In recent (and distant) memory, there’s been little to celebrate in publicly traded cannabis-land. We might speculate that investors in cannabis equities (at least those that are paying attention) are suffering from a combination of depression and anxiety. Depression, which is a fixation on the failures of the past, has undoubtedly set in and will persist for years to come. And anxiety, which is an obsession over the uncertainty that lies ahead, must also be hitting exponential levels these days, as we attempt to disentangle this new abnormal in which we live.

Truth be told, as a nation we are in uncharted territory, with an executive branch that has awarded itself a seat at the head of the table, leaving an apparently diminished role for Congress while providing the judicial branch with a bulging docket of constitutional cases. The norms that we have come to respect as citizens can no longer be taken for granted, as this now emboldened president seeks to decimate government agencies that Americans have always assumed were a basic right to be enjoyed by all. And it would seem as though there are no individuals or institutions that will be able to avoid getting caught in the jetwash, either directly or indirectly. So stay tuned, because it will be a wild four years.

Our embattled cannabis industry, which is sometimes legal and sometimes illegal, will likely be as vulnerable if not more vulnerable as any other to this new abnormal. For all the stakeholders in this redheaded stepchild of a business, we would contend that this administration’s path forward will undoubtedly have a significant impact on the cultivation, production and distribution of cannabis.

For several years, investors have had to endure the slow crawl toward long-awaited government reforms, and it is now unclear that they will even be considered by this administration. Furthermore, it’s the new agenda, including policies on immigration and tariffs, that will have a profound impact on both the marijuana and hemp industries, given their agrarian nature. Mass deportations will be a gut punch to growers and manufacturers who depend on immigrant labor, while tariffs on agricultural and processing supplies could force many CRBs completely out of the industry.

In our December 2024 newsletter, we insisted that there is still hope, and what we wrote then bears repeating:

At the state level, cannabis-related revenues continue to fill the coffers of the treasuries of the now 39 states with some form of legalization on the books. And while the U.S. government seems to be operating more like a circus than a government, the reforms that have been in the works for the last few years — DEA re-scheduling, SAFER Banking and even federal legalization — have bipartisan support and are wildly popular across the country.

Furthermore, the CRB Monitor database tracks more than 90,000 cannabis-related business that hold more than 200,000 cannabis licenses. And according to an April 2024 report by NORML, the cannabis industry employs more than 440,000 people. The main reason why this multi-billion dollar industry that employs a half million people can’t quite get it together at the corporate level is regulatory friction, plain and simple. If these companies were afforded the same conveniences as their counterparts in alcohol and tobacco (conventional banking and payment systems, interstate and international commerce, normal taxation, employee protections, etc.) and not treated by the federal government like illicit drug dealers then this market would explode.

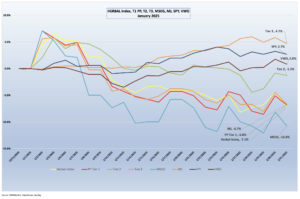

Cannabis-Linked Equity Performance

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of pure play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), performed in line with its peers in January (-7.1%), with most of the negative return coming from, as usual, Tier 1 CRBs. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The two largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-6.7%) and the actively managed MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-10.8%), continued their downward slide following the November elections and subsequent uncertainty in Washington. Both of these funds are benchmarked to CRB-themed indexes, and while they use different construction methodologies, their returns will generally be directionally close to each other. Unlike HERBAL, which is an index designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching MJ exposure tend to be more sensitive than HERBAL to the U.S. regulatory rollercoaster.

MJ’s performance has a high potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin in 2017, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings such as tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally in 2022, MJ added and still maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It is important to note that MJUS was scheduled to close in late January. As a replacement for its U.S. plant-touching exposure, MJ will now holds units of the Amplify Seymour Cannabis ETF (NYSE: CNBS).

