The difference between how the federal government views medical and adult-use cannabis could be at the center of Trulieve’s (TCNFF) tax strategy, but the Florida-based MSO is keeping its mouth shut about it.

Trulieve announced during its fourth quarter call on Feb. 29, that it had received $113 million in tax refunds after filing amended claims for the years 2019-2021. During that same call, the company also reported $527 million in net losses for all of 2023, with $33 million in net losses coming during the fourth quarter.

Trulieve claimed $143 million in refunds from the federal government and another $31 million from state governments. So far, they received $62 million in the fourth quarter and an additional $50 million in the first quarter of 2024. The company received a rejection of $1.2 million of their claims, leaving about $60 million in remaining refund claims from their amended 2019-2021 filings.

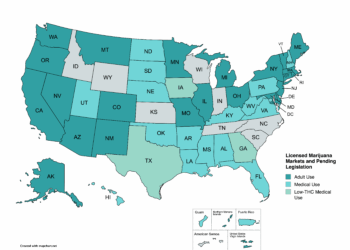

The company said in the call that the refund was based on its argument that 280E, which prevents cannabis operators from writing off business expenses while cannabis remains federally illegal, should not apply to its businesses. While they are not elaborating on whether their argument strictly applies to medical cannabis, the company’s quarterly 10-K does state that the amended claims were specifically made for Trulieve’s assets in Florida and West Virginia, which currently only allow medical cannabis.

There is currently no guarantee that the Florida-based cannabis giant has an iron-clad tax strategy to get around 280E restrictions, and the company stated in its quarterly filings that it expects to be audited by the IRS over this tax position.

“We recently took a tax position challenging the applicability of 280E to our business,” said Trulieve CFO Wes Getman during the company’s earnings call. “Last October, we filed amended tax returns for multiple business entities for 2019-2021 based on our legal interpretation of 280E.”

Getman also noted that Trulieve would not be divulging its tax position, at least until the company has a final resolution on the matter.

“Due to the unknown final outcome of this tax position at this time, we continue to accrue an uncertain tax position on our balance sheet,” he said. “Until this process reaches a final resolution, we anticipate the uncertain tax position will increase over time, and we will continue to make timely payments as an ordinary corporate tax payer.”

Jesse Hubers, senior manager at tax accountant HBK, said that he expects Trulieve to face further scrutiny from the IRS, but also that many other companies are watching this case.

“The Trulieve news is really not directly positive news to anybody else other than Trulieve. I think there’s this perception out there that they’ve won something. It’s likely that the refund just came because the government didn’t want to pay interest on it,” said Hubers. “We don’t even know that this is going to go to court. And we don’t know what Trulieve’s argument was. I think there’s a lot of speculation out there of what their argument is.”

Nathaniel Pollock is a partner at SouthBank Legal. Prior to that job, he spent over 17 years working in the U.S. Department of Justice, including about seven years in the agency’s tax division.

Pollock recently opined about what Trulieve’s supposed tax win means, and that the company was likely attempting to take advantage of subtle differences between how the federal government views medical and adult-use cannabis.

“If you narrow the argument to focus on medical cannabis businesses, you’ve got an argument that’s different from the argument available to adult-use businesses or combined businesses,” said Pollock.

Notably, Trulieve stated in their 10-K disclosure form, that the company filed its amended tax forms specifically for its assets in West Virginia and Florida, both states where Trulieve exclusively operates in the medical market.

Pollock hinted that there could be another strategy related to the legislature’s appropriations bill that bars spending tax dollars to pursue legal action against state-legal cannabis operators. He declined to comment further.

“One hurdle to get over is to convince your accounting firm to go ahead with the signing position. I think accounting firms are correctly interested and perhaps assured by the fact that although they don’t know what Trulieve’s position is, an accounting firm did go forward with a position related to 280E.”

Marcum is Trulieve’s accounting firm. The company also does accounting work for MSOs Cresco Labs (CRLBF) and AyrWellness (AYRWF).

Hubers said he expects that if any other companies attempt something similar to Trulieve, it would probably come from a fellow MSO, given the extensive amount of capital that company would need for legal expenses.

“This isn’t cheap. If you’re gonna get an opinion letter, we’re talking six figures to even think about taking this position on your tax return. If you’re at a major CPA firm, you might be able to find somebody who will file whatever you wanna file,” he said. “But if you’re working with a mainstream cannabis CPA, without having an opinion letter and having invested a significant amount of money into taking that position, it’s gonna be hard to find someone who will play ball with that.”

Huber said he was not sure that other companies would attempt to follow Trulieve’s lead, especially since Trulieve has yet to divulge what legal strategy the company is leaning on. What is more likely, according to Huber, is that companies could file for protective claims which covers claims that could be impacted by a pending court ruling or legal decision.

There is only a three-year statute of limitations on amended tax filings, meaning that 2020 tax claims are due in April 2024. If a company wanted to extend that window, especially as it waits to see how things play out for Trulieve, they could conceivably file a protective claim.

“The government will just hold it until whatever the contingency that’s implicated by that protective claim is removed,” said Huber. “If you’ve got deep enough pockets, a tax opinion letter might be the way to go. I think most of these big MSOs are all going to be doing this. They’re not gonna be able to find debt out there with terms on par with the government’s IRS interest rates. The debt market is just much, much tighter on cannabis, and the IRS doesn’t differentiate their interest rates depending on who the taxpayer is.”

Corporate overpayments to the IRS carry a 7% interest rate, while the underpayment rate is 10%. Even large MSOs typically pay several hundred basis points more in interest to borrow money from private lenders, and often must offer additional terms including equity warrants or convertible stock options.

Huber also noted that interest was likely one of the deciding factors in the IRS apparently issuing a refund to Trulieve. That refund would not be final, and Trulieve could ultimately end having to repay it. But if the IRS were to have kept the cash and Trulieve was successful in court, then the government would have also had to pay interest on it.