As we have done for nearly a decade, CRB Monitor provides our clients with the gold standard in cannabis and digital asset-linked market intelligence, and our insights are considered essential for stakeholders in these two high-risk industries. As such, we keep abreast of all the relevant news out of Washington D.C., the states, and globally, to ensure that no critical information about these two industries seeps through the cracks.

As we write this market commentary the United States is still in recovery from a 40+ day shutdown which left Americans wondering about the direction our legislators are headed as we make our way toward 2026 and midterm elections. The continuing resolution (CR) that ultimately passed and opened the government featured a new provision for the governance of hemp-derived THC, which is explained by a November 13th report by Cannabis Business Daily:

“…hemp-derived cannabinoid products will be federally illegal starting Nov. 13, 2026, if they contain:

- cannabinoids that are synthesized or manufactured outside the plant (delta-8 THC);

- cannabinoids that are not capable of being naturally produced by the plant (HHC)

- more than 0.3% total THC (including THCA) or other cannabinoids with similar effects; or

- more than 0.4 milligrams of total THC per container.”

Grab your popcorn and enjoy as the new hemp regulations play out at the state level. Given the recent proliferation (and profitability of largely unregulated intoxicating hemp in several states, what could follow is a race to get existing hemp businesses licensed, and we have seen plenty of evidence to support this as at least 20 state authorities are now issuing licenses to distribute intoxicating hemp.

And even more interesting to us is the participation in intoxicating hemp by no fewer than eighteen (18) publicly-traded CRBs, which we highlight in our chart of the month (to be published in the near future).

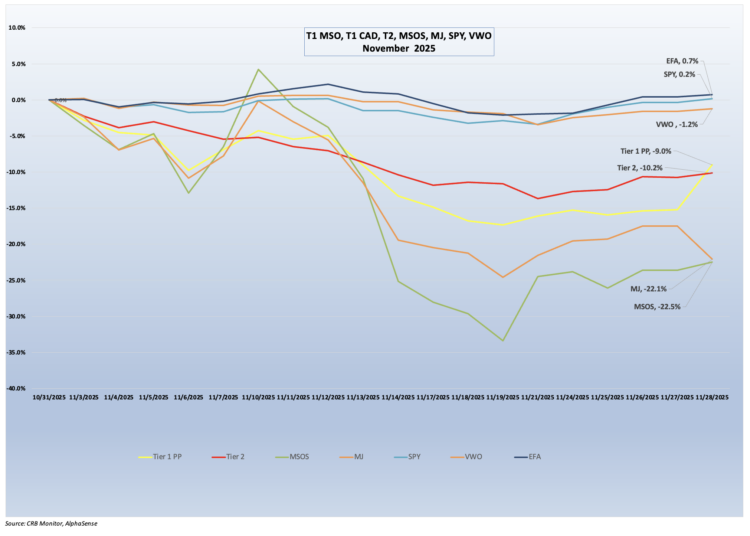

Now onto market performance. In the month of November 2025, cannabis-linked equities collapsed by double digits once again, showing essentially no tendency to keep pace with . For those investors who were thinking that these companies could not possibly sink lower, please think again. We have been treated to this same movie dozens of times, even though it seems impossible that a segment of the market can look so uniformly unwell no matter what time period we are looking at. With that said, we will continue to monitor this market for any updates.

Cannabis-Linked Equity Performance

For the second month in a row, Performance crashed for the two largest US plant-touching cannabis-themed ETFs, the Amplify Alternative Harvest ETF (NYSE Arca: MJ) (-22.1%) and the actively-managed MSO-heavy Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (-22.5%). The cannabis holdings in these funds (and other cannabis-themed ETFs) reacted negatively in November to the overall pessimism surrounding cannabis reforms, including the latest legislation regarding intoxicating hemp. Both of these funds are benchmarked to pure play CRB-themed indexes, and while they use different construction methodologies, their returns will be directionally close to each other. It’s worth mentioning that these funds are not considered Controlled Substances Act (CSA)-friendly, as they both carry exposure to US plant-touching marijuana businesses.

The CRB Monitor equally-weighted basket of top Pure Play Tier 1 CRBs also reversed course in November, returning -9.0%. This portfolio is an equally-weighted basket of the largest pure play Ther 1 CRBs (representing both US plant-touching and non-US plant-touching MJ companies).

