The pace of cannabis business licensing in North America slowed in the first quarter of 2024, with active licenses declining 6% from the fourth quarter of 2023 in the U.S., and falling 14% in Canada, as regulated markets in both countries entered a second year of rationalization and retrenchment after several years of torrid growth.

The decline in total U.S.licenses marked the fifth consecutive quarterly decline in active licenses since the fourth quarter of 2022. Active licenses declined 8% from the previous six-month period, and fell 10% from a year ago. Total business licenses peaked in the fourth quarter of 2022 at 44,323, and ended the quarter at 39,850.

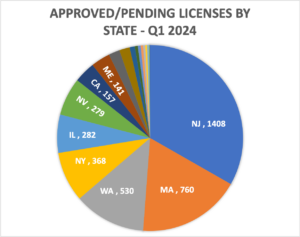

Approved/pending licenses in the U.S. fell 1% for the quarter to 4,719, and declined 9% from the third quarter of 2023, when approved/pending licenses peaked at 5,160. Total approved/pending licenses remained 14% higher than a year ago, when the opening of adult-use markets in several Northeast states led to a surge in licensing applications.

U.S. pre-licensing activity, defined as submitted license applications awaiting approval, peaked at 8,896 in the first quarter of 2023, and has declined precipitously since. Pre-licensing totals fell 64% in the first quarter, down 73% over the previous six months, and 78% lower from a year ago. Total business applications in pre-licensing stood at 1,907 nationally at the end of March.

Canada Licensing Falls

Canadian business licensing numbers fell 9% in the first quarter, a marked change from the stability the market had experienced for the previous two years. Active business licenses fell to just 6,267, the lowest number of active licenses since early 2022. Active licensing was 8% lower for the preceding six months and the full year as well. Virtually all of the decline was concentrated in owner/investor licensees, a minor license type not otherwise reflected in this analysis.

The decline in active licenses was somewhat mitigated by a nominal increase in approved/pending licenses and applications in pre-licensing, which increased 300% and 38% off of small fourth quarter bases of just three pending and less than 300 applications in pre-licensing. The 401 new applications in pre-licensing is the most since the second quarter of 2022.

The decline in active licenses was somewhat mitigated by a nominal increase in approved/pending licenses and applications in pre-licensing, which increased 300% and 38% off of small fourth quarter bases of just three pending and less than 300 applications in pre-licensing. The 401 new applications in pre-licensing is the most since the second quarter of 2022.

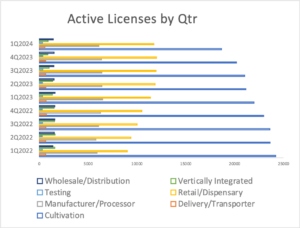

Activity by License Type

Of the major license types, cultivation and retail/dispensary licenses are far and away the most numerous. There were 18,650 active cultivation licenses and 11,724 active retail/dispensary licenses in the U.S. at the end of the first quarter, representing an 8% drop in cultivation licensing and a 2% decrease in retail/dispensary licenses from year-end 2023.

While slight, the drop in dispensary licenses represented only the second quarterly decrease in retailer licenses in the past two years. Cultivation licensees on the other hand continued to shed operations in an unrelenting supply-demand rationalization that is entering its third year. First quarter totals represent a 15% decline over a year ago.

Manufacturer/processor licenses made up the third largest U.S. license type at the end of the first quarter, with more than 6,000 active licenses, followed by wholesale/distribution licenses, with 1,431, representing a 4% and 5% quarterly drop, respectively.

Manufacturer/processor licenses made up the third largest U.S. license type at the end of the first quarter, with more than 6,000 active licenses, followed by wholesale/distribution licenses, with 1,431, representing a 4% and 5% quarterly drop, respectively.

Vertically integrated operators recovered a bit from steep declines in active licensees in 2023, posting a 1% increase in the quarter to 885 active licensees. Active vertically integrated licensees experienced a 34% decline in the past 12 months, falling from over 1,300 in Q1 2023.

