Co-authored by Kyle Buckley, Senior Analyst, CRB Monitor

The 2024 general election resulted in Republican majorities in both houses of Congress, as well as the presidency. The congressional majorities will hold for at least the next two years, and those with ties to the cannabis industry must be wondering whether this is a positive or negative development for their interests.

The Nov. 5 elections were full of surprises for some and full of affirmations for others. And a first: America elected a president who has been convicted of 34 felonies, which will hopefully be the one and only time that ever happens. And President-Elect Donald Trump is somewhat unclear about how he might act on just about everything – from immigration, to the economy, to law enforcement, to any of a number of policies that Americans are curious about. The least of these is cannabis reform.

Recent history informs us that cannabis reform does not have a groundswell of support among Republicans, even with SAFER Banking, which should be a layup for the party of the free market. And even if Republican support exists for SAFER Banking and some form of legalization, where do they reside on the list of priorities for this Congress?

The positions regarding cannabis reform at the House of Representatives and the U.S. Senate have been divided, so much so that we have not yet seen any such legislation pass both chambers. Even more important, the flip to a narrow Republican majority in both houses does not speak well for the near-term future of legal cannabis in the U.S.A. But hope springs eternal, and the handful of investors that have held on for dear life to their cannabis-related business shares might be surprised as the 2025 Congressional session and the 47th Presidency of the United States get underway.

It’s worth mentioning, given the imminent prospect of the implementation of Project 2025, whether or not cannabis even exists on the immediate slate of priorities for this administration is unclear as well. Given that one of Project 2025’s objectives is to dismantle government agencies, where does marijuana rescheduling fit into the overall plan? While rescheduling (and the resulting juicy tax cut for businesses) should be another layup for this new government, ideology might once again get in the way and derail the implementation… so stay tuned.

With all this uncertainty at the federal level giving investors fits and starts, we turn to the recent election results at the handful of states that had cannabis legalization on the ballot. With that said, investors had little to celebrate in November.

State Ballot Questions

Of particular interest to cannabis investors on Nov. 5 was the handful of states that had cannabis-related ballot questions, and the results were less than ideal. In total there were four states that had varying results on cannabis-related referenda on election day: North Dakota, South Dakota, Nebraska, and the “Big Kahuna”, Florida. Here are the results:

| State | On the Ballot | Pass/Fail |

| North Dakota | Recreational Marijuana | Failed |

| South Dakota | Recreational Marijuana | Failed |

| Nebraska | Medical Marijuana | Passed |

| Florida | Recreational Marijuana | Failed |

One can see that cannabis legalization passed in only one state, Nebraska; and that decision is tenuous at best as the result faces numerous legal challenges before it can advance.

For the purposes of this article, we will delve a bit deeper into the impact on cannabis investors. For a detailed recap of the election results and their effects on licensing in the applicable states, read our CRB Monitor News.

Here is a brief summary of the less-than-favorable outcomes:

Florida: By far, the cannabis industry had the most riding on Florida, where Amendment 3 (legalize recreational marijuana) appeared to carry the whole enchilada on its back. In the words of an article by the Associated Press:

“Florida voters rejected ballot measures Tuesday to protect abortion rights and legalize marijuana, handing victories to Republican Gov. Ron DeSantis and solidifying the state’s new reputation as a conservative stronghold. DeSantis used state resources and campaigned heavily against each issue, telling voters that whether they were for or against marijuana or abortion rights, the measures were flawed, poorly worded and would likely never be repealed if enshrined in the state constitution.” And even more compelling was this additional information: “But DeSantis’ campaign would have failed if it wasn’t for former Republican Gov. Jeb Bush, who 20 years ago successfully pushed the threshold to change the constitution to 60% support. Both measures had support from a majority of voters, but not enough to pass.”

Sadly for cannabis investors, legalized recreational marijuana was rejected, gathering only 56% of the votes. And how strange things are in the Sunshine State where a clear majority is not sufficient to satisfy the will of the people.