The CRB Monitor equally-weighted basket of Tier 2 CRBs underperformed the Tier 1 CRB basket, posting a -10.2% return for November 2025. In August 2025 CRB Monitor published an update to our article on correlations of Pure Play Tier 1 and Tier 2 CRBs, as well as correlations of MSO and Canadian operators. And what we have observed historically is that these two groups tend to display high correlation (~0.50) in the long term, while their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact of market forces (in this case marijuana rescheduling) that affect their sources of revenue that are derived from the Tier 1 group. If this theory holds, investors would be expected to load up on Tier 2 CRBs in the short term and we would witness this gap narrow over time.

In November 2025 U.S. equities led by the S&P 500, delivered a modest but positive return after a volatile October. The S&P 500 ended November up roughly 0.13%, bringing its year-to-date gain to about 16.45%. Despite periods of heavy selling — especially of AI and technology stocks — five of the last seven months have now been positive for the index. Investor sentiment was challenged mid-month as concerns over high valuations in AI-related and tech names triggered profit-taking, putting downward pressure on growth and large-cap tech components of the index. Value stocks and mid-caps lagged behind growth-oriented companies. The S&P 500 (represented by the SPDR S&P 500 ETF Trust (NYSE Arca: SPY)) posted a return of +0.2% for the month of November.

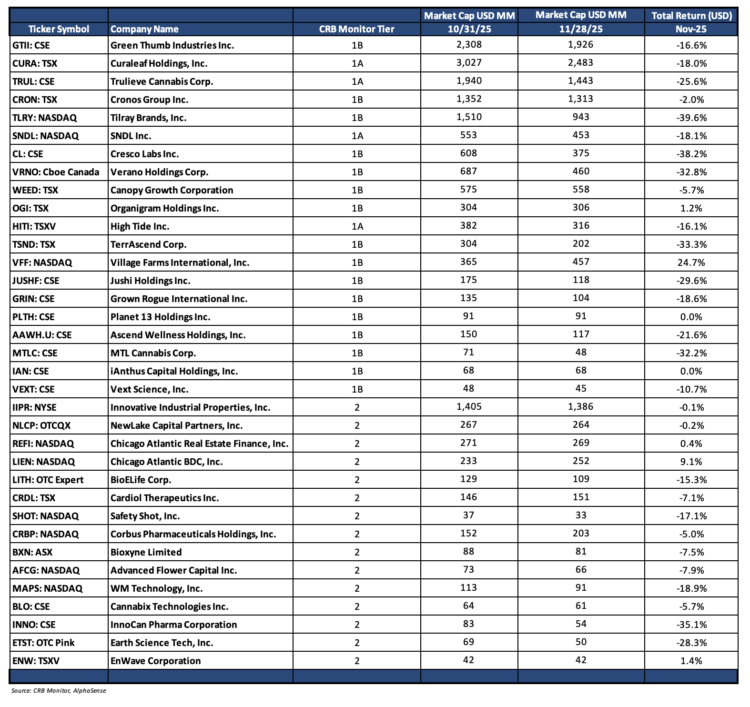

Largest Tier 1 Pure Play & Tier 2 CRBs by Market Cap – November 2025 Returns

An equally-weighted basket of the largest Tier 1 pure-play cannabis equities (a combination of MSO and CAD companies) struggled mightily in November, with mostly negative performance across the board. Tier 1 CRBs finished the month nearly in line with the Tier 2 basket (-9% vs. -10%).

CRB Monitor Tier 1

Tier 1 cannabis equities are now in the midst of a 3-month slump (which is part of a longer, multi-year slump), with many of the companies closing out November 2025 with double-digit negative returns. The MSO basket struggled with several CRBs closing out the month in double-digit negative territory. Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) (-25.6%), Tier 1B Cresco Labs Inc. (CSE: CL) (-38.2%), Tier 1B Verano Holdings Corp. (CSE: VRNO) (-32.8%), and Tier 1B TerrAscend Corp. (TSX: TSND) (-33.3%) slumped following November earnings reports. The two largest CRBs by market cap, Green Thumb Industries Inc. (CSE: GTII) (-16.6%) and Curaleaf Holdings, Inc. (CSE: CURA) (-18.0%) were licking their wounds in November as well.

