As the United States raced into the new year with much uncertainty, we witnessed a new government that’s intent on leaving a considerably large footprint on history. Suffice it to say, given recent world events, the future of the cannabis industry currently does not seem to be a high priority for this government. However, that could change as several of this administration’s policies have oscillated over the last 100 days. It will be interesting to see how things progress given that many regulatory authorities and government agencies have been gutted, leaving us to wonder how things will operate when this four-year term comes to an end. With that said, we wouldn’t take re-scheduling (or even de-scheduling), SAFER Banking or federal legalization off the table just yet.

Cannabis-Related Equity Performance

On that note, here are some highlights from our first quarter 2025 monthly newsletters:

In recent (and distant) memory there has been little to celebrate in publicly traded cannabis-land. We might speculate that investors in cannabis equities (at least those that are paying attention) are suffering from a combination of depression and anxiety. Depression, which is a fixation on the failures of the past, has undoubtedly set in and will persist for years to come. And anxiety, which is an obsession over the uncertainties that lay ahead, must also be hitting exponential levels these days, as we attempt to disentangle this new abnormal in which we live.

For those investors who are still hanging onto their cannabis stocks, what will the impact of recently imposed tariffs be on our incredibly shrinking industry? We can look at this two ways. On the one hand, the U.S. cannabis market, by virtue of it being insular within states and suffering a prohibition on international transactions, is virtually isolated from any impact on global tariffs. However, cannabis businesses, across the operational spectrum, are dependent on suppliers of goods and services from around the globe. Given their already razor-thin margins, the April tariffs could force many of these CRBs to the brink of disaster. And so we wait and hope there are more than two shoes that could drop over the coming months.

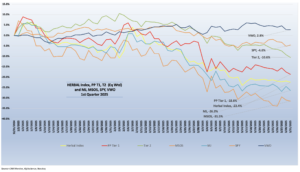

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL). A well-conceived representation of the universe of legal, pure play Tier 1 and Tier 2 cannabis equities weighted by both investability and strength of theme (SOT), HERBAL had a -22.4% return for the first quarter of 2025. However, HERBAL still outperformed its competitors over the quarter. This was due to the composition of the index, which resulted in an overweighting of Tier 2 CRBs and a portfolio that is concentrated in fewer overall securities. A full description of HERBAL’s strengths and benefits can be found in Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The largest U.S. plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-26.3%) and the MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-31.5%), finished Q1 with their tails between their legs. Unlike HERBAL, which is designed to be Controlled Substances Act (CSA)-friendly, these two funds with U.S. plant-touching marijuana exposure tend to be more sensitive to the federal regulatory rollercoaster, which is covered in our newsletters each month.

Over the last few years MJ’s performance has had the potential to deviate from HERBAL’s (and other cannabis-themed ETPs) due to its current unconventional composition. Since its origin, MJ has held a significant percentage of non-pure play (and in a few cases, non-CRB) holdings, specifically tobacco stocks and Tier 3 companies with either very small or no cannabis exposure at all. Additionally in 2022, MJ added and maintains close to a 50% U.S. plant-touching component via a holding in its sister fund, MJUS. The U.S. plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict U.S. cannabis exposure. It’s also important to note that both MJ and MJUS now operate under issuer Amplify ETFs.

The CRB Monitor equally weighted basket of the largest pure-play Tier 1 CRBs faced similar challenges in the first quarter, returning -18.6%. This basket is essentially a hybrid of CRBs without U.S. touchpoints (the CAD component) and U.S. multistate operators (the MSO component). Because the basket is equally weighted, its performance is likely to deviate from published indexes and listed funds, which generally employ some variation of market cap weighting.

The performance of the CRB Monitor equally weighted basket of the largest Tier 2 CRBs was negative but outperformed the Tier 1 basket significantly, with a return of-10.6%. As we have indicated in the past, pure play Tier 1 and Tier 2 CRBs tend to display high (~0.8) correlation in the long term (see our section on correlation in the CRB Monitor February 2024 newsletter), but their respective performances has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. In general, Tier 2 CRBs share in the overall success or failure of the Tier 1 universe and ultimately are expected to converge with the Tier 1 equity basket.