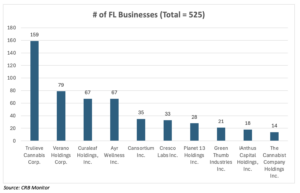

Here is a breakdown of the publicly traded CRBs and their operational footprint in the Sunshine State:

The above list is effectively a “who’s who” of multistate operators and the extent of their respective Florida bets. Stakeholders in these companies are painfully aware of the impact that November 5 had on their expected value, and on the expectations of investors.

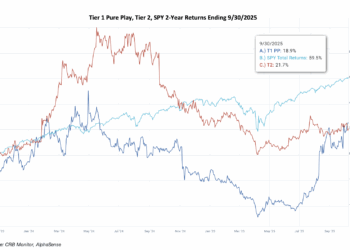

Here are these companies’ equity returns, for both YTD leading up to November and then November:

As an equally weighted portfolio, this group lost more than 30% of its value in November, for a few reasons. First, MSOs have been increasing their medical cannabis footprint in Florida for years at a considerable expense, betting on the legalization of recreational marijuana. This narrow defeat, while not necessarily the end of the road, was a major blow to these companies, and we will see what their plan will be going forward.

North Dakota: First, in North Dakota, where the legislature legalized medical marijuana in 2016, Measure 5 (legalize recreational marijuana) was rejected by a margin of 53% to 47%.

North Dakota is apparently not ready for legal adult use. Per an article in The North Dakota Monitor: “Pat Finken, chair of the Brighter Future Alliance, a group opposing Measure 5, said he hopes the recreational marijuana issue has been put to rest in North Dakota. ‘Once again, the voters of North Dakota have wisely rejected an attempt to legalize recreational marijuana,’ Finken said late Tuesday. ‘They understand that today’s marijuana is not safe and legalization will only add to the addiction and mental health crisis already punishing North Dakota families.’”

South Dakota: Now on to South Dakota, where residents failed to distinguish themselves from their neighbors to the north, defeating Measure 29 (legalize recreational marijuana) by a margin of 56% to 44%. According to the South Dakota Searchlight, “Measure 29 would have provided the groundwork by legalizing for adults 21 and older the possession, use and free distribution of up to 2 ounces of marijuana. South Dakota voters previously rejected recreational marijuana in 2022. In 2020, voters passed a constitutional amendment legalizing both recreational and medical marijuana, but it was overturned in court for violating the state constitution’s single-subject rule for ballot measures. A separate medical marijuana initiative that passed in 2020 laid the groundwork for the state’s current program.” (Medical marijuana became legal in South Dakota in July of 2021.)

Nebraska: As one of the eleven remaining states where marijuana is completely illegal for any purpose, Nebraskans passed Ballot Initiatives 437 and 438, which would decriminalize and legalize medical marijuana across the state. Here is how they are summarized in an article in Marijuana Moment:

- The patient-focused measure says that its aim is to “enact a statute that makes penalties inapplicable under state and local law for the use, possession, and acquisition of limited quantities of cannabis for medical purposes by a qualified patient with a written recommendation from a health care practitioner, and for a caregiver to assist a qualified patient in these activities.”

- The other initiative will create a new a Nebraska Medical Cannabis Commission to provide “necessary registration and regulation of persons that possess, manufacture, distribute, deliver, and dispense cannabis for medical purposes.”

And while this victory is something to be celebrated, legalization might be just a “pipe” dream for the foreseeable future, as a multi-pronged battle in the courts awaits. Please stay tuned.

Finally, there is the potential impact of this new federal government, which is about to start implementing its agenda in January. If re-scheduling or de-scheduling are off the table, the tax implications for CRBs will be devastating as well. Ditto for SAFER Banking and legalization, the fate of which seems to be increasingly hazy as the November elections become more of a distant memory.

The advent of a Republican trifecta and the failure of Florida voters to pass adult-use legalization have dealt the cannabis industry a significant blow, and this is evident given the performance of the MSO group, particularly the companies with ties to the Sunshine State. While investors and other cannabis industry stakeholders are very welcome to remain hopeful following the November elections, we feel that the future has gotten murky due to the results both at the federal and state levels.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update Defining “Cannabis-Related Business.”