The Canadian CRB basket competed with the MSOs for seats at the kid’s table in November. Tier 1B CRB Canopy Growth Corporation (TSX: WEED) (-5.7%) continued on its two-month slide, while Tier 1B craft beverage giant Tilray Brands, Inc. (Nasdaq: TLRY) (-39.6%) won the prize for “worst performing cannabis stock” of November 2025. Tier 1A SNDL, Inc. (Nasdaq: SNDL) (-18.1%), Tier 1B High Tide Inc. (TSXV: HITI) (-16.1%) and Tier 1B Cronos Group Inc. (TSX: CRON) (-2.0%) also disappointed the investors who were still paying attention.

As we have stated regarding these two groups (MSOs and CADs), short-term performance has deviated between the CAD and the MSO baskets (August 2025 was one of those months), but they tend to mean-revert over time and historical correlations are high. It is also worth mentioning that as an industry cannabis has fallen to the point where no company’s stock can even be regarded as a small capitalization stock; over the last few years they have all shrunk (some by more than 90%) to the point where they are considered micro-caps and effectively non-investable by most institutions from a policy perspective. For more detail on the MSO/CAD relationship, please see our August Chart of the Month on our CRB Monitor News website.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies slightly underperformed the Tier 1 basket in November 2025, posting a return of -10.2%. Historically the performance of these two portfolios (given their close business ties) has displayed high correlation (please see our recently-published August 2025 “Chart of the Month”), and we expect the returns of Tier 1 and Tier 2 CRBs to mean-revert over time. When the two baskets deviate from one another in the short term, the deviation could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship. This is due to the fact that Tier 2 CRBs are direct suppliers of goods and services to (and derive their revenues from) Tier 1 CRBs. However, the precise moment when these two baskets mean revert is not easy to predict and the costs required to systematically rebalance these illiquid portfolios could eat up any expected material gains from even the best rebalance strategy. In other words, gaming these two baskets can lead to losses, so proceed with caution!

The performance of the largest CRB in the Tier 2 basket, well-known REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (CRBM Sector: Real Estate) (-0.1%) was essentially flat in November following a weak return in October. On November 3rd IIPR reported its 3rd quarter 2025 results which featured the following highlights:

- Total revenues of $64.7 million and net income attributable to common stockholders of $28.3 million, or $0.97 per share (all per share amounts in this press release are reported on a diluted basis unless otherwise noted).

- Adjusted funds from operations (“AFFO”) and normalized funds from operations (“Normalized FFO”) of $48.3 million and $45.2 million, respectively.

- Paid a quarterly dividend of $1.90 per common share on October 15, 2025 to stockholders of record as of September 30, 2025. Since its inception, IIP has paid over $1.0 billion in common stock dividends to its stockholders.

Tier 2 REIT Advanced Flower Capital, Inc. (Nasdaq: AFCG) (CRBM Sector: Real Estate) (-7.9%) struggled for the third month in a row. On November 12th AFCG reported its 3rd Quarter 2025 financial results (featuring a net loss of $12.5) and the statement from CEO Daniel Neville:

“We continue to make progress resolving our nonaccrual positions and driving loan repayments across our portfolio. There remains limited new capital entering the cannabis market, and our conversion opens the investment universe for AFC beyond real estate owners in cannabis. Today, we see meaningful lending opportunities in several attractive markets, and we are actively evaluating opportunities in the lower-middle market that we believe can generate attractive risk-adjusted returns for the benefit of our shareholders.”

Tier 2 technology company, WM Technology, Inc. (Nasdaq: MAPS), operates Weedmaps, the leading online listings marketplace for cannabis consumers and businesses, and WM Business, the most comprehensive SaaS subscription offering sold to cannabis retailers and brands. WM Technology’s crashed along with the Tier 1 group, with a -18.9% return for November. On November 6th, MAPS reported its 3rd Quarter 2025 earnings, with the following chilling headlines:

- Net income decreased to $3.6 million as compared to $5.3 million in the prior year period.

- Adjusted EBITDA(3)decreased to $7.6 million from $11.3 million in the prior year period.

- Total shares outstanding across Class A and Class V Common Stock were 157.2 million as of September 30, 2025.