U.S. equities experienced a challenging first quarter in 2025, marked by heightened volatility and sector-specific underperformance. The S&P 500 declined by more than 4%, while the Nasdaq Composite fell over 10%, primarily due to significant sell-offs in high-growth technology stocks, including the “Magnificent 7’s” NVIDIA, Tesla and Broadcom, with each losing around 20% of their value. This downturn was precipitated by escalating trade tensions, notably the imposition of tariffs by President Donald Trump on China, Canada and Mexico, which spooked investors and led to a sharp market correction in March. In contrast, international markets showed resilience: the MSCI EAFE Index of developed markets gained 8.0%, and European equities outperformed U.S. stocks, driven by improving economic conditions and increased government spending. Despite the broad market decline, certain sectors such as energy and value stocks posted positive returns, highlighting the benefits of diversification during periods of market stress. U.S. equities held their own in the first quarter, with the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) returning a somber -4.6%.

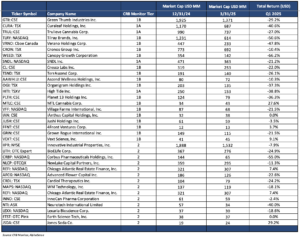

Largest Tier 1 Pure Play CRBs & Tier 2 CRBs – 1st Quarter 2025 Returns

CRB Monitor Tier 1

What can we say about this quarter that we haven’t already said about nearly every quarter for the last couple of years? Let’s face it, Tier 1 cannabis is merely a shadow of its former self, battered by relentless regulations, taxation and loopholes that have allowed the illicit market to operate and, more recently, invited intoxicating hemp to the party.

As we look at the table above, there were few options from the Tier 1 universe in Q1 that would have provided a positive return for cannabis investors. And all this badness was simply a replay of prior quarters for investors, or at least the ones that have hung on through all the pain. And while a few equity analysts still follow this market, it’s unclear how or where they are able to add value, given the extent of the oxygen that has escaped from these companies. Truth be told, even a few consecutive months of positive returns would not be nearly enough to save this universe, as most of these companies’ market caps are less than one-tenth of their highs (in other words, we would need to see 1,000% returns for them to return to their hey-day levels).

The MSO basket got taken down once again, with Tier 1B Cresco Labs Inc. (CSE: CL) (-22.0%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-47.8%), Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (-27.0%), Tier 1B TerrAscend Corp. (TSX: TSND) (-26.1%), and Tier 1A Curaleaf Holdings, Inc. (CSE: CURA) (-40.6%). Even the largest CRB by market cap, Tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) (-29.2%), struggled for the second quarter in a row as investors showed very little confidence in these companies to weather the economic storm that could hit in the next 90 days.

The Canadian CRB basket also struggled along with its MSO counterparts, as their need for cross-border trade continues to expose them to the lack of progress of U.S. cannabis legalization and reforms. And as we have stated periodically, historical performance has deviated between the CAD and the MSO baskets over short periods, but the two groups tend to mean revert over time. Tier 1B legend in the cannabis industry Canopy Growth Corporation (TSX: WEED) (-66.2%) fell into the abyss while Tier 1B Cronos Group Inc. (TSX: CRON) (-10.4%), Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-50.6%), and Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-21.2%) provided little optimism for investors. Tier 1B High Tide Inc. (TSXV: HITI) (-38.8%) reversed its positive trend in Q1 as it continued to expand its retail operations in Canada.

CRB Monitor Tier 2

An equally weighted basket of the largest CRB Monitor Tier 2 companies posted a return of -10.8% for the first quarter of 2025, outperforming the equally weighted Tier 1 basket by nearly 8%. Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (please see our February 2024 “Chart of the Month”), but their respective performance has a tendency to diverge in the short term, as it did in Q1, given the occasional lag from the positive or negative impact of market forces.

IIPR struggles again

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) (-7.9%) closely. IIPR is an internally managed real estate investment trust (CRBM sector – REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” On February 19, IIPR issued its 4th quarter 2024 earnings report, which featured the following highlights:

- “Total revenues of $308.5 million.

- Net income attributable to common stockholders of $159.9 million, or $5.52 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Adjusted funds from operations (AFFO) of $256.1 million, or $8.98 per share, and normalized funds from operations (Normalized FFO) of $231.0 million, or $8.10 per share.

- Declared dividends to common stockholders totaling $7.52 per share, increasing IIP’s common stock dividends declared each year since its inception in 2016.