The performance of the CRB Monitor equally weighted basket of top Pure Play Tier 1 CRBs was negative in January, returning -6.8%. This basket, which is an equally weighted portfolio of the 21 largest pure play CRBs (including both U.S. plant-touching and non-U.S. plant-touching MJ companies), had a return that was a reflection of the wide range of performance across the entire Tier 1 pure play space. We will take a closer look at some of these below.

The CRB Monitor equally weighted basket of Tier 2 CRBs outperformed the Tier 1 CRB basket, posting a -1.3% return for January. In February 2024, CRB Monitor published an update to our article on correlations of pure play Tier 1 and Tier 2 CRBs (among other tiers and baskets). And what we have observed historically is that these two groups tend to display high correlation (~0.75) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (like marijuana rescheduling) that affect their revenue sources that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term, and we would witness this gap narrow over time. We update this data a couple of times per year.

As a group, U.S. equities were generally positive in January 2025, extending their overall success from the previous year. The S&P 500 rose by approximately 3% during the month, driven by solid earnings reports from key sectors, particularly technology and healthcare. Investor sentiment was buoyed by expectations of moderate economic growth, despite ongoing concerns over inflation and interest rates. The Fed’s cautious stance on future rate hikes provided some relief, contributing to risk-on sentiment in the markets.

Additionally, positive macroeconomic data, such as strong consumer spending and job growth, helped support the bullish outlook, though some volatility persisted due to geopolitical uncertainties and mixed global growth signals. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted +2.7% return for the month of January.

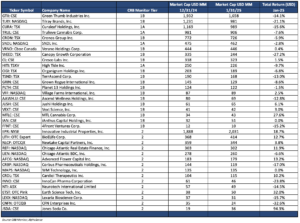

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – January 2025 Returns

An equally weighted basket of the largest Tier 1 pure play cannabis equities once again was negative in January, with most of the constituents underperforming the broad equity market. Tier 1 CRBs were outpaced by the Tier 2 basket by 5.5%.

CRB Monitor Tier 1

Publicly traded CRB performance was generally negative in January across the universe of Tier 1 cannabis stocks. The MSO basket continued its downward trend, with larger Tier 1A MSOs Trulieve Cannabis Corp. (CSE: TRUL) (-7.6%), Tier 1B TerrAscend Corp. (TSX: TSND) (-13.0%), Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-14.0%), and Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-15.6%) losing investors’ value for another month. Tier 1B Cresco Labs Inc. (CSE: CL) (+1.5%) and Tier 1B Verano Holdings Corp. (CSE: VRNO) (+0.4%) had small positive returns in January.

The Canadian CRB basket struggled along with the MSOs, in spite of their lower (but not complete lack of) exposure to the progress of U.S. cannabis legalization and reforms. As we have stated regarding these two groups, historical performance has deviated between the CAD and the MSO baskets over short periods, but they tend to mean revert over time. Tier 1B Canopy Growth Corporation (TSX: WEED)’s stock price (-27.2%) crumbled as they announced a new corporate president, while Tier 1B Cronos Group Inc. (TSX: CRON) (-5.9%), Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-21.1%), Tier 1B High Tide Inc. (TSXV: HITI) (-9.7%), and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-2.8%) rounded out a generally disappointing basket for the month.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies outperformed the Tier 1 basket in January, posting a return of -1.2% for the month. Historically these two portfolios are highly correlated (please see our February 2024 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to mean revert over time. When the two baskets deviate from one another (as they did in January and for much of last year) the deviation could be a signal for investors to rebalance their Tier 1 and Tier 2 baskets given their direct revenue relationship, as Tier 2 CRBs are direct suppliers of goods and services to Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict. Furthermore, the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lose money, so proceed with caution!

The largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (+18.7%), took an optimistic turn in January as it outperformed significantly relative to the Tier 1 CRBs that lease property from them.

Similarly, Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG) (CRBM Sector: Real Estate) (+13.2%) awarded investors in January, and over recent months it has also outperformed its Tier 1 CRB lending clients.