The decline in licensed vertical operators in 2023 was linked to the withdrawal of large multi-state operators from major maturing adult-use markets in California, Washington, Massachusetts, and Colorado. But anticipation over the potential opening of an adult-use market in Florida, a vertically-integrated licensing state, has renewed interest in vertical-operator licenses in that state.

Approved/pending license counts, which can be a leading indicator of sentiment and future growth in the market, were generally flat to lower in the first quarter, suggesting continuing weakness and uncertainty among operators eyeing market entries and expansion. The two largest of major license types, cultivation and retail dispensaries, ended the first quarter with 1,199 and 2,032 approved/pending licenses respectively. That represented a 7% and 2% decrease in approved/pending applications, respectively.

Approved/pending license counts, which can be a leading indicator of sentiment and future growth in the market, were generally flat to lower in the first quarter, suggesting continuing weakness and uncertainty among operators eyeing market entries and expansion. The two largest of major license types, cultivation and retail dispensaries, ended the first quarter with 1,199 and 2,032 approved/pending licenses respectively. That represented a 7% and 2% decrease in approved/pending applications, respectively.

Manufacturer/processors, delivery/transporters, and wholesale/distributors appeared more optimistic about the future, shepherding an increased number of new applications through the approved/pending phase. This was especially true of pending wholesale/distribution licenses, which increased 139% from the fourth quarter to 55. Pending and approved manufacturer/processor licenses increased 5% to 856, and delivery/transporter licenses rose 10% to 441.

Manufacturer/processors, delivery/transporters, and wholesale/distributors appeared more optimistic about the future, shepherding an increased number of new applications through the approved/pending phase. This was especially true of pending wholesale/distribution licenses, which increased 139% from the fourth quarter to 55. Pending and approved manufacturer/processor licenses increased 5% to 856, and delivery/transporter licenses rose 10% to 441.

The number of companies with approved/pending vertically integrated operator licenses continued to fall, declining 14% for the quarter and 44% over the past 12 months, Florida notwithstanding.

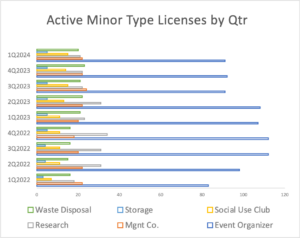

Applications in the pre-licensing stage, which reflect activity and sentiment in newer and expanding markets, were mostly steady for the quarter. Retail/dispensary and manufacturer/processor applications grew modestly at 7% and 8% respectively. Cultivation and retail/dispensary licenses dominated the category as usual, but showed dramatic declines from year-ago levels. Cultivation licenses in application fell 67% for preceding 12 months to 717, and retail/dispensary applications were down 49% to 718.

By contrast, the Canadian cannabis market’s national integration and maturity was reflected in the stability of its active licensing counts. All major licensing types experienced less than a single point of variance during the first quarter. The two largest license types, retail/dispensary and cultivation, logged 3% increases year over year. Manufacturer/processor licenses remained the third largest license type in Canada in 2023, remaining steady at 596 active licenses at the quarter’s end.

By contrast, the Canadian cannabis market’s national integration and maturity was reflected in the stability of its active licensing counts. All major licensing types experienced less than a single point of variance during the first quarter. The two largest license types, retail/dispensary and cultivation, logged 3% increases year over year. Manufacturer/processor licenses remained the third largest license type in Canada in 2023, remaining steady at 596 active licenses at the quarter’s end.