- Committed over $70 million for the payment of purchase prices and funding of qualifying building infrastructure improvements for two property acquisitions and lease amendments for three properties.

- Released 530,000 square feet totaling ~6% of the total portfolio’s rentable square feet.

- Improved liquidity by increasing IIP’s revolving credit facility capacity from $30.0 million at December 31, 2023 to $87.5 million at December 31, 2024.

- At year-end, IIP’s portfolio totaled $2.5 billion of invested / committed capital and was comprised of 109 properties totaling 9 million rentable square feet in 19 states.”

Tier 2 REIT Advanced Flower Capital, Inc. (formerly AFC Gamma, Inc.) (Nasdaq: AFCG, CRBM Sector: Real Estate) (-22.6%) got slammed in Q1 and is a reminder that Tier 2 CRBs eventually will be dragged down by their customers, which by and large are Tier 1 CRBs. On February 13, AFCG reported its 4th Quarter 2024 earnings of $6.3 million, which featured the following statement from CEO Daniel Neville:

“We believe that the capital supply and demand imbalance in the cannabis sector will remain in the medium-term, given the Republican sweep in November and the lack of progress on Federal reform. This provides the opportunity for AFC to deploy capital into deals with strong risk adjusted returns.”

He added, “We continue to put capital preservation at the forefront of our investments and remain disciplined on providing debt capital in a challenging environment for operators. As we have done over the last year and plan to do in the coming year, we continue to focus on diversifying our portfolio and providing debt capital to operators who have previous success executing in the cannabis industry.”

CRB Monitor Chart of the Quarter

Some New Risks to Consider in Spot Crypto ETPs

In CRB Monitor’s Chart of the Month for February, we headed back to the world of spot cryptocurrency exchange traded products (ETPs) to discuss some of the embedded risks that we have not covered in previous articles. These are related to, specifically, Staking, Airdrops, and Forking.

Those of us who were born during or around the leisure suit era may believe these terms might have something to do with camping, or perhaps dinner. But practitioners in the crypto space know these terms well and treat them as “sweeteners” for their crypto investments, as they exist to motivate investors that hold on to (or maybe add to) their crypto investments. Read the full-length article on CRBMonitor.com.

CRB Monitor Securities Database

As of March 31, 2025, the breakdown of publicly traded, cannabis-linked securities was as follows:

As we have observed over the last few years (following the failure of the Cresco and Columbia Care merger in July 2023), cannabis M&A activity is largely a thing of the past. With that said, the CRB Monitor research team operates in a busy daily environment as we build out and maintain, in real time, an accurate record of each CRB’s corporate structure and current security details. We make hundreds of updates to CRB profiles every quarter, and first quarter 2025 was no exception. In addition to business expansion and corporate finance, we are tracking daily changes to company identifiers, new security listings, risk tier changes, database additions and removals, and updates to company officers and directors.

CRB Monitor News-Related Securities Database Updates – Q1 2025

Cannabis Business Transaction News

Of the close to 5,000 announcements and filings reviewed during the first quarter, our daily research resulted in a total of 305 updates to CRB Monitor company profiles (122 updates to issuers’ records, 183 source documents added). The complete list of securities and detailed profiles for the approximately 1,200 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our latest monthly newsletters: CRB Monitor Securities Update | January 2025, CRB Monitor Securities Update | February 2025, and the CRB Monitor Securities Update | March 2025.

The following is a sampling of some of the highlights from the first quarter 2025 cannabis news cycle:

First, in January, we begin with news of Tier 1A CRB Agrify Corporation’s (NASDAQ: AGFY) exit from the cultivation business. According to a Jan. 6 press release, Agrify “signed an agreement for and closed the sale of its cultivation business to CP Acquisitions, LLC, an entity affiliated with Raymond Chang, the Company’s former Chairman and Chief Executive Officer. The Transaction involves the sale of the Agrify cultivation business and assets, the assumption of liabilities related to the cultivation business by CP, and the termination of two convertible notes held by CP totaling approximately $7 million.”

As a result of this sale, Agrify no longer has ownership, direct or indirect, of a cannabis license. With this transaction, Agrify has been downgraded to Tier 2 from Tier 1A in the CRB Monitor database.

