bundestag in the week between Feb. 19 and 23 and will go into force from April 1,” Lauterbach told the newspaper Die Welt, broadcaster Deutsche Welle reported.” With all that said, the ruling coalition in the Bundestag has not passed this into law.

The article notes that the latest plan calls for:

- Decriminalization of cannabis.

- Home cultivation and possession starting April 1, 2024.

- “Cultivation clubs” that would launch potentially in July.

We will stay tuned as German legalization could lead to further legalizations globally.

From our February newsletter: This story belongs somewhere in between the business operations section and the regulatory section, as we were treated to a uniquely Florida brand of news story. It was reported in MJ Biz Daily that Tier 1B MSO Trulieve Cannabis Corp. (CSE: TRUL) revealed “it has received $113 million worth of tax refunds as it challenges what it owes under Section 280E of the Internal Revenue Code. Florida-based Trulieve made waves in the U.S. marijuana industry when it announced the plan to seek $143 million worth of federal tax refunds in October 2023.”

This is a massive win for Trulieve, which has a market cap of $2.3 billion. And we find it curious, given that Section 280E is still in effect until the DEA rescheduling (or de-scheduling) is fully resolved. Here are a few more details from the news article:

“Trulieve also is seeking $31 million in state tax refunds.

In a fourth-quarter earnings report released Thursday, Trulieve said it has:

- Received $62 million worth of tax refunds during the quarter ended Dec. 31.

- Received “a total of $113 million in refunds to date,” including $50.3 million received in January 2024.

- Received “one rejection notice in the amount of $1.2 million.””

“Trulieve did not specify whether the successful or rejected refunds came from the federal government or state governments.”

What makes this story fascinating is the possible impact it will have on the universe of U.S. plant-touching CRBs, which could follow suit. So grab your popcorn, as this will only get more interesting for investors.

Now from Nevada: There is always plenty to report at the individual state level, and let’s begin with Nevada, where the news broke in February that the first license for a cannabis consumption lounge in Nevada has been issued to a business in Las Vegas. MJ Biz Daily reported that, according to TV station KTNV, Smoke and Mirrors was awarded its consumption lounge license “after passing a CCB inspection”. According to the article, “The establishment received a conditional license June 20. The CCB said 19 lounges have been approved for a conditional license, including 14 retail-adjacent locations and five independent lounges, the TV station reported. Administrative setbacks, tight funding and changing regulations governing smoke ventilation delayed the launch of dozens of lounges in Nevada for months last year.”

Next, a February article in Marijuana Moment reported that New York regulators “have approved draft rules to allow for the home cultivation of recreational marijuana, and have signed off on more than 100 new cannabis business licenses that they hope will help the legal market overcome its “rocky start” this year. … Regulators approved over 100 licenses for retailers, microbusinesses, cultivators, processors and distributors. Two cannabis research licenses were also granted under a separate resolution.”

The regulations would allow adults to grow up to six plants for personal use, only three of which could be mature at one time. Furthermore, “A residence with multiple adults could have a maximum of 12 plants, and people could possess up to five pounds of marijuana derived from the plants. The rules also contain requirements on storing the plants and remediating any odors “if they become a nuisance to neighbors.”

Next, from the “no surprises” file, in March it was reported that Glenn Youngkin, Virginia’s Republican governor, vetoed a bill “that would have finally legalized adult-use marijuana sales in the state.”

It looks like Governor Youngkin takes a view that differs from the majority of Americans. In the words of this MJ Biz Daily report, “Virginia legalized adult-use cannabis in 2021 with a bill signed into law by then-Gov. Ralph Northam, a Democrat. However, that law required state legislators to reenact portions setting up regulated sales. In the years since, a partisan logjam led by Youngkin has kept adult-use legalization bottled up, encouraging the emergence of an illicit market that some estimate is worth $3 billion. Medical marijuana sales are legal in the state, albeit under relatively tight restrictions that limit business opportunities to one operator per region. Those licenses are held by marijuana multistate operators. This year, the Democratic-controlled state Legislature passed a bill legalizing recreational sales by 2025, albeit without a veto-proof majority.”

And Youngkin spoiled everyone’s fun with his veto. Here’s a quote from the governor, which provides some insight into his thought process: “The proposed legalization of retail marijuana in the Commonwealth endangers Virginians’ health and safety,” adding that other states that have legalized recreational cannabis sales are following a “failed path.”

Finally, from the “hope springs eternal” file we turn to Germany, where it was reported in March that the German government “officially signed into law a bill to legalize marijuana nationwide with the reform set to take effect next week.” According to the Marijuana Moment article, “Bundesrat President Manuela Schwesig signed the legislation on Wednesday, the last step to enactment. Usually German Federal President Frank-Walter Steinmeier would sign legislation, but because he’s currently away on vacation, that responsibility was handed down to the head of the legislative chamber representing individual states.”

The significance of Germany legalizing marijuana cannot be understated particularly while the United States continues to drag its heels with legislative reforms. And as Germany begins its implementation, it is likely that CRBs from the west will step up their game there. In a related story (detailed above), Canadian CRB Canopy Growth Corporation (TSX: WEED) is well-positioned for success in a post-legalization Germany. In the words of Canopy Growth’s March 22 press release: “In addition to the cultural significance of Germany’s cannabis legalization progress, these changes present a unique opportunity for Canopy Growth to expand its commercial presence in the country through the German-based and world renowned Storz & Bickel vaporizer brand, as well as the Company’s medical cannabis product offerings through Canopy Medical which collectively position Canopy Growth as a top three player in the German cannabis industry.”

About CRB Monitor Securities Research

The CRB Monitor Securities Research team covers all aspects of the publicly traded cannabis ecosystem, including the regulatory environment, operational expansion/M&A activity, updates on officers/directors, and investment performance. With our monthly and quarterly newsletters, we keep our readership informed while we highlight the multi-faceted importance of CRB Monitor’s data to all types of users at financial institutions worldwide.

CRB Monitor also provides extensive coverage of all securities that have any connection to the digital asset ecosystem, including the more than 300 exchange traded products (ETPs) that provide investors with digital asset exposure.

For additional detail on our updates to the CRB Monitor database, please refer to our monthly cannabis-related securities newsletters: the CRB Monitor January 2024, CRB Monitor February 2024 and CRB Monitor March 2024.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update, Defining “Cannabis-Related Business”

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know