State Licensing Activity

State Licensing Activity

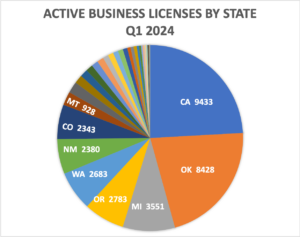

After a year-long moratorium on new licensing, coupled with crackdown on non-compliant operators, Oklahoma lost its place as the state with the most active licensed cannabis businesses in the first quarter. The Sooner State shed 2,050 medical licenses in the first quarter, ending March with 8,428 active licenses, a 20% decline from the end of 2023 and a 32% drop from a year ago. California regained its position as the leading state for cannabis operators, despite a 4% drop in its active licenses in the quarter, and a 22% decline from a year earlier, closing out the quarter with 9,433 licensed operators.

Michigan retained its third place position with 3551 licenses, a 5% decline for the quarter, but still 12% higher than the year ago period. New Mexico led the country in both the highest number and greatest percentage increases in new licensing, adding over 300 new licenses in the first quarter, expanding its active license count 15%, or 35% over the past 12 months.

Michigan retained its third place position with 3551 licenses, a 5% decline for the quarter, but still 12% higher than the year ago period. New Mexico led the country in both the highest number and greatest percentage increases in new licensing, adding over 300 new licenses in the first quarter, expanding its active license count 15%, or 35% over the past 12 months.

Missouri, in the second year of its adult-use rollout, experienced the largest percentage decline in the quarter, falling 24% to 347. Indeed, active licensing counts fell in 35 of the 45 regulated states, and just five states increased their licensing by more than 5%.

While Oklahoma slammed on the brakes of its wide-open medical market, California seems to be stabilizing after a year of precipitous decline saw the Golden State shed 22% of its licensed operators, or more than 2,600 licenses.

Other states with notable changes in active license counts included adult-use pioneer Colorado, where license counts fell 8% in the quarter, and New York, which rose 12% as that state continued the rollout of its adult market.

New Jersey increased its active count 16% as its adult-use market continued to see steady growth. Connecticut, the third New York metropolitan area market, once again shed licensees after a much-anticipated adult-use launch in January 2023, notching a 69% decline for the quarter, to just 43 active licensees. Massachusetts, the largest and most mature state market in the region, logged a steady but modest 4% growth in licenses during the period.

New License Pipeline

Cannabis business license applications which have been approved but have yet to become operational are grouped by CRB Monitor under the category of “approved/pending” status, and reflect the near-term pipeline of new cannabis business operations poised to enter the regulated market. While no guarantee that these new operations will commence, the investment of resources required to prepare, submit and successfully obtain a cannabis license does suggest a level of commitment that can be used as a proxy for future business activity.

New Jersey and Massachusetts continued to lead the country in the number of approved/pending licenses outstanding, with 1408 and 760 respectively. That represented a 3% decline from the end of 2023 for New Jersey, while Massachusetts plummeted 31%.

New Jersey and Massachusetts continued to lead the country in the number of approved/pending licenses outstanding, with 1408 and 760 respectively. That represented a 3% decline from the end of 2023 for New Jersey, while Massachusetts plummeted 31%.

States with notable increases in approved licenses include Missouri and Connecticut, which added 63 and 72 new licenses, respectively, and Oregon, which added 10 new approvals ahead of the implementation of a new population-based rationing scheme. Illinois and California experienced the greatest declines in approved/pending licenses, falling 25% and 46% respectively.

Applications for new cannabis business licenses that have yet to be approved are classified as having a “pre-licensing” status at CRB Monitor. While the proportion of these applicants that may succeed in gaining approval, much less opening a cannabis business, is unknown, pre-licensing data nonetheless serves as an indicator of interest in entering or expanding commercial activities in a given market.

New Mexico led the country in pre-licensing for the quarter, with 410 applications in pre-approval status, a 7% increase from the prior three months. New York, entering the third year of its adult-use market rollout, closed the quarter with 404 applications awaiting approval, the same number as the previous quarter.

The District of Columbia led the U.S. in the largest number of new applications in pre-licensing, increasing by 50 to 227 total, a 27% rise. California experienced the greatest nominal decline in new applications, which fell 36 to 197, the lowest number of new license applications in two years.![]()