- Cash increased to $62.6 million as of September 30, 2025, as compared to $52.0 million as of December 31, 2024.

CRB Monitor News Featured Article: President Orders Rescheduling and Hemp Reconsideration

It finally happened. After weeks of rumors and speculation, President Donald Trump signed an executive order on Dec. 18, ordering his attorney general to expedite the process of moving cannabis to Schedule III from Schedule I under the Controlled Substances Act.

“The facts compel the federal government to recognize that marijuana can be legitimate in terms of medical applications when carefully administered,” said Trump during the live-streamed executive order signing event. “This reclassification order will make it far easier to conduct marijuana related medical research, allowing us to study benefits, potential dangers, and future treatments. It’s going to have a tremendously positive impact.”

Click here for the full article on our CRB Monitor News website.

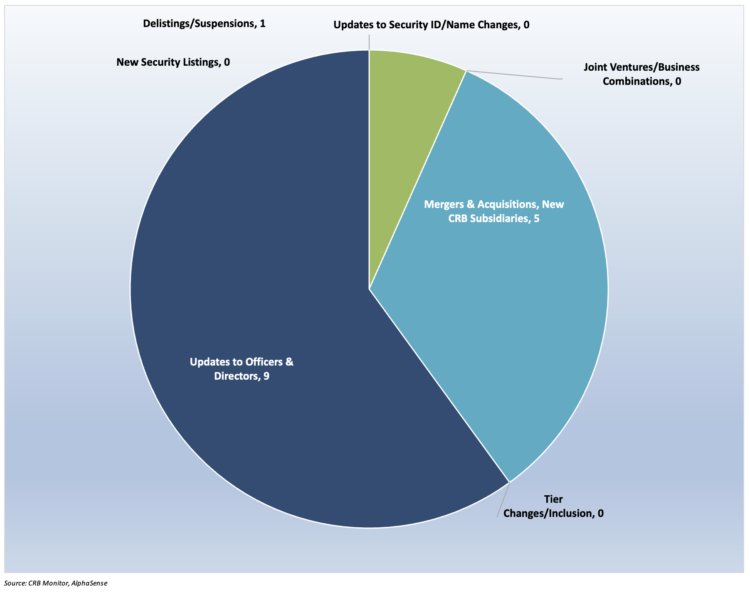

CRB Monitor Securities Database Updates

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for November 2025:

Cannabis Business Transaction News

The CRB Monitor research team has followed the cannabis industry daily for close to a decade. Our goal is to remain up to date on all the relevant information vital to the ongoing breadth and accuracy of our data in the CRB Monitor securities database. And while the cannabis industry has faced major regulatory obstacles over those years, there has never been a shortage of news as licensed CRBs’ operations evolve and survive in a complicated regulatory environment.

On that note, here are some of the cannabis company highlights from November 2025:

Tier 1A MSO Pure Harvest Corporate Group, Inc. (OTCQB: PHCG) announced in an November press release that “it has closed on its acquisition of Mixie IP Holdings, LLC and Mixie Labs, LLC. The closing follows the prior execution of the Letter of Intent as announced on October 28, 2025. As previously disclosed, the contemplated consideration consists of PHCG preferred shares and warrants. As a result of the acquisition, Mixie is now a wholly owned subsidiary of the Company. The Mixie IP portfolio includes software and related intellectual property for intelligent media transport, AI/ML pipelines at the edge, computer vision analytics, spatial/AR interfaces, and a video-centric learning & training suite (MiXie LTMS) alongside an enhanced video platform (MiXie Media/Cloud/Mobi). PHCG has also executed agreements intended to retain the core engineering team associated with the assets. While this does not appear to be a cannabis-related acquisition CRB Monitor’s policy is to cover all M&A activity for Tier 1 Pure Play CRBs. Pure Harvest currently holds 4 active cannabis licenses in the U.S.