CRB Monitor Chart of the Month:

Some New Risks to Consider in Spot Crypto ETPs

For this edition of CRB Monitor’s Chart of the Month we head back to the world of spot cryptocurrency exchange traded products (ETPs) to discuss some of the embedded risks that we have not covered in previous articles. These are related to, specifically, Staking, Airdrops and Forking.

To those of us who were born during or around the leisure suit era, we believe that these terms might have something to do with camping, or perhaps dinner. But practitioners in the crypto space know these terms well and treat them as “sweeteners” for their crypto investments, as they exist to motivate investors that hold onto (or maybe add to) their crypto investments. The full-length article can be found on CRBMonitor.com.

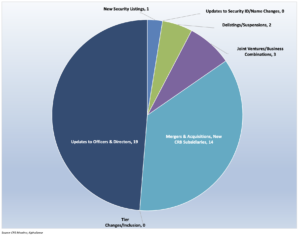

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for January 2025:

Cannabis Business Transaction News – January 2025

The cannabis business news cycle soldiered on in January, with several CRBs expanding operations and entering into joint ventures. Trulieve and High Tide had a particularly busy month, in spite of the uncertainty from Washington that is gradually taking its toll on the industry.

On that note, here are some of the highlights from January 2025:

We begin with news of the exit from the cultivation business by Tier 1A CRB Agrify Corporation (NASDAQ: AGFY). According to a January press release, Agrify “signed an agreement for and closed the sale of its cultivation business to CP Acquisitions, LLC, an entity affiliated with Raymond Chang, the Company’s former Chairman and Chief Executive Officer. The Transaction involves the sale of the Agrify cultivation business and assets, the assumption of liabilities related to the cultivation business by CP, and the termination of two convertible notes held by CP totaling approximately $7 million.”

As a result of this sale, Agrify no longer has ownership, either direct or indirect, of a cannabis license. As for Agrify’s CRB Monitor profile: With this transaction, Agrify has been downgraded to Tier 2 from Tier 1A in the CRB Monitor database.

Next we head out west, where Tier 1A CRB Trulieve Cannabis Corp. (CSE: TRUL) issued a Jan. 8 press release announcing “the opening of a new dispensary in Maricopa, Arizona…The new Trulieve Maricopa, located at 44405 West Honeycutt Avenue…carrying a wide variety of Trulieve in-house brands including Alchemy, Avenue, Co2lors, Loveli, Modern Flower, Muse, and Roll One, as well as a broad assortment of products from popular partner brands.”

Trulieve continues to expand operations in several states, even as it was dealt a crushing blow by the electorate in November when legal recreational marijuana was struck down at the polls. The announcement goes on to say, “In Arizona, Trulieve operates dispensaries in Apache Junction, Avondale, Casa Grande, Chandler, Cottonwood, Glendale, Guadalupe, Maricopa, Mesa, Peoria, Phoenix, Scottsdale, Sierra Vista, Tempe, and Tucson.”

Trulieve’s footprint expands to 111 active licenses in the U.S.

Next we head to the Great White North, where Canadian Tier 1B High Tide Inc. (TSXV: HITI) announced in a Jan. 13 press release that it is “entering the fast growing German medical cannabis market by signing a definitive agreement pursuant to which the Company will acquire 51% of Purecan GmbH, for approximately €4.8 Million , and will have a future option to acquire the remaining interest in Purecan. Purecan is a profitable, import-oriented pharmaceutical wholesaler based in Germany, that holds a license to import medical cannabis into Germany and is preparing to launch a telemedicine portal for medical cannabis patients in Germany, along with complete warehousing and logistics infrastructure.”

High Tide has been in expansion mode for much of the last 12 months and now holds 201 active cannabis licenses in Canada and Australia.