Also in January, we head to the Great White North, where Canadian Tier 1B High Tide Inc. (TSXV: HITI) announced in a Jan. 13 press release that it is “entering the fast growing German medical cannabis market by signing a definitive agreement pursuant to which the Company will acquire 51% of Purecan GmbH, for approximately €4.8 Million , and will have a future option to acquire the remaining interest in Purecan. Purecan is a profitable, import-oriented pharmaceutical wholesaler based in Germany, that holds a license to import medical cannabis into Germany and is preparing to launch a telemedicine portal for medical cannabis patients in Germany, along with complete warehousing and logistics infrastructure.”

High Tide has been in expansion mode for much of the last 12 months and now holds 201 active cannabis licenses in Canada and Australia.

Next, in February, Tier 1B CRB TILT Holdings Inc. (CSE: TILT) issued a press release announcing that it has signed an Asset Purchase Agreement to divest two dispensaries in Massachusetts. In the words of the announcement, “The Transaction is aligned with TILT’s broader strategy to explore strategic alternatives for its plant touching business, streamline operations, and unlock value in its vape hardware business, Jupiter Research. Under the terms of the Transaction, TILT will transition ownership of its Taunton dispensary to In Good Health, a private single-state cannabis operator, and shut down its Brockton dispensary for $2 million in cash considerations. The Company still has one location in Cambridge that is part of plant-touching assets under review.”

Could this be a sign of things to come in the Bay State? It’s too early to tell, but there have been rumblings of oversaturation there for more than a year. With this divestiture, Tilt now holds 13 active cannabis licenses in the U.S.

Also in February, we head to Michigan where Tier 1B MSO Ascend Wellness Holdings, Inc. (CSE: AAWH.U) issued a Feb. 12 press release announcing “the grand reopening of its Detroit dispensary…which will now serve recreational adult-use consumers. This marks Ascend’s 38th dispensary within its seven-state footprint, and the Company’s eighth dispensary in Michigan with additional locations in Ann Arbor, Battle Creek, Grand Rapids, East Lansing, and Morenci…The revamped Detroit dispensary features a modernized showroom with seven points of sale to ensure seamless shopping. Customers can explore a curated selection of top-shelf flower through a deli-style experience, Ascend’s first in Michigan. Orders can be placed in-store and online, with delivery options coming soon.”

With this opening, Ascend Wellness now holds 74 active cannabis licenses across 10 states.

Finally, in March, we head south to Florida, where Tier 1A CRB Trulieve Cannabis Corp. (CSE: TRUL) issued a March 18 press release announcing the opening of a new medical cannabis dispensary in North Miami Beach, Florida.

In the words of the statement, “The new dispensary will carry a wide variety of popular products including Trulieve’s portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk, and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Bellamy Brothers, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love’s Oven, Miami Mango, Seed Junky, and Sunshine Cannabis, all available exclusively at Trulieve in Florida. Across Florida, Trulieve offers home delivery, convenient online ordering, and in-store pickup. Veterans receive 20% off every order when they show their military ID, and all first-time guests are eligible for a 60% new customer discount at any Florida Trulieve location.”

As of the time of this opening, Trulieve held 113 active cannabis licenses in the U.S. and Canada.

In Nevada, the largest publicly traded CRB by market cap, tier 1B MSO Green Thumb Industries Inc. (CSE: GTII) issued a March press release announcing “the opening of RISE Dispensary Henderson on Boulder, located at 1000 S Boulder Hwy, Henderson, NV 89015, on March 4. The new Henderson location, conveniently near the Downtown Henderson Water Street District, marks the 12th RISE Dispensary location in Nevada and 102nd nationwide. Beginning March 4, RISE Dispensary Henderson on Boulder will bring patients and adult-use customers award-winning, high-quality products and convenient services, such as curbside pickup. RISE Dispensary Henderson on Boulder will be open 8 a.m. until 11 p.m. Monday through Sunday, offering a broad selection of curated products from Green Thumb’s family of brands, including RYTHM, Dogwalkers, Incredibles, Beboe, Good Green, &Shine and Doctor Solomon’s. RISE Dispensary Henderson on Boulder is the second RISE location in Henderson, Nevada. RISE Dispensary Henderson is located just 10 miles away from the new location at 4300 E Sunset Rd, Suite A3, Henderson, NV 89014.”

Green Thumb holds 96 active licenses in the U.S. and operates in 15 states.