Ianthus expands operations in Florida: Tier 1B Canadian CRB iAnthus Capital Holdings, Inc. (CSE: IAN) issued a November press release announcing “its expansion into Fort Myers with the opening of its 24th GrowHealthy dispensary in Florida. The new location opens its doors today with an expanded lineup of premium product brands, including The Vault, Sunshine State and MPX, offering patients greater choice and quality all under one roof… GrowHealthy continues to set itself apart through a focus on whole-plant wellness, premium genetics and community connection. Built on the foundation of cultivators and caregivers, the company leads with a flower-first philosophy, strong community ties, and a deep respect for the cannabis plant. The Fort Myers dispensary offers an extensive menu of products–including flower, vapes, concentrates and other formats–crafted to meet the local community’s diverse wellness needs.” With this acquisition Ianthus now holds 54 active licenses in the U.S and 4 in Canada.

Also in Florida, Tier 1B MSO FLUENT Corp. (CSE: FNT.U) issued a November press release announcing that “its new 2,800 sq ft Brandon, FL dispensary is now open for patients, with a grand opening celebration set for Saturday, November 22, 2025. The new store opening reflects FLUENT’s ongoing strategy to expand in high-demand markets and optimize its retail footprint to better serve patients and drive sustainable growth…The Company also plans to open new dispensaries in Orlando Sand Lake in December and Palm Bay (Q1 2026), expanding its network to 39 locations nationwide.” Following this purchase FLUENT’s operational footprint now includes CRBs in 5 countries and 136 active licenses.

Jazz Pharmaceuticals is selling off a cannabis holding: Finally, non-Pure Play Tier 1B CRB Jazz Pharmaceuticals plc (NASDAQ: JAZZ) issued a November press release announcing that “it has acquired the global Sativex (nabiximols) business from USA-based Jazz Pharmaceuticals (Nasdaq: JAZZ). The transaction, financial terms of which have not been revealed, closed on October 30, 2025. Sativex is indicated for symptom improvement in adult patients with moderate to severe spasticity due to multiple sclerosis (MS) who have not adequately responded to other anti-spasticity medication and who demonstrate clinically-significant improvement in spasticity-related symptoms during an initial trial of therapy.” Jazz Pharmaceuticals remains in the CRB Monitor database following this transaction, as it continues to operate through its Tier 1A subsidiary, Jazz Pharmaceuticals Research UK Limited.

Select CRB Business Transaction Highlights

Officers/Directors Highlights

| Company Name | Ticker Symbol | CRBM Tier | Event |

| Organigram Holdings Inc. | TSX: OGI | Tier 1B | Organigram Announces Appointment of Chief Executive Officer |

| Dr. Reddy’s Laboratories Limited | NYSE: RDY | Tier 1B | Dr Reddy’s Labs: Jayanth Sridhar resigns as Global Head of Biologics |

| Arovella Therapeutics Limited | ASX: ALA | Tier 1A | Arovella appoints former CSL Chief Scientific Officer Dr Andrew Nash to its Board |

| Dr. Reddy’s Laboratories Limited | NYSE: RDY | Tier 1B | Dr Reddy’s Laboratories elevates Manish Shukla to Global Head – HR, Corporate an ..

|

Select Updates to CRB Monitor

| Name | Ticker Symbol | CRBM Action | CRBM Tier/Sector |

| Trendlines Group Ltd. | OTCQX: TRNLY | Moved to Watchlist | Tier 3/ Fertilizers & Agricultural Chemicals |

| Wealthcraft Capital Inc. | OTCID: WCCP | Moved to Watchlist | Tier 2/Professional Services |

| International Flavors & Fragrances Inc | NYSE: IFF | Moved to Watchlist | Tier 3/CBD – Personal Products |

| Theralase Technologies Inc. | TSXV: TLT | Moved to Watchlist | Tier 3/ Health Care Equipment, Devices & Supplies |

Cannabis News: Regulatory News Updates

The cannabis regulatory news cycle continues to run hot, featuring stories at both state and federal levels of government as well as around the world. And not surprisingly, cannabis-related investments are largely sentiment-driven and highly sensitive to news (rather than value or growth-based), particularly when the news comes from Washington. With that said, here are some of the November 2025 highlights:

We begin in the Nutmeg State (Connecticut) and an article published by our CRB Monitor News Team reported that “A Connecticut hemp farmer is suing his state over social equity rules that have prevented him from converting his farm into a licensed cannabis cultivation site. This is the latest legal attack on Connecticut regulation from a state hemp industry that briefly thrived but is now fading away. “As of the date of this Complaint, a total of zero non-social equity marijuana cultivator licenses have been issued in Connecticut,” said the nine-page complaint filed Oct. 14 in the U.S. District Court of Connecticut. “No lotteries have ever been conducted for non-Social Equity applicants. No lotteries are currently being conducted for non-Social Equity cultivator licenses, and no future lotteries have been scheduled.” Given all the recent news about the proliferation of intoxicating hemp, this will be one to watch going forward.