Next, following several recent changes in its operation footprint, Canadian Tier 1B Canopy Growth Corporation (TSX: WEED) issued a press release on Jan. 6 announcing that M. Brooks Jorgensen has been appointed as the company’s first-ever president:

“With its powerhouse portfolio of brands including Wana, Jetty, and Acreage’s Superflux, as well as The Botanist retail locations, Mr. Jorgensen’s leadership of Canopy USA will help the Company channel its energy and expertise toward realizing the full potential of the U.S. cannabis market, which is projected to reach $50 billion in sales by 2026…Mr. Jorgensen joins Canopy USA with more than 25 years of leadership experience in high-growth industries, including cannabis, wine, and spirits. Most recently, Mr. Jorgensen served as President of Kiva Sales and Service, growing it to what is now the largest full-service distributor of cannabis products in the U.S.”

In recent years, investors have seen Canopy’s value decimated by failed expansion into several cannabis businesses and a market cap of $450 million that is a shadow of its former self (over $10 billion). Canopy, still a non-U.S. plant-touching CRB, operates in three countries and holds 59 active cannabis licenses.

Lesser-known Tier 1B CRB Eat Beyond Global Holdings Inc. (CSE: EATS) issued a Jan. 31 press release announcing that the Company “has entered into a securities exchange agreement dated January 31, which sets out the terms and conditions for the acquisition by the Company of 100% of the issued and outstanding shares and 100% of the outstanding warrants in the capital of Milo Media Technologies Inc. in exchange for securities of Eat & Beyond. Pursuant to the terms of the Definitive Agreement, the material terms of the Transaction are as follows:

- “In consideration for the Transaction and on closing thereof, Eat & Beyond will issue an aggregate of 15,000,000 common shares of Eat & Beyond to Milo Media shareholders at a deemed price of $0.185 per Payment Share and will issue 15,000,000 common share purchase warrants (“Replacement Warrants”);

- “Each Replacement Warrant will permit the holder thereof to acquire one common share in the capital of Eat & Beyond at the price of $0.05 per share for a period of 24 months from the date of issuance (being the same exercise price and expiration of the original warrants surrendered for cancellation); and

- “There is no hold period for the Payment Shares or the Replacement Warrants pursuant to applicable securities laws.”

Eat & Beyond has an indirect connection to the cannabis industry through its ownership in Best Cannabis Products Inc., which holds a license to cultivate hemp from Canadian regulators.

Finally, we head south to Florida, where Tier 1A CRB Trulieve Cannabis Corp. (CSE: TRUL) issued Jan. 27 press release announcing “the opening of a new medical cannabis dispensary in Palm Coast, Florida…

“The new dispensary will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, O.pen, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

Still on a mission to own the cannabis industry in the Sunshine State, Trulieve operates approximately 30% of all Florida dispensaries. [For more information, please see our Chart of the Month from November 2024, “The Florida Effect”.

Select CRB Business Transaction Highlights:

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Grown Rogue International Inc. | CSE: GRIN | Tier 1B | Grown Rogue Appoints New Chief Financial Officer |

| Canopy Growth Corporation | TSX: WEED | Tier 1B | Canopy USA Names Brooks Jorgensen as President |

| Red Light Holland Corp. | CSE: TRIP | Tier 1B | Red Light Holland Appoints Keith Li as Chief Financial Officer and Provides Corporate Updates |

| 1933 Industries Inc. | CSE: TGIF | Tier 1B | 1933 Industries Appoints New CFO and VP Finance |

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Agrify Corporation | NASDAQ: AGFY | Downgrade | Tier 2 – CBD – Food, Beverage & Tobacco |

| Lynx Global Digital Finance Corporation | CSE: LYNX | Moved to Watchlist | Tier 2 – IT Services & Software |

| New Wave Holdings Corp. | CSE: SPOR | Moved to Watchlist | Tier 2 – CBD – Online Wholesale & Retail |

| Amplify U.S. Alternative Harvest ETF | NYSE Arca: MJUS | Moved to Watchlist | Tier 1B – ETF – Cannabis-Themed |

| XWELL, Inc. | NASDAQ: XWEL | Moved to Watchlist | Tier 3 – CBD – Traditional Retail |

Cannabis News: Regulatory News Updates

As we leap into 2025 in earnest, both the near-term and long-term future of the cannabis industry are unknown, but it is certain that the future is firmly in the hands of the regulators. As such, the 2024 Cannabis Legal & Regulatory Review by our CRB Monitor News Team is an excellent summary of last year’s progress toward legalization across the U.S.