Regulatory Updates

In the aftermath of the November elections, owners and investors of CRBs licked their wounds and continued on their individual paths toward business survival. Nevertheless, the federal government will soldier on, and we will see the next wave of proposed cannabis-related reforms from the next Congress. Meanwhile, the DEA will continue, at a snail’s pace, to move forward with its plan for rescheduling (or perhaps descheduling) in the months to come. And there is no doubt that we will see progress toward the legalization of marijuana for adult use in new states, over and above the current count of 24.

Here are some of the first quarter 2025 regulatory highlights from the cannabis-related regulatory news cycle:

First, in January, we begin in the Big Apple, where our very own CRB Monitor News Team reported that New York State announced its adult-use market “surpassed the $1 billion mark in retail sales. That milestone came about two years after the first sales launched on Dec. 29, 2022. Despite numerous legal challenges, the Empire State managed to get its adult-use cannabis market off the ground this year. New York’s Cannabis Control Board prioritized applicants with cannabis-related criminal records in the first round of licensing, which was hindered by legal action from other applicants. Ultimately, the CCB would abandon its original time frame and allow general applicants to join the market, partially in response to lawsuits that temporarily halted licensing.

“’New York’s cannabis industry was designed with a focus on equity and opportunity, and today’s achievement is proof that our approach is working. By prioritizing Social and Economic Equity applicants, we’re creating a market that uplifts communities and fosters meaningful economic impact across the state,’ said CCB Chair Tremaine Wright in a statement. ‘The tax revenue generated by this thriving industry directly supports our Community Reinvestment Grant Program, ensuring that communities disproportionately impacted by cannabis prohibition receive critical investments. This is only the beginning of what’s possible when we invest in an inclusive and well-regulated industry.’”

The article goes on to highlight the expansion in license approvals: “Throughout 2024, the state also approved 221 cultivator licenses, 292 processor licenses, 569 Conditional Adult-Use Retail Dispensary licenses, 185 distributor licenses, 272 micro business licenses and seven new medical registered organizations to join the state’s existing 10. Since the market launched, the state has approved a total of 1,036 retail locations, 293 cultivation sites, 323 processors and 191 distributors, according to the CRB Monitor database.”

In Wisconsin, a January article in Marijuana Moment reported, “The governor of Wisconsin said that residents of the state should be allowed to propose new laws by putting binding questions on the ballot—citing the fact that issues such as marijuana legalization enjoy sizable bipartisan support while the GOP-controlled legislature has repeatedly refused to act. Gov. Tony Evers (D) said during a press conference that he will be including a proposal in his 2025-27 biennial budget to give citizens the right to put forward ballot initiative to enact statutory or constitutional policy changes if a majority of voters approve them.”

This seems to be a recurring issue in states where the will of the people is challenged by a considerably smaller group of people in the legislature. The article goes on to report, “At the presser on Friday, Evers specifically mentioned that there’s majority support for ‘legalizing and taxing marijuana like we do alcohol,’ as well as other issues such as abortion rights, gun safety and increasing funding for public education. Yet ‘Republican legislators have repeatedly ignored the will of the people of Wisconsin,’ he said, according to Wisconsin Examiner.’”

Next, in February, a CRB Monitor News article highlighted five states that will be looking to legalize recreational marijuana in 2025. Midway through February, five states had filed bills to legalize adult use and one state had legislation to allow medical use, while a lawmaker in South Dakota wanted to go in the other direction and outlaw the state’s current medical-use program. The states moving the ball forward were Kentucky (SB 36), New Hampshire (HB 198 and HB 75), Tennessee (SB 809 and HB 836), Texas (HB 1208), and Hawaii (HB 1246 and SB 1613).

The artlicle also highlighted a few more states with news:

“In Nebraska, where voter-approved medical-use measures are still being challenged in court, lawmakers have filed four separate bills to implement the laws. Other state bills introduced so far this year would decriminalize cannabis in three states where it is still illegal, allow for cannabis lounges in two adult-use states, require lab testing and track and trace in two states, increase law enforcement in New Mexico, and create new licensing restrictions in Montana. But the fastest moving legislation that will likely hit a brick wall at the governor’s mansion are a pair of bills to create a legal adult-use market in Virginia.”

According to a February article from CRB Monitor News, the great state of Alabama is apparently moving forward with a plan for cannabis licensing. It has actually been four long years since Alabama passed medical use legalization and businesses are still awaiting licenses to operate in the state.