Next we head west to Ohio and more news about intoxicating hemp: An article published by Marijuana Moment reported that “Ohio Gov. Mike DeWine (R) has issued a 90-day executive order banning the sale of intoxicating hemp products…Intoxicating hemp products are items that contain THC that are sold anywhere other than licensed marijuana dispensaries including gas stations, smoke shops and CBD stores, among others. This ban includes THC-infused beverages. “I am taking action today…to get these products off the streets and to have them taken off our shelves,” DeWine said…“Intoxicating hemp is dangerous, and we need to better protect our children… We believe this is the right thing to do.” Governor DeWine went onto say, “For too long, the hemp industry has recklessly exploited the Farm Bill loophole to line its pockets at the expense of Ohioans’ health,” OHCANN Executive Director David Bowling said in a statement. “Until today, unregulated synthetic hemp-derived cannabinoids were sold openly, putting consumers, especially children, at risk.””

You’re not doing fine, Oklahoma: A November article in the Cannabis Business Times reported that “Oklahomans for Responsible Cannabis Action (ORCA), the group behind a proposed constitutional amendment for the 2026 ballot, failed to file petition pamphlets by the Nov. 3 deadline, according to Oklahoma Secretary of State Benjamin Lepak’s office. The group needed to submit 172,993 valid signatures – 15% of the votes cast for governor – by Nov. 3 to place the initiated amendment on the November 2026 ballot. ORCA’s unsuccessful attempt to land a state question on the 2026 ballot comes after the group also failed to gather enough signatures for a proposed legalization measure in 2022, when they were also up against a three-month collection period.”

Next we head east to Tennessee for more hemp news: A November article in Marijuana Moment reported that “Tennessee’s hemp industry has reached an agreement with state agencies, dismissing a lawsuit and enabling some businesses to keep selling hemp-derived products such as THCA for a short time after new restrictions take effect.” Here’s the interesting part: “The Tennessee Healthy Alternatives Association announced it entered an order with the state Agriculture and Revenue Departments allowing businesses with licenses issued before December 31, 2025 to continue using a 2023 regulatory framework until their licenses expire June 30, 2026. Such a move allows stores to keep selling many products that will be banned after a new law takes effect January 1. Because of the agreement, a pending declaratory judgment against the Agriculture and Revenue departments has been dismissed, the association said in a statement.” This 6-month stay will be helpful for these businesses to get their affairs in order before the hammer comes down. But it could backfire: “Hemp industry representative Clint Palmer, who testified before lawmakers this year, said about 75 percent of the market will be considered illegal under the new ban, which includes THCA flower and vapes. The new law will push consumers to synthetic cannabinoids, he said.”

Finally, even more struggles over intoxicating hemp: An November article on our CRB Monitor News site reported on the multi-level political reaction to recent revelations regarding hemp-derived consumables: “With the stakes higher than they have ever been for a $28 billion industry, hemp businesses and advocates are wasting no time to reverse a hemp-derived cannabinoid (HDC) ban placed into spending legislation at the last minute and enact consumer-focused regulations. When President Donald Trump signed the budget bill, HR 5371, this month that reopened the federal government, part of that bill redefined legal hemp and essentially outlawed all HDC products by Nov. 12, 2026. The 2018 Farm Bill unlocked an intoxicating hemp and CBD industry when it stipulated that cannabis that contained less than 0.3% delta-9 THC was no longer a scheduled drug. This effectively legalized vapes, edibles and beverages containing THCA and delta-8 THC. The law also allowed new consumable products with delta-9 THC because the prohibited amount was based on a percentage of dry weight, so the heavier the product, the more delta-9 THC it could legally contain.”

CRBs In the News

The following is a sampling of highlights from the November 2025 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper, Defining “Marijuana-Related Business,” and its update, Defining “Cannabis-Related Business”.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses – What Financial Institutions Need to Know