With that said, here are some of the January highlights from the cannabis-related regulatory news cycle:

We begin in the Big Apple, where our very own CRB Monitor News Team reported on Jan. 10 that New York state announced its adult-use market “surpassed the $1 billion mark in retail sales. That milestone came about two years after the first sales launched on Dec. 29, 2022. Despite numerous legal challenges, the Empire State managed to get its adult-use cannabis market off the ground this year. New York’s Cannabis Control Board prioritized applicants with cannabis-related criminal records in the first round of licensing, which was hindered by legal action from other applicants. Ultimately, the CCB would abandon its original time frame and allow general applicants to join the market, partially in response to lawsuits that temporarily halted licensing.

“’New York’s cannabis industry was designed with a focus on equity and opportunity, and today’s achievement is proof that our approach is working. By prioritizing Social and Economic Equity applicants, we’re creating a market that uplifts communities and fosters meaningful economic impact across the state,” said CCB Chair Tremaine Wright in a statement. ‘The tax revenue generated by this thriving industry directly supports our Community Reinvestment Grant Program, ensuring that communities disproportionately impacted by cannabis prohibition receive critical investments. This is only the beginning of what’s possible when we invest in an inclusive and well-regulated industry.’”

The article goes on to highlight the expansion in license approvals: “Throughout 2024, the state also approved 221 cultivator licenses, 292 processor licenses, 569 Conditional Adult-Use Retail Dispensary licenses, 185 distributor licenses, 272 micro business licenses and seven new medical registered organizations to join the state’s existing 10. Since the market launched, the state has approved a total of 1,036 retail locations, 293 cultivation sites, 323 processors and 191 distributors, according to the CRB Monitor database.”

For a less upbeat story we head west to South Dakota, where an article in MJ Biz Daily reported that a South Dakota lawmaker has moved to repeal the state’s medical cannabis law. Really? In the words of the article, “After South Dakota’s Election Day defeat of adult-use legalization, an emboldened lawmaker is moving to repeal the state’s medical cannabis law. House Bill 1101, introduced Monday by Republican state Rep. Travis Ismay, would overturn South Dakota’s 2020 medical marijuana law and outlaw the more than 100 legal cannabis businesses in the state. It’s Ismay’s second effort to undo MMJ in the state, according to Dakota News Now. South Dakota voters legalized medical marijuana in 2020 despite opposition from influential politicians such as then-Gov. Kristi Noem. That same ballot initiative also legalized adult-use cannabis.”

It’s difficult to imagine that a state representative would so deeply resent the idea of legal marijuana that he would seek to cancel all that revenue, but here we are.

Meanwhile South Dakota is experiencing a decline in cannabis sales: “At least eight dispensaries closed in 2024 because of low patient counts and competition from other stores, the South Dakota Searchlight reported in December. South Dakota has a relatively low patient count, with 11,497 approved patient cards as of Jan. 8, according to state data. That’s down from a high of 13,705 a year ago. Observers attribute the decline in MMJ interest to the wide availability of products with intoxicating levels of hemp-derived THC in the state.”

Next we head over to Wisconsin, where a January article in Marijuana Moment reported, “The governor of Wisconsin said that residents of the state should be allowed to propose new laws by putting binding questions on the ballot—citing the fact that issues such as marijuana legalization enjoy sizable bipartisan support while the GOP-controlled legislature has repeatedly refused to act. Gov. Tony Evers (D) said during a press conference that he will be including a proposal in his 2025-27 biennial budget to give citizens the right to put forward ballot initiative to enact statutory or constitutional policy changes if a majority of voters approve them.”