“The Alabama Medical Cannabis Commission (AMCC) has attempted three separate times to issue the inaugural round of licenses for vertically integrated cannabis producers. Each attempt has been hindered by lawsuits from unsuccessful applicants. Most of the lawsuits currently remain before the Alabama Court of Appeals.”

The article goes on to report: “SB 72, introduced Feb. 4, is the latest attempt at a legislative fix to the commission’s legal trouble, though Schelper said she was skeptical it will solve the state’s licensing problem. Currently, the AMCC is authorized to issue no more than four processor licenses, four dispensary licenses and five integrated facility licenses, but the commission is also allowed to issue fewer than the cap. SB 72 would increase the number of available vertically integrated licenses from five to seven. Adding two more integrated facility licenses is a positive step, according to Schelper before explaining that she would rather see an unlimited number of licenses available.”

In March we headed down to the Sunshine State, where Florida regulators set their sights on the distribution of hemp-derived products. A March article in the Cannabis Business Times reported that The Florida Senate Fiscal Policy Committee voted unanimously, 18-0, on March 27 to advance Senate Bill 438, which “aims to prohibit all products containing hemp-derived synthetic cannabinoids, incorporate comprehensive rules for product testing, restrict where stores selling hemp products can be located and ban certain product advertising, among other regulations. The cannabinoids that would be prohibited under the legislation include delta-8 THC, delta-10 THC, HHC, THC-O, THCP and THCV.”

We have seen, typically in states that have yet to legalize adult-use marijuana, unlicensed businesses legally selling the above-mentioned compounds to the public. Because it is unregulated, this practice can be dangerous to consumers while undermining the progress of legal cannabis in those states.

The article goes on to report, “For quality control, (the) latest legislation (S.B. 438) aims to require hemp extracts to be tested by a certified medical cannabis laboratory—rather than an independent lab—before it may be sold in the state. Product labels would be required to have accurate THC and CBD concentrations and ensure the absence of contaminants that are unsafe for human consumption.”

Also in March, is another story related to the headache being caused by the proliferation of hemp-derived THC products in Colorado . An article published by MJ Biz Daily reported, “Colorado’s regulated marijuana market is riddled with unsafe and illegal hemp-derived THC, a flow that regulators are unable or unwilling to stop, a state-licensed cannabis company alleges in a lawsuit. In a March 10 complaint filed in state court in Denver, cultivator and manufacturer Mammoth Farms accused the Marijuana Enforcement Division (MED) of allowing Colorado’s distillate market to be ‘illegally taken over by synthetic THC from outside’ the state.”

Not another one! In all likelihood this phenomenon has all the makings of an epidemic, but this should be no surprise to investors given all the headwinds that legal cannabis businesses have faced over the last five to 10 years.

The article goes on to report, “The suit by Mammoth, headquartered in the rural town of Saguache, lists crimes allegedly committed by “bad actors who often have connections with drug cartels and other potentially dangerous criminals” that MED has failed to stop, including:

- “Allowing ‘millions of mislabeled and unsafe products’ to be ‘illegally sold in Colorado’s regulated marijuana market each year.’

- Failing to stop the flow of ‘cheap and dangerous Converted THC smuggled’ into Colorado from out of state that contains ‘methylene chloride, a toxic industrial chemical used in paint stripping.’

- Allowing ‘bad actors’ to thwart the state’s track-and-trace system and through the use of fake ‘ghost tags.’

- Failing to revoke marijuana industry employees’ state-issued badges even after felony convictions.”

The CRB Monitor Securities Research team covers all aspects of the publicly traded, as well as much of the privately held, cannabis ecosystem, including the regulatory environment, operational expansion and M&A activity, updates on officers and directors, and investment performance. And over the last two years we also have developed our research platform for businesses operating in the Digital Asset Space, and we now include Digital Asset Related Businesses (DARBs) research in our newsletters. As such, please feel free to contact us at CRBMonitor.com for the gold standard in business intelligence in both cannabis- and digital asset-related securities.

With our monthly and quarterly newsletters, we keep our readership informed while we highlight the usefulness of CRB Monitor’s data to all types of users at financial institutions worldwide.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business.”

For additional detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: the CRB Monitor Securities Update | January 2025, CRB Monitor Securities Update | February 2025, and the CRB Monitor Securities Update | March 2025.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know.