This seems to be a recurring issue in states where the will of the people is challenged by a considerably smaller group of people in the legislature. The article goes on to report, ‘At the presser on Friday, Evers specifically mentioned that there’s majority support for “legalizing and taxing marijuana like we do alcohol,’ as well as other issues such as abortion rights, gun safety and increasing funding for public education. Yet ‘Republican legislators have repeatedly ignored the will of the people of Wisconsin,’ he said, according to Wisconsin Examiner.”

Back to the U.S. Federal Government: In a somber note regarding rescheduling, a Jan. 22 article in Business of Cannabis North America reported on the status of this heavily-anticipated reform. “Cannabis rescheduling was dealt a major blow today as it was confirmed that long-time cannabis sceptic and anti-drug veteran Derek S. Maltz has been appointed as acting administrator of the DEA. Just days after the rescheduling hearings were placed indefinitely on hold amid allegations that the DEA (Drug Enforcement Administration) was actively working to undermine the process, the administration confirmed that Maltz will act as ‘interim administrator’ from January 21, 2025.”

As a number of programs at various agencies have been put on hold due to newly defined executive branch priorities, this could be bad news for those who were counting on rescheduling happening in the near future.

The article goes on to say, “As Business of Cannabis reported earlier this week, the rescheduling project now hinges more than ever on the views of the incoming leadership of the DEA, which has already been slammed by the judge for its behavior in the process. With Maltz confirmed, at least for now, Deborah Tharp who correctly predicted Maltz would be a frontrunner for the position, believes that any cannabis-friendly rescheduling option is dead now. ‘If they reschedule it in this environment, it will be an attempt by the feds to take control of our state markets,’ she added. Maltz has already expressed skepticism about federal rescheduling efforts. In response to the Department of Justice’s 2024 initiative to reclassify cannabis, he stated, ‘It’s crystal clear to me that the Justice Department hijacked the rescheduling process, placing politics above public safety.’”

Along with legalization efforts, these developments will be must-see politics in 2025.

Finally, we travel south to Texas, where a Jan. 31 story in the Cannabis Business Times reported that Texas Lt. Gov. Dan Patrick “listed legislation that aims to ban all consumable products containing any form of THC as one of his top 25 priority bills to push through the Senate this year. Senate Bill 3, which Patrick first announced in December, would repeal parts of House Bill 1325, which the Texas Legislature passed in 2019 to authorize the commercial production, manufacturing, retail sale and inspection of industrial hemp crops and products following the federal legalization of hemp in the 2018 Farm Bill. While H.B. 1325 was agricultural-related legislation, Patrick and other Texas conservatives argue its unintended consequences have since led to a multibillion-dollar market for finished products with intoxicating hemp-derived cannabinoids.”

This issue is not limited to Texas but rather any state that adopted the Farm Bill in hopes that hemp cultivation would result in a windfall for revenues; but in many cases it gave way to a burgeoning hemp-derived THC business.

The article goes on to report, “As Texas’ medical cannabis law limits physicians to prescribing low-THC cannabis or cannabis derivatives capped at 1% THC under the state’s Compassionate Use Program—one of the most restrictive programs in the country—hemp-derived products containing delta-8 or delta-9 THC have become increasingly popular in recent years. Patrick accused retailers that sell hemp-derived cannabinoid products of circumventing the law and putting Texans’ ‘lives in danger.’ Under the Texas Agriculture Code, hemp is defined as a cannabis plant or its derivatives consisting of less than 0.3% THC by weight, meaning a single gummy that weighs 10 grams can be infused with an intoxicating amount of THC (up to 30 milligrams) and remain under than 0.3% threshold.”

CRBs In the News

The following is a sampling of highlights from the January 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining “Marijuana-Related Business” and its update Defining “Cannabis-Related Business”).

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know.